The Antibody Drug Conjugates Market size was valued at USD 9.8 Billion in 2023 and the total Antibody Drug Conjugates revenue is expected to grow at a CAGR of 15.4% from 2024 to 2030, reaching nearly USD 22.5 Billion by 2030.Antibody Drug Conjugates Market Overview:

An Antibody-Drug Conjugate (ADC) typically consists of a monoclonal antibody (mAbs) covalently linked to a cytotoxic drug through a chemical linker. This innovative therapeutic approach harnesses the benefits of precise targeting capabilities and potent cytotoxic effects, facilitating the accurate and efficient elimination of cancer cells. The development of ADCs has emerged as a focal point in the research and advancement of anticancer drugs, owing to their potential to combine specificity and potency for enhanced therapeutic outcomes. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Antibody Drug Conjugates Market.To know about the Research Methodology :- Request Free Sample Report Antibody Drug Conjugates Market Competitive Landscapes: The competitive landscape section in the Antibody Drug Conjugates Market is highly fragmented and offers various strategies such as agreements, new product launches, partnerships, expansions, acquisitions, joint ventures, and other crucial aspects to lessen the competition in the market. The market boasts a major market share holder and key company, Pfizer Inc., with Gemtuzumab being the first FDA approved ADC in 2000 for the treatment of relapsed acute myeloid leukemia. In April 2019, AbbVie, another global market player, announced the acquisition of Stemcentrx, including rovalpituzumab tesirine (Rova-T), for $5.8bn, solidifying its position in the market. Additionally, AbbVie formed a joint venture with CytomX to develop and commercialize a probody-drug conjugate (PDC) against CD71, further establishing itself as a key company in the industry. Regeneron Pharmaceuticals and MedImmune also entered into an acquisition, enhancing Regeneron's capabilities to develop ADCs against various cancer targets. Adcetris (brentuximab vedotin), approved in 2011, is another noteworthy development, contributing to the market dynamics. Furthermore, F. Hoffmann La Roche Ltd collaborated with Syapse in January 2018, aiming to accelerate growth in the cancer segment and solidify its position as a global market player. The objective of the report is to present a comprehensive analysis of the Global Antibody Drug Conjugates Market, encompassing all stakeholders in the industry. The report covers the past and current status of the industry, providing a forecasted market size and trends. Key players, including market leaders, followers, and new entrants, are examined. The report incorporates PORTER, SVOR, PESTEL analysis, considering the potential impact of micro-economic factors on the market. Both external and internal factors affecting the business are analyzed, offering decision-makers a clear futuristic view of the industry. Recent industry developments showcase advancements in pharmacogenomics, with a major market share held by this technology (24%), followed by genomics. The genomics market is predicted to grow at the highest CAGR of 13.67% during 204-2030, further influencing the competitive landscape. Growing biopharmaceutical players focusing on treating diseases like cancer are expected to drive positive market growth. The report aids in understanding Global Antibody Drug Conjugates Market dynamics and structure by analyzing market segments. It projects the Global Antibody Drug Conjugates Market size and provides a clear representation of competitive analysis of key players. Factors such as technology type, price, financial position, product portfolio, growth strategies, and regional presence are considered, making the report an investor's guide in the dynamic market landscape.

