The Global Base Layer Market reached USD 9.30 billion in 2024 and is expected to grow to USD 12.15 billion by 2032 at a 3.4% CAGR. Factors such as increasing demand for performance-based clothing, sustainability trends, and advancements in fabric technology are driving growth across key regions, including North America, Europe, and Asia-Pacific.Base Layer Market Overview

Base layers are critical for outdoor and sports activities such as skiing, hiking, and snowboarding. These garments are engineered to manage moisture, provide warmth, and offer comfort during physical exertion. The performance-oriented clothing is designed to be worn as the first layer of an outfit, typically for activities that require thermal regulation and moisture-wicking properties. The increasing outdoor participation, advancements in fabric technologies, and growing demand for high-performance sportswear drive the Base Layer Market. Base layer clothing includes tops, bottoms, one-piece suits, and accessories made from materials such as synthetic fabrics, merino wool, cotton, and blends. Consumer demand for performance-based layers for winter sports, outdoor activities, and fitness. Innovations in eco-friendly base layers and improvements in synthetic materials are expected to contribute to market growth.To know about the Research Methodology :- Request Free Sample Report

Trend: Increasing demand for eco-friendly base layers

Consumers are becoming increasingly aware of the environmental impact of their purchases, leading to a significant shift towards eco-friendly base layer apparel. Innovations in synthetic base layers made from recycled polyester and other sustainable fibers are gaining popularity as an alternative to traditional materials. Additionally, brands are focusing on incorporating merino wool sourced from ethical, sustainable farming practices to meet consumer demand for more environmentally conscious products. The rise of eco-friendly base layers aligns with the global trend towards sustainability and is expected to propel the market. In 2024, approximately 20% of the North American Base Layer Market is anticipated to consist of sustainable and eco-friendly base layer products. Consumers, particularly millennials and Gen Z, are prioritizing brands that emphasize environmental responsibility, which is expected to further drive the adoption of these products. Key Drivers Behind the Increasing Demand for Eco-Friendly Base LayersGrowing participation in outdoor and winter sports to drive Base Layer Market Growth Activities such as skiing, snowboarding, hiking, and mountain biking require specialized performance base layers to ensure comfort and protection in extreme weather conditions. The rise of outdoor tourism and adventure sports is directly influencing the demand for high-performance thermal base layers that regulate body temperature, wick moisture, and provide comfort during physical exertion. As participation in winter sports grows, the demand for specialized base layer products that cater to these activities is also on the rise, drives Base Layer Market. Moreover, with increasing awareness about the benefits of proper layering for comfort and performance, athletes and outdoor enthusiasts are prioritizing high-quality base layers to enhance their experiences. High cost of merino wool base layers to Restraint Market Growth Although merino wool is known for its superior moisture-wicking, insulating, and odor-resistant properties, it is considerably more expensive than synthetic base layers. The high production costs associated with merino wool including ethical sourcing and manufacturing processes, contribute to its premium price, making it less accessible to a broader consumer base. In 2024, merino wool base layers accounted for 15-18% of the total base layer market in North America. This price barrier limits the growth of merino wool base layers, especially in regions where consumers prioritize affordability. As synthetic materials become more advanced and cost-effective, the demand for merino wool base layers may face challenges, particularly in price-sensitive segments. Cost restraint is a critical factor that brands need to address by exploring more affordable sourcing or production methods to make merino wool products more accessible to a wider audience.

