The Alpha-Methylstyrene Market was valued at USD 498.3 Mn in 2024, and the total revenue of the Global Alpha-Methylstyrene Market is expected to grow at a CAGR of 3.9% from 2025 to 2032, reaching nearly USD 676.73 Mn by 2032.Alpha-Methylstyrene Market Overview

Alpha-methylstyrene (AMS) is a high-purity chemical intermediate primarily used in producing ABS resins, adhesives, coatings, and plasticisers used for enhancing heat resistance and polymer performance. The global Alpha-methylstyrene market is growing due to rising demand for lightweight, durable plastics in the automotive and construction sectors, alongside growing adhesive applications in packaging. Key factors include increasing disposable incomes and cost-effective alternatives to traditional materials, though compatibility issues with oxidizers pose challenges. Supply is concentrated among integrated petrochemical players, with demand surging for high-purity AMS in premium applications. North America led in R&D and adhesives production. Also, Asia Pacific dominated ABS resin manufacturing, driven by China’s automotive boom. Top players like INEOS Styrolution and Mitsubishi Chemical leverage vertical integration and sustainable innovations, while SABIC capitalises on Middle East feedstock advantages. End-use industries (automotive, electronics) contribute significantly, though trade tariffs on benzene/propylene derivatives and regulations like REACH impact cost structures and regional trade flows. The report coverd the Alpha-Methylstyrene Market dynamics, structure by analysing the market segments and projecting the Alpha-Methylstyrene Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies and regional presence in the Alpha-Methylstyrene Market.To know about the Research Methodology:-Request Free Sample Report

Global Alpha-Methylstyrene Market Dynamics

Rising Demand in Acrylonitrile-Butadiene-Styrene ABS Resins to Boost the Alpha-Methylstyrene Market Growth The major drivers of using alpha-methylstyrene include acrylonitrile-butadiene-styrene (ABS) resins that account for approximately one-third of the demand. The alpha-methylstyrene market is experiencing growth on account of increasing disposable income all over the globe. The major factor driving the growth of the overall market is a constant increase in disposable income across the world. The market has experienced a significant rise in the adoption of alpha-methylstyrene (AMS), as there is a very small investment cost associated with it as compared to the customary machines. Adhesives, Coatings to Drive Alpha-Methylstyrene Market Growth Additionally, the alpha-methylstyrene market is expected to find new opportunities related to coatings and paints. The alpha-methylstyrene can grow as the more plasticizers, low molecular weighted, coatings, waxes and adhesives are in demand. Also, the adhesives market is witnessing healthy growth, further enhancing the prospects of the alpha-methylstyrene market. However, the alpha-methylstyrene market is an incompatibility with strong oxidising agents such as mercury, copper and alkaline pesticides is a major restraint for the market growth.Global Alpha-Methylstyrene Market (AMS) Segment Analysis:

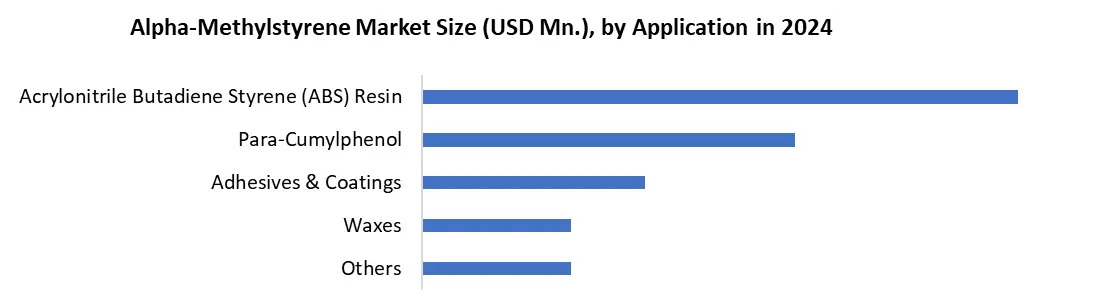

Based on Purity, the Assay Above 99.5% segment dominated the Alpha-Methylstyrene market by purity. This is primarily due to its higher demand in premium applications such as the production of high-performance plastics, adhesives, and resins, where purity is critical for ensuring product consistency and performance. Industries like automotive, electronics, and construction prefer high-purity AMS to meet stringent quality and regulatory standards. Additionally, advancements in purification technologies have made high-purity AMS more accessible, further boosting its market share. Based on Application, the Acrylonitrile Butadiene Styrene (ABS) Resin segment dominated the global Alpha-Methylstyrene Market in 2024 because of the high glass transition temperatures and high heat distortion of ABS. ABS (acrylonitrile-butadiene-styrene) market is rising at a CAGR of around 4.5% owing to its application in automotive and protective equipment, which has increased product usage. Additionally, its production output will rise with processes like the involvement of dehydrogenation in FSU. These factors are expected to propel the alpha-methylstyrene market.

