The 5G Security Market Size was valued at USD 1.8 Billion in 2023, and the total revenue is expected to grow at a CAGR of 40.2% from 2024 to 2030, reaching nearly USD 10.52 Billion by 2030.5G Security Market Overview

5G security is a specialized area of wireless network security aimed at safeguarding fifth-generation (5G) networks. This security framework encompasses a range of technologies designed to protect 5G infrastructure and 5G-enabled devices from data breaches, cyberattacks, malware, and other digital threats. Unlike previous generations, 5G leverages advanced features like virtualization, network slicing, and software-defined networking (SDN), introducing new vulnerabilities that require robust protection measures. The global rollout of 5G technology significantly impacts critical infrastructure and industries worldwide. This widespread adoption underscores the need for strong security protocols to protect against emerging cyber threats that could disrupt essential services and compromise sensitive data across sectors. Recent Developments in 5G Security Market• In February 2024, Palo Alto Networks introduced a comprehensive private 5G security solution in partnership with leading Private 5G collaborators, including Druid, Celona, Ataya, NVIDIA, NETSCOUT, and NTT DATA. This solution aims to secure 5G networks from initial deployment through ongoing operation, addressing the rising security risks in complex 5G ecosystems where the proliferation of 5G-connected devices has heightened security concerns for 70% of executives. By integrating Palo Alto Networks' enterprise-grade 5G security with partner technologies, the solution delivers enhanced visibility, secure access, AI-powered applications, and threat detection for private 5G networks, offering robust protection for mission-critical 5G infrastructures and supporting digital transformation across industries.

• In February 2023, Atos launched its “5Guard” security portfolio, designed to provide end-to-end protection for private 5G networks and telecom operators. The 5Guard offering helps organizations establish a holistic security approach across the 5G ecosystem, covering RAN, MEC, and multi-cloud platforms. Incorporating Atos' encryption, identity management, and managed detection and response (MDR) solutions, along with technologies from partners like Fortinet, 5Guard ensures compliance with international standards such as 3GPP, enabling secure deployment and operation of 5G networks.

To Know About The Research Methodology :- Request Free Sample Report

5G Security Market Dynamics

Navigating security challenges within 5G networks is becoming a key driver for growth in the 5G security market, especially as CIOs prioritize protection across these complex infrastructures. The distributed architecture of 5G, involving technologies like Software-Defined Networking (SDN), Network Virtualization (NV), and cloud-native structures, allows for flexibility in handling network functions. However, this also introduces vulnerabilities that increase demand for robust security solutions specifically designed to protect 5G environments.• Complex Network Architectures: Unlike previous network generations, 5G’s reliance on cloud-native and virtualized frameworks means that network functions can operate across decentralized data centers, including both public and private clouds. For instance, as a network function might transfer data from a private cloud to a public one, the chance of data interception or unauthorized access rises, creating opportunities for vendors to provide standardized, cross-environment security solutions. This complexity is propelling investments in technologies like Secure Access Service Edge (SASE) and zero-trust frameworks, which help secure dynamic data flow across different environments within the 5G Security Market.

• Integration with Legacy and Industry-Specific Networks: 5G networks not only support traditional communication but also connect with 2G, 3G, and 4G networks, as well as critical vertical industries such as automotive, manufacturing, and IoT. These sectors, each with unique security requirements, depend on 5G’s speed and connectivity but also face risks. For example, IoT devices in smart cities and factories that are not fully secured could become entry points for attackers. To address these needs, CIOs are increasingly seeking 5G-specific security solutions that focus on network segmentation, endpoint protection, and industry-compliant safeguards, driving growth in this niche market

• Multi-Layered and End-to-End Security Demand: The interconnectedness of 5G’s architecture with other devices and networks means that a single vulnerability can have widespread effects. CIOs need to implement multi-layered security, ensuring that data is protected from the edge to the core. Solutions like AI-based threat detection and real-time monitoring are becoming essential to pre-emptively identify threats across various network layers, thereby boosting the adoption of security products in the 5G Security market and services specifically built for 5G.

