The Cargo Transportation Insurance Market size was valued at USD 57.91 Billion in 2024, and is expected to grow by 3.2 % from 2024 to 2032, reaching USD 74.51 Billion in 2032Cargo Transportation Insurance Market Overview

The cargo transportation insurance provides financial protection against the physical loss or damage of goods during transit via sea, air, or land. It encompasses a diverse range of coverages aimed at mitigating risks in global goods movement. Growing cross-border trade, particularly from e-commerce platforms, exporters, importers, and manufacturers, is boosting demand for uninterrupted and comprehensive coverage. The market features both traditional insurers and innovative insurtech providers offering advanced analytics, digital platforms, and parametric insurance models to deliver faster, tailored solutions. In 2024, North America dominated the market, supported by its advanced logistics infrastructure, robust regulatory framework, and rapid adoption of technology-enabled insurance offerings. Key industry developments highlight this growth trajectory. Allianz SE integrated AI-powered cargo tracking systems in 2024 to enhance claims efficiency, while Chubb Ltd. launched specialized war-risk coverage for high-conflict trade routes. In May 2024, Arta partnered with Chubb to embed valuables insurance for high-value shipments, strengthening tailored service offerings. In early 2025, Fortress Logistics Insurance Services LLC introduced streamlined logistics coverage in the U.S., targeting the expanding freight sector. These innovations reflect the industry’s focus on efficiency, security, and adapting to evolving global trade dynamics.To know about the Research Methodology :- Request Free Sample Report

Cargo Transportation Insurance Market Dynamics

Growing E-commerce industry to drive the growth Cargo Transportation Insurance Market The significantly increases shipment volumes, delivery frequency, and cross-border trade drives the growth of E-commerce industry. The diversity of e-commerce shipments from electronics and apparel to perishables demands customized, flexible policies, while rising international trade adds complexity through multimodal transport and customs risks. Technological integration, such as real-time tracking, AI-driven risk assessment, and automated claims processing, further strengthens the appeal and efficiency of cargo insurance, with innovations such as Echo Global Logistics’ EchoInsure+ offering fast, deductible-free claims for small shipments. India’s booming digital economy, supported by over 944 million internet subscribers, 100% FDI in e-commerce, and increasing investments from major players such as Flipkart, Walmart, and Google, is amplifying cargo flows. Social commerce, quick commerce, and growing tier-2 and tier-3 city participation are expanding delivery networks, increasing exposure to logistical risks. As regulatory requirements tighten and businesses aim to maintain consumer trust, cargo insurance becomes an essential safeguard-commerce growth directly fuels demand for cargo transportation insurance by amplifying shipment volume, value, and complexity necessitating advanced, tailored coverage to protect goods across diverse and high-risk delivery environments.Fluctuating Freight Costs limits the Cargo Transportation Insurance Market growth Fluctuating rates create uncertainty, discouraging long-term commitments from customers and complicating pricing strategies for insurers. In 2025, ocean freight rates exceeded $6,000–$7,000 per 40-foot container at peak times due to tariff-driven frontloading and capacity imbalances, before declining sharply as supply improved. Such volatility disrupts stable premium setting and impacts market growth. Rapidly changing freight costs, shifting trade routes, and modal shifts such as increased rail use add complexity to risk assessment, raising operational costs for underwriters. This often results in higher premiums or restricted coverage, particularly affecting cost-sensitive small and medium-sized enterprises that reduce or forgo insurance during cost spikes. Freight volatility often coincides with supply chain disruptions, including port congestion, labor strikes, and geopolitical tensions, which heighten risks and claims. Developing flexible, usage-based policies to adapt to these fluctuations is costly and operationally challenging, limiting insurers’ ability to offer competitive, customized products. Unpredictable freight rates undermine pricing stability, increase underwriting challenges, and reduce demand, collectively restraining the Cargo Transportation Insurance Market’s growth potential. Digital Insurance Platforms creates lucrative growth opportunities to the Cargo Transportation Insurance Market The Digital insurance platforms are unlocking lucrative growth opportunities in the cargo transportation insurance market by enhancing accessibility, efficiency, and customization. These platforms make insurance more inclusive, particularly for small and medium enterprises (SMEs) and transporters traditionally underserved by conventional channels. For instance, in India, the 2023 partnership between Vahak and SecureNow enables transporters to purchase transit insurance digitally during booking, increasing coverage rates and reducing administrative burdens. Automation of policy issuance, premium calculation, and claims processing further drives market appeal. In the UK, Breeze’s 2023 collaboration with Ceedbox and Cardinal Global Logistics introduced an automated cargo insurance solution that minimizes manual inputs, cuts errors, and accelerates claims resolution. Integration of insurance directly into logistics platforms, such as Echo Global Logistics’ EchoInsure+ in the US, provides seamless coverage options at the time of freight booking, encouraging higher adoption. Moreover, digital platforms leverage AI, blockchain, IoT, and advanced analytics to offer usage-based, customizable policies, enhance risk assessment, and reduce fraud.

