Broadcast Cameras Market was valued at USD 2.40 billion in 2024, and is expected to grow at a CAGR of 3.7 % from 2025 to 2032, reaching nearly USD 3.21 billion in 2032Broadcast Cameras Market Overview

The Broadcast cameras are high-resolution professional-grade video recording devices used for live events, television studios, newsrooms, film production, and OTT platforms. These cameras feature advanced capabilities such as 4K/8K resolution, IP streaming, HDR, wide color gamut (WCG), and PTZ automation, enabling superior image quality and dynamic content creation. Rising demand for UHD content across TV, film, and digital streaming platforms, along with innovations in camera sensors, lenses, and image processing technologies. AI and machine learning integration are increasingly vital for real-time editing, image stabilization, and intelligent camera functions. Live production is the leading segment, driven by OTT content demand and live sports coverage. In 2024, North America dominated the Broadcast Cameras Market due to its advanced broadcast infrastructure, widespread adoption of ultra-HD workflows, and growing use of AI-powered PTZ systems in live sports and entertainment. Asia-Pacific, especially China and India, the market growth through media and entertainment infrastructure investments. Leading players such as Sony, Canon, Panasonic, and ARRI dominate through R&D investments, diverse product portfolios, and strategic alliances.To know about the Research Methodology :- Request Free Sample Report

Broadcast Cameras Market Dynamics

Rising Sports Events and Digital Platforms to Drive the Broadcast Cameras Market Growth Over 290 major sports events held annually, spanning more than 65 sports disciplines including high-profile competitions such as the Olympics, FIFA World Cup, Grand Slam tennis tournaments, Formula 1, and continental championships the demand for advanced broadcasting equipment is steadily rising. These events attract massive global audiences, boosting the need for high-quality motion picture capture through professional broadcasting and cinematography cameras equipped with specialized lenses and high-density sensors. The rapid adoption of digital entertainment platforms and the availability of faster internet connectivity offer consumers greater flexibility in accessing diverse media content anytime and anywhere. This shift towards digital consumption such as boosts demand for superior broadcasting technologies to deliver seamless, high-definition sports coverage. The convergence of expanding sports calendars and growing digital media consumption creates a robust market environment, driving innovation and investment in advanced broadcasting cameras to meet evolving industry and consumer needs. There are over 290 major sports events held globally each year, spanning more than 65 sports disciplines and including high-profile competitions such as the Olympics, FIFA World Cup, major tennis and golf championships, motorsport series, and continental tournaments. The increasing number of global sports events is a significant drive the growth of the Broadcast Cameras Market growth. The high cost and weight of Professional Broadcasting Cameras to limits the Broadcast Cameras Market Growth TAdvanced 4K and 8K cameras, along with compatible lenses and supporting infrastructure, often require investments running into tens of thousands of dollars per unit. This significant upfront expense limits adoption, especially among smaller broadcasters, independent producers, and regional event organizers for more affordable consumer or semi-professional cameras, or even smartphones, to stay within budget.The heavy weight of professional cameras, largely due to their large lenses and high-performance sensors, poses logistical challenges for live event coverage requiring mobility, such as outdoor sports tournaments. Transporting and setting up these bulky devices are difficult, sometimes forcing organizers to rely on lighter but less capable alternatives or reduce the number of cameras used. Rapid technological advancements contribute to frequent obsolescence, compelling broadcasters to undertake costly upgrades to keep pace with evolving content quality demands, such as transitioning from HD to 4K/8K. Moreover, the growing quality of cheaper consumer-grade cameras intensifies competitive pressure, especially for budget-constrained events. These factors hinder the broader adoption of high-end broadcasting cameras, impacting the overall growth of Broadcast Cameras Market. Increased Usage of 3D Cameras to Create Opportunity in the Broadcast Cameras Market Growth The growing adoption of 3D cameras creates new and exciting opportunities in the Broadcast Cameras Market, thanks to increasing demand for immersive and high-quality content. In live sports and entertainment, broadcasters employ 3D camera systems to deliver multi-angle replays and enriched graphics, creating a more immersive and engaging viewing experience. This attracts bigger audiences and helps increase advertising revenue. With virtual reality (VR) and augmented reality (AR) gaining popularity, many TV networks and streaming platforms are using 3D cameras to create VR-ready broadcasts, such as virtual concerts and sports events. These applications rely on the advanced depth perception and spatial mapping that only 3D cameras provide. Production houses is important factor driving demand. As more movies, TV shows, and short films are being made, many are using 3D cameras to add depth and realism to their visuals, making content more captivating for viewers.3D cameras are being used for remote event production, allowing concerts and conferences to be broadcast live in a way that makes viewers feel like they’re really there. On the industrial side, AI-powered 3D cameras help automate camera control and motion tracking, making live broadcasts more efficient. Because of all these applications, the 3D camera market is expected to grow rapidly, driving the broader growth of the Broadcast Cameras Market.Broadcast Cameras Market Segment Analysis

