Biliary Catheters Market size was valued at USD 3.20 Billion in 2024 and the total Global Biliary Catheters Market revenue is expected to grow at a CAGR of 7.2% from 2025 to 2032, reaching nearly USD 5.58 Billion.Biliary Catheters Market Overview

Biliary catheters are thin, flexible tubes are inserted into the bile ducts, the normal flow is interrupted, to remove the bile from the liver. They are usually used in the treatment of conditions such as bile duct obstructions, bile stones and tumours. Biliary catheters are important health devices used to drain bile from blocked ducts, manage bile leakage and deliver therapeutic agents. The market has been experiencing strong growth because the increasing prevalence of liver-related diseases such as cholangitis, bile duct cancer, and cirrhosis, coupled with the rising geriatric population globally. Increasing incidence of liver disorders is increasing preference for minimum invasive processes, and increasing adoption of image-directed catheterization techniques. With technological progress in catheter design, improvement in better healthcare infrastructure in emerging markets is expected to create important opportunities for market expansion. By application, the drainage segment dominated the market driven by the high demand biliary drainage in obstructive conditions. North America held the largest market share due to well-established healthcare systems early adoption of advanced treatments as well as rising patient awareness. Major Key players include Boston Scientific Corporation, Cook Medical, Medtronic plc, Becton, Dickinson, Company, and Teleflex Incorporated, are focusing on modernization or global expansion to maintain competitive advantage.To Know About The Research Methodology :- Request Free Sample Report

Biliary Catheters Market Dynamics

Rising Liver Disease Burden and Advancements to Drive the Market Growth Rising inclination towards unhealthy food habits, sedentary lifestyle, alcohol, and tobacco consumption are the key factors contributing to the rise in cases of liver cirrhosis and cholangitis. This factor fuels the global biliary catheter market as the demand for biliary drainage increases. Also, new product launches, improvement in liver function, and increasing awareness about various liver disorders help to boost the market growth. According to National statistics in the UK, liver diseases have been ranked as the fifth most common cause of death. Liver diseases are recognized as the second leading cause of mortality amongst all digestive diseases in the US. Global prevalence of cirrhosis from autopsy studies ranges from 4.5% to 9.5% of the general population. However, high cost and discomfort due to catheter caused to the patient may impact negatively on the market growth. Rising Geriatric Population to Boost Growth of the Biliary Catheter Market The growing global omist population is making significant contribution to the demand for bile catheter. Large adults are susceptible to liver and bile disorders such as bile duct barrier, bile stones, and collangitis due to age -related physical changes. This demographic innings increases the requirement of minimum invasive intervention such as bile catheterization, which leads to an increase in the market. Risk of Complications and Infections to Impact of the Market Biliary catheterization, being an aggressive process, risk several complications, including infection, bile leak, bleeding and catheter obstruction. These adverse consequences may lead to stay, additional treatment and discomfort of the patient. As a result, healthcare provider and patients can hesitate, limiting the process widely.Biliary Catheters Market Segment Analysis

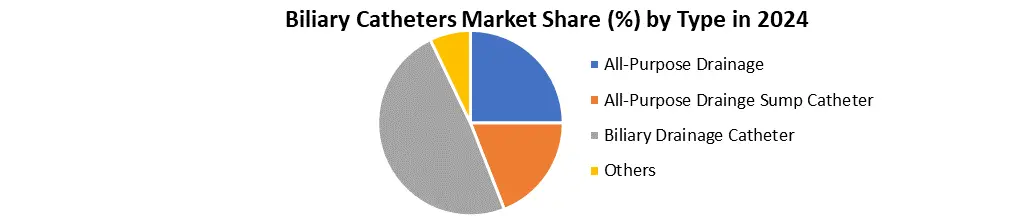

Based on Application, the market is segmented into Thrombectomy, Drainage, Infusion Dialysis, Stent Delivery, Dilatation. Drainage segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Due to the high proliferation of bile barriers due to conditions such as liver cancer, bile stones and collangitis. Biliary drainage is a significant intervention that is used to relieve bile duct blockage, reduce the risk of infection and improve liver function. Its minimal invasive nature and comprehensive clinical acceptance make it the most performing process, especially among elderly patients and people with inoperable tumors. Progress in imaging and catheter technology has further enhanced the protection and efficacy of drainage processes, which contributes to its dominance in the market. Based on type, All-Purpose Drainage, All-Purpose Drainage Sump Catheter, Biliary Drainage Catheter and Others. Biliary Drainage Catheter segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Due to its widespread use in the management of bile barriers, strictness and fatal obstructions. Especially among the elderly population, the increasing prevalence of cholangiocarcinoma, gallstones and pancreatic cancer has greatly increased the demand for bile drainage catheter. With the progression of imaging technologies (such as fluoroscopy and endoscopic ultrasound), with an increase in minimum invasive processes such as ERCP, it has contributed further to the dominance of this section. In addition, the biliary drainage catheter is widely preferred in both clinical and therapeutic applications, giving them a comprehensive clinical utility compared to the general-referred drainage or the ignorance catheter.

