The Europe E-bike Market size was valued at USD 10.92 billion in 2024, and the total Revenue is expected to grow at a CAGR of 8.63 % from 2025 to 2032, reaching nearly USD 21.17 billion.Europe E-bike Market Overview:

The MMR report on the Europe E-Bike Market provides an extensive analysis covering key dimensions such as Demand & Usage Trends, Infrastructure Development, and Consumer Behavior Patterns across the region. It delves into Pricing, Leasing, and Cost Structures, along with Import–Export & Trade Flow Analysis, highlighting supply chain dependencies and market dynamics. The report also examines Technology & Innovation Landscape, Country-Level Demand Hotspots, and the Value Chain Ecosystem, emphasizing localization and manufacturing clusters. it addresses ESG and Sustainability Aspects, and the Regulatory & Policy Landscape, showcasing how environmental initiatives, incentives, and compliance frameworks are shaping market growth across Europe.To know about the Research Methodology:- Request Free Sample Report Europe emphasis on sustainability and environmental consciousness has fueled the demand for eco-friendly transportation options. E-bikes offer a clean and energy-efficient alternative to traditional vehicles, making them increasingly popular among urban commuters and recreational cyclists. Many European governments have implemented policies and incentives to promote e-mobility and reduce greenhouse gas emissions. Subsidies, tax incentives, and infrastructure investments have encouraged consumers to adopt e-bikes as a practical and sustainable mode of transportation. Advances in e-bike technology, including lighter and more efficient batteries, powerful motors, and integrated electronic systems, have improved the performance, reliability, and user experience of e-bikes, which is expected to boost the Europe E-bike Market growth. A forecast for the near future is that Europe is expected to see the sale of approximately 10 million e-bikes annually by 2025, which is significantly expected to boost the Europe E-bike Market growth. This surge in adoption underscores the undeniable practical advantages of e-bikes, with their growth outpacing that of electric cars. It's an exciting shift that's reshaping how people approach sustainable mobility across the continent.

Europe E-bike Market Dynamics

Growing research and development activity to boost Europe E-bike Market growth E-bikes reign supreme as the focal point of bicycle manufacturers' research and development endeavors, spanning various segments including road bikes, mountain bikes tailored for gravity riding, and even children's bikes. The pervasive influence of electric assistance drive systems has left virtually no niche untouched by this transformative trend. Particularly in urban locales, cargo bikes equipped with electric motors have emerged as a compelling alternative to car ownership for families, bolstered by governmental subsidies aimed at facilitating their adoption. Despite economic challenges in countries such as Germany, Belgium, and the Netherlands, the sustained popularity of e-bikes persists, buoyed by the emergence of leasing programs catering to diverse consumer needs. In 2022, the rising Europe E-bike market share and comparatively higher average prices of e-bikes have emerged as significant contributors to the continued growth trajectory of the bicycle industry in numerous European countries. While this growth is evident, particularly in terms of revenue, it's essential to consider a couple of factors. A portion of the increased turnover is attributed to inflation and escalating prices. When evaluating year-on-year comparisons, it's crucial to acknowledge the various disruptions caused by the pandemic. Taking a broader perspective by examining trends from 2019, before the onset of the pandemic, provides a more comprehensive understanding of the industry's performance.Last year, the import of e-bikes into the EU surged to 1,185,695 units, marking a notable 14.8 percent increase compared to the previous year. Concurrently, prominent domestic e-bike suppliers, such as Portugal, also achieved unprecedented levels of e-bike exports. The primary bottleneck hindering the growth of Europe e-bike sales appears to be the availability of batteries and electronic assistance drive systems. Major suppliers reached their maximum production capacity in 2022, leading to constraints in meeting the rising demand. For instance, Bosch E-Bike Systems faced challenges in producing an adequate supply of its in-tube Power tube batteries, causing disruptions for production planners across Europe in the spring of 2022. For example, e-bikes propelling the growth of the bicycle market is evident in Germany, the largest market in Europe. Despite an overall decrease in the number of bicycles sold in Germany in 2022, dropping by 100,000 units to 4.6 million, e-bike sales surged by 10 percent to 2.2 million units, capturing nearly 48 percent of the Europe E-bike market share. Conversely, sales of conventional bikes experienced an 11 percent decline to 2.4 million units. Notably, the average sales price for conventional bikes increased to €500, while the average sales price for e-bikes rose to €2800. With these figures in mind, Germany's Zweirad Industrie Verband (ZIV) estimates the total revenue generated from bicycle sales to reach €7.36 billion – a new record. Approximately 76 percent of these sales occurred through brick-and-mortar stores, while direct-to-consumer (D2C) players accounted for another 21 percent. High Initial Costs to limit the Europe E-bike Market growth E-bikes typically have higher costs compared to traditional bicycles, primarily due to the cost of batteries and electric components. The initial investment deters price-sensitive consumers from purchasing e-bikes, limiting Europe E-bike market penetration. E-bike regulations vary across European countries, leading to inconsistencies in standards, licensing requirements, and infrastructure development. Regulatory complexities hinder market growth and create barriers to cross-border trade and adoption. E-bikes are complex systems that rely on various electronic components, including motors, batteries, and controllers. Technical issues, such as battery malfunction, motor failure, or software glitches, lead to maintenance issues and reliability concerns for e-bike users. Concerns about battery range and the availability of charging infrastructure contribute to "range anxiety" among e-bike users. The fear of running out of battery power during a ride may discourage some consumers from investing in e-bikes, particularly for longer journeys.

