Automotive Defroster Nozzles Market size was valued at USD 1.48 billion in 2024, and the total Automotive Defroster Nozzles revenue is expected to grow at a CAGR of 6.42% from 2025 to 2032, reaching nearly USD 2.43 billion.Automotive Defroster Nozzles Market Overview

Automotive defroster nozzles are essential components of a vehicle’s heating, ventilation, and air conditioning (HVAC) system, designed to direct warm air onto the windshield and side windows to eliminate frost, ice, or condensation, thereby enhancing driver visibility in cold weather. The data-driven method allows engineers to predict defrosting patterns during the design phase, significantly reducing development time and enabling more effective nozzle placement and airflow control. Typically integrated into the dashboard, defroster nozzles work by projecting heated air across glass surfaces, accelerating defrosting and defogging processes. The adoption of advanced methodologies has since contributed to the development of high-performance HVAC systems that are not only energy-efficient but also effective across a wide range of climatic conditions, thereby driving innovation and growth in the Automotive Defroster Nozzles Market. The rising global vehicle production, increasing adoption of advanced HVAC systems, and heightened consumer demand for safety features in both passenger and commercial vehicles are driving the growth of the automotive defroster nozzles market. In 2024, global car sales reached 74.6 billion units, with strong performance in China and steady growth in the EU and North America. Despite a 6.2% drop in EU car production, global output stood at 75.5 billion units. Commercial vehicle sales also rose, particularly vans and buses in the EU and overall volumes in North America. These production trends, alongside a shift toward energy-efficient and high-performance HVAC components, underscore the increasing demand for effective defrosting systems, driving the Automotive Defroster Nozzles industry growth. The EU’s USD 94.09 billion automotive trade surplus, despite a slight decline, reflects continued export strength. As visibility and climate adaptability become more critical, defroster nozzles, key components of modern HVAC systems, are poised for broader integration in both traditional and electric vehicles across global markets. Innovations in nozzle design, such as the integration of computational modeling and multiple-regression analysis, have streamlined development processes, enabling precise airflow distribution and improved defrosting efficiency during the vehicle design phase.To Know About The Research Methodology :- Request Free Sample Report

