Aesthetic Fillers Market size was valued at USD 6.06 Billion in 2024 and the total revenue is expected to grow at CAGR 10.25 % through 2025 to 2032, reaching nearly USD 13.23 Billion. The MMR report provides coverage of the aesthetic fillers market by evaluating the global supply–demand balance, regional production capacity, trade flows across HA, CaHA, and PLLA fillers, and country-level import dependence versus self-sufficiency. It further analyzes the technology and innovation roadmap, including advanced filler materials, injection device evolution, hybrid formulations, and AI-enabled aesthetic planning, supported by pipeline and clinical trial insights. The report also addresses regulatory and compliance frameworks across major regions, alongside advertising controls and post-market surveillance requirements. In addition, it delivers in-depth consumer and practitioner insights, detailed pricing benchmarks by material, brand, and procedure, and a full supply chain and distribution assessment. Finally, the study incorporates sustainability and ethical sourcing analysis, highlighting environmental impact, green manufacturing trends, CSR initiatives, and a strategic sustainability roadmap.Aesthetic Fillers Market Overview:

Aesthetic Fillers are the gel-like substances in aesthetic fillers market when injected into the skin to restore lost volume, smooth lines, soften wrinkles, and improve facial contours. The aesthetic filler treatment and non-surgical aesthetic filler procedures are the most widely used which contain hyaluronic acid, collagen, polymers, and particles. The demand for aesthetic injectables has risen in recent years as a result of customers' increasing emphasis on beauty. The industry is expected to show a rise because of increased consumer awareness of minimally cut-involved procedures brought on by numerous beauty advertisements run by major market participants.To know about the Research Methodology :- Request Free Sample Report Botox being one of the most widely used products, has raised demand for cosmetic operations. The Aesthetic filler market products are continually expanding the range of offerings and making greater inroads into the demographic groups that value aesthetics. The popularity of anti-aging therapies and the rising acceptability of tissue fillers, in conjunction with the increase in dermal filler procedures, stimulate the demand for aesthetic fillers market. Access to aesthetic procedures is expanding rapidly across the globe, and many new medical professionals are entering the market to provide aesthetic services in dental surgeries or nurse-administered therapies in large aesthetic-focused practices. Over the past five to six years more than 400 aesthetic clinics and care centers have raised $3.2 billion from investors, making the fastest-growing segment of the aesthetic industry. The range of offerings in Aesthetic filler market products is more. It is making a greater impact on the demographic groups that value aesthetics. Many medical specialists are entering the market to provide aesthetic services, as access to Aesthetic procedures is growing rapidly across the globe.

Aesthetic Fillers Market Dynamics:

Various Options available to try from the variety: Botox is one of the most widely used products. Increasing choice for non-invasive aesthetic procedures is the major factor driving the market growth for aesthetic fillers market. The increase in healthcare expenditure, and rising acceptance of tissue fillers. The growing aging population is a significant factors that augment the aesthetic fillers market's growth worldwide. The rapid technological advances in cosmetology and dermatology resulted in increased demand for Dermal filler. Another parameter is the increasing awareness of modern and innovative cosmetic procedures. The government is helping research and development programs is drive up market value. Consumer’s maximum expectations from the procedure: The challenge for the Aesthetic Fillers market is that patients often come with unrealistic expectations from misleading advertisements and are pressured to undergo procedures that may or may not be beneficial to them. There is a need for trained staff to deal with patients and gain the confidence of them. Every medical and surgical field has led to the commercialization of medicine with the attendant introduction of compromised medical ethics and compromised quality, growth of patient risk, poor patient selection, and office surgery centers without regulation or peer review. Invasive Surgeries available from aesthetic treatment: Quick surgeries with fewer cuts are the main focus of Aesthetic Medicine Practice. The market is growing due to the rising popularity of minimally invasive operations and a variety of such treatment alternatives. Among these, injectables such as hyaluronic acid and botulinum toxin (Botox Injection) were among the most frequently used treatments. These above-mentioned factors have created the growth opportunity of the aesthetic Fillers market.Aesthetic Fillers Market Segment Analysis:

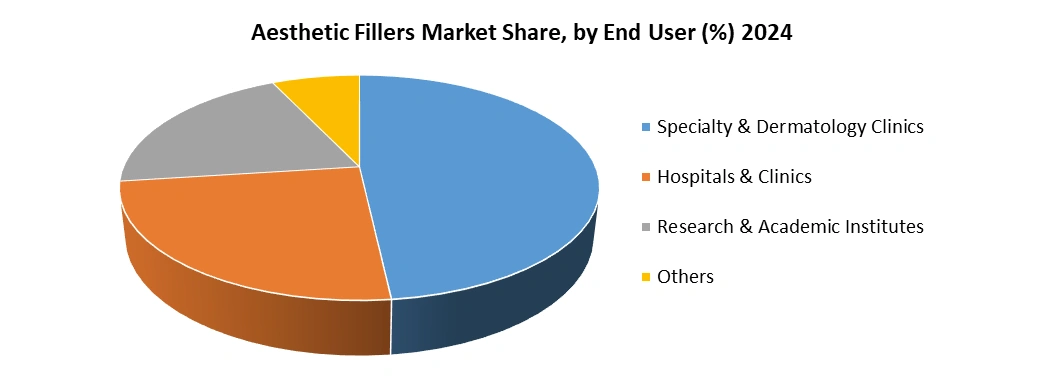

Based on Product, in 2024, Absorbable fillers dominated the Aesthetic Fillers Market and hold the largest share of the market due to their strong safety profile, widespread clinical use, and reversible nature preferred by practitioners and patients alike. Absorbable fillers such as hyaluronic acid and collagen-based injectables benefit from high regulatory acceptance and frequent use in routine aesthetic procedures. Non-absorbable fillers hold a smaller share in 2024, as they are chosen for longer-lasting outcomes and durability but are less widely used due to permanence concerns and greater requirement for skilled application. The dominance of absorbable fillers reflects patient preference for temporary, customizable treatments with minimal long-term risk, while non-absorbable formulations are gradually gaining traction for specific long-term enhancement needs. Based on End User, in 2024, Specialty & Dermatology Clinics dominated the Aesthetic Fillers Market, driven by their high procedure volumes, specialized expertise, and strong patient preference for minimally invasive cosmetic treatments. Hospitals & Clinics follow, supported by advanced medical infrastructure and the availability of certified aesthetic practitioners. Research & Academic Institutes account for a smaller share, primarily focused on clinical research, training, and product development rather than large-scale treatment delivery. The Others segment, including medical spas and wellness centers, is gradually expanding with increasing consumer demand for aesthetic services in non-hospital settings.

Aesthetic Fillers Market Regional Insights:

The Large senior population in the United States and Canada is crucial for this growth, which is expected to fuel the need for face injectable over the projected period. It was noted that there was an 8.45 percent increase in the use of Botox injections from aesthetic fillers market. Thus, it is expected to show growth in the upcoming years in North America. The fastest CAGR of 10.25 % is anticipated for the Asia Pacific market over the period. Countries like South Korea, Australia, and India support the region. In these developing nations, there is projected to be a growing focus on physical beauty, which will significantly impact the market for facial injectable treatments. The countries with the fastest-growing economies are favoured. E.g. India.Aesthetic Fillers Market Scope: Inquire before buying

Global Aesthetic Fillers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 6.06 Bn. Forecast Period 2025 to 2032 CAGR: 10.25% Market Size in 2032: USD 13.23 Bn. Segments Covered: by Material Hyaluronic Acid Calcium Hydroxylapatite Poly-L-Lactic Acid (Plla) Pmma (Poly (Methyl Methacrylate)) Fat Fillers Others by Product Absorbable Non-absorbable by Application Scar Treatment Wrinkle Correction Treatment Lip Enhancement Restoration of Volume/Fullness Others by End-User Specialty & Dermatology Clinics Hospitals & Clinics Research & Academic Institutes Others Aesthetic Fillers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Aesthetic Fillers Market, Key Players are:

1. Allergan (AbbVie) 2. Galderma S.A 3. Merz Pharma 4. Johnson & Johnson (Mentor) 5. Teoxane 6. Revance Therapeutics 7. Suneva Medical 8. Anika Therapeutics 9. Integra LifeSciences 10. Sinclair Pharma 11. FillMed (formerly Anteis/Filorga) 12. Ipsen Pharma 13. Fidia Farmaceutici 14. Medytox 15. Huons 16. LG Chem (LG Life Sciences) 17. BioPlus 18. Croma Pharma 19. Prollenium Medical Technologies 20. Laboratoires Vivacy 21. Bioxis Pharmaceutical 22. Mesoestetic 23. Contura International 24. Bohus Biotech 25. SciVision Biotech 26. Zhejiang Jingjia Medical Technology 27. Dr. Korman Laboratories 28. Cutera Inc. 29. Elan Aesthetics 30. Cytophil 31. OthersFAQs:

1] What segments are covered in the Aesthetic Fillers Market report? Ans. The segments covered in the Aesthetic Fillers Market report are based on Material, Product, Application, end-user, and region 2] Which region is expected to hold the highest share of the Aesthetic Fillers Market? Ans. North America region is expected to hold the highest share of the Aesthetic Fillers Market. 3] What is the market size of Aesthetic Fillers Market by 2032? Ans. The market size of Aesthetic Fillers Market by 2032 is USD 13.23 Bn. 4] What is the growth rate of Aesthetic Fillers Market? Ans. The Global Aesthetic Fillers Market is growing at a CAGR of 10.25% during forecasting period 2025-2032. 5] What was the market size of Aesthetic Fillers Market in 2024? Ans. The market size of Aesthetic Fillers Market in 2024 was USD 6.06 Bn.

1. Aesthetic Fillers Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion and Volume in Units’000) - By Segments, Regions, and Country 2. Aesthetic Fillers Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Positioning Of Key Players 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Headquarter 2.4.3. Product Segment 2.4.4. Revenue (2024) 2.4.5. Market Share (%) 2.4.6. Y-O-Y (%) 2.4.7. Profit Margin (%) 2.4.8. Unit Cost Breakdown 2.4.9. R&D Spend as % of Sales 2.4.10. Unique selling propositions (USP) 2.4.11. Customer Engagement Metrics 2.4.12. Reviews and Ratings 2.4.13. Regional Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. Research and Development 3. Aesthetic Fillers Market: Dynamics 3.1. Aesthetic Fillers Market Trends 3.2. Aesthetic Fillers Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Aesthetic Fillers Market 4. Global Supply–Demand & Trade Analysis 4.1. Global Production Footprint & Capacity Distribution 4.2. Supply–Demand Gap Analysis by Region 4.3. Key Import & Export Flows (HA, CaHA, PLLA Fillers) 4.4. Self-sufficiency vs. Import Dependence by Country 4.5. Strategic Trade & Supply Insights 5. Technology & Innovation Roadmap 5.1. Material Advancements – Cross-linked HA, Bio-stimulatory Fillers 5.2. Injection Device Innovations – Cannula vs. Needle Trends 5.3. Hybrid Fillers (HA + CaHA, PLLA blends) 5.4. AI & Imaging-assisted Aesthetic Planning 5.5. Clinical Trials & Product Pipeline Analysis 6. Regulatory & Compliance Analysis 6.1. Global Regulatory Classification of Fillers (US, EU, Asia-Pacific, LATAM, MEA) 6.2. Product Approval & Certification Requirements 6.3. Advertising & Marketing Restrictions by Region 6.4. Post-market Surveillance & Adverse Event Reporting 6.5. Strategic Compliance Insights & Market Entry Considerations 7. Consumer & Practitioner Insights 7.1. Patient Demographics & Segmentation 7.2. Key Decision Factors in Filler Selection (Safety, Longevity, Price) 7.3. Practitioner Preferences & Brand Loyalty 7.4. Social Media & Celebrity Influence on Demand 7.5. Repeat Purchase & Procedure Frequency Trends 8. Pricing Analysis 8.1. Global & Regional Price Benchmarking 8.2. Average Price per Syringe (1ml) by Material Type: 8.2.1. Hyaluronic Acid 8.2.2. Calcium Hydroxylapatite 8.2.3. Poly-L-Lactic Acid (PLLA) 8.2.4. PMMA 8.2.5. Fat Fillers 8.3. Brand & Product-level Price Segmentation 8.4. Procedure-level Pricing by Application 8.4.1. Lip Enhancement 8.4.2. Nasolabial Fold Correction 8.4.3. Cheek/Chin Augmentation 8.4.4. Scar Treatment 8.4.5. Others 8.5. Pricing Trends & Cost Drivers 9. Supply Chain & Distribution Analysis 9.1. Global Supply Chain Structure & Key Stakeholders 9.2. Raw Material Sourcing & Dependency Risks 9.3. Manufacturing Footprint & Outsourcing Trends 9.4. Distribution