Growing Adoption of Network Slicing to Enhance 5G Service Delivery Globally Network slicing is one of the types of virtual networking architecture that is nearly same as software-defined networking (SDN) and network functions virtualization (NFV). These technologies are developed to achieve software-based automation in modern networks. Mobile operators and telecommunication vendors are preparing themselves for the implementation and adoption of 5G technology. 5G networks present a revolution over last generation 4G networks in terms of capacity, performance, and spectrum-access in radio networks, and are designed for extremely flexible and highly programmable environment. Network slicing helps service providers to achieve these goals by allowing single network that can be used to offer various services, which is based on the requirements of users. Furthermore, it helps communication service operators to minimize capital expenditure and operational expense.• For instance, in October 2020, Nokia Corporation launched first ever commercial network slicing for 5G network. It includes new network management, controller, and orchestration capabilities in its solution, by enabling mobile operators for the first time to rapidly deliver and assure network slicing services within minutes instead of hours. Moreover, in January 2021, Ericsson launched 5G network slicing-based radio access network service that will enable communications service providers to deliver customized 5G services with guaranteed high performance. Thus, all these factors collectively contribute toward the growth of the 5G security industry.

Comparative Analysis of 5G vs. 4G Network:4G and 5G are advanced wireless telecommunication technologies that enable high-speed data transmission for mobile devices, each bringing significant improvements over previous generations. In terms of data rates, 4G technology can reach speeds of up to approximately 100 Mbps, which is suitable for streaming high-definition video, online gaming, and other bandwidth-intensive applications. However, 5G offers a substantial leap forward, with speeds potentially reaching up to 20 Gbps, enabling ultra-fast downloads, seamless virtual reality experiences, and enhanced remote operations. Latency, or the delay in data transfer between devices, is another critical difference. In 4G networks, latency typically ranges from around 60 to 100 milliseconds. By contrast, 5G technology is designed to reduce this latency dramatically, achieving response times as low as 1 to 5 milliseconds. This reduced latency is particularly beneficial for applications requiring real-time responsiveness, such as autonomous vehicles, remote surgery, and high-frequency trading. In terms of network capacity, 4G can support a few thousand devices per square kilometer. However, 5G networks are built to handle far greater device densities, supporting up to a million connected devices in the same area. This capability makes 5G ideal for supporting the vast number of Internet of Things (IoT) devices expected to proliferate in smart cities, industrial automation, and connected healthcare applications. The complex infrastructure of 5G increases its attack surface. With significantly more connected devices and much faster data transfer rates compared to 4G, 5G is far more vulnerable to cyberattacks. Additionally, 5G networks incorporate new technologies like virtualization and software-defined networking, which may introduce novel vulnerabilities for threat actors to exploit. One of the most critical differences between 4G and 5G is that 5G operates at the network edge, unlike 4G’s reliance on traditional centralized infrastructure. As a result, security must also be delivered at the network edge rather than through conventional network infrastructure.

5G Security Market Segment Analysis

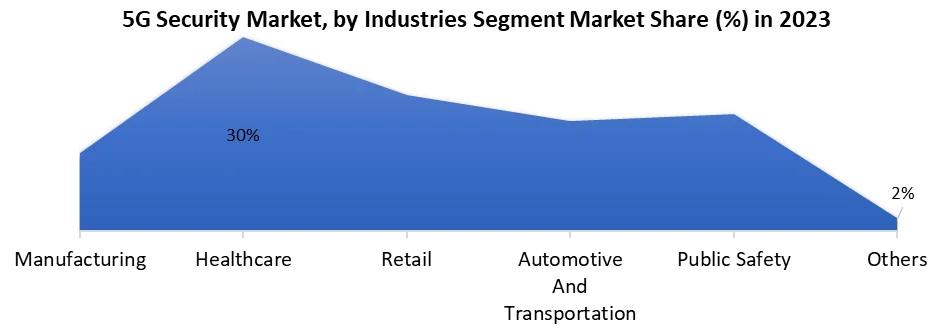

By Deployment, models further diversify the 5G Security market, with both cloud-based and on-premise deployments playing essential roles. Cloud deployment is emerging as a dominant segment due to its scalability, flexibility, and cost-effectiveness, catering to enterprises looking for seamless and easily scalable security infrastructure in the 5G security market. Cloud-based deployments also benefit from frequent security updates and remote monitoring capabilities, making them especially attractive to industries with limited IT resources. In contrast, on-premise deployments are preferred by organizations with stringent data control and regulatory compliance requirements, such as in healthcare and public safety sectors, where data sensitivity is paramount. By Architecture perspective, 5G NR Non-Standalone (NSA) remains a widely adopted segment due to the prevalence of legacy infrastructure in early-stage 5G deployments. However, 5G NR Standalone (SA) is expected to gain momentum as more networks transition to fully independent 5G architectures, requiring dedicated security solutions to address unique SA challenges, including low latency, high reliability, and enhanced mobility. This transition to standalone 5G is anticipated to fuel demand for advanced security solutions tailored to the architectural shifts within the 5G Security Market ecosystem. By Industries, the manufacturing sector emerges as a dominant player in the 5G security market. With the rise of smart factories and industrial IoT, manufacturing relies heavily on secure 5G connectivity to protect data flows across devices and automated systems. Other sectors, such as healthcare, automotive and transportation, and public safety, are also driving demand as they adopt 5G-enabled applications that require stringent security measures to maintain operational safety and privacy. In healthcare, for example, secure 5G networks enable telemedicine, connected health devices, and secure patient data exchange. The automotive and transportation sector demands robust 5G security for vehicle-to-everything (V2X) communications, while public safety agencies leverage secure networks for reliable emergency response coordination. This industry-specific demand underscores the segment’s impact on the overall 5G security market, shaping targeted innovations and regulatory considerations.

