Dental Surgical Diagnostic Devices market size reached USD 7.32 Bn in 2022 and is expected to reach USD 13.04 Bn by 2029, growing at a CAGR of 8.6 % during the forecast period. According to the World Health Organization, over 2.3 billion people worldwide suffer from dental caries of permanent teeth. Digital technology is transforming the dental industry, and dental clinics and hospitals are increasingly adopting digital diagnostic devices such as X-ray machines, digital scanners, and intraoral cameras. The introduction of CAD/CAM technology and 3D imaging has also led to improvements in patient outcomes, as these technologies reduce the need for multiple appointments and allow for more efficient treatment. The dental surgical diagnostic devices market is driven by rapid technological advancements, the development of new materials and devices, and improvements in imaging and diagnostic technologies.Dentsply Sirona is a leading manufacturer of dental equipment and supplies and is known for its broad range of products for dental professionals. The company produces a wide range of dental products such as dental surgical diagnostic devices, imaging systems, CAD/CAM systems, and other dental equipment and supplies. Asia Pacific region has an emerging market for dental surgical diagnostic devices, with increasing demand for dental services and a growing focus on healthcare infrastructure development.

To know about the Research Methodology :- Request Free Sample Report

Dental Surgical Diagnostic Devices Market Dynamics:

Dental technology advancements are the primary growth driver for the Dental Surgical Diagnostic Devices market. Dental technology advancements have played a significant role in the growth of the dental surgical diagnostic devices market. The development of advanced imaging technologies, such as cone beam computed tomography (CBCT) and digital radiography has revolutionized the way dentists diagnose and treat dental conditions. CBCT scans provide highly detailed 3D images of the teeth, jawbone, and surrounding tissues, enabling dentists to identify and diagnose a wide range of dental issues with greater accuracy and precision than traditional X-rays. Artificial intelligence has had a significant impact on the dental surgical diagnostic devices market by improving the accuracy and efficiency of dental diagnoses and treatment planning. The Planmeca PlanMill 35 is a leading manufacturer of Dental Surgical Diagnostic Devices which provides advanced scanning technology that improves accuracy, speed, and ease of use. With its intuitive user interface and automated features, it allows dentists to create restorations quickly and easily, without the need for multiple appointments.Rising dental caries cases and an increase in tooth repair procedures drive the Dental Surgical Diagnostic Devices market. Over the past decade, there has been a significant increase in the global burden of dental diseases, including dental cavities, edentulism, and periodontal diseases. The American Association of Oral and Maxillofacial Surgeons (MOMS) found that nearly 70% of individuals aged 35 to 44 lose at least one permanent tooth annually because of decay, gum disease, or trauma. Tooth decay affects people of all ages, and the prevalence of missing and decaying teeth (DMT) has been rising worldwide. The Global Burden of Disease Study indicates that 4.2 billion people worldwide suffer from oral disorders, including 624 million children with primary tooth decay and 2.4 billion individuals with permanent dental caries in 2021. Despite this, the CDC reports that only 68.9% of individuals over the age of 18 received dental checkups or cleanings in 2021. Thus, the increasing prevalence of dental diseases is fuelling the demand for the Dental Surgical Diagnostic Devices market during the forecast period.

Growing emphasis on emerging markets and increasing disposable income levels drive the Dental Surgical Diagnostic Devices market. According to MMR, South Korea and Italy have the highest penetration rates for dental surgical diagnostic devices. This means that these countries have a relatively high proportion of dental professionals and facilities compared to other countries. The reasons for these high rates may include factors such as the availability of advanced dental technologies and the importance placed on dental health in these countries. The Dental Consumables market potential in these locations presents considerable opportunity for industry players. Furthermore, Increased awareness about oral health is expected to drive the Dental Surgical Diagnostic Devices industry in the coming years. Several oral health awareness campaigns are run across the world to raise public knowledge of oral hygiene. Furthermore, Favorable government policies and initiatives attract several industry stakeholders to enter this market. In China, the government's deregulation and relaxation of restrictions for establishing private healthcare facilities have increased the number of privately held dentistry clinics and they encourage the adoption of innovative technology such as CAD/CAM systems and high-quality restoration equipment and materials. The introduction of advanced restoration products and digital systems as well as training workshops for dental practitioners to ensure the efficient use of advanced equipment and restoration products are expected to provide significant growth opportunities for the Dental Surgical Diagnostic Devices market players during the forecast period.

