The Aircraft Transparencies Market size was valued at USD 1.38 Bn in 2024, and the total Aircraft Transparencies Market revenue is expected to grow by 7.2% from 2025 to 2032, reaching nearly USD 2.41 Bn.Aircraft Transparencies Market Overview:

Aircraft transparencies are the clear components of an aircraft, such as windshields, canopies, passenger windows, and lenses, manufactured from transparent materials. They play a vital role in ensuring visibility for pilots and passengers and supporting the aircraft’s structural integrity and enhancing its aerodynamic performance. Advanced coatings are being integrated with new aircraft transparencies for functionality to include anti-icing and anti-fogging visible light reduction, UV protection, and infrared filtering, whereas transparencies in military aviation provide ballistic resistance and stealth capabilities (low IR signatures, situational awareness), while those in commercial aviation improve passenger visibility and reduce weight of Aircraft Transparencies. Increasing advancements in technologies in manufacturing transparency allows manufacturers to factor in design specifications for accurate design features and graphics, depending on the type of aircraft, in commercial, military, rotary-wing. The increasing production rates of commercial jets, post-pandemic rebuilding of defense aircraft, and MRO (maintenance, repair, overhaul) of existing jet fleets continue to fuel the demand for aircraft transparencies, especially in the MRO sector of the market. Leading companies such as PPG Industries, GKN Aerospace, Dialight, Gentex Corporation, Trelleborg, and a few others, which propel the Aircraft Transparencies Market.To know about the Research Methodology:-Request Free Sample Report

Aircraft Transparencies Market, Dynamics:

Rising Global Air Fleet Expansion to Drive the Aircraft Transparencies Market The aircraft transparencies industry is experiencing strong momentum due to rising air travel demand and subsequent fleet expansion across commercial, business, and military aviation. Increasing passenger volumes are prompting airlines to place large aircraft orders, while defense forces are modernizing fleets to enhance operational readiness. This drives the need for cockpit windshields, passenger windows, canopies, and other transparency components. Furthermore, the aftermarket segment benefits from retrofits and replacements, as aging fleets require upgraded or replacement transparencies to maintain safety and optical clarity. Regulatory requirements from aviation authorities, such as FAA and EASA, mandate stringent quality and safety standards, boosting demand for high-performance products. The combination of fleet growth, maintenance cycles, and high regulatory standards makes fleet expansion a core driver of Aircraft Transparencies Market growth. The Growing Adoption of Electrochromic and Smart Glass Technologies to Create Aircraft Transparencies Market Opportunity The adoption of electrochromic and smart glass technologies creates an opportunity for the aircraft transparencies market. These advanced solutions enable real-time control over light transmission, allowing passengers to adjust window tint for optimal comfort without physical shades. Beyond enhancing passenger experience, smart glass reduces cabin heat load, thereby lowering air conditioning demand and improving aircraft fuel efficiency critical benefits in an industry striving for greater sustainability. Airlines, particularly in the premium and long-haul segment, are prioritizing such features to differentiate services and meet eco-efficiency goals. Business jets and next-generation commercial aircraft are lead adoption, creating lucrative prospects for transparency manufacturers who invest in R&D and integration capabilities. As sustainability regulations tighten and customer expectations for comfort rise, the integration of smart glass into cabin and cockpit designs is expected to become a major growth catalyst in Aircraft Transparencies Market. High Cost of Advanced Materials and Technologies to Create Restraint in the Aircraft Transparencies Market Producing transparencies with specialized features such as impact resistance, UV filtering, anti-icing coatings, and electrochromic capabilities requires expensive raw materials like polycarbonate composites and multi-layer laminates. Additionally, the production involves precision engineering, stringent quality testing, and compliance with aviation safety standards, all of which increase costs. These factors make adoption financially challenging, especially for smaller aircraft manufacturers, operators in cost-sensitive markets, and budget-constrained defense programs. While high-end commercial and defense aircraft investment, the price barrier slows penetration into mid-tier and regional fleets. The cost factor is by maintenance and replacement expenses over the product lifecycle. Unless advancements in manufacturing reduce costs or incentives are provided, the adoption of premium transparency solutions remains limited in certain Aircraft Transparencies Market growth.Aircraft Transparencies Market Segment Analysis

