Clinical Trial Supply and Logistic Market size was valued at US$ 20.80 Bn. in 2022 and the total revenue is expected to grow at CAGR 9.10% through 2022 to 2029, reaching nearly US$ 38.25 Bn.Clinical Trial Supply and Logistic Market Overview:

The clinical trial phase of research is the trial of the end product to maeasure the safety and efficacy of the drug. Clinical Trial and logistic service providers are aiming to provide support and equipment for clinical trials to the research institute. The service provider also manages the trial sits and contacts the patients on which drug can be tested. The market is driven by technological advancement in the supply chain. Increasing Research and Development expenditure by pharmaceutical and biopharmaceutical firms and rising number of Clinical Trial conducted globally, these factor is contributing to the market growth.To know about the Research Methodology:- Request Free Sample Report

Clinical Trial Supply and Logistic Market Dynamics:

The Pharmaceutical and biopharmaceutical sector is one of the biggest Research and Development spenders globally. Research and Development expenditure has risen for drug development and researches these are the main factor responsible for driving the market growth. Growing complexity in clinical studies and increased competition among key players are the factors responsible for the adoption of new technologies in supply chain management. As per the research and published article in 2019, 40,000 novel investigators globally are conducting a minimum of one clinical trial that is Food and Drug Administration (FDA) regulated. The rising incidence of cancer globally is providing novel opportunities for the biopharmaceutical global community and clinical trial supply and logistics management to develop new products in the market. As per the World Health Organization (WHO), approximately 555,318 latest cancer were noticed in the Middle East, in the year 2019. This region is expected to foresee over 961,098 cases by 2030, which would be the most number of cases of cancer among other global regions. The Covid-19 pandemic introduced logistical challenges to the clinical trial market. With the rapid and widespread adoption of the remote trial approach, the conventional supply chain has seen significant changes. Direct to patient approaches were used to manage the various logistical constraint of remote trials. The entry of new diseases, infections, and viruses are boost the Clinical Trial Supply and Logistic market during the forecast period. Because these new entries of disease are responsible for new Drug Development and Clinical Trials in the research institute.Clinical Trial Supply and Logistic Market Segment Analysis:

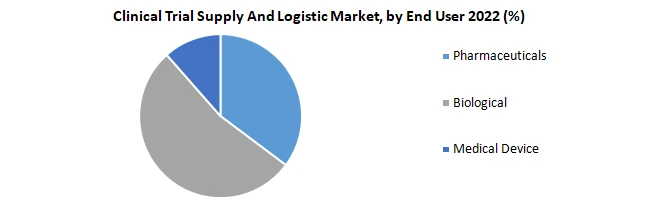

Based on the Service Type, The Clinical Trial Supply and Logistic Market is segmented into Logistics & Distribution, Storage & retention, Packaging, labeling, and blinding, Manufacturing, Comparator sourcing. Logistics & distribution segment is dominated by the Clinical Trial Supply and Logistic Market with the largest market share of 25% in the year 2021.This segment is also estimated to grow with the highest CAGR of xx% during the forecast period. This is because of an increasing number of trials and drug development of sensitive products and the highly regulated structure of the industry. Technology development is positively impacting the global market, both on the inbound and outbound side. Based on the End User, The Clinical Trial Supply and Logistic Market is segmented into Pharmaceuticals, Biological, and Medical Device. The pharmaceuticals segment has dominated the market with the highest market share of 41% in the year 2022. An increasing number of clinical studies conducted by pharmaceutical companies and Research and Development investment by these companies this factors are driving the market growth. Technological development and research are also the main dominating factors for the Market. The biological segment is the second largest segment in the market with 28% of the market share in the year 2021. This segment is also estimated to grow with the highest CAGR during the forecasting period.

Clinical Trial Supply and Logistic Market Regional Insights:

North America dominated the Clinical Trial Supply and Logistic Market with the largest market share of 36.2% in 2022. It is also expected to register a CAGR of 5.8% during the forecast period. An increasing number of clinical trials for drug development conducted by pharmaceutical companies drive the market in this region. According to research, the U.S. Performs the highest number of clinical trial operations per year.US investment in medical and health, Research and Development grew by 45% from 2019 to 2021. The U.S Also spends 3.6 trillion on Research and Development, medical, and health. Asia Pacific is estimated to grow with the highest CAGR of 7.8% during the forecasting period. The region has access to a large and diversified patient pool, cheaper recruitment costs, and favourable policies that make the Asia Pacific desirable for clinical studies. The technological development and entry of new diseases, infections, and viruses in the region is the main responsible factor in growing the Clinical Trial Supply and Logistic Market during the forecast period. Europe is anticipated to grow rapidly in this market thanks to the easy accessibility of new technology. The highest growth has been seen in this region. For Example, Marken offers in-home clinical trial services such as DTP delivery and collection of biological samples. Marken's direct-to-patient services establish a supply chain that allows drugs to be delivered to the patient instead of the site. The objective of the report is to present a comprehensive analysis of the Clinical Trial Supply and Logistic Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the Clinical Trial Supply and Logistic Market dynamic, structure by analyzing the market segments and project the Market size. Clear representation of competitive analysis of key players by Product, price, financial position, Product portfolio, growth strategies, and regional presence in the Clinical Trial Supply and Logistic Market make the report investor’s guide.Clinical Trial Supply and Logistic Market Scope: Inquire before buying

