Global Automotive Bushing Market size was valued at USD 139.96 Billion in 2024, and the total Automotive Bushing Market revenue is expected to grow by 5.10% from 2025 to 2032, reaching nearly USD 208.37 Billion.Automotive Bushing Market Overview

Automotive bushings are vital vehicle components, typically made of rubber, polyurethane, or advanced polymers, designed to provide flexible connections between rigid parts, absorb shocks, and reduce noise, vibration, and harshness (NVH), thereby enhancing ride comfort, handling, and overall vehicle durability. These bushings are widely used in suspension systems, steering assemblies, metal joints, and transmission systems. The global automotive bushing market is witnessing significant growth due to technological advancements in high-performance materials, such as thermoplastic elastomer bushings, composite bushings, and lightweight designs, which improve strength, heat resistance, and longevity.To know about the Research Methodology:-Request Free Sample Report The increasing adoption of electric vehicles (EVs) and autonomous vehicles (AVs) is driving demand for smart bushings embedded with sensors and actuators for real-time monitoring, predictive maintenance, and enhanced safety. Moreover, automotive bushing manufacturers are leveraging robotics and energy-efficient production methods to meet sustainability goals and comply with stringent NVH and environmental regulations. Asia-Pacific dominated the automotive bushing market owing to its high automotive production, while North America and Europe show steady growth due to advanced NVH standards and rising demand for lightweight, durable components. Passenger cars remain the largest application segment, although commercial vehicle bushings contribute significantly to market revenues. Overall, the automotive bushing market is rapidly evolving, focusing on improving vehicle performance, comfort, durability, and sustainability, positioning bushings as key components in next-generation mobility solutions.

Automotive Bushing Market Dynamics

Rising Vehicle Production and Electrification to Fuel Automotive Bushing Market Growth The consistent growth in vehicle production around the world - especially in emerging economies - is driving the demand for automotive bushings. Likewise, the growing trend toward electric vehicles (EVs) and hybrid platforms means there is a new demand for bushings that perform under higher torque and weight conditions while also managing noise, vibration, and harshness (NVH). Manufacturers have begun adopting lightweight and modular designs for automotive components like suspensions to improve fuel economy or zero emissions range. Our expectation is that, regardless of the vehicle segment, overall bushing demand is increasing and will continue to do so at a constant rate. Additional parts featuring bushings continue to proliferate the vehicle as well. Smart Suspension and Sensor Integration to Drive the Automotive Bushing Market Innovation The automotive industry is woven with technology gusto, and bushings are no exception. Manufacturers are placing sensors in bushings that report real-time data such as temperature, load, and wear. "Smart" bushings are particularly valuable for electric and autonomous vehicles that require ride stability and predictive maintenance of vehicle performance. This is contributing to increased efforts in R&D spending on materials science, integration of electronics and sensors, and more applicable adaptive suspension systems. Sustainability and Lightweighting Efforts Reshaping Manufacturing to Boost Automotive Bushing Market Environmental regulations and consumer interest in sustainable vehicles have propelled bushing manufacturers to pursue environmentally friendly materials and manufacturing processes. More bushing manufacturers are now transitioning to recyclable composites, bio-based elastomers, and reduced-emission manufacturing practices to further the global sustainability objectives that have been highlighted in North America and Europe.Automotive Bushing Market Segment Analysis

