The Air Source Heat Pumps Market size was valued at USD 48.99 Billion in 2024 and the total Air Source Heat Pumps revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 82.93 Billion. A Heat Pump that transports heat from the outside to the inside of a building envelope or vice versa is known as an air source heat pump. With a growing emphasis on using renewable energy systems for both heating and cooling, the demand for air source heat pumps is expected to rise over the forecast period. To transmit heat to and from the building envelope, these air source heat pumps use refrigerants and compressors. Air source heat pumps are currently being widely used, as they not only cut emissions but also save money for those who use them. Air source heat pumps use significantly less electricity than traditional heating and cooling systems because of the technology. With rising energy and electricity prices, homeowners are gradually looking for energy-efficient heating and cooling systems that can save money in the long run while also generating appealing revenue flows, which in turn are expected to boost the air source heat pumps market across the globe. Air source heat pumps offer the advantage of being easier and quicker to install compared to ground source heat pumps. They don't require excavation of land for installation and resemble air conditioning units, typically mounted outside a property near an external wall. Some air source heat pumps come with an inside unit, similar in size to a traditional boiler. Those without an inside unit are called 'monoblocs,' while those with an inside unit are referred to as 'split' systems. The International Energy Agency (IEA) reported that 177 million heat pumps were installed by globally. China accounted for the majority at 33%, followed by North America at 23% and Europe at 12%. However, until recently, the heat pump market had been growing at a slower pace than required by the IEA or the UK's Committee on Climate Change (CCC) decarbonization targets. This is evident from the IEA's data on global heat pump installations. At the current growth rate, only 253 million heat pumps would be installed worldwide by , falling short of the 600 million units needed in the IEA's net-zero scenario by that year, creating a 58% shortfall. This figure encompasses various heat pump types, including air-to-air, air-to-water, water-to-water, and ground-to-water heat pumps. Sales of this technology have remained relatively modest in many countries, with Europe leading the transition, experiencing double-digit growth rates since . Other countries, including China and the USA, have begun to witness similar developments more recently. Much like the electric vehicle market, the increasing recognition of this technology in energy strategies and the growing adoption of clean heating are anticipated to drive rapid and potentially substantial deployment and utilization of heat pumps worldwide, consequently boosting the air source heat pumps market's growth.To know about the Research Methodology :- Request Free Sample Report

Air Source Heat Pumps Market Competitive Landscape:

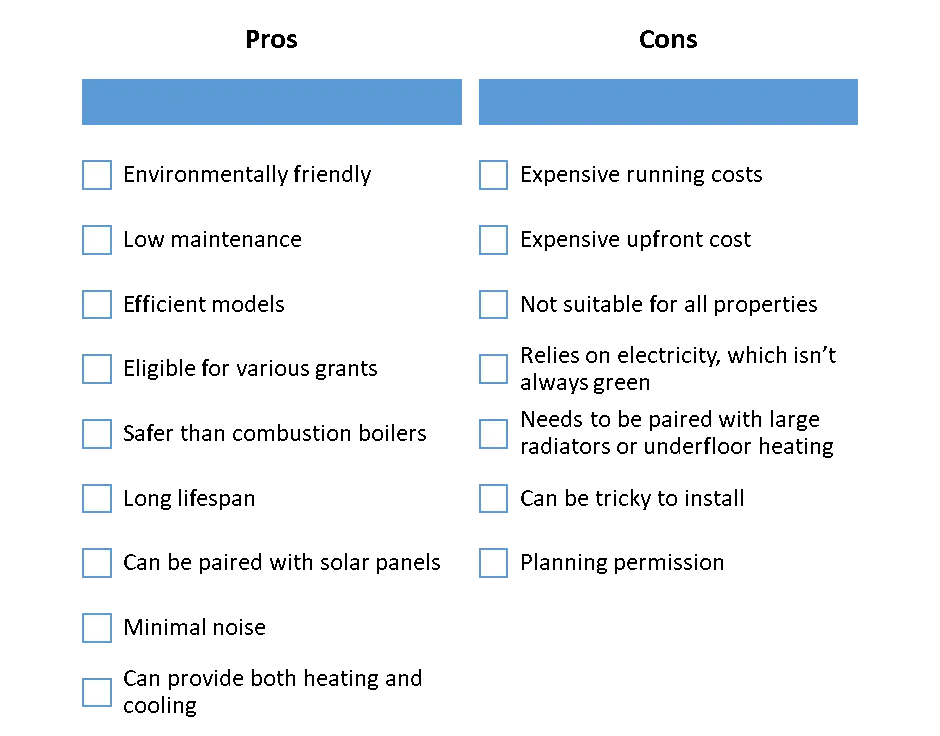

Manufacturers Are Investing Billions To Expand Heat Pump Production Capacities As of , manufacturers had disclosed investments exceeding USD 4 billion for expanding heat pump production capacity and associated efforts, with a notable concentration in Europe. To meet the production targets outlined in the Net Zero Emissions (NZE) Scenario for , an additional global investment of USD 15 billion would be required. Anticipated manufacturing announcements are likely to be driven by new incentives targeting consumers and offering direct support to manufacturers, particularly in the United States and the European Union. Moreover, to address the shortage of installers, a growing number of manufacturers are initiating installation training programs. Additionally, major industry players are actively introducing innovative products into their portfolios, aiming to meet the surging demand for energy-efficient heating and cooling solutions while enhancing their market share. This factor is further expected to benefit the air source heat pumps market growth. For instance, November - Mitsubishi launched a cascaded air source heat pump that can produce between 7.8 kW and 640 kW of heat. The heat pump can generate hot water at a temperature of up to 70 C without boost heaters. Mitsubishi Electric released the air source heat pump for commercial applications, including schools and hospitals. Leading manufacturers in the air source heat pumps market include companies like Daikin, Mitsubishi Electric, Panasonic, Carrier, and Fujitsu General. These industry giants are known for their established global presence and extensive distribution networks, allowing them to reach a wide customer base. The market also features numerous regional players and smaller, specialized manufacturers that focus on niche segments and local markets. This diversity fosters healthy competition and encourages innovation in product design and performance. Government incentives and regulations promoting energy-efficient solutions play a pivotal role in shaping the competitive landscape. Many countries offer incentives and subsidies to encourage the adoption of air source heat pumps, which is expected to impact manufacturers' market positioning and air source heat pumps market growth.Pros and Cons of Air Source Heat Pumps

Air Source Heat Pumps Market Dynamics:

Growing Demand for Energy-Efficient Systems across the Globe: The growing demand for energy-efficient systems is primarily driving the air source heat pumps market growth across the globe. This trend is being driven by rising electricity prices and government measures to minimize greenhouse gas emissions. In addition, technical improvements such as digitalization have resulted in faster delivery of more reliable Products, which has aided the growth of the air source heat pumps market. The rising environmental worries over non-renewable resource depletion, combined with growing customer awareness of renewable energy options, have boosted the adoption rate globally. To limit the growing carbon footprint, developing countries like India, China, and South Korea have issued strict regulatory criteria and have consequently developed advantageous policies and procedures for the adoption of efficient heating systems. In addition, rising urbanization and industrialization in emerging economies across the globe have sparked an increase in demand for heating, which is expected to add to the statistics for air source heat pumps market trends. Even if electric heat pumps only met 7% of global building heating needs in , they could easily supply more than 90% of global space and water heating at a lower CO2 emissions level than condensing gas boiler technology – even when the upstream carbon intensity of electricity is taken into account (which typically operates at 92-95% efficiency). This potential coverage is a significant gain over the level of 50%, thanks to continuous advances in heat pump energy performance and cleaner power generation. Rapid reductions in power supply emissions in the NZE indicate that by , 100% of the heat pump stock will emit less than natural gas-fired condensing boilers.Supportive Government Policies and International Cooperation Various policies have been recently implemented or reinforced to expedite the adoption of heat pumps, especially in Europe and North America. This heightened emphasis on heat pumps is in response to soaring natural gas prices triggered by Russia's invasion of Ukraine and ongoing initiatives to curtail greenhouse gas emissions. These measures have provided an additional drive for the growth of the air source heat pumps market. Prominent policy mechanisms include: 1. Heat pump industry confidence is being bolstered by the establishment of deployment targets in select European Union member states and the United Kingdom for the period leading up to . 2. To incentivize the adoption of heat pumps and reduce upfront costs, various financial incentives are currently available in more than 30 countries globally. These countries collectively represent over 70% of the global heating demand for buildings. 3. Energy taxation and heat pump tariffs are being rebalanced to encourage the transition from conventional fuels to electric heating, with measures such as specially metered electricity or discounted rates for electric heating consumers. For example, Germany offers special rates that can reduce operating costs by an average of 20%. The Dutch government is planning to raise natural gas taxation by up to 43% by while simultaneously reducing taxes on clean heating fuels. 4. Efforts to ensure the deployment of efficient heat pumps include the introduction of mandatory labeling schemes and minimum performance standards in over 45 countries. In the United States, more stringent efficiency requirements for new heat pumps will be enforced starting in . 5. Bans on the installation of fossil fuel technology are gaining traction in over 20 countries at national or subnational levels. In , Austria, Slovenia, and Flanders implemented new bans. Furthermore, around 90 local governments in the United States have mandated that new residential properties exclusively rely on electricity for space and water heating and other end uses, reinforcing the shift towards clean heating alternatives. In addition, International cooperation plays a pivotal role in advancing innovation and enhancing the collection of data concerning heat pumps. Collaborative efforts at the international level promote the exchange and generation of knowledge and data, while also expediting the harmonization of standards among nations. For instance, 1. The IEA Technology Collaboration Programme on Heat Pumping Technologies, established in 1978, has been actively engaged in international research collaborations aimed at innovating, demonstrating, and communicating progress in heat pumping technologies. The Mission Innovation Community on Affordable Heating and Cooling of Buildings strives to facilitate new partnerships, attract private investments, and foster research collaboration to accelerate innovation in these sectors. Furthermore, increased international cooperation is imperative for streamlining the collection of data related to heat pump deployment. Such data harmonization efforts are essential to inform policy decisions and accelerate the adoption of heat pumps on a global scale, thereby supporting the air source heat pumps market growth during the forecast period. Installation, Maintenance, High Cost, and Substantial Energy Bills Poor installation, duct losses, and insufficient maintenance are a few of the barriers to the Air Source Heat pumps market's growth across the globe. The majority of heat pumps have substantial installation or service issues, lowering their performance and efficiency. More than half of all heat pumps have serious problems with inadequate airflow, leaky ducts, and inaccurate refrigerant charge. If heat pumps are not maintained and serviced regularly, their performance will decline. These factors are expected to hamper the air source heat pumps market growth during the forecast period. Maintenance costs for air source heat pumps, including professional annual servicing, are further expected to be a potential restraint on the growth of the air source heat pumps market. While these systems have a long working life of 15 years or more, the necessity for annual professional servicing, akin to traditional boilers, can lead to ongoing expenses. This factor might deter some potential users, especially those who are cost-conscious, from adopting air source heat pump technology. Moreover, the responsibility of ensuring adequate airflow around the heat pump, removing debris, and clearing snow during cold weather can be seen as additional maintenance tasks, which may not align with the convenience expectations of some consumers. These considerations could present barriers to the broader adoption of air source heat pumps, as users may perceive them as requiring more upkeep and cost compared to alternative heating solutions. Thus, addressing the perception of higher maintenance requirements and costs may be essential in promoting the continued growth of the air source heat pump market.

Annual Running Costs of Heating Methods for a 3-Bedroom House (Based on 12,000 kWh Heat Requirement)