Antibody Drug Conjugates Market Dynamics:

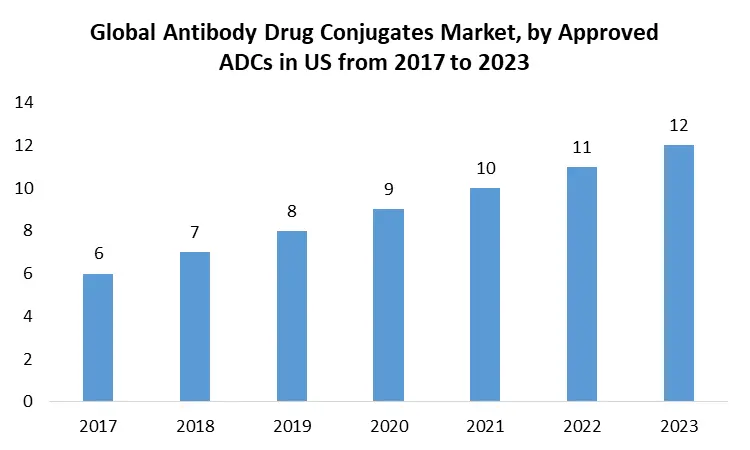

Increasing prevalence of cancer and High demand for Antibody-based Cancer Therapies Driving the As stringent regulation set by the government for approval and different complication related with drug development besides, not so uniform growth in infrastructure across the region becomes a challenging factor for developing countries and the shortage of skilled IT specialists in healthcare are anticipating to restraints the Antibody Drug conjugates market growth. The Antibody Drug Conjugates (ADC) market is experiencing substantial growth driven by various factors. A significant catalyst is the escalating prevalence of cancer, with global estimates revealing approximately 19.3 million new cancer cases and nearly 10.0 million cancer-related deaths in 2022. As cancer incidence correlates with age, there is an increasing demand for ADCs to mitigate the heightened risk associated with aging populations. This trend contributes significantly to the expansion of the Antibody Drug Conjugates Market potential. A pivotal factor contributing to the market's expansion is the heightened incidence of breast cancer, wherein a majority of approved ADCs find application. Variables such as age, obesity, alcohol consumption, family history, and reproductive history collectively contribute to an augmented risk of breast cancer. Given that breast cancer holds the highest incidence and second-highest overall mortality rate among women in the United States, the demand for ADCs in this specific oncological domain contributes substantially to the Antibody Drug conjugates market penetration of Antibody Drug Conjugates. The demand for Antibody-based Cancer therapies is on the ascent, driven by their diverse mechanisms of action, encompassing natural properties, engagement of cytotoxic T cells, and the delivery of cytotoxic payloads. Antibody-drug conjugates (ADCs) constitute a noteworthy share in the clinical pipeline of cancer therapies, accounting for approximately 20%. This underscores the substantial market share held by ADCs within the broader landscape of antibody-based cancer treatments. Technological advancements have played a pivotal role in shaping the Antibody Drug Conjugates market. The transition from first-generation ADCs to second-generation (from 2010 onwards) and third-generation (from 2019 onwards) ADCs exemplifies the market potential for innovations. The introduction of advanced conjugation methods and stable linkers has elevated cytotoxic drug conjugation levels, yielding a more controlled and homogeneous product. This technological progress significantly enhances the potential of the Antibody Drug Conjugates Market. Advancing age remains a critical risk factor for cancer, with approximately 60% of cancers occurring in individuals aged 65 or older. The exponential increase in cancer risk with age underscores the significance of ADCs in addressing healthcare challenges associated with an aging population. This demographic factor constitutes a driving force behind the Antibody Drug Conjugates Market growth. The Antibody Drug Conjugates market is further propelled by intensified research and clinical trials, positioning ADCs as a vital class of anti-cancer drugs. The burgeoning number of ADCs in clinical studies for hematologic malignancies and solid tumors over the past five years reflects the maturation of ADC technology. Notably, nearly 60% of ADCs approved by the Food and Drug Administration in the past three years signify productive clinical outcomes emerging from heightened research and development efforts. Approved ADCs include Polivy (2019), Padcev (2019), EnHertu (2019), Trodelvy (2020), Blenrep (2020), Zynlonta (2021), and Tivdak (2021).Antibody Drug Conjugates Market Segment Analysis:

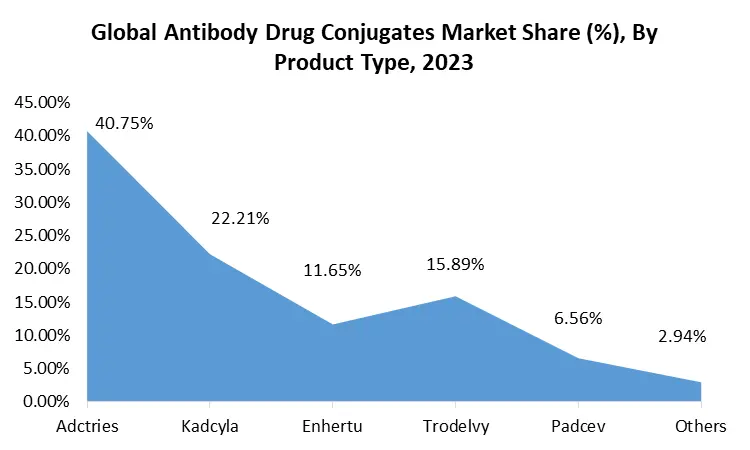

