Calcium Citrate Market size was valued at USD 908.35 Million in 2024, and the total Calcium Citrate market is expected to grow at a CAGR of 3.7% from 2025 to 2032, reaching nearly USD 1214.74 Million.Calcium Citrate Market Overview

Calcium citrate is a calcium compound with excellent bioavailability, commonly used in dietary supplements and in the pharmaceutical industry to support bone health, muscle function, and nerve signaling, which is especially valuable for individuals with low stomach acid levels. Calcium is an important factor in the prevention of some osteoporotic and deficiency-related diseases. In the food and beverage space, calcium citrate is used as a stabilizer, firming agent, and acidity regulator, improving both the texture and nutritional value of dairy products, baked goods, and beverages, which drives the Calcium Citrate Market growth. Calcium citrate is a popular option for consumers who are health and wellness focused, and for manufacturers looking for effective calcium fortification. Calcium Citrate is widely used to prevent and treat calcium deficiencies, particularly among postmenopausal women, elderly individuals, and those with low stomach acid. Its applications span the pharmaceutical, food and beverage, and water treatment industries, where it functions as a stabilizer, firming agent, and nutritional fortifier. As consumers shift toward functional foods and preventive healthcare, manufacturers are leveraging calcium citrate to meet regulatory and wellness demands. Innovations in fortified foods, clean-label trends, and a global emphasis on bone and muscle health drive the growth of the Calcium Citrate Market.To know about the Research Methodology :- Request Free Sample Report

Calcium Citrate Market Trend

Rising Advanced Delivery Systems, Especially Microencapsulation and Controlled-Release Technologies Modern delivery systems are transforming calcium citrate design and how it is utilized, and making it more bioavailable, targeted, and efficacious for a wide range of nutraceuticals, pharmaceuticals, and functional food applications. In the calcium citrate market, microencapsulation involves enclosing calcium citrate particles in biodegradable polymer microcapsules, enhancing stability, bioavailability, and controlled nutrient release in applications. Microencapsulation results in bioencapsulated calcium citrate drug particles, which are released steadily and controllably at a particular time. Microencapsulation protects calcium citrate from degradation in the gastrointestinal tract and allows the delivery of calcium citrate at the desired time to maximize absorption and minimize the likelihood of side effects in the gastrointestinal tract. The potential of creating a favorable nutrient profile is exceedingly advantageous and critical, particularly in the case of bone and mineral health, where the delivery of calcium is consistent, even in patients with conditions such as osteoporosis or low bone density. Controlled-release technologies are becoming more popular in the niches of specialized healthcare and nutrition. These delivery systems are designed to respond to triggers via changes in pH, enzymatic activity, or changes in body temperature for site-specific release. For example, calcium citrate placed within a pH-responsive polymer escapes the stomach and releases calcium directly in the intestine. This is beneficial for patients with gastric sensitivity or for patients who require inordinate amounts of calcium without perceptible discomfort while taking it. When blended with other micronutrients or bioactives vitamin D3 or magnesium, these systems ensure simultaneous and synergistic release of the multitude of nutrients, which multiply the bioefficacy of the calcium formulations.Calcium Citrate Market Dynamics

