Global Automated Container Terminal Market expected to hit USD 14.88 Bn by 2029 from USD 10.23 Bn in 2022 at a CAGR of 5.5% during the forecast periodAutomated Container Terminal Market Overview

An Automated Container Terminal refers to a port facility or terminal that utilizes advanced automation technologies to handle the movement, storage, and processing of containers. It is a modernized version of a traditional container terminal that relies heavily on manual labor and conventional equipment. The continued growth of international trade and the widespread adoption of containerization drive the demand for efficient container handling. Automated Container Terminals offer higher throughput, reduced handling time and offers attractive options for port operators to handle the increasing volume of containers. This is expected to drive the Automated Container Terminal Market. Workforce displacement concerns and technological challenges and integration complexity are expected to limit the Automated Container Terminal Market.To know about the Research Methodology :- Request Free Sample Report

Automated Container Terminal Market Dynamics

Technical Advancements in Robotics and Increased Operational Efficiency Expected to Boost Automated Container Terminal Market The development of advanced robotics and automation technologies in the automotive industry is expected to drive the Automated Container Terminal Market. These terminals utilize automated stacking cranes, automated guided vehicles and robotic arms to handle containers without the help of labor. These technologies enable precise and efficient container handling, reduce errors and eliminate the risk of accidents. These factors are driving the demand for Automated Container Terminal. Automated container terminals offer substantial improvements in operational efficiency and cost reduction. By automating various tasks, such as container stacking, transportation and loading/unloading, these terminals are able to optimize the use of space and increase the operation speed. The increased efficiency is expected to be resulted in reduced turnaround times for ships, improved productivity and lower operating costs for terminal operators. These factors are expected to drive the Global Automated Container Terminal Market. Government’s Favorable Initiatives, Labor Shortages and Need for Workforce Optimization Driving the Automated Container Terminal Market Many governments around the world are investing in infrastructure development and port modernization projects. These initiatives aim toward enhancing the competitiveness of their respective ports and accommodate the growing demand for container handling. Automated container terminals offer advanced capabilities, increased capacity and improved efficiency. Government support and investments in these projects are driving the growth of the Automated Container Terminal Market. The container terminal industry has been facing labor shortages and challenges in workforce optimization. Automated container terminals address these issues by reducing the reliability of human labor and optimizing the use of available resources. With the automation of repetitive and physically demanding tasks, the need for a large workforce diminishes, which is expected to propel the growth of the Automated Container Terminal Market. Although the industry of ports and container shipping is often regarded as conservative and resistant to change, there are new technologies, systems and solutions emerging that will alter this perception in the coming years, leading the entire sector to a brighter, more connected future. A Smart Port uses automated Container Terminals and innovative technologies including Artificial Intelligence (AI), Big Data, the Internet of Things (IoT) and Blockchain to improve its performance.Recommendations for the Grow in the Automated Container Terminal Market: More Focus on Flexible Labor Arrangements to Avoid Conflicts: The MMR research observed that the adoption of automated containers drives anxiety regarding job security between workers. So it is the need of an hour for governments and private owners to do flexible labor arrangements. Governments should consider how such flexible port labor arrangements are facilitated. These flexible arrangements between labor and automation are expected to provide job security to workers and help to increase the Automated Container Terminal Key Company’s profit share in Automated Container Terminal Market. Adopt the Port Automation Projects and Get Cost Benefits: The automated container terminal adoption increases productivity and reliability and reduces the turnaround time for vessels. This provides cost benefits for ports and shipping companies and faster transportation of goods. These findings from report help governments, Automated Container Terminal Key Players and policymakers to identify under which conditions automation expected to be greatly effective. Increase Awareness about Benefits of Port Automation between Employers and Workers: It is important to have dialogues between employers, workers and representatives on the changing dynamics of the port due to automation. Further, findings from the report state that the agreement to share profitable gains with workers is expected to clear the way of implementing automation. This is expected to propel the growth of the Automated Container Terminal Market. Address the Impact of Automation and Automated Containers on Social Needs: Impact of port automation projects that include estimations of societal costs, including impacts on local employment and tax revenues. Governments need this information even if issues related to automation are much broader than the port sector and subject to policies on the balance between the taxation of capital and labor. The Automated Container Terminal Key Companies expected to break a deal by pitching governments and customers on the basis of these factors. High Cost of Investment and Complexity Expected to Limit Automated Container Terminal Market The Automated Container Terminal Market faces several restraints that impact its growth and adoption such as the high initial investment required for implementing automated systems poses a significant barrier for many terminal operators, especially in developing regions. Also, the complexity of integrating automated technologies with existing infrastructure and legacy systems can be challenging and time-consuming. The limited availability of skilled labor in operating and maintaining automated terminal systems is another constraint. Moreover, regulatory and compliance issues, including safety standards and environmental regulations, are expected to impede the Automated Container Terminal Market.