The Antibody Drug Conjugates Market analyzed by different types, including monoclonal antibodies, linker, Drug/toxin, and Others. Monoclonal antibodies, serving as indicators for cancer treatment, are anticipated to play a pivotal role in market growth, with an estimated CAGR of 35.7%, reaching approximately USD 59,110 million by 2030. Monoclonal antibodies are administered by injection and demonstrate high sensitivity, making them integral for targeted therapy and immunotherapy to activate the immune system against cancer. This is expected to significantly contribute to the Antibody Drug Conjugates Market segment share, with regional segments experiencing notable growth. The market is further segmented by product, featuring key players such as Adcertis, Kadcyla, and others. These products contribute significantly to the revenue of the Antibody Drug Conjugates Market. Adcertis, Kadcyla, and other innovative formulations demonstrate the market's diversity and are poised to impact cancer treatment strategies. The Antibody Drug Conjugates Market segment share for these products is expected to vary based on regional segment growth, reflecting the evolving landscape of cancer therapeutics. The technological landscape of the Antibody Drug Conjugates Market is characterized by various platforms, including ImmunoGen technology, Seattle Genetics technology, Immunomedics technology, and others. These technologies are instrumental in the development of ADCs, contributing to their efficacy and therapeutic potential. The diverse technological approaches provide options for tailored treatment solutions in cancer therapy. The Antibody Drug Conjugates Market segment share for each technology is influenced by regional segment growth, indicating the adaptability of these technologies in different markets. In terms of application, the market exhibits distinctive trends with Breast cancer anticipated to dominate revenue during the forecast period. The high prevalence of Breast cancer, particularly in women, has led to its status as a leading cause of mortality, responsible for half a million deaths globally. Treatment procedures, including ADCs and chemotherapy, are pivotal in targeting Breast cancer, with notable advancements such as Ado-Trastuzumab emtansine (T-DM1) approved for HER2-positive Breast cancer treatment. The market is further segmented into ovarian cancer, lung cancer, blood cancer, and brain tumor, reflecting the diverse landscape of cancer therapeutics. Regional segment growth in these applications influences the Antibody Drug Conjugates Market segment share and overall market dynamics.

Antibody Drug Conjugates Market Regional Insights:

North America stands as the major force in the Antibody Drug Conjugates (ADC) Market, holding the largest market share and projected to attain a value of USD 6.72 billion by 2030, Within North America, the United States is poised to play a central role, exceptional other regional counterparts such as Canada, Mexico, and others. This dominance attributed to the forefront position achieved through advancements in nanotechnology, the presence of well-established biopharmaceutical companies, strategic government initiatives investing significantly in research and development (R&D), and a substantial uptick in product approvals and commercialization of ADCs within the pharmaceutical sector. The proactive regulatory oversight of the U.S. Food and Drug Administration (FDA) further bolsters the growth prospects of the market in North America. The regional growth of the Antibody Drug Conjugates Market in North America is underlined by these influential factors. In Europe, the Antibody Drug Conjugates Market signifies the second-largest regional segment. The European market is composed for substantial growth, driven by key factors such as a mature