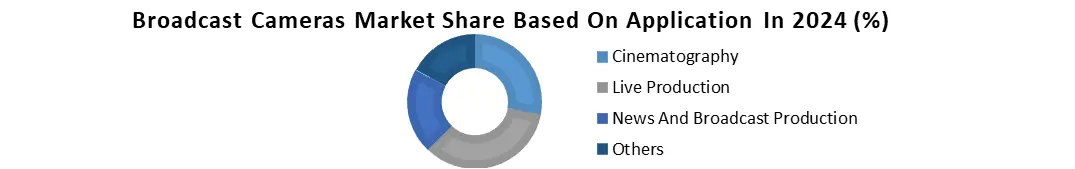

Based on Type, the Broadcast Cameras Market is segmented into 2K, 4K, 8K, and Others. The 4K segment has dominated the largest market share accounting in 2024. Due to its superior image quality and growing industry adoption. Offering four times the resolution of 2K cameras, 4K technology delivers exceptionally sharp and detailed visuals, essential for modern broadcast standards. This high resolution enhances viewer experience across live sports, entertainment, and news broadcasting, driving strong demand from broadcasters aiming to meet audience expectations. Technological advancements have made 4K cameras more affordable and accessible, encouraging widespread usage. Also, increasing content consumption on large-screen TVs and streaming platforms favors 4K resolution, which ensures clear and immersive visuals. Broadcasters are investing heavily in 4K infrastructure to stay competitive, as 8K remains costly and less established. The balance between quality and cost-effectiveness makes 4K the preferred choice for many broadcasters globally. The supportive government policies and industry regulations promoting high-definition broadcasting further fuel the 4K segment’s leading market share.Based on Application, the Broadcast Cameras Market has segmented into Cinematography, Live Production, News and Broadcast Production, Others. Live production dominated the application segment in the broadcast cameras market in 2024. Due to the rising demand for real-time content across sports, concerts, and events. Live broadcasts require cameras that deliver high-quality, reliable, and low-latency video feeds to engage audiences instantly. Broadcasters are increasingly investing in advanced camera systems that support multi-angle coverage, slow-motion replays, and augmented reality to enhance viewer experience during live events. The surge in digital streaming platforms and social media live content has further accelerated the adoption of live production cameras. These platforms prioritize immediacy and immersive experiences, pushing broadcasters to upgrade their equipment. Additionally, the growth of eSports and virtual events has expanded the live production market significantly. Technological innovations such as IP-based workflows and wireless camera solutions have made live production more flexible and scalable, appealing to content creators. The combination of growing live content demand, technological advancements, and audience engagement needs drives the dominance of live production in the broadcast cameras market.