The high cost associated with tests and equipment are restraining the growth of the Dental Surgical Diagnostic Devices Market The high cost of Dental Surgical Diagnostic Devices is a potential challenge for the growth of the market particularly in developing countries or regions with limited healthcare budgets. In addition, some insurance providers may not cover the cost of these devices or may offer limited coverage, which can further limit their adoption. The high cost of these devices can also affect patient access to care. Patients may be unable to pay the high costs associated with diagnostic tests, which can lead to delays in diagnosis and treatment. This can have negative implications for patient outcomes and overall healthcare costs. Thus, the Dental Surgical Diagnostic Devices Market is expected to hamper during the forecast period. However, there are efforts underway to address the cost challenge in the Dental Surgical Diagnostic Devices market. For instance, some manufacturers are exploring new business models such as leasing or financing options that make these devices more accessible and affordable. Additionally, governments and regulatory agencies are working to create policies that promote price transparency and competition, which can help lower costs over time.

Dental Surgical Diagnostic Devices Market Segment Analysis:

Based on the Devices, the Dental Diagnostic Devices segment held the largest revenue share of 15.2 % in 2022 and is expected to continue to experience significant growth in the coming years. The growth of this segment is driven by factors such as increasing awareness of oral health, growing demand for cosmetic dentistry, and technological advancements in dental diagnostic equipment. Some of the key players Danaher Corporation, Carestream Health, Inc., Dentsply Sirona Inc., Henry Schein, Inc., and Planmeca Oy, among others are investing heavily in research and development to bring innovative and technologically advanced devices to the Dental Surgical Diagnostic Devices market, which is expected to drive growth in the segment. According to MMR study, the global CAD/CAM Segment is expected to grow at a CAGR of approximately 8.1% during the forecast period. The growth is attributed to increasing demand for cosmetic dentistry, the rising prevalence of dental diseases, and technological advancements in CAD/CAM systems.

Dental Surgical Diagnostic Devices Market Regional Insights

According to a report by MMR, the North America Dental Surgical Diagnostic Devices market is expected to grow at a CAGR of 9.2% during the forecast period. The market growth is being driven by factors such as the increasing prevalence of dental diseases, rising demand for cosmetic dentistry, and the availability of favorable reimbursement policies for dental procedures. Some of the key players in the North America Dental Surgical Diagnostic Devices market are investing heavily in research and development to bring innovative and technologically advanced dental surgical diagnostic devices. There has been a growing trend towards minimally invasive dental procedures in North America, as patients increasingly seek out treatments that are less invasive and have shorter recovery times. This has led to the development of new dental surgical diagnostic devices that allow for minimally invasive procedures, such as laser dentistry. The US is the largest market for Dental Surgical Diagnostic Devices in North America, followed by Canada. The growing awareness of oral health, the increasing number of dental clinics and hospitals, and the availability of advanced diagnostic and treatment technologies are some of the factors contributing to the growth of the market in this region. Danaher Corporation is a leading manufacturer of dental surgical diagnostic devices, such as dental lasers, intraoral cameras, and digital imaging systems in the North American region. Danaher's KaVo Kerr launched the KaVo X Pro intraoral scanner, which provides fast, accurate, and easy-to-use digital impressions for dental procedures. The Dental Surgical Diagnostic Devices market in the Asia Pacific region is expected to experience significant growth in the coming years. Countries such as China, India, Japan, and South Korea are expected to be the major contributors to the growth of the dental surgical diagnostic devices market in the Asia Pacific. In these countries, increasing disposable income and a growing middle class are leading to increased demand for advanced dental care and diagnostic tools. Additionally, favorable government policies and initiatives aimed at improving oral healthcare are also driving market growth. The increasing prevalence of dental diseases such as dental caries and periodontal diseases is also fuelling demand for dental surgical diagnostic devices in the region. For instance, in India, it is estimated that around 50% of the population suffers from dental caries, and the prevalence of periodontal diseases is also high. This has created a significant demand for dental diagnostic devices in the country.Dental Surgical Diagnostic Devices Market Research Methodology:

The Market offers a comprehensive overview of the current market situation and provides a forecast until 2029. This report provides qualitative and quantitative information that highlights important market developments, trends, challenges, competition, and new opportunities within the Dental Surgical Diagnostic Devices Market. This report aims to provide a comprehensive presentation of the global market for Dental Surgical Diagnostic Devices, with both quantitative and qualitative analysis to help readers develop business/growth strategies, assess the market competitive situation, and analyze their position in the current marketplace. The report also discusses technological trends and new product developments. It includes Porter’s Five Forces analysis, which explains the five forces: buyers' bargaining power, supplier's bargaining power, the threat of new entrants, and the degree of competition in the market. The report also focuses on the competitive landscape of the market.The analysis will help the market players to understand the present situation of the market.Dental Surgical Diagnostic Devices Market Scope: Inquire before buying

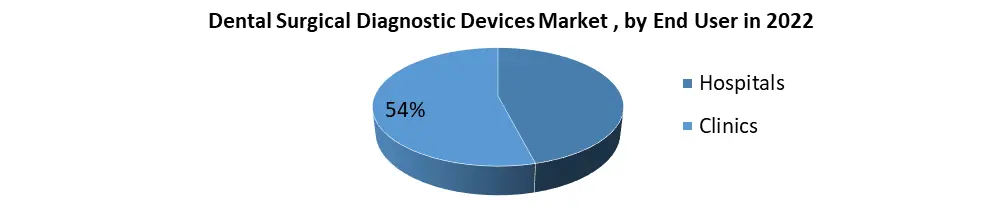

Dental Surgical Diagnostic Devices Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 7.32 Bn. Forecast Period 2023 to 2029 CAGR: 8.6 % Market Size in 2029: US $ 13.04 Bn. Segments Covered: by Devices 1. Diagnostic Devices 1. CAD/CAM Systems 2. Instrument Delivery systems 3. Extra oral Radiology Equipment 4. Intra Oral Radiology Equipment 5. Cone Beam Computed Tomography (CBCT) 2. Surgical Devices 1. Dental Laser 2. Dental handpieces 3. Dental Forceps & Pliers 4. Curettes and Scalers 5. Dental Probes 6. Dental Burs 7. Electrosurgical Equipment 8. Others by End User 1. Hospitals 2. Clinics Dental Surgical Diagnostic Devices Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Dental Surgical Diagnostic Devices Market, Key Players are

1. Biolase Technologies 2. Sirona Dental Systems Inc. 3. 3M Company 4. Danaher Corp. 5. American Medicals 6. Zolar Dental Laser 7. Midmark Diagnostic Group 8. A-Dec Inc. 9. Dentsply International, Inc. 10. Ivoclar Vivadent AG 11. Carestream Health, Inc. 12. Planmeca OY 13. Henry Schein Inc. 14. KaVo Kerr FAQs: 1. Who are the key players in the market? Ans. Carestream Health, Danaher Corporation, Biolase Technologies and Zolar Dental Laser are the major companies operating in the market. 2. Which Diagnostic Devices segment dominates the market? Ans. The CAD/CAM Systems segment accounted for the largest share of the global Dental Surgical Diagnostic Devices market in 2022. 3. How big is the market? Ans. The Global market size reached USD 7.32 Bn in 2022 and is expected to reach USD 13.04 Bn by 2029, growing at a CAGR of 8.6 % during the forecast period. 4. What are the key regions in the global market? Ans. Based On the region, the Market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and Latin America. North America dominates the global market. 5. What is the study period of this market? Ans. The Global Market is studied from 2021 to 2029.