Automotive Defroster Nozzles Market Dynamics

Trend: Integration of smart, sensor-driven systems and lightweight materials to boost the Automotive Defroster Nozzles Market Growth Modern nozzles incorporate sensor-based climate control systems that deliver real-time temperature and humidity data, enabling HVAC units to respond swiftly to changing conditions and maintain optimal visibility. With the global automotive sensor market projected to surge from USD 40.42 billion in 2024, the demand for smart defrosting systems is escalating rapidly. These systems feature embedded sensors that not only regulate airflow direction and intensity based on the cabin environment but also enhance energy efficiency and passenger comfort, contributing to the technological advancement of the Automotive Defroster Nozzles Market. The use of lightweight composite materials such as carbon fiber-reinforced polymers (CFRP) and glass fiber-reinforced polymers (GFRP) in defroster nozzle design contributes to vehicle weight reduction, key to improving fuel efficiency and reducing emissions. With CFRP offering a strength-to-weight ratio up to five times greater than steel while being 70% lighter, and GFRP delivering a 25% weight reduction compared to traditional materials, automakers meet increasingly stringent emission regulations without compromising performance. Smart defroster systems are being integrated with gesture-recognition technologies, LiDAR, and mmWave radar to support touchless environmental control inside the vehicle, adding a new dimension of user experience and safety, and driving innovation in the Automotive Defroster Nozzles Market. PXV and PGV absolute positioning systems from Pepperl+Fuchs exemplify how sensor innovation enables accurate skid and AGV positioning during automotive assembly, which enhances production precision and nozzle integration. With over 200 sensors in some modern vehicles, sensor fusion combining data from radar, LiDAR, and cameras is becoming vital for real-time decision-making, and HVAC systems are benefiting from this intelligence. The SAAF sensor series, specifically designed for HVAC applications, exemplifies how smart, compact, and rugged sensors can be embedded seamlessly into modern vehicle architectures, improving performance in harsh conditions while supporting fast, reliable response. Increasing demand for enhanced in-cabin comfort and visibility in extreme weather conditions to Boost Market growth The Automotive Defroster Nozzles Market is witnessing significant growth, driven by rising demand for enhanced in-cabin comfort and clear visibility in extreme weather. Over 70% of global drivers operate in regions frequently impacted by frost, snow, or fog, making efficient defrosting systems essential. Defroster nozzles, once considered luxury add-ons, are viewed as critical safety components within HVAC systems. Global road safety reports indicate that nearly 20% of winter-related accidents in cold climates are caused by poor visibility due to fogged or frosted windows. Automakers are integrating advanced defroster nozzles across various vehicle segments. For example, North America has seen a 35% rise in the adoption of beam-style wipers with embedded heating elements in SUVs and sedans over the past five years. According to MMR, 62% of car buyers in colder regions prioritize heated windshields, mirrors, and defroster-equipped HVAC systems in 2024. Features such as remote start, heated steering wheels, and rear electric defroster grids are becoming increasingly popular in Canada, Northern Europe, and the northern U.S., prompting brands such as Audi, BMW, and Volvo to report double-digit growth in winter package sales. The increase in EV adoption adds urgency for energy-efficient defrosting, as systems clear windows rapidly without draining battery life. Chargetrip includes defrosting energy in its EV route predictions. Regulatory mandates in Europe and Japan are accelerating innovation, encouraging OEMs to adopt composite, lightweight nozzles with precision airflow to meet safety and emissions benchmarks. The maintenance awareness is driving aftermarket demand, with defroster system complaints rising 40% in winter months. Service centers such as Auto Car Repair (myTVS) and Quick Lane offer advanced nozzle diagnostics and replacements, reflecting the growing aftermarket potential within the Automotive Defroster Nozzles Market. Technological upgrades, advancing efficiency AI-powered nozzles that adapt in real-time, have boosted defrosting performance by up to 50%, ensuring better safety during cold-weather driving. High Cost and Complex Integration in Entry-Level Vehicles to Hamper Automotive Defroster Nozzles Market Growth High cost and complex integration are impeding the growth of the automotive defroster nozzles market, particularly in the entry-level vehicle segment. While defroster nozzles are essential for ensuring driver visibility and meeting safety regulations under extreme weather conditions, their effective performance depends on advanced HVAC systems. This requires precise airflow control and thermal distribution, which in turn involve sophisticated engineering and manufacturing. Computational fluid dynamics (CFD) has demonstrated that defroster airflow tends to be highly nonuniform, demanding meticulous design refinements and customized ducting to achieve compliance with stringent standards such as those set by NHTSA. For entry-level vehicles, where affordability and production efficiency are key, these complex requirements pose serious cost and design challenges. Integrating high-efficiency defrost systems into basic vehicle models can significantly inflate production costs, and manufacturers are reluctant to compromise on other features or reduce profit margins to accommodate such systems. The need for simulation tools, iterative testing, and sensor-driven control mechanisms elevates the cost and complexity of integration. Smaller or budget-focused automakers lack the R&D infrastructure to implement these designs efficiently, slowing adoption and innovation in the low-cost vehicle segment, which hampers the Automotive Defroster Nozzles Market growth.Automotive Defroster Nozzles Market Segment Analysis