Global Clinical Trial Supply and Logistic Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 20.80 Bn. Forecast Period 2023 to 2029 CAGR: 9.10% Market Size in 2029: US$ 38.25 Bn. Segments Covered: by Type Logistics & distribution Storage & retention Packaging, labeling, and blinding Manufacturing Comparator sourcing by End Users Pharmaceuticals Biological Medical Device Clinical Trial Supply and Logistic Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Clinical Trial Supply and Logistic Market Major key players:

1. Piramal Pharma Solutions 2. UDG Healthcare 3. DHL 4. FedEx 5. Movianto 6. Packaging Coordinators Inc. 7. Thermo Fisher Scientific (Patheon) 8. Catalent, Inc. 9. Parexel 10.Almac Group 11.Marken 12.Merck & Co. Inc. 13.GlaxoSmithKline plc 14.SK Bioscience 15.TransMotion Medical Inc. Frequently Asked Questions: 1. Which region has the largest share in Global Clinical Trial Supply and Logistic Market? Ans: North America region holds the highest share in 2022. 2. What is the growth rate of Global Clinical Trial Supply and Logistic Market? Ans: The Global Market is growing at a CAGR of 9.10% during forecasting period 2023-2029. 3. What is scope of the Global market report? Ans: Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global market? Ans: The important key players in the Global Market are – Piramal Pharma Solutions, UDG Healthcare, DHL, FedEx, Movianto, Packaging Coordinators Inc., Thermo Fisher Scientific (Patheon), Catalent, Inc., Parexel, Almac Group, Marken, Merck & Co. Inc., and GlaxoSmithKline plc. 5. What is the study period of this market? Ans: The Global Market is studied from 2022 to 2029.

