Global Automotive Bearing Market is expected to grow at a CAGR of 4% throughout the forecast period, to reach US$ 27 Bn by 2026.To know about the Research Methodology :- Request Free Sample Report

Global Automotive Bearing Market Overview:

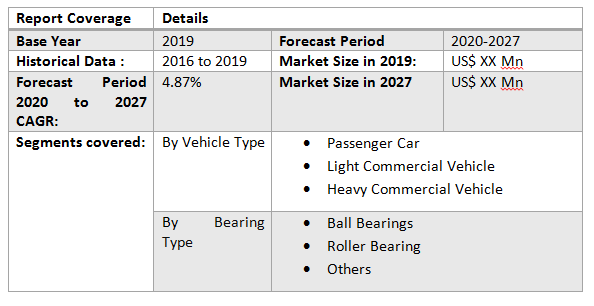

The global market for automotive bearings is expected to raise at a promising rate of about 4.87% due to the growing production of vehicles through the globe. The preference towards technically advanced solution in vehicles market is motivating the demand for the bearings market. The Booming automotive industry worldwide, it has been witnessed that growing average vehicular age will highly fuel the demand for revamping, maintenance, & replacement of automotive components in turn raising the sales of automotive bearings. Rising & falling fleet is swiftly putting forth the aftermarket demand for automotive bearings, which is recognized to be another important driver to market development. Despite the total decline in the number of bearings in the new electric vehicles, product innovations are anticipated to endure generating demand for bearings during the forecast period. Moreover, the market is presently facing polarization towards the most leading companies in the competitive landscape, which is also expected to increase the market growth over the forecast period. China Set to Outpace the European Market: As per the geographical analysis in the MMR report on the automotive bearing market, Europe is presently the global leader, followed by China. Europe, the largest geographical segment with approximately 23.83 percent share by value, is expected to face a slight drop by 2027 end, losing its market share to China. China, which is presently the 2nd largest market in terms of value, is expected to witness strong development during the forecast period, gaining a major market value share to become the leading regional market for automotive bearing by 2027 end. China is also recognized to be the fastest rising market at a projected CAGR of 5.35 percent over 2019-2027, capturing a value share of over 24 percent. Led by the United States, North America currently holds more than 18.64 percent share of the global market revenue & will reportedly see steady growth through the forecast period, keeping a market value share of around 19 percent by 2027 end. United States accounts for more than 82 percent share of North America's total revenues, attributed to continued demand for applications in automotive transmission system. Europe & North America are expected to witness moderate growth at CAGRs of above 4.45 percent. While Brazil is expected to create a significantly important market in Latin America, the complete SEAP region is supposed to be the most adaptable market for automotive bearings during the forecast period, in terms of demand. South East Asia & Pacific is slated for encouraging growth during the forecast period at a CAGR of 4.8 percent & market value share of above 15 percent. Development of SEAP is attributed to the possibility of multiple attractive prospects which the region is likely to present to established as well as developing players in coming years. The global market for automotive bearings unusually has occurrence of a limited number of significant industry players based in Europe & Japan.Global Automotive Bearing Market Improved Investments in R&D:

Growing average lifespan of vehicles is anticipated to increase substantial demand for vehicular component repairing, replacement, & maintenance, eventually pushing the bearing market up during the forecast period. Rapidly increasing fleet is generating decent aftermarket demand for automotive bearings, which is additional key factor responsible for market development. Companies are increasingly investing in the growth of production capacity of automotive bearings; also, a majority companies are focusing more on Research &Development in order to bring in innovation to the marketplace.Technical Advances Composed to Bring in Innovation:

With arrival of technology including IoT & emergence of cyber-physical systems, companies are inclining more towards sensitized automotive components & mechatronic products, which enable digital service incorporation. This strategy is expected to help them make for the future manufacturing, i.e. Industry 4.0. MMR identifies this as an important development in shaping the future of automotive bearings market. The global market for automotive bearings is presently trending with the rising use of ceramic ball bearings in a bid to open up new doors to some innovative application areas, like in electric vehicles. The market for automotive bearings is witnessed to be polarized towards a limited number of establishments operating globally, which is expected to fuel the market growth during the forecast period. The report covers Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle type with detailed analysis Global Automotive Bearing Market industry with the classifications of the market on the Vehicle Type, Bearing type, & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced technology, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the report.Scope of the Global Automotive Bearing Market: Inquire before buying

Global Automotive Bearing Market, By Region

• North America: o US o Canada • Europe o UK o Germany o France o Spain o Italy o Sweden o CIS countries o Rest of Europe • APAC o China o India o South Korea o Japan o Australia o Rest of APAC o ASEAN Indonesia Malaysia Singapore Thailand Vietnam • Middle East & Africa o GCC Countries o South Africa o Rest of MEA • Latin America o Mexico o Brazil o Rest of Latin AmericaGlobal Automotive Bearing Market Key Players

• chaeffler AG • SvenskaKullagerfabriken AB • NTN Corporation • Jtekt Corporation • Iljin Bearing Co., Ltd. • Timken Company • MinebeaMitsumi Inc • RKB Bearings. • THB Bearings • SKF • Koyo.

