The Ferroelectric Materials Market was valued at USD 4.6 Bn. in 2024, and the total revenue of the Ferroelectric Materials Market is expected to grow at a CAGR of 8.98% from 2025 to 2032, reaching nearly USD 9.15 Bn. by 2032. Surge in EV demand and 2D material innovation drives next-gen energy solutions.Ferroelectric Materials Market Overview

Ferroelectric Materials Market is a representative of certain materials that has an impulsive electric polarization that is inverted by the application of an external electric field. The ferroelectrics are pyroelectric, with the property that their natural electrical polarization is reversible. The materials demonstrating the phenomenon of Ferroelectricity are called Ferroelectric Materials. Global Ferroelectric Materials Market’s main Companies are Sakai Chemical, Nippon Chemical, Ferro, Fuji Titanium, Shandong Sinocera, etc. The top five companies grasp a segment above 75%. Japan is the largest market, with a share of 35%. This unit delivers the possibility of different segments and applications that possibly impact the Ferroelectric Materials Market during the forecast period. This segment provides a study of the volume of production in approximately the global Ferroelectric Materials Market and each type from 2024 to 2030. Ferroelectricity is used in profitable industries like automotive, electronics, and aerospace. The worldwide growth in the demand for electric applications results in an increase in the demand for the Ferroelectric Materials Market in the forecast period. In the region such as the U.S. and Japan, the development of technology leads to the demand of the market in countless marketable and industrial sections. Ferroelectric Materials Market is a progressive material that is used in different commercial electric applications such as automotive, smart home electric appliances, the aerospace industry, and other electronic segments as well. The commercialization of piezoelectric materials in the field of electric application inclines to the advanced demand for ferroelectricity materials benefits the devices affordable, smaller, and consumer friendly. Increase in the invention of technologies in the practice materials in the electric field.To know about the Research Methodology :- Request Free Sample Report

Competitive Landscape

Sakai Chemical The Sakai Chemical include the intellectual property department, This department plays an important role in guaranteeing remaining operations and development by supporting the implementation of intellectual property strategies. The Onahama Development Department involves in application development, quality improvement efforts, and development of industrial methods for products such as titanium dioxide, barium sulfate, barium carbonate, zinc oxide, and barium titanate produced at the Onahama Manufacturing Site located in Iwaki City, Fukushima Prefecture. The R & D department encourage the development of catchphrases that underline competitive advantages and development concepts teamwork with outside organizations is also important, and the department plays a role in finding potential targets for joint research with industry, government, and academia. Ferro The developments has achieved in the growth of ferroelectric structures during the forecast period. The development of epitaxial growth methods, it is now possible to make high-quality and ultrathin Ferroelectric materials that are single-crystal and defect free. . The growth method has to be sensibly selected to obtain a certain film with desired properties. In this section, the growth methods of Ferroelectric Materials are discussed and some comparisons will be made among them. At the primary stage of thin Ferroelectric Materials growth, which is the so-called nucleation stage, plentiful vapor atoms or molecules condense and undergo surface diffusion and migration under the drive of both their self-energy and substrate thermal energy, then move to a stable position on the substrate.Ferroelectric Materials Market Dynamics:

Ferroelectric Materials Market Drivers Increased demand for smart electric devices in the commercial and industrial sector Ferroelectric Materials Market are also known as function materials. Ferroelectricity materials are used in countless profitable and industrial sectors. Commercially it is used in numerous electric applications in the industries like automotive, manufacturing, smart devices, etc. Smart devices are one of the important applications that used ferroelectricity material as their electric application. The continuing technological inventions in smart electronic devices and the improved demand for smart electronic devices in profitable and national sectors has resulted in the growth of the Ferroelectric Materials Market. Piezoelectric sensors are used in pharmaceutical industries in ultrasonic imaging and ultrasonic procedure. Structural health monitoring is one of the popular fields in piezoelectric technology. Structural health monitoring is widely assessed by the atmosphere industry as a method to progress the security and consistency of aircraft constructions and decrease working costs. Constructed in sensor networks on an aircraft structure deliver critical information concerning the disorder, damage state, and provision environment of the structure. The different kinds of transducers used for Structural health monitoring, and piezoelectric materials are widely used because they are employed as either actuators or sensors due to their piezoelectric effect and vice versa. Ferroelectric Materials Market Restraints Higher costs and lack of awareness Ferroelectric Materials Market has various properties that benefit numerous commercial and domestic industries. There are some preventive issues that are hampering the market from growth. There is a lack of awareness of the technologies of ferroelectricity materials in various regions. The higher cost of materials and technology is one of the limiting factors for the Ferroelectric Materials Market. Ferroelectric materials are naturally produced using complex manufacturing processes. The requirement of specialized equipment and expertise for the development enhances the cost of the materials, this lead to advanced production costs. he development of new and innovative ferroelectric materials requires significant research, which is costly. High cost of manufacturing boundary end-users from entering the market. The batteries and electrochemical capacitors, energy is stored and generated in ferroelectric materials through reorientable ionic polarization. These materials has a storage life of magnitude longer than that of batteries and electrochemical capacitors. Under adiabatic compression, ferroelectrics has used to produce high electric charge density. The substance for the formation of compact, lightweight ferroelectric power sources that are accomplished of producing high voltage, high current, and megawatt power levels for brief intervals of time. Ferroelectric Materials Market Opportunities Advancement in the technology of 2D ferroelectric material The two-dimensional (2D) Ferroelectric Materials Market is hopeful for use in high-performance nanoelectronic devices due to the non-volatility, high storage density, low energy cost and short response time originating from their bistable and switchable polarization states. The developing advancement in the 2D ferroelectric material, the future of nanoelectronics is highly reliant on the novel class of high-dimensional materials. To the subject of the application and novel technologies, Van der Waals ferroelectrics has huge future opportunities for nanotechnologies. The development in technologies of the VDW Ferroelectric Materials Market and widely developing. The development functionality of multiple orders and multiferroicity. 2D materials has emerged in recent years to provide possible solutions for the dilemma due to their outstanding optical, electrical, thermal, mechanical, and ferroelectric properties that do not exist in the majority of materials. In particular, 2D ferroelectric materials with spotless surfaces and stable polarization are promising for electronic device applications. Two dimensions projected for the fabrication of ferroelectric devices and great successes has achieved at the laboratory level. The practical applications are still delayed by inherent issues including depolarization and structural instabilities when the thickness is reduced to atomic scale due to surface reconstruction and hanging bonds.Ferroelectric Materials Market Segment Analysis