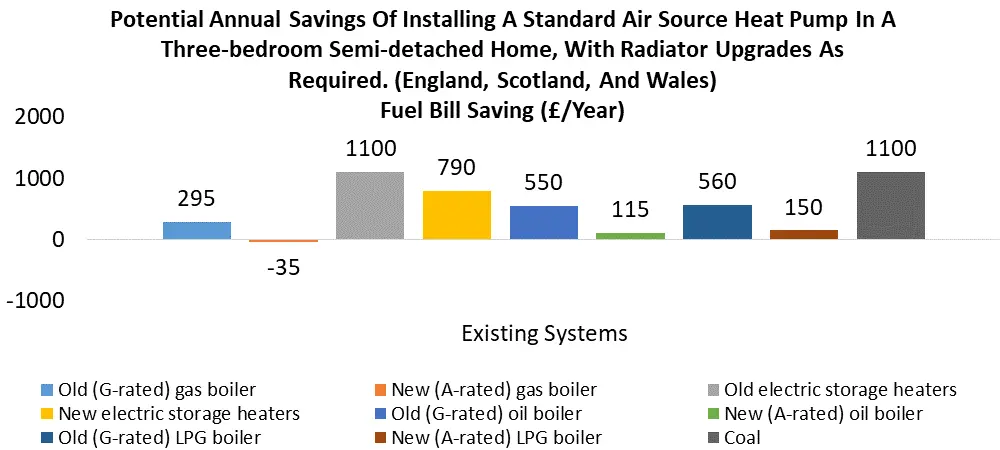

The running costs of an air source heat pump, when compared to traditional heating methods, further restrain the air source heat pump market growth during the forecast period. The operating expenses are influenced by energy prices and individual home characteristics, making it challenging to provide an exact figure for running costs. The perception of higher running costs for air source heat pumps may deter potential users, particularly those who prioritize cost savings in the short term. Addressing this cost perception and highlighting the long-term energy efficiency and environmental benefits of air source heat pumps is essential to promote their broader adoption and overcome potential market growth restraints.

Heating Method Annual Running Cost (Approx.) in Euros Annual Running Cost (Approx.) in USD New Gas Boiler £ 899 USD 948.04 Older, 70% Efficient Gas Boiler £ 1,181 USD 1245.43 Oil-Fueled Boiler £ 1,043 USD 1099.90 LPG-Fueled Boiler £ 1,434 USD 1512.23 Air Source Heat Pump £ 1,094 USD 1153.68 Air Source Heat Pumps Market Segment Analysis:

Based on Product Type, the Air-To-Air segment dominated the global air source heat pumps market with the highest share of over 70% in 2024. The segment is further expected to grow at a CAGR of 6.00% during the forecast period. The growth is attributed to its low power requirements and ability to provide appropriate and speedy heating circulation. Air-to-air heat pumps have been increasingly popular in recent years. For example, Annual shipments in the United States, increased from 2.3 million units in to 3.4 million in , with the growth rate remaining consistent with previous years. Policy development enhanced construction requirements that make heat pumps in new buildings more competitive, and increased air-conditioning demand are all factors that have boosted the adoption of air-to-air heat pump technology across the globe. Air-to-air source heat pump systems have a high market share due to their ease of installation and simple designs. Low initial installation costs, minimal space requirements, and flexible integration across numerous applications are all important aspects of the product that are boosting the air source heat pump demand. Air-To-Air source heat pumps are increasingly adopted by multiple end-users due to their offer of efficient and eco-friendly solutions for indoor climate control, leveraging the principles of refrigeration to ensure year-round comfort while minimizing environmental impact. Air-to-air air source heat pump systems are versatile solutions for both heating and cooling of interior spaces, with a primary focus on heating. These systems operate on principles like those found in refrigerators, freezers, and air conditioning units, with the key distinction being the positioning of system components. The outdoor evaporator heat exchanger coil extracts heat from the ambient air, even in colder weather conditions. Indoor condenser heat exchanger coils transfer this heat to the indoor environment, either through the distribution of warm air or by heating systems such as water-filled radiators and underfloor circuits. This technology significantly outperforms electric resistance heaters by providing three to four times more heat for the same electricity consumption. Importantly, air-source heat pumps contribute to environmental sustainability by emitting no carbon dioxide, nitrogen oxide, or any other harmful gases. Instead, they use a minimal amount of electricity to transfer a substantial amount of heat. Furthermore, these systems are reversible, allowing for both heating and cooling applications, making them highly adaptable to various climate needs. Thus, these factors contribute to the segment growth and drive the air source heat pumps market. The Air-To-Water segment is expected to grow at a rapid pace and offer lucrative growth opportunities for air source heat pump manufacturers during the forecast period. An air-to-water system only pumps heat inwards and provides space heating and hot water. The growth of the segment is driven by the increasing demand for energy-efficient and environmentally friendly heating and hot water solutions. For instance, 1. In the United Kingdom, the Renewable Heat Incentive (RHI) has stimulated substantial interest in air-to-water heat pumps, offering financial incentives to encourage their adoption. The RHI was introduced to promote the installation of renewable heating systems, which has led to a surge in the use of air-to-water heat pumps for space heating and domestic hot water production. Moreover, countries like Sweden and Norway, known for their cold climates, have witnessed a growing preference for air-to-water heat pumps in residential and commercial applications. These systems efficiently extract heat from the outdoor air and transfer it to water-based heating systems, demonstrating their versatility and effectiveness, particularly in colder regions. The strong growth in the Air-to-Water segment reflects the broader trend toward sustainable heating solutions and is indicative of the increasing recognition of air source heat pumps as a viable and efficient alternative to traditional heating methods. This growth is set to continue as more consumers and businesses prioritize eco-friendly heating and hot water systems.Air Source Heat Pumps Market Regional Insights:

Contrary to some media claims suggesting that heat pumps are ineffective in cold climates, the highest adoption of air source heat pumps is most prevalent in the coldest regions. In Europe, the four countries boasting the largest proportion of air source heat pumps market in households are Norway (60%), Sweden (43%), Finland (41%), and Estonia (34%). Notably, these nations experience the chilliest winters in Europe, as measured by heating degree days, which quantify the need for heating based on outdoor temperatures above a specific threshold. This leadership in heat pump usage can be partly attributed to these countries' historical reliance on oil heating and their strategic response to oil price crises, which led to a shift away from oil-based heating systems. In China, the largest global region for air source heat pumps market, sales saw a 7% increase, reaching 12.5 million units in , according to an analysis by MMR. The promotion of clean heating in China has been guided by government policies that mandate the adoption of advanced technologies. Notable initiatives include the Clean Winter Heat Plan in Northern China and the Electric Heating Policy, which advocates the replacement of coal-based heating with electric heating. These endeavors have been further incentivized by local financial support, like the subsidies in Beijing that encourage the deployment of heat pumps. Moreover, China's efforts to enhance air quality through the Clean Air Act have also contributed to the growth of the air source heat pumps market. In the USA, another significant region in the air source heat pumps market, sales of air-source heat pumps exceeded those of gas furnaces for the first time in . This trend continued in with a 15% market growth, capping a consistent annual growth pattern of over 5% since . The adoption of heat pumps varies by building type, with approximately 40-50% of new buildings opting for heat pumps as their primary heating solution. The installations of heat pumps in the United States have been, in part, stimulated by a range of tax incentives, amounting to 20-30% of the system cost, supporting both air-source and geothermal heat pump deployment.The Japan air source heat pumps market witnessed significant growth in 2024, particularly in the air-to-water segment, which experienced a notable 19% growth. This remarkable surge is expected to be primarily attributed to the increased adoption of heat pump water heaters. Japan's heightened interest in air source heat pumps reflects a growing emphasis on energy efficiency and environmental sustainability. The country's technological advancements, coupled with initiatives promoting clean heating solutions, have spurred this trend. Heat pump water heaters, in particular, offer a more energy-efficient and environmentally friendly alternative to traditional water heating methods. As Japan continues to prioritize energy conservation and carbon reduction, the air source heat pumps market is positioned for sustained growth, contributing to the nation's broader efforts to mitigate climate change and achieve a more sustainable energy landscape. In addition, the air source heat pumps market has seen significant developments in recent times, with 2024 witnessing France's substantial increase in subsidy levels, setting the stage for a surge in heat pump adoption. This move has been followed by countries like the United States, Ireland, and Austria, who have also raised their subsidies in early 2024. These policy enhancements play a crucial role in incentivizing the transition to cleaner and more efficient heating technologies. Air source heat pumps offer a promising solution for reducing carbon emissions and achieving energy sustainability. With the continued support of such financial incentives, the heat pump market is poised for sustained growth in these nations, aligning with their climate goals and the broader global commitment to combat climate change. These positive developments not only drive the adoption of heat pumps but also contribute to a more environmentally responsible and energy-efficient future.

Air Source Heat Pumps Market Scope: Inquiry Before Buying

Air Source Heat Pumps Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 48.99 Bn. Forecast Period 2025 to 2032 CAGR: 6.8% Market Size in 2032: USD 82.93 Bn. Segments Covered: by Product Type Air-To-Air Air-To-Water by Type Ductless Ducted Short Run Ducted by Application Heating Cooling Both heating and cooling by End-use Sector Residential Commercial Others Air Source Heat Pumps Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Air Source Heat Pumps Market Key Players:

1. BDR Thermea Group B.V. 2. Bosch Thermotechnik GmbH 3. Carrier Corporation 4. China Yangzi Group 5. Daikin Industries Ltd. 6. Danfoss A/S 7. Dimplex North America Ltd. 8. Emerson Climate Technologies Inc. 9. Fujitsu General Ltd. 10. Haier Group 11. Hitachi Appliances, Inc. 12. Ingersoll-Rand PLC 13. LG Electronics, Inc. 14. Mitsubishi Electric Corporation 15. Panasonic Corporation 16. Samsung Electronics Co., Ltd. 17. Swegon 18. Thermia Heat Pumps 19. Toshiba Corporation 20. Viessmann Werke GmbH & Co. KG 21. United Technologies Corporation 22. Johnson Controls International PLC 23. Lennox International Inc. 24. NIBE Industrier AB 25. Vaillant Group 26. Rheem Manufacturing Company 27. A.O. Smith CorporationFAQs:

1. What are the growth drivers for the Air Source Heat Pumps market? Ans. The increasing environmental concerns, energy efficiency, government incentives, rising energy prices, technological advancements, climate change mitigation, versatility, consumer comfort, policy support, and international collaboration are expected to be the major drivers for the Air Source Heat Pumps market. 2. What are the major restraining factors for the Air Source Heat Pumps market growth? Ans. The major restraining factors for the Air Source Heat pumps market growth include high upfront costs, the need for professional maintenance, varying energy prices, and potential consumer perception of higher running costs compared to traditional heating systems. 3. Which region is expected to lead the Global Air Source Heat Pumps market during the forecast period? Ans. The European region is expected to lead the Global Air Source Heat Pumps market during the forecast period, driven by strong policy support for energy-efficient solutions and the increasing adoption of heat pumps for heating and cooling in both residential and commercial applications. 4. What was the Global Air Source Heat Pumps Market size in 2024? Ans: The Global Air Source Heat Pumps Market size was USD 48.99 Billion in 2024. 5. What segments are covered in the Air Source Heat Pumps Market report? Ans. The segments covered in the Air Source Heat Pumps market report are Product Type, Type, Applications End-user sector, and Region.

1. Air Source Heat Pumps Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Air Source Heat Pumps Market: Dynamics 2.1. Air Source Heat Pumps Market Trends by Region 2.1.1. North America Air Source Heat Pumps Market Trends 2.1.2. Europe Air Source Heat Pumps Market Trends 2.1.3. Asia Pacific Air Source Heat Pumps Market Trends 2.1.4. Middle East and Africa Air Source Heat Pumps Market Trends 2.1.5. South America Air Source Heat Pumps Market Trends 2.2. Air Source Heat Pumps Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Air Source Heat Pumps Market Drivers 2.2.1.2. North America Air Source Heat Pumps Market Restraints 2.2.1.3. North America Air Source Heat Pumps Market Opportunities 2.2.1.4. North America Air Source Heat Pumps Market Challenges 2.2.2. Europe 2.2.2.1. Europe Air Source Heat Pumps Market Drivers 2.2.2.2. Europe Air Source Heat Pumps Market Restraints 2.2.2.3. Europe Air Source Heat Pumps Market Opportunities 2.2.2.4. Europe Air Source Heat Pumps Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Air Source Heat Pumps Market Drivers 2.2.3.2. Asia Pacific Air Source Heat Pumps Market Restraints 2.2.3.3. Asia Pacific Air Source Heat Pumps Market Opportunities 2.2.3.4. Asia Pacific Air Source Heat Pumps Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Air Source Heat Pumps Market Drivers 2.2.4.2. Middle East and Africa Air Source Heat Pumps Market Restraints 2.2.4.3. Middle East and Africa Air Source Heat Pumps Market Opportunities 2.2.4.4. Middle East and Africa Air Source Heat Pumps Market Challenges 2.2.5. South America 2.2.5.1. South America Air Source Heat Pumps Market Drivers 2.2.5.2. South America Air Source Heat Pumps Market Restraints 2.2.5.3. South America Air Source Heat Pumps Market Opportunities 2.2.5.4. South America Air Source Heat Pumps Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Air Source Heat Pumps Industry 2.8. Analysis of Government Schemes and Initiatives For Air Source Heat Pumps Industry 2.9. The Global Pandemic Impact on Air Source Heat Pumps Market 2.10. Air Source Heat Pumps Price Trend Analysis 3. Air Source Heat Pumps Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2024-2032) 3.1. Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 3.1.1. Air-To-Air 3.1.2. Air-To-Water 3.2. Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 3.2.1. Ductless 3.2.2. Ducted 3.2.3. Short Run Ducted 3.3. Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 3.3.1. Heating 3.3.2. Cooling 3.3.3. Both heating and cooling 3.4. Air Source Heat Pumps Market Size and Forecast, by Industry (2024-2032) 3.4.1. Residential 3.4.2. Commercial 3.4.3. Others 3.5. Air Source Heat Pumps Market Size and Forecast, by Region (2024-2032) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Air Source Heat Pumps Market Size and Forecast by Segmentation(by Value in USD Million) (2024-2032) 4.1. North America Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Air-To-Air 4.1.2. Air-To-Water 4.2. North America Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 4.2.1. Ductless 4.2.2. Ducted 4.2.3. Short Run Ducted 4.3. North America Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 4.3.1. Heating 4.3.2. Cooling 4.3.3. Both heating and cooling 4.4. North America Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 4.4.1. Residential 4.4.2. Commercial 4.4.3. Others 4.5. North America Air Source Heat Pumps Market Size and Forecast, by Country (2024-2032) 4.5.1. United States 4.5.1.1. United States Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 4.5.1.1.1. Air-To-Air 4.5.1.1.2. Air-To-Water 4.5.1.2. United States Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 4.5.1.2.1. Ductless 4.5.1.2.2. Ducted 4.5.1.2.3. Short Run Ducted 4.5.1.3. United States Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 4.5.1.3.1. Heating 4.5.1.3.2. Cooling 4.5.1.3.3. Both heating and cooling 4.5.1.4. United States Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 4.5.1.4.1. Residential 4.5.1.4.2. Commercial 4.5.1.4.3. Others 4.5.2. Canada 4.5.2.1. Canada Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 