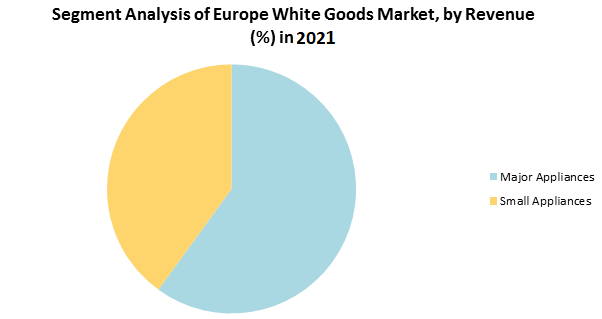

Europe White Goods Market was valued around at USD 160893.19 Million in the year 2021 and is projected to reach USD 193236.72 Million by the year 2027, growing at a CAGR of 3.10% during the forecast period. Europe White Goods Market Overview The report covers the detailed analysis of the Europe White Goods industry with the classifications of the market on the basis of Type of white goods, segmented under Major and Small appliances respectively, and country. Analysis of past market dynamics from 2016 to 2020 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key player's contribution in it.Europe White Goods Market Introduction

White Goods are the large home appliances, which include stoves, refrigerators, freezers, washing machines, tumble driers, dishwashers, and air conditioners, among many others. They can be` called as the large electrical goods for the house. These electrical goods are called as white goods because they were traditionally only available in white color, though now they are available in wide range of colors.To Know About The Research Methodology:- Request Free Sample Report The report segments white goods, also called as home appliances, based on the type, categorized under major appliances and small appliances. This report does not include any insights on consumer electronics.

Top European White Goods Manufacturers

The report has profiled four major manufacturing companies in the market from different countries, in Europe. However, the report also has considered all the global market leaders, followers, and new entrants with investors while analyzing the market and estimating the size of the same. The manufacturing environment in each country is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced technology, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in Germany. As per the study, Miele, a German manufacturer of high – end domestic appliances, reported its annual revenue of US $4.89 billion for the year ended 2021, out of which around 74% is generated from its originating region. Moreover, the other two manufacturing companies, Robert Bosch and Electrolux account for around xx% and xx% revenue share from the European region, respectively. The European market for White Goods is studied under two major segments and further into sub-segments to forecast the market size by value.Europe White Goods Market, by Major Appliances

The major appliances, or large domestic appliances, are non – portable or semi – portable home appliances. The report further divides this segment into Refrigeration Equipment, Cooking Equipment, Washing & Drying Equipment, and Heating & Cooling Equipment. Out of all the types, the refrigeration equipment accounted for a maximum share in the European White Goods Market.Europe White Goods Market, by Small Appliances

The small appliances, or small electric appliances, are portable home machines, usually used on table – tops, or such other platforms. The report further divides this segment into Beverage making Equipment, Cleaning Equipment, Cooking Equipment, among many others.

COVID – 19 impact on Sales of White Goods Market in Europe

As per the study, the sales of white goods in the European region declined around by 5 – 7%, during the 2nd quarter of 2021, as compared to the sales in the year 2021; the prime reason was the tight restrictions on the movement of people and still spending’s by them. However, the sales for major home appliances witnessed a significant rise of about xx% after the ease in the restrictions imposed in the region. For instance, considering the sales of a major player in the European market; the company’s sales in q2 for the year 2021 declined by almost 20% as compared to the sales in q2 for the year 2021. However, sales of the company witnessed a huge rise of around xx% in the q4 for the year 2021 as the company reported net sales of US $40.55 billion.Regional Comparison

As compared to Europe, Asia Pacific and North America account for a higher market share, registering a revenue of US $xx billion in the year 2021 in the global white goods market. Germany Holds the Largest Market Share in the Europe White Goods Market For the first quarter in 2021, Germany dominated the European market for white goods, and accounted for a revenue of US $2.17 billion for small home appliances and US $xx billion for major home appliances. This substantial growth of the country is attributed to the changing lifestyles of people and rise in the expenditure by them. Moreover, the country is known to be the originating foundation of many international and local players in the market of white goods. Further, it is also expected that the country would continue to its dominance in the market, over the forecast period. The report also helps in understanding Europe White Goods Market dynamics, structure by analyzing the market segments and projects the Europe White Goods Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Europe White Goods Market make the report investor’s guide.Europe White Goods Market Scope: Inquiry before Buying