Base Layer Market Segment Analysis

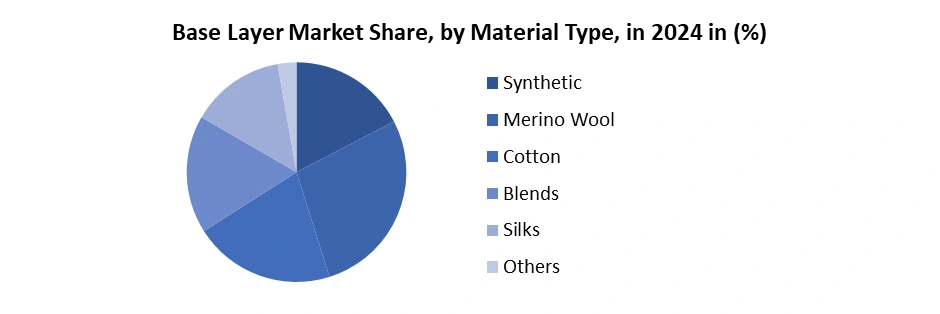

By product Type, the market is segmented into the Tops, Bottoms, One-piece Suits, Accessories and Others. Tops held the Largest Base Layer Market share in 2024. As the primary garment worn in layering systems, base layer tops are critical in providing comfort, warmth, and moisture management. The Tops segment is particularly popular in winter sports such as skiing, snowboarding, and hiking, where temperature regulation and moisture-wicking capabilities are crucial. Base layer tops made from materials like merino wool and synthetic fibers offer superior moisture-wicking and temperature control, making them ideal for activewear base layers. In North America, demand for base layer tops has surged as outdoor activities, including hiking and skiing, continue to rise in popularity. This growth is driven by the increasing preference for performance-based layers, which provide athletes and outdoor enthusiasts with enhanced comfort during physical exertion. As a result, the Tops segment is expected to remain the largest segment within the base layer apparel market. Additionally, the rise of eco-friendly base layers, made from sustainable materials, has bolstered this segment's popularity, especially among environmentally conscious consumers. The Tops segment is also favored for its versatility, as it can be worn across multiple seasons, providing both warmth and breathability.By Material Type, the market is categorized into the Synthetic, Merino Wool, Cotton, Blends, Silks and Others. Synthetic material type is expected to dominate the Base layer Market over the forecast period. Synthetic fibers such as polyester and nylon are commonly used in the manufacturing of base layers because of their ability to wick away moisture, dry quickly, and retain warmth while remaining lightweight. These characteristics make synthetic base layers ideal for outdoor activities, particularly winter sports like skiing and snowboarding, where performance, comfort, and quick-drying properties are essential. The North American Base Layer Market has experienced significant growth in synthetic base layers due to their versatility and practical advantages over natural fibers. Synthetic materials are more affordable than premium options like merino wool while offering comparable moisture-wicking and insulation benefits. Additionally, synthetic base layers are known for their durability, withstanding frequent wear and harsh outdoor conditions. The growing trend of activewear base layers, where performance, comfort, and value are key factors, has contributed to the increasing popularity of synthetic base layers.

Base Layer Market Regional Insights

North America dominated the Base Layer Market in 2024 and is expected to continue its dominance over the forecast period. This region encompasses the U.S., Canada, and Mexico, where base layer clothing is essential for various outdoor activities, including skiing, hiking, and snowboarding. The demand for performance base layers and thermal base layers, particularly those made from synthetic and merino wool blends, is rising due to increasing participation in winter sports and outdoor adventures. Key market trends include a growing preference for moisture-wicking, breathable, and odour-resistant base layers. Merino wool base layers are popular for their superior insulation and moisture management properties, while synthetic base layers are favored for their durability and quick-drying features. Compression base layers are gaining traction among fitness enthusiasts and athletes due to their performance-enhancing benefits. The U.S. dominates the market share, driven by its large winter sports community and active outdoor lifestyle. In Canada, the demand for thermal base layers for extreme cold conditions also contributes to market growth. Mexico, while smaller in comparison, is showing a steady increase in outdoor activity participation, driving the need for high-performance base layers.Base Layer Market Competitive Landscape

The global base layer market is characterized by moderate consolidation, with leading players such as Nike, Adidas, Under Armour, The North Face, and Columbia Sportswear holding a significant share of the market. These companies leverage their strong brand recognition, extensive distribution networks, and continuous innovation in materials and performance features, such as moisture-wicking and thermal regulation. In addition to these global giants, smaller, niche players focus on specialized segments, offering products made from merino wool, sustainable fabrics, or designs tailored for outdoor or tactical use. These brands differentiate themselves by emphasizing performance, comfort, and sustainability. The competition is driven by online direct-to-consumer sales models, along with traditional retail channels. • Adidas Terrex and National Geographic Collaboration (July 2024): Adidas Terrex partnered with National Geographic to launch a new hiking collection in July 2024. This collaboration, marking its fourth chapter, focused on outdoor performance apparel and footwear inspired by frozen landscapes. The collection, designed for extreme conditions, emphasizes comfort and protection for explorers in cold-weather environments. The apparel features graphics and imagery representing winter landscapes, highlighting advancements in base layer technology for those engaging in challenging outdoor activities. • Smartwool’s Thermal Merino Baselayer in Plus Size (February 2024): In February 2024, Smartwool launched a new Thermal Merino Baselayer in Plus Size for women as part of its Fall/Winter 2024/2025 collection. Available in sizes 1X, 2X, and 3X, this move aimed to enhance inclusivity in outdoor apparel. The new base layer offered the same high-performance merino wool qualities moisture-wicking, insulating, and comfortable ensuring that a wider range of body types could experience the benefits of stylish and functional outdoor gear.Base Layer Market Scope: Inquire before buying