Broadcast Cameras Market Regional Analysis

North America dominates the Broadcast Cameras Market in 2024. Due to the technological adoption, strong industry presence, and robust infrastructure investments the region remain forefront. The United States, hosts leading broadcasters such as ESPN, NBC, CBS, and FOX, who continuously upgrade their camera equipment to deliver high-quality sports, news, and entertainment content. This drives substantial demand for advanced cameras supporting HD, 4K, and 8K resolutions. Technological leadership is another key factor. North American broadcasters were pioneers in deploying cutting-edge innovations such as 8K cameras, HDR imaging, AI-enabled and remote-controlled camera systems. These advancements set global market trends and attract high-volume purchases. Also, significant investments from the government and private sectors in digital broadcast infrastructure enable seamless deployment of high-tech cameras and support real-time streaming nationwide. The region’s massive content production ecosystem, with the U.S. media and entertainment sector generating over $800 billion annually, sustains continuous demand for state-of-the-art broadcast technology. High-profile events such as the Super Bowl showcase extensive use of 4K and 8K cameras, establishing North America as a global benchmark in live sports coverage. The rapid growth of OTT platforms and live streaming services fuels the need for premium content, further increasing camera demand. Efficient supply chains, strong technical support, and consumer expectations for superior visuals consolidate North America’s dominant position in the broadcast cameras market. Broadcast Cameras Market Competitive Landscape The Broadcast Cameras Market is driven by established industry leaders and innovative niche players, driven by rapid technological advancements and diverse application needs. Major companies such as Sony Corporation, Panasonic Corporation, Canon Inc., ARRI AG, Blackmagic Design, Red Digital Cinema, Grass Valley, Hitachi Kokusai Electric, JVCKENWOOD, and Ikegami Tsushinki dominate the market. The leaders focus on distinct segments including high-end cinematography is led by ARRI, Red Digital Cinema, and Sony’s CineAlta series; live production and broadcast are spearheaded by Sony, Panasonic, and Hitachi; while mid-range and prosumer markets see innovation from Blackmagic Design and AJA Video Systems offering affordable, feature-rich solutions. Key products include Sony’s FX9 6K camera, Canon’s EOS C500 Mark II with 4K HDR, ARRI Alexa LF for premium film and TV, and Blackmagic URSA Broadcast, popular among independent producers. Innovation in 4K/8K resolution, HDR, AI integration, and workflow efficiency fuels intense competition. Broadcast Cameras Market Key TrendsBroadcast Cameras Market Recent Developments • On January 30, 2025, Sony, the NFL’s official technology partner, deploy over 240 cameras for Super Bowl LIX, including 100+ professional broadcast units for FOX Sports, Alpha series for photography, and VENICE cinema models for the halftime show, enhancing fan engagement, replays, officiating, and immersive coverage across broadcast and streaming platforms. • On July 17, 2024, Canon Europe has launched the EOS R1 and EOS R5 Mark II, flagship additions to the EOS R System. Powered by the new Accelerated Capture platform with Deep Learning, both models deliver advanced autofocus, high-speed shooting, exceptional image quality, and professional-grade video capabilities, redefining performance for photographers and hybrid creatives. • On June 5, 2025, ARRI unveiled the NIA-1 Network Interface Adapter, enabling seamless IP integration for its Electronic Control System. Compatible with select Sony and Blackmagic cameras, the compact device offers low-latency remote control, multi-camera support, and versatile broadcast, cine, and live production applications. • On July 11, 2025, Grass Valley and Daktronics announced a strategic partnership combining live production technology with large-scale LED display expertise. The alliance delivers integrated, end-to-end solutions for sports and entertainment venues, enhancing fan experiences, streamlining workflows, and setting new standards for immersive, scalable content presentation.

Key Trends Market Implication Shift to 4K & 8K Ultra HD Broadcasters are upgrading to 4K and 8K cameras to deliver higher resolution and improved viewing experiences, especially for sports and live events. Rise of IP-based Broadcasting Adoption of IP-enabled cameras for seamless integration with cloud workflows, enabling remote production and cost-efficient content delivery. Growth in Remote & Cloud Production Increasing use of remote production (REMI) and cloud-based editing tools reduces on-site crew requirements and speeds up content delivery. Demand for High Frame Rate (HFR) & Slow Motion Sports and live entertainment broadcasting is driving demand for HFR cameras capable of capturing detailed slow-motion replays. Adoption of PTZ & Robotic Cameras Automated camera systems are being used in studios and live events to reduce manpower and enhance operational efficiency. Broadcast Cameras Market Scope: Inquiry Before Buying