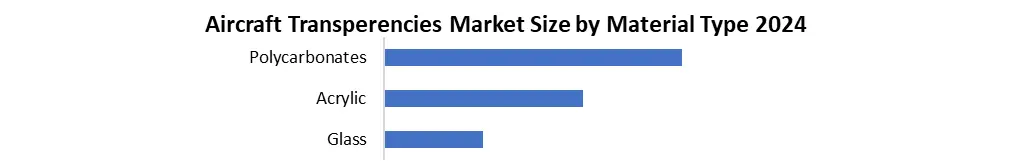

By Material Type, the material Aircraft Transparencies Market segmented into Glass, Acrylic, and Polycarbonate shows distinct usage patterns across industries such as construction, automotive, electronics, and signage. Among these, Polycarbonate emerges as the dominant segment due to its exceptional impact resistance, lightweight properties, and high versatility. Polycarbonate held the largest market share in 2024. Polycarbonate’s dominance is driven due to its superior durability, thermal resistance, and adaptability, making it ideal for demanding applications such as bulletproof glass, safety shields, and roofing panels. These performance advantages position polycarbonate as the material of choice across various high-performance and safety-critical industries.

Aircraft Transparencies Market Regional Insights

The Aircraft Transparencies industry with strong regional variation, North America held the dominant share, accounting for XX% of global revenue. The region is home to leading aerospace OEMs such as Boeing, Gulfstream, Bombardier (in Canada), and Textron Aviation, all of which consistently place large orders for high-quality transparent windows, windshields, and canopies across commercial, business, and military aircraft programs. This constant production pipeline ensures a steady market for transparency suppliers. North America has one of the largest active aircraft fleets in the world, which drives frequent maintenance, repair, and replacement of transparencies due to wear, damage, or regulatory upgrades. This includes MRO operations for both domestic and international carriers. The technological leadership plays a key role. The region benefits from robust R&D funding from both government defense budgets and private sector investment, leading to innovations in lightweight materials, anti-icing coatings, UV protection, and impact resistance. Strict FAA safety regulations push for high-performance standards, incentivizing the adoption of advanced materials like polycarbonate and acrylic with superior optical clarity and durability. This regulatory environment, combined with manufacturing expertise and global export capabilities, cements North America’s dominance in Aircraft Transparencies Market. Aircraft Transparencies Market Competitive Landscape The major key players have significant Aircraft Transparencies Market shares due to their technological expertise, global reach, and strong relationships with aircraft OEMs. Leading companies such as PPG Industries Inc. dominate the market by offering a wide range of aircraft windshields, canopies, and cabin windows, and are known for innovations in lightweight and scratch-resistant coatings. Gentex Corporation is a major innovator in electrochromic window technology, notably used in Boeing’s 787 Dreamliner, which enhances passenger comfort and energy efficiency. GKN Aerospace and Nordam Group focus heavily on military aircraft transparencies, offering advanced composite materials and solutions designed for impact resistance and weight reduction. Saint-Gobain Aerospace stands out for its high-performance transparency systems that provide optical clarity and UV protection, while Lee Aerospace serves both OEM and aftermarket segments with FAA-certified aircraft window solutions. Additionally, niche players such as Control Logistics Inc. cater to defense aviation with custom-built transparencies. The market is seeing increased investment in smart transparencies, infrared-reflective coatings, and next-generation lightweight materials. Strategic collaborations, acquisitions, and a rising focus on aftermarket services are central to competitive strategies, alongside compliance with stringent aviation safety regulations. Aircraft Transparencies Market Recent Development • On June 6, 2024, GKN Aerospace will double its F-35 canopy production capacity at its Garden Grove, California, facility, supported by up to $150 million in customer investment. The expansion, set for completion by January 2027, will add a new production line, creating over 100 skilled jobs in manufacturing and engineering. This moves addresses rising demand from both original equipment and aftermarket needs for the F-35 Lightning II. GKN Aerospace, a long-term supplier of high-performance cockpit canopies and other components for the F-35, says the investment strengthens its leadership in military transparencies while supporting jobs across its global supply chain. • On February 15, 2023 – GKN Aerospace has begun an 80,000-square-foot expansion of its Chihuahua, Mexico, facility to boost production of advanced composite aerostructures for the business jet industry. The multi-million-dollar investment, set for completion by the end of 2023, will create 100 new jobs and strengthen the company’s presence in Mexico. The facility currently supplies composite and metal structures, special processes, and engineering services to major customers such as Airbus, Gulfstream, and Honda Jet. This expansion will enhance GKN Aerospace’s capacity to meet future industry demand while supporting its growth strategy and partnerships in the global aerospace market. • On June 16, 2025, GKN Aerospace is expanding its partnership with Archer Aviation to manufacture and supply key airframe components, including the wing structure, for Archer’s Midnight electric vertical takeoff and landing (eVTOL) aircraft. Production will take place at GKN’s UK facilities, supporting Archer’s production ramp-up and commercial launch. Building on its existing supply of low voltage Electrical Wiring Interconnection Systems (EWIS) since 2023, GKN will leverage advanced manufacturing technologies to meet strict performance and certification standards. This collaboration underscores both companies’ commitment to advancing sustainable aviation and industrializing the eVTOL market.