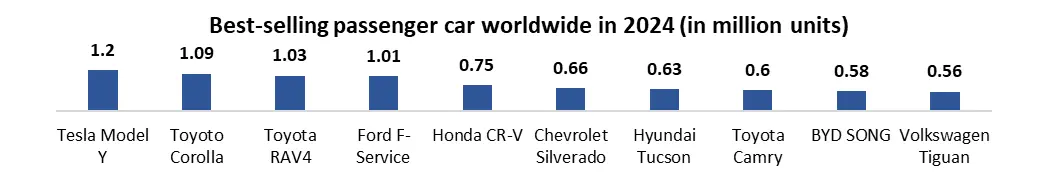

Based on Type, the Automotive Defroster Nozzles Market is segmented into the Inlet Defroster Nozzle and Outlet Defroster Nozzle. Outlet Defroster Nozzle held the largest Automotive Defroster Nozzles Market share in 2024. These nozzles are critical components of a vehicle’s HVAC system, strategically positioned to ensure maximum defrosting efficiency and visibility under extreme weather conditions. As consumer expectations around safety and comfort continue to rise especially in regions such as North America and Europe where winter driving is common automakers are prioritizing high-performance outlet nozzles that ensure rapid, uniform air distribution. The inlet nozzles, which manage air intake into the HVAC system, outlet defroster nozzles directly influence the driver’s field of vision, making them a more safety-sensitive component and thus more widely adopted. The growing popularity of SUVs, premium vehicles, and electric cars with smart climate control systems is driving demand for advanced defroster outlet nozzles integrated with sensors and automatic defrost features. In 2024, SUVs accounted for 54% of global car sales, continuing their upward trend due to consumer preferences for space, comfort, and higher driving positions.Based on Vehicle Type, the Automotive Defroster Nozzles market is segmented into Passenger Cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). Passenger Cars are expected to dominate the Automotive Defroster Nozzles Market during the forecast period. the sustained rise in global passenger vehicle production and sales, particularly SUVs and premium models that are increasingly equipped with advanced climate control and comfort features. These vehicles are designed with integrated HVAC systems that include high-performance defroster nozzles to ensure optimal windshield visibility and cabin comfort in several weather conditions. As urbanization and disposable incomes increase, especially in emerging economies, consumer preference is shifting toward passenger vehicles that offer enhanced safety, convenience, and technology integration. The growing adoption of electric and hybrid passenger cars further contributes to this trend, as these vehicles prioritize efficient energy management and intelligent defrosting systems that reduce energy consumption. In 2024, the Tesla Model Y became the best-selling passenger car globally, with approximately 1.09 million units sold, surpassing traditional leaders like the Toyota Corolla and RAV4. This shift highlights the growing consumer preference for electric and SUV-style vehicles. The surge in EV adoption, combined with the demand for enhanced in-cabin comfort and safety, is accelerating the integration of smart HVAC technologies, thereby driving significant growth and innovation in the Automotive Defroster Nozzles Market.

Automotive Defroster Nozzles Market Regional Insights

North America is expected to dominate the Automotive Defroster Nozzles Market over the forecast period. The harsh winter conditions, high vehicle ownership rates, and strict safety regulations drive the Automotive Defroster Nozzles Industry growth. With Billions of vehicles navigating snow, frost, and fog-prone environments each year, the demand for efficient windshield defrosting systems has become a critical priority for both OEMs and consumers. Automakers across the U.S. and Canada are increasingly integrating advanced HVAC systems with precision-engineered defroster nozzles to ensure rapid de-icing and enhanced visibility. The region's strong aftermarket ecosystem supports high replacement and upgrade rates, especially in colder states and provinces. The increase in SUV and electric vehicle sales is driving innovation in smart, energy-efficient nozzle designs tailored for next-generation mobility. As regulatory bodies such as NHTSA continue to enforce visibility and safety standards, North America has both technological adoption and Automotive Defroster Nozzles Market volume, making it a powerhouse in the defroster nozzle landscape. Automotive Defroster Nozzles Market Competitive Landscape The presence of several established global and regional players competing on technology innovation, product reliability, cost-efficiency, and OEM partnerships. Leading Automotive Defroster Nozzles companies such as Denso Corporation, MAHLE GmbH, Valeo SA, and Marelli Corporation dominate the market with their strong R&D capabilities, extensive global supply networks, and integration expertise with advanced HVAC systems. These companies focus heavily on developing lightweight, energy-efficient, and sensor-integrated defroster nozzles that align with evolving automotive design trends, particularly in electric and autonomous vehicles. Tier 1 suppliers work closely with automakers to co-develop custom solutions that meet vehicle-specific airflow and defrosting performance requirements. The smaller manufacturers and new entrants are increasingly targeting niche applications or offering cost-effective aftermarket solutions to gain a competitive edge. • Partnership with Betterfrost: In February 2024, DENSO collaborated with Betterfrost, a technology firm specializing in low-energy defrost solutions, to develop an innovative defrost and defog system for electric vehicles (EVs). Supported by nearly USD 1.5 Billion in funding from the Ontario Vehicle Innovation Network (OVIN) R&D Partnership Fund and industry contributions, the project aims to create a system that is 20 times more energy-efficient than current models.Automotive Defroster Nozzles Market Scope: Inquiry before Buying

Automotive Defroster Nozzles Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.48 Bn. Forecast Period 2025 to 2032 CAGR: 6.42% Market Size in 2032: USD 2.43 Bn. Segments Covered: by Type Inlet Defroster Nozzle Outlet Defroster Nozzle by Vehicle Type Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) by Material Plastic Metal Others by Sales Channel OEM Aftermarket Automotive Defroster Nozzles Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Automotive Defroster Nozzles Market Key Players

