The Baby Toys Market size was valued at USD 13.96 Billion in 2023 and the total Baby Toys revenue is expected to grow at a CAGR of 4.66% from 2024 to 2030, reaching nearly USD 19.20 Billion.Baby Toys Market Overview:

A baby toy is an item of entertainment used primarily by children that may also be marketed to adults under certain circumstances. Playing with toys can be an enjoyable way of training young children for life experiences. Infants and toddlers like different sorts of toys depending on their developmental stage. As part of their entire development, baby toys assist excite their senses of shape, color, texture, taste, and sound. Language, social-emotional, fine motor, gross motor, and cognitive development are all aspects of child development. Toy materials are chosen by guardians, and learning activities for newborns are planned based on the experience that toys bring to babies, which aids in their growth. Construction toys and building blocks are also essential for babies' development of motor skills and hand-eye coordination.To know about the Research Methodology :- Request Free Sample Report Baby toys are important towards the development of the particular babies' learning ability as well as their motor skills. In addition, it helps keep them happily busy playing with toys whilst their parents can manage things at home. For doing that, it needs to give them something which will definitely charm all of them if not they will certainly lose interest easily. The report explores the Global Baby Toys Market segments (Product Type, Distribution Channel, End User and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The MMR market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2017 to 2020. The report investigates the Global Baby Toys Market drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Global Baby Toys Market contemporary competitive scenario.

Baby Toys Market Dynamics:

The COVID-19 pandemic has fundamentally changed the buying behaviour of consumers. They are deeply concerned about the impact of COVID-19, both from a health and economic perspective. It has been noticed that consumers are shifting their budget towards essential goods such as masks, sanitizers, and household goods. Their priorities are now centered towards most basic needs, creating a huge demand for hygiene and staple products, while non-essential categories slumped. Furthermore, with the slow-moving economy, people are adapting to the new normal. Digital commerce has witnessed a spike as new consumers move toward online channels, which is anticipated to continue long-term. The buying concept of products physically among the people has been reduced during the spread of corona virus. The regulations and the lockdown which is imposed by the government has changed the scenario of buying products and leads to the reduction in the manufacturing. The toys market had severe effect during the pandemic as there were allegations imposed by the government and the threat of spreading the virus which leads to the reduction of the growth of the baby toys market. One of the key factors is the increasing per capita disposable income in developing nations. Rising demand for skill developmental baby toys is also expected to boost the market's growth during the review period. However, the prevalence of an unorganized market for baby toys hampers the market growth. Also, the rising threat of counterfeit products poses a major challenge for the growth of the market. Nevertheless, Strategic mergers and acquisitions create scope for market growth. Moreover, the growth of the organized retail sector in Asia-Pacific is projected to propel market growth in the coming years. The rise in the population of working women particularly in an emerging country such as India contributes to the increased baby care products sector, making it one of the most significantly growing markets in India. The demand for baby products has seen to be growing significantly owing to increased disposable income and the spending power of the population on such superior quality products that assure improved baby health. Rising awareness about the health benefits of consuming baby food that have fewer pesticide residues and is particularly formulated for infants to toddlers, approximately between six months to two years of age further augments its demand. The online availability of baby toys products and the increase in internet penetration leads to the market expansion across the globe. The rising number of smartphone users, easy access to internet connectivity, and the rise in the use of e-banking systems are the factors which drives the growth of the baby toys market on the online platform. Owing to hectic lifestyles, consumers opt for the convenience of online shopping instead of visiting physical stores, which not only offer instant doorstep delivery but multiple discounts and offers at the same time. The use of mobile wallets is anticipated to increase in the years to come. There are many options to buy the baby toys online such as Amazon, Flipkart etc. the people are most frequently using the online platforms to buy toys as it saves time and they are provided with the extra offers. This leads to the growth of the baby toys market. The existence of an unorganized industry for baby toys is severely impeding the market growth. In addition, the rising threat of counterfeit items is posing a limitation to the market's growth. The materials which are used to make the toys can harm the kids. The harmful material may injure the baby. The toys are made of various chemicals which can cause problems to the baby. Plastic toys/materials are inexpensive and vibrantly coloured. And while they pose the same risks as any other plastic item, these cheap playthings often have shorter life spans than high-quality toys and are pretty much impossible to recycle. One of the things that separate plastic toys from other plastic objects is that they’re essentially destined for the landfill because they’re typically composed of other materials too, such as metals. The recyclable components can’t be separated out, and become prohibitive for recycling centres. These plastics material toys can have adverse effect on baby because the plastic which is used for making are not good for health and the baby skin are very sensitive. These restraining factors lead to hinder the growth of the baby toy market. The toys help to develop cognitive skills in child which is the new opportunity for the growth of the baby toys market. Different toys will teach the child different cognitive skills. For example, a board game helps them develop concentration and memory, while building blocks help with problem solving. Having access to these toys helps them develop these skills before they ever go to school. When a child has a favourite toy, they are practising bonding in a healthy way. When parents play with them, it in turn helps them bond with them. It helps them create great childhood memories, and create great futures for them as they could fully experience childhood. The children play with a set of toys like building blocks, pretend food or dolls, they use these to create narratives as they play. The toy becomes more than what it actually is. The blocks become a castle, the food is part of a pretend restaurant, and the dolls become a family just like the one the child lives in. This creates new opportunity for the child to improve its creative thinking while playing with the toy. As a major industry in the business world, there are several challenges that have faced by toy industry. Nowadays, challenges have increased due to the advancement of technology, quality of the product, price of the product and other challenges. Other than that, the sales of toys industry have decreased year by year because the toys are not attractive. The lack of advanced technology, traditional toys such as barbie dolls, teddy bear that does not attach with high-tech will be more difficult to attract people to buy it. Children nowadays are playing games more frequently with their smart phone or tablet rather than playing toys. Even though the toy industry has tried to add some special functions on the toys such as sound and lights, but it still unable to compete with electronic games. Other than that, the price of purchasing a smart phone’s game is cheaper than purchasing a physical toy. The seasonal changing of product causes the life cycle of the toys.Baby Toys Market Segment Analysis:

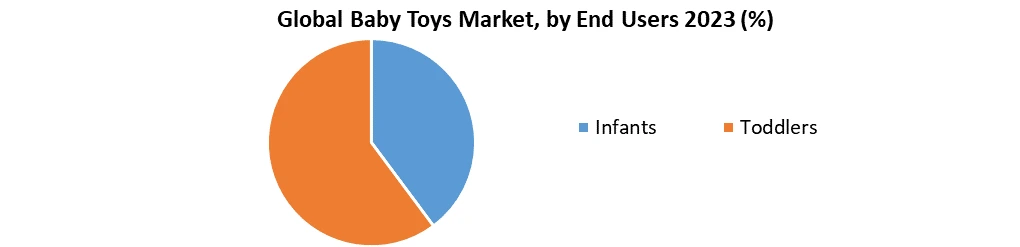

Based on Product Type, The segment soft toys & dolls are expected to grow with the CAGR of xx% during the forecast period. Dolls are one of the oldest and most popular types of toys, with technological breakthroughs such as computerized dolls that can speak and walk in recent years. The soft toys and dolls are the most comfortable toy for kids to which they gets attracted. Construction toys are very popular with generations of children. The primary principle of construction toys is assembly. A sequence of basic components is provided in construction toys. They are designed to allow children to create objects of their own design that can be taken apart again and rebuilt as something different. Construction toys are powerful and creative toys. Children follow instructions for building their toys, which encourages children's physical, social and cognitive development. Based on Distribution Channel, The toddler’s segment is expected to grow with the higher pace during the forecast period. Toddlers are children who are 13 to 48 months old. Dolls, play vehicles, cooking equipment and gadgets, playhouse items, art and craft toys, building blocks, cuddly animals, and musical toys are all popular among toddlers. Toddlers rapidly learn languages and develop a sense of danger. Toddlers usually participate in several physical testing activities such as jumping from heights, climbing, hanging by their arms, rolling, and rough-and-tumble play. This age group develops good control of their hands and fingers and likes to do things with small objects. Solving puzzles, building blocks, role play, and drawing are a few of the popular activities among toddlers. Based on End-Users, The store-based segment is dominating the market with the highest market CAGR of xx% during the forecast period. The store-based segment is rising as it is easy to buy the toys of kids’ choice physically. The convenience of fast product delivery through offline outlets is also assisting segment growth. The non-store-based segment is also at the pace of highest market share. Companies are launching new products with improved quality and unique features and designs, which cannot always be made available to consumers in different regions. Due to this, the online platforms are gaining immense traction worldwide. ;

Regional Insights:

The North America region is expected to witness significant growth at a CAGR of xx% through the forecast period due to the increased demand for toys among children and the youthful population. Also, several manufacturers in the region are focused on releasing novel toys, which is expected to drive the North American baby toys market forward throughout the forecast period. Technological advancement, working parents, government initiatives for infant safety, and early adoption of advanced products are the factors which leads to the growth of the baby toys market in Nort America region during the forecast period. Because of the region's growing organized retail sector, Asia-Pacific is expected to be a lucrative market for baby toy producers. This rise can also be attributed to the increased demand for skill-development baby toys among youngsters in the region, which is likely to drive the Asia-Pacific baby toys market forward over the forecast period. In growing markets like China and India, the demand for infant toys is fast increasing. The Asia-Pacific baby toys industry offers significant prospects for key makers of baby toys. The expansion of Asia-organized Pacific's retail sector provides attractive potential for infant toy makers. The objective of the report is to present a comprehensive analysis of the Baby Toys Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Baby Toys Market dynamic, structure by analyzing the market segments and projecting the Baby Toys Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Baby Toys Market make the report investor’s guide.Baby Toys Market Scope: Inquire before buying