pharmaceutical industry, a vigorous healthcare infrastructure, and escalating investments in research and development. Regulatory bodies like the European Medicines Agency (EMA) play an essential role in overseeing approvals and ensuring the safety and efficacy of ADCs. The market dynamics in Europe are characterized by a growing emphasis on precision medicine and targeted therapies, contributing significantly to the overall expansion of the Market in the region. The Antibody Drug Conjugates Market share in the US is a noteworthy contributor to the comprehensive market dynamics. In the Asia Pacific (APAC) region, the Antibody Drug Conjugates segment emerges as the fastest-growing market, projected to achieve the highest Compound Annual Growth Rate (CAGR) of 13.11% during the forecast period. The APAC region, featuring dynamic economies such as India and China, propels market growth through promising government initiatives, a rising awareness of ADCs, and a burgeoning number of biopharmaceutical companies. Consequently, APAC is anticipated to make a substantial contribution to the global Antibody Drug Conjugates Market, reflecting a transformative shift in the pharmaceutical landscape towards precision medicine and targeted therapeutics. The Antibody Drug Conjugates Market potential in North America and Asia Pacific underscores the pivotal roles these regions play in shaping the future landscape of cancer therapeutics.Antibody Drug Conjugates Market Scope: Inquire before buying

Global Antibody Drug Conjugates Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 9.8 Bn. Forecast Period 2024 to 2030 CAGR: 15.4% Market Size in 2030: US $ 22.5 Bn. Segments Covered: by Application Blood Cancer Prostate cancer kidney cancer Pancreas cancer Ovary cancer Glioblastoma lung cancer Colon cancer Breast cancer Skin cancer Solid tumors Other cancers by Type Monoclonal antibodies linker Drug/toxin Others by Product Adcertis Kadcyla Others by Technology ImmunoGen technology Seattle Genetics technology Immunomedics technology Others by End User Hospitals Specialized cancer centers Academic research institutes Biotechnology companies Biopharmaceutical companies Others Antibody Drug Conjugates Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Antibody Drug Conjugates Market Key Players:

North America: 1. AbbVie 2. Stem CentRx 3. Biogen Idec 4. Millennium 5. PDL BioPharma 6. Progenics Pharmaceuticals 7. Seattle Genetics 8. Viventia Biotechnologies 9. ImmunoGen, Inc 10. Pfizer Inc. 11. Immunomedics Inc. 12. Celldex Therapeutics Inc Europe: 1. Roche 2. UCB 3. Nordic Nanovector 4. Biotest AG 5. Synthon Holding B.V. 6. Sanofi S.A. 7. Bayer Healthcare Pharmaceuticals Asia Pacific: 1. Novartis 2. Merck 3. AbGenomics Corporation Global: 1. AstraZeneca 2. Johnson & Johnson 3. Amgen Inc. 4. Gilead Sciences 5. Eli Lilly and Company 6. Takeda Pharmaceutical Company 7. GlaxoSmithKline FAQs: 1. What are Antibody Drug Conjugates (ADCs)? Ans: ADCs are a class of targeted therapies combining monoclonal antibodies with cytotoxic drugs to treat various cancers. 2. Who are the major players in the global Antibody Drug Conjugates Market? Ans: Key global market players include Pfizer Inc., AbbVie, Regeneron Pharmaceuticals, and F. Hoffmann La Roche Ltd. 3. Which ADC gained FDA approval first and for what indication? Ans: Gemtuzumab, marketed by Pfizer Inc., was the first FDA-approved ADC in 2000 for relapsed acute myeloid leukemia. 4. What significant acquisition took place in the Antibody Drug Conjugates Market? Ans: AbbVie's acquisition of Stemcentrx, including Rova-T, for USD 5.8 Bn in April 2019, was a notable development. 5. How is the market responding to advancements in pharmacogenomics? Ans: Pharmacogenomics, holding a major market share (24%), is contributing to drug efficacy based on genetic evidence, fostering market growth.

