The Aerospace Parts Manufacturing Market size was valued at USD 996.03 Billion in 2025 and the total Aerospace Parts Manufacturing revenue is expected to grow at a CAGR of 4.10% from 2025 to 2032, reaching nearly USD 1319.56 Billion by 2032.Aerospace Parts Manufacturing Market Overview:

The Aerospace Parts Manufacturing Market is witnessing a remarkable evolution, driven by rapid advancements in aerospace manufacturing, precision manufacturing, and aircraft engineering technologies. Rising global demand for aerospace components across commercial, defense, and space sectors is fueling the market’s growth. The increasing adoption of AS9100 certified manufacturers, precision aerospace machining services, and custom aerospace components is enabling aerospace companies to meet stringent quality standards and regulatory requirements.Aerospace Parts Manufacturing Market Executive Summary

Every decade transforms what aerospace vehicles can achieve; the next decade will redefine what their parts can deliver. The Global Aerospace Parts Manufacturing Market is standing at the intersection of precision manufacturing, aircraft engineering, and advanced aerospace technology. Between 2025 and 2032, the market is expected to grow from USD 996.03 Bn. to USD 1319.56 Bn.by 2032, at a CAGR of 4.10%. Aerospace parts are not just mechanical and structural components; they have now become a strategic node linking aircraft systems, avionics engineering, and digital aerospace manufacturing solutions. Deeper technological transformation: commercial aircraft require lightweight and modular aerospace components, defense applications are driving precision aerospace parts for military applications, and space exploration is demanding aerospace parts for satellites and propulsion systems. North America leads with technological innovation and established aerospace hubs, while Asia-Pacific emerges as the fastest-growing ecosystem, powered by the expansion of the Indian aerospace industry, Bangalore aerospace companies, and Hyderabad aerospace companies. The market’s pulse is accelerating as aircraft manufacturing companies, AS9100-certified manufacturers, and precision aerospace component suppliers shift from conventional materials to advanced aerospace composites and smart aerospace structures.To know about the Research Methodology :- Request Free Sample Report Aerospace Parts Manufacturing Market Objective & Scope The goal of this report is to equip OEMs, Tier 1 and Tier 2 suppliers, aftermarket integrators, investors, and regulators with a comprehensive understanding of the aerospace parts manufacturing market’s transformation into a high-precision, technology-driven sector.

Scope includes:

• Market evolution (2021–2024) and forecast till 2032 • Demand segmentation by Product Type, Material, and Aircraft Type • Cost structure and margin of products across OEM and aftermarket suppliers • Technological disruption – precision aerospace components, custom aerospace components, aerospace parts for electric aircraft • Regional intelligence – North America, Europe, APAC, MEA, and South America • Competitive benchmarking, value chain shifts, and regulatory frameworks Aerospace Parts Manufacturing Market Definition & Strategic Context Aerospace parts are not only passive mechanical or structural components. They are critical interfaces connecting mechanical, electronic, and digital systems across aircraft, defense vehicles, drones, and satellites. The modern aerospace parts market extends across: • Aerospace parts for commercial aircraft – high-volume precision components • Aerospace parts for military applications – rugged and mission-critical systems • Aerospace parts for space exploration – propulsion, avionics, and satellite systems • Unmanned aerial vehicle (UAV) parts – lightweight and autonomous-compatible • Electric and supersonic aircraft components – optimized for new aviation technologies These parts integrate into aircraft engines, flight control systems, landing gear systems, hydraulic and pneumatic systems, and cabin interiors, expanding from traditional manufacturing to digital aerospace manufacturing and smart component integration.Aerospace Parts Manufacturing Market Dynamics: The Evolution Story

The industry narrative is one of reinvention — a shift from rugged mechanics to responsive aerospace technology.1. Commercial Aviation & Defense Expansion Global commercial aircraft and defense production continues to grow, pushing demand for aerospace parts manufacturing companies in India, the USA, and Europe. Defense programs, UAVs, and satellite initiatives are driving precision requirements and increased reliance on custom aerospace components. 2. Technological Advancement & Material Innovation Traditional aluminum and titanium alloys are being supplemented with aerospace composites and advanced aerospace materials. Aerospace structures are now designed to integrate sensors, avionics, and lightweight designs, reducing weight while improving performance. 3. Smart Integration & Digital Manufacturing Aerospace parts suppliers are adopting AS9100 certified manufacturing, digital twin modeling, and predictive maintenance technologies. AI-driven quality control, automated aerospace machining services, and real-time telemetry integration are becoming standard. 4. Sustainability & Circular Manufacturing Manufacturers are shifting to green materials, recyclable components, and precision manufacturing processes that reduce emissions and waste. ESG compliance is becoming a key differentiator for top aerospace companies worldwide. Aerospace Parts Manufacturing Market Growth Drivers & Restraints 2024