Europe White Goods Market Report Coverage Details Base Year: 2021 Forecast Period: 2021-2027 Historical Data: 2016 to 2021 Market Size in 2021: USD 160893.19 Mn. Forecast Period 2021 to 2027 CAGR: 3.10% Market Size in 2027: USD 193236.72 Mn. Segments Covered: by Major Appliances • Refrigeration Equipments • Cooking Equipments • Washing and Drying Equipments • Heating & Cooling Equipments by Small Appliances • Beverages Making Equipment • Cleaning Equipment • Cooking Equipment • Others Country Analysis of Europe White Goods Market

• Germany • U.K. • France • Italy • SpainKey Players in the Europe Market for White Goods

• Whirlpool Corporation • Samsung Electronics • LG Electronics • Arcelik A.S • Daikin Industries • Ariston • Thermo SpA • Gorenje Group • Miele • Robert Bosch • Electrolux AB • Phlips N.V. • Dyson Household Appliances Frequently Asked Questions: 1. Which region has the largest share in Europe White Goods Market? Ans: Germany region holds the highest share in 2021. 2. What is the growth rate of Europe White Goods Market? Ans: The Europe White Goods Market is growing at a CAGR of 3.10% during forecasting period 2022-2027. 3. What is scope of the Europe White Goods market report? Ans: Europe White Goods Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Europe White Goods market? Ans: The important key players in the Europe White Goods Market are – Whirlpool Corporation, Samsung Electronics, LG Electronics, Arcelik A.S, Daikin Industries, Ariston, Thermo SpA, Gorenje Group, Miele, Robert Bosch, Electrolux AB, Phlips N.V., and Dyson Household Appliances 5. What is the study period of this market? Ans: The Europe White Goods Market is studied from 2021 to 2027.

