Global Automotive Carbon Monocoque Chassis Market is anticipated to reach US$ XX Mn by 2026 from US$ XX Mn in 2019 at a CAGR of 5.2% during a forecast period.Global Automotive Carbon Monocoque Chassis Market Overview

The primary supporting structure of an automobile on which a complete vehicle load is applied is the chassis. The chassis is in charge of bearing the weight of the engine, gearbox, shaft, and even the goods and passengers in the car. Furthermore, it performs various purposes such as withstanding the force induced by rapid braking, acceleration, and stresses caused by poor road conditions. Internal combustion engines, electric vehicles, and hybrid vehicles all make extensive use of them. It is available in a variety of shapes and sizes, as well as various material compositions. The report also helps in understanding Global Automotive Carbon Monocoque Chassis Market dynamics, structure by analyzing the market segments and project the Global Automotive Carbon Monocoque Chassis Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Automotive Carbon Monocoque Chassis Market make the report investor’s guide.To know about the Research Methodology :- Request Free Sample Report

Global Automotive Carbon Monocoque Chassis Market Dynamics

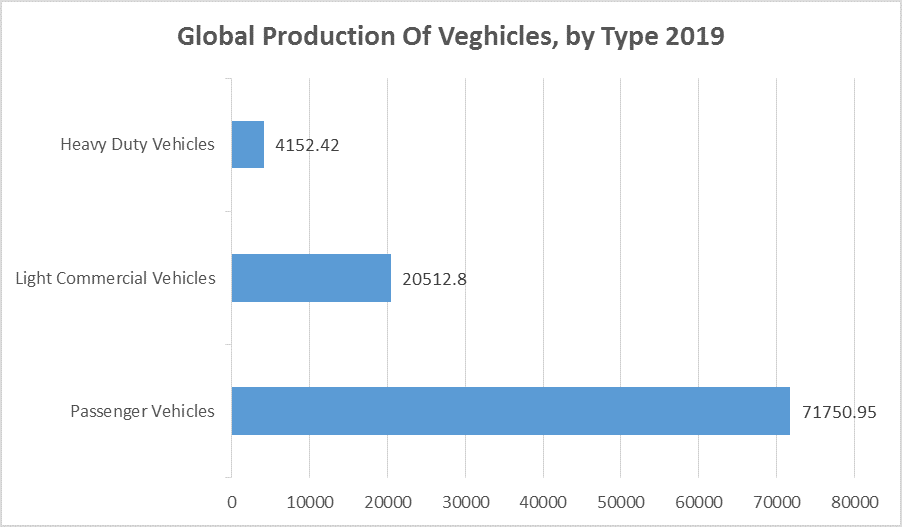

Increased production and sales of luxury cars and passenger vehicles, as well as light commercial vehicles like pick-up trucks and heavy-duty vehicles, are increasing automotive carbon monocoque chassis demand. With the availability of income on emerging markets worldwide, the purchase of sports cars is rising, which is expected to boost the demand for the automobile carbon monocoque chassis market. Also, the increasing adoption of electric and hybrid vehicles worldwide is an advantage for the automotive carbon monocoque chassis market. Major automakers like BMW AG, Volvo Car Corporation, Daimler AG, etc. are planning soon to build and market diesel, hybrid, plug-in electrical cars. Magna International and Ford Motor Corp. work together to build car chassis that weighs less than steel chassis in-car carbon monocoque. Advanced robotics that stimulates the mass development of single-hull chassis can also lead to the growth of the market during the forecast period.Production of Passenger, Light commercial and Heavy-duty Vehicles Growing Rapidly:

The production of passenger vehicles, light commercial vehicles and heavy-duty vehicles have risen significantly across the world, which can be attributed to the growing need for automotive carbon monocoque chassis.

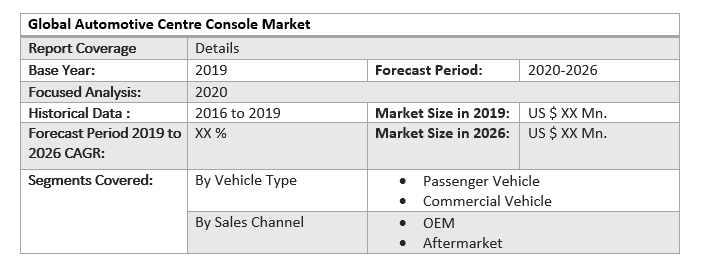

Global Automotive Carbon Monocoque Chassis Market Segmentation Analysis

By Vehicle Type, the passenger vehicle segment is anticipated to emerge as the fastest-growing segment, registering a CAGR of XX% during the forecast period. It includes sedans, hatchbacks, station wagons, Sports Utility Vehicles (SUVs), and Multi-Utility Vehicles (MUVs) equipped with several smart components, like smart controllers, which give access to several cabin features. The passenger vehicle segment of the automobile carbon monocoque chassis market is growing rapidly in Asia Pacific's developing countries. The region's demand growth can be due to an increase in GDP and population, a change in lifestyle, improved customer buying power, and the expansion of infrastructure. Similarly, commercial vehicles are anticipated to boost the automotive carbon monocoque chassis market due to technological advancements during the forecast period.By Sales Channel, the OEM segment accounted for the largest market share in 2019 and is expected to account for the largest global automotive carbon monocoque chassis market share during the forecast period. The automobile carbon monocoque chassis market’s original equipment manufacturers (OEMs) are now concentrating on manufacturing lightweight, lighter automobiles with improved performance and fuel economy. BMW AG, Volvo Car Corporation, Daimler AG, and other manufacturers who are aiding automakers in recasting vehicles are preparing to develop and sell petrol, hybrid, and plug-in electric cars soon. The OEM segment, and thus the automotive carbon monocoque chassis market, is expected to benefit from this major trend. McLaren has also announced to produce 10,000 carbon monocoque chassis by the end of 2019. McLaren intends to use 5,000 carbon monocoque chassis for its use and sell the remainder to other vehicle manufacturers.