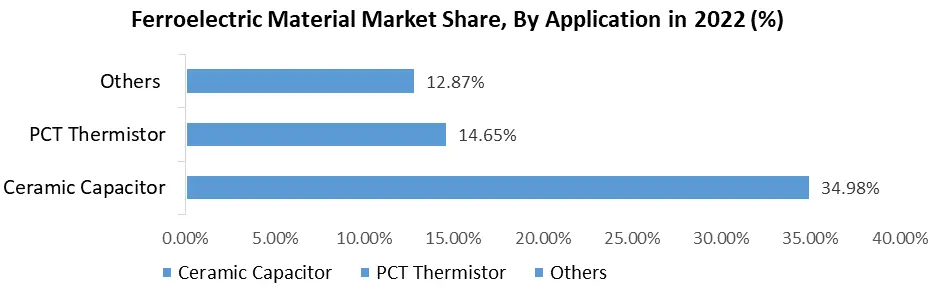

Based on Type, the Barium Titanate segment dominated the Ferroelectric Materials Market in the year 2024 and is expected to do the same during the forecast period. The barium titanate has the largest market share in 2024. Barium titanate is commercially considered a ferroelectric and piezoelectric material. It is generally used in the electronics industry. In the Ferroelectric Materials Market, barium titanate is used in the multilayer dielectric ceramic capacitor. Barium titanate Ceramic is frequently decreased in an atmosphere that increases the conductivity of the ceramic and leads to lifelong reduction. The Ferroelectric Materials Market is largely driven by the electric vehicle demand in the commercial sectors. The increasing government apprehension about global warming through the excess use of petrol and diesel vehicles results in a greater demand for electric vehicles and an increasing demand for barium titanate. Based on the Price Point, The Premium segment dominates the Ferroelectric Materials Market in the year 2023 and is expected to do the same during the forecast period. There are some preventive issues that are hampering the market from growth. The higher cost of materials and technology is one of the limiting factors for the Ferroelectric Materials Market. Ferroelectric materials are naturally produced using complex manufacturing processes. The requirement of specialized equipment and expertise for the development enhances the cost of the materials, this lead to advanced production costs. The development functionality of multiple orders and multiferroicity. 2D materials has emerged in recent years to provide possible solutions for the dilemma due to their outstanding optical, electrical, thermal, mechanical, and ferroelectric properties that do not exist in the majority of materials. In particular, 2D ferroelectric materials with spotless surfaces and stable polarization are promising for electronic device applications. The substance for the formation of compact, lightweight ferroelectric power sources that are accomplished of producing high voltage, high current, and megawatt power levels for brief intervals of time.Based on the Application, the Ceramic Capacitor segment dominated the Ferroelectric Materials Market in the year 2024 and is expected to do the same during the forecast period. A ceramic capacitor is complete of granules of ferroelectric materials. The maximum use of ferroelectric material in industries is in the multilayer ceramic capacitor. The increasing demand in the different industries like automotive, consumer goods, energy, power and telecommunication, etc. Increasing demand for automotive and increasing existing standards result in a greater demand in the market. The ceramic capacitor is a fixed-value capacitor where the ceramic material acts as the dielectric. It is constructed of two or more irregular layers of ceramic, and a metal layer substitutes as the electrodes. The composition of the ceramic material describes the electrical behaviour and, consequently, applications. The Ceramic capacitors, particularly multilayer ceramic capacitors, are the most produced and used capacitors in the Ferroelectric Materials Market, equipment that incorporates approximately one trillion (1012) pieces per year. The PTC thermistor is another emerging segment of the global ferroelectric materials market. The precise temperature detection and regulator offered by ferroelectric materials in PTC thermistors is considered to continue the development of the segment.

Ferroelectric Materials Market Regional Insights

North America has the largest market share in the Ferroelectric Materials Market .North America is continue its supremacy during the forecast period. There is continuous growth in technological invention in the region which is dominate the market during the forecast period. With increasing infrastructure and the already availability of various industries such as automotive, Pharmaceuticals, building and materials, construction, consumer goods, etc. the demand for ferroelectric materials in these industries will probable increase the demand of the market. The increasing demand for the electric vehicle in the United State region is anticipated for the development of the Ferroelectric Materials Market in this region. Asia-pacific region is a significant increase in the growth of the ferroelectric material market during the forecast period. An increase in development and increasing living standards will improvement the demand in the market. The increase in global warming in the environment in the Asia Pacific results in a greater demand for electric vehicles. Which tends to the increasing demand for the Ferroelectric Materials Market. Europe is another developing marketplace for ferroelectric materials, countries including, Germany and United Kingdom are to contribute the largest share of the market’s growth during the forecast period. The continuous technological innovations in the region are predicted to offer a excess of opportunities for the market’s growth in Europe during the forecast period.Ferroelectric Materials Market Scope: Inquire before buying