Global Automotive Bearing Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Automotive Bearing Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Global Automotive Bearing Market Analysis and Forecast 6.1. Global Automotive Bearing Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Global Automotive Bearing Market Analysis and Forecast, by Vehicle Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. Global Automotive Bearing Market Value Share Analysis, by Vehicle Type 7.4. Global Automotive Bearing Market Size (US$ Mn) Forecast, by Vehicle Type 7.5. Global Automotive Bearing Market Analysis, by Vehicle Type 7.6. Global Automotive Bearing Market Attractiveness Analysis, by Vehicle Type 8. Global Automotive Bearing Market Analysis and Forecast, by Bearing Types 8.1. Introduction and Definition 8.2. Key Findings 8.3. Global Automotive Bearing Market Value Share Analysis, by Bearing Types 8.4. Global Automotive Bearing Market Size (US$ Mn) Forecast, by Bearing Types 8.5. Global Automotive Bearing Market Analysis, by Bearing Types 8.6. Global Automotive Bearing Market Attractiveness Analysis, by Bearing Types 9. Global Automotive Bearing Market Analysis, by Region 9.1. Global Automotive Bearing Market Value Share Analysis, by Region 9.2. Global Automotive Bearing Market Size (US$ Mn) Forecast, by Region 9.3. Global Automotive Bearing Market Attractiveness Analysis, by Region 10. North America Automotive Bearing Market Analysis 10.1. Key Findings 10.2. North America Automotive Bearing Market Overview 10.3. North America Automotive Bearing Market Value Share Analysis, by Vehicle Type 10.4. North America Automotive Bearing Market Forecast, by Vehicle Type 10.4.1. Passenger Car 10.4.2. Light Commercial Vehicle 10.4.3. Heavy Commercial Vehicle 10.5. North America Automotive Bearing Market Forecast, by Bearing Types 10.5.1. Ball Bearings 10.5.2. Roller Bearing 10.5.3. Others 10.6. North America Automotive Bearing Market Value Share Analysis, by Country 10.7. North America Automotive Bearing Market Forecast, by Country 10.7.1. U.S. 10.7.2. Canada 10.8. North America Automotive Bearing Market Analysis, by Country 10.9. US Automotive Bearing Market Forecast, by Vehicle Type 10.9.1. Passenger Car 10.9.2. Light Commercial Vehicle 10.9.3. Heavy Commercial Vehicle 10.10. US Automotive Bearing Market Forecast, by Bearing Types 10.10.1. Ball Bearings 10.10.2. Roller Bearing 10.10.3. Others 10.11. Canada Automotive Bearing Market Forecast, by Vehicle Type 10.11.1. Passenger Car 10.11.2. Light Commercial Vehicle 10.11.3. Heavy Commercial Vehicle 10.12. Canada Automotive Bearing Market Forecast, by Bearing Types 10.12.1. Ball Bearings 10.12.2. Roller Bearing 10.12.3. Others 10.13. PEST Analysis 10.14. Key Trends 10.15. Key Developments 11. Europe Automotive Bearing Market Analysis 11.1. Key Findings 11.2. Europe Automotive Bearing Market Overview 11.3. Europe Automotive Bearing Market Forecast, by Vehicle Type 11.3.1. Passenger Car 11.3.2. Light Commercial Vehicle 11.3.3. Heavy Commercial Vehicle 11.4. Europe Automotive Bearing Market Forecast, by Bearing Types 11.4.1. Ball Bearings 11.4.2. Roller Bearing 11.4.3. Others 11.5. Europe Automotive Bearing Market Value Share Analysis, by Country 11.6. Europe Automotive Bearing Market Forecast, by Country 11.6.1. Germany 11.6.2. U.K. 11.6.3. France 11.6.4. Italy 11.6.5. Spain 11.6.6. Rest of Europe 11.7. Europe Automotive Bearing Market Analysis, by Country 11.8. UK Automotive Bearing Market Forecast, by Vehicle Type 11.8.1. Passenger Car 11.8.2. Light Commercial Vehicle 11.8.3. Heavy Commercial Vehicle 11.9. UK Automotive Bearing Market Forecast, by Bearing Types 11.9.1. Ball Bearings 11.9.2. Roller Bearing 11.9.3. Others 11.10. France Automotive Bearing Market Forecast, by Vehicle Type 11.10.1. Passenger Car 11.10.2. Light