The Detergent Market size was valued at USD 157.76 Billion in 2025 and the total Detergent revenue is expected to grow at a CAGR of 15.2% from 2025 to 2032, reaching nearly USD 424.79 Billion by 2032. The global detergent market is undergoing a major transformation shaped by evolving consumer behavior, sustainability mandates, and technological innovation. The household laundry habits shows that families in growing economies perform 5–6 loads per week, reinforcing consistently high detergent penetration. The strong per-capita usage in countries such as Japan (34 kg) and the U.S. (31 kg annually), while emerging economies such as India are experiencing measurable increases in detergent adoption as urbanisation and hygiene awareness accelerate. The major shift from traditional powder detergents to liquid formats, which offer improved cold-wash efficiency and better solubility, while pods and capsules continue to expand as premium, pre-measured solutions. Sustainability-focused research expressions rising demand for plant-based, biodegradable, phosphate-free and hypoallergenic detergents, with over 45% of new global detergent launches featuring eco-friendly attributes. Life-cycle studies also indicate reductions in water and energy consumption when consumers switch to concentrated liquids and cold-wash cycles. Regionally, Asia-Pacific leads global detergent consumption, supported by strong manufacturing ecosystems, while North America and Europe dominate in premium formulations and innovation intensity. E-commerce research shows rapid growth in online detergent sales, driven by convenience, subscription models, and digitally informed purchasing patterns in detergent market.To know about the Research Methodology :- Request Free Sample Report

Detergent Market Dynamics:

Rising Hard-Water Prevalence Requiring Specialized Detergents The global detergent market is propelled with a wide range of structural and emerging drivers that extend far beyond shifts in consumer behavior and sustainability trends. One major force accelerating demand is the increasing prevalence of hard-water conditions, which affect more than half of the world’s households. Hard water reduces the cleaning effectiveness of conventional formulas by nearly 40–50%, prompting consumers to adopt specialized detergents enriched with chelating agents, water-softening ingredients, and low-suds surfactants. Parallel to this, the rapid rise in automatic and high-efficiency washing machines—now present in more than 90 million U.S. households and expanding quickly across India, Indonesia, and Southeast Asia—has created strong demand for liquid, enzyme-rich, and fast-dissolving detergents specifically designed for HE washers, driving growth in the detergent market. Institutional and Industrial Demand Plays a Critical Role Institutional and industrial demand play a critical role in the detergent market. Commercial laundry operations in the hospitality, healthcare, textile, and foodservice industries are growing at 6–7% annually, increasing the need for high-performance detergents that work under strict sanitation and low-temperature washing protocols. Hospitals, in particular, are shifting to hypoallergenic, antimicrobial, and residue-free detergents to comply with infection control standards. This rise of professional laundry solutions is supported by increasing disposable income and changing household structures; with over 4 billion people now classified as global middle class, lifestyles are becoming more convenience-led. Single-person and nuclear households prefer ready-to-use liquid detergents, pre-measured pods, quick-rinse formulations, and compact packaging, driving SKU diversification across brands and contributing to expansion of the detergent market. Shift Toward Fragrance Innovation & Sensory Experience Innovation in fragrance and sensorial experience has also emerged as a strong demand catalyst in the detergent market. Long-lasting scents and micro-encapsulated fragrance boosters are now among the top purchase drivers in Europe and Latin America. Consumers increasingly prioritize products with aromatherapy-inspired profiles lavender, citrus, or essential oil blends pushing brands to differentiate through unique sensory offerings. Technological advancements in enzymes and surfactants further reinforce this shift in the detergent market. New-generation enzyme cocktails enable superior stain removal at 20–30°C, supporting energy-efficient cold washing. Plant-derived, non-ionic surfactants are reducing skin irritation and improving biodegradability, aligning performance with dermatological safety.Regulation Has Become a Transformative Factor Regulation has become a transformative factor in the detergent market. Stricter ingredient mandates in regions like the EU, including limitations on phosphates, optical brighteners, microplastics, and allergens, are pushing manufacturers to redesign formulations using safer, more transparent ingredient systems. Retailers increasingly demand full ingredient disclosure and third-party dermatological certifications, intensifying innovation around clean-label detergents. Sustainability-driven packaging regulations are also accelerating the shift toward refill packs, concentrated tablets, and bulk refill stations that use up to 90% less plastic, reshaping the detergent market. Smart washing machines equipped with automated detergent dosing, load sensors, and auto-replenishment systems are influencing purchasing decisions. E-commerce growth supported by subscription models, online grocery platforms, and consumer review ecosystems is making detergent buying more personalised and convenient.