Automated Container Terminal Market Segment Analysis

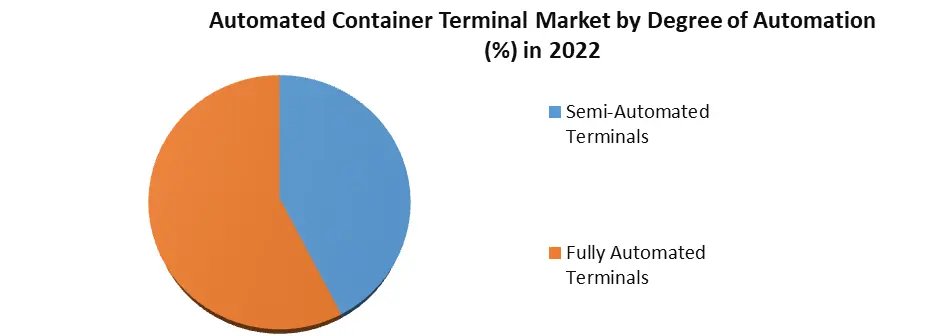

Based on Degree of Automation, Fully automated Terminals are expected to grow significantly throughout the forecast period (2023-2029). Due to the rapid adoption of artificial intelligence (AI) and machine learning (ML), automated container terminals immediately eliminate the labor workforce, which is favorable for port owners. But the growing anxiety among laborers is expected to limit the growth of the fully automated Terminals segment. While Semi-Automated Terminals are more like hybrid systems and involve a workforce for the operation. And this segment is expected to have support from the laborers. Based on Offering, the equipment segment dominated the Automated Container Terminal Market in 2022. This includes various types of automated machinery and infrastructure required to handle containers efficiently, such as automated stacking cranes, automated guided vehicles (AGVs), and terminal operating systems (TOS). These equipment solutions are essential for automating the movement and storage of containers within a terminal. Software and services are also crucial components in an automated container terminal ecosystem. Software solutions, including advanced planning and optimization systems, terminal management systems, and automation control systems play an important role in managing the operations of automated container terminals.

Automated Container Terminal Market Regional Insights

The United States dominated the Automated Container Terminal Market in 2022 and is expected to grow significantly throughout the forecast period (2023-2029). The country has a well-developed and extensive transportation infrastructure, including a vast network of ports and terminals, which makes it an ideal environment for implementing automated container handling systems. The country is home to several innovative companies specializing in automation and robotics. Recently, labor secretary Thomas Perez said U.S. ports should consider automation to compete with high-tech rival destinations abroad and focus on labor flexibility by involving them in the process. All these factors are expected to propel the North America Automated Container Terminal Market. But the workers on the west coast are anxious among U.S. industries due to the automation of ports. This is expected to hamper the desired investment in U.S. Automated Container Terminal Industry.The world’s supply chain is badly hampered by the Covid-19 pandemic. Asia Pacific is expected to hold the largest share of the market. The developing economies in the region such as China and India and the growing rate of import and export are expected to propel the demand for port automation. A decade ago Singapore launched a project to build the biggest automated container port by 2040 by doubling the space and reducing the manpower. The plan set in place long before the onset of supply-chain upheaval now appears prescient. Shipping experts say the city-state handled the most trans-shipped cargo in the world in 2020 and is adding new capacity at a time when the growth of ports is slowing. These factors are expected to drive the Asia Pacific Automated Container Terminal Market.

Automated Container Terminal Market Scope: Inquire Before Buying

Global Automated Container Terminal Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 10.23 Bn. Forecast Period 2023 to 2029 CAGR: 5.5% Market Size in 2029: US $ 14.88 Bn. Segments Covered: by Degree of Automation Semi-Automated Terminals Fully Automated Terminals by Project Type Brownfield Projects Greenfield Projects by Offering Equipment Software Services Automated Container Terminal Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automated Container Terminal Market, Key Players are

1. Cargotec 2. Konecranes 3. Liebherr 4. ABB 5. Künz 6. CyberLogitec 7. IDENTEC SOLUTIONS 8. Camco Technologies 9. ORBCOMM 10. Hitachi Transport System 11. Mitsubishi Heavy Industries 12. Toyota Industries 13. SSA Marine 14. DP World 15. APM Terminals 16. Evergreen Marine 17. CMA CGMFrequently Asked Questions:

1] What is the growth rate of the Market? Ans. The Market is growing at a CAGR of 5.5% during the forecast period. 2] Which region is expected to dominate the Market? Ans. North America is expected to dominate the Market during the forecast period from 2023 to 2029. 3] What is the expected Market Project Type by 2029? Ans. The Project Type of Market by 2029 is expected to reach USD 14.88 Bn. 4] Who are the top players in the Market? Ans. The major key players in the Market are American Keg Company, LLC, The Metal Drum Company and Blefa GmbH, Ardagh Group S.A. 5] Which factors contributed to the growth of the Market in 2022? Ans. The Market is expected to grow due to the growing increased consumption and demand for beer.