Global Base Layer Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 9.30 Bn. Forecast Period 2025 to 2032 CAGR: 3.4% Market Size in 2032: USD 12.15 Bn. Segments Covered: by Product Type Tops Bottoms One-piece Suits Accessories Others by Material Type Synthetic Merino Wool Cotton Blends Silks Others by Price High Medium Low by Gender Men Women Kids by Application Sports & Fitness Outdoor Activities Military & Tactical Industrial Workwear Casual Wear Others by Distribution Channel Specialty Stores Supermarket/Hypermarket Online Retail Others Base Layer Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Base Layer Key Players

1. Adidas 2. ANTA Sports 3. Arc’teryx 4. Columbia Sportswear 5. Falke 6. GORE 7. Helly Hansen 8. Icebreaker 9. Li Ning 10. Löffler 11. Mizuno 12. Nike 13. Odlo 14. Puma 15. Rab 16. Skins 17. The North Face 18. Tommy Copper 19. Under Armour 20. VF Corporation 21. Decathlon 22. Craft Sportswear 23. Smartwool 24. Patagonia 25. Sofitex S.R.L. 26. Unigrand Group Ltd. 27. AMETRA 28. PIERRE YVES FashionFrequently Asked Questions:

1] What is the growth rate of the Global Base Layer Market? Ans. The Global Base Layer Market is growing at a significant rate of 3.4 % during the forecast period. 2] Which region is expected to dominate the Global Base Layer Market? Ans. North America is expected to dominate the Base Layer Market during the forecast period. 3] What was the Global Base Layer Market size in 2024? Ans. The Base Layer Market size is expected to reach USD 9.30 billion in 2024. 4] What is the expected Global Base Layer Market size by 2032? Ans. The Base Layer Market size is expected to reach USD 12.15. billion by 2032. 5] Which are the top players in the Global Base Layer Market? Ans. The major players in the Global Base Layer Market are Adidas, ANTA Sports, Arc’teryx, Columbia Sportswear, Falke and Others. 6] What are the factors driving the Global Base Layer Market growth? Ans. The increasing participation in outdoor activities, rising demand for performance apparel, advancements in sustainable materials, technological innovations, and growing consumer awareness of environmental impact drive Base Layer Market growth.