Biliary Catheters Market Regional Analysis

North America led the Biliary Catheters market in 2024 and is expected to lead the global market during the forecast period(2025-2032) Advancements in research facilities and increased funding for the same increased awareness about various liver diseases due to high alcohol consumption rate in the region, healthcare expenditure are the factors driving the market in North America. Around 4.5 a million adults are diagnosed with the live disease every year in the US. Biliary Catheters Market Competitive Landscape Major Key players such as Boston Scientific Corporation, Cook Medical Inc., and Medtronic plc form backbone of the biliary catheters market. collectively account for over 45% of the global market share due to their technological leadership and extensive distribution networks. Boston Scientific Corporation holds approximately 20–22% of the global biliary catheters market. The company’s dominance is supported by its cutting-edge biliary access and drainage product lines, such as the WallFlex Biliary RX Stent and Advanix biliary stents and a strong presence across North America, Europe, and Asia-Pacific. Cook Medical Inc. maintains a share of about 13–15%, known for its focus on minimally invasive solutions, particularly in diagnostic and interventional biliary procedures. Products like the Fusion OMNI Drainage Catheter enhance its standing in specialty care. Medtronic plc controls around 10–12% of the market, leveraging its advanced imaging systems and integration with navigation platforms to support catheter-based biliary interventions. Medtronic’s global operations, spanning over 150 countries, support rapid commercialization and product adaptation.The product innovation of these companies strengthens their competitive edge in the innovation, clinical efficacy, and the expansion of access to emerging markets. Biliary Catheters Market TrendsBiliary Catheters Market Key Development • In 14 March 2024 Boston Scientific Corporation (USA) Launched the SpyGlass Discover Digital Catheter to enhance biliary imaging during ERCP. • In 15 November 2023 Terumo Corporation (Japan) Opened a new manufacturing facility in Vietnam to scale up production of interventional catheters. • In 28 February 2024 B. Braun Melsungen AG (Germany) Launched Easymed biliary catheter series focused on patient comfort and high maneuverability. • In 9 January 2024 Cook Medical Inc. (USA) Expanded its biliary access product line with the release of the Fusion OMNI Drainage Catheter. • In 20 June 2023 Medtronic plc (Ireland) Announced collaboration with Philips to integrate real-time imaging in biliary interventions.

Trends Description Minimally Invasive Procedures Rising Increasing adoption of minimally invasive biliary drainage and stenting. Technological Advancements Development of image-guided, drug-eluting, and steerable biliary catheters. Aging Population & Liver Disorders Rising cases of gallstones, liver cancer, and biliary obstructions in elderly. Biliary Catheters Market Scope : Inquire before buying

Biliary Catheters Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.20 Bn. Forecast Period 2025 to 2032 CAGR: 7.2% Market Size in 2032: USD 5.58 Bn. Segments Covered: by Type All-Purpose Drainage All-Purpose Drainage Sump Catheter Biliary Drainage Catheter Others by Application Thrombectomy Drainage Infusion Dialysis Stent Delivery Dilatation by End Users Hospitals Clinics Dialysis Centers Biliary Catheters Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand and Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Biliary Catheters Market Key Players

North America 1. Boston Scientific Corporation (USA) 2. Cook Medical Inc. (USA) 3. Medtronic plc (USA/Ireland) 4. BD (Becton, Dickinson and Company) (USA) 5. Abbott Laboratories (USA) 6. Teleflex Incorporated (USA) 7. Merit Medical Systems, Inc. (USA) Europe 8. B. Braun Melsungen AG (Germany) 9. Sartorius AG (Germany) 10. Smiths Medical (ICU Medical) (UK) 11. Coloplast A/S (Denmark) 12. Vygon Group (France) 13. Peter Pflugbeil GmbH (Germany) 14. AngioDynamics Europe B.V. (Netherlands) Asia-Pacific 15. Terumo Corporation (Japan) 16. Nipro Corporation (Japan) 17. Asahi Intecc Co., Ltd. (Japan) 18. Lifetech Scientific Corporation (China) 19. Suru International Pvt. Ltd. (India) 20. Allwell Medical (Hong Kong) 21. SCW Medicath Ltd. (China) South America 22. BIOTRONIK Latin America (Brazil) 23. Laboratorios Silanes S.A. de C.V. (Mexico) Middle East & Africa 24. DISA Vascular (South Africa) 25. SAAPP MedTech (UAE) 26. Biosensors International (Middle East operations) (Singapore/UAE)Frequently Asked Questions