The increasing prevalence of osteoporosis and other bone-related disorders globally is to boost the Calcium Citrate Market growth Rising osteoporosis cases impacting 500 million globally, including 21.2% of women over 50, are driving demand in the Calcium Citrate Market for effective supplementation solutions. Fragility fractures, including hip, spine, and wrist fractures, impact up to 37 million people annually, equivalent to 70 fractures per minute, highlighting the massive public health burden. 1 in 3 women and 1 in 5 men over 50 suffer osteoporotic fractures, with vertebral and hip fractures being the most prevalent and debilitating. In Europe alone, 32 million individuals aged 50+ were living with osteoporosis in 2019, including 25.5 million women and 6.5 million men. The hip fractures, numbering over 10 million annually in those aged 55+, are projected to increase by 240% in women and 310% in men by 2050. The lifetime risk of hip fracture is 15% in women and 5.7% in men, peaking at ages 75–79, with a 20–24% one-year mortality rate and up to 33% of patients requiring long-term care. Vertebral fractures, the most common osteoporotic fractures, increase mortality eightfold and remain underdiagnosed, up to 46% in South America and 45% in North America. In the U.S., 50-year-old women face a 16% lifetime risk of vertebral fracture, and those with one vertebral fracture have a 25% risk of another within 5 years. Men account for 25% of hip fractures, with mortality twice as high in the first six months post-fracture compared to women. The wrist fractures in aging men are early indicators of skeletal fragility. Fragility fractures account for the fourth highest disease burden in Europe, trailing only ischemic heart disease, dementia, and lung cancer. The treatment gap remains vast 71% in Europe, with 15 million women untreated despite being eligible for osteoporosis therapy, and 80% of high-risk patients not receiving care even after a first fracture. The cumulative lifetime risk of clinically apparent fractures (hip, forearm, vertebral) reaches 40%, equal to cardiovascular disease. As bone density declines and fractures increase, the Calcium Citrate Market sees rising demand for supplementation in preventive and therapeutic regimens across medical and geriatric care. High Dosage Requirements and Low Elemental Calcium Content to Hamper the Calcium Citrate Market Calcium citrate contains only 21% elemental calcium compared to calcium carbonate's 40%, meaning that individuals must consume nearly double the quantity to achieve the same calcium intake. • For instance, to meet the recommended daily intake of 1,000–1,200 mg of calcium for adults, a person needs to consume around 4,800–5,700 mg of calcium citrate, which often requires taking multiple tablets per day. This high pill burden not only increases costs but also reduces compliance, especially among older adults, postmenopausal women, and patients with chronic conditions. While calcium citrate is recommended for people with low stomach acid or gastrointestinal issues due to its superior solubility and absorption without food, its lower calcium density necessitates more frequent dosing. The excessive intake of calcium through supplements can lead to gastrointestinal side effects such as bloating, gas, and constipation, side effects more commonly associated with calcium carbonate but still reported with calcium citrate in higher doses. The situation is further complicated for individuals with conditions such as kidney stones, where improper or excessive calcium supplementation worsens risks. Calcium citrate’s interaction with certain medications, such as bisphosphonates, antibiotics, and thyroid hormones, requires careful timing of intake, which adds another layer of complexity to usage. Despite being better absorbed than carbonate by approximately 22–27% depending on whether it’s taken with food, the lower concentration of elemental calcium limits its efficiency in high-risk populations such as ICU patients with hypocalcemia, post-surgical cases, or those with chronic calcium malabsorption syndromes.Calcium Citrate Market Segment Analysis

Based on Form, the Calcium Citrate market is segmented into Powder, Granules, and Others. Powder dominated the Calcium Citrate Market in 2024 and is expected to continue its dominance over the forecast period. Calcium Citrate, a widely recognized calcium supplement, exists predominantly as a white, odorless, crystalline powder, making it the dominant and most practical form for a wide range of applications. This chelated calcium salt of citric acid, derived from citrus fruits, offers excellent bioavailability, ensuring superior absorption in the human body compared to other calcium sources. The powder form is slightly hygroscopic, poorly soluble in water, and insoluble in alcohol, yet possesses a smooth, free-flowing texture ideal for formulation. Its stability and ease of blending make it especially suitable for pharmaceutical, nutraceutical, and food industries. Calcium Citrate powder is used to fortify cereals, juices, and dairy alternatives, addressing dietary calcium gaps, especially in lactose-intolerant populations. The health and wellness sector also employs it in women’s health, anti-aging, and bone-strengthening products.Based on Application, the Calcium Citrate Market is categorized into the Nutritional & Dietary Supplements, Pharmaceuticals, Food & Beverages, Animal Feed, and Others. Nutritional & Dietary Supplements are expected to dominate the Calcium Citrate Market during the forecast period. Calcium is a vital nutrient for maintaining bone health, and while food is the preferred source, many individuals, particularly older adults, vegans, and those with dietary restrictions, require supplements to meet their recommended daily intake (1,000–1,200 mg). The nutritional and dietary supplements represent the dominant application for calcium products. Supplements are available in various forms pills, chewables, liquids, and commonly used calcium carbonate or calcium citrate. Vitamin D is critical for calcium absorption, and many supplements are fortified accordingly. However, exceeding the upper limit (2,000–2,500 mg/day) poses risks such as kidney stones or possible cardiovascular concerns. In the calcium citrate market, selecting the appropriate supplement based on absorption rate, dosage, and dietary needs is essential for effective bone health and wellness. Individuals evaluate the label for elemental calcium content and serving size, and consult healthcare professionals to ensure effective use.