1. Antibody Drug Conjugates Market: Research Methodology 2. Antibody Drug Conjugates Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Antibody Drug Conjugates Market: Qualitative Analysis 3.1. Technological Innovations Shaping the Market 3.2. Rising Healthcare Expenditure 4. Antibody Drug Conjugates Market: Dynamics 4.1. Antibody Drug Conjugates Market Trends by Region 4.1.1. North America Antibody Drug Conjugates Market Trends 4.1.2. Europe Antibody Drug Conjugates Market Trends 4.1.3. Asia Pacific Antibody Drug Conjugates Market Trends 4.1.4. Middle East and Africa Antibody Drug Conjugates Market Trends 4.1.5. South America Antibody Drug Conjugates Market Trends 4.2. Antibody Drug Conjugates Market Dynamics by Region 4.2.1. North America 4.2.1.1. North America Antibody Drug Conjugates Market Drivers 4.2.1.2. North America Antibody Drug Conjugates Market Restraints 4.2.1.3. North America Antibody Drug Conjugates Market Opportunities 4.2.1.4. North America Antibody Drug Conjugates Market Challenges 4.2.2. Europe 4.2.2.1. Europe Antibody Drug Conjugates Market Drivers 4.2.2.2. Europe Antibody Drug Conjugates Market Restraints 4.2.2.3. Europe Antibody Drug Conjugates Market Opportunities 4.2.2.4. Europe Antibody Drug Conjugates Market Challenges 4.2.3. Asia Pacific 4.2.3.1. Asia Pacific Antibody Drug Conjugates Market Drivers 4.2.3.2. Asia Pacific Antibody Drug Conjugates Market Restraints 4.2.3.3. Asia Pacific Antibody Drug Conjugates Market Opportunities 4.2.3.4. Asia Pacific Antibody Drug Conjugates Market Challenges 4.2.4. Middle East and Africa 4.2.4.1. Middle East and Africa Antibody Drug Conjugates Market Drivers 4.2.4.2. Middle East and Africa Antibody Drug Conjugates Market Restraints 4.2.4.3. Middle East and Africa Antibody Drug Conjugates Market Opportunities 4.2.4.4. Middle East and Africa Antibody Drug Conjugates Market Challenges 4.2.5. South America 4.2.5.1. South America Antibody Drug Conjugates Market Drivers 4.2.5.2. South America Antibody Drug Conjugates Market Restraints 4.2.5.3. South America Antibody Drug Conjugates Market Opportunities 4.2.5.4. South America Antibody Drug Conjugates Market Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Technology Roadmap 4.6. Regulatory Landscape by Region 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 4.7. Key Opinion Leader Analysis For Antibody Drug Conjugates Industry 4.8. Analysis of Government Schemes and Initiatives For Antibody Drug Conjugates Industry 4.9. The Global Pandemic Impact on Antibody Drug Conjugates Market 5. Antibody Drug Conjugates Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 5.1.1. Blood Cancer 5.1.2. Prostate cancer 5.1.3. kidney cancer 5.1.4. Pancreas cancer 5.1.5. Ovary cancer 5.1.6. Glioblastoma 5.1.7. lung cancer 5.1.8. Colon cancer 5.1.9. Breast cancer 5.1.10. Skin cancer 5.1.11. Solid tumors 5.1.12. Other cancers 5.2. Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 5.2.1. Monoclonal antibodies 5.2.2. linker 5.2.3. Drug/toxin 5.2.4. Others 5.3. Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 5.3.1. Adcertis 5.3.2. Kadcyla 5.3.3. Others 5.4. Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 5.4.1. ImmunoGen technology 5.4.2. Seattle Genetics technology 5.4.3. Immunomedics technology 5.4.4. Others 5.5. Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 5.5.1. Hospitals 5.5.2. Specialized cancer centers 5.5.3. Academic research institutes 5.6. Antibody Drug Conjugates Market Size and Forecast, by Region (2023-2030) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Antibody Drug Conjugates Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. North America Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 6.1.1. Blood Cancer 6.1.2. Prostate cancer 6.1.3. kidney cancer 6.1.4. Pancreas cancer 6.1.5. Ovary cancer 6.1.6. Glioblastoma 6.1.7. lung cancer 6.1.8. Colon cancer 6.1.9. Breast cancer 6.1.10. Skin cancer 6.1.11. Solid tumors 6.1.12. Other cancers 6.2. North America Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 6.2.1. Monoclonal antibodies 6.2.2. linker 6.2.3. Drug/toxin 6.2.4. Others 6.3. North America Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 6.3.1. Adcertis 6.3.2. Kadcyla 6.3.3. Others 6.4. North America Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 6.4.1. ImmunoGen technology 6.4.2. Seattle Genetics technology 6.4.3. Immunomedics technology 6.4.4. Others 6.5. North America Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 6.5.1. Hospitals 6.5.2. Specialized cancer centers 6.5.3. Academic research institutes 6.6. Antibody Drug Conjugates Market Size and Forecast, by Country (2023-2030) 6.6.1. United States 6.6.1.1. United States Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 6.6.1.1.1. Blood Cancer 6.6.1.1.2. Prostate cancer 6.6.1.1.3. kidney cancer 6.6.1.1.4. Pancreas cancer 6.6.1.1.5. Ovary cancer 6.6.1.1.6. Glioblastoma 6.6.1.1.7. lung cancer 6.6.1.1.8. Colon cancer 6.6.1.1.9. Breast cancer 6.6.1.1.10. Skin cancer 6.6.1.1.11. Solid tumors 6.6.1.1.12. Other cancers 6.6.1.2. United States Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 6.6.1.2.1. Monoclonal