Category Key Trend Example Product/Application Market Impact Materials Shift towards advanced composite and polycarbonate transparencies Polycarbonate canopies in fighter jets Improved impact resistance and weight reduction; enhanced pilot safety and fuel efficiency Technology Integration of smart and electrochromic technologies Electrically dimmable windows in business jets (e.g., Boeing 787) Boosted passenger comfort and customization; growing demand for premium commercial aircraft Sustainability Emphasis on lightweight and recyclable materials Acrylic transparencies with enhanced recyclability Lower carbon footprint and operational costs; aligns with green aviation initiatives Safety & Durability Development of multi-layered, UV- and scratch-resistant transparencies Scratch-resistant cockpit windows with UV filters Increased lifespan and reduced maintenance; compliance with strict safety regulations Regional Innovation Growing R&D and manufacturing in Asia-Pacific Indigenous transparency systems for defense aircraft (India, China) Strengthened regional supply chains; enhanced self-reliance and export capabilities Aircraft Transparencies Market Scope: Inquire before buying

Aircraft Transparencies Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.38 Bn. Forecast Period 2025 to 2032 CAGR: 7.2% Market Size in 2032: USD 2.41 Bn. Segments Covered: by Material Glass Acrylic Polycarbonate by Aircraft Type Commercial Aviation Narrow Body Aircraft (NBA) Military Aviation Helicopters by Coating Type Polyurethane Gold Bismuth Oxide by Application Windows Windshields Canopies Landing Lights & Wingtip Lenses Others by End Use Original Equipment Manufacturers (OEM) Aftermarket Aircraft Transparencies Market by Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Aircraft Transparencies Market by Key Players

North America Key Players 1. PPG Industries Inc. (Pittsburgh, Pennsylvania, USA) 2. Gentex Corporation (Zeeland, Michigan, USA) 3. Lee Aerospace (Wichita, Kansas, USA) 4. Control Logistics Inc. (Rancho Cucamonga, California, USA) 5. The Nordam Group LLC (Tulsa, Oklahoma, USA) 6. LOPOX Inc. (Montreal, Canada) 7. GKN Aerospace Transparency Systems (Garden Grove, California, USA) 8. Llamas Plastics Inc. (San Dimas, California, USA) Europe Key Players 9. Umicore (Brussels, Belgium) 10. Heraeus (Hanau, Germany) 11. Atotech (Berlin, Germany) 12. Johnson Matthey (London, United Kingdom) 13. Coventya (Villeneuve-la-Garenne, France) 14. BASF SE (Ludwigshafen, Germany) 15. Mecaplex Ltd. (Grenchen, Switzerland) 16. Saint-Gobain Sully (Sully-sur-Loire, France) Asia Pacific Key Players 17. NanoXplore Technologies (China) 18. JGC Catalysts & Chemicals Ltd. (Tokyo, Japan) 19. Altair Nanomaterials India Pvt. Ltd. (India) 20. TANAKA Holdings Co., Ltd. (Tokyo, Japan) 21. EPRUI Biotech Co. Ltd. (China) 22. Nanoshel LLC (India) 23. ShinMaywa Industries Ltd. (Hyogo, Japan) 24. Fukuraya Metal Co., Ltd. (Yamagata, Japan) 25. KDX Composite Material Co., Ltd. (Guangdong, China)Frequently Asked Questions:

1. What is the market size of the Global Aircraft Transparencies Market in 2024? Ans. The market size Global Aircraft Transparencies Market in 2024 was USD 1.38 billion. 2. What are the different segments of the Global Aircraft Transparencies Market ? Ans. The Global Aircraft Transparencies Market is divided into Material, Application, End-Use, Coating Type, and Aircraft Type. 3. Which region is expected to hold the highest Global Aircraft Transparencies Market share? Ans. North America dominates the market share in the market. 4. What is the Forecast Period of the Global Aircraft Transparencies Market? Ans. The Forecast Period of the market is 2025-2032 in the market.

1. Aircraft Transparencies Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Aircraft Transparencies Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Aircraft Transparencies Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Aircraft Transparencies Market: Dynamics 3.1. Aircraft Transparencies Market Trends by Region 3.1.1. North America Aircraft Transparencies Market Trends 3.1.2. Europe Aircraft Transparencies Market Trends 3.1.3. Asia Pacific Aircraft Transparencies Market Trends 3.1.4. Middle East and Africa Aircraft Transparencies Market Trends 3.1.5. South America Aircraft Transparencies Market Trends 3.2. Aircraft Transparencies Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Aircraft Transparencies Market Drivers 3.2.1.2. North America Aircraft Transparencies Market Restraints 3.2.1.3. North America Aircraft Transparencies Market Opportunities 3.2.1.4. North America Aircraft Transparencies Market Challenges 3.2.2. Europe 3.2.2.1. Europe Aircraft Transparencies Market Drivers 3.2.2.2. Europe Aircraft Transparencies Market Restraints 3.2.2.3. Europe Aircraft Transparencies Market Opportunities 3.2.2.4. Europe Aircraft Transparencies Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Aircraft Transparencies Market Drivers 3.2.3.2. Asia Pacific Aircraft Transparencies Market Restraints 3.2.3.3. Asia Pacific Aircraft Transparencies Market Opportunities 3.2.3.4. Asia Pacific Aircraft Transparencies Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Aircraft Transparencies Market Drivers 3.2.4.2. Middle East and Africa Aircraft Transparencies Market Restraints 3.2.4.3. Middle East and Africa Aircraft Transparencies Market Opportunities 3.2.4.4. Middle East and Africa Aircraft Transparencies Market Challenges 3.2.5. South America 3.2.5.1. South America Aircraft Transparencies Market Drivers 3.2.5.2. South America Aircraft Transparencies Market Restraints 3.2.5.3. South America Aircraft Transparencies Market Opportunities 3.2.5.4. South America Aircraft Transparencies Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Aircraft Transparencies Industry 3.8. Analysis of Government Schemes and Initiatives For Aircraft Transparencies Industry 3.9. Aircraft Transparencies Market Trade Analysis 3.10. The Global Pandemic Impact on Aircraft Transparencies Market 4. Aircraft Transparencies Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 4.1.1. Glass 4.1.2. Acrylic 4.1.3. Polycarbonate 4.2. Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 4.2.1. Commercial Aviation 4.2.2. Narrow Body Aircraft (NBA) 4.2.3. Military Aviation 4.2.4. Helicopters 4.3. Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 4.3.1. Polyurethane 4.3.2. Gold 4.3.3. Bismuth Oxide 4.4. Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 4.4.1. Windows 4.4.2. Windshields 4.4.3. Canopies 4.4.4. Landing Lights & Wingtip Lenses 4.4.5. Others 4.5. Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 4.5.1. Original Equipment Manufacturers (OEM) 4.5.2. Aftermarket 4.6. Aircraft Transparencies Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Aircraft Transparencies Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 5.1.1. Glass 5.1.2. Acrylic 5.1.3. Polycarbonate 5.2. North America Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 5.2.1. Commercial Aviation 5.2.2. Narrow Body Aircraft (NBA) 5.2.3. Military Aviation 5.2.4. Helicopters 5.3. North America Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 5.3.1. Polyurethane 5.3.2. Gold 5.3.3. Bismuth Oxide 5.4. North America Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 5.4.1. Windows 5.4.2. Windshields 5.4.3. Canopies 5.4.4. Landing Lights & Wingtip Lenses 5.4.5. Others 5.5. North America Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 5.5.1. Original Equipment Manufacturers (OEM) 5.5.2. Aftermarket 5.6. North America Aircraft Transparencies Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 5.6.1.1.1. Glass 5.6.1.1.2. Acrylic 5.6.1.1.3. Polycarbonate 5.6.1.2. United States Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 5.6.1.2.1. Commercial Aviation 5.6.1.2.2. Narrow Body Aircraft (NBA) 5.6.1.2.3. Military Aviation 5.6.1.2.4. Helicopters 5.6.1.3. United States Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 5.6.1.3.1. Polyurethane 5.6.1.3.2. Gold 5.6.1.3.3. Bismuth Oxide 5.6.1.4. United States Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Windows 5.6.1.4.2. Windshields 5.6.1.4.3. Canopies 5.6.1.4.4. Landing Lights & Wingtip Lenses 5.6.1.4.5. Others 5.6.1.5. United States Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 5.6.1.5.1. Original Equipment Manufacturers (OEM) 5.6.1.5.2. Aftermarket 5.6.2. Canada 5.6.2.1. Canada Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 5.6.2.1.1. Glass 5.6.2.1.2. Acrylic 5.6.2.1.3. Polycarbonate 5.6.2.2. Canada Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 5.6.2.2.1. Commercial Aviation 5.6.2.2.2. Narrow Body Aircraft (NBA) 5.6.2.2.3. Military Aviation 5.6.2.2.4. Helicopters 5.6.2.3. Canada Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 5.6.2.3.1. Polyurethane 5.6.2.3.2. Gold 5.6.2.3.3. Bismuth Oxide 5.6.2.4. Canada Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Windows 5.6.2.4.2. Windshields 5.6.2.4.3. Canopies 5.6.2.4.4. Landing Lights & Wingtip Lenses 5.6.2.4.5. Others 5.6.2.5. Canada Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 5.6.2.5.1. Original Equipment Manufacturers (OEM) 5.6.2.5.2. Aftermarket 5.6.3. Mexico 5.6.3.1. Mexico Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 5.6.3.1.1. Glass 5.6.3.1.2. Acrylic 5.6.3.1.3. Polycarbonate 5.6.3.2. Mexico Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 5.6.3.2.1. Commercial Aviation 5.6.3.2.2. Narrow Body Aircraft (NBA) 5.6.3.2.3. Military Aviation 5.6.3.2.4. Helicopters 5.6.3.3. Mexico Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 5.6.3.3.1. Polyurethane 5.6.3.3.2. Gold 5.6.3.3.3. Bismuth Oxide 5.6.3.4. Mexico Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Windows 5.6.3.4.2. Windshields 5.6.3.4.3. Canopies 5.6.3.4.4. Landing Lights & Wingtip Lenses 5.6.3.4.5. Others 5.6.3.5. Mexico Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 5.6.3.5.1. Original Equipment Manufacturers (OEM) 5.6.3.5.2. Aftermarket 6. Europe Aircraft Transparencies Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 6.2. Europe Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 6.3. Europe Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 6.4. Europe Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 6.5. Europe Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 6.6. Europe Aircraft Transparencies Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 6.6.1.2. United Kingdom Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 6.6.1.3. United Kingdom Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 6.6.1.4. United Kingdom Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 6.6.2. France 6.6.2.1. France Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 6.6.2.2. France Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 6.6.2.3. France Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 6.6.2.4. France Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 6.6.3.2. Germany Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 6.6.3.3. Germany Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 6.6.3.4. Germany Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 6.6.4.2. Italy Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 6.6.4.3. Italy Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 6.6.4.4. Italy Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 6.6.5.2. Spain Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 6.6.5.3. Spain Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 6.6.5.4. Spain Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 6.6.6.2. Sweden Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 6.6.6.3. Sweden Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 6.6.6.4. Sweden Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 6.6.7.2. Austria Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 6.6.7.3. Austria Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 6.6.7.4. Austria Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 6.6.8.2. Rest of Europe Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 6.6.8.3. Rest of Europe Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 6.6.8.4. Rest of Europe Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific Aircraft Transparencies Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.2. Asia Pacific Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.3. Asia Pacific Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.4. Asia Pacific Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6. Asia Pacific Aircraft Transparencies Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.1.2. China Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.1.3. China Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.1.4. China Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.2.2. S Korea Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.2.3. S Korea Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.2.4. S Korea Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.3.2. Japan Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.3.3. Japan Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.3.4. Japan Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6.4. India 