Broadcast Cameras Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.40 Bn. Forecast Period 2025 to 2032 CAGR: 3.7% Market Size in 2032: USD 3.21 Bn. Segments Covered: by Type 2K 4K 8K by Camera Type System Cameras Camcorders Ptz Cameras by Sensor CCD (Charge-Coupled Device) CMOS (Complementary Metal-Oxide-Semiconductor) by Application Cinematography Live Production News And Broadcast Production Others Broadcast Cameras Market, By Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Broadcast Cameras Market key players

North America 1. Grass Valley (Montreal, Canada) 2. Blackmagic Design USA (Fremont, USA) 3. RED Digital Cinema (Irvine, USA) 4. Ross Video (Ottawa, Canada) 5. AJA Video Systems (Grass Valley, USA) 6. LiveU (Hackensack, USA) 7. Core SWX (Plainview, USA) 8. PTZOptics (Downingtown, USA) Europe 1. ARRI (Munich, Germany) 2. Ikegami Europe (Neuss, Germany) 3. FOR-A Europe (London, UK) 4. Bright Tangerine (Hampshire, UK) 5. Decimator Europe (London, UK) 6. EVS Broadcast Equipment (Liège, Belgium) Asia Pacific 1. Sony Corporation (Tokyo, Japan) 2. Panasonic Corporation (Osaka, Japan) 3. Canon Inc. (Tokyo, Japan) 4. Hitachi Kokusai Electric (Tokyo, Japan) 5. Ikegami Tsushinki (Tokyo, Japan) 6. JVC Kenwood (Yokohama, Japan) 7. Kinefinity (Beijing, China) 8. Z CAM (Shenzhen, China) 9. DJI (Shenzhen, China) 10. BirdDog APAC (Melbourne, Australia) Middle East and Africa 1. Vision Research – Phantom Cameras (Wayne, USA) 2. Telemetrics (Allendale, USA)Frequently Asked Questions

1. Which region has the largest share in Global Broadcast Cameras Market? Ans: North America region held the highest share in 2024. 2. What is the growth rate of Global Broadcast Cameras Market? Ans: The Global Broadcast Cameras Market is growing at a CAGR of 3.7 % during forecasting period 2025-2032. 3. What is scope of the Global Broadcast Cameras Market report? Ans: Global Broadcast Cameras Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Broadcast Cameras Market? Ans: The important key players in the Global Broadcast Cameras Market are – ARRI, Sony Corp, Panasonic Corp, Grass Valley USA LLC, Hitachi Ltd, Blackmagic Design Pty. Ltd, Canon Inc, JVC Kenwood, and Others 5. What is the study period of this Market? Ans: The Global Market is studied from 2024 to 2032.