Global Alpha-Methylstyrene Market (AMS) Regional Analysis:

North America market held the largest share of the global Alpha-Methylstyrene Market in 2024 and is projected to register a significant CAGR over the forecast period, owing to the rising demand for the product in the production of waxes. The USA is expected to contribute a major share to the regional market because of advanced R&D capabilities and extensive use of the product in the production of adhesives and coatings. The Asia Pacific is likely to be the fastest-growing regional alpha-methylstyrene market during the forecast period, owing to the increasing use of the product in ABS resin production. China was the leading market in the region in 2023 by reason of the increasing application of the product in plasticisers and automobiles. Recent Developments in the alpha-methylstyrene market. In Jan 2019, Mitsui Chemicals, Inc. announced its aim to begin the production of alpha-methylstyrene by 2023 at its Singapore-based subsidiary, Mitsui Phenols Singapore Pte. Ltd. This development aims at catering to the increased demand for alpha-methylstyrene across the world, owing to an increase in the consumption of ABS resins and petroleum resins in various end-use industries.Alpha-Methylstyrene Market Competitive Landscape

The Alpha-Methylstyrene (AMS) Market is dominated by some major key players like INEOS Styrolution, SI Group, Mitsubishi Chemical Corporation, SABIC and Kumho P&B Chemicals by its strategic innovation and market dominance. INEOS Styrolution excels in high purity AMS production, catering to ABS resins and adhesives, backed by vertical integration and strong R&D. SI Group focuses on specialty AMS derivatives for coatings and lubricants, leveraging its global distribution network. Mitsubishi Chemical drives advancements in sustainable AMS applications, including bio-based alternatives, while SABIC capitalises on cost-efficient petrochemical integration in the Middle East. Kumho P&B Chemicals dominated the Asia Pacific market with high volume production and strategic partnerships in automotive polymers. These leaders maintain their positions by technological expertise, economies of scale, and responsiveness to regional demand shifts, particularly in automotive, construction and packaging sectors, solidifying their edge in a price-sensitive and application-driven market. AdvanSix Inc. and Altivia Petrochemicals strengthen North America's supply chain by captive production and tailored solutions for niche applications. LyondellBasell and Versalis led in Europe with advanced polymerisation technologies and circular economy initiatives, while Sinopec and LG Chem drive Asia's growth through massive production scale and government-backed expansions.Alpha-Methylstyrene Market Key Trends

Trend Description Growing Demand in Polymer Production Rising use of AMS as a comonomer in ABS (Acrylonitrile Butadiene Styrene) resins and other high-performance plastics, driven by the automotive and construction industries. Shift Towards Sustainable Alternatives Increasing R&D in bio-based AMS to meet environmental regulations and reduce reliance on petrochemical feedstocks. Expansion in Adhesives & Coatings Growth in demand for AMS-based adhesives and specialty coatings, particularly in packaging and automotive applications. Volatility in Raw Material Prices Fluctuations in benzene and propylene (key feedstocks) prices impact AMS production costs and market stability. Alpha-Methylstyrene Market Recent Development

• On April 3, 2023, INEOS Phenol completed the acquisition of Mitsui Phenols Singapore Ltd, adding approximately 20 kilotons per year of Alpha-Methylstyrene production capacity, strengthening its global AMS footprint. • On June 11, 2024, INEOS Styrolution (United States) announced it would permanently close its styrene monomer plant in Sarnia, Ontario, which impacts the upstream supply of Alpha-Methylstyrene.Scope of the Global Alpha-Methylstyrene Market (AMS): Inquire before buying

Global Alpha-Methylstyrene Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 498.3 Mn. Forecast Period 2025 to 2032 CAGR: 3.9% Market Size in 2032: USD 676.73 Mn. Segments Covered: by Purity Assay Above 99.5% Between 95% and 99.5% by Application Acrylonitrile Butadiene Styrene (ABS) Resin Para-Cumylphenol Adhesives & Coatings Waxes Others Alpha-Methylstyrene Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Alpha-Methylstyrene Market, Key Players