7.6.4.1. India Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.4.2. India Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.4.3. India Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.4.4. India Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.5.2. Australia Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.5.3. Australia Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.5.4. Australia Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.6.2. Indonesia Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.6.3. Indonesia Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.6.4. Indonesia Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.7.2. Malaysia Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.7.3. Malaysia Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.7.4. Malaysia Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.8.2. Vietnam Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.8.3. Vietnam Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.8.4. Vietnam Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.9.2. Taiwan Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.9.3. Taiwan Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.9.4. Taiwan Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 7.6.10.2. Rest of Asia Pacific Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 7.6.10.3. Rest of Asia Pacific Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 7.6.10.4. Rest of Asia Pacific Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa Aircraft Transparencies Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 8.2. Middle East and Africa Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 8.3. Middle East and Africa Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 8.4. Middle East and Africa Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 8.6. Middle East and Africa Aircraft Transparencies Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 8.6.1.2. South Africa Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 8.6.1.3. South Africa Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 8.6.1.4. South Africa Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 8.6.2.2. GCC Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 8.6.2.3. GCC Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 8.6.2.4. GCC Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 8.6.3.2. Nigeria Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 8.6.3.3. Nigeria Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 8.6.3.4. Nigeria Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 8.6.4.2. Rest of ME&A Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 8.6.4.3. Rest of ME&A Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 8.6.4.4. Rest of ME&A Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 9. South America Aircraft Transparencies Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 9.2. South America Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 9.3. South America Aircraft Transparencies Market Size and Forecast, by Coating Type(2024-2032) 9.4. South America Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 9.5. South America Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 9.6. South America Aircraft Transparencies Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 9.6.1.2. Brazil Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 9.6.1.3. Brazil Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 9.6.1.4. Brazil Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 9.6.2.2. Argentina Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 9.6.2.3. Argentina Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 9.6.2.4. Argentina Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Aircraft Transparencies Market Size and Forecast, by Material (2024-2032) 9.6.3.2. Rest Of South America Aircraft Transparencies Market Size and Forecast, by Aircraft Type (2024-2032) 9.6.3.3. Rest Of South America Aircraft Transparencies Market Size and Forecast, by Coating Type (2024-2032) 9.6.3.4. Rest Of South America Aircraft Transparencies Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Aircraft Transparencies Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. PPG Industries Inc. (Pittsburgh, Pennsylvania, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Gentex Corporation (Zeeland, Michigan, USA) 10.3. Lee Aerospace (Wichita, Kansas, USA) 10.4. Control Logistics Inc. (Rancho Cucamonga, California, USA) 10.5. The Nordam Group LLC (Tulsa, Oklahoma, USA) 10.6. LOPOX Inc. (Montreal, Canada) 10.7. GKN Aerospace Transparency Systems (Garden Grove, California, USA) 10.8. Llamas Plastics Inc. (San Dimas, California, USA) 10.9. Umicore (Brussels, Belgium) 10.10. Heraeus (Hanau, Germany) 10.11. Atotech (Berlin, Germany) 10.12. Johnson Matthey (London, United Kingdom) 10.13. Coventya (Villeneuve-la-Garenne, France) 10.14. BASF SE (Ludwigshafen, Germany) 10.15. Mecaplex Ltd. (Grenchen, Switzerland) 10.16. Saint-Gobain Sully (Sully-sur-Loire, France) 10.17. NanoXplore Technologies (China) 10.18. JGC Catalysts & Chemicals Ltd. (Tokyo, Japan) 10.19. Altair Nanomaterials India Pvt. Ltd. (India) 10.20. TANAKA Holdings Co., Ltd. (Tokyo, Japan) 10.21. EPRUI Biotech Co. Ltd. (China) 10.22. Nanoshel LLC (India) 10.23. ShinMaywa Industries Ltd. (Hyogo, Japan) 10.24. Fukuraya Metal Co., Ltd. (Yamagata, Japan) 10.25. KDX Composite Material Co., Ltd. (Guangdong, China) 11. Key Findings 12. Industry Recommendations 13. Aircraft Transparencies Market: Research Methodology 14. Terms and Glossary