Rank Brand Price per kg (USD) approx. Producing Company Key Features 1 Surf Excel USD 1.58 Hindustan Unilever Limited Quick dissolving, powerful aroma, machine washable 2 Ariel USD 3.61 Procter & Gamble Oxy-stain molecules, suitable for both cotton and polycotton 3 Rin USD 0.97 Hindustan Unilever Limited Easy washing, eliminates difficult stains, bucket and machine washing 4 Tide USD 1.44 Procter & Gamble Powerful formula eliminates filth and tough stains 5 Ghadi US $0.68 RSPL Limited Dissolves easily, fights tough stains, pleasant scent 6 Nirma US $1.15 Nirma Ltd. Effective hand wash leaves clothes soft and fragrant 7 Presto USD 1.53 Foxtel Phosphate-free extends life of clothes, hand and machine washing 8 Henko Matic USD 1.26 Jyothy Labs Ltd. Prevents color fading, silky texture, perfumed scent Detergent Market Segment Analysis:

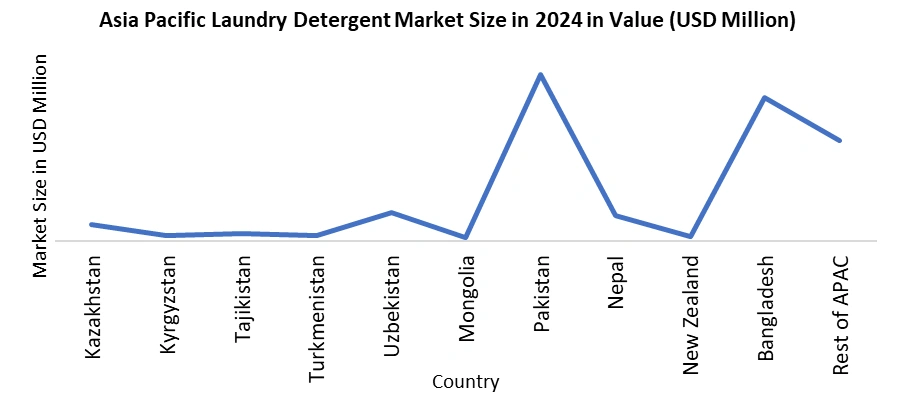

Based on Surfactant Type, the Detergent Market is segmented into Anionic, Non-Ionic, Cationic, and Others, with the Anionic segment leading in 2025 and projected to maintain dominance due to its high detergency, affordability, and widespread use in household laundry products. Anionic surfactants account for over 40% of global detergent formulations, supported by strong demand in Asia and Africa where powder detergents remain prevalent. Non-Ionic surfactants, growing steadily at 4–5% annually, are increasingly adopted in liquid and cold-wash detergents due to superior solubility and compatibility with enzyme-based systems. Cationic types benefit from rising fabric-softener and antimicrobial applications, while Others, including amphoteric blends, gain traction in premium, dermatologically safe, and eco-focused product lines.Based on Region, the Asia–Pacific region held dominant market share in the global detergent industry in 2025, driven by large population bases, expanding middle-class households, and ingrained hygiene practices. In key countries such as China, India, and those across Southeast Asia, detergents are considered essential consumer goods with highly consistent purchasing patterns, even during periods of economic fluctuation. Rapid urbanisation and the rise of dual-income and working-class households have accelerated the shift toward modern laundry habits, increasing the adoption of liquid detergents, compact packaging formats, and high-efficiency washing machines. Local manufacturers in many Asia–Pacific markets continue to strengthen their position by offering cost-effective, culturally tailored detergent formulations that meet local washing methods, water conditions, and fragrance preferences. These brands often compete directly with global players, contributing to a dynamic, innovation-led competitive landscape. Additionally, growing emphasis on hygiene, cleanliness, and fabric care across the region further supports stable and expanding demand for both basic and premium detergent products. Asia–Pacific maintains its leadership in the global detergent market through strong consumer fundamentals, diversified product offerings, and robust market adaptability.

Competitive Landscape

The global laundry-detergent market is dominated of key players such as Procter & Gamble (P&G), Unilever PLC and Henkel AG & Co. KGaA which have significant brand strength and international reach. However, the structure remains moderately concentrated: one source estimates that the leading four manufacturers control only about 35% of the global market, leaving a substantial portion to regional and smaller competitors. The emerging‐market local brands are gaining ground, particularly in price‐sensitive segments, increasing competitive pressure on the large incumbents to innovate, optimise cost and strengthen distribution.Recent Development