5G Security Market Regional Analysis

5G Security Market Impact on US The U.S. 5G security market is projected to experience robust growth from 2025 to 2030. As 5G technology underpins essential infrastructure across sectors like healthcare, finance, manufacturing, and transportation, the need for strong security measures to guard against evolving cyber threats is becoming paramount. To address these risks, U.S. enterprises and government agencies are making substantial investments in advanced security solutions, including encryption, threat intelligence, and real-time network monitoring tools.• For example, AT&T has partnered with IBM to integrate AI-driven threat detection and response capabilities into its 5G networks, enhancing protection against sophisticated cyber-attacks and reinforcing trust in critical 5G infrastructure.

5G Security Market Impact on Asia Pacific The Asia Pacific region is expected to be the fastest-growing market for 5G security solutions over the forecast period. This growth can be attributed to rising awareness of 5G security in emerging economies like India and Japan. Additionally, the rapid increase in 5G connections and stringent government regulations mandating 5G security protocols are anticipated to drive regional expansion. For instance, the GSM Association's Mobile Economy Asia-Pacific 2022 report predicts that 5G adoption across Asia-Pacific will surpass 400 million connections, accounting for over 14% of total mobile connections by 2025. • In China, the 5G security market is projected to see substantial growth from 2025 to 2030. As China accelerates its 5G rollout across sectors such as manufacturing, transportation, and smart cities, the demand for advanced security solutions is intensifying. The proliferation of connected devices and critical systems reliant on 5G has heightened concerns around data privacy, cybersecurity threats, and network integrity.5G Security Market Competitive Insights

Leading competitors in the 5G security market are focused on providing solutions that enhance operational efficiency and improve working conditions for various industries. Key players are expanding their product lines through collaborations and product launches, with a strong emphasis on validating security within 5G networks. Companies in the 5G security sector are incorporating advanced technologies such as AI and low latency into their solutions, enabling them to strengthen their competitive edge and enhance customer experience. The integration of network slicing in 5G solutions delivers more reliable, resilient, and dynamically responsive network speeds and connectivity.• Ericsson is a key player in the 5G security market, dedicated to embedding robust security features within its telecommunications infrastructure. Its offerings include secure network slicing, encrypted communication, and comprehensive cybersecurity controls designed specifically for 5G environments. Ericsson’s focus on end-to-end security provides thorough data protection across networks, devices, and cloud systems, positioning it as a valuable partner for operators deploying secure, resilient 5G networks.

• Palo Alto Networks also offers tailored cybersecurity solutions for the unique demands of 5G networks. Leveraging expertise in advanced threat detection, AI-driven analytics, and holistic security frameworks, the company protects against diverse cyber threats, ensuring robust security for 5G applications.

5G Security Market Scope: Inquire before buying

Global Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 1.8 Bn. Forecast Period 2024 to 2030 CAGR: 4.5% Market Size in 2030: USD 10.52 Bn. Segments Covered: by Offering Solutions Services by Deployment Cloud On-premise by Architecture 5G NR Standalone 5G NR Non-Standalone by Network Security RAN Security Core Security by Industries Manufacturing Healthcare Retail Automotive And Transportation Public Safety Others 5G Security Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and Rest of APAC) Middle East and Africa (South Africa, GCC, and Rest of the MEA) South America (Brazil, Argentina, and Rest of South America)5G Security Market Key Players