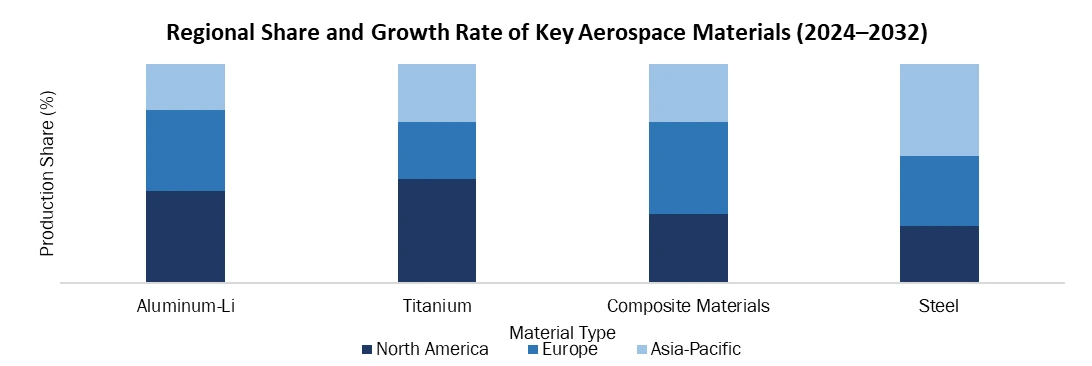

Regional Intelligence: Global Growth, Local Momentum Europe – The Innovation Hub Europe accounts for a significant share of aerospace engineering revenue, driven by strong OEMs, regulatory standards, and defense programs. Aircraft companies in Germany, France, and the UK lead in integrating aerospace parts for propulsion systems, flight control systems, and aerospace parts for avionics systems. North America – The Technology Leader The US remains the epicenter of aerospace innovation. Demand for aerospace parts for military applications, space exploration, and UAVs is high. Companies leverage precision aerospace component suppliers and advanced aerospace composites for next-generation aircraft. Asia-Pacific – The Growth Engine China, India, and Japan are rapidly expanding their aircraft manufacturing companies and regional aerospace hubs. The Indian aerospace industry, centered around Bangalore aerospace companies and Hyderabad aerospace companies, is witnessing exponential growth. Demand for aerospace parts for commercial aircraft, UAVs, and electric aircraft is soaring. GCC & South America – Emerging Markets Investment in defense programs, UAVs, and satellite manufacturing is driving aerospace parts for military applications and space exploration. Emerging players are focusing on precision aerospace components to compete globally. Aerospace Parts Manufacturing Market Revenue & Market Share (%) by Region 2024 Cost Structure & Profitability Lens In a typical aerospace parts unit: • Raw Materials (Aluminum, Titanium, Composites, Steel, Others): XX% • Labor & Assembly: 20–25% • Electrical/Avionics Components: 10–15% • Gross Margin: xx% OEM | xx% Aftermarket High-value components, such as aerospace parts for propulsion systems and aerospace parts for avionics systems, deliver gross margins 2–3x higher than standard structural components.