Europe E-bike Market Segment Analysis

Based on Mode, the Europe E-Bike Market is segmented into Pedal Assist and Throttle. In 2024, Pedal Assist E-Bikes dominated the market, driven by their strong adoption across urban commuting and recreational applications due to better energy efficiency, longer battery life, and compliance with European regulatory limits on motor assistance. These bikes are preferred for their natural riding experience and alignment with sustainability and health-conscious consumer trends. The Throttle segment, though smaller, is growing steadily, particularly in niche markets and for short-distance travel, where riders seek effortless acceleration without continuous pedaling. Overall, Pedal Assist leads the market in value and volume, while Throttle E-Bikes are expected to gain traction in specific consumer segments seeking enhanced comfort and convenience.Based on the Design, Based on Design, the Europe E-Bike Market is segmented into Foldable and Non-Foldable E-Bikes. In 2024, Non-Foldable E-Bikes held the largest market share, supported by their robust frame structure, higher battery capacity, and suitability for long-distance commuting and cargo applications. They remain the preferred choice among daily commuters and logistics users due to superior performance and stability. Meanwhile, Foldable E-Bikes are witnessing rapid growth, driven by increasing urbanization, limited parking spaces, and rising demand from city commuters and travelers seeking portability and easy storage. Overall, Non-Foldable E-Bikes dominate the market in terms of volume, while Foldable models are gaining popularity in metropolitan areas for their convenience and compact design.