North America 1. INEOS Styrolution (United States) 2. SI Group (United States) 3. AdvanSix Inc. (United States) 4. Altivia Petrochemicals (United States) 5. The Dow Chemical Company (United States) Europe 6. Cepsa Química (Spain) 7. DOMO Chemicals (Belgium) 8. LyondellBasell Industries (Netherlands) 9. Versalis S.p.A. (Italy) 10. INEOS Group (United Kingdom) 11. Borealis AG (Austria) 12. Synthos S.A. (Poland) Asia Pacific 13. Kumho P&B Chemicals (South Korea) 14. Mitsui Chemicals, Inc. (Japan) 15. LG Chem Ltd. (South Korea) 16. Taiwan Prosperity Chemical Corp. (Taiwan) 17. Shandong Huaxing Petrochemical Group (China) 18. Yantai Yixin Chemical Co., Ltd. (China) 19. Sinopec Group (China) 20. Mitsubishi Chemical Corporation (Japan) 21. Formosa Chemicals & Fibre Corporation (Taiwan) Middle East and Africa 22. SABIC (Saudi Arabia) 23. Iranian Chemical Industries Investment Co. (Iran) 24. Qatar Petrochemical Company (Qatar) South America 25. Braskem S.A. (Brazil) 26. Oxiteno S.A. (Brazil) 27. Unipar Carbocloro (Brazil) FAQ: 1] What Major Key players in the Global Alpha-Methylstyrene Market report? Ans. The Major Key players covered in the Alpha-Methylstyrene Market report are INEOS Styrolution (US), SI Group (US), Mitsubishi Chemical Corporation (Japan), SABIC (Saudi Arabia), and Kumho P&B Chemicals. 2] Which region has the largest share in the Global Alpha-Methylstyrene Market (AMS)? Ans. The North America region held the highest share in 2024. 3] What is the market size of the Global Alpha-Methylstyrene Market by 2032? Ans. The market size of the Alpha-Methylstyrene Market by 2032 is expected to reach USD 676.73 Million. 4] What is the forecast period for the Global Alpha-Methylstyrene Market? Ans. Global Alpha-Methylstyrene Market (AMS) report helps with the PESTEL, Porter's, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 5] What was the market size of the Global Alpha-Methylstyrene Market in 2024? Ans. The market size of the Alpha-Methylstyrene Market in 2024 was valued at USD 498.3 Million.