Baby Toys Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 13.96 Bn. Forecast Period 2024 to 2030 CAGR: 4.66% Market Size in 2030: USD 19.20 Bn. Segments Covered: by Product Type Board games Soft toys & Dolls Action toys Arts & Craft toys Construction toys Vehicles Musical toys & Rattles Others by Distribution Channel Stored Based Supermarkets & Hypermarkets, Specialty Stores Others Non-Stored Based by End-Users Infants Toddlers Baby Toys Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Baby Toys Market, Key Players:

1. LEGO System A/S 2. Mattel, Inc. 3. Hasbro, Inc. 4. Bandai Namco Holdings Inc. 5. Spin Master 6. Kids II, Inc. 7. Nintendo Co., Ltd. 8. Brandstätter Group 9. Tomy Company, Ltd. 10. Basic Fun! 11. Funskool 12. Fіѕhеr-Рrісе 13. Nеwеll Rubbеrmаіd 14. Vtесh Ноldіngѕ 15. Вrеvі 16. Сhіссо 17. Тоуѕ R Us 18. Веіјіng Ѕmаrt Тоуѕ 19. LеарFrоg Еntеrрrіѕеѕ 20. Mothercare Frequently Asked Questions: 1] What segments are covered in the Baby Toys Market report? Ans. The segments covered in the Baby Toys Market report are based on Product Type, Distribution Channel and End-Users. 2] Which region is expected to hold the highest share in the Baby Toys Market? Ans. North America region is expected to hold the highest share in the Baby Toys Market. 3] What is the market size of the Baby Toys Market by 2030? Ans. The market size of the Baby Toys Market by 2030 is expected to reach USD 19.20 Bn. 4] What is the forecast period for the Baby Toys Market? Ans. The forecast period for the Baby Toys Market is 2024-2030. 5. What was the Global Baby Toys Market size in 2023? Ans: The Global Baby Toys Market size was USD 13.96 Billion in 2023.

1. Global Baby Toys Market: Research Methodology 2. Global Baby Toys Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Baby Toys Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Baby Toys Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Baby Toys Market Segmentation 4.1. Global Baby Toys Market, By Product Type (2023-2030) • Board games • Soft toys & Dolls • Action toys • Arts & Craft toys • Construction toys • Vehicles • Musical toys & Rattles • Others 4.2. Global Baby Toys Market, By Distribution Channel (2023-2030) • Stored Based o Supermarkets & Hypermarkets, o Specialty Stores o Others • Non-Stored Based 4.3. Global Baby Toys Market, By End Users (2023-2030) • Infants • Toddlers 5. North America Baby Toys Market (2023-2030) 5.1. North America Baby Toys Market, By Product Type (2023-2030) • Board games • Soft toys & Dolls • Action toys • Arts & Craft toys • Construction toys • Vehicles • Musical toys & Rattles • Others 5.2. North America Baby Toys Market, By Distribution Channel (2023-2030) • Stored Based o Supermarkets & Hypermarkets, o Specialty Stores o Others • Non-Stored Based 5.3. North America Baby Toys Market, By End Users (2023-2030) • Infants • Toddlers 5.4. North America Baby Toys Market, by Country (2023-2030) • United States • Canada • Mexico 6. European Baby Toys Market (2023-2030) 6.1. European Baby Toys Market, By Product Type (2023-2030) 6.2. European Baby Toys Market, By Distribution Channel (2023-2030) 6.3. European Baby Toys Market, By End Users (2023-2030) 6.4. European Baby Toys Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Baby Toys Market (2023-2030) 7.1. Asia Pacific Baby Toys Market, By Product Type (2023-2030) 7.2. Asia Pacific Baby Toys Market, By Distribution Channel (2023-2030) 7.3. Asia Pacific Baby Toys Market, By End Users (2023-2030) 7.4. Asia Pacific Baby Toys Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Baby Toys Market (2023-2030) 8.1. Middle East and Africa Baby Toys Market, By Product Type (2023-2030) 8.2. Middle East and Africa Baby Toys Market, By Distribution Channel (2023-2030) 8.3. Middle East and Africa Baby Toys Market, By End Users (2023-2030) 8.4. Middle East and Africa Baby Toys Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Baby Toys Market (2023-2030) 9.1. South America Baby Toys Market, By Product Type (2023-2030) 9.2. South America Baby Toys Market, By Distribution Channel (2023-2030) 9.3. South America Baby Toys Market, By End Users (2023-2030) 9.4. South America Baby Toys Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 LEGO System A/S 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Mattel, Inc. 10.3. Hasbro, Inc. 10.4. Bandai Namco Holdings Inc. 10.5. Spin Master 10.6. Kids II, Inc. 10.7. Nintendo Co., Ltd. 10.8. Brandstätter Group 10.9. Tomy Company, Ltd. 10.10. Basic Fun! 10.11. Funskool 10.12. Fіѕhеr-Рrісе 10.13. Nеwеll Rubbеrmаіd 10.14. Vtесh Ноldіngѕ 10.15. Вrеvі 10.16. Сhіссо 10.17. Тоуѕ R Us 10.18. Веіјіng Ѕmаrt Тоуѕ 10.19. LеарFrоg Еntеrрrіѕеѕ 10.20. Mothercare