Unilever Launched Probiotic Cif Infinite Clean On April 20, 2025, Unilever PLC launched Cif Infinite Clean, a probiotic-based cleaning spray formulated for both hard and soft surfaces. The product focused on pet- and child-safe cleaning and relied on influencer-led digital promotion instead of traditional advertising. The launch aligned with Unilever’s strategy to expand within the $40-billion global home-care market, responding to rising demand for eco-conscious, microbiome-safe cleaning solutions. P&G Expanded Rollout of Eco-Friendly Tide Evo On July 29, 2025, P&G expanded the rollout of Tide evo, a concentrated detergent in a recyclable fiber-tile format designed for cold-water washing. Manufactured using renewable energy, Tide evo demonstrated strong early demand despite premium pricing, showing rising consumer willingness to pay for sustainable, plastic-free detergent innovations.Detergent Market Scope: Inquire Before Buying

Global Detergent Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 157.76 Bn. Forecast Period 2026 to 2032 CAGR: 15.2% Market Size in 2032: USD 424.79 Bn. Segments Covered: by Type Anionic Cationic Non-Ionic Others by Form Powder Liquid Gel Pods Others by Application Food and Beverage Processing Animal Hygiene Laundry Care Household Cleaning Personal Care Others by Distribution Channel Online Supermarket/Hypermarket Convenience Stores Independent Retailers Others Detergent Market, by Region

North America - United States, Canada, and Mexico Europe - United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe Asia Pacific - China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC Middle East and Africa - South Africa, GCC, and the Rest of ME&A South America - Brazil, Argentina Rest of South AmericaLeading Detergent Market, Key Players:

1. Unilever PLC 2. The Procter & Gamble Company 3. Johnson & Johnson 4. Church and Dwight Company 5. Henkel AG & Co. KGaA 6. Formula Corp 7. TY Cosmetic 8. Top Seller Chemicals 9. Rustic Strength 10. Reckitt Benckiser Group plc. 11. Sun Products Corporation 12. LG Household & Health Care, Inc. 13. Kao Corporation 14. Colgate-Palmolive Company 15. Hindustan Unilever Limited 16. Alconox, Inc. 17. Chemical Store Inc. 18. SAE Manufacturing Specialties Corp 19. NMB Technologies Corporation 20. General Organics, Inc 21. USA Detergent Manufacturing Inc. 22. AG Scientific 23. Persil 24. CascadeFAQs:

1. What are the growth drivers for the Detergent market? Ans. The increasing urbanisation, rising disposable incomes, and growing awareness of hygiene and cleanliness are expected to be the major drivers for the Detergent market. 2. What are the factors restraining the global Detergent market growth during the forecast period? Ans. The environmental concerns over chemical ingredients, high competition, and fluctuating raw material prices are expected to be the major factors restraining the global Detergent market growth during the forecast period. 3. Which region is expected to lead the global Detergent market during the forecast period? Ans. Asia Pacific is expected to lead the global Detergent market during the forecast period. 4. What is the projected market size and growth rate of the Detergent Market? Ans. The Detergent Market size was valued at USD 157.76 Billion in 2025 and the total Detergent revenue is expected to grow at a CAGR of 15.2% from 2025 to 2032, reaching nearly USD 424.79 Billion by 2032. 5. What segments are covered in the Detergent Market report? Ans. The segments covered in the Detergent market report are Type, Form, Application, Distribution Channel, and Region.

