Global Electric Vehicle Sound Generators Market size was valued at USD 1.57 Bn in 2024 and the total Electric Vehicle Sound Generators Market revenue is expected to grow by 10.17% from 2025 to 2032, reaching nearly USD 3.41 Bn by 2032.Electric Vehicle Sound Generators Market Overview:

Electric Vehicle (EV) Sound Generators are electronic systems that produce artificial audible alert for pedestrian safety and brand specific acoustic signature in silent EVs. Electric Vehicle (EV) Sound Generators Market has been experiencing rapid growth driven by increasing EV adoption and stringent global safety regulation mandating Acoustic Vehicle Alerting Systems (AVAS). Asia Pacific dominated market fuelled by China's leadership in EV production, Japan's technological advancements in sound engineering and supportive government policies across region. Innovation leader like Harman International (US), Denso (Japan) and Bosch (Germany) are pioneering intelligent sound solution including customizable brand signatures, AI optimized pedestrian alert and noise cancelling technologies. Electric Vehicle (EV) Sound Generators market benefit from diverse application like OEMs integrate regulatory compliant warning systems, premium brands develop distinctive acoustic identities and smart cities adopt adaptive soundscape for urban environments. This evolving landscape demonstrates how EV sound generators are transforming with connected technologies, personalized audio experiences and sustainability focused designs, meeting both safety requirements and consumer preference while aligning with future of mobility.To know about the Research Methodology :- Request Free Sample Report The objective of the report is to present a comprehensive analysis of the Electric Vehicle Sound Generators Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.

Electric Vehicle Sound Generators Market Dynamics:

Rising Adoption of Electric Vehicles to Boost Electric Vehicle Sound Generators Market The increasing demand for electric vehicles is a key aspect that driving the growth of the electric vehicle sound generator market. Electric vehicles are expected to become more mainstream during the forecast period (2024-2030) as it is gaining a reputation as a superior and more environment-friendly mode of transportation. Thus, compared with traditional cars, electric cars have benefits zero emission of harmful gases, reduced noise, and improved fuel efficiency. In addition, Governments are incentivizing the use of electric vehicles with a variety of financial and non-financial benefits, including discounts and tax exemptions. For example, the Chinese government offers a subsidy of US$ 6,750 to US$ 14,000 to customers on every purchase of hybrid or electric vehicles. Advancements Driving EV Popularity to Drive Electric Vehicle Sound Generators Market Electric vehicles are expected to reach a market size of 726 billion U.S. dollars by 2029. Due to improved range, battery life, and affordability, electric vehicles have become a much more appealing option for customers. EVs have dominated the automotive markets of northern European, and Asian countries, with sales in China forecast to hit 3.7 million by 2029. However, Norway now has the highest proportion of electric vehicles in its fleet, accounting for the bulk of new registrations in 2022. Electric vehicles are common in Norway, due to the government's strong subsidies, but also to the abundance of charging stations. With so many countries committed to the adoption of electric vehicles, it looks set to dominate electric vehicles sound generators during the forecast period. Europe registered 1.4 million units of electric vehicles in 2022. Where Germany is the largest market of EVS in Europe, which registered 295 000 new electric vehicles. China the largest market in the Asia Pacific registered 1.2 million units of electric vehicles, while the United Kingdom registered 176 000 electric vehicles. In 2022, the biggest EVs sales share is Norway with a record of 75% market share, followed by 50% in Iceland and 30% in Sweden. Thus, the growth in the electric vehicle is expected to drive the growth of the electric vehicle sound generator market during the forecast period (2023-2030). Limited Charging Infrastructure to Restrain Electric Vehicle Sound Generators Market Higher electric vehicle costs and reduced charging station capacity are expected to hinder the electric vehicle sound generators market during the forecast period. Thus, due to the high cost of electric vehicles, there is a lack of acceptance of electric sound generators in many developing countries.Electric Vehicle Sound Generators Market Segmentation Analysis:

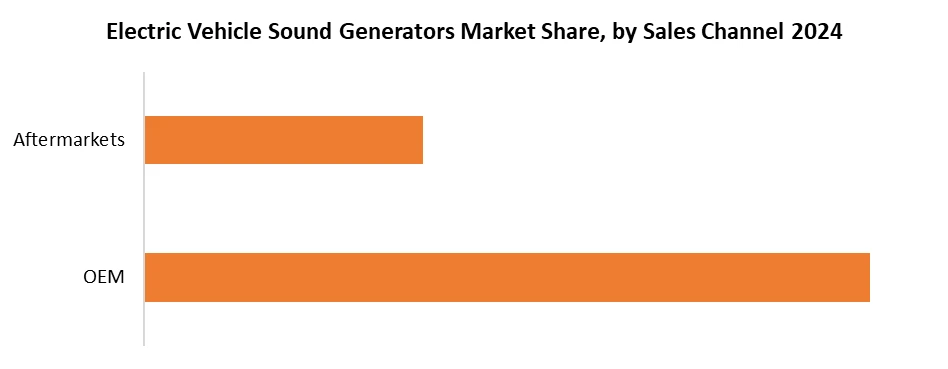

By Vehicle Type, the passenger vehicles segment accounts for the largest share of xx% in the market due to an increase in the sale of passenger vehicles and technological advancement in vehicles of developed countries. The growing interest of consumers towards safety, premium, luxury, and comfortable vehicles is expected to drive the growth of the passenger vehicles segment during the forecast period. The United States dominates the market for passenger cars segment accounting for 27 % of the global sales in 2024. Of all the regional markets, Asia Pacific has seen a remarkable rise in electric vehicles, especially in India and China. Further, governments support for adopting EVs in the transportation industry has fueled the demand for sound generator mechanisms for passenger vehicles. Globally, 56 million passenger vehicles were in 2023, down 11.7 percent from the previous year. China was the world's largest regional market for vehicles in 2022, with over 20 million units sold those accounts for 38.33% of the world's car sales. Where Japan, the United States of America, Germany, and India account for 62.19% world's total passenger car sales. By Sales Channel, the OEM segment held the largest share of xx% in 2024. the growth of the segment is due to governments regulations for the installation of electric vehicle sound generators in all new electric & hybrid vehicles. Thus, several key players are focusing on new product developments to gain a stronghold in the EV sound generators market. This creates lucrative opportunities for the original equipment manufacturers of electric vehicle sound generators. In addition, demand for the sound generator in electric vehicles is strong in the aftermarket. Acoustic comfort is a future hotspot in electric vehicles, which can drive the growth of the electric vehicle sound generator market as customers are opting for big brands like Tesla, Mercedes, Toyota, and Audi are looking for appealing sounds.

Electric Vehicle Sound Generators Market Regional Insights:

Asia Pacific dominated the electric vehicle sound generators market and held 60% of the market share in 2024. The region is expected to grow at a 15% CAGR during the forecast period. The countries of Asia Pacific like Japan & China which are the largest electric automotive manufacturing countries in the world are expected to hold a maximum share in the global electric sound generator market. In addition, the government's efforts for the adoption of electric vehicles in the region boost the sound generator for electric vehicles. Similarly, the region's growth can be traced to the Chinese market's dominance as well as the global presence of leading OEMs such as BYD, Yutong, Zhongtong, and Ankai resulting in the exponential growth of the electric vehicle sound generators market.North America is expected to register xx% of the market share in 2023. In addition, the governor of California's target of meeting 1.5 million zero-emission cars by 2029 is adding to regional demand. In Norway, by 2030 100% of car sales are expected to be electric., and thus no traditional vehicles are expected to run on roads.

Electric Vehicle Sound Generators Market Competitive Landscape:

In Electric Vehicle (EV) Sound Generators Market, Tesla (US) competes with global leaders like Continental AG (Germany), Harman International (US) and Denso (Japan) which dominate OEM supply chains with advanced Acoustic Vehicle Alerting Systems (AVAS). While Tesla prioritizes minimalist design (often avoiding artificial sounds), innovators like Bose (US) and Mercedes-Benz (Germany) are developing branded premium soundscape (e.g., Mercedes’ "Sound Drive" for EVs). Emerging players like SoundHound AI (US) and Revvo (Sweden) focus on AI generated adaptive sound while Chinese firm (BYD, NIO) integrate localized AVAS solutions. Tesla’s competitive edge lies in its software-controlled sound profiles (e.g., pedestrian warnings via OTA updates) but it faces pressure from stricter global pedestrian safety regulation (EU, US, China) pushing standardized AVAS adoption. The landscape blends regulatory compliance, brand differentiation and tech driven customization with Tesla balancing its anti-noise ethos against safety mandates.Electric Vehicle Sound Generators Market Key Trends:

• Biophilic Soundscapes for Urban EVs: EV sound generators are integrating nature-inspired audio (e.g., rustling leaves, flowing water) to reduce urban noise pollution while meeting pedestrian safety regulations. • Dynamic Sound Personalization via AI: AI-driven systems now allow drivers to customize EV sounds in real-time (e.g., futuristic tones for highways, subtle hums for neighborhoods). • V2X (Vehicle-to-Everything) Acoustic Signaling: Next-gen sound generators emit targeted alerts for nearby pedestrians (via smartphones) or autonomous vehicles, enabling silent roads until collision risks arise. Electric Vehicle Sound Generators Market Key Developments: • Lucid Motors (US)- March 12, 2025: Launched "Sonic Signature", an AI-driven soundscape co-developed with Dolby Atmos, allowing drivers to customize exterior pedestrian alerts and cabin sounds via the Lucid UX interface. • Daimler AG (Mercedes-Benz Group, Germany)- November 5, 2024: Debuted "Sound Drive 2.0" for its EQ lineup, featuring geofenced adaptive tones that shift sounds based on location (e.g., softer alerts near schools). • Renault Group (France)- September 18, 2024: Introduced "Renault Sound Lab", a collaborative project with IRCAM (Paris) to design culturally tailored AVAS sounds for European and emerging markets. • Honda Motor (Japan)- July 22, 2025: Patented "Honda Acoustic Guidance", a directional sound system using ultrasonic beams to alert pedestrians without adding urban noise pollution. • BYD Auto (China)- January 30, 2025: Unveiled "Dynaudio Harmony", a biophilic sound system mimicking natural noises (e.g., bamboo rustling) for its premium Yangwang EVs, complying with China’s GB/T 40429-2021 standards.Electric Vehicle Sound Generators Market Scope: Inquire before buying

Global Electric Vehicle Sound Generators Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.57 Bn. Forecast Period 2025 to 2032 CAGR: 10.17% Market Size in 2032: USD 3.41 Bn. Segments Covered: by Vehicle Type Passenger Vehicles LCVs HCVs Others by Sales Channel OEM Aftermarket Electric Vehicle Sound Generators Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Electric Vehicle Sound Generators Market, Key Players

North America 1. Harman International (US) 2. Lucid Motors (US) 3. Rivian Automotive, Inc. (US) 4. Tesla (US) Europe 5. Continental (Germany) 6. Daimler AG (Mercedes-Benz Group) (Germany) 7. Volkswagen (Germany) 8. Kufatec GmbH (Germany) 9. BMW (Germany) 10. Robert Bosch GmbH (Germany) 11. Renault Group (France) 12. Sound Racer (Sweden) 13. Delphi (Ireland) 14. Kendrion (Netherlands) Asia Pacific 15. Denso (Japan) 16. Nissan Motor (Japan) 17. Honda Motor (Japan) 18. BYD Auto Co., Ltd. (China) 19. XPeng Inc. (China) 20. NIO Inc. (China) 21. Mando-Hella (South Korea) 22. Hyundai Motor Company (South Korea) Frequently Asked Questions: 1. What is the projected market size & growth rate of Electric Vehicle Sound Generators Market? Ans- Electric Vehicle Sound Generators Market was valued at USD 1.57 Bn in 2024 and is projected to reach USD 3.41 Bn by 2032, growing at a CAGR of 10.17% during the forecast period. 2. What is the key driving factor for the growth of Market? Ans- Growth in the electric vehicle is expected to drive the growth of the market during the forecast period (2025-2032). 3. Which Region accounted for the largest Electric Vehicle Sound Generators Market share? Ans- The Asia Pacific dominated the electric vehicle sound generators market and held 60% of the market share in 2024. 4. What makes North America a Lucrative Market for Electric Vehicle Sound Generators Market? Ans- North America is expected to register xx% of the market share in 2024. In addition, the governor of California's target of meeting 1.5 million zero-emission cars by 2030 is adding to regional demand. 5. What are the top players operating in Market? Ans- Delphi, Denso, Continental, Harman, Nissan Motor, Tesla, and Daimler.

