Automotive Hypervisor Market size was valued at 417.72 million USD in 2024, and the total Automotive Hypervisor Market is expected to grow at 27.2% from 2025 to 2032, reaching nearly 2862.74 million USD.Automotive Hypervisor Market Overview

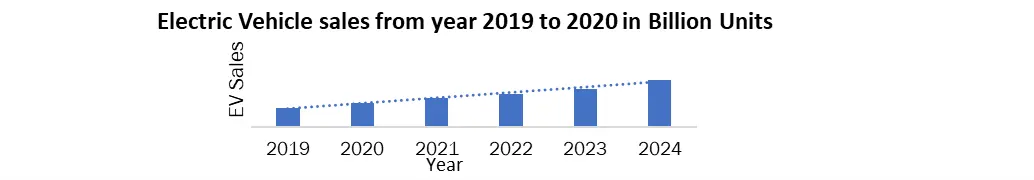

An automotive hypervisor is a software platform that allows a number of automotive applications and operating systems to run on a single hardware platform. The automotive hypervisor is a system that is responsible for managing the distribution of resources and isolating applications for the highest level of safety, security, and reliability in vehicle electronic and software systems. The Automotive Hypervisor Market has been witnessing rapid growth, because of the increasing complexity of vehicle electronic systems and the growing demand for advanced driver assistance systems (ADAS), infotainment, and connectivity solutions. Automotive hypervisors, which were initially developed as basic virtualization tools to enable multiple operating systems on a single hardware platform, have evolved significantly, offering real-time performance, enhanced security, and scalability. These advancements have made them vital for connected and autonomous vehicles, supported by innovations in hardware-assisted virtualization, secure boot mechanisms, and adaptive partitioning. Global adoption has accelerated, with ADAS now integrated into over 90% of newly manufactured premium vehicles and in-vehicle infotainment systems becoming standard in more than 75% of passenger cars. The rise of electric mobility has further boost Automotive Hypervisor Market growth, as global electric vehicle (EV) sales have surpassed 14 million units in 2024, and autonomous driving pilot programs have expanded to over 30 countries. This surge in technology integration was created strong demand for hypervisors to optimize resource utilization, improve safety, and support complex software ecosystems. The rapid EV adoption in China, India and increasing government safety regulations, and investments in intelligent transportation systems helps to drive the Automotive Hypervisor Industry. Key players such as BlackBerry QNX, Siemens (Mentor Graphics), Wind River, Green Hills Software, and VMware have been competing on performance, security compliance (ISO 26262, ISO 21434), and strategic OEM partnerships. Their innovations in real-time virtualization and secure system architectures have positioned automotive hypervisors as a core enabler of next-generation software-defined vehicles.To know about the Research Methodology:-Request Free Sample Report