Cargo Transportation Insurance Market Segment Analysis

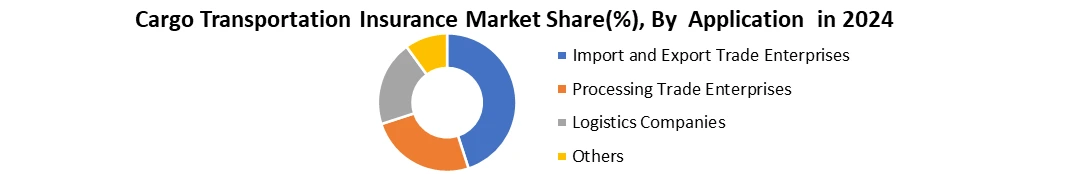

Based on Mode of Transportation, the Cargo Transportation Insurance Market is segmented into Air, Sea, Road and Rail. The marine cargo insurance held the largest market share in the year 2024. The high volume of global trade conducted via sea routes. Shipping remains the most cost-effective and practical mode for transporting large quantities of goods, including bulk commodities, machinery, and manufactured products, across long distances. The rise in international trade agreements, expansion of e-commerce, and growing demand for raw materials have significantly increased maritime shipping activities. The sea transport faces higher exposure to risks such as storms, piracy, collisions, and cargo damage during loading or unloading, making insurance coverage essential for shippers and freight forwarders. The value and variety of goods transported by sea often require comprehensive policies, further driving premium volumes. Technological advancements in marine logistics and the growth of containerization have also boosted cargo volumes, reinforcing the dominant position of marine cargo insurance in the market.Based on the Application, the Cargo Transportation Insurance Market is segmented into Import & Export Trade Enterprises, Processing Trade Enterprises, Logistics Companies and Others. The Import & Export Trade Enterprises cargo insurance held the largest market share in the year 2024. Due to the rapid expansion of global trade and the increasing complexity of international supply chains. These enterprises consistently engage in high-value cross-border transactions, making them more exposed to risks such as damage, theft, loss, or delays during transit. As international trade volumes surged, particularly in sectors like electronics, automotive, chemicals, and consumer goods, the demand for comprehensive cargo insurance coverage rose significantly. Rising geopolitical uncertainties, fluctuating freight rates, and stricter regulatory compliance across shipping lanes encouraged importers and exporters to safeguard their shipments through insurance. The growing use of multimodal transport combining sea, air, and land routes has also increased the need for tailored policies that cover multiple risk points. Additionally, digitalization in trade documentation and online cargo insurance platforms has made policy procurement faster and more transparent for these enterprises.