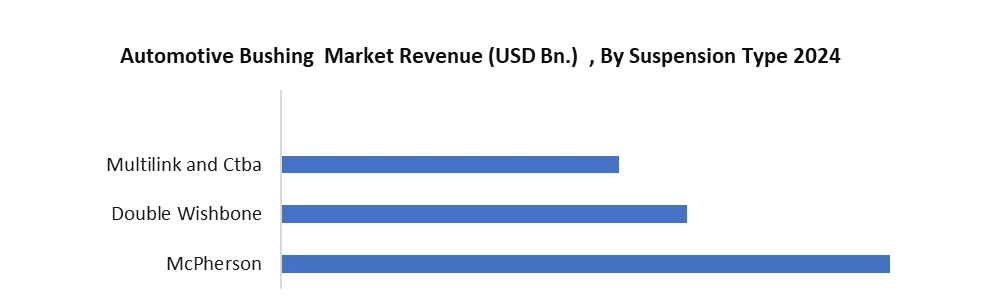

Based on suspension type, the automotive bushing market is classified into McPherson, Double Wishbone, and Multilink/CTBA systems. McPherson systems are considerably more common in compact and mid-size vehicles, yielding strong and steady demand due to the simplicity and cheapness of production. Double Wishbone systems require more bushings for enhanced performance and control along with the assurance of wear and durability, making these commonly found in high-performance vehicles and utility vehicles. Multilink and CTBA systems are similar in their advanced suspension design used in most modern sedans and crossovers, requiring advanced bushings for ride comfort, improvement of NVH of the leading edge of soft road conditions, road travel, driver friction (effort), and driver control (performance). Each suspension type offers meaningful and descriptive growth opportunities contributing to the overall growth of the Automotive Bushing Market.

Automotive Bushing Market Regional Insights

The Asia-Pacific (APAC) automotive bushing market dominated globally due to its large-scale vehicle production, cost-effective manufacturing, and strong supply chains across China, India, Japan, and South Korea. In China, global leaders such as Continental AG, ZF Friedrichshafen AG, and Tenneco Inc. have established strong operations alongside domestic manufacturers, benefiting from the country’s vast OEM base and raw material availability. India is emerging as a competitive hub for high-volume suspension bushings and metal-rubber hybrid bushings, with companies like SKF India and Sundaram Auto Components focusing on affordability and scalability supported by the government’s “Make in India” push. Japan leads in advanced technologies, with Sumitomo Riko Company Limited and NOK Corporation specializing in high-performance polyurethane and synthetic rubber bushings tailored for electric and hybrid vehicles, ensuring long-lasting durability. South Korea, supported by its strong EV ecosystem, is advancing in high-end NVH control bushings, with players like Hyundai Polytech catering to electrified platforms. The competitive landscape in APAC is thus defined by the synergy of cost-competitive mass production in China and India, coupled with innovation-driven R&D in Japan and South Korea, enabling the region to lead both in volume and in next-generation smart, lightweight, and durable bushings for future mobility solutions.Automotive Bushing Market Competitive Landscape:

The automotive bushing market is largely influenced by two global leaders, Continental AG (Germany) and Sumitomo Riko Company Limited (Japan), each driving growth with distinct yet complementary strategies. Continental leverages its heritage, scale, and global manufacturing footprint to deliver a broad range of rubber and polymer bushings, from suspension components to NVH-focused solutions, emphasizing lightweight, eco-friendly materials and close OEM collaborations across Europe and North America. Its competitive strength lies in operational efficiency, supply chain reliability, and premium quality, positioning it as a trusted partner for high-volume global contracts. In contrast, Sumitomo Riko focuses on advanced polymer science and materials innovation, with strong R&D in Asia enabling precision bushings that enhance ride comfort, durability, and safety for both internal combustion and electric vehicles. Known for its agility and responsiveness, Sumitomo Riko adapts quickly to shifting market demands in the Asia-Pacific, targeting niche applications and cost-sensitive markets through flexible, innovation-driven strategies. While both companies invest in green manufacturing and lightweight technologies, Continental’s approach is rooted in scale and long-term partnerships, whereas Sumitomo Riko thrives on adaptability, material breakthroughs, and regional strength, making them two defining forces shaping the future of the global automotive bushing market.Automotive Bushing Market Key Developments:

May-2024-Trelleborg-Europe Promoted ConneX Livestream event highlighting next-gen rotary sealing technology and innovation partnerships directly with OEMs in multiple industries; event was held June 27 from the Stuttgart Innovation Centre. Apr-2025-Vibracoustic-Global Developing new air springs, jounce bumpers, and hydro bushings to enhance driving comfort and performance in a premium electric pickup truck June 2024 – Vibracoustic (Global) According to a source with direct knowledge, Vibracoustic introduced a Thermal Management Decoupling System for use in various elements of EV applications. The system combines thermal components, allowing for better space utilization, better assembly, and NVH (Noise, vibration, and harshness) decoupling with bushings and integrated bracket systems.Automotive Bushing Market Key Trends:

Eco-driven Material Innovation Growing use of recycled materials, plant-based polymers, and biodegradable composites to reduce environmental impact while maintaining performance Smart and Adaptive Bushing Designs Integration of sensor-equipped “smart bushings” for real-time monitoring, predictive maintenance, and NVH control in EV and connected vehicle platforms.Scope of the Global Automotive Bushing Market: Inquire before buying

Global Automotive Bushing Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 139.96 Bn. Forecast Period 2025 to 2032 CAGR: 5.1% Market Size in 2032: USD 208.37 Bn. Segments Covered: by Suspension Type McPherson Double Wishbone Multilink and CTBA by Vehicle Passenger Car Light Commercial Vehicle Heavy Commercial Vehicle by Type Rubber Bushings Polyurethane Bushings Metal Bushings Composite Bushings by Application Metal Busing Suspension Chassis Interior Exhaust Transmission Global Automotive Bushing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key players operating in the Global Automotive Bushing Market

The automotive bushing industry features leading manufacturing companies alongside emerging players striving to enhance their market position. These key competitors in the automotive bushing industry are leveraging strategic initiatives such as product innovation, expanding their technological capabilities, and forming strategic alliances. Emphasis is placed on developing high-performance bushings to optimize vehicle performance and strengthen their global market presence.Automotive Bushing Market, Key Players

North America 1. Martinrea International Inc. (Canada) 2. KYB Corporation (USA) Europe 1. Eibach GmbH (Germany) 2. Schaeffler AG (Germany) 3. ContiTech Deutschland GmbH (Germany) 4. Vibracoustic GmbH (Germany) 5. Teknorot (Turkey) 6. Powerflex (UK) Asia-Pacific 1. DN Automotive Corp. (Yansang) 2. Sumitomo Riko Co., Ltd. (Japan) 3. NHK Spring Co., Ltd. (Japan) 4. KYB Corporation (Japan) 5. DN Automotive Corp. (South Korea) 6. Hyundai Polytech India (India)Frequently Asked Questions

1. Which region has the largest share in the Global Automotive Bushing Market? Ans: Asia Pacific region held the highest share in 2024. 2. What is the growth rate of Global Automotive Bushing Market? Ans: The Global market is growing at a CAGR of 5.1% during the forecasting period 2025-2032. 3. What is scope of the Global market report? Ans: Global market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors& Leaders, and market estimation of the forecast period. 4. Who are the key players in Global market? Ans: The important key players in the Global Automotive Bushing Market include Continental AG, ZF Friedrichshafen AG, Sumitomo Riko Company Limited, DuPont, MAHLE GmbH, Tenneco Inc, Federal-Mogul, Oiles Corporation, Cooper Standard Holdings Inc., Vibracoustic SE, BOGE Rubber & Plastics, Hyundai Polytech India, Nolathane, Paulstra SNC, Benara Udyog Limited, Powerflex, Schaeffler AG, ContiTech Deutschland GmbH, Eibach GmbH, Martinrea International Inc., and DN Automotive Corp. 5. What is the study period of this Market? Ans: The Global market is studied from 2024 to 2032.