Automotive Hypervisor Market Dynamics

Growing adoption of advanced driver-assistance systems (ADAS) to drive the Automotive Hypervisor Market The rising implementation of Advanced Driver-Assistance Systems (ADAS) is a key driver for the automotive hypervisor market. Modern vehicles integrate multiple complex electronic systems such as ADAS, infotainment, and advanced connectivity which require efficient resource allocation, real-time processing, and isolation of critical functions. Hypervisor solutions enable these capabilities by allowing multiple operating systems to run securely on a single hardware platform, ensuring safety and performance. The shift towards electric vehicles (EVs) has further accelerated this trend. For instance, Tesla’s EV platforms utilize hypervisors to optimize resource utilization, improve scalability, and support continuous software updates. Similarly, the advancement of autonomous driving demands robust computing environments capable of running diverse software stacks. Companies such as Waymo leverage hypervisors to manage the highly complex software ecosystem required for self-driving operations. Compliance with stringent safety standards such as ISO 26262 also promotes hypervisor adoption, ensuring functional safety in critical vehicle systems. Additionally, the growth of software-defined vehicle architectures and demand for cost optimization are pushing automakers to adopt centralized computing platforms supported by hypervisors. Collaborations in the industry further enhance market growth. For example, NVIDIA and Continental have partnered to develop hypervisor-enabled automotive solutions that integrate safety, infotainment, and ADAS functions efficiently. The rise of Mobility-as-a-Service (MaaS) models such as Uber’s fleet management also benefits from hypervisors, enabling reliable and scalable vehicle operations. The convergence of safety regulations, autonomous driving advancements, EV adoption, and connected vehicle trends positions hypervisor technology as a critical enabler in next-generation automotive architectures. High Implementation Costs to restrain the Automotive Hypervisor Market Growth The High implementation costs and integration complexity remain primary challenges, as deploying hypervisor solutions often requires advanced hardware upgrades, extensive software customization, and specialized technical expertise. Specialized hardware requirements, as hypervisors demand advanced System-on-Chips (SoCs), increased RAM, enhanced security modules, and robust Electronic Control Units (ECUs). Upgrading existing vehicle architectures especially in older or budget models entails significant costs. Software development and integration also pose barriers, requiring heavy investment in research and development, rigorous system integration, and extensive testing to ensure compatibility across diverse hardware platforms and operating systems. Maintenance and upgrade requirements add complexity, as hypervisor systems need continuous updates, security patches, and adherence to evolving industry standards such as ISO 26262 and UNECE WP.29. Each software update or introduction of a new vehicle feature can trigger substantial additional costs. For mainstream OEMs, the complexity and risk of retrofitting existing models or designing new platforms specifically for hypervisors can be prohibitive. This often limits adoption to luxury carmakers or high-end models where the investment can be justified by premium pricing. Regulatory compliance further amplifies the challenge, as meeting stringent safety and cybersecurity requirements demands extensive certification, audits, and additional engineering efforts. Smaller or cost-sensitive automakers struggle to bear these expenses, particularly in competitive markets where cost efficiency is critical. These combined factors ranging from costly hardware upgrades to ongoing regulatory and technical burdens create significant barriers to scaling hypervisor adoption across all vehicle segments, potentially slowing the market’s growth despite strong demand for advanced in-vehicle computing and virtualization solutions. Electric Vehicle Growth creates lucrative growth opportunities to the Automotive Hypervisor Market The growth of the electric vehicle (EV) market presents a significant opportunity for the Automotive Hypervisor Market. EVs demand advanced software integration for battery management, power distribution, real-time safety systems, infotainment, and connectivity. Hypervisors enable these diverse applications to run securely and efficiently on shared hardware, facilitating system consolidation and reducing the number of Electronic Control Units (ECUs). This not only saves space and costs but also optimizes energy use critical for EV efficiency. With EV adoption surging over 4 million units sold globally in Q1 2025 alone automakers are increasingly integrating autonomous and connected features, making hypervisors essential for isolating safety-critical tasks from non-critical ones. This ensures functional safety, supports over-the-air updates, and meets stringent regulatory standards in markets such as North America and Europe. Leading EV manufacturers such as Tesla, BMW, Mercedes-Benz, and Volkswagen are already deploying hypervisor platforms (e.g., BlackBerry QNX, Green Hills Software) to integrate ADAS, battery monitoring, and infotainment within unified architectures. Regional policies, such as Brazil’s $3.8 billion green mobility incentives, are accelerating adoption by funding advanced vehicle platforms. As the EV market grows toward 245 million units globally by 2030, hypervisor adoption rise in parallel, positioning the technology as a cornerstone of next-generation electric mobility.

Automotive Hypervisor Market Segment Analysis:

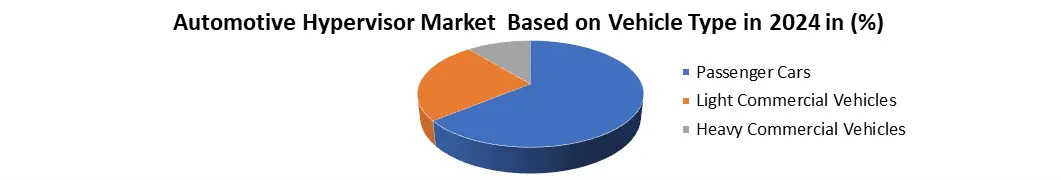

Based on Type, the autonomous hypervisor market is segmented by type Type 1, and Type 2. In 2024, Type 1 hypervisors dominated the Automotive Hypervisor Market, driven by their ability to operate directly on hardware, delivering superior efficiency, low latency, and enhanced security. By granting direct access to system resources, they are ideal for mission-critical automotive functions such as advanced driver assistance systems (ADAS), autonomous driving platforms, and high-reliability infotainment systems. Their robust performance and isolation capabilities make them the preferred choice for safety-critical applications, where seamless operation and stringent cybersecurity are essential. In contrast, Type 2 hypervisors run on top of an operating system, introducing additional latency and slightly reduced security. However, they offer simpler installation, lower deployment costs, and easier maintenance, making them suitable for less demanding automotive applications, including prototype testing, secondary infotainment systems, and non-critical connectivity solutions. Automakers often select Type 1 hypervisors for electric and premium vehicles, where maximum performance and safety are priorities, while Type 2 solutions cater to use cases prioritizing flexibility and faster integration. This performance-security balance paved Type 1’s position as the market leaderBased on Vehicle Type, the autonomous hypervisor market Segment by vehicle type into passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV) segments. In 2024, the passenger car segment held the largest share of the Automotive Hypervisor Market. the strong demand for advanced features, rapid urbanization, and cutting-edge technology integration. Passenger cars increasingly adopt hypervisor technology to power infotainment, ADAS, connectivity, and autonomous driving systems securely on shared hardware. Rising living standards and personal transportation needs boosted sales, with Asia Pacific capturing over 39.8% of the market. Automakers such as Tesla, BMW, and Mercedes-Benz prioritized passenger cars for innovations, leveraging hypervisors to enhance safety, performance, and user experience. The shift toward connected, electric, and semi-autonomous vehicles is most prominent in this segment, supported by regulatory and sustainability goals. Hypervisors enable efficient system consolidation, reducing costs while improving functionality. Notable examples include Tesla’s Model S/X and BMW’s i Series, which showcased hypervisor-driven ADAS and connectivity. This made passenger cars the dominant and fastest-growing segment for automotive hypervisor solutions.

Automotive Hypervisor Market Regional Insights:

Asia Pacific Dominated the Automotive Hypervisor Market The Asia Pacific dominated the Automotive Hypervisor Market in 2024. The demand for luxury segment vehicles in countries such as India and Thailand is boosting the adoption of automotive hypervisors. The increasing uptake of advanced features such as ADAS, in-vehicle infotainment, and navigation systems in next-generation vehicles is boosting the overall demand for hypervisors in the region. Asia Pacific boasts a robust ecosystem for the development of self-driving cars, with the presence of tech giants, automotive OEMs, and tier 1 suppliers. Collaborations among these stakeholders, coupled with support from government agencies, further augur well for the growth of the automotive hypervisor market in the region during the forecast period. The Asia Pacific region was dominated the global automotive hypervisor market in 2024. The vast automotive production base, rapid technology adoption, and accelerating electric vehicle (EV) growth. The region accounts for over 60% of global vehicle production, with China, Japan, South Korea, and India leading manufacturing output. This scale creates a strong foundation for embedding hypervisor technology in new models. Advanced vehicle features such as ADAS, infotainment, connected services, and autonomous driving are gaining traction across the region, all of which rely on hypervisors for secure and efficient system integration. EV adoption is a major growth engine China alone registered 8.1 million new electric cars in 2023, a 35% year-on-year rise while India, Japan, and South Korea also see rapid growth driven by government initiatives like China’s “Made in China 2025” and India’s FAME II. Leading OEMs such as BYD, Toyota, Hyundai, and Tata Motors, alongside technology firms like Panasonic, Renesas Electronics, and NXP Semiconductors, are investing heavily in hypervisor-enabled platforms. The deployments range from BYD’s integrated ADAS and infotainment systems in China to Hyundai’s hypervisor-supported EV safety features in South Korea. Collaborative ecosystems involving automakers, tech suppliers, and governments further accelerate adoption, solidifying Asia Pacific’s position as the global hub for automotive hypervisor innovation. Automotive Hypervisor Market Competitive Landscape The automotive hypervisor market is highly competitive, driven by collaborations, technological innovations, and expanding applications in software-defined vehicles. Key players include BlackBerry Limited, Panasonic Holdings Corporation, Green Hills Software, Sasken Technologies, Visteon Corporation, Siemens AG, Wind River Systems, Renesas Electronics, Continental, Harman, Hangsheng Technology, and IBM. BlackBerry’s QNX Type 1 hypervisor is widely adopted for secure, multi-OS integration, with partnerships like ETAS GmbH and Marelli enhancing safety-critical and eCockpit solutions. Panasonic Automotive Systems leads in virtualization security and high-performance computing innovations, including the Neuron HPC platform and vSkipGen virtual cockpit. NXP Semiconductors’ S32G Vehicle Integration Platform accelerates software-defined vehicle development. Industry collaborations, such as LDRA with OpenSynergy, strengthen cybersecurity strategies for embedded automotive systems. These companies focus on integrating ADAS, infotainment, and connectivity while ensuring compliance with safety standards like ISO 26262, leveraging hypervisors to enable system consolidation, security, and OTA capabilities positioning themselves to capture growth in the rapidly evolving EV and autonomous vehicle landscape. Automotive Hypervisor Market Key Developments • June 2021: LDRA, a provider of automated software verification, testing tools, and analysis services, partnered with automotive embedded software specialist OpenSynergy to promote a defense-in-depth strategy for embedded automotive functions and applications using hypervisor technology. • February 2022: NXP Semiconductors launched the S32G Vehicle Integration Platform, designed to accelerate the development of software-defined vehicles (SDVs) using S32G vehicle network processors. The platform supports processor evaluation, software development, rapid prototyping, and real-time performance monitoring. • January 2023: Panasonic Automotive Systems Co., Ltd. introduced VERZEUSE for Virtualization Extensions, an advanced virtualization security solution aimed at protecting next-generation vehicle cockpit systems from cyber-attacks by consolidating multiple ECUs into a single ECU via a hypervisor platform. • November 2023 : Panasonic Automotive Systems released Virtual SkipGen (vSkipGen) on AWS Marketplace, enabling early-stage automotive development without physical hardware. vSkipGen is a virtual replica of Panasonic’s 3rd generation SkipGen Digital Cockpit, developed in collaboration with Amazon. • January 2024: Panasonic Automotive Systems unveiled Neuron™ HPC, a high-performance computing platform that supports both software and hardware upgrades across a vehicle’s lifecycle, addressing evolving SDV requirements. • April 2024: BlackBerry Limited partnered with ETAS GmbH to co-develop and market software solutions that enhance safety-critical functions in next-generation SDVs. Automotive Hypervisor Market Key Trends 1. Rising Adoption of Hypervisors to Support Advanced Vehicle Functionalities Across regions, there is a clear shift toward vehicles with advanced driver assistance systems (ADAS), connected features, and autonomous capabilities. Markets such as the U.S., Europe, and Asia Pacific are witnessing strong demand for hypervisors as they efficiently manage multiple ECUs and enable seamless integration of complex electronic systems. This trend is fueled by luxury and premium vehicle growth in the U.S. and India, regulatory-driven safety feature adoption in Europe, and consumer preference for connected vehicles in Asia Pacific. 2. Regulatory and Technological Push Accelerating Hypervisor Integration Global automotive markets are experiencing a dual push from stringent safety, emissions, and cybersecurity regulations, alongside rapid technological innovation. Governments in regions like the UK, Germany, and Latin America are promoting EVs, autonomous driving, and secure vehicle architectures. This is compelling OEMs and technology providers to deploy hypervisors to meet compliance requirements, enhance vehicle performance, and safeguard data, making regulatory-driven technology adoption a central growth driver worldwide.Automotive Hypervisor Market Scope: Inquire before buying

Automotive Hypervisor Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 417.72 Mn. Forecast Period 2025 to 2032 CAGR: 27.2% Market Size in 2032: USD 2862.74 Mn. Segments Covered: by Type Type 1 Type 2 by Vehicle Type Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles by Bus System CAN LIN Ethernet Flexray by End-User Economy vehicles Mid-priced vehicle Luxury vehicle by Level Of Autonomous Driving Semi-autonomous Vehicle Autonomous Vehicle Automotive Hypervisor Market, by Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Automotive Hypervisor Market, Key Players

North America 1. BlackBerry –Canada 2. Green Hills Software – USA 3. Harman International – USA 4. Qualcomm Technologies – USA 5. Texas Instruments – USA 6. Lynx Software Technologies – USA 7. VMware – USA Europe 1. NXP Semiconductors – Netherlands 2. Siemens – Germany 3. Elektrobit – Germany 4. SYSGO – Germany 5. OpenSynergy – Germany 6. Luxoft – Switzerland 7. QT Company – Finland 8. ETAS – Germany 9. Infineon Technologies – Germany Asia-Pacific 1. Panasonic – Japan 2. Renesas Electronics – Japan 3. Visteon Corporation – USA 4. Sasken Technologies – India 5. KPIT Technologies – India 6. Tata Elxsi – India 7. Hangsheng Technology – ChinaFrequently Asked Questions:

1] What Major Key players in the Global Automotive Hypervisor Market report? Ans. The Major Key players covered in the Automotive Hypervisor Market report are BlackBerry QNX, Green Hills Software, Wind River Systems, Mentor (a Siemens Business), Wind River Systems Red Hat (part of IBM). 2] Which region is expected to hold the highest share in the Global Automotive Hypervisor Market? Ans. Asia Pacific region is expected to hold the highest share in the Automotive Hypervisor Market. 3] What is the market size of the Global Automotive Hypervisor Market by 2030? Ans. The market size of the Automotive Hypervisor Market by 2032 is expected to reach US$ 2862.74 Million. 4] What is the forecast period for the Global Automotive Hypervisor Market? Ans. The forecast period for the Automotive Hypervisor Market is 2025-2032. 5] What was the market size of the Global Automotive Hypervisor Market in 2024? Ans. The market size of the Automotive Hypervisor Market in 2024 was valued at US$ 417.72 Million.

1. Automotive Hypervisor Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Automotive Hypervisor Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Automotive Hypervisor Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Automotive Hypervisor Market: Dynamics 3.1. Automotive Hypervisor Market Trends by Region 3.1.1. North America Automotive Hypervisor Market Trends 3.1.2. Europe Automotive Hypervisor Market Trends 3.1.3. Asia Pacific Automotive Hypervisor Market Trends 3.1.4. Middle East and Africa Automotive Hypervisor Market Trends 3.1.5. South America Automotive Hypervisor Market Trends 3.2. Automotive Hypervisor Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Automotive Hypervisor Market Drivers 3.2.1.2. North America Automotive Hypervisor Market Restraints 3.2.1.3. North America Automotive Hypervisor Market Opportunities 3.2.1.4. North America Automotive Hypervisor Market Challenges 3.2.2. Europe 3.2.2.1. Europe Automotive Hypervisor Market Drivers 3.2.2.2. Europe Automotive Hypervisor Market Restraints 3.2.2.3. Europe Automotive Hypervisor Market Opportunities 3.2.2.4. Europe Automotive Hypervisor Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Automotive Hypervisor Market Drivers 3.2.3.2. Asia Pacific Automotive Hypervisor Market Restraints 3.2.3.3. Asia Pacific Automotive Hypervisor Market Opportunities 3.2.3.4. Asia Pacific Automotive Hypervisor Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Automotive Hypervisor Market Drivers 3.2.4.2. Middle East and Africa Automotive Hypervisor Market Restraints 3.2.4.3. Middle East and Africa Automotive Hypervisor Market Opportunities 3.2.4.4. Middle East and Africa Automotive Hypervisor Market Challenges 3.2.5. South America 3.2.5.1. South America Automotive Hypervisor Market Drivers 3.2.5.2. South America Automotive Hypervisor Market Restraints 3.2.5.3. South America Automotive Hypervisor Market Opportunities 3.2.5.4. South America Automotive Hypervisor Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Automotive Hypervisor Industry 3.8. Analysis of Government Schemes and Initiatives For Automotive Hypervisor Industry 3.9. Automotive Hypervisor Market Trade Analysis 3.10. The Global Pandemic Impact on Automotive Hypervisor Market 4. Automotive Hypervisor Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 4.1.1. Type 1 4.1.2. Type 2 4.2. Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 4.2.1. Passenger Cars 4.2.2. Light Commercial Vehicles 4.2.3. Heavy Commercial Vehicles 4.3. Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 4.3.1. CAN 4.3.2. LIN 4.3.3. Ethernet 4.3.4. Flexray 4.4. Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 4.4.1. Economy vehicles 4.4.2. Mid-priced vehicle 4.4.3. Luxury vehicle 4.5. Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 4.5.1. Semi-autonomous Vehicle 4.5.2. Autonomous Vehicle 4.6. Automotive Hypervisor Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Automotive Hypervisor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 5.1.1. Type 1 5.1.2. Type 2 5.2. North America Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 5.2.1. Passenger Cars 5.2.2. Light Commercial Vehicles 5.2.3. Heavy Commercial Vehicles 5.3. North America Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 5.3.1. CAN 5.3.2. LIN 5.3.3. Ethernet 5.3.4. Flexray 5.4. North America Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 5.4.1. Economy vehicles 5.4.2. Mid-priced vehicle 5.4.3. Luxury vehicle 5.5. North America Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 5.5.1. Semi-autonomous Vehicle 5.5.2. Autonomous Vehicle 5.6. North America Automotive Hypervisor Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 5.6.1.1.1. Type 1 5.6.1.1.2. Type 2 5.6.1.2. United States Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 5.6.1.2.1. Passenger Cars 5.6.1.2.2. Light Commercial Vehicles 5.6.1.2.3. Heavy Commercial Vehicles 5.6.1.3. United States Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 5.6.1.3.1. CAN 5.6.1.3.2. LIN 5.6.1.3.3. Ethernet 5.6.1.3.4. Flexray 5.6.1.4. United States Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 5.6.1.4.1. Economy vehicles 5.6.1.4.2. Mid-priced vehicle 5.6.1.4.3. Luxury vehicle 5.6.1.5. United States Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 5.6.1.5.1. Semi-autonomous Vehicle 5.6.1.5.2. Autonomous Vehicle 5.6.2. Canada 5.6.2.1. Canada Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 5.6.2.1.1. Type 1 5.6.2.1.2. Type 2 5.6.2.2. Canada Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 5.6.2.2.1. Passenger Cars 5.6.2.2.2. Light