North America: 1. Palo Alto Networks (US) 2. Cisco (US) 3. A10 Networks (US) 4. F5 Networks (US) 5. Juniper Networks (US) 6. Spirent (US) 7. Fortinet (US) 8. Mobileum (US) 9. Trend Micro (US) 10. Akamai (US) 11. AT&T (US) 12. Check Point (US) 13. ForgeRock (US) 14. Cellwise (US) 15. Banu Networks (US) 16. Suavei (US) 17. Cachengo (US) 18. Trilogy (US) 19. Movandi (US) 20. Deepsig (US) 21. EdgeQ (US) Europe: 22. Ericsson (Sweden), CLAVISTER (Sweden) 23. Nokia (Finland) 24. Colt Technology (UK), 25. Positive Technologies (UK) 26. Riscure (Netherlands), Broad Forward (Netherlands) 27. G+D Mobile Security (Germany), 28. Alcan Systems (Germany) 29. Avast (Czech Republic) 30. Microamp Solutions (Poland) Asia Pacific: 31. China: Huawei (China), ZTE (China) 32. Israel: Allot (Israel), Radware (Israel) South America: 33. Colombia: Mixcomm (Colombia)Frequently Asked Questions:

1] What segments are covered in the Global 5G Security Market report? Ans. The segments covered in the Global 5G Security Market report are based on Offering, Deployment, Architecture, Network Security, and Industries. 2] Which region is expected to hold the highest share in the Global 5G Security Market? Ans. North America is expected to hold the highest share of the Global 5G Security Market. 3] Who is the Refractory Market key competitors in the Industry? Ans. Palo Alto Networks (US), Cisco (US), A10 Networks (US), F5 Networks (US), Juniper Networks (US)are the key players in the Global 5G Security Market. 4] Which segment is expected to hold the largest 5G Security market share by 2030? Ans. The 5G NR Non-Standalone (NSA) in Architecture segment hold the largest market share in the Global 5G Security market by 2030. 5] What is the market size of the Global 5G Security market by 2030? Ans. The market size of the Global 5G Security market is USD 10.52 Bn by 2030. 6] What was the market size of the Global 5G Security market in 2023? Ans. The market size of the Global 5G Security market was worth USD 1.8 Bn in 2023.