1. Base Layer Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Base Layer Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Base Layer Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Base Layer Market: Dynamics 3.1. Base Layer Market Trends by Region 3.1.1. North America Base Layer Market Trends 3.1.2. Europe Base Layer Market Trends 3.1.3. Asia Pacific Base Layer Market Trends 3.1.4. Middle East and Africa Base Layer Market Trends 3.1.5. South America Base Layer Market Trends 3.2. Base Layer Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Base Layer Market Drivers 3.2.1.2. North America Base Layer Market Restraints 3.2.1.3. North America Base Layer Market Opportunities 3.2.1.4. North America Base Layer Market Challenges 3.2.2. Europe 3.2.2.1. Europe Base Layer Market Drivers 3.2.2.2. Europe Base Layer Market Restraints 3.2.2.3. Europe Base Layer Market Opportunities 3.2.2.4. Europe Base Layer Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Base Layer Market Drivers 3.2.3.2. Asia Pacific Base Layer Market Restraints 3.2.3.3. Asia Pacific Base Layer Market Opportunities 3.2.3.4. Asia Pacific Base Layer Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Base Layer Market Drivers 3.2.4.2. Middle East and Africa Base Layer Market Restraints 3.2.4.3. Middle East and Africa Base Layer Market Opportunities 3.2.4.4. Middle East and Africa Base Layer Market Challenges 3.2.5. South America 3.2.5.1. South America Base Layer Market Drivers 3.2.5.2. South America Base Layer Market Restraints 3.2.5.3. South America Base Layer Market Opportunities 3.2.5.4. South America Base Layer Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Base Layer Industry 3.8. Analysis of Government Schemes and Initiatives For Base Layer Industry 3.9. Base Layer Market Trade Analysis 3.10. The Global Pandemic Impact on Base Layer Market 4. Base Layer Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Base Layer Market Size and Forecast, by Material Type (2024-2032) 4.1.1. Synthetic 4.1.2. Merino Wool 4.1.3. Cotton 4.1.4. Blends 4.1.5. Others 4.2. Base Layer Market Size and Forecast, by Gender (2024-2032) 4.2.1. Men 4.2.2. Women 4.2.3. Kids 4.3. Base Layer Market Size and Forecast, by Product Type (2024-2032) 4.3.1. Tops 4.3.2. Bottoms 4.3.3. One-piece Suits 4.3.4. Accessories 4.4. Base Layer Market Size and Forecast, by End Use (2024-2032) 4.4.1. Sports & Fitness 4.4.2. Outdoor Activities 4.4.3. Military & Tactical 4.4.4. Industrial Workwear 4.4.5. Casual Wear 4.5. Base Layer Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Base Layer Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Base Layer Market Size and Forecast, by Material Type (2024-2032) 5.1.1. Synthetic 5.1.2. Merino Wool 5.1.3. Cotton 5.1.4. Blends 5.1.5. Others 5.2. North America Base Layer Market Size and Forecast, by Gender (2024-2032) 5.2.1. Men 5.2.2. Women 5.2.3. Kids 5.3. North America Base Layer Market Size and Forecast, by Product Type (2024-2032) 5.3.1. Tops 5.3.2. Bottoms 5.3.3. One-piece Suits 5.3.4. Accessories 5.4. North America Base Layer Market Size and Forecast, by End Use (2024-2032) 5.4.1. Sports & Fitness 5.4.2. Outdoor Activities 5.4.3. Military & Tactical 5.4.4. Industrial Workwear 5.4.5. Casual Wear 5.5. North America Base Layer Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Base Layer Market Size and Forecast, by Material Type (2024-2032) 5.5.1.1.1. Synthetic 5.5.1.1.2. Merino Wool 5.5.1.1.3. Cotton 5.5.1.1.4. Blends 5.5.1.1.5. Others 5.5.1.2. United States Base Layer Market Size and Forecast, by Gender (2024-2032) 5.5.1.2.1. Men 5.5.1.2.2. Women 5.5.1.2.3. Kids 5.5.1.3. United States Base Layer Market Size and Forecast, by Product Type (2024-2032) 5.5.1.3.1. Tops 5.5.1.3.2. Bottoms 5.5.1.3.3. One-piece Suits 5.5.1.3.4. Accessories 5.5.1.4. United States Base Layer Market Size and Forecast, by End Use (2024-2032) 5.5.1.4.1. Sports & Fitness 5.5.1.4.2. Outdoor Activities 5.5.1.4.3. Military & Tactical 5.5.1.4.4. Industrial Workwear 5.5.1.4.5. Casual Wear 5.5.2. Canada 5.5.2.1. Canada Base Layer Market Size and Forecast, by Material Type (2024-2032) 5.5.2.1.1. Synthetic 5.5.2.1.2. Merino Wool 5.5.2.1.3. Cotton 5.5.2.1.4. Blends 5.5.2.1.5. Others 5.5.2.2. Canada Base Layer Market Size and Forecast, by Gender (2024-2032) 5.5.2.2.1. Men 5.5.2.2.2. Women 5.5.2.2.3. Kids 5.5.2.3. Canada Base Layer Market Size and Forecast, by Product Type (2024-2032) 5.5.2.3.1. Tops 5.5.2.3.2. Bottoms 5.5.2.3.3. One-piece Suits 5.5.2.3.4. Accessories 5.5.2.4. Canada Base Layer Market Size and Forecast, by End Use (2024-2032) 5.5.2.4.1. Sports & Fitness 5.5.2.4.2. Outdoor Activities 5.5.2.4.3. Military & Tactical 5.5.2.4.4. Industrial Workwear 5.5.2.4.5. Casual Wear 5.5.3. Mexico 5.5.3.1. Mexico Base Layer Market Size and Forecast, by Material Type (2024-2032) 5.5.3.1.1. Synthetic 5.5.3.1.2. Merino Wool 5.5.3.1.3. Cotton 5.5.3.1.4. Blends 5.5.3.1.5. Others 5.5.3.2. Mexico Base Layer Market Size and Forecast, by Gender (2024-2032) 5.5.3.2.1. Men 5.5.3.2.2. Women 