Channels – Direct Sales, Distributors, Online Platforms 9.5. Supply Chain Resilience & Risk Mitigation Strategies 10. Sustainability & Ethical Sourcing Analysis 10.1. Environmental Impact of Filler Manufacturing & Packaging 10.2. Sustainable Raw Material Sourcing Practices 10.3. Regulatory Push for Green Manufacturing in Medical Devices 10.4. Corporate Social Responsibility (CSR) in Aesthetic Medicine 10.5. Strategic Sustainability Roadmap 11. Aesthetic Fillers Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 11.1. Aesthetic Fillers Market Size and Forecast, By Material (2024-2032) 11.1.1. Hyaluronic Acid 11.1.2. Calcium Hydroxylapatite 11.1.3. Poly-L-Lactic Acid (Plla) 11.1.4. Pmma (Poly (Methyl Methacrylate)) 11.1.5. Fat Fillers 11.1.6. Others 11.2. Aesthetic Fillers Market Size and Forecast, By Product (2024-2032) 11.2.1. Absorbable 11.2.2. Non-absorbable 11.3. Aesthetic Fillers Market Size and Forecast, By Application (2024-2032) 11.3.1. Scar Treatment 11.3.2. Wrinkle Correction Treatment 11.3.3. Lip Enhancement 11.3.4. Restoration of Volume/Fullness 11.3.5. Others 11.4. Aesthetic Fillers Market Size and Forecast, By End-User (2024-2032) 11.4.1. Specialty & Dermatology Clinics 11.4.2. Hospitals & Clinics 11.4.3. Research & Academic Institutes 11.4.4. Others 11.5. Aesthetic Fillers Market Size and Forecast, By Region (2024-2032) 11.5.1. North America 11.5.2. Europe 11.5.3. Asia Pacific 11.5.4. Middle East and Africa 11.5.5. South America 12. North America Aesthetic Fillers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 12.1. North America Aesthetic Fillers Market Size and Forecast, By Material (2024-2032) 12.1.1. Hyaluronic Acid 12.1.2. Calcium Hydroxylapatite 12.1.3. Poly-L-Lactic Acid (Plla) 12.1.4. Pmma (Poly (Methyl Methacrylate)) 12.1.5. Fat Fillers 12.1.6. Others 12.2. North America Aesthetic Fillers Market Size and Forecast, By Product (2024-2032) 12.2.1. Absorbable 12.2.2. Non-absorbable 12.3. North America Aesthetic Fillers Market Size and Forecast, By Application (2024-2032) 12.3.1. Scar Treatment 12.3.2. Wrinkle Correction Treatment 12.3.3. Lip Enhancement 12.3.4. Restoration of Volume/Fullness 12.3.5. Others 12.4. North America Aesthetic Fillers Market Size and Forecast, By End-User (2024-2032) 12.4.1. Specialty & Dermatology Clinics 12.4.2. Hospitals & Clinics 12.4.3. Research & Academic Institutes 12.4.4. Others 12.5. North America Aesthetic Fillers Market Size and Forecast, by Country (2024-2032) 12.5.1. United States 12.5.1.1. United States Aesthetic Fillers Market Size and Forecast, By Material (2024-2032) 12.5.1.2. United States Aesthetic Fillers Market Size and Forecast, By Product (2024-2032) 12.5.1.3. United States Aesthetic Fillers Market Size and Forecast, By Application (2024-2032) 12.5.1.4. United States Aesthetic Fillers Market Size and Forecast, By End-User (2024-2032) 12.5.2. Canada 12.5.2.1. Canada Aesthetic Fillers Market Size and Forecast, By Material (2024-2032) 12.5.2.2. Canada Aesthetic Fillers Market Size and Forecast, By Product (2024-2032) 12.5.2.3. Canada Aesthetic Fillers Market Size and Forecast, By Application (2024-2032) 12.5.2.4. Canada Aesthetic Fillers Market Size and Forecast, By End-User (2024-2032) 12.5.3. Mexico 12.5.3.1. Mexico Aesthetic Fillers Market Size and Forecast, By Material (2024-2032) 12.5.3.2. Mexico Aesthetic Fillers Market Size and Forecast, By Product (2024-2032) 12.5.3.3. Mexico Aesthetic Fillers Market Size and Forecast, By Application (2024-2032) 12.5.3.4. Mexico Aesthetic Fillers Market Size and Forecast, By End-User (2024-2032) 13. Europe Aesthetic