Ferroelectric Materials Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.6 Bn. Forecast Period 2025 to 2032 CAGR: 8.98% Market Size in 2032: USD 9.15 Bn. Segments Covered: by Type Barium Titanate Lead Zirconate Titanate Lead Titanate Others by Application Ceramic Capacitor PCT Thermistor Piezoelectric Devices FeRAM Actuators & Sensors Others by End-Use Industry Consumer Electronics Automotive Healthcare Aerospace & Defense Industrial Others Ferroelectric Materials Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Ferroelectric Materials Market Key Players

1. Sakai Chemical 2. Nippon Chemical 3. Ferro 4. Fuji Titanium 5. Shandong Sinocera 6. KCM 7. Shanghai Dian Yang 8. Kyocera Corporation 9. Murata Manufacturing Co., Ltd. 10. TDK Corporation 11. Ferro Corporation 12. Kemet Corporation 13. PI Ceramic GmbH 14. CeramTec GmbH 15. Vishay Intertechnology, Inc. 16. Morgan Advanced Materials plc 17. APC International, Ltd. 18. Noliac A/S 19. EPCOS AG 20. Central Electronics Limited 21. Piezo Kinetics, Inc. 22. TRS Technologies, Inc. 23. Physik Instrumente (PI) GmbH & Co. KG 24. APC International, Ltd. 25. CETC (China Electronics Technology Group Corporation) 26. Exelis Inc. (Harris Corporation) 27. Ferroperm Piezoceramics A/SFrequently Asked Questions:

1] What segments are covered in the Ferroelectric Materials Market report? Ans. The segments covered in the Ferroelectric Materials Market report are based on Type, End-Use Industry, Application, and Region. 2] Which region is expected to hold the highest share in the Ferroelectric Materials Market? Ans. The North America region is expected to hold the highest share of the Ferroelectric Materials Market. 3] What is the market size of the Ferroelectric Materials Market by 2032? Ans. The market size of the Ferroelectric Materials Market by 2032 is expected to reach USD 9.15 Bn. 4] What is the forecast period for the Ferroelectric Materials Market? Ans. The forecast period for the Ferroelectric Materials Market is 2025-2032. 5] What was the market size of the Ferroelectric Materials Market in 2024? Ans. The market size of the Ferroelectric Materials Market in 2024 was valued at USD 4.6 Bn.