Commercial Vehicle 11.10.3. Heavy Commercial Vehicle 11.11. France Automotive Bearing Market Forecast, by Bearing Types 11.11.1. Ball Bearings 11.11.2. Roller Bearing 11.11.3. Others 11.12. Germany Automotive Bearing Market Forecast, by Vehicle Type 11.12.1. Passenger Car 11.12.2. Light Commercial Vehicle 11.12.3. Heavy Commercial Vehicle 11.13. Germany Automotive Bearing Market Forecast, by Bearing Types 11.13.1. Ball Bearings 11.13.2. Roller Bearing 11.13.3. Others 11.14. Russia Automotive Bearing Market Forecast, by Vehicle Type 11.14.1. Passenger Car 11.14.2. Light Commercial Vehicle 11.14.3. Heavy Commercial Vehicle 11.15. Russia Automotive Bearing Market Forecast, by Bearing Types 11.15.1. Ball Bearings 11.15.2. Roller Bearing 11.15.3. Others 11.16. Rest of Europe Automotive Bearing Market Forecast, by Vehicle Type 11.16.1. Passenger Car 11.16.2. Light Commercial Vehicle 11.16.3. Heavy Commercial Vehicle 11.17. Rest of Europe Automotive Bearing Market Forecast, by Bearing Types 11.17.1. Ball Bearings 11.17.2. Roller Bearing 11.17.3. Others 11.18. PEST Analysis 11.19. Key Trends 11.20. Key Developments 12. Asia Pacific Automotive Bearing Market Analysis 12.1. Key Findings 12.2. Asia Pacific Automotive Bearing Market Overview 12.3. Asia Pacific Automotive Bearing Market Value Share Analysis, by Type 12.4. Asia Pacific Automotive Bearing Market Forecast, by Vehicle Type 12.4.1. Passenger Car 12.4.2. Light Commercial Vehicle 12.4.3. Heavy Commercial Vehicle 12.5. Asia Pacific Automotive Bearing Market Forecast, by Bearing Types 12.5.1. Ball Bearings 12.5.2. Roller Bearing 12.5.3. Others 12.6. Asia Pacific Automotive Bearing Market Value Share Analysis, by Country 12.7. Asia Pacific Automotive Bearing Market Forecast, by Country 12.7.1. China 12.7.2. India 12.7.3. Japan 12.7.4. ASEAN 12.7.5. Rest of Asia Pacific 12.8. Asia Pacific Automotive Bearing Market Analysis, by Country 12.9. China Automotive Bearing Market Forecast, by Vehicle Type 12.9.1. Passenger Car 12.9.2. Light Commercial Vehicle 12.9.3. Heavy Commercial Vehicle 12.10. China Automotive Bearing Market Forecast, by Bearing Types 12.10.1. Ball Bearings 12.10.2. Roller Bearing 12.10.3. Others 12.11. India Automotive Bearing Market Forecast, by Vehicle Type 12.11.1. Passenger Car 12.11.2. Light Commercial Vehicle 12.11.3. Heavy Commercial Vehicle 12.12. India Automotive Bearing Market Forecast, by Bearing Types 12.12.1. Ball Bearings 12.12.2. Roller Bearing 12.12.3. Others 12.13. Japan Automotive Bearing Market Forecast, by Vehicle Type 12.13.1. Passenger Car 12.13.2. Light Commercial Vehicle 12.13.3. Heavy Commercial Vehicle 12.14. Japan Automotive Bearing Market Forecast, by Bearing Types 12.14.1. Ball Bearings 12.14.2. Roller Bearing 12.14.3. Others 12.15. ASEAN Automotive Bearing Market Forecast, by Vehicle Type 12.15.1. Passenger Car 12.15.2. Light Commercial Vehicle 12.15.3. Heavy Commercial Vehicle 12.16. ASEAN Automotive Bearing Market Forecast, by Bearing Types 12.16.1. Ball Bearings 12.16.2. Roller Bearing 12.16.3. Others 12.17. Rest of APAC Automotive Bearing Market Forecast, by Vehicle Type 12.17.1. Passenger Car 12.17.2. Light Commercial Vehicle 12.17.3. Heavy Commercial Vehicle 12.18. Rest of APAC Automotive Bearing Market Forecast, by Bearing Types 12.18.1. Ball Bearings 12.18.2. Roller Bearing 12.18.3. Others 12.19. PEST Analysis 12.20. Key Trends 12.21. Key Developments 13. Middle East & Africa Automotive Bearing Market Analysis 13.1. Key Findings 13.2. Middle East & Africa Automotive Bearing Market Overview 13.3. Middle East & Africa Automotive Bearing Market Forecast, by Vehicle Type 13.3.1. Passenger Car 13.3.2. Light Commercial Vehicle 13.3.3. Heavy Commercial Vehicle 13.4. Middle East & Africa Automotive Bearing Market Forecast, by Bearing Types 13.4.1. Ball