Aerospace Parts Manufacturing Market Competitive Landscape

Airbus Defence and Space, Boeing Defense, Space & Security, Spirit AeroSystems, GKN Aerospace, and Safran form a powerful, complementary competitive set in the Aerospace Parts Manufacturing Market. Airbus and Boeing dominate platform-level aerostructures and systems integration; Spirit AeroSystems excels in high-volume fuselage and wing assemblies; GKN focuses on advanced composite structures and engine components for civil and defense OEMs; Safran leads in propulsion systems, nacelles, and avionics subsystems—together driving innovation in composites, propulsion, and digital manufacturing. The market is moderately consolidated with leading players including top aerospace companies in North America, Europe, and Asia. Focus areas include: • Technological innovation in aerospace composites and aerospace structures • Expansion of aerospace parts manufacturing companies in India, USA, UK • Integration of custom aerospace components and digital manufacturing Emerging competitors in Asia and Eastern Europe are driving innovation in lightweight aerospace parts and precision aerospace machining services, applying pressure on incumbents.Regulatory & Technological Integration • Safety and certification standards such as AS9100, FAA regulations, and EASA standards govern aerospace parts manufacturing. • Industry is moving towards digital twin simulations, predictive AI maintenance, and IoT-enabled aerospace parts for unmanned aerial vehicles and space exploration systems. Aerospace Parts Manufacturing Market Forecast & Financial Outlook The global Aerospace Parts Manufacturing Market is forecast to grow from USD 956.81 Bn. to USD 1,319.57 Bn. by 2032, representing a CAGR of 4.10%. Regional split: • North America: USD xx Bn (Leading Region) • Europe: USD xx Bn • Asia-Pacific: USD xx Bn • MEA: USD xx Bn • South America: USD xx Bn Aerospace Parts Manufacturing Market Strategic Recommendations • For OEMs: Integrate advanced aerospace components, adopt AS9100 certified manufacturing, and collaborate with precision aerospace component suppliers to maintain technological leadership. • For Aftermarket Players: Focus on custom aerospace components, predictive maintenance services, and digital integration for retrofits and upgrades. • For Investors: Prioritize companies innovating in aerospace parts for propulsion systems, flight control systems, and avionics systems. High ROI exists in mid-tier supplier ecosystems. • For Policymakers: Harmonize aerospace standards, incentivize sustainable aerospace materials, and support innovation in space engineering and UAV applications. Analyst Insight: The Next Decade of Advanced Aerospace Parts The aerospace parts manufacturing market is no longer a back-end industrial function. Between precision engineering and digital aerospace technology, these components are shaping the future of commercial aviation, defense, and space exploration. By 2032, every aircraft, drone, and spacecraft will rely on smart, lightweight, and precision aerospace parts, connecting data, power, and purpose in a global ecosystem of aerospace innovation.

Aerospace Parts Manufacturing Market Scope: Inquiry Before Buying

Global Aerospace Parts Manufacturing Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 996.03 Bn. Forecast Period 2026 to 2032 CAGR: 4.10% Market Size in 2032: USD 1319.56 Bn. Segments Covered: by Product Type Engines & Engine Components Cabin Interiors Aerostructure Equipment, System, and Support Avionics Insulation Components Others by Material Aluminum Titanium Composite Materials Steel Others by Aircraft Type Commercial Aircraft Business Aircraft Military Aircraft Others Aerospace Parts Manufacturing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Aerospace Parts Manufacturing Market, Key Players

North America 1. Spirit AeroSystems Inc. (USA) 2. Honeywell Aerospace (USA) 3. General Electric (GE Aerospace) (USA) 4. Parker Aerospace (USA) 5. Triumph Group (USA) 6. Woodward, Inc. (USA) 7. CPI Aerostructures (USA) 8. Intrex Aerospace (USA) 9. Collins Aerospace (Raytheon Technologies) (USA) 10. Lockheed Martin Aeronautics (USA) 11. Boeing Defense, Space & Security (USA) 12. Northrop Grumman Corporation (USA) 13. Textron Aviation (USA) 14. Moog Inc. (USA) 15. Eaton Aerospace (USA) 16. AAR Corp. (USA) 17. Curtiss-Wright Corporation (USA) 18. Ducommun Incorporated (USA) 19. Kaman Corporation (USA) 20. Hexcel Corporation (USA) 21. Barnes Aerospace (USA) 22. Magellan Aerospace (Canada) Europe 1. GKN Aerospace (UK) 2. Safran (France) 3. Rolls-Royce (UK) 4. MTU Aero Engines (Germany) 5. Liebherr-Aerospace (Germany/France) 6. Senior Aerospace (UK) 7. Thales Group (France) 8. FACC AG (Austria) 9. Latecoere (France) 10. Patria Aviation (Finland) 11. Airbus Defence and Space (France/Germany/Spain) 12. Leonardo S.p.A. (Italy) 13. Dassault Aviation (France) 14. RUAG International Holding AG (Switzerland) 15. Cobham Limited (UK) 16. Senior Plc (UK) Asia Pacific 1. TAE Aerospace (Australia) 2. HAL (Hindustan Aeronautics Limited) (India) 3. COMAC (China) 4. Sansera (India) 5. Aequs Private Limited (India) 6. ALPHA DESIGN TECHNOLOGIES PVT LTD (India) 7. Bharat Electronics Limited (India) 8. L&T Technology Services Limited (India) 9. Tata Advanced Systems Limited (India) 10. Avantel Limited (India) 11. ST Engineering Aerospace Ltd (Singapore) Middle East & Africa (MEA) 1. IAI (Israel Aerospace Industries) (Israel)Frequently Asked Questions:

1. Which region has the largest share in the Global Aerospace Parts Manufacturing Market? Ans: The North America region held the highest share in 2025. 2. What is the growth rate of the Global Aerospace Parts Manufacturing Market? Ans: The Global Market is expected to grow at a CAGR of 4.10% during the forecast period 2026-2032. 3. What is the scope of the Global Aerospace Parts Manufacturing Market report? Ans: The Global Aerospace Parts Manufacturing Market report helps with the PESTEL, PORTER, Market estimation of the forecast period, Material Analysis and Dependency Mapping, Production and Manufacturing Analysis, Pricing and Cost Structure Analysis (2025), etc. 4. Who are the key players in the Global Aerospace Parts Manufacturing Market? Ans: The important key players in the Global Aerospace Parts Manufacturing Market are – Airbus Defence and Space, Boeing Defense, Space & Security, Spirit AeroSystems Inc., GKN Aerospace, Safran, etc. 5. What is the study period of this market? Ans: The Global Aerospace Parts Manufacturing Market is studied from 2025 to 2032.

1. Aerospace Parts Manufacturing Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2025) & Forecast (2025-2032), 1.1.2. Market Size (USD) (Value) and (volume in Units) and Market Share (%) - By Segments, Regions and Country 2. Aerospace Parts Manufacturing Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. MMR Competitive Positioning [Revenue and Market Share (%)] 2.3. Key Players Benchmarking for Aerospace Parts Manufacturing 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. Key Clients 2.3.5. On-Time Delivery Rate (%) 2.3.6. New Product Development/Innovation Rate 2.3.7. Technology Integration 2.3.8. Supplier Dependency Ratio 2.3.9. Recycling and Material Reuse Rate (%) 2.3.10. Market Share (%) by Region 2.3.11. Profit Margin (%) 2.3.12. Revenue (2025) 2.3.13. Y-O-Y (%) 2.3.14. R&D spending as % of revenue 2.3.15. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Global Market Concentration and Herfindahl Index 2.6.1. Quantitative concentration ratios (Top-5 and Top-10 share) by subsystem category – airframe, propulsion, avionics, actuation, and interiors 2.6.2. Regional Herfindahl-Hirschman Index (HHI) comparison to highlight market fragmentation vs consolidation 2.6.3. Consolidation impact analysis – post-merger share shifts (e.g., Spirit AeroSystems–Boeing, Collins–UTC integration) 2.6.4. Evaluation of vertical vs horizontal integration strategies across major players 2.7. Top OEM and Tier-1/Tier-2 Market Shares 2.7.1. Global and regional revenue share by component type (structural, engine, electronics, landing gear, etc.) 2.7.2. Top 10 Tier-1 suppliers’ contribution to global output by value and volume 2.7.3. Ranking of Tier-2 and Tier-3 precision manufacturers by capability specialization 2.7.4. Comparative study of OEMs’ supplier dependency ratios and sourcing diversity 2.8. Emerging Entrants and Niche Specialists 2.8.1. Growth of additive manufacturing specialists entering OEM supply chains 2.8.2. Tier-3 innovators in advanced coatings, composite layup, or precision micro-machining 2.8.3. Regional SME participation driven by local offset mandates 2.8.4. Strategic acquisitions of niche firms by Tier-1s for technology access 3. Aerospace Parts Manufacturing Market: Dynamics 3.1. Market Trends 3.2. Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 4. Industry Ecosystem and Value Chain 4.1. Aerospace Parts Manufacturing Ecosystem Overview 4.2. Role of OEMs (Airbus, Boeing, Embraer, Lockheed Martin, etc.) 4.3. Tier-1 & Tier-2 Supplier Network and Interdependencies 4.4. Collaboration Models: OEM–Supplier Partnerships 4.5. Design-to-Manufacturing and Certification Workflow 4.6. Role of Aftermarket and MRO Parts Manufacturing 5. Material Analysis and Dependency Mapping 5.1. Material Composition by Component Type 5.2. Key Aerospace Materials – Aluminum-Lithium, Titanium, Nickel Superalloys, Carbon Fiber Composites 5.3. Regional Production Capacities and Material Supply Concentration 5.4. Rare Material Dependency – Magnesium, Niobium, Beryllium, and Cobalt 5.5. Material Qualification Timelines and OEM Standards 5.6. Recycling, Substitution, and Reusability Strategies 5.7. Price Volatility and Procurement Risk Modeling 6. Technology and Innovation Landscape 6.1. Adoption of Additive Manufacturing (AM) and 3D-Printed Components 6.2. Smart Machining, AI, and Digital Twin Applications 6.3. Advancements in Composite Material Manufacturing 6.4. Process Automation and Robotics Integration 6.5. Precision Tooling and Metrology Developments 6.6. Emerging Trends: Lightweight Electrified and Modular Components 7. Supply Chain Analysis 7.1. Overview of the Global Aerospace Supply Chain Ecosystem 7.2. Supply Chain Architecture: OEMs, Tier-1, Tier-2, Tier-3, and Raw Material Suppliers 7.3. Global Supplier Network Mapping and Regional Dependencies 7.4. Key Supply Chain Hubs (U.S., EU, Japan, India, China, Mexico) 7.5. Material Sourcing Channels for Aluminum, Titanium, Composites, and Alloys 7.6. Logistics, Warehousing, and Inventory Management Systems 8. Production and Manufacturing Analysis 8.1. Overview of Aerospace Parts Production Processes 8.2. Global Manufacturing Capacity and Facility Distribution by Region 8.3. Key Production Hubs and Aerospace Industrial Corridors 8.4. Production Workflow: Design → Machining → Assembly → Quality Testing 8.5. Process Technologies: Forging, Casting, Machining, Additive Manufacturing 9. Advanced Materials and Sustainability Strategy 9.1. Application-specific Material Innovations – Civil vs. Defense Requirements 9.2. Lightweighting and Energy Efficiency Gains 9.3. Recyclability and Circular Economy Models 9.4. Green Coatings, Surface Treatments, and Composite Reuse 9.5. Lifecycle Emission and Eco-Compliance Benchmarking 9.6. Material Traceability and Digital Passports 9.7. Carbon-neutral Manufacturing and Energy Transition Pathways 10. Regulatory and Certification Framework 10.1. Global Standards (AS9100, NADCAP, FAA, EASA) 10.2. Defense Procurement Regulations and Export Controls (ITAR, EAR) 10.3. Environmental and Safety Compliance in Aerospace Production 10.4. Certification Pathways for New Parts and Suppliers 10.5. Government Initiatives Supporting Domestic Aerospace Manufacturing 11. Pricing and Cost Structure Analysis (2025) 11.1. Cost Breakdown by Material, Process, and Certification 11.2. Comparative Cost Analysis: Conventional vs. Additive Manufacturing 11.3. Impact of Raw Material and Energy Prices 11.4. Economies of Scale and Production Efficiency 11.5. Margin and Profitability Analysis by Component Category 12. Program-Level Demand and Platform Analysis (2025) 12.1. Active and Upcoming Aircraft Programs – A320neo, 737 MAX, 787, A350, KC-46, etc. 12.2. Component Sourcing Strategy by Program and Tier 12.3. Localization Requirements and Offset Agreements by Program 12.4. Tier Participation by Aircraft Platform (Fixed-wing, Rotary, Space) 12.5. Program Lifecycle Positioning – Ramp-up, Steady State, Decline 12.6. Supplier Qualification and Replacement Cycles per Program 13. Additive Manufacturing and Digital Factory Analysis 13.1. Role of 3D Printing in Aerospace Component Supply 13.2. Case Studies: Airbus, GE, and Boeing Additive Initiatives 13.3. Certification and Testing of Additive Manufactured Parts 13.4. Cost Comparison: Conventional vs. 3D-Printed Parts 13.5. Future of Digital Factories and On-Demand Manufacturing 14. Defense and Space