antibodies 6.6.1.2.2. linker 6.6.1.2.3. Drug/toxin 6.6.1.2.4. Others 6.6.1.3. United States Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 6.6.1.3.1. Adcertis 6.6.1.3.2. Kadcyla 6.6.1.3.3. Others 6.6.1.4. United States Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 6.6.1.4.1. ImmunoGen technology 6.6.1.4.2. Seattle Genetics technology 6.6.1.4.3. Immunomedics technology 6.6.1.4.4. Others 6.6.1.5. United States Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 6.6.1.5.1. Hospitals 6.6.1.5.2. Specialized cancer centers 6.6.1.5.3. Academic research institutes 6.6.2. Canada 6.6.2.1. Canada Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 6.6.2.1.1. Blood Cancer 6.6.2.1.2. Prostate cancer 6.6.2.1.3. kidney cancer 6.6.2.1.4. Pancreas cancer 6.6.2.1.5. Ovary cancer 6.6.2.1.6. Glioblastoma 6.6.2.1.7. lung cancer 6.6.2.1.8. Colon cancer 6.6.2.1.9. Breast cancer 6.6.2.1.10. Skin cancer 6.6.2.1.11. Solid tumors 6.6.2.1.12. Other cancers 6.6.2.2. Canada Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 6.6.2.2.1. Monoclonal antibodies 6.6.2.2.2. linker 6.6.2.2.3. Drug/toxin 6.6.2.2.4. Others 6.6.2.3. Canada Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 6.6.2.3.1. Adcertis 6.6.2.3.2. Kadcyla 6.6.2.3.3. Others 6.6.2.4. Canada Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 6.6.2.4.1. ImmunoGen technology 6.6.2.4.2. Seattle Genetics technology 6.6.2.4.3. Immunomedics technology 6.6.2.4.4. Others 6.6.2.5. Canada Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 6.6.2.5.1. Hospitals 6.6.2.5.2. Specialized cancer centers 6.6.2.5.3. Academic research institutes 6.6.3. Mexico 6.6.3.1. Mexico Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 6.6.3.1.1. Blood Cancer 6.6.3.1.2. Prostate cancer 6.6.3.1.3. kidney cancer 6.6.3.1.4. Pancreas cancer 6.6.3.1.5. Ovary cancer 6.6.3.1.6. Glioblastoma 6.6.3.1.7. lung cancer 6.6.3.1.8. Colon cancer 6.6.3.1.9. Breast cancer 6.6.3.1.10. Skin cancer 6.6.3.1.11. Solid tumors 6.6.3.1.12. Other cancers 6.6.3.2. Mexico Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 6.6.3.2.1. Monoclonal antibodies 6.6.3.2.2. linker 6.6.3.2.3. Drug/toxin 6.6.3.2.4. Others 6.6.3.3. Mexico Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 6.6.3.3.1. Adcertis 6.6.3.3.2. Kadcyla 6.6.3.3.3. Others 6.6.3.4. Mexico Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 6.6.3.4.1. ImmunoGen technology 6.6.3.4.2. Seattle Genetics technology 6.6.3.4.3. Immunomedics technology 6.6.3.4.4. Others 6.6.3.5. Mexico Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 6.6.3.5.1. Hospitals 6.6.3.5.2. Specialized cancer centers 6.6.3.5.3. Academic research institutes 7. Europe Antibody Drug Conjugates Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Europe Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 7.2. Europe Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 7.3. Europe Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 7.4. Europe Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 7.5. Europe Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 7.6. Europe Antibody Drug Conjugates Market Size and Forecast, by Country (2023-2030) 7.6.1. United Kingdom 7.6.1.1. United Kingdom Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 7.6.1.2. United Kingdom Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 7.6.1.3. United Kingdom Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 7.6.1.4. United Kingdom Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 7.6.1.5. United Kingdom Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 7.6.2. France 7.6.2.1. France Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 7.6.2.2. France Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 7.6.2.3. France Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 7.6.2.4. France Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 7.6.2.5. France Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 7.6.3. Germany 7.6.3.1. Germany Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 7.6.3.2. Germany Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 7.6.3.3. Germany Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 7.6.3.4. Germany Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 7.6.3.5. Germany Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 7.6.4. Italy 7.6.4.1. Italy Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 7.6.4.2. Italy Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 7.6.4.3. Italy Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 7.6.4.4. Italy Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 7.6.4.5. Italy Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 7.6.5. Spain 7.6.5.1. Spain Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 7.6.5.2. Spain Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 7.6.5.3. Spain Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 7.6.5.4. Spain Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 7.6.5.5. Spain Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 7.6.6. Sweden 7.6.6.1. Sweden Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 7.6.6.2. Sweden Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 