1. Detergent Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2025) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Detergent Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2025) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Integration Capabilities 2.3.10. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Detergent Market: Dynamics 3.1. Detergent Market Trends 3.2. Detergent Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Detergent Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Detergent Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 4.1. Detergent Market Size and Forecast, By Type (2025-2032) 4.1.1.1. Anionic 4.1.1.2. Cationic 4.1.1.3. Non-Ionic 4.1.1.4. Others 4.2. Detergent Market Size and Forecast, By Form (2025-2032) 4.2.1.1. Powder 4.2.1.2. Liquid 4.2.1.3. Gel 4.2.1.4. Pods 4.2.1.5. Others 4.3. Detergent Market Size and Forecast, By Application (2025-2032) 4.3.1.1. Food and Beverage Processing 4.3.1.2. Animal Hygiene 4.3.1.3. Laundry Care 4.3.1.4. Household Cleaning 4.3.1.5. Personal Care 4.3.1.6. Others 4.4. Detergent Market Size and Forecast, By Distribution Channel (2025-2032) 4.4.1.1. Online 4.4.1.2. Supermarket/Hypermarket 4.4.1.3. Convenience Stores 4.4.1.4. Independent Retailers 4.4.1.5. Others 4.5. Detergent Market Size and Forecast, By Region (2025-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Detergent Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 5.1. North America Detergent Market Size and Forecast, By Product Type (2025-2032) 5.1.1.1. Anionic 5.1.1.2. Cationic 5.1.1.3. Non-Ionic 5.1.1.4. Others 5.2. North America Detergent Market Size and Forecast, By Form (2025-2032) 5.2.1.1. Powder 5.2.1.2. Liquid 5.2.1.3. Gel 5.2.1.4. Pods 5.2.1.5. Others 5.3. North America Detergent Market Size and Forecast, By Application (2025-2032) 5.3.1.1. Food and Beverage Processing 5.3.1.2. Animal Hygiene 5.3.1.3. Laundry Care 5.3.1.4. Household Cleaning 5.3.1.5. Personal Care 5.3.1.6. Others 5.4. North America Detergent Market Size and Forecast, By Distribution Channel (2025-2032) 5.4.1.1. Online 5.4.1.2. Supermarket/Hypermarket 5.4.1.3. Convenience Stores 5.4.1.4. Independent Retailers 5.4.1.5. Others 5.5. North America Detergent Market Size and Forecast, by Country (2025-2032) 5.5.1.1. United States 5.5.1.2. Canada 5.5.1.3. Mexico 6. Europe Detergent Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 6.1. Europe Detergent Market Size and Forecast, By Product Type (2025-2032) 6.2. Europe Detergent Market Size and Forecast, By Form (2025-2032) 6.3. Europe Detergent Market Size and Forecast, By Application (2025-2032) 6.4. Europe Detergent Market Size and Forecast, By Distribution Channel (2025-2032) 6.5. Europe Detergent Market Size and Forecast, By Country (2025-2032) 6.5.1. United Kingdom 6.5.2. France 6.5.3. Germany 6.5.4. Italy 6.5.5. Spain 6.5.6. Sweden 6.5.7. Russia 6.5.8. Rest of Europe 7. Asia Pacific Detergent Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 7.1. Asia Pacific Detergent Market Size and Forecast, By Product Type (2025-2032) 7.2. Asia Pacific Detergent Market Size and Forecast, By Form (2025-2032) 7.3. Asia Pacific Detergent Market Size and Forecast, By Application (2025-2032) 7.4. Asia Pacific Detergent Market Size and Forecast, By Distribution Channel (2025-2032) 7.5. Asia Pacific Detergent Market Size and Forecast, by Country (2025-2032) 7.5.1. China 7.5.2. S Korea 7.5.3. Japan 7.5.4. India 7.5.5. Australia 7.5.6. Indonesia 7.5.7. Malaysia 7.5.8. Philippines 7.5.9. Thailand 7.5.10. Vietnam 7.5.11. Rest of Asia Pacific 8. Middle East and Africa Detergent Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 8.1. Middle East and Africa Detergent Market Size and Forecast, By Product Type (2025-2032) 8.2. Middle East and Africa Detergent Market Size and Forecast, By Form (2025-2032) 8.3. Middle East and Africa Detergent Market Size and Forecast, By Application (2025-2032) 8.4. Middle East and Africa Detergent Market Size and Forecast, By Distribution Channel (2025-2032) 8.5. Middle East and Africa Detergent Market Size and Forecast, By Country (2025-2032) 8.5.1. South Africa 8.5.2. GCC 8.5.3. Nigeria 8.5.4. Rest of ME&A 9. South America Detergent Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 9.1. South America Detergent Market Size and Forecast, By Product Type (2025-2032) 9.2. South America Detergent Market Size and Forecast, By Form (2025-2032) 9.3. South America Detergent Market Size and Forecast, By Application (2025-2032) 9.4. South America Detergent Market Size and Forecast, By Distribution Channel (2025-2032) 9.5. South America Detergent Market Size and Forecast, By Country (2025-2032) 9.5.1. Brazil 9.5.2. Argentina 9.5.3. Colombia 9.5.4. Chile 9.5.5. Rest of South America 10. Company Profile: Key Players 10.1. Unilever PLC 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. The Procter & Gamble Company 10.3. Johnson & Johnson 10.4. Church and Dwight Company 10.5. Henkel AG & Co. KGaA 10.6. Formula Corp 10.7. TY Cosmetic 10.8. Top Seller Chemicals 10.9. Rustic Strength 10.10. Reckitt Benckiser Group plc. 10.11. Sun Products Corporation 10.12. LG Household & Health Care, Inc. 10.13. Kao Corporation 10.14. Colgate-Palmolive Company 10.15. Hindustan Unilever Limited 10.16. Alconox, Inc. 10.17. Chemical Store Inc. 10.18. SAE Manufacturing Specialties Corp 10.19. NMB Technologies Corporation 10.20. General Organics, Inc 10.21. USA Detergent Manufacturing Inc. 10.22. AG Scientific 10.23. Persil 10.24. Cascade 11. Key Findings 12. Analyst Recommendations 13. Detergent Market – Research Methodology