5.5.3.2.3. Kids 5.5.3.3. Mexico Base Layer Market Size and Forecast, by Product Type (2024-2032) 5.5.3.3.1. Tops 5.5.3.3.2. Bottoms 5.5.3.3.3. One-piece Suits 5.5.3.3.4. Accessories 5.5.3.4. Mexico Base Layer Market Size and Forecast, by End Use (2024-2032) 5.5.3.4.1. Sports & Fitness 5.5.3.4.2. Outdoor Activities 5.5.3.4.3. Military & Tactical 5.5.3.4.4. Industrial Workwear 5.5.3.4.5. Casual Wear 6. Europe Base Layer Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Base Layer Market Size and Forecast, by Material Type (2024-2032) 6.2. Europe Base Layer Market Size and Forecast, by Gender (2024-2032) 6.3. Europe Base Layer Market Size and Forecast, by Product Type (2024-2032) 6.4. Europe Base Layer Market Size and Forecast, by End Use (2024-2032) 6.5. Europe Base Layer Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Base Layer Market Size and Forecast, by Material Type (2024-2032) 6.5.1.2. United Kingdom Base Layer Market Size and Forecast, by Gender (2024-2032) 6.5.1.3. United Kingdom Base Layer Market Size and Forecast, by Product Type (2024-2032) 6.5.1.4. United Kingdom Base Layer Market Size and Forecast, by End Use (2024-2032) 6.5.2. France 6.5.2.1. France Base Layer Market Size and Forecast, by Material Type (2024-2032) 6.5.2.2. France Base Layer Market Size and Forecast, by Gender (2024-2032) 6.5.2.3. France Base Layer Market Size and Forecast, by Product Type (2024-2032) 6.5.2.4. France Base Layer Market Size and Forecast, by End Use (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Base Layer Market Size and Forecast, by Material Type (2024-2032) 6.5.3.2. Germany Base Layer Market Size and Forecast, by Gender (2024-2032) 6.5.3.3. Germany Base Layer Market Size and Forecast, by Product Type (2024-2032) 6.5.3.4. Germany Base Layer Market Size and Forecast, by End Use (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Base Layer Market Size and Forecast, by Material Type (2024-2032) 6.5.4.2. Italy Base Layer Market Size and Forecast, by Gender (2024-2032) 6.5.4.3. Italy Base Layer Market Size and Forecast, by Product Type (2024-2032) 6.5.4.4. Italy Base Layer Market Size and Forecast, by End Use (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Base Layer Market Size and Forecast, by Material Type (2024-2032) 6.5.5.2. Spain Base Layer Market Size and Forecast, by Gender (2024-2032) 6.5.5.3. Spain Base Layer Market Size and Forecast, by Product Type (2024-2032) 6.5.5.4. Spain Base Layer Market Size and Forecast, by End Use (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Base Layer Market Size and Forecast, by Material Type (2024-2032) 6.5.6.2. Sweden Base Layer Market Size and Forecast, by Gender (2024-2032) 6.5.6.3. Sweden Base Layer Market Size and Forecast, by Product Type (2024-2032) 6.5.6.4. Sweden Base Layer Market Size and Forecast, by End Use (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Base Layer Market Size and Forecast, by Material Type (2024-2032) 6.5.7.2. Austria Base Layer Market Size and Forecast, by Gender (2024-2032) 6.5.7.3. Austria Base Layer Market Size and Forecast, by Product Type (2024-2032) 6.5.7.4. Austria Base Layer Market Size and Forecast, by End Use (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Base Layer Market Size and Forecast, by Material Type (2024-2032) 6.5.8.2. Rest of Europe Base Layer Market Size and Forecast, by Gender (2024-2032) 6.5.8.3. Rest of Europe Base Layer Market Size and Forecast, by Product Type (2024-2032) 6.5.8.4. Rest of Europe Base Layer Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific Base Layer Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.2. Asia Pacific Base Layer Market Size and Forecast, by Gender (2024-2032) 7.3. Asia Pacific Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.4. Asia Pacific Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5. Asia Pacific Base Layer Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.1.2. China Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.1.3. China Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.1.4. China Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.2.2. S Korea Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.2.3. S Korea Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.2.4. S Korea Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.3.2. Japan Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.3.3. Japan Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.3.4. Japan Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5.4. India 