1. Electric Vehicle Sound Generators Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Electric Vehicle Sound Generators Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Electric Vehicle Sound Generators Market: Dynamics 3.1. Electric Vehicle Sound Generators Market Trends 3.1.1. North America Electric Vehicle Sound Generators Market Trends 3.1.2. Europe Electric Vehicle Sound Generators Market Trends 3.1.3. Asia Pacific Electric Vehicle Sound Generators Market Trends 3.1.4. Middle East and Africa Electric Vehicle Sound Generators Market Trends 3.1.5. South America Electric Vehicle Sound Generators Market Trends 3.2. Electric Vehicle Sound Generators Market Dynamics 3.2.1. Electric Vehicle Sound Generators Market Drivers 3.2.1.1. Rising Adoption of Electric Vehicles 3.2.1.2. Advancements Driving EV Popularity 3.2.2. Electric Vehicle Sound Generators Market Restraints 3.2.3. Electric Vehicle Sound Generators Market Opportunities 3.2.4. Electric Vehicle Sound Generators Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree Map Analysis 3.4.1. Regulatory Mandates 3.4.2. Tech Advancements 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Electric Vehicle Sound Generators Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 4.1.1. Passenger Vehicles 4.1.2. LCVs 4.1.3. HCVs 4.1.4. Others 4.2. Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 4.2.1. OEM 4.2.2. Aftermarket 4.3. Electric Vehicle Sound Generators Market Size and Forecast, By Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Electric Vehicle Sound Generators Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 5.1.1. Passenger Vehicles 5.1.2. LCVs 5.1.3. HCVs 5.1.4. Others 5.2. North America Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 5.2.1. OEM 5.2.2. Aftermarket 5.3. North America Electric Vehicle Sound Generators Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 5.3.1.1.1. Passenger Vehicles 5.3.1.1.2. LCVs 5.3.1.1.3. HCVs 5.3.1.1.4. Others 5.3.1.2. United States Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 5.3.1.2.1. OEM 5.3.1.2.2. Aftermarket 5.3.2. Canada 5.3.2.1. Canada Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 5.3.2.1.1. Passenger Vehicles 5.3.2.1.2. LCVs 5.3.2.1.3. HCVs 5.3.2.1.4. Others 5.3.2.2. Canada Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 5.3.2.2.1. OEM 5.3.2.2.2. Aftermarket 5.3.3. Mexico 5.3.3.1. Mexico Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 5.3.3.1.1. Passenger Vehicles 5.3.3.1.2. LCVs 5.3.3.1.3. HCVs 5.3.3.1.4. Others 5.3.3.2. Mexico Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 5.3.3.2.1. OEM 5.3.3.2.2. Aftermarket 6. Europe Electric Vehicle Sound Generators Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 6.2. Europe Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 6.3. Europe Electric Vehicle Sound Generators Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 6.3.1.2. United Kingdom Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 6.3.2. France 6.3.2.1. France Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 6.3.2.2. France Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 6.3.3.2. Germany Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 6.3.4.2. Italy Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 6.3.5.2. Spain Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 6.3.6.2. Sweden Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 6.3.7. Russia 6.3.7.1. Russia Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 6.3.7.2. Russia Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 6.3.8.2. Rest of Europe Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7. Asia Pacific Electric Vehicle Sound Generators Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.2. Asia Pacific Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3. Asia Pacific Electric Vehicle Sound Generators Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.1.2. China Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.2.2. S Korea Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.3.2. Japan Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.4. India 7.3.4.1. India Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.4.2. India Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.5.2. Australia Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.6.2. Indonesia Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.7. Malaysia 7.3.7.1. Malaysia Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.7.2. Malaysia Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.8. Philippines 7.3.8.1. Philippines Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.8.2. Philippines Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.9. Thailand 7.3.9.1. Thailand Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.9.2. Thailand Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.10. Vietnam 7.3.10.1. Vietnam Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.10.2. Vietnam Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 7.3.11.2. Rest of Asia Pacific Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 8. Middle East and Africa Electric Vehicle Sound Generators Market Size and Forecast (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 8.2. Middle East and Africa Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 8.3. Middle East and Africa Electric Vehicle Sound Generators Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 8.3.1.2. South Africa Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 8.3.2.2. GCC Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 8.3.3. Egypt 8.3.3.1. Egypt Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 8.3.3.2. Egypt Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 8.3.4. Nigeria 8.3.4.1. Nigeria Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 8.3.4.2. Nigeria Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 8.3.5. Rest of ME&A 8.3.5.1. Rest of ME&A Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 8.3.5.2. Rest of ME&A Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 9. South America Electric Vehicle Sound Generators Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 9.2. South America Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 9.3. South America Electric Vehicle Sound Generators Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 9.3.1.2. Brazil Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 9.3.2.2. Argentina Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 9.3.3. Colombia 9.3.3.1. Colombia Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 9.3.3.2. Colombia Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 9.3.4. Chile 9.3.4.1. Chile Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 9.3.4.2. Chile Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 9.3.5. Rest Of South America 9.3.5.1. Rest Of South America Electric Vehicle Sound Generators Market Size and Forecast, By Vehicle Type (2024-2032) 9.3.5.2. Rest Of South America Electric Vehicle Sound Generators Market Size and Forecast, By Sales Channel (2024-2032) 10. Company Profile: Key Players 10.1. Harman International 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Lucid Motors 10.3. Rivian Automotive, Inc. 10.4. Tesla 10.5. Continental 10.6. Daimler AG (Mercedes-Benz Group) 10.7. Volkswagen 10.8. Kufatec GmbH 10.9. BMW 10.10. Robert Bosch GmbH 10.11. Renault Group 10.12. Sound Racer 10.13. Delphi 10.14. Kendrion 10.15. Denso 10.16. Nissan Motor 10.17. Honda Motor 10.18. BYD Auto Co., Ltd. 10.19. XPeng Inc. 10.20. NIO Inc. 10.21. Mando-Hella 10.22. Hyundai Motor Company 11. Key Findings 12. Industry Recommendations 13. Electric Vehicle Sound Generators Market: Research Methodology