Fillers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 13.1. Europe Aesthetic Fillers Market Size and Forecast, By Material (2024-2032) 13.2. Europe Aesthetic Fillers Market Size and Forecast, By Product (2024-2032) 13.3. Europe Aesthetic Fillers Market Size and Forecast, By Application (2024-2032) 13.4. Europe Aesthetic Fillers Market Size and Forecast, By End-User (2024-2032) 13.5. Europe Aesthetic Fillers Market Size and Forecast, By Country (2024-2032) 13.5.1. United Kingdom 13.5.2. France 13.5.3. Germany 13.5.4. Italy 13.5.5. Spain 13.5.6. Sweden 13.5.7. Russia 13.5.8. Rest of Europe 14. Asia Pacific Aesthetic Fillers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 14.1. Asia Pacific Aesthetic Fillers Market Size and Forecast, By Material (2024-2032) 14.2. Asia Pacific Aesthetic Fillers Market Size and Forecast, By Product (2024-2032) 14.3. Asia Pacific Aesthetic Fillers Market Size and Forecast, By Application (2024-2032) 14.4. Asia Pacific Aesthetic Fillers Market Size and Forecast, By End-User (2024-2032) 14.5. Asia Pacific Aesthetic Fillers Market Size and Forecast, by Country (2024-2032) 14.5.1. China 14.5.2. S Korea 14.5.3. Japan 14.5.4. India 14.5.5. Australia 14.5.6. Indonesia 14.5.7. Malaysia 14.5.8. Philippines 14.5.9. Thailand 14.5.10. Vietnam 14.5.11. Rest of Asia Pacific 15. Middle East and Africa Aesthetic Fillers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 15.1. Middle East and Africa Aesthetic Fillers Market Size and Forecast, By Material (2024-2032) 15.2. Middle East and Africa Aesthetic Fillers Market Size and Forecast, By Product (2024-2032) 15.3. Middle East and Africa Aesthetic Fillers Market Size and Forecast, By Application (2024-2032) 15.4. Middle East and Africa Aesthetic Fillers Market Size and Forecast, By End-User (2024-2032) 15.5. Middle East and Africa Aesthetic Fillers Market Size and Forecast, by Country (2024-2032) 15.5.1. South Africa 15.5.2. GCC 15.5.3. Nigeria 15.5.4. Egypt 15.5.5. Turkey 15.5.6. Rest of ME&A 16. South America Aesthetic Fillers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 16.1. South America Aesthetic Fillers Market Size and Forecast, By Material (2024-2032) 16.2. South America Aesthetic Fillers Market Size and Forecast, By Product (2024-2032) 16.3. South America Aesthetic Fillers Market Size and Forecast, By Application (2024-2032) 16.4. South America Aesthetic Fillers Market Size and Forecast, By End-User (2024-2032) 16.5. South America Aesthetic Fillers Market Size and Forecast, by Country (2024-2032) 16.5.1. Brazil 16.5.2. Argentina 16.5.3. Colombia 16.5.4. Chile 16.5.5. Peru 16.5.6. Rest of South America 17. Company Profile: Key Players 17.1. Allergan (AbbVie) 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Financial Overview 17.1.4. SWOT Analysis 17.1.5. Strategic Analysis 17.2. Galderma 17.3. Merz Pharma 17.4. Johnson & Johnson (Mentor) 17.5. Teoxane 17.6. Revance Therapeutics 17.7. Suneva Medical 17.8. Anika Therapeutics 17.9. Integra LifeSciences 17.10. Sinclair Pharma 17.11. FillMed (formerly Anteis/Filorga) 17.12. Ipsen Pharma 17.13. Fidia Farmaceutici 17.14. Medytox 17.15. Huons 17.16. LG Chem (LG Life Sciences) 17.17. BioPlus 17.18. Croma Pharma 17.19. Prollenium Medical Technologies 17.20. Laboratoires Vivacy 17.21. Bioxis Pharmaceutical 17.22. Mesoestetic 17.23. Contura International 17.24. Bohus Biotech 17.25. SciVision Biotech 17.26. Zhejiang Jingjia Medical Technology 17.27. Dr. Korman Laboratories 17.28. Cutera 17.29. Elan Aesthetics 17.30. Cytophil 17.31. Others 18. Key Findings 19. Analyst Recommendations 20. Research Methodology