1. What was the size of the global biliary catheters market in 2024, and what is it expected to reach by 2032? Ans: The market was valued at USD 3.20 billion in 2024 and is expected to reach USD 5.58 billion by 2032, growing at a CAGR of 7.2%. 2. Which application segment dominated the biliary catheters market in 2024? Ans: The Drainage segment dominated the market in 2024 due to its wide use in treating bile duct blockages and improving liver function. 3. Which region held the largest share of the biliary catheters market in 2024? Ans: North America held the largest market share due to advanced healthcare infrastructure, high awareness, and early adoption of new treatments. 4. Who are the major key players in the global biliary catheters market? Ans: Key players include Boston Scientific Corporation, Cook Medical Inc., Medtronic plc, Becton, Dickinson and Company, and Teleflex Incorporated. 5. What are the major trends in the biliary catheters market? Ans: Major trends include increased adoption of minimally invasive procedures, technological advancements (like drug-eluting and image-guided catheters), and rising liver diseases among the aging population.

1. Biliary Catheters Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Biliary Catheters Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Application Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Biliary Catheters Market: Dynamics 3.1. Region wise Trends of Biliary Catheters Market 3.1.1. North America Biliary Catheters Market Trends 3.1.2. Europe Biliary Catheters Market Trends 3.1.3. Asia Pacific Biliary Catheters Market Trends 3.1.4. Middle East and Africa Biliary Catheters Market Trends 3.1.5. South America Biliary Catheters Market Trends 3.2. Biliary Catheters Market Dynamics 3.2.1. Global Biliary Catheters Market Drivers 3.2.1.1. Rising liver disease cases 3.2.1.2. Growing geriatric population 3.2.2. Global Biliary Catheters Market Restraints 3.2.3. Global Biliary Catheters Market Opportunities 3.2.3.1. Emerging healthcare markets 3.2.3.2. Technological innovation 3.2.4. Global Biliary Catheters Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Biliary Catheters Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Biliary Catheters Market Size and Forecast, By Type (2024-2032) 4.1.1. All-Purpose Drainage 4.1.2. All-Purpose Drainage Sump Catheter 4.1.3. Biliary Drainage Catheter 4.1.4. Others 4.2. Biliary Catheters Market Size and Forecast, By Application (2024-2032) 4.2.1. Thrombectomy 4.2.2. Drainage 4.2.3. Infusion 4.2.4. Dialysis 4.2.5. Stent Delivery 4.2.6. Dilatation 4.3. Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 4.3.1. Hospitals 4.3.2. Clinics 4.3.3. Dialysis Centers 4.4. Biliary Catheters Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Biliary Catheters Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Biliary Catheters Market Size and Forecast, By Type (2024-2032) 5.1.1. All-Purpose Drainage 5.1.2. All-Purpose Drainage Sump Catheter 5.1.3. Biliary Drainage Catheter 5.1.4. Others 5.2. North America Biliary Catheters Market Size and Forecast, By Application (2024-2032) 5.2.1. Thrombectomy 5.2.2. Drainage 5.2.3. Infusion 5.2.4. Dialysis 5.2.5. Stent Delivery 5.2.6. Dilatation 5.3. North America Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 5.3.1. Hospitals 5.3.2. Clinics 5.3.3. Dialysis Centers 5.4. North America Biliary Catheters Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Biliary Catheters Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. All-Purpose Drainage 5.4.1.1.2. All-Purpose Drainage Sump Catheter 5.4.1.1.3. Biliary Drainage Catheter 5.4.1.1.4. Others 5.4.1.2. United States Biliary Catheters Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Thrombectomy 5.4.1.2.2. Drainage 5.4.1.2.3. Infusion 5.4.1.2.4. Dialysis 5.4.1.2.5. Stent Delivery 5.4.1.2.6. Dilatation 5.4.1.3. United States Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 5.4.1.3.1. Hospitals 5.4.1.3.2. Clinics 5.4.1.3.3. Dialysis Centers 5.4.2. Canada 5.4.2.1. Canada Biliary Catheters Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. All-Purpose Drainage 5.4.2.1.2. All-Purpose Drainage Sump Catheter 5.4.2.1.3. Biliary Drainage Catheter 5.4.2.1.4. Others 5.4.2.2. Canada Biliary Catheters Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Thrombectomy 5.4.2.2.2. Drainage 5.4.2.2.3. Infusion 5.4.2.2.4. Dialysis 5.4.2.2.5. Stent Delivery 5.4.2.2.6. Dilatation 5.4.2.3. Canada Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 5.4.2.3.1. Hospitals 5.4.2.3.2. Clinics 5.4.2.3.3. Dialysis Centers 5.4.2.4. Mexico Biliary Catheters Market Size and Forecast, By Type (2024-2032) 5.4.2.4.1. All-Purpose Drainage 5.4.2.4.2. All-Purpose Drainage Sump Catheter 5.4.2.4.3. Biliary Drainage Catheter 5.4.2.4.4. Others 5.4.2.5. Mexico Biliary Catheters Market Size and Forecast, By Application (2024-2032) 5.4.2.5.1. Thrombectomy 5.4.2.5.2. Drainage 5.4.2.5.3. Infusion 5.4.2.5.4. Dialysis 5.4.2.5.5. Stent Delivery 5.4.2.5.6. Dilatation 5.4.2.6. Mexico Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 5.4.2.6.1. Hospitals 5.4.2.6.2. Clinics 5.4.2.6.3. Dialysis Centers 6. Europe Biliary