Automotive Emission Analyser Market was valued at US$ 229.10 Mn. in 2022. Global Automotive Emission Analyser Market size is estimated to grow at a CAGR of 6.2%. The market is expected to reach value of US$ 349.06 Mn in 2029.Automotive Emission Analyser Market Overview:

An automotive emission analyzer is a device that monitors gas emissions from automobiles that run on both diesel and gasoline. For gasoline-fueled automobiles, an emission analyzer monitors and shows the level of air pollutants such as carbon monoxide (CO), hydrocarbons (HC), and nitrous oxides. The opacity measurement is displayed by the analyzer in the case of diesel-fueled cars. Input devices, sensors, an LCD display, and a microcontroller make up an automotive emission analyzer. Iridium 50 gas sensor and NOXO 100 sensor are utilized in the vehicle emission analyzer. Carbon dioxide, hydrocarbons, and nitrous oxide are all detected by these sensors. The analyzer also has a temperature sensor, which provides the user with rpm and temperature information when they first turn it on. The results of the emission analyzer are compared to those of a recognized emission testing center with the Land Transportation Office (LTO). The precision of an emission analyzer is determined by repeating the test for the same vehicle ten times. Carbon dioxide, hydrocarbons, and nitrous oxide have accuracy values of 98.88 %, 98.42 %, and 98.08 %, respectively.To know about the Research Methodology :- Request Free Sample Report

Automotive Emission Analyser Market Dynamics:

Government agencies have been forced to impose strict controls on the emission of nitrogen oxides, sulfur oxides, and particulate matter as a result of climate change. In addition, the market for emission analyzers is being driven by rising pollution and related contaminants that endanger human life. Some examples of such regulations include the EPA's (Environmental Protection Agency) and UNFCC's (United Nations Framework Classification for Resources) guidelines for wastewater treatment, as well as the Chinese government's new emission standards to limit the emission of VOCs (volatile organic components) in the country. These new laws will also help to boost the market for emission analyzers. The high cost of emission analyzers is a major stumbling block to the market's expansion. The issue is that enterprises must make costly adjustments to current systems in order to include combustion control components, and so emission analyzers may prove to be a financial burden for low-income organizations and manufacturers. Emission standards in several first-world countries aren't as strict as they should be, which will hurt the market in the coming years. Furthermore, in the long run, increased awareness of the negative consequences of dangerous gases may offset and reduce the severity of the constraints. Vehicle economy can be enhanced by adjusting the fuel input and engine firing cycle to match the vehicle's emissions. This will result in the best option for less pollution and more vehicle efficiency, as well as improved engine performance. The Automotive Emission Analyzer has a precision of 98.88 % for carbon dioxide, 98.42 % for hydrocarbons, and 98.08 % for nitrogen oxide. Governments all around the world have signed numerous agreements to decrease air pollution caused by automobile emissions. This approach is adopted by Europe, and countries in APAC such as Japan, India, China, and South Korea have made it essential to use Harmonized light vehicle test procedures, which will assist reduce fuel emissions and grow the Global Automotive Emission Analyzer Market. Automobile manufacturers all over the world are attempting to create fuel-efficient vehicles. These steps are being done by the automobile industry, and they are projected to boost the Global Automotive Emission Analyzer Market forward.Automotive Emission Analyser Market Segment Analysis:

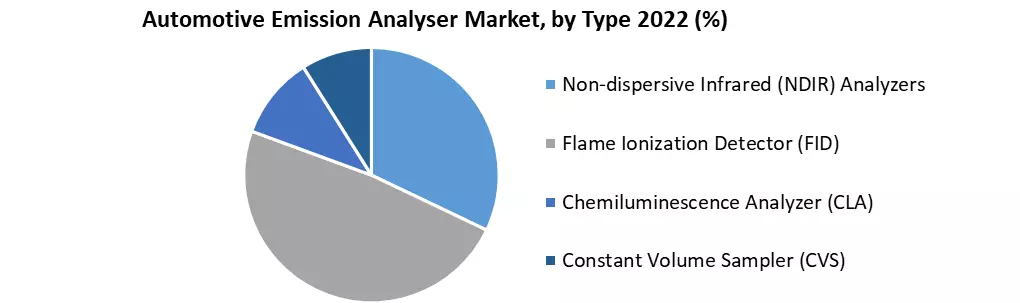

Based on Type, the market is sub-segmented into non-dispersive Infrared (NDIR) Analyzers, Flame Ionization Detector (FID), Chemiluminescence Analyzer (CLA) and Constant Volume Sampler (CVS). Over the anticipated period, the non-dispersive infrared (NDIR) category is expected to increase at the fastest rate. The non-dispersive infrared (NDIR) analyzer uses NDIR technology to monitor SO2, NOx, CO, and other gases that absorb infrared light, such as CO2 and hydrocarbons. This method can be used to measure both low and high sensitivity gases such as CO2, CO, CH4, NO, and SO2. Furthermore, non-dispersive infrared (NDIR) technology employs a broadband infrared (IR) emitter that covers all of the wavelengths of interest for a specific set of gases to be monitored, resulting in the highest CAGR during the forecast period. For example, in March 2022, HORIBA, Ltd. released the APCA-370 Ambient Carbon Analyzer.