1. 5G Security Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global 5G Security Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Service Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Manufacturing Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. 5G Security Market: Dynamics 3.1. Market Trends by Region 3.1.1. North America 5G Security Market Trends 3.1.2. Europe 5G Security Market Trends 3.1.3. Asia Pacific 5G Security Market Trends 3.1.4. Middle East and Africa 5G Security Market Trends 3.2. Market Dynamics by Region 3.2.1. Global 5G Security Market Drivers 3.2.2. Global 5G Security Market Restraints 3.2.3. Global 5G Security Market Opportunities 3.2.4. Global 5G Security Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Analysis of Government Schemes and Initiatives for 5G Security Industry 3.8. Key Opinion Leader Analysis 3.9. The Global Pandemic Impact on 5G Security Market 4. 5G Security Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. 5G Security Market Size and Forecast, By Offering (2023-2030) 4.1.1. Solutions 4.1.2. Services 4.2. 5G Security Market Size and Forecast, By Deployment (2023-2030) 4.2.1. Cloud 4.2.2. On-premise 4.3. 5G Security Market Size and Forecast, By Architecture (2023-2030) 4.3.1. 5G NR Standalone 4.3.2. 5G NR Non-Standalone 4.4. 5G Security Market Size and Forecast, By Network Security (2023-2030) 4.4.1. RAN Security 4.4.2. Core Security 4.5. 5G Security Market Size and Forecast, By Industries (2023-2030) 4.5.1. Manufacturing 4.5.2. Healthcare 4.5.3. Retail 4.5.4. Automotive And Transportation 4.5.5. Public Safety 4.5.6. Others 4.6. 5G Security Market Size and Forecast, By Region (2023-2030) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America 5G Security Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America 5G Security Market Size and Forecast, By Offering (2023-2030) 5.1.1. Solutions 5.1.2. Services 5.2. North America 5G Security Market Size and Forecast, By Deployment (2023-2030) 5.2.1. Cloud 5.2.2. On-premise 5.3. North America 5G Security Market Size and Forecast, By Architecture (2023-2030) 5.3.1. 5G NR Standalone 5.3.2. 5G NR Non-Standalone 5.4. North America 5G Security Market Size and Forecast, By Network Security (2023-2030) 5.4.1. RAN Security 5.4.2. Core Security 5.5. North America 5G Security Market Size and Forecast, By Industries (2023-2030) 5.5.1. Manufacturing 5.5.2. Healthcare 5.5.3. Retail 5.5.4. Automotive And Transportation 5.5.5. Public Safety 5.5.6. Others 5.6. North America 5G Security Market Size and Forecast, by Country (2023-2030) 5.6.1. United States 5.6.1.1. United States 5G Security Market Size and Forecast, By Offering (2023-2030) 5.6.1.1.1. Solutions 5.6.1.1.2. Services 5.6.1.2. United States 5G Security Market Size and Forecast, By Deployment (2023-2030) 5.6.1.2.1. Cloud 5.6.1.2.2. On-premise 5.6.1.3. United States 5G Security Market Size and Forecast, By Architecture (2023-2030) 5.6.1.3.1. 5G NR Standalone 5.6.1.3.2. 5G NR Non-Standalone 5.6.1.4. United States 5G Security Market Size and Forecast, By Network Security (2023-2030) 5.6.1.4.1. RAN Security 5.6.1.4.2. Core Security 5.6.1.5. United States 5G Security Market Size and Forecast, By Industries (2023-2030) 5.6.1.5.1. Manufacturing 5.6.1.5.2. Healthcare 5.6.1.5.3. Retail 5.6.1.5.4. Automotive And Transportation 5.6.1.5.5. Public Safety 5.6.1.5.6. Others 5.6.2. Canada 5.6.2.1. Canada 5G Security Market Size and Forecast, By Offering (2023-2030) 5.6.2.1.1. Solutions 5.6.2.1.2. Services 5.6.2.2. Canada 5G Security Market Size and Forecast, By Deployment (2023-2030) 5.6.2.2.1. Cloud 5.6.2.2.2. On-premise 5.6.2.3. Canada 5G Security Market Size and Forecast, By Architecture (2023-2030) 5.6.2.3.1. 5G NR Standalone 5.6.2.3.2. 5G NR Non-Standalone 5.6.2.4. Canada 5G Security Market Size and Forecast, By Network Security (2023-2030) 5.6.2.4.1. RAN Security 5.6.2.4.2. Core Security 5.6.2.5. Canada 5G Security Market Size and Forecast, By Industries (2023-2030) 5.6.2.5.1. Manufacturing 5.6.2.5.2. Healthcare 5.6.2.5.3. Retail 5.6.2.5.4. Automotive And Transportation 5.6.2.5.5. Public Safety 5.6.2.5.6. Others 5.6.3. Mexico 5.6.3.1. Mexico 5G Security Market Size and Forecast, By Offering (2023-2030) 5.6.3.1.1. Solutions 5.6.3.1.2. Services 5.6.3.2. Mexico 5G Security Market Size and Forecast, By Deployment (2023-2030) 5.6.3.2.1. Cloud 5.6.3.2.2. On-premise 5.6.3.3. Mexico 5G Security Market Size and Forecast, By Architecture (2023-2030) 5.6.3.3.1. 5G NR Standalone 5.6.3.3.2. 