7.5.4.1. India Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.4.2. India Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.4.3. India Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.4.4. India Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.5.2. Australia Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.5.3. Australia Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.5.4. Australia Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.6.2. Indonesia Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.6.3. Indonesia Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.6.4. Indonesia Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.7.2. Malaysia Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.7.3. Malaysia Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.7.4. Malaysia Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.8.2. Vietnam Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.8.3. Vietnam Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.8.4. Vietnam Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.9.2. Taiwan Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.9.3. Taiwan Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.9.4. Taiwan Base Layer Market Size and Forecast, by End Use (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Base Layer Market Size and Forecast, by Material Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Base Layer Market Size and Forecast, by Gender (2024-2032) 7.5.10.3. Rest of Asia Pacific Base Layer Market Size and Forecast, by Product Type (2024-2032) 7.5.10.4. Rest of Asia Pacific Base Layer Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa Base Layer Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Base Layer Market Size and Forecast, by Material Type (2024-2032) 8.2. Middle East and Africa Base Layer Market Size and Forecast, by Gender (2024-2032) 8.3. Middle East and Africa Base Layer Market Size and Forecast, by Product Type (2024-2032) 8.4. Middle East and Africa Base Layer Market Size and Forecast, by End Use (2024-2032) 8.5. Middle East and Africa Base Layer Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Base Layer Market Size and Forecast, by Material Type (2024-2032) 8.5.1.2. South Africa Base Layer Market Size and Forecast, by Gender (2024-2032) 8.5.1.3. South Africa Base Layer Market Size and Forecast, by Product Type (2024-2032) 8.5.1.4. South Africa Base Layer Market Size and Forecast, by End Use (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Base Layer Market Size and Forecast, by Material Type (2024-2032) 8.5.2.2. GCC Base Layer Market Size and Forecast, by Gender (2024-2032) 8.5.2.3. GCC Base Layer Market Size and Forecast, by Product Type (2024-2032) 8.5.2.4. GCC Base Layer Market Size and Forecast, by End Use (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Base Layer Market Size and Forecast, by Material Type (2024-2032) 8.5.3.2. Nigeria Base Layer Market Size and Forecast, by Gender (2024-2032) 8.5.3.3. Nigeria Base Layer Market Size and Forecast, by Product Type (2024-2032) 8.5.3.4. Nigeria Base Layer Market Size and Forecast, by End Use (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Base Layer Market Size and Forecast, by Material Type (2024-2032) 8.5.4.2. Rest of ME&A Base Layer Market Size and Forecast, by Gender (2024-2032) 8.5.4.3. Rest of ME&A Base Layer Market Size and Forecast, by Product Type (2024-2032) 8.5.4.4. Rest of ME&A Base Layer Market Size and Forecast, by End Use (2024-2032) 9. South America Base Layer Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Base Layer Market Size and Forecast, by Material Type (2024-2032) 9.2. South America Base Layer Market Size and Forecast, by Gender (2024-2032) 9.3. South America Base Layer Market Size and Forecast, by Product Type(2024-2032) 9.4. South America Base Layer Market Size and Forecast, by End Use (2024-2032) 9.5. South America Base Layer Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Base Layer Market Size and Forecast, by Material Type (2024-2032) 9.5.1.2. Brazil Base Layer Market Size and Forecast, by Gender (2024-2032) 9.5.1.3. Brazil Base Layer Market Size and Forecast, by Product Type (2024-2032) 9.5.1.4. Brazil Base Layer Market Size and Forecast, by End Use (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Base Layer Market Size and Forecast, by Material Type (2024-2032) 9.5.2.2. Argentina Base Layer Market Size and Forecast, by Gender (2024-2032) 9.5.2.3. Argentina Base Layer Market Size and Forecast, by Product Type (2024-2032) 9.5.2.4. Argentina Base Layer Market Size and Forecast, by End Use (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Base Layer Market Size and Forecast, by Material Type (2024-2032) 9.5.3.2. Rest Of South America Base Layer Market Size and Forecast, by Gender (2024-2032) 9.5.3.3. Rest Of South America Base Layer Market Size and Forecast, by Product Type (2024-2032) 9.5.3.4. Rest Of South America Base Layer Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. The North Face 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Gore 10.3. Odlo 10.4. Falke 10.5. Nike 10.6. Adidas 10.7. Under Armour 10.8. ANTA Sports 10.9. Helly Hansen 10.10. Rab 10.11. Mizuno 10.12. LiNing 10.13. Skins 10.14. Tommy Copper 10.15. Icebreaker 10.16. AMETRA 10.17. PIERRE YVES Fashion 10.18. Shree Sai Trading Limited 10.19. Sofitex S.R.L. 10.20. Unigrand Group Ltd. 11. Key Findings 12. Industry Recommendations 13. Base Layer Market: Research Methodology 14. Terms and Glossary