1. Broadcast Cameras Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Broadcast Cameras Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Broadcast Cameras Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Broadcast Cameras Market: Dynamics 3.1. Broadcast Cameras Market Trends by Region 3.1.1. North America Broadcast Cameras Market Trends 3.1.2. Europe Broadcast Cameras Market Trends 3.1.3. Asia Pacific Broadcast Cameras Market Trends 3.1.4. Middle East and Africa Broadcast Cameras Market Trends 3.1.5. South America Broadcast Cameras Market Trends 3.2. Broadcast Cameras Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Broadcast Cameras Market Drivers 3.2.1.2. North America Broadcast Cameras Market Restraints 3.2.1.3. North America Broadcast Cameras Market Opportunities 3.2.1.4. North America Broadcast Cameras Market Challenges 3.2.2. Europe 3.2.2.1. Europe Broadcast Cameras Market Drivers 3.2.2.2. Europe Broadcast Cameras Market Restraints 3.2.2.3. Europe Broadcast Cameras Market Opportunities 3.2.2.4. Europe Broadcast Cameras Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Broadcast Cameras Market Drivers 3.2.3.2. Asia Pacific Broadcast Cameras Market Restraints 3.2.3.3. Asia Pacific Broadcast Cameras Market Opportunities 3.2.3.4. Asia Pacific Broadcast Cameras Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Broadcast Cameras Market Drivers 3.2.4.2. Middle East and Africa Broadcast Cameras Market Restraints 3.2.4.3. Middle East and Africa Broadcast Cameras Market Opportunities 3.2.4.4. Middle East and Africa Broadcast Cameras Market Challenges 3.2.5. South America 3.2.5.1. South America Broadcast Cameras Market Drivers 3.2.5.2. South America Broadcast Cameras Market Restraints 3.2.5.3. South America Broadcast Cameras Market Opportunities 3.2.5.4. South America Broadcast Cameras Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Broadcast Cameras Industry 3.8. Analysis of Government Schemes and Initiatives For Broadcast Cameras Industry 3.9. Broadcast Cameras Market Trade Analysis 3.10. The Global Pandemic Impact on Broadcast Cameras Market 4. Broadcast Cameras Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 4.1.1. 2K 4.1.2. 4K 4.1.3. 8K 4.2. Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 4.2.1. System Cameras 4.2.2. Camcorders 4.2.3. Ptz Cameras 4.3. Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 4.3.1. CCD (Charge-Coupled Device) 4.3.2. CMOS (Complementary Metal-Oxide-Semiconductor) 4.4. Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 4.4.1. Cinematography 4.4.2. Live Production 4.4.3. News And Broadcast Production 4.4.4. Others 4.5. Broadcast Cameras Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Broadcast Cameras Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 5.1.1. 2K 5.1.2. 4K 5.1.3. 8K 5.2. North America Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 5.2.1. System Cameras 5.2.2. Camcorders 5.2.3. Ptz Cameras 5.3. North America Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 5.3.1. CCD (Charge-Coupled Device) 5.3.2. CMOS (Complementary Metal-Oxide-Semiconductor) 5.4. North America Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 5.4.1. Cinematography 5.4.2. Live Production 5.4.3. News And Broadcast Production 5.4.4. Others 5.5. North America Broadcast Cameras Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 5.5.1.1.1. 2K 5.5.1.1.2. 4K 5.5.1.1.3. 8K 5.5.1.2. United States Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 5.5.1.2.1. System Cameras 5.5.1.2.2. Camcorders 5.5.1.2.3. Ptz Cameras 5.5.1.3. United States Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 5.5.1.3.1. CCD (Charge-Coupled Device) 5.5.1.3.2. CMOS (Complementary Metal-Oxide-Semiconductor) 5.5.1.4. United States Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Cinematography 5.5.1.4.2. Live Production 5.5.1.4.3. News And Broadcast Production 5.5.1.4.4. Others 5.5.2. Canada 5.5.2.1. Canada Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 5.5.2.1.1. 2K 5.5.2.1.2. 4K 5.5.2.1.3. 8K 5.5.2.2. Canada Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 5.5.2.2.1. System Cameras 5.5.2.2.2. Camcorders 5.5.2.2.3. Ptz Cameras 5.5.2.3. Canada Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 5.5.2.3.1. CCD (Charge-Coupled Device) 5.5.2.3.2. CMOS (Complementary Metal-Oxide-Semiconductor) 5.5.2.4. Canada Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Cinematography 5.5.2.4.2. Live Production 5.5.2.4.3. News And Broadcast Production 5.5.2.4.4. Others 5.5.3. Mexico 5.5.3.1. Mexico Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 5.5.3.1.1. 2K 5.5.3.1.2. 4K 5.5.3.1.3. 8K 5.5.3.2. Mexico Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 5.5.3.2.1. System Cameras 5.5.3.2.2. Camcorders 5.5.3.2.3. Ptz Cameras 5.5.3.3. Mexico Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 5.5.3.3.1. CCD (Charge-Coupled Device) 5.5.3.3.2. CMOS (Complementary Metal-Oxide-Semiconductor) 5.5.3.4. Mexico Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Cinematography 5.5.3.4.2. Live Production 5.5.3.4.3. News And Broadcast Production 5.5.3.4.4. Others 6. Europe Broadcast Cameras Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 6.2. Europe Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 6.3. Europe Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 6.4. Europe Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 6.5. Europe Broadcast Cameras Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 6.5.1.2. United Kingdom Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 6.5.1.3. United Kingdom Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 6.5.1.4. United Kingdom Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 6.5.2.2. France Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 6.5.2.3. France Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 6.5.2.4. France Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Germany Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 6.5.3.3. Germany Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 6.5.3.4. Germany Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 6.5.4.2. Italy Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 6.5.4.3. Italy Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 6.5.4.4. Italy Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Spain Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 