5G NR Non-Standalone 5.6.3.4. Mexico 5G Security Market Size and Forecast, By Network Security (2023-2030) 5.6.3.4.1. RAN Security 5.6.3.4.2. Core Security 5.6.3.5. Mexico 5G Security Market Size and Forecast, By Industries (2023-2030) 5.6.3.5.1. Manufacturing 5.6.3.5.2. Healthcare 5.6.3.5.3. Retail 5.6.3.5.4. Automotive And Transportation 5.6.3.5.5. Public Safety 5.6.3.5.6. Others 6. Europe 5G Security Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe 5G Security Market Size and Forecast, By Offering (2023-2030) 6.2. Europe 5G Security Market Size and Forecast, By Deployment (2023-2030) 6.3. Europe 5G Security Market Size and Forecast, By Architecture (2023-2030) 6.4. Europe 5G Security Market Size and Forecast, By Network Security (2023-2030) 6.5. Europe 5G Security Market Size and Forecast, By Industries (2023-2030) 6.6. Europe 5G Security Market Size and Forecast, by Country (2023-2030) 6.6.1. United Kingdom 6.6.1.1. United Kingdom 5G Security Market Size and Forecast, By Offering (2023-2030) 6.6.1.2. United Kingdom 5G Security Market Size and Forecast, By Deployment (2023-2030) 6.6.1.3. United Kingdom 5G Security Market Size and Forecast, By Architecture (2023-2030) 6.6.1.4. United Kingdom 5G Security Market Size and Forecast, By Network Security (2023-2030) 6.6.1.5. United Kingdom 5G Security Market Size and Forecast, By Industries (2023-2030) 6.6.2. France 6.6.2.1. France 5G Security Market Size and Forecast, By Offering (2023-2030) 6.6.2.2. France 5G Security Market Size and Forecast, By Deployment (2023-2030) 6.6.2.3. France 5G Security Market Size and Forecast, By Architecture (2023-2030) 6.6.2.4. France 5G Security Market Size and Forecast, By Network Security (2023-2030) 6.6.2.5. France 5G Security Market Size and Forecast, By Industries (2023-2030) 6.6.3. Germany 6.6.3.1. Germany 5G Security Market Size and Forecast, By Offering (2023-2030) 6.6.3.2. Germany 5G Security Market Size and Forecast, By Deployment (2023-2030) 6.6.3.3. Germany 5G Security Market Size and Forecast, By Architecture (2023-2030) 6.6.3.4. Germany 5G Security Market Size and Forecast, By Network Security (2023-2030) 6.6.3.5. Germany 5G Security Market Size and Forecast, By Industries (2023-2030) 6.6.4. Italy 6.6.4.1. Italy 5G Security Market Size and Forecast, By Offering (2023-2030) 6.6.4.2. Italy 5G Security Market Size and Forecast, By Deployment (2023-2030) 6.6.4.3. Italy 5G Security Market Size and Forecast, By Architecture (2023-2030) 6.6.4.4. Italy 5G Security Market Size and Forecast, By Network Security (2023-2030) 6.6.4.5. Italy 5G Security Market Size and Forecast, By Industries (2023-2030) 6.6.5. Spain 6.6.5.1. Spain 5G Security Market Size and Forecast, By Offering (2023-2030) 6.6.5.2. Spain 5G Security Market Size and Forecast, By Deployment (2023-2030) 6.6.5.3. Spain 5G Security Market Size and Forecast, By Architecture (2023-2030) 6.6.5.4. Spain 5G Security Market Size and Forecast, By Network Security (2023-2030) 6.6.6. Sweden 6.6.6.1. Sweden 5G Security Market Size and Forecast, By Offering (2023-2030) 6.6.6.2. Sweden 5G Security Market Size and Forecast, By Deployment (2023-2030) 6.6.6.3. Sweden 5G Security Market Size and Forecast, By Architecture (2023-2030) 6.6.6.4. Sweden 5G Security Market Size and Forecast, By Network Security (2023-2030) 6.6.6.5. Sweden 5G Security Market Size and Forecast, By Industries (2023-2030) 6.6.7. Russia 6.6.7.1. Russia 5G Security Market Size and Forecast, By Offering (2023-2030) 6.6.7.2. Russia 5G Security Market Size and Forecast, By Deployment (2023-2030) 6.6.7.3. Russia 5G Security Market Size and Forecast, By Architecture (2023-2030) 6.6.7.4. Russia 5G Security Market Size and Forecast, By Network Security (2023-2030) 6.6.7.5. Russia 5G Security Market Size and Forecast, By Industries (2023-2030) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe 5G Security Market Size and Forecast, By Offering (2023-2030) 6.6.8.2. Rest of Europe 5G Security Market Size and Forecast, By Deployment (2023-2030) 6.6.8.3. Rest of Europe 5G Security Market Size and Forecast, By Architecture (2023-2030) 6.6.8.4. Rest of Europe 5G Security Market Size and Forecast, By Network Security (2023-2030) 6.6.8.5. Rest of Europe 5G Security Market Size and Forecast, By Industries (2023-2030) 7. Asia Pacific 5G Security Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific 5G Security Market Size and Forecast, By Offering (2023-2030) 7.2. Asia Pacific 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.3. Asia Pacific 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.4. Asia Pacific 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.5. Asia Pacific 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6. Asia Pacific 5G Security Market Size and Forecast, by Country (2023-2030) 7.6.1. China 7.6.1.1. China 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.1.2. China 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.1.3. China 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.1.4. China 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.1.5. China 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.2. S Korea 7.6.2.1. S Korea 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.2.2. S Korea 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.2.3. S Korea 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.2.4. S Korea 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.2.5. S Korea 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.3. Japan 