Commercial Vehicles 5.6.2.2.3. Heavy Commercial Vehicles 5.6.2.3. Canada Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 5.6.2.3.1. CAN 5.6.2.3.2. LIN 5.6.2.3.3. Ethernet 5.6.2.3.4. Flexray 5.6.2.4. Canada Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 5.6.2.4.1. Economy vehicles 5.6.2.4.2. Mid-priced vehicle 5.6.2.4.3. Luxury vehicle 5.6.2.5. Canada Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 5.6.2.5.1. Semi-autonomous Vehicle 5.6.2.5.2. Autonomous Vehicle 5.6.3. Mexico 5.6.3.1. Mexico Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 5.6.3.1.1. Type 1 5.6.3.1.2. Type 2 5.6.3.2. Mexico Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 5.6.3.2.1. Passenger Cars 5.6.3.2.2. Light Commercial Vehicles 5.6.3.2.3. Heavy Commercial Vehicles 5.6.3.3. Mexico Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 5.6.3.3.1. CAN 5.6.3.3.2. LIN 5.6.3.3.3. Ethernet 5.6.3.3.4. Flexray 5.6.3.4. Mexico Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 5.6.3.4.1. Economy vehicles 5.6.3.4.2. Mid-priced vehicle 5.6.3.4.3. Luxury vehicle 5.6.3.5. Mexico Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 5.6.3.5.1. Semi-autonomous Vehicle 5.6.3.5.2. Autonomous Vehicle 6. Europe Automotive Hypervisor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 6.2. Europe Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 6.3. Europe Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 6.4. Europe Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 6.5. Europe Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 6.6. Europe Automotive Hypervisor Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 6.6.1.2. United Kingdom Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.1.3. United Kingdom Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 6.6.1.4. United Kingdom Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 6.6.1.5. United Kingdom Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 6.6.2. France 6.6.2.1. France Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 6.6.2.2. France Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.2.3. France Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 6.6.2.4. France Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 6.6.2.5. France Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 6.6.3.2. Germany Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.3.3. Germany Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 6.6.3.4. Germany Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 6.6.3.5. Germany Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 6.6.4.2. Italy Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.4.3. Italy Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 6.6.4.4. Italy Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 6.6.4.5. Italy Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 6.6.5.2. Spain Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.5.3. Spain Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 6.6.5.4. Spain Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 6.6.5.5. Spain Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 6.6.6.2. Sweden Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.6.3. Sweden Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 6.6.6.4. Sweden Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 6.6.6.5. Sweden Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 6.6.7.2. Austria Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.7.3. Austria Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 6.6.7.4. Austria Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 6.6.7.5. Austria Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 6.6.8.2. Rest of Europe Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.8.3. Rest of Europe Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 6.6.8.4. Rest of Europe Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 6.6.8.5. Rest of Europe Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7. Asia Pacific Automotive Hypervisor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.3. Asia Pacific Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.4. Asia Pacific Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.5. Asia Pacific Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6. Asia Pacific Automotive Hypervisor Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.1.2. China Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.1.3. China Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.1.4. China Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.1.5. China Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.2.2. S Korea Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.2.3. S Korea Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.2.4. S Korea Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.2.5. S Korea Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.3.2. Japan Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.3.3. Japan Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.3.4. Japan Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.3.5. Japan Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6.4. India 