Global Automotive Emission Analyser Market Regional Insights:

With increased vehicle sales in the region, the North American automotive emission analyzer market is expected to reach US$ 313.5 Mn with a CAGR of 5.2 % over the forecast period. Because of the enormous number of automobile sales, emission management is one of the most difficult tasks in the United States, owing to the rise in air pollution. According to the Bureau of Transportation Statistics of America, 118,200 vehicles were sold in the United States in May of 2022. The market for automobile emission analyzers in North America is expected to grow significantly as a result of this aspect. The European automotive emission analyzer market is also increasing rapidly, mainly to the growth of the European automobile market, which is likely to boost demand for automotive emission analyzers. The EU passenger car fleet increased by 5.7 % during the forecast period, according to the European Automobile Manufacturers Association. Furthermore, throughout this time, the number of automobiles on the road climbed from 243 to 257 million. The objective of the report is to present a comprehensive analysis of the Automotive Emission Analyser Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help understand the Automotive Emission Analyser Market dynamic and structure by analyzing the market segments and projecting the Automotive Emission Analyser Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Automotive Emission Analyser Market make the report investor’s guide.Automotive Emission Analyser Market Scope: Inquiry Before Buying

Automotive Emission Analyser Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 229.10 Mn. Forecast Period 2023 to 2029 CAGR: 6.2% Market Size in 2029: US$ 349.06 Mn. Segments Covered: by Type • Non-dispersive Infrared (NDIR) Analyzers • Flame Ionization Detector (FID) • Chemiluminescence Analyzer (CLA) • Constant Volume Sampler (CVS) by Supply chain • OEM • Aftermarket Automotive Emission Analyser Market, by Region:

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Automotive Emission Analyser Market Key Players are:

• HORIBA • AVL • BOSCH • SENSORS • Motorscan • Fuji Eletric • Kane • MRU Instrument • ECOM • EMS Emission System • Nanhua • Foshan Analytical • Mingquan • Tianjin Shengwei • Cubic Optoelectronic Frequently Asked Questions: 1] What segments are covered in the Automotive Emission Analyser Market report? Ans. The segments covered in the Automotive Emission Analyser Market report are based on Type and Supply chain 2] Which region is expected to hold the highest share in the Automotive Emission Analyser Market? Ans. The Asia Pacific region is expected to hold the highest share in the Automotive Emission Analyser Market. 3] What is the market size of the Automotive Emission Analyser Market by 2029? Ans. The market size of the Automotive Emission Analyser Market is expected to reach US $ 349.06 Mn. by 2029. 4] What is the forecast period for the Automotive Emission Analyser Market? Ans. The Forecast period for the Automotive Emission Analyser Market is 2023-2029. 5] What was the market size of the Automotive Emission Analyser Market in 2022? Ans. The market size of the Automotive Emission Analyser Market in 2022 was valued at US $ 229.10 Mn

1. Global Automotive Emission Analyser Market Size: Research Methodology 2. Global Automotive Emission Analyser Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Automotive Emission Analyser Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Automotive Emission Analyser Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Automotive Emission Analyser Market Size Segmentation 4.1. Global Automotive Emission Analyser Market Size, by Type (2022-2029) • Non-dispersive Infrared (NDIR) Analyzers • Flame Ionization Detector (FID) • Chemiluminescence Analyzer (CLA) • Constant Volume Sampler (CVS) 4.2. Global Automotive Emission Analyser Market Size, by Supply chain (2022-2029) • OEM • Aftermarket 5. North America Automotive Emission Analyser Market (2022-2029) 5.1. North America Automotive Emission Analyser Market Size, by Type (2022-2029) • Non-dispersive Infrared (NDIR) Analyzers • Flame Ionization Detector (FID) • Chemiluminescence Analyzer (CLA) • Constant Volume Sampler (CVS) 5.2. North America Automotive Emission Analyser Market Size, by Supply chain (2022-2029) • OEM • Aftermarket 5.3. North America Automotive Emission Analyser Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Automotive Emission Analyser Market (2022-2029) 6.1. European Automotive Emission Analyser Market, by Type (2022-2029) 6.2. European Automotive Emission Analyser Market Size, by Supply chain (2022-2029) 6.3. European Automotive Emission Analyser Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Automotive Emission Analyser Market (2022-2029) 7.1. Asia Pacific Automotive Emission Analyser Market, by Type (2022-2029) 7.2. Asia Pacific Automotive Emission Analyser Market Size, by Supply chain (2022-2029) 7.3. Asia Pacific Automotive Emission Analyser Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Automotive Emission Analyser Market (2022-2029) 8.1. Middle East and Africa Automotive Emission Analyser Market, by Type (2022-2029) 8.2. Middle East and Africa America Automotive Emission Analyser Market Size, by Supply chain (2022-2029) 8.3. Middle East and Africa Automotive Emission Analyser Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Automotive Emission Analyser Market (2022-2029) 9.1. Latin America Automotive Emission Analyser Market, by Type (2022-2029) 9.2. Latin America Automotive Emission Analyser Market Size, by Supply chain (2022-2029) 9.3. Latin America Automotive Emission Analyser Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. HORIBA 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. AVL 10.3. BOSCH 10.4. SENSORS 10.5. Motorscan 10.6. Fuji Eletric 10.7. Kane 10.8. MRU Instrument 10.9. ECOM 10.10. EMS Emission System 10.11. Nanhua 10.12. Foshan Analytical 10.13. Mingquan 10.14. Tianjin Shengwei 10.15. Cubic Optoelectronic