7.6.3.1. Japan 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.3.2. Japan 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.3.3. Japan 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.3.4. Japan 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.3.5. Japan 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.4. India 7.6.4.1. India 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.4.2. India 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.4.3. India 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.4.4. India 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.4.5. India 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.5. Australia 7.6.5.1. Australia 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.5.2. Australia 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.5.3. Australia 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.5.4. Australia 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.5.5. Australia 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.6. Indonesia 7.6.6.1. Indonesia 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.6.2. Indonesia 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.6.3. Indonesia 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.6.4. Indonesia 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.6.5. Indonesia 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.7. Malaysia 7.6.7.1. Malaysia 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.7.2. Malaysia 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.7.3. Malaysia 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.7.4. Malaysia 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.7.5. Malaysia 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.8. Philippians 7.6.8.1. Philippians 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.8.2. Philippians 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.8.3. Philippians 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.8.4. Philippians 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.8.5. Philippians 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.9. Thailand 7.6.9.1. Thailand 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.9.2. Thailand 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.9.3. Thailand 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.9.4. Thailand 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.9.5. Thailand 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.10. Vietnam 7.6.10.1. Vietnam 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.10.2. Vietnam 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.10.3. Vietnam 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.10.4. Vietnam 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.10.5. Vietnam 5G Security Market Size and Forecast, By Industries (2023-2030) 7.6.11. Rest of Asia Pacific 7.6.11.1. Rest of Asia Pacific 5G Security Market Size and Forecast, By Offering (2023-2030) 7.6.11.2. Rest of Asia Pacific 5G Security Market Size and Forecast, By Deployment (2023-2030) 7.6.11.3. Rest of Asia Pacific 5G Security Market Size and Forecast, By Architecture (2023-2030) 7.6.11.4. Rest of Asia Pacific 5G Security Market Size and Forecast, By Network Security (2023-2030) 7.6.11.5. Rest of Asia Pacific 5G Security Market Size and Forecast, By Industries (2023-2030) 8. Middle East and Africa 5G Security Market Size and Forecast (by Value in USD Million) (2023-2030 8.1. Middle East and Africa 5G Security Market Size and Forecast, By Offering (2023-2030) 8.2. Middle East and Africa 5G Security Market Size and Forecast, By Deployment (2023-2030) 8.3. Middle East and Africa 5G Security Market Size and Forecast, By Architecture (2023-2030) 8.4. Middle East and Africa 5G Security Market Size and Forecast, By Network Security (2023-2030) 8.5. Middle East and Africa 5G Security Market Size and Forecast, By Industries (2023-2030) 8.6. Middle East and Africa 5G Security Market Size and Forecast, by Country (2023-2030) 8.6.1. South Africa 8.6.1.1. South Africa 5G Security Market Size and Forecast, By Offering (2023-2030) 8.6.1.2. South Africa 5G Security Market Size and Forecast, By Deployment (2023-2030) 8.6.1.3. South Africa 5G Security Market Size and Forecast, By Architecture (2023-2030) 8.6.1.4. South Africa 5G Security Market Size and Forecast, By Network Security (2023-2030) 8.6.1.5. South Africa 5G Security Market Size and Forecast, By Industries (2023-2030) 8.6.2. GCC 8.6.2.1. GCC 5G Security Market Size and Forecast, By Offering (2023-2030) 8.6.2.2. GCC 5G Security Market Size and Forecast, By Deployment (2023-2030) 8.6.2.3. GCC 5G Security Market Size and Forecast, By Architecture (2023-2030) 8.6.2.4. GCC 5G Security Market Size and Forecast, By Network Security (2023-2030) 8.6.2.5. GCC 5G Security Market Size and Forecast, By Industries (2023-2030) 8.6.3. Egypt 8.6.3.1. Egypt 5G Security Market Size and Forecast, By Offering (2023-2030) 8.6.3.2. Egypt 5G Security Market Size and