7.6.4.1. India Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.4.2. India Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.4.3. India Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.4.4. India Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.4.5. India Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.5.2. Australia Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.5.3. Australia Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.5.4. Australia Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.5.5. Australia Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.6.2. Indonesia Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.6.3. Indonesia Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.6.4. Indonesia Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.6.5. Indonesia Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.7.2. Malaysia Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.7.3. Malaysia Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.7.4. Malaysia Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.7.5. Malaysia Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.8.2. Vietnam Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.8.3. Vietnam Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.8.4. Vietnam Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.8.5. Vietnam Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.9.2. Taiwan Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.9.3. Taiwan Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.9.4. Taiwan Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.9.5. Taiwan Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 7.6.10.2. Rest of Asia Pacific Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.10.3. Rest of Asia Pacific Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 7.6.10.4. Rest of Asia Pacific Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 7.6.10.5. Rest of Asia Pacific Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 8. Middle East and Africa Automotive Hypervisor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 8.3. Middle East and Africa Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 8.4. Middle East and Africa Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 8.5. Middle East and Africa Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 8.6. Middle East and Africa Automotive Hypervisor Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 8.6.1.2. South Africa Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.1.3. South Africa Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 8.6.1.4. South Africa Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 8.6.1.5. South Africa Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 8.6.2.2. GCC Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.2.3. GCC Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 8.6.2.4. GCC Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 8.6.2.5. GCC Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 8.6.3.2. Nigeria Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.3.3. Nigeria Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 8.6.3.4. Nigeria Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 8.6.3.5. Nigeria Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 8.6.4.2. Rest of ME&A Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.4.3. Rest of ME&A Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 8.6.4.4. Rest of ME&A Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 8.6.4.5. Rest of ME&A Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 9. South America Automotive Hypervisor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 9.2. South America Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 9.3. South America Automotive Hypervisor Market Size and Forecast, by Bus System(2024-2032) 9.4. South America Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 9.5. South America Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 9.6. South America Automotive Hypervisor Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 9.6.1.2. Brazil Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 9.6.1.3. Brazil Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 9.6.1.4. Brazil Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 9.6.1.5. Brazil Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 9.6.2.2. Argentina Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 9.6.2.3. Argentina Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 9.6.2.4. Argentina Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 9.6.2.5. Argentina Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Automotive Hypervisor Market Size and Forecast, by Type (2024-2032) 9.6.3.2. Rest Of South America Automotive Hypervisor Market Size and Forecast, by Vehicle Type (2024-2032) 9.6.3.3. Rest Of South America Automotive Hypervisor Market Size and Forecast, by Bus System (2024-2032) 9.6.3.4. Rest Of South America Automotive Hypervisor Market Size and Forecast, by End-User (2024-2032) 9.6.3.5. Rest Of South America Automotive Hypervisor Market Size and Forecast, by Level Of Autonomous Driving (2024-2032) 10. Company Profile: Key Players 10.1. BlackBerry –Canada 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Green Hills Software – USA 10.3. Harman International – USA 10.4. Qualcomm Technologies – USA 10.5. Texas Instruments – USA 10.6. Lynx Software Technologies – USA 10.7. VMware – USA 10.8. NXP Semiconductors – Netherlands 10.9. Siemens – Germany 10.10. Elektrobit – Germany 10.11. SYSGO – Germany 10.12. OpenSynergy – Germany 10.13. Luxoft – Switzerland 10.14. QT Company – Finland 10.15. ETAS – Germany 10.16. Infineon Technologies – Germany 10.17. Panasonic – Japan 10.18. Renesas Electronics – Japan 10.19. Visteon Corporation – USA 10.20. Sasken Technologies – India 10.21. KPIT Technologies – India 10.22. Tata Elxsi – India 10.23. Hangsheng Technology – China 11. Key Findings 12. Industry Recommendations 13. Automotive Hypervisor Market: Research Methodology 14. Terms and Glossary