Bearings 13.4.2. Roller Bearing 13.4.3. Others 13.5. Middle East & Africa Automotive Bearing Market Value Share Analysis, by Country 13.6. Middle East & Africa Automotive Bearing Market Forecast, by Country 13.6.1. GCC 13.6.2. South Africa 13.6.3. Rest of Middle East & Africa 13.7. Middle East & Africa Automotive Bearing Market Analysis, by Country 13.8. GCC Automotive Bearing Market Forecast, by Vehicle Type 13.8.1. Passenger Car 13.8.2. Light Commercial Vehicle 13.8.3. Heavy Commercial Vehicle 13.9. GCC Automotive Bearing Market Forecast, by Bearing Types 13.9.1. Ball Bearings 13.9.2. Roller Bearing 13.9.3. Others 13.10. South Africa Automotive Bearing Market Forecast, by Vehicle Type 13.10.1. Passenger Car 13.10.2. Light Commercial Vehicle 13.10.3. Heavy Commercial Vehicle 13.11. South Africa Automotive Bearing Market Forecast, by Bearing Types 13.11.1. Ball Bearings 13.11.2. Roller Bearing 13.11.3. Others 13.12. Rest of MEA &Africa Automotive Bearing Market Forecast, by Vehicle Type 13.12.1. Passenger Car 13.12.2. Light Commercial Vehicle 13.12.3. Heavy Commercial Vehicle 13.13. Rest of MEA &Africa Automotive Bearing Market Forecast, by Bearing Types 13.13.1. Ball Bearings 13.13.2. Roller Bearing 13.13.3. Others 13.14. PEST Analysis 13.15. Key Trends 13.16. Key Developments 14. Latin America Automotive Bearing Market Analysis 14.1. Key Findings 14.2. Latin America Automotive Bearing Market Overview 14.3. Latin America Automotive Bearing Market Forecast, by Vehicle Type 14.3.1. Passenger Car 14.3.2. Light Commercial Vehicle 14.3.3. Heavy Commercial Vehicle 14.4. Latin America Automotive Bearing Market Forecast, by Bearing Types 14.4.1. Ball Bearings 14.4.2. Roller Bearing 14.4.3. Others 14.5. Latin America Automotive Bearing Market Value Share Analysis, by Country 14.6. Latin America Automotive Bearing Market Forecast, by Country 14.6.1. Brazil 14.6.2. Mexico 14.6.3. Rest of South America 14.7. Latin America Automotive Bearing Market Analysis, by Country 14.8. Mexico Automotive Bearing Market Forecast, by Vehicle Type 14.8.1. Passenger Car 14.8.2. Light Commercial Vehicle 14.8.3. Heavy Commercial Vehicle 14.9. Mexico Automotive Bearing Market Forecast, by Bearing Types 14.9.1. Ball Bearings 14.9.2. Roller Bearing 14.9.3. Others 14.10. Brazil Automotive Bearing Market Forecast, by Vehicle Type 14.10.1. Passenger Car 14.10.2. Light Commercial Vehicle 14.10.3. Heavy Commercial Vehicle 14.11. Brazil Automotive Bearing Market Forecast, by Bearing Types 14.11.1. Ball Bearings 14.11.2. Roller Bearing 14.11.3. Others 14.12. Rest of LA Automotive Bearing Market Forecast, by Vehicle Type 14.12.1. Passenger Car 14.12.2. Light Commercial Vehicle 14.12.3. Heavy Commercial Vehicle 14.13. Rest of LA Automotive Bearing Market Forecast, by Bearing Types 14.13.1. Ball Bearings 14.13.2. Roller Bearing 14.13.3. Others 14.14. PEST Analysis 14.15. Key Trends 14.16. Key Developments 15. Company Profiles 15.1. Market Share Analysis, by Company 15.2. Competition Matrix 15.2.1. Competitive Benchmarking of key players by price, presence, market share, Deployment Type and R&D investment 15.2.2. New Product Launches and Product Enhancements 15.2.3. Market Consolidation 15.2.3.1. M&A by Regions, Investment and Deployment Types 15.2.3.2. M&A Key Players, Forward Integration and Backward Integration 15.3. Company Profiles: Key Players 15.3.1. chaeffler AG 15.3.1.1. Company Overview 15.3.1.2. Financial Overview 15.3.1.3. Product Portfolio 15.3.1.4. Business Strategy 15.3.1.5. Recent Developments 15.3.1.6. Company Footprint 15.3.2. SvenskaKullagerfabriken AB 15.3.3. NTN Corporation 15.3.4. Jtekt Corporation 15.3.5. Iljin Bearing Co., Ltd. 15.3.6. Timken Company 15.3.7. MinebeaMitsumi Inc 15.3.8. RKB Bearings. 15.3.9. THB Bearings 15.3.10. SKF 15.3.11. Koyo 16. Primary Key Insights.