Cargo Transportation Insurance Market Regional Insights

North America held the largest market share of the global Cargo Transportation Insurance Market in 2024, which attributed to a developing transportation market in the region. The growing import and product market and rising marine transportation are prime elements driving the growth of the Market in North America. The U.S., dominated the cargo transportation insurance market, supported by its strong logistics and transportation infrastructure. The region’s extensive network of highways, railroads, ports, and airports facilitates massive cargo movement, creating a strong need for insurance to safeguard goods in transit. High insurance penetration and advanced risk management practices strengthen its position. The rapid growth of e-commerce in North America has significantly increased shipment volumes, raising exposure to risks such as theft, damage, or delays. The companies are investing more in comprehensive insurance coverage to meet consumer expectations for timely and secure deliveries. Technological leadership also plays a key role, as companies adopt real-time tracking, AI-driven analytics, and digital insurance platforms, enhancing accessibility and efficiency. For example, in early 2025, Fortress Logistics Insurance Services LLC launched simplified logistics insurance solutions in the U.S., while in May 2024, Arta partnered with Chubb to offer embedded insurance for high-value goods. Combined with strict freight liability regulations, a strong legal framework, and economic resilience, these factors ensure North America remains a global leader in cargo transportation insurance. Cargo Transportation Insurance Market Competitive Landscape The global cargo transportation insurance market is dominated by international insurers, specialty underwriters, and regional providers. Leading players such as AIG, Allianz Global Corporate & Specialty (AGCS), AXA XL, and Chubb leverage global networks, diverse product portfolios, and strong reinsurance backing to maintain leadership across marine, land, and air cargo segments. Competition centers on product innovation, digital transformation, and geographic expansion. Firms develop tailored policies for specific cargo types and adopt advanced digital platforms to streamline policy issuance, claims processing, and real-time tracking. Strategic partnerships with logistics providers, tech firms, and reinsurers expand reach and strengthen risk management. AGCS has grown its marine portfolio in Asia and Europe, investing in real-time risk analytics and specialized solutions for renewable energy cargo. Tokio Marine focuses on Asia-Pacific, offering customized coverage for containerized and perishable goods, supported by its 2024 “Smart Freight” policy integrating predictive logistics and climate risk mitigation. Cargo Transportation Insurance Market Key Trends • Growing Role of IoT in Risk Management and Claims Handling The rapid development of IoT technologies is not just improving risk assessment but also revolutionising claims handling by enabling real-time monitoring and loss prevention. This tech-driven approach significantly reduces claim disputes and enhances insurer-client transparency. • Data-Driven Mobility Solutions in Cargo Insurance There is a growing emphasis on using real-time data and accident analytics to proactively reduce risks in fleet management, shifting the focus from reactive claims handling to proactive risk prevention and efficiency. Cargo Transportation Insurance Market Recent Development • In May 27, 2025, Tokio Marine Holdings (Japan) declared the launch of TMGX, a specialized unit dedicated to low-carbon transition insurance. Aiming to generate $1 billion in revenue by 2030, TMGX will offer comprehensive coverage for emerging sustainable sectors, including green hydrogen, solar energy, electric vehicles, and related clean technologies. This initiative reflects the company’s strategic commitment to supporting global decarbonization efforts while expanding its portfolio in climate-focused insurance solutions, positioning itself as a key player in the growing sustainable energy and transportation markets. • In September 14, 2023, Chubb (United States) unveiled a Lloyd’s of London consortium dedicated to insuring lithium battery transit and storage. Offering coverage of up to $50 million, the program addresses key risk areas, including transportation hazards, warehouse liability, and climate-related threats. This initiative strengthens risk management for the rapidly expanding lithium battery sector, supporting safer logistics and storage in line with growing global demand for energy storage solutions.Cargo Transportation Insurance Market Scope: Inquire before buying

Cargo Transportation Insurance Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 57.91 Bn. Forecast Period 2025 to 2032 CAGR: 3.2% Market Size in 2032: USD 74.51 Bn. Segments Covered: by Coverage All Risks Named Perils General Average Contributory Negligence by Commodity Type Manufactured Goods Perishables Dangerous Goods Electronics by Cargo Value Low Value Cargo High Value Cargo Ultra-High Value Cargo by Form of Transport Domestic International by Mode of Transportation Air Sea Road Rail by Policy Type Open Cover Cargo Policy Contingency Insurance Policy Specific Cargo Policy Others by Application Import & Export Trade Enterprises Processing Trade Enterprises Logistics Companies Others Cargo Transportation Insurance Market By Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Cargo Transportation Insurance Market Key Players