4.5.2.1.1. Air-To-Air 4.5.2.1.2. Air-To-Water 4.5.2.2. Canada Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 4.5.2.2.1. Ductless 4.5.2.2.2. Ducted 4.5.2.2.3. Short Run Ducted 4.5.2.3. Canada Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 4.5.2.3.1. Heating 4.5.2.3.2. Cooling 4.5.2.3.3. Both heating and cooling 4.5.2.4. Canada Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 4.5.2.4.1. Residential 4.5.2.4.2. Commercial 4.5.2.4.3. Others 4.5.3. Mexico 4.5.3.1. Mexico Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 4.5.3.1.1. Air-To-Air 4.5.3.1.2. Air-To-Water 4.5.3.2. Mexico Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 4.5.3.2.1. Ductless 4.5.3.2.2. Ducted 4.5.3.2.3. Short Run Ducted 4.5.3.3. Mexico Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 4.5.3.3.1. Heating 4.5.3.3.2. Cooling 4.5.3.3.3. Both heating and cooling 4.5.3.4. Mexico Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 4.5.3.4.1. Residential 4.5.3.4.2. Commercial 4.5.3.4.3. Others 5. Europe Air Source Heat Pumps Market Size and Forecast by Segmentation(by Value in USD Million) (2024-2032) 5.1. Europe Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 5.2. Europe Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 5.3. Europe Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 5.4. Europe Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 5.5. Europe Air Source Heat Pumps Market Size and Forecast, by Country (2024-2032) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 5.5.1.2. United Kingdom Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 5.5.1.3. United Kingdom Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 5.5.1.4. United Kingdom Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 5.5.2. France 5.5.2.1. France Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 5.5.2.2. France Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 5.5.2.3. France Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 5.5.2.4. France Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 5.5.3. Germany 5.5.3.1. Germany Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 5.5.3.2. Germany Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 5.5.3.3. Germany Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 5.5.3.4. Germany Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 5.5.4. Italy 5.5.4.1. Italy Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 5.5.4.2. Italy Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 5.5.4.3. Italy Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 5.5.4.4. Italy Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 5.5.5. Spain 5.5.5.1. Spain Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 5.5.5.2. Spain Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 5.5.5.3. Spain Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 5.5.5.4. Spain Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 5.5.6. Sweden 5.5.6.1. Sweden Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 5.5.6.2. Sweden Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 5.5.6.3. Sweden Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 5.5.6.4. Sweden Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 5.5.7. Austria 5.5.7.1. Austria Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 5.5.7.2. Austria Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 5.5.7.3. Austria Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 5.5.7.4. Austria Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 5.5.8.2. Rest of Europe Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 5.5.8.3. Rest of Europe Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 5.5.8.4. Rest of Europe Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6. Asia Pacific Air Source Heat Pumps Market Size and Forecast by Segmentation(by Value in USD Million) (2024-2032) 6.1. Asia Pacific Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.2. Asia Pacific Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.3. Asia Pacific Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.4. Asia Pacific Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5. Asia Pacific Air Source Heat Pumps Market Size and Forecast, by Country (2024-2032) 6.5.1. China 6.5.1.1. China Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.1.2. China Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.1.3. China Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.1.4. China Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5.2. S Korea 6.5.2.1. S Korea Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.2.2. S Korea Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.2.3. S Korea Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.2.4. S Korea Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5.3. Japan 6.5.3.1. Japan Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.3.2. Japan Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.3.3. Japan Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Japan Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5.4. India 6.5.4.1. India Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.4.2. India Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.4.3. India Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.4.4. India Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5.5. Australia 6.5.5.1. Australia Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.5.2. Australia Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.5.3. Australia Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Australia Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5.6. Indonesia 