Calcium Citrate Market Regional Insights

Asia Pacific dominated the Calcium Citrate Market and is expected to continue its dominance over the forecast period. The rising awareness of bone health, increasing osteoporosis cases, and a growing elderly population, especially in countries such as Japan, South Korea, China, and India. Calcium Citrate Malate (CCM) is gaining traction in the region due to its superior water solubility, pH-independent absorption, and higher bioavailability compared to traditional calcium salts. Complex of calcium, citric acid, and malic acid, CCM delivers approximately 22% elemental calcium and is highly effective for both nutritional supplementation and food fortification, particularly in products like soymilk and plant-based alternatives, which are popular in vegetarian and lactose-intolerant demographics across Asia. Calcium Citrate Leading players such as Bajaj Healthcare are contributing to market growth by offering a wide portfolio of nutritional ingredients, including calcium citrate, malate, and amino acids, supplying international pharmaceutical, nutraceutical, and food industries. Global companies such as Dr. Paul Lohmann, known for premium calcium citrate malate produced in Germany, are also entering or expanding their presence in the Asia Pacific Calcium Citrate Market with products tailored for food systems and supplements, including fine granular grades suitable for tablets, capsules, and powder blends. These offerings are vegan, allergen-free, non-GMO, Halal, and Kosher certified, aligning with regional dietary and religious preferences.Calcium Citrate Market Competitive Landscape

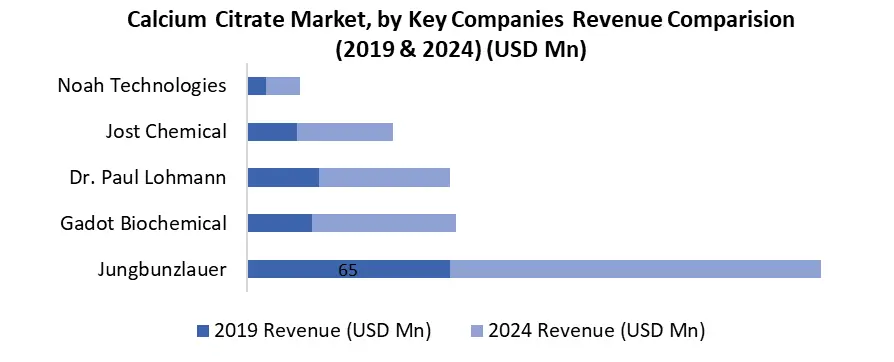

The Calcium Citrate Market is consolidated, with key players competing on product quality, purity, and application-specific formulations. Calcium Citrate Major companies such as Jungbunzlauer, Gadot Biochemical Industries, Jost Chemical Co., and Sucroal dominate the market through global distribution networks and extensive R&D capabilities. These players cater to diverse end-use sectors, including pharmaceuticals, food and beverages, and nutritional supplements. Strategic partnerships, product innovation, and compliance with regulatory standards (e.g., USP, FCC, EU) are common competitive strategies. Emerging manufacturers in Asia-Pacific, particularly in China and India, are intensifying competition by offering cost-effective products and expanding their global footprint. • In 2024, Jungbunzlauer Suisse AG expanded its Tricalcium Citrate (TCC) product line to cater to the growing demand in dairy alternatives, infant nutrition, and sports beverages. This strategic move focused on providing formulations with enhanced solubility and a neutral flavor profile, making the ingredient more versatile for health-focused and sensitive applications. The expansion aligns with rising consumer preference for clean-label, plant-based, and nutritionally enriched products.

Calcium Citrate Market Recent Developments

In 2024, Jungbunzlauer expanded production capacity for calcium citrate and other citrates at its Lauterbourg plant in France to meet growing demand in Europe and Asia. Strengthened sustainability initiatives by introducing biodegradable packaging for bulk citrates. In 2023, Gadot Biochemical Industries published that the company’s expanded value proposition for 2023 is to respond to the dramatically increased interest in targeted nutraceuticals, food, beverages, and sports nutrition health products for consumers worldwide.Calcium Citrate Market Scope: Inquire before buying

Calcium Citrate Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 908.35 Mn. Forecast Period 2025 to 2032 CAGR: 3.7% Market Size in 2032: USD 1214.74 Mn. Segments Covered: by Form Powder Granules Others by Application Nutritional & Dietary Supplements Pharmaceuticals Food & Beverages Animal Feed Others Calcium Citrate Market, by region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Thailand, Philippines, and Rest of APAC) South America (Brazil, Argentina, Rest of South America)Calcium Citrate Key Players are:

1. Jungbunzlauer (Switzerland) 2. Gadot Biochemical Industries Ltd. (Israel) 3. Jost Chemical Co. (USA) 4. Sucroal S.A. (Colombia) 5. PMP Fermentation Products, Inc. (USA) 6. Dr. Paul Lohmann GmbH & Co. KGaA (Germany) 7. Nikunj Chemicals (India) 8. FBC Industries, Inc. (USA) 9. Triveni Interchem Pvt. Ltd. (India) 10. Zhejiang Shengda Bio-pharm Co., Ltd. (China) 11. Foodchem International Corporation (China) 12. Weifang Ensign Industry Co., Ltd. (China) 13. Merck KGaA (Germany) 14. Noah Chemicals (USA) 15. Anmol Chemicals Group (India) 16. Yixing Hongbo Fine Chemical Co., Ltd. (China) 17. American Elements (USA) 18. Global Calcium Pvt. Ltd. (India) 19. Tate & Lyle PLC (UK) 20. Panvo Organics Pvt. Ltd. (India) 21. Advance Inorganics (India) 22. Xinchang County Gaoyuan Chemical Co., Ltd. (China) 23. Chemische Fabrik Budenheim KG (Germany) 24. Spectrum Chemical Mfg. Corp. (USA) 25. Shreeji Pharma International (India) 26. Zhejiang Aoda Chemical Co., Ltd. (China) 27. Nippon Chemical Industrial Co., Ltd. (Japan) 28. Prakash Chemicals International Pvt. Ltd. (India)Frequently Asked Questions:

1] What segments are covered in the Calcium Citrate Market report? Ans. The segments covered in the Calcium Citrate Market report are based on Form, Application and region. 2] Which region is expected to hold the highest share of the Calcium Citrate Market? Ans. The Asia Pacific region is expected to hold the highest share of the Calcium Citrate Market. 3] What was the market size of the Calcium Citrate Market in 2024? Ans. The market size of the Calcium Citrate Market in 2024 was USD 908.35 Mn. 4] What is the market size of the Calcium Citrate Market by 2032? Ans. The market size of the Calcium Citrate Market by 2032 is USD 1214.74 Mn. 5] What is the growth rate of the Calcium Citrate Market? Ans. The Global Calcium Citrate Market is growing at a CAGR of 3.7 % during the forecasting period 2025-2032.