North America 1. AIG (United States) 2. Liberty Mutual Insurance (United States) 3. Chubb (United States) 4. Berkshire Hathaway Specialty Insurance (United States) 5. The Hartford (United States) Europe 6. Allianz Global Corporate & Specialty (Germany) 7. AXA XL (France) 8. Zurich Insurance Group (Switzerland) 9. Lloyd's of London (United Kingdom) 10. RSA Insurance Group (United Kingdom) 11. HDI Global SE (Germany) Asia Pacific 12. Tokio Marine Holdings (Japan) 13. Mitsui Sumitomo Insurance (Japan) 14. Samsung Fire & Marine Insurance (South Korea) 15. Ping An Insurance (China) 16. China Pacific Insurance Company – CPIC (China) 17. QBE Insurance (Australia) Middle East & Africa 18. Oman Insurance Company (UAE) 19. Qatar Insurance Company – QIC (Qatar) 20. AXA Gulf (UAE) 21. Jubilee Insurance (Kenya) South America 22. Porto Seguro (Brazil) 23. Bradesco Seguros (Brazil) 24. Sura Insurance (Colombia)FAQ:

1] What are the major Key players in the Cargo Transportation Insurance Market? Ans. The top companies in the Cargo Transportation Insurance Market are AIG, Allianz Global Corporate & Specialty, AXA XL, Chubb, Zurich Insurance Group, Tokio Marine Holdings, Lloyd's of London, and Liberty Mutual Insurance. 2] Which region is expected to hold the highest growth rate in the Global Cargo Transportation Insurance Market? Ans. The North America region is expected to hold the highest growth rate of the Cargo Transportation Insurance Market. 3] What is the market size of the Cargo Transportation Insurance Market by 2032? Ans. The Cargo Transportation Insurance Market size by 2032 is expected to reach USD 74.51 billion. 4] What was the market size of the Cargo Transportation Insurance Market in 2024? Ans. The market size of the Cargo Transportation Insurance Market in 2024 was valued at USD 57.91 billion.

1. Cargo Transportation Insurance Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Cargo Transportation Insurance Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Cargo Transportation Insurance Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Cargo Transportation Insurance Market: Dynamics 3.1. Cargo Transportation Insurance Market Trends by Region 3.1.1. North America Cargo Transportation Insurance Market Trends 3.1.2. Europe Cargo Transportation Insurance Market Trends 3.1.3. Asia Pacific Cargo Transportation Insurance Market Trends 3.1.4. Middle East and Africa Cargo Transportation Insurance Market Trends 3.1.5. South America Cargo Transportation Insurance Market Trends 3.2. Cargo Transportation Insurance Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Cargo Transportation Insurance Market Drivers 3.2.1.2. North America Cargo Transportation Insurance Market Restraints 3.2.1.3. North America Cargo Transportation Insurance Market Opportunities 3.2.1.4. North America Cargo Transportation Insurance Market Challenges 3.2.2. Europe 3.2.2.1. Europe Cargo Transportation Insurance Market Drivers 3.2.2.2. Europe Cargo Transportation Insurance Market Restraints 3.2.2.3. Europe Cargo Transportation Insurance Market Opportunities 3.2.2.4. Europe Cargo Transportation Insurance Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Cargo Transportation Insurance Market Drivers 3.2.3.2. Asia Pacific Cargo Transportation Insurance Market Restraints 3.2.3.3. Asia Pacific Cargo Transportation Insurance Market Opportunities 3.2.3.4. Asia Pacific Cargo Transportation Insurance Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Cargo Transportation Insurance Market Drivers 3.2.4.2. Middle East and Africa Cargo Transportation Insurance Market Restraints 3.2.4.3. Middle East and Africa Cargo Transportation Insurance Market Opportunities 3.2.4.4. Middle East and Africa Cargo Transportation Insurance Market Challenges 3.2.5. South America 3.2.5.1. South America Cargo Transportation Insurance Market Drivers 3.2.5.2. South America Cargo Transportation Insurance Market Restraints 3.2.5.3. South America Cargo Transportation Insurance Market Opportunities 3.2.5.4. South America Cargo Transportation Insurance Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Cargo Transportation Insurance Industry 3.8. Analysis of Government Schemes and Initiatives For Cargo Transportation Insurance Industry 3.9. Cargo Transportation Insurance Market Trade Analysis 3.10. The Global Pandemic Impact on Cargo Transportation Insurance Market 4. Cargo Transportation Insurance Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 4.1.1. All Risks 4.1.2. Named Perils 4.1.3. General Average 4.1.4. Contributory Negligence 4.2. Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 4.2.1. Manufactured Goods 4.2.2. Perishables 4.2.3. Dangerous Goods 4.2.4. Electronics 4.3. Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 4.3.1. Low Value Cargo 4.3.2. High Value Cargo 4.3.3. Ultra-High Value Cargo 4.4. Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 4.4.1. Domestic 4.4.2. International 4.5. Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 4.5.1. Air 4.5.2. Sea 4.5.3. Road 4.5.4. Rail 4.6. Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 4.6.1. Open Cover Cargo Policy 4.6.2. Contingency Insurance Policy 4.6.3. Specific Cargo Policy 4.6.4. Others 4.7. Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 4.7.1. Import & Export Trade Enterprises 4.7.2. Processing Trade Enterprises 4.7.3. Logistics Companies 4.7.4. Others 4.8. Cargo Transportation Insurance Market Size and Forecast, by Region (2024-2032) 4.8.1. North America 4.8.2. Europe 4.8.3. Asia Pacific 4.8.4. Middle East and Africa 4.8.5. South America 5. North America Cargo Transportation Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 5.1.1. All Risks 5.1.2. Named Perils 5.1.3. General Average 5.1.4. Contributory Negligence 5.2. North America Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 5.2.1. Manufactured Goods 5.2.2. Perishables 5.2.3. Dangerous Goods 5.2.4. Electronics 5.3. North America Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 5.3.1. Low Value Cargo 5.3.2. High Value Cargo 5.3.3. Ultra-High Value Cargo 5.4. North America Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 5.4.1. Domestic 5.4.2. International 5.5. North America Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 5.5.1. Air 5.5.2. Sea 5.5.3. Road 5.5.4. Rail 5.6. North America Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 5.6.1. Open Cover Cargo Policy 5.6.2. Contingency Insurance Policy 5.6.3. Specific Cargo Policy 5.6.4. Others 5.7. North America Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 5.7.1. Import & Export Trade Enterprises 5.7.2. Processing Trade Enterprises 5.7.3. Logistics Companies 5.7.4. Others 5.8. North America Cargo Transportation Insurance Market Size and Forecast, by Country (2024-2032) 5.8.1. United States 5.8.1.1. United States Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 5.8.1.1.1. All Risks 5.8.1.1.2. Named Perils 5.8.1.1.3. General Average 5.8.1.1.4. Contributory Negligence 5.8.1.2. United States Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 5.8.1.2.1. Manufactured Goods 5.8.1.2.2. Perishables 5.8.1.2.3. Dangerous Goods 5.8.1.2.4. Electronics 5.8.1.3. United States Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 5.8.1.3.1. Low Value Cargo 5.8.1.3.2. High Value Cargo 5.8.1.3.3. Ultra-High Value Cargo 5.8.1.4. United States Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 5.8.1.4.1. Domestic 5.8.1.4.2. International 5.8.1.5. United States Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 5.8.1.5.1. Air 5.8.1.5.2. Sea 5.8.1.5.3. Road 5.8.1.5.4. Rail 5.8.1.6. United States Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 5.8.1.6.1. Open Cover Cargo Policy 5.8.1.6.2. Contingency Insurance Policy 5.8.1.6.3. Specific Cargo Policy 5.8.1.6.4. Others 5.8.1.7. United States Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 5.8.1.7.1. Import & Export Trade Enterprises 5.8.1.7.2. Processing Trade Enterprises 5.8.1.7.3. Logistics Companies 5.8.1.7.4. Others 5.8.2. Canada 5.8.2.1. Canada Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 5.8.2.1.1. All Risks 5.8.2.1.2. Named Perils 5.8.2.1.3. General Average 5.8.2.1.4. Contributory Negligence 5.8.2.2. Canada Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 5.8.2.2.1. Manufactured Goods 5.8.2.2.2. Perishables 5.8.2.2.3. Dangerous Goods 5.8.2.2.4. Electronics 5.8.2.3. Canada Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 5.8.2.3.1. Low Value Cargo 5.8.2.3.2. High Value Cargo 5.8.2.3.3. Ultra-High Value Cargo 5.8.2.4. Canada Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 5.8.2.4.1. Domestic 5.8.2.4.2. International 5.8.2.5. Canada Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 5.8.2.5.1. Air 5.8.2.5.2. Sea 5.8.2.5.3. Road 5.8.2.5.4. Rail 5.8.2.6. Canada Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 5.8.2.6.1. Open Cover Cargo Policy 5.8.2.6.2. Contingency Insurance Policy 5.8.2.6.3. Specific Cargo Policy 5.8.2.6.4. Others 5.8.2.7. Canada Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 5.8.2.7.1. Import & Export Trade Enterprises 5.8.2.7.2. Processing Trade Enterprises 5.8.2.7.3. Logistics Companies 5.8.2.7.4. Others 5.8.3. Mexico 5.8.3.1. Mexico Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 5.8.3.1.1. All Risks 5.8.3.1.2. Named Perils 5.8.3.1.3. General Average 5.8.3.1.4. Contributory Negligence 5.8.3.2. Mexico Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 5.8.3.2.1. Manufactured Goods 5.8.3.2.2. Perishables 5.8.3.2.3. Dangerous Goods 5.8.3.2.4. Electronics 5.8.3.3. Mexico Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 5.8.3.3.1. Low Value Cargo 5.8.3.3.2. High Value Cargo 5.8.3.3.3. Ultra-High Value Cargo 5.8.3.4. Mexico Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 5.8.3.4.1. Domestic 5.8.3.4.2. International 5.8.3.5. Mexico Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 5.8.3.5.1. Air 5.8.3.5.2. Sea 5.8.3.5.3. Road 5.8.3.5.4. Rail 5.8.3.6. Mexico Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 5.8.3.6.1. Open Cover Cargo Policy 5.8.3.6.2. Contingency Insurance Policy 5.8.3.6.3. Specific Cargo Policy 5.8.3.6.4. Others 5.8.3.7. Mexico Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 5.8.3.7.1. Import & Export Trade Enterprises 5.8.3.7.2. Processing Trade Enterprises 5.8.3.7.3. Logistics Companies 5.8.3.7.4. Others 6. Europe Cargo Transportation Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 6.2. Europe Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 6.3. Europe Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 