1. DENSO Corporation 2. Valeo S.A. 3. MAHLE GmbH 4. Bergstrom Inc. 5. Red Dot Corporation 6. Thermo King Corporation 7. Proair, LLC 8. SGM Company 9. Full Vision, Inc. 10. Interdynamics Research & Development 11. Delphi Technologies 12. Modine Manufacturing Company 13. Calsonic Kansei Corporation 14. Behr Hella Service GmbH 15. Hanon Systems 16. T.RAD Co., Ltd. 17. Calsonic Kansei 18. Mitsubishi Heavy Industries 19. Visteon Corporation 20. Toyota Boshoku Corporation 21. Sumitomo Electric Industries, Ltd. 22. Johnson Electric Holdings Limited 23. Mahindra & Mahindra Ltd. 24. Hella GmbH & Co. KGaA 25. Visteon Climate Control 26. BorgWarner Inc. 27. Continental AG 28. Sodecar Automotive 29. Dorman Products, Inc. 30. Kyungshin CorporationFrequently Asked Questions:

1] What segments are covered in the Automotive Defroster Nozzles Market report? Ans. The segments covered in the Automotive Defroster Nozzles Market report are based on Type, Vehicle Type, Material, End-use Industry, and region 2] Which region is expected to hold the highest share of the Automotive Defroster Nozzles Market? Ans. North America region is expected to hold the highest share of the Automotive Defroster Nozzles Market. 3] What was the market size of the Automotive Defroster Nozzles Market in 2024? Ans. The market size of the Automotive Defroster Nozzles Market in 2024 was USD 1.48 Bn. 4] What is the market size of the Automotive Defroster Nozzles Market by 2032? Ans. The market size of the Automotive Defroster Nozzles Market by 2032 is USD 2.43 Billion. 5] What is the growth rate of the Automotive Defroster Nozzles Market? Ans. The Global Automotive Defroster Nozzles Market is growing at a CAGR of 6.42% during the forecasting period 2025-2032.