1. Calcium Citrate Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Million and Volume Metric Tons) - By Segments, Regions, and Country 2. Calcium Citrate Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share % 2.3.7. Profit Margin % 2.3.8. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Calcium Citrate Market: Dynamics 3.1. Calcium Citrate Market Trends 3.2. Calcium Citrate Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Calcium Citrate Market 3.6. Government Schemes and Initiatives for the Calcium Citrate Market 3.7. Value Chain Analysis 4. Technology and Innovation 4.1. Controlled-Release Formulations 4.2. Plant-Based Chelation Techniques 4.3. Clean-Label Ingredient Processing 4.4. Enhanced Flavor Masking Technologies 5. Calcium Citrate Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume Metric Tons) (2024-2032) 5.1. Calcium Citrate Market Size and Forecast, By Form (2024-2032) 5.1.1. Powder 5.1.2. Granules 5.1.3. Others 5.2. Calcium Citrate Market Size and Forecast, By Application (2024-2032) 5.2.1. Nutritional & Dietary Supplements 5.2.2. Pharmaceuticals 5.2.3. Food & Beverages 5.2.4. Animal Feed 5.2.5. Others 5.3. Calcium Citrate Market Size and Forecast, By Region (2024-2032) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Calcium Citrate Market Size and Forecast by Segmentation (by Value in USD Million and Volume Metric Tons) (2024-2032) 6.1. North America Calcium Citrate Market Size and Forecast, By Form (2024-2032) 6.1.1. Powder 6.1.2. Granules 6.1.3. Others 6.2. North America Calcium Citrate Market Size and Forecast, By Application (2024-2032) 6.2.1. Nutritional & Dietary Supplements 6.2.2. Pharmaceuticals 6.2.3. Food & Beverages 6.2.4. Animal Feed 6.2.5. Others 6.3. North America Calcium Citrate Market Size and Forecast, by Country (2024-2032) 6.3.1. United States 6.3.1.1. United States Calcium Citrate Market Size and Forecast, By Form (2024-2032) 6.3.1.1.1. Powder 6.3.1.1.2. Granules 6.3.1.1.3. Others 6.3.1.2. United States Calcium Citrate Market Size and Forecast, By Application (2024-2032) 6.3.1.2.1. Nutritional & Dietary Supplements 6.3.1.2.2. Pharmaceuticals 6.3.1.2.3. Food & Beverages 6.3.1.2.4. Animal Feed 6.3.1.2.5. Others 6.3.2. Canada 6.3.2.1. Canada Calcium Citrate Market Size and Forecast, By Form (2024-2032) 6.3.2.1.1. Powder 6.3.2.1.2. Granules 6.3.2.1.3. Others 6.3.2.2. Canada Calcium Citrate Market Size and Forecast, By Application (2024-2032) 6.3.2.2.1. Nutritional & Dietary Supplements 6.3.2.2.2. Pharmaceuticals 6.3.2.2.3. Food & Beverages 6.3.2.2.4. Animal Feed 6.3.2.2.5. Others 6.3.2.2.6. 6.3.3. Mexico 6.3.3.1. Mexico Calcium Citrate Market Size and Forecast, By Form (2024-2032) 6.3.3.1.1. Powder 6.3.3.1.2. Granules 6.3.3.1.3. Others 6.3.3.2. Mexico Calcium Citrate Market Size and Forecast, By Application (2024-2032) 6.3.3.2.1. Nutritional & Dietary Supplements 6.3.3.2.2. Pharmaceuticals 6.3.3.2.3. Food & Beverages 6.3.3.2.4. Animal Feed 6.3.3.2.5. Others 7. Europe Calcium Citrate Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Europe Calcium Citrate Market Size and Forecast, By Form (2024-2032) 7.2. Europe Calcium Citrate Market Size and Forecast, By Application (2024-2032) 7.3. Europe Calcium Citrate Market Size and Forecast, By Country (2024-2032) 7.3.1. United Kingdom 7.3.2. France 7.3.3. Germany 7.3.4. Italy 7.3.5. Spain 7.3.6. Sweden 7.3.7. Russia 7.3.8. Rest of Europe 8. Asia Pacific Calcium Citrate Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Asia Pacific Calcium Citrate Market Size and Forecast, By Form (2024-2032) 8.2. Asia Pacific Calcium Citrate Market Size and Forecast, By Application (2024-2032) 8.3. Asia Pacific Calcium Citrate Market Size and Forecast, by Country (2024-2032) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Philippines 8.3.9. Thailand 8.3.10. Vietnam 8.3.11. Rest of Asia Pacific 9. Middle East and Africa Calcium Citrate Market Size and Forecast by Segmentation (by Value in USD Million and Volume Metric Tons) (2024-2032) 9.1. Middle East and Africa Calcium Citrate Market Size and Forecast, By Form (2024-2032) 9.2. Middle East and Africa Calcium Citrate Market Size and Forecast, By Application (2024-2032) 9.3. Middle East and Africa Calcium Citrate Market Size and Forecast, by Country (2024-2032) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Nigeria 9.3.4. Rest of ME&A 10. South America Calcium Citrate Market Size and Forecast by Segmentation (by Value in USD Million and Volume Metric Tons) (2024-2032) 10.1. South America Calcium Citrate Market Size and Forecast, By Form (2024-2032) 10.2. South America Calcium Citrate Market Size and Forecast, By Application (2024-2032) 10.3. South America Calcium Citrate Market Size and Forecast, by Country (2024-2032) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Colombia 10.3.4. Chile 10.3.5. Rest of South America 11. Company Profile: Key Players 11.1. Jungbunzlauer (Switzerland) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.2. Gadot Biochemical Industries Ltd. (Israel) 11.3. Jost Chemical Co. (USA) 11.4. Sucroal S.A. (Colombia) 11.5. PMP Fermentation Products, Inc. (USA) 11.6. Dr. Paul Lohmann GmbH & Co. KGaA (Germany) 11.7. Nikunj Chemicals (India) 11.8. FBC Industries, Inc. (USA) 11.9. Triveni Interchem Pvt. Ltd. (India) 11.10. Zhejiang Shengda Bio-pharm Co., Ltd. (China) 11.11. Foodchem International Corporation (China) 11.12. Weifang Ensign Industry Co., Ltd. (China) 11.13. Merck KGaA (Germany) 11.14. Noah Chemicals (USA) 11.15. Anmol Chemicals Group (India) 11.16. Yixing Hongbo Fine Chemical Co., Ltd. (China) 11.17. American Elements (USA) 11.18. Global Calcium Pvt. Ltd. (India) 11.19. Tate & Lyle PLC (UK) 11.20. Panvo Organics Pvt. Ltd. (India) 11.21. Advance Inorganics (India) 11.22. Xinchang County Gaoyuan Chemical Co., Ltd. (China) 11.23. Chemische Fabrik Budenheim KG (Germany) 11.24. Spectrum Chemical Mfg. Corp. (USA) 11.25. Shreeji Pharma International (India) 11.26. Zhejiang Aoda Chemical Co., Ltd. (China) 11.27. Nippon Chemical Industrial Co., Ltd. (Japan) 11.28. Prakash Chemicals International Pvt. Ltd. (India) 12. Key Findings 13. Analyst Recommendations 14. Calcium Citrate Market – Research Methodology