1. Alpha-Methylstyrene Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Alpha-Methylstyrene Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Service Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Alpha-Methylstyrene Market: Dynamics 3.1. Region-wise Trends of Alpha-Methylstyrene Market 3.1.1. North America Alpha-Methylstyrene Market Trends 3.1.2. Europe Alpha-Methylstyrene Market Trends 3.1.3. Asia Pacific Alpha-Methylstyrene Market Trends 3.1.4. Middle East and Africa Alpha-Methylstyrene Market Trends 3.1.5. South America Alpha-Methylstyrene Market Trends 3.2. Alpha-Methylstyrene Market Dynamics 3.2.1. Alpha-Methylstyrene Market Drivers 3.2.1.1. ABS Resin Demand 3.2.1.2. Rising Disposable Income 3.2.1.3. Low Investment Requirement 3.2.2. Alpha-Methylstyrene Market Restraints 3.2.3. Alpha-Methylstyrene Market Opportunities 3.2.3.1. Growing Adhesives Market 3.2.3.2. Paints and Coatings Expansion 3.2.4. Alpha-Methylstyrene Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Low-cost raw material availability 3.4.2. Increased use in consumer goods 3.4.3. Innovation in AMS processing 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Alpha-Methylstyrene Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 4.1.1. Assay Above 99.5% 4.1.2. Between 95% and 99.5% 4.2. Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 4.2.1. Acrylonitrile Butadiene Styrene (ABS) Resin 4.2.2. Para-Cumylphenol 4.2.3. Adhesives & Coatings 4.2.4. Waxes 4.2.5. Others 4.3. Alpha-Methylstyrene Market Size and Forecast, By Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Alpha-Methylstyrene Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 5.1.1. Assay Above 99.5% 5.1.2. Between 95% and 99.5% 5.2. North America Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 5.2.1. Acrylonitrile Butadiene Styrene (ABS) Resin 5.2.2. Para-Cumylphenol 5.2.3. Adhesives & Coatings 5.2.4. Waxes 5.2.5. Others 5.3. North America Alpha-Methylstyrene Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 5.3.1.1.1. Assay Above 99.5% 5.3.1.1.2. Between 95% and 99.5% 5.3.1.2. United States Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 5.3.1.2.1. Acrylonitrile Butadiene Styrene (ABS) Resin 5.3.1.2.2. Para-Cumylphenol 5.3.1.2.3. Adhesives & Coatings 5.3.1.2.4. Waxes 5.3.1.2.5. Others 5.3.2. Canada 5.3.2.1. Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 5.3.2.1.1. Assay Above 99.5% 5.3.2.1.2. Between 95% and 99.5% 5.3.2.2. Canada Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 5.3.2.2.1. Acrylonitrile Butadiene Styrene (ABS) Resin 5.3.2.2.2. Para-Cumylphenol 5.3.2.2.3. Adhesives & Coatings 5.3.2.2.4. Waxes 5.3.2.2.5. Others 5.3.3. Mexico 5.3.3.1. Mexico Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 5.3.3.1.1. Assay Above 99.5% 5.3.3.1.2. Between 95% and 99.5% 5.3.3.2. Mexico Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 5.3.3.2.1. Acrylonitrile Butadiene Styrene (ABS) Resin 5.3.3.2.2. Para-Cumylphenol 5.3.3.2.3. Adhesives & Coatings 5.3.3.2.4. Waxes 5.3.3.2.5. Others 6. Europe Alpha-Methylstyrene Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 6.2. Europe Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 6.3. Europe Alpha-Methylstyrene Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 6.3.1.2. United Kingdom Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 6.3.2. France 6.3.2.1. France Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 6.3.2.2. France Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 6.3.3.2. Germany Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 6.3.4.2. Italy Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 6.3.5.2. Spain Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 6.3.6.2. Sweden Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 6.3.7. Russia 6.3.7.1. Russia Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 6.3.7.2. Russia Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 6.3.8.2. Rest of Europe Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Alpha-Methylstyrene Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.2. Asia Pacific Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Alpha-Methylstyrene Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.1.2. China Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.2.2. S Korea Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.3.2. Japan Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.4. India 7.3.4.1. India Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.4.2. India Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.5.2. Australia Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.6.2. Indonesia Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.7. Malaysia 7.3.7.1. Malaysia Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.7.2. Malaysia Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.8. Philippines 7.3.8.1. Philippines Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.8.2. Philippines Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.9. Thailand 7.3.9.1. Thailand Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.9.2. Thailand Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.10. Vietnam 7.3.10.1. Vietnam Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.10.2. Vietnam Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 7.3.11.2. Rest of Asia Pacific Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Alpha-Methylstyrene Market Size and Forecast (by Value in USD Million) (2024-2032 8.1. Middle East and Africa Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 8.2. Middle East and Africa Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Alpha-Methylstyrene Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 8.3.1.2. South Africa Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 8.3.2.2. GCC Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 8.3.3. Egypt 8.3.3.1. Egypt Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 8.3.3.2. Egypt Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 8.3.4. Nigeria 8.3.4.1. Nigeria Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 8.3.4.2. Nigeria Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 8.3.5. Rest of ME&A 8.3.5.1. Rest of ME&A Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 8.3.5.2. Rest of ME&A Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 9. South America Alpha-Methylstyrene Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 9.1. South America Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 9.2. South America Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 9.3. South America Alpha-Methylstyrene Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 9.3.1.2. Brazil Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 9.3.2.2. Argentina Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 9.3.3. Colombia 9.3.3.1. Colombia Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 9.3.3.2. Colombia Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 9.3.4. Chile 9.3.4.1. Chile Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 9.3.4.2. Chile Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 9.3.5. Rest Of South America 9.3.5.1. Rest Of South America Alpha-Methylstyrene Market Size and Forecast, By Purity (2024-2032) 9.3.5.2. Rest Of South America Alpha-Methylstyrene Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. INEOS Styrolution (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. SI Group (United States) 10.3. AdvanSix Inc. (United States) 10.4. Altivia Petrochemicals (United States) 10.5. The Dow Chemical Company (United States) 10.6. Cepsa Química (Spain) 10.7. DOMO Chemicals (Belgium) 10.8. LyondellBasell Industries (Netherlands) 10.9. Versalis S.p.A. (Italy) 10.10. INEOS Group (United Kingdom) 10.11. Borealis AG (Austria) 10.12. Synthos S.A. (Poland) 10.13. Kumho P&B Chemicals (South Korea) 10.14. Mitsui Chemicals, Inc. (Japan) 10.15. LG Chem Ltd. (South Korea) 10.16. Taiwan Prosperity Chemical Corp. (Taiwan) 10.17. Shandong Huaxing Petrochemical Group (China) 10.18. Yantai Yixin Chemical Co., Ltd. (China) 10.19. Sinopec Group (China) 10.20. Mitsubishi Chemical Corporation (Japan) 10.21. Formosa Chemicals & Fibre Corporation (Taiwan) 10.22. SABIC (Saudi Arabia) 10.23. Iranian Chemical Industries Investment Co. (Iran) 10.24. Qatar Petrochemical Company (Qatar) 10.25. Braskem S.A. (Brazil) 10.26. Oxiteno S.A. (Brazil) 10.27. Unipar Carbocloro (Brazil) 11. Key Findings 12. Industry Recommendations 13. Alpha-Methylstyrene Market: Research Methodology