Manufacturing Outlook 14.1. Expansion of Defense Aerospace Programs (Fighter Jets, UAVs, Missiles) 14.2. Localization of Critical Defense Parts Manufacturing 14.3. Growth in Spacecraft and Launch Vehicle Components 14.4. Public–Private Collaboration in Space Manufacturing 14.5. Case Studies: DRDO, NASA, ISRO, ESA Supplier Networks 15. Risk and Resilience Framework 15.1. Supply Chain Vulnerability and Bottleneck Mapping 15.2. Raw Material Shortage and Price Fluctuation Risks 15.3. Geopolitical Impacts and Trade Restrictions 15.4. Business Continuity and Digital Risk Mitigation Strategies 15.5. Scenario Planning and Market Resilience Forecast 16. Logistics and Inventory Dynamics 16.1. Global Supply Nodes and Inventory Distribution Networks 16.2. Just-in-Time (JIT) and Just-in-Case (JIC) Trade-offs 16.3. Warehousing, Cold Chain, and Hazardous Material Handling 16.4. Logistics Partners and 4PL/5PL Integration in Aerospace 16.5. Inventory Cost Trends and Optimization Strategies 16.6. Regional Logistics Risk Mapping – Port Delays, Freight Rate Volatility 17. Research, Development, and Patent Landscape 17.1. Global R&D Spending and Focus Areas in Aerospace Manufacturing 17.2. Patent Filing Trends in Material Science, AM, and Aerostructures 17.3. Technology Partnerships Between OEMs, Academia, and Startups 17.4. Emerging Research in Lightweight Structures and Smart Materials 17.5. Case Studies: Innovation Centers and Demonstrator Programs 18. Maintenance, Repair, and Overhaul (MRO) Parts Market Integration 18.1. MRO as a Growth Engine for the Parts Aftermarket 18.2. OEM vs. Independent MRO: Value Share Analysis 18.3. Certification Requirements for PMA (Parts Manufacturer Approval) 18.4. Digitization and Predictive Maintenance in MRO Operations 18.5. Global MRO Supply Chain and Regional Hubs 18.6. Linkages Between Manufacturing and MRO Ecosystems 18.7. Spares Management, Reverse Engineering, and Lifecycle Extension 19. Aerospace Parts Manufacturing Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000’Units) (2025-2032) 19.1. Global Aerospace Parts Manufacturing Market Size and Forecast, By Product Type (2025-2032) 19.1.1. Engines & Engine Components 19.1.2. Cabin Interiors 19.1.3. Aerostructure 19.1.4. Equipment, System, and Support 19.1.5. Avionics 19.1.6. Insulation Components 19.1.7. Others 19.2. Global Aerospace Parts Manufacturing Market Size and Forecast, By Material (2025-2032) 19.2.1. Aluminum 19.2.2. Titanium 19.2.3. Composite Materials 19.2.4. Steel 19.2.5. Others 19.3. Global Aerospace Parts Manufacturing Market Size and Forecast, By Aircraft Type (2025-2032) 19.3.1. Commercial Aircraft 19.3.2. Business Aircraft 19.3.3. Military Aircraft 19.3.4. Others 19.4. Aerospace Parts Manufacturing Market Size and Forecast, by Region (2025-2032) 19.4.1. North America 19.4.2. Europe 19.4.3. Asia Pacific 19.4.4. Middle East and Africa 19.4.5. South America 20. North America Aerospace Parts Manufacturing Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000’Units) (2025-2032) 20.1. North America Market Size and Forecast, By Product Type 20.2. North America Market Size and Forecast, By Material 20.3. North America Market Size and Forecast, By Aircraft Type 20.4. North America Market Size and Forecast, by Country 20.4.1. United States 20.4.1.1. United States Market Size and Forecast, By Product Type 20.4.1.2. United States Market Size and Forecast, By Material 20.4.1.3. United States Market Size and Forecast, By Aircraft Type 20.4.2. Canada 20.4.3. Mexico 21. Europe Aerospace Parts Manufacturing Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000’Units) (2025-2032) 21.1. Europe Market Size and Forecast, By Product Type 21.2. Europe Market Size and Forecast, By Material 21.3. Europe