1. Clinical Trial Supply and Logistic Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Clinical Trial Supply and Logistic Market: Dynamics 2.1. Clinical Trial Supply and Logistic Market Trends by Region 2.1.1. North America Clinical Trial Supply and Logistic Market Trends 2.1.2. Europe Clinical Trial Supply and Logistic Market Trends 2.1.3. Asia Pacific Clinical Trial Supply and Logistic Market Trends 2.1.4. Middle East and Africa Clinical Trial Supply and Logistic Market Trends 2.1.5. South America Clinical Trial Supply and Logistic Market Trends 2.2. Clinical Trial Supply and Logistic Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Clinical Trial Supply and Logistic Market Drivers 2.2.1.2. North America Clinical Trial Supply and Logistic Market Restraints 2.2.1.3. North America Clinical Trial Supply and Logistic Market Opportunities 2.2.1.4. North America Clinical Trial Supply and Logistic Market Challenges 2.2.2. Europe 2.2.2.1. Europe Clinical Trial Supply and Logistic Market Drivers 2.2.2.2. Europe Clinical Trial Supply and Logistic Market Restraints 2.2.2.3. Europe Clinical Trial Supply and Logistic Market Opportunities 2.2.2.4. Europe Clinical Trial Supply and Logistic Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Clinical Trial Supply and Logistic Market Drivers 2.2.3.2. Asia Pacific Clinical Trial Supply and Logistic Market Restraints 2.2.3.3. Asia Pacific Clinical Trial Supply and Logistic Market Opportunities 2.2.3.4. Asia Pacific Clinical Trial Supply and Logistic Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Clinical Trial Supply and Logistic Market Drivers 2.2.4.2. Middle East and Africa Clinical Trial Supply and Logistic Market Restraints 2.2.4.3. Middle East and Africa Clinical Trial Supply and Logistic Market Opportunities 2.2.4.4. Middle East and Africa Clinical Trial Supply and Logistic Market Challenges 2.2.5. South America 2.2.5.1. South America Clinical Trial Supply and Logistic Market Drivers 2.2.5.2. South America Clinical Trial Supply and Logistic Market Restraints 2.2.5.3. South America Clinical Trial Supply and Logistic Market Opportunities 2.2.5.4. South America Clinical Trial Supply and Logistic Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Clinical Trial Supply and Logistic Industry 2.8. Analysis of Government Schemes and Initiatives For Clinical Trial Supply and Logistic Industry 2.9. Clinical Trial Supply and Logistic Market Trade Analysis 2.10. The Global Pandemic Impact on Clinical Trial Supply and Logistic Market 3. Clinical Trial Supply and Logistic Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 3.1.1. Logistics & distribution 3.1.2. Storage & retention 3.1.3. Packaging, labeling, and blinding 3.1.4. Manufacturing 3.1.5. Comparator sourcing 3.2. Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 3.2.1. Pharmaceuticals 3.2.2. Biological 3.2.3. Medical Device 3.2.4. 3.2.5. 3.3. Clinical Trial Supply and Logistic Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Clinical Trial Supply and Logistic Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 4.1.1. Logistics & distribution 4.1.2. Storage & retention 4.1.3. Packaging, labeling, and blinding 4.1.4. Manufacturing 4.1.5. Comparator sourcing 4.2. North America Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 4.2.1. Pharmaceuticals 4.2.2. Biological 4.2.3. Medical Device 4.2.4. 4.2.5. 4.3. North America Clinical Trial Supply and Logistic Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 4.3.1.1.1. Logistics & distribution 4.3.1.1.2. Storage & retention 4.3.1.1.3. Packaging, labeling, and blinding 4.3.1.1.4. Manufacturing 4.3.1.1.5. Comparator sourcing 4.3.1.2. United States Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 4.3.1.2.1. Pharmaceuticals 4.3.1.2.2. Biological 4.3.1.2.3. Medical Device 4.3.1.2.4. 4.3.1.2.5. 4.7.2. Canada 4.3.2.1. Canada Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 4.3.2.1.1. Logistics & distribution 4.3.2.1.2. Storage & retention 4.3.2.1.3. Packaging, labeling, and blinding 4.3.2.1.4. Manufacturing 4.3.2.1.5. Comparator sourcing 4.3.2.2. Canada Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 4.3.2.2.1. Pharmaceuticals 4.3.2.2.2. Biological 4.3.2.2.3. Medical Device 4.3.2.2.4. 4.3.2.2.5. 4.7.3. Mexico 4.3.3.1. Mexico Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 4.3.3.1.1. Logistics & distribution 4.3.3.1.2. Storage & retention 4.3.3.1.3. Packaging, labeling, and blinding 4.3.3.1.4. Manufacturing 4.3.3.1.5. Comparator sourcing 4.3.3.2. Mexico Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 4.3.3.2.1. Pharmaceuticals 4.3.3.2.2. Biological 4.3.3.2.3. Medical Device 4.3.3.2.4. 4.3.3.2.5. 5. Europe Clinical Trial Supply and Logistic Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 5.2. Europe Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 5.3. Europe Clinical Trial Supply and Logistic Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 5.3.1.2. United Kingdom Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 5.3.2. France 5.3.2.1. France Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 5.3.2.2. France Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 5.3.3.2. Germany Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 5.3.4.2. Italy Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 5.3.5.2. Spain Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 5.3.6.2. Sweden Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 5.3.7.2. Austria Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 5.3.8.2. Rest of Europe Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6. Asia Pacific Clinical Trial Supply and Logistic Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.7. Asia Pacific Clinical Trial Supply and Logistic Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.1.2. China Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.2.2. S Korea Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.3.2. Japan Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.3.4. India 6.3.4.1. India Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.4.2. India Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.5.2. Australia Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.6.2. Indonesia Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.7.2. Malaysia Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.8.2. Vietnam Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.9.2. Taiwan Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 6.3.10.2. Rest of Asia Pacific Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 7. Middle East and Africa Clinical Trial Supply and Logistic Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 7.7. Middle East and Africa Clinical Trial Supply and Logistic Market Size and Forecast, by Country (2022-2029) 7.7.1. South Africa 7.3.1.1. South Africa Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 7.3.1.2. South Africa Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 7.7.2. GCC 7.3.2.1. GCC Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 7.3.2.2. GCC Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 7.7.3. Nigeria 7.3.3.1. Nigeria Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 7.3.3.2. Nigeria Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 7.3.4.2. Rest of ME&A Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 8. South America Clinical Trial Supply and Logistic Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 8.2. South America Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 8.7. South America Clinical Trial Supply and Logistic Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 8.3.1.2. Brazil Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 8.3.2.2. Argentina Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Clinical Trial Supply and Logistic Market Size and Forecast, by Type (2022-2029) 8.3.3.2. Rest Of South America Clinical Trial Supply and Logistic Market Size and Forecast, by End Users (2022-2029) 9. Global Clinical Trial Supply and Logistic Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Clinical Trial Supply and Logistic Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Piramal Pharma Solutions 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. UDG Healthcare 10.3. DHL 10.4. FedEx 10.5. Movianto 10.6. Packaging Coordinators Inc. 10.7. Thermo Fisher Scientific (Patheon) 10.8. Catalent, Inc. 10.9. Parexel 10.10. Almac Group 10.11. Marken 10.12. Merck & Co. Inc. 10.13. GlaxoSmithKline plc 10.14. SK Bioscience 10.15. TransMotion Medical Inc. 11. Key Findings 12. Industry Recommendations 13. Clinical Trial Supply and Logistic Market: Research Methodology 14. Terms and Glossary