1. Dental Surgical Diagnostic Devices Market: Research Methodology 2. Dental Surgical Diagnostic Devices Market: Executive Summary 3. Dental Surgical Diagnostic Devices Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Dental Surgical Diagnostic Devices Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Dental Surgical Diagnostic Devices Market: Segmentation (by Value USD) 5.1. Dental Surgical Diagnostic Devices Market, by Devices (2022-2030) 5.1.1. Diagnostic Devices o CAD/CAM Systems o Instrument Delivery systems o Extra oral Radiology Equipment o Intra Oral Radiology Equipment o Cone Beam Computed Tomography (CBCT) 5.1.2. Surgical Devices o Dental Laser o Dental handpieces o Dental Forceps & Pliers o Curettes and Scalers o Dental Probes o Dental Burs o Electrosurgical Equipment o Others 5.2. Dental Surgical Diagnostic Devices Market, by End User (2022-2030) 5.2.1. Hospitals 5.2.2. Clinics 5.3. Dental Surgical Diagnostic Devices Market, by Region (2022-2030) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Dental Surgical Diagnostic Devices Market (by Value USD) 6.1. North America Dental Surgical Diagnostic Devices Market, by Devices (2022-2030) 6.1.1. Diagnostic Devices o CAD/CAM Systems o Instrument Delivery systems o Extra oral Radiology Equipment o Intra Oral Radiology Equipment o Cone Beam Computed Tomography (CBCT) 6.1.2. Surgical Devices o Dental Laser o Dental handpieces o Dental Forceps & Pliers o Curettes and Scalers o Dental Probes o Dental Burs o Electrosurgical Equipment o Others 6.2. North America Dental Surgical Diagnostic Devices Market, by End User (2022-2030) 6.2.1. Hospitals 6.2.2. Clinics 6.3. North America Dental Surgical Diagnostic Devices Market, by Country (2022-2030) 6.3.1. United States 6.3.2. Canada 6.3.3. Mexico 7. Europe Dental Surgical Diagnostic Devices Market (by Value USD) 7.1. Europe Dental Surgical Diagnostic Devices Market, by Devices (2022-2030) 7.2. Europe Dental Surgical Diagnostic Devices Market, by End User (2022-2030) 7.3. Europe Dental Surgical Diagnostic Devices Market, by Industry (2022-2030) 7.4. Europe Dental Surgical Diagnostic Devices Market, by Country (2022-2030) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Dental Surgical Diagnostic Devices Market (by Value USD) 8.1. Asia Pacific Dental Surgical Diagnostic Devices Market, by Devices (2022-2030) 8.2. Asia Pacific Dental Surgical Diagnostic Devices Market, by End User (2022-2030) 8.3. Asia Pacific Dental Surgical Diagnostic Devices Market, by Country (2022-2030) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Vietnam 8.3.9. Taiwan 8.3.10. Bangladesh 8.3.11. Pakistan 8.3.12. Rest of Asia Pacific 9. Middle East and Africa Dental Surgical Diagnostic Devices Market (by Value USD) 9.1. Middle East and Africa Dental Surgical Diagnostic Devices Market, by Devices (2022-2030) 9.2. Middle East and Africa Dental Surgical Diagnostic Devices Market, by End User (2022-2030) 9.3. Middle East and Africa Dental Surgical Diagnostic Devices Market, by Country (2022-2030) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Egypt 9.3.4. Nigeria 9.3.5. Rest of ME&A 10. South America Dental Surgical Diagnostic Devices Market (by Value USD) 10.1. South America Dental Surgical Diagnostic Devices Market, by Devices (2022-2030) 10.2. South America Dental Surgical Diagnostic Devices Market, by End User (2022-2030) 10.3. South America Dental Surgical Diagnostic Devices Market, by Country (2022-2030) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Rest of South America 11. Company Profile: Key players 11.1. IBM Corporation 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Biolase Technologies 11.3. Sirona Dental Systems Inc. 11.4. 3M Company 11.5. Danaher Corp. 11.6. American Medicals 11.7. Zolar Dental Laser 11.8. Midmark Diagnostic Group 11.9. A-Dec Inc. 11.10. Dentsply International, Inc. 11.11. Ivoclar Vivadent AG 11.12. Carestream Health, Inc. 11.13. Planmeca OY 11.14. Henry Schein Inc. 11.15. KaVo Kerr 12. Key Findings 13. Industry Recommendation