7.6.6.3. Sweden Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 7.6.6.4. Sweden Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 7.6.6.5. Sweden Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 7.6.7. Austria 7.6.7.1. Austria Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 7.6.7.2. Austria Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 7.6.7.3. Austria Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 7.6.7.4. Austria Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 7.6.7.5. Austria Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 7.6.8. Rest of Europe 7.6.8.1. Rest of Europe Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 7.6.8.2. Rest of Europe Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 7.6.8.3. Rest of Europe Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 7.6.8.4. Rest of Europe Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 7.6.8.5. Rest of Europe Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8. Asia Pacific Antibody Drug Conjugates Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.2. Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.3. Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.4. Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.5. Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6. Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by Country (2023-2030) 8.6.1. China 8.6.1.1. China Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.1.2. China Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.1.3. China Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.1.4. China Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.1.5. China Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6.2. S Korea 8.6.2.1. S Korea Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.2.2. S Korea Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.2.3. S Korea Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.2.4. S Korea Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.2.5. S Korea Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6.3. Japan 8.6.3.1. Japan Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.3.2. Japan Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.3.3. Japan Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.3.4. Japan Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.3.5. Japan Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6.4. India 8.6.4.1. India Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.4.2. India Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.4.3. India Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.4.4. India Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.4.5. India Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6.5. Australia 8.6.5.1. Australia Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.5.2. Australia Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.5.3. Australia Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.5.4. Australia Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.5.5. Australia Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6.6. Indonesia 8.6.6.1. Indonesia Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.6.2. Indonesia Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.6.3. Indonesia Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.6.4. Indonesia Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.6.5. Indonesia Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6.7. Malaysia 8.6.7.1. Malaysia Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.7.2. Malaysia Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.7.3. Malaysia Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.7.4. Malaysia Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.7.5. Malaysia Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6.8. Vietnam 8.6.8.1. Vietnam Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.8.2. Vietnam Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.8.3. Vietnam Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.8.4. Vietnam Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.8.5. Vietnam Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6.9. Taiwan 8.6.9.1. Taiwan Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.9.2. Taiwan Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.9.3. Taiwan Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.9.4. Taiwan Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.9.5. Taiwan Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 8.6.10. Rest of Asia Pacific 8.6.10.1. Rest of Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 8.6.10.2. Rest of Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 8.6.10.3. Rest of Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 8.6.10.4. Rest of Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 8.6.10.5. Rest of Asia Pacific Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 9. Middle East and Africa Antibody Drug Conjugates Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. Middle East and Africa Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 9.2. Middle East and Africa Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 