1. Ferroelectric Materials Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Ferroelectric Materials Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Ferroelectric Materials Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Ferroelectric Materials Market: Dynamics 3.1. Ferroelectric Materials Market Trends by Region 3.1.1. North America Ferroelectric Materials Market Trends 3.1.2. Europe Ferroelectric Materials Market Trends 3.1.3. Asia Pacific Ferroelectric Materials Market Trends 3.1.4. Middle East and Africa Ferroelectric Materials Market Trends 3.1.5. South America Ferroelectric Materials Market Trends 3.2. Ferroelectric Materials Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Ferroelectric Materials Market Drivers 3.2.1.2. North America Ferroelectric Materials Market Restraints 3.2.1.3. North America Ferroelectric Materials Market Opportunities 3.2.1.4. North America Ferroelectric Materials Market Challenges 3.2.2. Europe 3.2.2.1. Europe Ferroelectric Materials Market Drivers 3.2.2.2. Europe Ferroelectric Materials Market Restraints 3.2.2.3. Europe Ferroelectric Materials Market Opportunities 3.2.2.4. Europe Ferroelectric Materials Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Ferroelectric Materials Market Drivers 3.2.3.2. Asia Pacific Ferroelectric Materials Market Restraints 3.2.3.3. Asia Pacific Ferroelectric Materials Market Opportunities 3.2.3.4. Asia Pacific Ferroelectric Materials Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Ferroelectric Materials Market Drivers 3.2.4.2. Middle East and Africa Ferroelectric Materials Market Restraints 3.2.4.3. Middle East and Africa Ferroelectric Materials Market Opportunities 3.2.4.4. Middle East and Africa Ferroelectric Materials Market Challenges 3.2.5. South America 3.2.5.1. South America Ferroelectric Materials Market Drivers 3.2.5.2. South America Ferroelectric Materials Market Restraints 3.2.5.3. South America Ferroelectric Materials Market Opportunities 3.2.5.4. South America Ferroelectric Materials Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Ferroelectric Materials Industry 3.8. Analysis of Government Schemes and Initiatives For Ferroelectric Materials Industry 3.9. Ferroelectric Materials Market Trade Analysis 3.10. The Global Pandemic Impact on Ferroelectric Materials Market 4. Ferroelectric Materials Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 4.1.1. Barium Titanate 4.1.2. Lead Zirconate Titanate 4.1.3. Lead Titanate 4.1.4. Others 4.2. Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 4.2.1. Ceramic Capacitor 4.2.2. PCT Thermistor 4.2.3. Piezoelectric Devices 4.2.4. FeRAM 4.2.5. Actuators & Sensors 4.2.6. Others 4.3. Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 4.3.1. Consumer Electronics 4.3.2. Automotive 4.3.3. Healthcare 4.3.4. Aerospace & Defense 4.3.5. Industrial 4.3.6. Others 4.4. Ferroelectric Materials Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Ferroelectric Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 5.1.1. Barium Titanate 5.1.2. Lead Zirconate Titanate 5.1.3. Lead Titanate 5.1.4. Others 5.2. North America Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 5.2.1. Ceramic Capacitor 5.2.2. PCT Thermistor 5.2.3. Piezoelectric Devices 5.2.4. FeRAM 5.2.5. Actuators & Sensors 5.2.6. Others 5.3. North America Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 5.3.1. Consumer Electronics 5.3.2. Automotive 5.3.3. Healthcare 5.3.4. Aerospace & Defense 5.3.5. Industrial 5.3.6. Others 5.4. North America Ferroelectric Materials Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 5.4.1.1.1. Barium Titanate 5.4.1.1.2. Lead Zirconate Titanate 5.4.1.1.3. Lead Titanate 5.4.1.1.4. Others 5.4.1.2. United States Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 5.4.1.2.1. Ceramic Capacitor 5.4.1.2.2. PCT Thermistor 5.4.1.2.3. Piezoelectric Devices 5.4.1.2.4. FeRAM 5.4.1.2.5. Actuators & Sensors 5.4.1.2.6. Others 5.4.1.3. United States Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 5.4.1.3.1. Consumer Electronics 5.4.1.3.2. Automotive 5.4.1.3.3. Healthcare 5.4.1.3.4. Aerospace & Defense 5.4.1.3.5. Industrial 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 5.4.2.1.1. Barium Titanate 5.4.2.1.2. Lead Zirconate Titanate 5.4.2.1.3. Lead Titanate 5.4.2.1.4. Others 5.4.2.2. Canada Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 5.4.2.2.1. Ceramic Capacitor 5.4.2.2.2. PCT Thermistor 5.4.2.2.3. Piezoelectric Devices 5.4.2.2.4. FeRAM 5.4.2.2.5. Actuators & Sensors 5.4.2.2.6. Others 5.4.2.3. Canada Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 5.4.2.3.1. Consumer Electronics 5.4.2.3.2. Automotive 5.4.2.3.3. Healthcare 5.4.2.3.4. Aerospace & Defense 5.4.2.3.5. Industrial 5.4.2.3.6. Others 5.4.3. Mexico 5.4.3.1. Mexico Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 5.4.3.1.1. Barium Titanate 5.4.3.1.2. Lead Zirconate Titanate 5.4.3.1.3. Lead Titanate 5.4.3.1.4. Others 5.4.3.2. Mexico Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 5.4.3.2.1. Ceramic Capacitor 5.4.3.2.2. PCT Thermistor 5.4.3.2.3. Piezoelectric Devices 5.4.3.2.4. FeRAM 5.4.3.2.5. Actuators & Sensors 5.4.3.2.6. Others 5.4.3.3. Mexico Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 5.4.3.3.1. Consumer Electronics 5.4.3.3.2. Automotive 5.4.3.3.3. Healthcare 5.4.3.3.4. Aerospace & Defense 5.4.3.3.5. Industrial 5.4.3.3.6. Others 6. Europe Ferroelectric Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 6.2. Europe Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 