North America is a major multinational producer of automotive composite monocoque chassis accounts for 45% of the global market’s share. The United States is the region's biggest market since it is the world's second-largest car and passenger vehicle market for the sale of sports and super sports cars, trailed only by Canada. Europe is one of the world's leading producers of automotive carbon monocoque chassis. Germany is Europe's biggest economy and it has the largest car market and is the world's fourth-largest commercial vehicle producer. Other main European manufacturers include France, Italy, Spain, the United Kingdom, Belgium, Sweden, and the Netherlands. The Asia Pacific has the world's largest vehicle carbon monocoque market. China is the largest market in the Asia Pacific region, as well as the world's largest car and passenger vehicle market. Japan and India are important markets in the Asia Pacific region, as they are the world's third and fifth largest passenger vehicle markets, respectively. Other big vehicle carbon monocoque chassis markets in the world include South Korea and Australia.

Global Automotive Carbon Monocoque Chassis Market Scope: Inquire before buying

Global Automotive Carbon Monocoque Chassis Market by Region

• North America • Asia pacific • Europe • Middle East and Africa • South AmericaGlobal Automotive Carbon Monocoque Chassis Market Key Players

• Robert Bosch GmbH (Germany) • Continental AG (Germany) • ZF Friedrichshafen AG (Germany) • Benteler International AG (Germany) • Magna International (Canada) • American Axle & Manufacturing, Inc. (the U.S) • Bharat Forge Limited (India) • KLT Automotive & Tubular Products Limited (India) • Surin Automotive Private Limited (India) • Cytec Solvay Group (the U.S) • CarboTech AC GmbH • Daimler AG • Dallara Group Srl • Koenigsegg Automotive AB • McLaren Group Ltd • Multimatic Inc • Porsche AG • Toyota Motor Corporation • Williams Advanced Engineering Ltd

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Automotive Carbon Monocoque Chassis Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Automotive Carbon Monocoque Chassis Market 3.4. Geographical Snapshot of the Automotive Carbon Monocoque Chassis Market, By Manufacturer share 4. Global Automotive Carbon Monocoque Chassis Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Market Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Automotive Carbon Monocoque Chassis Market 5. Supply Side and Demand Side Indicators 6. Global Automotive Carbon Monocoque Chassis Market Analysis and Forecast, 2019-2026 6.1. Global Automotive Carbon Monocoque Chassis Market Size & Y-o-Y Growth Analysis. 7. Global Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 7.1.1. Passenger Vehicle 7.1.2. Commercial Vehicle 7.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 7.2.1. OEM 7.2.2. Aftermarket 8. Global Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2026 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 9.1.1. Passenger Vehicle 9.1.2. Commercial Vehicle 9.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 9.2.1. OEM 9.2.2. Aftermarket 10. North America Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 12. Canada Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 13. Mexico Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 13.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 13.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 14. Europe Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 14.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 14.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 15. Europe Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 16.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 16.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 17. France Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 17.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 17.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 18. Germany Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 18.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 18.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 19. Italy Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 19.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 19.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 20. Spain Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 20.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 20.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 21. Sweden Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 21.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 21.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 22. CIS Countries Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 22.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 22.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 23. Rest of Europe Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 23.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 23.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 24. Asia Pacific Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 24.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 24.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 25. Asia Pacific Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 26.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 26.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 27. India Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 27.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 27.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 28. Japan Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 28.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 28.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 29. South Korea Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 29.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 29.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 30. Australia Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 30.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 30.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 31. ASEAN Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 31.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 31.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 32. Rest of Asia Pacific Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 32.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 32.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 33. Middle East Africa Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 33.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 33.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 34. Middle East Africa Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 35.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 35.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 36. GCC Countries Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 36.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 36.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 37. Egypt Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 37.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 37.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 38. Nigeria Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 38.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 38.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 39. Rest of ME&A Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 39.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 39.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 40. South America Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 40.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 40.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 41. South America Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 42.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 42.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 43. Argentina Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 43.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 43.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 44. Rest of South America Automotive Carbon Monocoque Chassis Market Analysis and Forecasts, 2019-2026 44.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 44.2. Market Size (Value) Estimates & Forecast By Sales Channel, 2019-2026 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Automotive Carbon Monocoque Chassis Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Applications 45.2.3.2. M&A Key Players, Forward Integration and Backward Integration 45.3. Company Profile : Key Players 45.3.1. Daimler AG 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.4. Robert Bosch GmbH (Germany) 45.5. Continental AG (Germany) 45.6. ZF Friedrichshafen AG (Germany) 45.7. Benteler International AG (Germany) 45.8. Magna International (Canada) 45.9. American Axle & Manufacturing, Inc. (the U.S) 45.10. Bharat Forge Limited (India) 45.11. KLT Automotive & Tubular Products Limited (India) 45.12. Surin Automotive Private Limited (India) 45.13. Cytec Solvay Group (the U.S) 45.14. CarboTech AC GmbH 45.15. Daimler AG 45.16. Dallara Group Srl 45.17. Koenigsegg Automotive AB 45.18. McLaren Group Ltd 45.19. Multimatic Inc 45.20. Porsche AG 45.21. Toyota Motor Corporation 45.22. Williams Advanced Engineering Ltd 46. Primary Key Insights