Europe E-bike Market Regional Insight

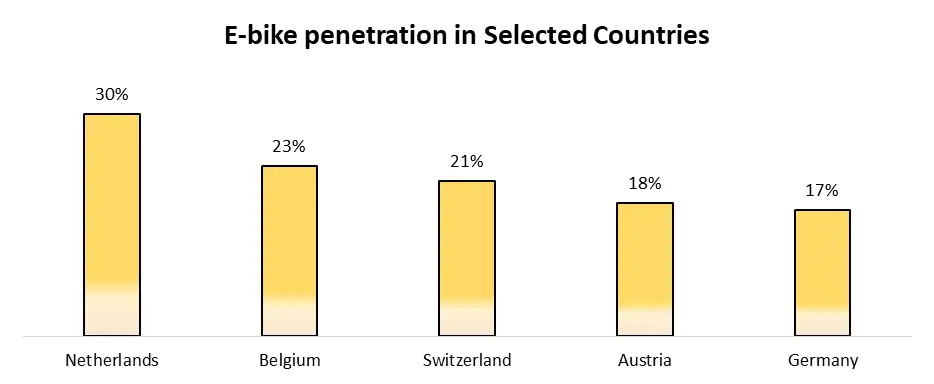

Germany, Austria and Switzerland just behind the leaders The Europe e-bike market exhibits varying trends and dynamics across different regions, each influenced by factors such as infrastructure, regulations, consumer preferences, and market maturity. Germany leads the European e-bike market in terms of both production and consumption. It has a strong cycling culture, extensive cycling infrastructure, and supportive government policies. The United Kingdom has seen rapid growth in e-bike sales, particularly in urban areas, as consumers seek alternatives to traditional transportation modes. The penetration rate of e-bikes Market across individual European countries reveals significant disparities. It also underscores the considerable progress made in the adoption of electric bicycles. The DACH countries (Germany, Austria, and Switzerland) lead the way in this trend. According to a recent consumer survey, 17 percent of respondents in Germany reported owning an e-bike, with similar figures in neighboring Austria (18%) and Switzerland (21%). While these numbers already indicate substantial progress, they fall short of the Netherlands, which boasts a remarkable 30% ownership rate, positioning it as the clear leader in Europe. Despite the DACH countries advancement in e-bike ownership, they still trail slightly behind the Netherlands and Belgium in terms of e-bike sales shares within the total bicycle market. As per the bicycle associations of respective countries, Germany recorded a 39% share of e-bikes in total sales in 2020, while Switzerland and Austria reported 34% and 41% respectively, which significantly helps to boost the Europe E-bike Market growth. In contrast, the Netherlands surpassed these figures with a 50% share in 2020, while Belgium had already exceeded the halfway mark, with e-bikes accounting for more than half of all bicycles sold in 2019.

Europe E-bike Market Scope: Inquire before buying

Europe E-bike Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 10.92 Bn. Forecast Period 2025 to 2032 CAGR: 8.63% Market Size in 2032: USD 21.17 Bn. Segments Covered: by Mode Pedal Assist Throttle by Component Battery Motor Frame Display Light and Reflector Wheels and Gears Brake System Others by Battery Type Lead Acid Lithium Ion Nickel-Metal Hydride (NiMH) Others by Battery Capacity Below 250W 251W to 450W 451W to 650 W Above 650W by Motor Type Hub Motor Mid-drive Motor Others by Class Class I Class II Class III by Design Foldable Non-Foldable by Usage City/Urban Mountain/Trekking Bikes Racing Cargo Others by Ownership Shared Personal Europe E-bike Market, by Country

UK Germany France Italy Spain Austria Netherlands Rest of EuropeLeading Europe E-bike manufacturers include:

1. Accell Group 2. Brompton Bicycle 3. CUBE Bikes 4. Georg Fritzmeier GmbH & Co. KG 5. Kalkhoff Werke GmbH 6. Pon Holdings B.V. 7. Riese & Müller GmbH 8. Royal Dutch Gazelle 9. Swiss E-Mobility Group 10. VanMoof BV 11. Haibike 12. F.I.V.E. Bianchi S.p.A. 13. Moustache Bikes 14. Gocycle 15. AIMA Ebike 16. Lekker Bikes 17. Tenways 18. WATT e-Bike 19. BearEBike 20. E-BIKE FANTOM 21. OthersFrequently Asked Questions:

1] What segments are covered in the Europe E-bike Market report? Ans. The segments covered in the Europe E-bike Market report are based on Mode, Component, Battery Type, Battery Capacity, Motor Type, Class, Design, Usage, Ownership, and Country. 2] What is the market size of the Europe E-bike Market by 2032? Ans. The market size of the Europe E-bike Market by 2032 is USD 21.17 Bn. 3] What is the growth rate of the Europe E-bike Market? Ans. The Europe E-bike Market is growing at a CAGR of 8.63 % during the forecasting period 2025-2032. 4] What was the market size of the Europe E-bike Market in 2024? Ans. The market size of the Europe E-bike Market in 2024 was USD 10.92 Bn. 5] What major key players are covered in the Europe E-bike Market report?? Ans. The major key players in the market are Accell Group, Brompton Bicycle ,CUBE Bikes ,Georg Fritzmeier GmbH & Co. KG, Kalkhoff Werke GmbH ,Pon Holdings B.V. ,Riese & Müller GmbH ,Royal Dutch Gazelle ,Swiss E-Mobility Group ,VanMoof BV ,Haibike, Others