Market Size and Forecast, By Aircraft Type 21.4. Europe Market Size and Forecast, by Country 21.4.1. United Kingdom 21.4.2. France 21.4.3. Germany 21.4.4. Italy 21.4.5. Spain 21.4.6. Sweden 21.4.7. Russia 21.4.8. Poland 21.4.9. Netherlands 21.4.10. Czech Republic 21.4.11. Rest Of Europe 22. Asia Pacific Aerospace Parts Manufacturing Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000’Units) (2025-2032) 22.1. Asia Pacific Market Size and Forecast, By Product Type 22.2. Asia Pacific Market Size and Forecast, By Material 22.3. Asia Pacific Market Size and Forecast, By Aircraft Type 22.4. Asia Pacific Market Size and Forecast, by Country 22.4.1. China 22.4.2. S. Korea 22.4.3. India 22.4.4. Japan 22.4.5. Australia 22.4.6. Indonesia 22.4.7. Malaysia 22.4.8. Philippines 22.4.9. Thailand 22.4.10. Vietnam 22.4.11. Singapore 22.4.12. Taiwan 22.4.13. Rest of Asia Pacific 23. Middle East and Africa Aerospace Parts Manufacturing Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000’Units) (2025-2032) 23.1. Middle East and Africa Market Size and Forecast, By Product Type 23.2. Middle East and Africa Market Size and Forecast, By Material 23.3. Middle East and Africa Market Size and Forecast, By Aircraft Type 23.4. Middle East and Africa Market Size and Forecast, by Country 23.4.1. South Africa 23.4.2. GCC 23.4.3. Egypt 23.4.4. Nigeria 23.4.5. Turkey 23.4.6. Israel 23.4.7. Morocco 23.4.8. Rest of MEA 24. South America Aerospace Parts Manufacturing Market Size and Forecast by Segmentation (By Value in USD Billion & Volume in 000’Units) (2025-2032) 24.1. South America Market Size and Forecast, By Product Type 24.2. South America Market Size and Forecast, By Material 24.3. South America Market Size and Forecast, By Aircraft Type 24.4. South America Market Size and Forecast, by Country 24.5. Brazil 24.6. Argentina 24.7. Colombia 24.8. Chile 24.9. Peru 24.10. Rest of South America 25. Company Profile: Key Players 25.1. Spirit Aerosystems Inc. 25.1.1. Company Overview 25.1.2. Business Portfolio 25.1.3. Financial Overview 25.1.4. Strategic Analysis 25.1.5. SWOT Analysis 25.1.6. Recent Developments 25.2. GKN Aerospace 25.3. Safran 25.4. Honeywell Aerospace 25.5. Rolls-Royce 25.6. General Electric (GE Aerospace) 25.7. Parker Aerospace 25.8. MTU Aero Engines 25.9. Liebherr-Aerospace 25.10. Triumph Group 25.11. Senior Aerospace 25.12. Woodward, Inc. 25.13. Thales Group 25.14. FACC AG 25.15. Magellan Aerospace 25.16. Latecoere 25.17. TAE Aerospace 25.18. HAL (Hindustan Aeronautics Limited) 25.19. IAI (Israel Aerospace Industries) 25.20. Patria Aviation 25.21. COMAC 25.22. CPI Aerostructures 25.23. Intrex Aerospace 25.24. Sansera 25.25. Aequs Private Limited 25.26. ALPHA DESIGN TECHNOLOGIES PVT LTD 25.27. Bharat Electronics Limited 25.28. L&T Technology Services Limited 25.29. Tata Advanced Systems Limited 25.30. Avantel Limited 25.31. Collins Aerospace (Raytheon Technologies) 25.32. Lockheed Martin Aeronautics 25.33. Boeing Defense, Space & Security 25.34. Airbus Defence and Space 25.35. Leonardo S.p.A. 25.36. Northrop Grumman Corporation 25.37. Textron Aviation 25.38. Dassault Aviation 25.39. RUAG International Holding AG 25.40. ST Engineering Aerospace Ltd 25.41. Moog Inc. 25.42. Eaton Aerospace 25.43. Cobham Limited 25.44. AAR Corp. 25.45. Curtiss-Wright Corporation 25.46. Ducommun Incorporated 25.47. Kaman Corporation 25.48. Hexcel Corporation 25.49. Barnes Aerospace 25.50. Senior Plc (UK) 26. Key Findings 27. Strategic Outlook & Opportunity Assessment 27.1. Market Attractiveness Matrix by Segment & Region 27.2. Entry Barriers for New Players 27.3. OEM-Supplier Consolidation Trends 27.4. Growth Strategies for Tiered Suppliers 27.5. Risk Factors and Mitigation Strategies 28. Research Methodology