1. Automotive Defroster Nozzles Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion and Volume in Units) - By Segments, Regions, and Country 2. Automotive Defroster Nozzles Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. Revenue (2024) 2.3.5. Market Share (%) 2024 2.3.6. Market Expansion Strategies 2.3.7. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Automotive Defroster Nozzles Market: Dynamics 3.1. Automotive Defroster Nozzles Market: Market Trends 3.2. Automotive Defroster Nozzles Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Automotive Defroster Nozzles Market 4. Technological Landscape 4.1. Smart Sensors and Control Integration 4.2. Lightweight Materials and 3D Printing 4.3. Innovations in Airflow and Venting Design 4.4. Embedded Heating Elements 4.5. AI-Driven Climate Control Algorithms 5. Regulatory and Environmental Considerations 5.1. Automotive Safety Standards 5.2. Environmental Impact and Compliance 5.3. Emission Regulations Impacting HVAC Systems 5.4. Material Recycling and End-of-Life Directives 5.5. Compliance with REACH and RoHS 5.6. Noise and Air Quality Standards Inside Cabin 5.7. Regulatory Push Toward Smart Safety Features 6. Automotive Defroster Nozzles Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 6.1. Automotive Defroster Nozzles Market Size and Forecast, By Type (2024-2032) 6.1.1. Inlet Defroster Nozzle 6.1.2. Outlet Defroster Nozzle 6.2. Automotive Defroster Nozzles Market Size and Forecast, By Vehicle Type (2024-2032) 6.2.1. Passenger Cars 6.2.2. Light Commercial Vehicles (LCVs) 6.2.3. Heavy Commercial Vehicles (HCVs) 6.3. Automotive Defroster Nozzles Market Size and Forecast, By Material (2024-2032) 6.3.1. Plastic 6.3.2. Metal 6.3.3. Others 6.4. Automotive Defroster Nozzles Market Size and Forecast, By Sales Channel (2024-2032) 6.4.1. OEM 6.4.2. Aftermarket 6.5. Automotive Defroster Nozzles Market Size and Forecast, By Region (2024-2032) 6.5.1. North America 6.5.2. Europe 6.5.3. Asia Pacific 6.5.4. Middle East and Africa 6.5.5. South America 7. North America Automotive Defroster Nozzles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 7.1. North America Automotive Defroster Nozzles Market Size and Forecast, By Type (2024-2032) 7.1.1. Inlet Defroster Nozzle 7.1.2. Outlet Defroster Nozzle 7.2. North America Automotive Defroster Nozzles Market Size and Forecast, By Vehicle Type (2024-2032) 7.2.1. Passenger Cars 7.2.2. Light Commercial Vehicles (LCVs) 7.2.3. Heavy Commercial Vehicles (HCVs) 7.3. North America Automotive Defroster Nozzles Market Size and Forecast, By Material (2024-2032) 7.3.1. Plastic 7.3.2. Metal 7.3.3. Others 7.4. North America Automotive Defroster Nozzles Market Size and Forecast, By Sales Channel (2024-2032) 7.4.1. OEM 7.4.2. Aftermarket 7.5. North America Automotive Defroster Nozzles Market Size and Forecast, by Country (2024-2032) 7.5.1. United States 7.5.1.1. United States Automotive Defroster Nozzles Market Size and Forecast, By Type (2024-2032) 7.5.1.1.1. Inlet Defroster Nozzle 7.5.1.1.2. Outlet Defroster Nozzle 7.5.1.2. United States Automotive Defroster Nozzles Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.1.2.1. Passenger Cars 7.5.1.2.2. Light Commercial Vehicles (LCVs) 7.5.1.2.3. Heavy Commercial Vehicles (HCVs) 7.5.1.3. United States Automotive Defroster Nozzles Market Size and Forecast, By Material (2024-2032) 7.5.1.3.1. Plastic 7.5.1.3.2. Metal 7.5.1.3.3. Others 7.5.1.4. United States Automotive Defroster Nozzles Market Size and Forecast, By Sales Channel (2024-2032) 7.5.1.4.1. OEM 7.5.1.4.2. Aftermarket 7.5.2. Canada 7.5.2.1. Canada Automotive Defroster Nozzles Market Size and Forecast, By Type (2024-2032) 7.5.2.1.1. Inlet Defroster Nozzle 7.5.2.1.2. Outlet Defroster Nozzle 7.5.2.2. Canada Automotive Defroster Nozzles Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.2.2.1. Passenger Cars 7.5.2.2.2. Light Commercial Vehicles (LCVs) 7.5.2.2.3. Heavy Commercial Vehicles (HCVs) 7.5.2.3. Canada Automotive Defroster Nozzles Market Size and Forecast, By Material (2024-2032) 7.5.2.3.1. Plastic 7.5.2.3.2. Metal 7.5.2.3.3. Others 7.5.2.4. Canada Automotive Defroster Nozzles Market Size and Forecast, By Sales Channel (2024-2032) 7.5.2.4.1. OEM 7.5.2.4.2. Aftermarket 7.5.3. Mexico 7.5.3.1. Mexico Automotive Defroster Nozzles Market Size and Forecast, By Type (2024-2032) 7.5.3.1.1. Inlet Defroster Nozzle 7.5.3.1.2. Outlet Defroster Nozzle 7.5.3.2. Mexico Automotive