6.4. Europe Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 6.5. Europe Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 6.6. Europe Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 6.7. Europe Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 6.8. Europe Cargo Transportation Insurance Market Size and Forecast, by Country (2024-2032) 6.8.1. United Kingdom 6.8.1.1. United Kingdom Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 6.8.1.2. United Kingdom Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 6.8.1.3. United Kingdom Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 6.8.1.4. United Kingdom Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 6.8.1.5. United Kingdom Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 6.8.1.6. United Kingdom Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 6.8.1.7. United Kingdom Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 6.8.2. France 6.8.2.1. France Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 6.8.2.2. France Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 6.8.2.3. France Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 6.8.2.4. France Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 6.8.2.5. France Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 6.8.2.6. France Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 6.8.2.7. France Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 6.8.3. Germany 6.8.3.1. Germany Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 6.8.3.2. Germany Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 6.8.3.3. Germany Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 6.8.3.4. Germany Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 6.8.3.5. Germany Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 6.8.3.6. Germany Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 6.8.3.7. Germany Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 6.8.4. Italy 6.8.4.1. Italy Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 6.8.4.2. Italy Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 6.8.4.3. Italy Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 6.8.4.4. Italy Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 6.8.4.5. Italy Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 6.8.4.6. Italy Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 6.8.4.7. Italy Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 6.8.5. Spain 6.8.5.1. Spain Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 6.8.5.2. Spain Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 6.8.5.3. Spain Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 6.8.5.4. Spain Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 6.8.5.5. Spain Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 6.8.5.6. Spain Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 6.8.5.7. Spain Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 6.8.6. Sweden 6.8.6.1. Sweden Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 6.8.6.2. Sweden Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 6.8.6.3. Sweden Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 6.8.6.4. Sweden Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 6.8.6.5. Sweden Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 6.8.6.6. Sweden Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 6.8.6.7. Sweden Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 6.8.7. Austria 6.8.7.1. Austria Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 6.8.7.2. Austria Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 6.8.7.3. Austria Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 6.8.7.4. Austria Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 6.8.7.5. Austria Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 6.8.7.6. Austria Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 6.8.7.7. Austria Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 6.8.8. Rest of Europe 6.8.8.1. Rest of Europe Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 6.8.8.2. Rest of Europe Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 6.8.8.3. Rest of Europe Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 6.8.8.4. Rest of Europe Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 6.8.8.5. Rest of Europe Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 6.8.8.6. Rest of Europe Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 6.8.8.7. Rest of Europe Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Cargo Transportation Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.2. Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.3. Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.4. Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.5. Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.6. Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.7. Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8. Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Country (2024-2032) 7.8.1. China 7.8.1.1. China Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.1.2. China Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.1.3. China Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.1.4. China Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.1.5. China Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.1.6. China Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.1.7. China Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8.2. S Korea 7.8.2.1. S Korea Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.2.2. S Korea Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.2.3. S Korea Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.2.4. S Korea Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.2.5. S Korea Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.2.6. S Korea Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.2.7. S Korea Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8.3. Japan 7.8.3.1. Japan Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.3.2. Japan Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.3.3. Japan Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.3.4. Japan Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.3.5. Japan Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.3.6. Japan Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.3.7. Japan Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8.4. India 7.8.4.1. India Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.4.2. India Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.4.3. India Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.4.4. India Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.4.5. India Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.4.6. India Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.4.7. India Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8.5. Australia 7.8.5.1. Australia Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.5.2. Australia Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.5.3. Australia Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.5.4. Australia Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.5.5. Australia Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.5.6. Australia Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.5.7. Australia Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8.6. Indonesia 7.8.6.1. Indonesia Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.6.2. Indonesia Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.6.3. Indonesia Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.6.4. Indonesia Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.6.5. Indonesia Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.6.6. Indonesia Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.6.7. Indonesia Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8.7. Malaysia 7.8.7.1. Malaysia Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.7.2. Malaysia Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.7.3. Malaysia Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.7.4. Malaysia Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.7.5. Malaysia Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.7.6. Malaysia Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.7.7. Malaysia Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8.8. Vietnam 7.8.8.1. Vietnam Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.8.2. Vietnam Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.8.3. Vietnam Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.8.4. Vietnam Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.8.5. Vietnam Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.8.6. Vietnam Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.8.7. Vietnam Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8.9. Taiwan 7.8.9.1. Taiwan Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.9.2. Taiwan Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.9.3. Taiwan Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.9.4. Taiwan Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.9.5. Taiwan Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.9.6. Taiwan Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.9.7. Taiwan Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 7.8.10. Rest of Asia Pacific 7.8.10.1. Rest of Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 7.8.10.2. Rest of Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 7.8.10.3. Rest of Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 7.8.10.4. Rest of Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 7.8.10.5. Rest of Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 7.8.10.6. Rest of Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 7.8.10.7. Rest of Asia Pacific Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Cargo Transportation Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 8.2. Middle East and Africa Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 8.3. Middle East and Africa Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 8.4. Middle East and Africa Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 8.5. Middle East and Africa Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 8.6. Middle East and Africa Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 8.7. Middle East and Africa Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 8.8. Middle East and Africa Cargo Transportation Insurance Market Size and Forecast, by Country (2024-2032) 8.8.1. South Africa 8.8.1.1. South Africa Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 8.8.1.2. South Africa Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 8.8.1.3. South Africa Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 8.8.1.4. South