1. Europe E-bike Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion and Volume in Units ) - By Segments, Country 2. Europe E-bike Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. Product Consistency & Quality 2.3.5. Pricing Strategy 2.3.6. New Product Innovation Rate 2.3.7. Market Share (%) 2.3.8. R&D Investment 2.3.9. Revenue, (2024) 2.3.10. Revenue Growth Rate (Y-O-Y) 2.3.11. Review and Ratings 2.3.12. Retail Footprint 2.3.13. Repeat Purchase Rate 2.3.14. Carbon Footprint Disclosure 2.3.15. Ad Spend as % of Sales 2.3.16. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Europe E-bike Market: Dynamics 3.1. Europe E-bike Market Trends 3.2. Europe E-bike Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Europe E-bike Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Demand & Usage Analysis 4.1. Weekday vs. Weekend Transport Mode Preferences (2024) 4.1.1. Comparison of E-Bike vs. Traditional Bike Usage on Weekdays and Weekends 4.1.2. Identification of Peak Usage Periods Across Major European Cities 4.2. Changes in Bike and E-Bike Usage Patterns (2024) 4.2.1. Growth or Decline in Bike vs. E-Bike Usage Compared to Previous Years 4.2.2. Trends Across Urban, Suburban, and Rural Areas 4.3. Bicycle Ownership Penetration Across Europe (2024) 4.3.1. Percentage of Consumers Owning at Least One Bicycle or E-Bike 4.3.2. Country-wise Penetration Analysis Highlighting Leading Markets 4.4. E-Bike Leasing and Purchase Intentions (2024) 4.4.1. Consumer Interest in E-Bike Leasing vs. Direct Purchase 4.4.2. Key Motivations Driving Leasing or Buying Decisions (Convenience, Cost, Sustainability) 5. Infrastructure and Ecosystem Development 5.1. Charging Infrastructure Development (Fast-Charging and Battery Swap Stations) 5.2. Expansion of Bike Lanes and Protected Urban Cycling Corridors 5.3. E-Cargo Integration into Last-Mile Logistics Ecosystem 5.4. E-Bike Parking, Storage, and Urban Planning Initiatives 5.5. Integration of E-Bikes with MaaS (Mobility-as-a-Service) Platforms 6. Consumer Behavior Analysis 6.1. Buying Preferences 6.1.1. Shift Toward E-Bikes Over Traditional Bicycles 6.1.2. Growing Interest in Premium, High-Performance, and Cargo E-Bikes 6.1.3. Preference for Smart Features (GPS, App Connectivity, Theft Protection) 6.2. Usage Patterns 6.2.1. Commuting & Utility Use 6.2.2. Leisure & Recreational Riding 6.2.3. Cargo & Delivery Applications 6.3. Demographic Insights 6.3.1. Ownership Trends by Age, Income, and Gender 6.3.2. Urban vs. Rural Consumer Behavior 6.4. Motivations to Use E-Bikes 6.4.1. Environmental & Sustainability Concerns 6.4.2. Health & Fitness Benefits 6.4.3. Convenience & Cost Efficiency 6.4.4. Impact of Cultural and Lifestyle Differences on Adoption 6.5. Digital Influence 6.5.1. Role of Online Platforms & E-Commerce 6.5.2. Social Media & Influencer Impact 7. Pricing, Leasing, & Cost Analysis 7.1. Average Selling Price of E-Bikes by Country (2019–2024) 7.2. Electric Bike Sales in the EU (2019–2024) 7.3. Cost Structure Breakdown: Battery, Motor, Frame, and Accessories 7.4. Leasing, Subscription, and Pay-Per-Ride Models for E-Bikes 7.5. Financing, Installment Schemes, and Micro-Credit Adoption 7.6. Price Sensitivity and Variations Across Europe 7.7. Impact of Technological Advancements on Pricing 8. Import–Export & Trade Flow Analysis 8.1. EU E-Bike Imports & Leading Supplier Countries (2019–2024) 8.2. EU E-Bike Exports & Top Destination Markets (2019–2024) 8.3. Trade Barriers, Tariffs & Regulatory Challenges 8.4. Impact of Supply Chain & Semiconductor / Lithium Availability 9. Technology & Innovation Landscape 9.1. Battery Innovations (Energy Density, Swappable, Fast Charging, Solid-State) 9.2. Motor Technologies (Mid-Drive vs Hub Motors, Torque Sensors) 9.3. Smart Features: App Connectivity, GPS, Anti-Theft, Geofencing, OTA Updates 9.4. Lightweight Materials (Carbon Composites, Magnesium Alloys) 9.5. Safety Features: ABS Brakes, Traction Control, Regenerative Braking Systems 10. Country-Level Insights and