1. Automotive Bushing Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Bushing Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Company Location 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Automotive Bushing Market: Dynamics 3.1. Region-wise Trends of Automotive Bushing Market 3.1.1. North America Automotive Bushing Market Trends 3.1.2. Europe Automotive Bushing Market Trends 3.1.3. Asia Pacific Automotive Bushing Market Trends 3.1.4. Middle East and Africa Automotive Bushing Market Trends 3.1.5. South America Automotive Bushing Market Trends 3.2. Automotive Bushing Market Dynamics 3.2.1. Automotive Bushing Market Drivers 3.2.1.1. Enhanced Comfort & NVH Expectations 3.2.1.2. Lightweight 3.2.2. Automotive Bushing Market Opportunity 3.2.2.1. Aftermarket Growth 3.2.3. Automotive Bushing Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Fluctuations in raw material prices 3.4.2. Growing urbanization and demand for personal mobility 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Automotive Bushing Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 4.1.1. McPherson 4.1.2. Double Wishbone 4.1.3. MULTILINK WISHBONE 4.2. Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 4.2.1. Passenger Car 4.2.2. Light Commercial Vehicles 4.2.3. Heavy Commercial Vehicle 4.3. Automotive Bushing Market Size and Forecast, By Application (2024-2032) 4.3.1. Metal Busing 4.3.2. Suspension 4.3.3. Chassis 4.3.4. Interior 4.3.5. Exhaust 4.3.6. Transmission 4.4. Automotive Bushing Market Size and Forecast, By Type (2024-2032) 4.4.1. Rubber Bushing 4.4.2. Polyurethane 4.4.3. Metal Busing 4.4.4. Composite Busing 4.5. Automotive Bushing Market Size and Forecast, By region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Automotive Bushing Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 5.1.1. McPherson 5.1.2. Double Wishbone 5.1.3. MULTILINK AND CTBA 5.2. North America Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 5.2.1. Passenger Car 5.2.2. Light Commercial Vehicles 5.2.3. Heavy Commercial Vehicle 5.3. North America Automotive Bushing Market Size and Forecast, By Application (2024-2032) 5.3.1. Engine 5.3.2. Suspension 5.3.3. Chassis 5.3.4. Interior 5.3.5. Exhaust 5.3.6. Transmission 5.4. North America Automotive Bushing Market Size and Forecast, By Type (2024-2032) 5.4.1. Rubber Bushing 5.4.2. Polyurethane 5.4.3. Metal Busing 5.4.4. Composite Busing 5.5. North America Automotive Bushing Market Size and Forecast, By Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 5.5.1.1.1. Mc Pherson 5.5.1.1.2. Double Wishbone 5.5.1.1.3. MULTILINK AND CTBA 5.5.1.2. United States Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 5.5.1.2.1. Passenger Car 5.5.1.2.2. Light Commercial Vehicles 5.5.1.2.3. Heavy Commercial Vehicle 5.5.1.3. United States Automotive Bushing Market Size and Forecast, By Application (2024-2032) 5.5.1.3.1. Engine 5.5.1.3.2. Suspension 5.5.1.3.3. Chassis 5.5.1.3.4. Interior 5.5.1.3.5. Exhaust 5.5.1.3.6. Transmission 5.5.1.4. United States Automotive Bushing Market Size and Forecast, By Type (2024-2032) 5.5.1.4.1. Rubber Bushing 5.5.1.4.2. Polyurethane 5.5.1.4.3. Metal Busing 5.5.1.4.4. Composite Busing 5.5.2. Canada 5.5.2.1. Canada Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 5.5.2.1.1. Mc Pherson 5.5.2.1.2. Double Wishbone 5.5.2.1.3. MULTILINK AND CTBA 5.5.2.2. Canada Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 5.5.2.2.1. Passenger Car 5.5.2.2.2. Light Commercial Vehicles 5.5.2.2.3. Heavy Commercial Vehicle 5.5.2.3. Canada Automotive Bushing Market Size and Forecast, By Application (2024-2032) 5.5.2.3.1. Engine 5.5.2.3.2. Suspension 5.5.2.3.3. Suspension 5.5.2.3.4. Chassis 5.5.2.3.5. Interior 5.5.2.3.6. Exhaust 5.5.2.3.7. Transmission 5.5.2.4. Canada Automotive Bushing Market Size and Forecast, By Type (2024-2032) 5.5.2.4.1. Rubber Bushing 5.5.2.4.2. Polyurethane 5.5.2.4.3. Metal Busing 5.5.2.4.4. Composite Busing 5.5.3. Mexico 5.5.3.1. Mexico Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 5.5.3.1.1. Mc Pherson 5.5.3.1.2. Double Wishbone 5.5.3.1.3. MULTILINK AND CTBA 5.5.3.2. Mexico Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 5.5.3.2.1. Passenger Car 5.5.3.2.2. Light Commercial Vehicles 5.5.3.2.3. Heavy Commercial Vehicle 5.5.3.3. Mexico Automotive Bushing Market Size and Forecast, By Application (2024-2032) 5.5.3.3.1. Engine 5.5.3.3.2. Suspension 5.5.3.3.3. Chassis 5.5.3.3.4. Interior 5.5.3.3.5. Exhaust 5.5.3.3.6. Transmission 5.5.3.4. Mexico Automotive Bushing Market Size and Forecast, By Type (2024-2032) 5.5.3.4.1. Rubber Bushing 