9.3. Middle East and Africa Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 9.4. Middle East and Africa Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 9.5. Middle East and Africa Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 9.6. Middle East and Africa Antibody Drug Conjugates Market Size and Forecast, by Country (2023-2030) 9.6.1. South Africa 9.6.1.1. South Africa Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 9.6.1.2. South Africa Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 9.6.1.3. South Africa Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 9.6.1.4. South Africa Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 9.6.1.5. South Africa Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 9.6.2. GCC 9.6.2.1. GCC Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 9.6.2.2. GCC Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 9.6.2.3. GCC Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 9.6.2.4. GCC Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 9.6.2.5. GCC Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 9.6.3. Nigeria 9.6.3.1. Nigeria Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 9.6.3.2. Nigeria Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 9.6.3.3. Nigeria Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 9.6.3.4. Nigeria Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 9.6.3.5. Nigeria Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 9.6.4. Rest of ME&A 9.6.4.1. Rest of ME&A Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 9.6.4.2. Rest of ME&A Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 9.6.4.3. Rest of ME&A Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 9.6.4.4. Rest of ME&A Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 9.6.4.5. Rest of ME&A Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 10. South America Antibody Drug Conjugates Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 10.1. South America Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 10.2. South America Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 10.3. South America Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 10.4. South America Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 10.5. South America Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 10.6. South America Antibody Drug Conjugates Market Size and Forecast, by Country (2023-2030) 10.6.1. Brazil 10.6.1.1. Brazil Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 10.6.1.2. Brazil Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 10.6.1.3. Brazil Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 10.6.1.4. Brazil Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 10.6.1.5. Brazil Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 10.6.2. Argentina 10.6.2.1. Argentina Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 10.6.2.2. Argentina Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 10.6.2.3. Argentina Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 10.6.2.4. Argentina Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 10.6.2.5. Argentina Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 10.6.3. Rest Of South America 10.6.3.1. Rest Of South America Antibody Drug Conjugates Market Size and Forecast, by Application (2023-2030) 10.6.3.2. Rest Of South America Antibody Drug Conjugates Market Size and Forecast, by Type (2023-2030) 10.6.3.3. Rest Of South America Antibody Drug Conjugates Market Size and Forecast, by Product (2023-2030) 10.6.3.4. Rest Of South America Antibody Drug Conjugates Market Size and Forecast, by Technology (2023-2030) 10.6.3.5. Rest Of South America Antibody Drug Conjugates Market Size and Forecast, by End-User (2023-2030) 11. Global Antibody Drug Conjugates Market: Competitive Landscape 11.1. MMR Competition Matrix 11.2. Competitive Landscape 11.3. Key Players Benchmarking 11.3.1. Company Name 11.3.2. Service Segment 11.3.3. End-user Segment 11.3.4. Revenue (2023) 11.3.5. Company Locations 11.4. Leading Antibody Drug Conjugates Market Companies, by Market Capitalization 11.5. Market Structure 11.5.1. Market Leaders 11.5.2. Market Followers 11.5.3. Emerging Players 11.6. Mergers and Acquisitions Details 12. Company Profile: Key Players 12.1. AstraZeneca 12.1.1. Business Portfolio 12.1.2. Financial Overview 12.1.3. SWOT Analysis 12.1.4. Strategic Analysis 12.1.5. Scale of Operation (Small, Medium, and Large) 12.1.6. Recent Developments 12.2. AbbVie 12.3. Stem CentRx 12.4. Biogen Idec 12.5. Millennium 12.6. PDL BioPharma 12.7. Progenics Pharmaceuticals 12.8. Seattle Genetics 12.9. Viventia Biotechnologies 12.10. ImmunoGen, Inc 12.11. Pfizer Inc. 12.12. Immunomedics Inc. 12.13. Celldex Therapeutics Inc 12.14. Roche 12.15. UCB 12.16. Nordic Nanovector 12.17. Biotest AG 12.18. Synthon Holding B.V. 12.19. Sanofi S.A. 12.20. Bayer Healthcare Pharmaceuticals 12.21. Novartis 12.22. Merck 12.23. AbGenomics Corporation 12.24. Johnson & Johnson 12.25. Amgen Inc. 12.26. Gilead Sciences 12.27. Eli Lilly and Company 12.28. Takeda Pharmaceutical Company 12.29. GlaxoSmithKline 13. Key Findings 14. Industry Recommendations