6.5.5.3. Spain Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 6.5.5.4. Spain Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Sweden Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 6.5.6.3. Sweden Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 6.5.6.4. Sweden Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Austria Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 6.5.7.3. Austria Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 6.5.7.4. Austria Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Rest of Europe Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 6.5.8.3. Rest of Europe Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 6.5.8.4. Rest of Europe Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Broadcast Cameras Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.3. Asia Pacific Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.4. Asia Pacific Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Broadcast Cameras Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.1.2. China Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.1.3. China Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.1.4. China Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.2.2. S Korea Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.2.3. S Korea Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.2.4. S Korea Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Japan Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.3.3. Japan Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.3.4. Japan Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.4.2. India Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.4.3. India Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.4.4. India Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.5.2. Australia Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.5.3. Australia Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.5.4. Australia Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.6.2. Indonesia Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.6.3. Indonesia Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.6.4. Indonesia Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.7.2. Malaysia Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.7.3. Malaysia Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.7.4. Malaysia Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.8.2. Vietnam Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.8.3. Vietnam Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.8.4. Vietnam Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.9.2. Taiwan Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.9.3. Taiwan Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.9.4. Taiwan Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 7.5.10.4. Rest of Asia Pacific Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Broadcast Cameras Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 8.3. Middle East and Africa Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 8.4. Middle East and Africa Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Broadcast Cameras Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 8.5.1.2. South Africa Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 8.5.1.3. South Africa Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 8.5.1.4. South Africa Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 8.5.2.2. GCC Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 8.5.2.3. GCC Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 8.5.2.4. GCC Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Nigeria Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 8.5.3.3. Nigeria Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 8.5.3.4. Nigeria Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 8.5.4.2. Rest of ME&A Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 8.5.4.3. Rest of ME&A Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 8.5.4.4. Rest of ME&A Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 9. South America Broadcast Cameras Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 9.2. South America Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 9.3. South America Broadcast Cameras Market Size and Forecast, by Sensor(2024-2032) 9.4. South America Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 9.5. South America Broadcast Cameras Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 9.5.1.2. Brazil Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 9.5.1.3. Brazil Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 9.5.1.4. Brazil Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 9.5.2.2. Argentina Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 9.5.2.3. Argentina Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 9.5.2.4. Argentina Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Broadcast Cameras Market Size and Forecast, by Type (2024-2032) 9.5.3.2. Rest Of South America Broadcast Cameras Market Size and Forecast, by Camera Type (2024-2032) 9.5.3.3. Rest Of South America Broadcast Cameras Market Size and Forecast, by Sensor (2024-2032) 9.5.3.4. Rest Of South America Broadcast Cameras Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Grass Valley (Montreal, Canada) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Blackmagic Design USA (Fremont, USA) 10.3. RED Digital Cinema (Irvine, USA) 10.4. Ross Video (Ottawa, Canada) 10.5. AJA Video Systems (Grass Valley, USA) 10.6. LiveU (Hackensack, USA) 10.7. Core SWX (Plainview, USA) 10.8. PTZOptics (Downingtown, USA) 10.9. ARRI (Munich, Germany) 10.10. Ikegami Europe (Neuss, Germany) 10.11. FOR-A Europe (London, UK) 10.12. Bright Tangerine (Hampshire, UK) 10.13. Decimator Europe (London, UK) 10.14. EVS Broadcast Equipment (Liège, Belgium) 10.15. Sony Corporation (Tokyo, Japan) 10.16. Panasonic Corporation (Osaka, Japan) 10.17. Canon Inc. (Tokyo, Japan) 10.18. Hitachi Kokusai Electric (Tokyo, Japan) 10.19. Ikegami Tsushinki (Tokyo, Japan) 10.20. JVC Kenwood (Yokohama, Japan) 10.21. Kinefinity (Beijing, China) 10.22. Z CAM (Shenzhen, China) 10.23. DJI (Shenzhen, China) 10.24. BirdDog APAC (Melbourne, Australia) 10.25. Vision Research – Phantom Cameras (Wayne, USA) 10.26. Telemetrics (Allendale, USA) 11. Key Findings 12. Industry Recommendations 13. Broadcast Cameras Market: Research Methodology 14. Terms and Glossary