5.5.3.4.2. Polyurethane 5.5.3.4.3. Metal Busing 5.5.3.4.4. Composite Busing 6. Europe Automotive Bushing Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 6.2. Europe Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 6.3. Europe Automotive Bushing Market Size and Forecast, By Application (2024-2032) 6.4. Europe Automotive Bushing Market Size and Forecast, By Type (2024-2032) 6.5. Europe Automotive Bushing Market Size and Forecast, By Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 6.5.1.2. United Kingdom Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.1.3. United Kingdom Automotive Bushing Market Size and Forecast, By Application (2024-2032) 6.5.1.4. United Kingdom Automotive Bushing Market Size and Forecast, By Type (2024-2032) 6.5.2. France 6.5.2.1. France Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 6.5.2.2. France Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.2.3. France Automotive Bushing Market Size and Forecast, By Application (2024-2032) 6.5.2.4. France Automotive Bushing Market Size and Forecast, By Type (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 6.5.3.2. Germany Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.3.3. Germany Automotive Bushing Market Size and Forecast, By Application (2024-2032) 6.5.3.4. Germany Automotive Bushing Market Size and Forecast, By Type (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 6.5.4.2. Italy Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.4.3. Italy Automotive Bushing Market Size and Forecast, By Application (2024-2032) 6.5.4.4. Italy Automotive Bushing Market Size and Forecast, By Type (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 6.5.5.2. Spain Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.5.3. Spain Automotive Bushing Market Size and Forecast, By Application (2024-2032) 6.5.5.4. Spain Automotive Bushing Market Size and Forecast, By Type (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 6.5.6.2. Sweden Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.6.3. Sweden Automotive Bushing Market Size and Forecast, By Application (2024-2032) 6.5.6.4. Sweden Automotive Bushing Market Size and Forecast, By Type (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 6.5.7.2. Austria Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.7.3. Austria Automotive Bushing Market Size and Forecast, By Application (2024-2032) 6.5.7.4. Austria Automotive Bushing Market Size and Forecast, By Type (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 6.5.8.2. Rest of Europe Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.8.3. Rest of Europe Automotive Bushing Market Size and Forecast, By Application (2024-2032) 6.5.8.4. Rest of Europe Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7. Asia Pacific Automotive Bushing Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.2. Asia Pacific Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.3. Asia Pacific Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5. Asia Pacific Automotive Bushing Market Size and Forecast, By Country (2024-2032) 7.5.1. China 7.5.1.1. China Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.1.2. China Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.1.3. China Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.1.4. China Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.2.2. S Korea Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.2.3. S Korea Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.2.4. S Korea Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.3.2. Japan Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.3.3. Japan Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.3.4. Japan Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.4. India 7.5.4.1. India Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.4.2. India Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.4.3. India Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.4.4. India Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.5.2. Australia Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.5.3. Australia Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.5.4. Australia Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.6.2. Indonesia Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.6.3. Indonesia Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.6.4. Indonesia Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.7.2. Philippines Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.7.3. Philippines Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.7.4. Philippines Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.8.2. Malaysia Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.8.3. Malaysia Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.8.4. Malaysia Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.9.2. Vietnam Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.9.3. Vietnam Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.9.4. Vietnam Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.10.2. Thailand Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.10.3. Thailand Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.10.4. Thailand