Demand Hotspots 10.1. Germany, Netherlands, and France — Mature Markets Analysis 10.2. Italy, Spain, and Nordics — Fast-Growth Markets 10.3. Eastern Europe — Emerging Opportunities and Barriers 10.4. Country-Level Policy Incentives and Market Readiness Scores 10.5. Tourism-Driven Seasonal E-Bike Demand Clusters 11. Supply Chain and Value Chain Analysis 11.1. Component Supply Landscape (Batteries, Motors, Controllers, Frames, Tires) 11.2. Dependency on Asian Suppliers vs European Localization Efforts 11.3. Assembly, Final Production, Clusters in Europe 11.4. Logistics, Warehousing, and Cross-Border Trade Flows 11.5. Risk Analysis: Battery Raw Material Sourcing, Shipping Delays, Trade Tariffs 12. Real Estate and Retail Ecosystem 12.1. Growth of E-Bike Retail Showrooms and Flagship Experience Centers 12.2. Service Center and After-Sales Infrastructure Development 12.3. Omni-Channel Strategies of E-Bike Brands 12.4. Integration with Sporting Goods and Electronics Retail Chains 13. ESG and Sustainability Aspects 13.1. Lifecycle Carbon Emission Reduction Compared to Cars 13.2. End-of-Life Battery Recycling and Second-Life Use Cases 13.3. ESG Initiatives by Major Manufacturers and Platforms 13.4. Eco-Certifications and Sustainable Materials Sourcing 13.5. Role of E-Bikes in Achieving Urban Climate Goals 14. Regulatory and Policy Landscape 14.1. EU Directives on E-Bike Classification and Speed Limits 14.2. Country-Specific Licensing, Insurance, and Road Use Regulations 14.3. Safety Standards and Testing Protocols (EN 15194, CE Certification) 14.4. Subsidies, Incentive Schemes, and Tax Credits by Country 14.5. Harmonization Challenges Across the EU Single Market 15. Europe E-bike Market: Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 15.1. Europe E-bike Market Size and Forecast, By Mode (2024-2032) 15.1.1. Pedal Assist 15.1.2. Throttle 15.2. Europe E-bike Market Size and Forecast, By Component (2024-2032) 15.2.1. Battery 15.2.2. Motor 15.2.3. Frame 15.2.4. Display 15.2.5. Light and Reflector 15.2.6. Wheels and Gears 15.2.7. Brake System 15.2.8. Others 15.3. Europe E-bike Market Size and Forecast, By Battery Type (2024-2032) 15.3.1. Lead Acid 15.3.2. Lithium Ion 15.3.3. Nickel-Metal Hydride (NiMH) 15.3.4. Others 15.4. Europe E-bike Market Size and Forecast, By Battery Capacity(2024-2032) 15.4.1. Below 250W 15.4.2. 251W to 450W 15.4.3. 451W to 650 W 15.4.4. Above 650W 15.5. Europe E-bike Market Size and Forecast, By Motor Type (2024-2032) 15.5.1. Hub Motor 15.5.2. Mid-drive Motor 15.5.3. Others 15.6. Europe E-bike Market Size and Forecast, By Class (2024-2032) 15.6.1. Class I 15.6.2. Class II 15.6.3. Class III 15.7. Europe E-bike Market Size and Forecast, By Design (2024-2032) 15.7.1. Foldable 15.7.2. Non-Foldable 15.8. Europe E-bike Market Size and Forecast, By Usage (2024-2032) 15.8.1. City/Urban 15.8.2. Mountain/Trekking Bikes 15.8.3. Racing 15.8.4. Cargo 15.8.5. Others 15.9. Europe E-bike Market Size and Forecast, By Ownership (2024-2032) 15.9.1. Shared 15.9.2. Personal 15.10. Europe E-bike Market Size and Forecast, By Country (2024-2032) 15.10.1. United Kingdom 15.10.2. France 15.10.3. Germany 15.10.4. Netherlands 15.10.5. Switzerland 15.10.6. Belgium 15.10.7. Italy 15.10.8. Spain 15.10.9. Sweden 15.10.10. Russia 15.10.11. Rest of Europe 16. Company Profile: Key Players 16.1. Accell Group 16.1.1. Company Overview 16.1.2. Business Portfolio 16.1.3. Financial Overview 16.1.4. SWOT Analysis 16.1.5. Strategic Analysis 16.2. Brompton Bicycle 16.3. CUBE Bikes 16.4. Georg Fritzmeier GmbH & Co. KG 16.5. Kalkhoff Werke GmbH 16.6. Pon Holdings B.V. 16.7. Riese & Müller GmbH 16.8. Royal Dutch Gazelle 16.9. Swiss E-Mobility Group 16.10. VanMoof BV 16.11. Haibike 16.12. F.I.V.E. Bianchi S.p.A. 16.13. Moustache Bikes 16.14. Gocycle 16.15. AIMA Ebike 16.16. Lekker Bikes 16.17. Tenways 16.18. WATT e-Bike 16.19. BearEBike 16.20. E-BIKE FANTOM 16.21. Others 17. Key Findings 18. Analyst Recommendations 19. Europe E-bike Market – Research Methodology