1. Automated Container Terminal Market: Research Methodology 2. Automated Container Terminal Market: Executive Summary 3. Automated Container Terminal Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Automated Container Terminal Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Automated Container Terminal Market Project Type and Forecast by Segments (by Value USD and Volume Units) 5.1. Automated Container Terminal Market Project Type and Forecast, by Degree of Automation (2022-2029) 5.1.1. Semi-Automated Terminals 5.1.2. Fully Automated Terminals 5.2. Automated Container Terminal Market Project Type and Forecast, by Project Type (2022-2029) 5.2.1. Brownfield Projects 5.2.2. Greenfield Projects 5.3. Automated Container Terminal Market Project Type and Forecast, by Offering (2022-2029) 5.3.1. Equipment 5.3.2. Software 5.3.3. Services 5.4. Automated Container Terminal Market Project Type and Forecast, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Automated Container Terminal Market Project Type and Forecast (by Value USD and Volume Units) 6.1. North America Automated Container Terminal Market Project Type and Forecast, by Degree of Automation (2022-2029) 6.1.1. Semi-Automated Terminals 6.1.2. Fully Automated Terminals 6.2. North America Automated Container Terminal Market Project Type and Forecast, by Project Type (2022-2029) 6.2.1. Brownfield Projects 6.2.2. Greenfield Projects 6.3. North America Automated Container Terminal Market Project Type and Forecast, by Offering (2022-2029) 6.3.1. Equipment 6.3.2. Software 6.3.3. Services 6.4. North America Automated Container Terminal Market Project Type and Forecast, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Automated Container Terminal Market Project Type and Forecast (by Value USD and Volume Units) 7.1. Europe Automated Container Terminal Market Project Type and Forecast, by Degree of Automation (2022-2029) 7.1.1. Semi-Automated Terminals 7.1.2. Fully Automated Terminals 7.2. Europe Automated Container Terminal Market Project Type and Forecast, by Project Type (2022-2029) 7.2.1. Brownfield Projects 7.2.2. Greenfield Projects 7.3. Europe Automated Container Terminal Market Project Type and Forecast, by Offering (2022-2029) 7.3.1. Equipment 7.3.2. Software 7.3.3. Services 7.4. Europe Automated Container Terminal Market Project Type and Forecast, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Automated Container Terminal Market Project Type and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Automated Container Terminal Market Project Type and Forecast, by Degree of Automation (2022-2029) 8.1.1. Semi-Automated Terminals 8.1.2. Fully Automated Terminals 8.2. Asia Pacific Automated Container Terminal Market Project Type and Forecast, by Project Type (2022-2029) 8.2.1. Brownfield Projects 8.2.2. Greenfield Projects 8.3. Asia Pacific Automated Container Terminal Market Project Type and Forecast, by Offering (2022-2029) 8.3.1. Equipment 8.3.2. Software 8.3.3. Services 8.4. Asia Pacific Automated Container Terminal Market Project Type and Forecast, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Automated Container Terminal Market Project Type and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Automated Container Terminal Market Project Type and Forecast, by Degree of Automation (2022-2029) 9.1.1. Semi-Automated Terminals 9.1.2. Fully Automated Terminals 9.2. Middle East and Africa Automated Container Terminal Market Project Type and Forecast, by Project Type (2022-2029) 9.2.1. Brownfield Projects 9.2.2. Greenfield Projects 9.3. Middle East and Africa Automated Container Terminal Market Project Type and Forecast, by Offering (2022-2029) 9.3.1. Equipment 9.3.2. Software 9.3.3. Services 9.4. Middle East and Africa Automated Container Terminal Market Project Type and Forecast, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Automated Container Terminal Market Project Type and Forecast (by Value USD and Volume Units) 10.1. South America Automated Container Terminal Market Project Type and Forecast, by Degree of Automation (2022-2029) 10.1.1. Semi-Automated Terminals 10.1.2. Fully Automated Terminals 10.2. South America Automated Container Terminal Market Project Type and Forecast, by Project Type (2022-2029) 10.2.1. Brownfield Projects 10.2.2. Greenfield Projects 10.3. South America Automated Container Terminal Market Project Type and Forecast, by Offering (2022-2029) 10.3.1. Equipment 10.3.2. Software 10.3.3. Services 10.4. South America Automated Container Terminal Market Project Type and Forecast, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Cargotec 1.1.1. Company Overview 1.1.2. Financial Overview 1.1.3. Business Portfolio 1.1.4. SWOT Analysis 1.1.5. Business Strategy 1.1.6. Recent Developments 11.2. Konecranes 11.3. Liebherr 11.4. ABB 11.5. Künz 11.6. CyberLogitec 11.7. IDENTEC SOLUTIONS 11.8. Camco Technologies 11.9. ORBCOMM 11.10. Hitachi Transport System 11.11. Mitsubishi Heavy Industries 11.12. Toyota Industries 11.13. SSA Marine 11.14. DP World 11.15. APM Terminals 11.16. Evergreen Marine 11.17. CMA CGM 12. Key Findings 13. Industry Recommendation