Europe White Goods Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: WHITE GOODS Market Size, By Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Porter’s Analysis 4.3. Value Chain Analysis 4.4. Market Risk Analysis 4.5. SWOT Analysis 4.6. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Europe WHITE GOODS Market Analysis and Forecast 6.1. WHITE GOODS Market Size & Y-o-Y Growth Analysis 6.1.1. Germany 6.1.2. France 6.1.3. Italy 6.1.4. Spain 6.1.5. United Kingdom 7. Europe WHITE GOODS Market Analysis and Forecast, By Major Appliances 7.1. Introduction and Definition 7.2. Key Findings 7.3. WHITE GOODS Market Value Share Analysis, By Major Appliances 7.4. WHITE GOODS Market Size (US$ Mn) Forecast, By Major Appliances 7.5. WHITE GOODS Market Analysis, By Major Appliances 7.6. WHITE GOODS Market Attractiveness Analysis, By Major Appliances 8. Europe WHITE GOODS Market Analysis and Forecast, By Small Appliances 8.1. Introduction and Definition 8.2. Key Findings 8.3. WHITE GOODS Market Value Share Analysis, By Small Appliances 8.4. WHITE GOODS Market Size (US$ Mn) Forecast, By Small Appliances 8.5. WHITE GOODS Market Analysis, By Small Appliances 8.6. WHITE GOODS Market Attractiveness Analysis, By Small Appliances 9. Europe WHITE GOODS Market Analysis, By Country 9.1. WHITE GOODS Market Value Share Analysis, By Country 9.2. WHITE GOODS Market Size (US$ Mn) Forecast, By Country 9.3. WHITE GOODS Market Attractiveness Analysis, By Country 10. Europe WHITE GOODS Market Analysis 10.1. Key Findings 10.2. Europe WHITE GOODS Market Overview 10.3. Europe WHITE GOODS Market Value Share Analysis, By Major Appliances 10.4. Europe WHITE GOODS Market Forecast, By Major Appliances 10.4.1. REFRIGERATION EQUIPMENT 10.4.2. COOKING EQUIPMENT 10.4.3. WASHING & DRYING EQUIPMENT 10.4.4. HEATING & COOLING EQUIPMENT 10.5. Europe WHITE GOODS Market Value Share Analysis, By Small Appliances 10.6. Europe WHITE GOODS Market Forecast, By Small Appliances 10.6.1. Beverages Making Equipment 10.6.2. Cleaning Equipment 10.6.3. Cooking Equipment 10.6.4. Others 10.7. Europe WHITE GOODS Market Value Share Analysis, By Country 10.8. Europe WHITE GOODS Market Forecast, By Country 10.8.1. Germany 10.8.2. France 10.8.3. Italy 10.8.4. Spain 10.8.5. United Kingdom 10.9. Europe WHITE GOODS Market Analysis, By Country 10.10. U.K. WHITE GOODS Market Forecast, By Major Appliances 10.10.1. REFRIGERATION EQUIPMENT 10.10.2. COOKING EQUIPMENT 10.10.3. WASHING & DRYING EQUIPMENT 10.10.4. HEATING & COOLING EQUIPMENT 10.11. U.K. WHITE GOODS Market Forecast, By Small Appliances 10.11.1. Beverages Making Equipment 10.11.2. Cleaning Equipment 10.11.3. Cooking Equipment 10.11.4. Heating & Cooling Equipment 10.12. Germany WHITE GOODS Market Forecast, By Major Appliances 10.12.1. REFRIGERATION EQUIPMENT 10.12.2. COOKING EQUIPMENT 10.12.3. WASHING & DRYING EQUIPMENT 10.12.4. HEATING & COOLING EQUIPMENT 10.13. Germany WHITE GOODS Market Forecast, By Small Appliances 10.13.1. Beverages Making Equipment 10.13.2. Cleaning Equipment 10.13.3. Cooking Equipment 10.13.4. Heating & Cooling Equipment 10.14. France WHITE GOODS Market Forecast, By Major Appliances 10.14.1. REFRIGERATION EQUIPMENT 10.14.2. COOKING EQUIPMENT 10.14.3. WASHING & DRYING EQUIPMENT 10.14.4. HEATING & COOLING EQUIPMENT 10.15. France WHITE GOODS Market Forecast, By Small Appliances 10.15.1. Beverages Making Equipment 10.15.2. Cleaning Equipment 10.15.3. Cooking Equipment 10.15.4. Heating & Cooling Equipment 10.16. Italy WHITE GOODS Market Forecast, By Major Appliances 10.16.1. REFRIGERATION EQUIPMENT 10.16.2. COOKING EQUIPMENT 10.16.3. WASHING & DRYING EQUIPMENT 10.16.4. HEATING & COOLING EQUIPMENT 10.17. Italy WHITE GOODS Market Forecast, By Small Appliances 10.17.1. Beverages Making Equipment 10.17.2. Cleaning Equipment 10.17.3. Cooking Equipment 10.17.4. Heating & Cooling Equipment 10.18. Spain WHITE GOODS Market Forecast, By Major Appliances 10.18.1. REFRIGERATION EQUIPMENT 10.18.2. COOKING EQUIPMENT 10.18.3. WASHING & DRYING EQUIPMENT 10.18.4. HEATING & COOLING EQUIPMENT 10.19. Spain WHITE GOODS Market Forecast, By Small Appliances 10.19.1. Beverages Making Equipment 10.19.2. Cleaning Equipment 10.19.3. Cooking Equipment 10.19.4. Heating & Cooling Equipment 10.20. Europe WHITE GOODS Market Attractiveness Analysis 10.20.1. By Major Appliances 10.20.2. By Small Appliances 10.21. PEST Analysis 10.22. Key Trends 10.23. Key Developments 11. Company Profiles 11.1. Market Share Analysis, By Company 11.2. Competition Matrix 11.2.1. Competitive Benchmarking of key players By price, presence, market share, End - User, and R&D investment 11.2.2. New Product Launches and Product Enhancements 11.2.3. Market Consolidation 11.2.3.1. M&A By Regions, Investment and End - User 11.2.3.2. M&A Key Players, Forward Integration and Backward Integration 11.3. Company Profiles: Key Players 11.3.1. Electrolux Inc. 11.3.1.1. Company Overview 11.3.1.2. Financial Overview 11.3.1.3. Product Portfolio 11.3.1.4. Business Strategy 11.3.1.5. Recent Developments 11.3.1.6. Development Footprint 11.3.2. Robert Bosch 11.3.3. Whirlpool Corporation 11.3.4. LG Electronics 11.3.5. Samsung Electronics 11.3.6. Miele 11.3.7. Arcelik A.S 11.3.8. Daikin Industries 11.3.9. Ariston 11.3.10. Thermo SpA 11.3.11. Gorenje Group 11.3.12. Philips N.V. 11.3.13. Dyson Household Appliances 12. Primary key Insights