Defroster Nozzles Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.3.2.1. Passenger Cars 7.5.3.2.2. Light Commercial Vehicles (LCVs) 7.5.3.2.3. Heavy Commercial Vehicles (HCVs) 7.5.3.3. Mexico Automotive Defroster Nozzles Market Size and Forecast, By Material (2024-2032) 7.5.3.3.1. Plastic 7.5.3.3.2. Metal 7.5.3.3.3. Others 7.5.3.4. Mexico Automotive Defroster Nozzles Market Size and Forecast, By Sales Channel (2024-2032) 7.5.3.4.1. OEM 7.5.3.4.2. Aftermarket 8. Europe Automotive Defroster Nozzles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 8.1. Europe Automotive Defroster Nozzles Market Size and Forecast, By Type (2024-2032) 8.2. Europe Automotive Defroster Nozzles Market Size and Forecast, By Vehicle Type (2024-2032) 8.3. Europe Automotive Defroster Nozzles Market Size and Forecast, By Material (2024-2032) 8.4. Europe Automotive Defroster Nozzles Market Size and Forecast, By Sales Channel (2024-2032) 8.5. Europe Automotive Defroster Nozzles Market Size and Forecast, By Country (2024-2032) 8.5.1. United Kingdom 8.5.2. France 8.5.3. Germany 8.5.4. Italy 8.5.5. Spain 8.5.6. Sweden 8.5.7. Russia 8.5.8. Rest of Europe 9. Asia Pacific Automotive Defroster Nozzles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 9.1. Asia Pacific Automotive Defroster Nozzles Market Size and Forecast, By Type (2024-2032) 9.2. Asia Pacific Automotive Defroster Nozzles Market Size and Forecast, By Vehicle Type (2024-2032) 9.3. Asia Pacific Automotive Defroster Nozzles Market Size and Forecast, By Material 2024-2032) 9.4. Asia Pacific Automotive Defroster Nozzles Market Size and Forecast, By Sales Channel (2024-2032) 9.5. Asia Pacific Automotive Defroster Nozzles Market Size and Forecast, by Country (2024-2032) 9.5.1. China 9.5.2. S Korea 9.5.3. Japan 9.5.4. India 9.5.5. Australia 9.5.6. Indonesia 9.5.7. Malaysia 9.5.8. Philippines 9.5.9. Thailand 9.5.10. Vietnam 9.5.11. Rest of Asia Pacific 10. Middle East and Africa Automotive Defroster Nozzles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 10.1. Middle East and Africa Automotive Defroster Nozzles Market Size and Forecast, By Type (2024-2032) 10.2. Middle East and Africa Automotive Defroster Nozzles Market Size and Forecast, By Vehicle Type (2024-2032) 10.3. Middle East and Africa Automotive Defroster Nozzles Market Size and Forecast, By Material (2024-2032) 10.4. Middle East and Africa Automotive Defroster Nozzles Market Size and Forecast, By Sales Channel (2024-2032) 10.5. Middle East and Africa Automotive Defroster Nozzles Market Size and Forecast, by Country (2024-2032) 10.5.1. South Africa 10.5.2. GCC 10.5.3. Nigeria 10.5.4. Rest of ME&A 11. South America Automotive Defroster Nozzles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 11.1. South America Automotive Defroster Nozzles Market Size and Forecast, By Type (2024-2032) 11.2. South America Automotive Defroster Nozzles Market Size and Forecast, By Vehicle Type (2024-2032) 11.3. South America Automotive Defroster Nozzles Market Size and Forecast, By Material (2024-2032) 11.4. South America Automotive Defroster Nozzles Market Size and Forecast, By Sales Channel (2024-2032) 11.5. South America Automotive Defroster Nozzles Market Size and Forecast, by Country (2024-2032) 11.5.1. Brazil 11.5.2. Argentina 11.5.3. Colombia 11.5.4. Chile 11.5.5. Rest of South America 12. Company Profile: Key Players 12.1. DENSO Corporation 12.1.1. Company Overview 12.1.2. Business Portfolio 12.1.3. Financial Overview 12.1.4. SWOT Analysis 12.1.5. Strategic Analysis 12.2. Valeo S.A. 12.3. MAHLE GmbH 12.4. Bergstrom Inc. 12.5. Red Dot Corporation 12.6. Thermo King Corporation 12.7. Proair, LLC 12.8. SGM Company 12.9. Full Vision, Inc. 12.10. Interdynamics Research & Development 12.11. Delphi Technologies 12.12. Modine Manufacturing Company 12.13. Calsonic Kansei Corporation 12.14. Behr Hella Service GmbH 12.15. Hanon Systems 12.16. T.RAD Co., Ltd. 12.17. Calsonic Kansei 12.18. Mitsubishi Heavy Industries 12.19. Visteon Corporation 12.20. Toyota Boshoku Corporation 12.21. Sumitomo Electric Industries, Ltd. 12.22. Johnson Electric Holdings Limited 12.23. Mahindra & Mahindra Ltd. 12.24. Hella GmbH & Co. KGaA 12.25. Visteon Climate Control 12.26. BorgWarner Inc. 12.27. Continental AG 12.28. Sodecar Automotive 12.29. Dorman Products, Inc. 12.30. Kyungshin Corporation 13. Key Findings 14. Analyst Recommendations 15. Automotive Defroster Nozzles Market – Research Methodology