Automotive Bushing Market Size and Forecast, By Type (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Automotive Bushing Market Size and Forecast, By Application (2024-2032) 7.5.11.4. Rest of Asia Pacific Automotive Bushing Market Size and Forecast, By Type (2024-2032) 8. Middle East and Africa Automotive Bushing Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 8.2. Middle East and Africa Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 8.3. Middle East and Africa Automotive Bushing Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Automotive Bushing Market Size and Forecast, By Type (2024-2032) 8.5. Middle East and Africa Automotive Bushing Market Size and Forecast, By Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 8.5.1.2. South Africa Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.1.3. South Africa Automotive Bushing Market Size and Forecast, By Application (2024-2032) 8.5.1.4. South Africa Automotive Bushing Market Size and Forecast, By Type (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 8.5.2.2. GCC Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.2.3. GCC Automotive Bushing Market Size and Forecast, By Application (2024-2032) 8.5.2.4. GCC Automotive Bushing Market Size and Forecast, By Type (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 8.5.3.2. Nigeria Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.3.3. Nigeria Automotive Bushing Market Size and Forecast, By Application (2024-2032) 8.5.3.4. Nigeria Automotive Bushing Market Size and Forecast, By Type (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 8.5.4.2. Rest of ME&A Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.4.3. Rest of ME&A Automotive Bushing Market Size and Forecast, By Application (2024-2032) 8.5.4.4. Rest of ME&A Automotive Bushing Market Size and Forecast, By Type (2024-2032) 9. South America Automotive Bushing Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 9.2. South America Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 9.3. South America Automotive Bushing Market Size and Forecast, By Application (2024-2032) 9.4. South America Automotive Bushing Market Size and Forecast, By Type (2024-2032) 9.5. South America Automotive Bushing Market Size and Forecast, By Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 9.5.1.2. Brazil Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.1.3. Brazil Automotive Bushing Market Size and Forecast, By Application (2024-2032) 9.5.1.4. Brazil Automotive Bushing Market Size and Forecast, By Type (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 9.5.2.2. Argentina Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.2.3. Argentina Automotive Bushing Market Size and Forecast, By Application (2024-2032) 9.5.2.4. Argentina Automotive Bushing Market Size and Forecast, By Type (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Automotive Bushing Market Size and Forecast, By Suspension Type (2024-2032) 9.5.3.2. Rest of South America Automotive Bushing Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.3.3. Rest of South America Automotive Bushing Market Size and Forecast, By Application (2024-2032) 9.5.3.4. Rest of South America Automotive Bushing Market Size and Forecast, By Type (2024-2032) 10. Company Profile (Detailed Profile for all Major Industry Players) 10.1. Eibach GmbH (Germany) 10.1.1. Business Portfolio 10.1.2. Financial Overview 10.1.3. SWOT Analysis 10.1.4. Strategic Analysis 10.1.5. Recent Developments 10.2. Martinrea International Inc. (Canada) 10.3. KYB Corporation (USA) 10.4. Eibach GmbH (Germany) 10.5. Schaeffler AG (Germany) 10.6. ContiTech Deutschland GmbH (Germany) 10.7. Vibracoustic GmbH (Germany) 10.8. Teknorot (Turkey) 10.9. Powerflex (UK) 10.10. DN Automotive Corp. (Yansang) 10.11. Sumitomo Riko Co., Ltd. (Japan) 10.12. NHK Spring Co., Ltd. (Japan) 10.13. KYB Corporation (Japan) 10.14. DN Automotive Corp. (South Korea) 10.15. Hyundai Polytech India (India) 11. Analyst Recommendations 12. Automotive Bushing Market: Research Methodology