Africa Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 8.8.1.5. South Africa Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 8.8.1.6. South Africa Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 8.8.1.7. South Africa Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 8.8.2. GCC 8.8.2.1. GCC Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 8.8.2.2. GCC Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 8.8.2.3. GCC Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 8.8.2.4. GCC Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 8.8.2.5. GCC Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 8.8.2.6. GCC Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 8.8.2.7. GCC Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 8.8.3. Nigeria 8.8.3.1. Nigeria Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 8.8.3.2. Nigeria Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 8.8.3.3. Nigeria Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 8.8.3.4. Nigeria Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 8.8.3.5. Nigeria Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 8.8.3.6. Nigeria Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 8.8.3.7. Nigeria Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 8.8.4. Rest of ME&A 8.8.4.1. Rest of ME&A Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 8.8.4.2. Rest of ME&A Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 8.8.4.3. Rest of ME&A Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 8.8.4.4. Rest of ME&A Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 8.8.4.5. Rest of ME&A Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 8.8.4.6. Rest of ME&A Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 8.8.4.7. Rest of ME&A Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 9. South America Cargo Transportation Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 9.2. South America Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 9.3. South America Cargo Transportation Insurance Market Size and Forecast, by Cargo Value(2024-2032) 9.4. South America Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 9.5. South America Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 9.6. South America Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 9.7. South America Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 9.8. South America Cargo Transportation Insurance Market Size and Forecast, by Country (2024-2032) 9.8.1. Brazil 9.8.1.1. Brazil Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 9.8.1.2. Brazil Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 9.8.1.3. Brazil Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 9.8.1.4. Brazil Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 9.8.1.5. Brazil Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 9.8.1.6. Brazil Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 9.8.1.7. Brazil Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 9.8.2. Argentina 9.8.2.1. Argentina Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 9.8.2.2. Argentina Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 9.8.2.3. Argentina Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 9.8.2.4. Argentina Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 9.8.2.5. Argentina Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 9.8.2.6. Argentina Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 9.8.2.7. Argentina Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 9.8.3. Rest Of South America 9.8.3.1. Rest Of South America Cargo Transportation Insurance Market Size and Forecast, by Coverage (2024-2032) 9.8.3.2. Rest Of South America Cargo Transportation Insurance Market Size and Forecast, by Commodity Type (2024-2032) 9.8.3.3. Rest Of South America Cargo Transportation Insurance Market Size and Forecast, by Cargo Value (2024-2032) 9.8.3.4. Rest Of South America Cargo Transportation Insurance Market Size and Forecast, by Form of Transport (2024-2032) 9.8.3.5. Rest Of South America Cargo Transportation Insurance Market Size and Forecast, by Mode of Transportation (2024-2032) 9.8.3.6. Rest Of South America Cargo Transportation Insurance Market Size and Forecast, by Policy Type (2024-2032) 9.8.3.7. Rest Of South America Cargo Transportation Insurance Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. AIG (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Liberty Mutual Insurance (United States) 10.3. Chubb (United States) 10.4. Berkshire Hathaway Specialty Insurance (United States) 10.5. The Hartford (United States) 10.6. Allianz Global Corporate & Specialty (Germany) 10.7. AXA XL (France) 10.8. Zurich Insurance Group (Switzerland) 10.9. Lloyd's of London (United Kingdom) 10.10. RSA Insurance Group (United Kingdom) 10.11. HDI Global SE (Germany) 10.12. Tokio Marine Holdings (Japan) 10.13. Mitsui Sumitomo Insurance (Japan) 10.14. Samsung Fire & Marine Insurance (South Korea) 10.15. Ping An Insurance (China) 10.16. China Pacific Insurance Company – CPIC (China) 10.17. QBE Insurance (Australia) 10.18. Oman Insurance Company (UAE) 10.19. Qatar Insurance Company – QIC (Qatar) 10.20. AXA Gulf (UAE) 10.21. Jubilee Insurance (Kenya) 10.22. Porto Seguro (Brazil) 10.23. Bradesco Seguros (Brazil) 10.24. Sura Insurance (Colombia) 11. Key Findings 12. Industry Recommendations 13. Cargo Transportation Insurance Market: Research Methodology 14. Terms and Glossary