6.5.6.1. Indonesia Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.6.2. Indonesia Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.6.3. Indonesia Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Indonesia Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5.7. Malaysia 6.5.7.1. Malaysia Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.7.2. Malaysia Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.7.3. Malaysia Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Malaysia Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5.8. Vietnam 6.5.8.1. Vietnam Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.8.2. Vietnam Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.8.3. Vietnam Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Vietnam Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5.9. Taiwan 6.5.9.1. Taiwan Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.9.2. Taiwan Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.9.3. Taiwan Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.9.4. Taiwan Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 6.5.10.2. Rest of Asia Pacific Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 6.5.10.3. Rest of Asia Pacific Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 6.5.10.4. Rest of Asia Pacific Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 7. Middle East and Africa Air Source Heat Pumps Market Size and Forecast by Segmentation(by Value in USD Million) (2024-2032 7.1. Middle East and Africa Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 7.2. Middle East and Africa Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 7.3. Middle East and Africa Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 7.4. Middle East and Africa Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 7.5. Middle East and Africa Air Source Heat Pumps Market Size and Forecast, by Country (2024-2032) 7.5.1. South Africa 7.5.1.1. South Africa Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 7.5.1.2. South Africa Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 7.5.1.3. South Africa Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 7.5.1.4. South Africa Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 7.5.2. GCC 7.5.2.1. GCC Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 7.5.2.2. GCC Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 7.5.2.3. GCC Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 7.5.2.4. GCC Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 7.5.3. Nigeria 7.5.3.1. Nigeria Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 7.5.3.2. Nigeria Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 7.5.3.3. Nigeria Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Nigeria Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 7.5.4.2. Rest of ME&A Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 7.5.4.3. Rest of ME&A Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 7.5.4.4. Rest of ME&A Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 8. South America Air Source Heat Pumps Market Size and Forecast by Segmentation(by Value in USD Million) (2024-2032) 8.1. South America Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 8.2. South America Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 8.3. South America Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 8.4. South America Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 8.5. South America Air Source Heat Pumps Market Size and Forecast, by Country (2024-2032) 8.5.1. Brazil 8.5.1.1. Brazil Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 8.5.1.2. Brazil Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 8.5.1.3. Brazil Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 8.5.1.4. Brazil Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 8.5.2. Argentina 8.5.2.1. Argentina Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 8.5.2.2. Argentina Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 8.5.2.3. Argentina Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 8.5.2.4. Argentina Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Air Source Heat Pumps Market Size and Forecast, by Product Type (2024-2032) 8.5.3.2. Rest Of South America Air Source Heat Pumps Market Size and Forecast, by Type (2024-2032) 8.5.3.3. Rest Of South America Air Source Heat Pumps Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Rest Of South America Air Source Heat Pumps Market Size and Forecast, by End-use Sector (2024-2032) 9. Global Air Source Heat Pumps Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Leading Air Source Heat Pumps Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. BDR Thermea Group B.V. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Bosch Thermotechnik GmbH 10.3. Carrier Corporation 10.4. China Yangzi Group 10.5. Daikin Industries Ltd. 10.6. Danfoss A/S 10.7. Dimplex North America Ltd. 10.8. Emerson Climate Technologies Inc. 10.9. Fujitsu General Ltd. 10.10. Haier Group 10.11. Hitachi Appliances, Inc. 10.12. Ingersoll-Rand PLC 10.13. LG Electronics, Inc. 10.14. Mitsubishi Electric Corporation 10.15. Panasonic Corporation 10.16. Samsung Electronics Co., Ltd. 10.17. Swegon 10.18. Thermia Heat Pumps 10.19. Toshiba Corporation 10.20. Viessmann Werke GmbH & Co. KG 10.21. United Technologies Corporation 10.22. Johnson Controls International PLC 10.23. Lennox International Inc. 10.24. NIBE Industrier AB 10.25. Vaillant Group 10.26. Rheem Manufacturing Company 10.27. A.O. Smith Corporation 11. Key Findings 12. Industry Recommendations 13. Air Source Heat Pumps Market: Research Methodology 14. Terms and Glossary