Catheters Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Biliary Catheters Market Size and Forecast, By Type (2024-2032) 6.2. Europe Biliary Catheters Market Size and Forecast, By Application (2024-2032) 6.3. Europe Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 6.4. Europe Biliary Catheters Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Biliary Catheters Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Biliary Catheters Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 6.4.2. France 6.4.2.1. France Biliary Catheters Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Biliary Catheters Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Biliary Catheters Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Biliary Catheters Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Biliary Catheters Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Biliary Catheters Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Biliary Catheters Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Biliary Catheters Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Biliary Catheters Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Biliary Catheters Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Biliary Catheters Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Austria Biliary Catheters Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Biliary Catheters Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Biliary Catheters Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7. Asia Pacific Biliary Catheters Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4. Asia Pacific Biliary Catheters Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.4. India 7.4.4.1. India Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Philippines Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Malaysia Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Vietnam Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Thailand Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Biliary Catheters Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Biliary Catheters Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 8. Middle East and Africa Biliary Catheters Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Biliary Catheters Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Biliary Catheters Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 8.4. Middle East and Africa Biliary Catheters Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Biliary Catheters Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Biliary Catheters Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Biliary Catheters Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Biliary Catheters Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Biliary Catheters Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Nigeria Biliary Catheters Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Biliary Catheters Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Rest of ME&A Biliary Catheters Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 9. South America Biliary Catheters Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Biliary Catheters Market Size and Forecast, By Type (2024-2032) 9.2. South America Biliary Catheters Market Size and Forecast, By Application (2024-2032) 9.3. South America Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 9.4. South America Biliary Catheters Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Biliary Catheters Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Biliary Catheters Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Biliary Catheters Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Biliary Catheters Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Biliary Catheters Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Rest of South America Biliary Catheters Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Biliary Catheters Market Size and Forecast, By End-User (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Type Players) 10.1. Boston Scientific Corporation (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Cook Medical Inc. (USA) 10.3. Medtronic plc (USA/Ireland) 10.4. BD (Becton, Dickinson and Company) (USA) 10.5. Abbott Laboratories (USA) 10.6. Teleflex Incorporated (USA) 10.7. Merit Medical Systems, Inc. (USA) 10.8. B. Braun Melsungen AG (Germany) 10.9. Sartorius AG (Germany) 10.10. Smiths Medical (ICU Medical) (UK) 10.11. Coloplast A/S (Denmark) 10.12. Vygon Group (France) 10.13. Peter Pflugbeil GmbH (Germany) 10.14. AngioDynamics Europe B.V. (Netherlands) 10.15. Terumo Corporation (Japan) 10.16. Nipro Corporation (Japan) 10.17. Asahi Intecc Co., Ltd. (Japan) 10.18. Lifetech Scientific Corporation (China) 10.19. Suru International Pvt. Ltd. (India) 10.20. Allwell Medical (Hong Kong) 10.21. SCW Medicath Ltd. (China) 10.22. BIOTRONIK Latin America (Brazil) 10.23. Laboratorios Silanes S.A. de C.V. (Mexico) 10.24. DISA Vascular (South Africa) 10.25. SAAPP MedTech (UAE) 10.26. Biosensors International (Middle East operations) (Singapore/UAE) 11. Key Findings 12. Analyst Recommendations 13. Biliary Catheters Market: Research Methodology