Forecast, By Deployment (2023-2030) 8.6.3.3. Egypt 5G Security Market Size and Forecast, By Architecture (2023-2030) 8.6.3.4. Egypt 5G Security Market Size and Forecast, By Network Security (2023-2030) 8.6.3.5. Egypt 5G Security Market Size and Forecast, By Industries (2023-2030) 8.6.4. Nigeria 8.6.4.1. Nigeria 5G Security Market Size and Forecast, By Offering (2023-2030) 8.6.4.2. Nigeria 5G Security Market Size and Forecast, By Deployment (2023-2030) 8.6.4.3. Nigeria 5G Security Market Size and Forecast, By Architecture (2023-2030) 8.6.4.4. Nigeria 5G Security Market Size and Forecast, By Network Security (2023-2030) 8.6.4.5. Nigeria 5G Security Market Size and Forecast, By Industries (2023-2030) 8.6.5. Rest of ME&A 8.6.5.1. Rest of ME&A 5G Security Market Size and Forecast, By Offering (2023-2030) 8.6.5.2. Rest of ME&A 5G Security Market Size and Forecast, By Deployment (2023-2030) 8.6.5.3. Rest of ME&A 5G Security Market Size and Forecast, By Architecture (2023-2030) 8.6.5.4. Rest of ME&A 5G Security Market Size and Forecast, By Network Security (2023-2030) 8.6.5.5. Rest of ME&A 5G Security Market Size and Forecast, By Industries (2023-2030) 9. South America 5G Security Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America 5G Security Market Size and Forecast, By Offering (2023-2030) 9.2. South America 5G Security Market Size and Forecast, By Deployment (2023-2030) 9.3. South America 5G Security Market Size and Forecast, By Architecture (2023-2030) 9.4. South America 5G Security Market Size and Forecast, By Network Security (2023-2030) 9.5. South America 5G Security Market Size and Forecast, By Industries (2023-2030) 9.6. South America 5G Security Market Size and Forecast, by Country (2023-2030) 9.6.1. Brazil 9.6.1.1. Brazil 5G Security Market Size and Forecast, By Offering (2023-2030) 9.6.1.2. Brazil 5G Security Market Size and Forecast, By Deployment (2023-2030) 9.6.1.3. Brazil 5G Security Market Size and Forecast, By Architecture (2023-2030) 9.6.1.4. Brazil 5G Security Market Size and Forecast, By Network Security (2023-2030) 9.6.1.5. Brazil 5G Security Market Size and Forecast, By Industries (2023-2030) 9.6.2. Argentina 9.6.2.1. Argentina 5G Security Market Size and Forecast, By Offering (2023-2030) 9.6.2.2. Argentina 5G Security Market Size and Forecast, By Deployment (2023-2030) 9.6.2.3. Argentina 5G Security Market Size and Forecast, By Architecture (2023-2030) 9.6.2.4. Argentina 5G Security Market Size and Forecast, By Network Security (2023-2030) 9.6.2.5. Argentina 5G Security Market Size and Forecast, By Industries (2023-2030) 9.6.3. Colombia 9.6.4. Colombia 5G Security Market Size and Forecast, By Offering (2023-2030) 9.6.4.1. Colombia 5G Security Market Size and Forecast, By Deployment (2023-2030) 9.6.4.2. Colombia 5G Security Market Size and Forecast, By Architecture (2023-2030) 9.6.4.3. Colombia 5G Security Market Size and Forecast, By Network Security (2023-2030) 9.6.4.4. Colombia 5G Security Market Size and Forecast, By Industries (2023-2030) 9.6.5. Chile 9.6.5.1. Chile 5G Security Market Size and Forecast, By Offering (2023-2030) 9.6.5.2. Chile 5G Security Market Size and Forecast, By Deployment (2023-2030) 9.6.5.3. Chile 5G Security Market Size and Forecast, By Architecture (2023-2030) 9.6.5.4. Chile 5G Security Market Size and Forecast, By Network Security (2023-2030) 9.6.5.5. Chile 5G Security Market Size and Forecast, By Industries (2023-2030) 9.6.6. Rest Of South America 9.6.6.1. Rest Of South America 5G Security Market Size and Forecast, By Offering (2023-2030) 9.6.6.2. Rest Of South America 5G Security Market Size and Forecast, By Deployment (2023-2030) 9.6.6.3. Rest Of South America 5G Security Market Size and Forecast, By Architecture (2023-2030) 9.6.6.4. Rest Of South America 5G Security Market Size and Forecast, By Network Security (2023-2030) 9.6.6.5. Rest Of South America 5G Security Market Size and Forecast, By Industries (2023-2030) 10. Company Profile: Key Players 10.1. Ericsson (Sweden) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Palo Alto Networks (US) 10.3. Cisco (US), Allot (Israel) 10.4. Huawei (China) 10.5. A10 Networks (US) 10.6. Nokia (Finland) 10.7. F5 Networks (US) 10.8. Juniper Networks (US) 10.9. Spirent (US) 10.10. Fortinet (US) 10.11. Mobileum (US) 10.12. Trend Micro (US) 10.13. ZTE (China) 10.14. Akamai (US) 10.15. Colt Technology (UK) 10.16. CLAVISTER (Sweden) 10.17. Radware (Israel) 10.18. AT&T (US) 10.19. Riscure (Netherlands) 10.20. Avast (Czech Republic) 10.21. G+D Mobile Security (Germany) 10.22. Check Point (US) 10.23. ForgeRock (US) 10.24. Positive Technologies (UK) 10.25. Cellwise (US) 10.26. Banu Networks (US) 10.27. Suavei (US) 10.28. Cachengo (US) 10.29. Broad Forward (Netherlands) 10.30. Trilogy (US) 10.31. Movandi (US) 10.32. Deepsig (US) 10.33. EdgeQ (US) 10.34. Alcan systems (Germany) 10.35. Mixcomm (Colombia) 10.36. Microamp Solutions (Poland) 11. Key Findings 12. Industry Recommendations 13. 5G Security Market: Research Methodology