6.3. Europe Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 6.4. Europe Ferroelectric Materials Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 6.4.1.2. United Kingdom Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 6.4.1.3. United Kingdom Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 6.4.2. France 6.4.2.1. France Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 6.4.2.2. France Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 6.4.2.3. France Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 6.4.3.2. Germany Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Germany Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 6.4.4.2. Italy Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 6.4.4.3. Italy Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 6.4.5.2. Spain Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Spain Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 6.4.6.2. Sweden Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Sweden Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 6.4.7.2. Austria Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Austria Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 6.4.8.2. Rest of Europe Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Rest of Europe Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7. Asia Pacific Ferroelectric Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4. Asia Pacific Ferroelectric Materials Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.1.2. China Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.1.3. China Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.2.2. S Korea Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.2.3. S Korea Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.3.2. Japan Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Japan Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4.4. India 7.4.4.1. India Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.4.2. India Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.4.3. India Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.5.2. Australia Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.5.3. Australia Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.6.2. Indonesia Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.6.3. Indonesia Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.7.2. Malaysia Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.7.3. Malaysia Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.8.2. Vietnam Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.8.3. Vietnam Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.9.2. Taiwan Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.9.3. Taiwan Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 7.4.10.3. Rest of Asia Pacific Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 8. Middle East and Africa Ferroelectric Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 8.4. Middle East and Africa Ferroelectric Materials Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 8.4.1.2. South Africa Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 8.4.1.3. South Africa Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 8.4.2.2. GCC Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 8.4.2.3. GCC Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 8.4.3.2. Nigeria Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Nigeria Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 8.4.4.2. Rest of ME&A Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 8.4.4.3. Rest of ME&A Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 9. South America Ferroelectric Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 9.2. South America Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 9.3. South America Ferroelectric Materials Market Size and Forecast, by End-Use Industry(2024-2032) 9.4. South America Ferroelectric Materials Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 9.4.1.2. Brazil Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 9.4.1.3. Brazil Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 9.4.2.2. Argentina Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 9.4.2.3. Argentina Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Ferroelectric Materials Market Size and Forecast, by Type (2024-2032) 9.4.3.2. Rest Of South America Ferroelectric Materials Market Size and Forecast, by Application (2024-2032) 9.4.3.3. Rest Of South America Ferroelectric Materials Market Size and Forecast, by End-Use Industry (2024-2032) 10. Company Profile: Key Players 10.1. Sakai Chemical 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Nippon Chemical 10.3. Ferro 10.4. Fuji Titanium 10.5. Shandong Sinocera 10.6. KCM 10.7. Shanghai Dian Yang 10.8. Kyocera Corporation 10.9. Murata Manufacturing Co., Ltd. 10.10. TDK Corporation 10.11. Ferro Corporation 10.12. Kemet Corporation 10.13. PI Ceramic GmbH 10.14. CeramTec GmbH 10.15. Vishay Intertechnology, Inc. 10.16. Morgan Advanced Materials plc 10.17. APC International, Ltd. 10.18. Noliac A/S 10.19. EPCOS AG 10.20. Central Electronics Limited 10.21. Piezo Kinetics, Inc. 10.22. TRS Technologies, Inc. 10.23. Physik Instrumente (PI) GmbH & Co. KG 10.24. APC International, Ltd. 10.25. CETC (China Electronics Technology Group Corporation) 10.26. Exelis Inc. (Harris Corporation) 10.27. Ferroperm Piezoceramics A/S 11. Key Findings 12. Industry Recommendations 13. Ferroelectric Materials Market: Research Methodology 14. Terms and Glossary