The global Autonomous Trains Market size was valued at USD 9.41 Billion in 2024, and the total Autonomous Trains Market revenue is expected to grow by 5.8% from 2025 to 2032, reaching nearly USD 14.77 BillonAutonomous Trains Market Overview

Autonomous trains leverage advanced technologies such as AI, sensors, and IoT for driverless operations, enhancing efficiency, safety, and reliability. They reduce human error, optimize energy use, and enable predictive maintenance. Widely adopted in metros, freight, and high-speed rail, they represent a transformative shift in modern rail transport systems. The rapid growth of advancements in digitalization, artificial intelligence, and sensor technologies is transforming global railway operations, driving the Autonomous Trains Market growth. Rail operators worldwide are increasingly adopting automation to enhance safety, efficiency, and cost-effectiveness, with autonomous systems enabling reduced human dependency and optimized traffic flow.To know about the Research Methodology:-Request Free Sample Report Growing urbanization, coupled with the increasing demand for sustainable mobility solutions, has fueled investments in metro and light rail networks, where automation ensures higher frequency, punctuality, and energy efficiency. The governments are supporting smart rail infrastructure development through funding and regulatory frameworks, driving the Autonomous Trains Market. Emerging technologies such as predictive maintenance, real-time monitoring, and AI-driven control systems are reshaping operational strategies, paving the way for fully driverless train models over the coming decade. Autonomous Trains Major players such as Siemens Mobility, Alstom, Hitachi Rail, and Wabtec are actively investing in automation R&D, while pilot projects in Europe, Asia-Pacific, and North America demonstrate strong commercial potential.

Autonomous Trains Market Dynamics

Technological Advancements and Increasing Demand for Smart Urban Mobility to Boost the Autonomous Trains Market The global cities grapple with rising population density, traffic congestion, and environmental concerns, and governments and transport authorities are increasingly turning to automated rail systems to deliver reliable, high-capacity transit options. Autonomous trains, equipped with cutting-edge sensors, LiDAR, radar modules, advanced communication systems, and AI-driven control platforms, enable precise operations that minimize delays, optimize energy use, and reduce operational risks associated with human error. Metro and light rail projects in megacities such as Singapore, Dubai, Shanghai, and Paris have already demonstrated the economic and environmental benefits of autonomous train adoption, inspiring similar initiatives in developing economies. The integration of predictive maintenance powered by IoT and big data analytics ensures enhanced safety and reduced downtime, driving the Autonomous Trains Market. The versatility of automation grades, especially the dominance of GoA2, provides operators with scalable options to transition from semi-automated to fully driverless systems in a phased manner. High Capital Costs and Complex Regulatory Frameworks to hamper the Autonomous Trains Market Deploying autonomous train systems requires massive upfront expenditure on infrastructure upgrades, including track modernization, signaling systems, communication networks, and station redesigns, which often stretch the financial capacities of operators and governments, particularly in developing regions. The transition from conventional railways to automated systems is complicated by interoperability challenges across different networks, requiring harmonization of standards and certifications. The regulatory bodies remain cautious about fully automated operations (GoA3 and GoA4) due to concerns over cybersecurity threats, passenger safety, and emergency handling, slowing down approvals and public acceptance. Labor unions resist higher levels of automation, fearing job losses, which creates political and social hurdles in several countries, hampering the Autonomous Trains Market.Autonomous Trains Market Segment Analysis

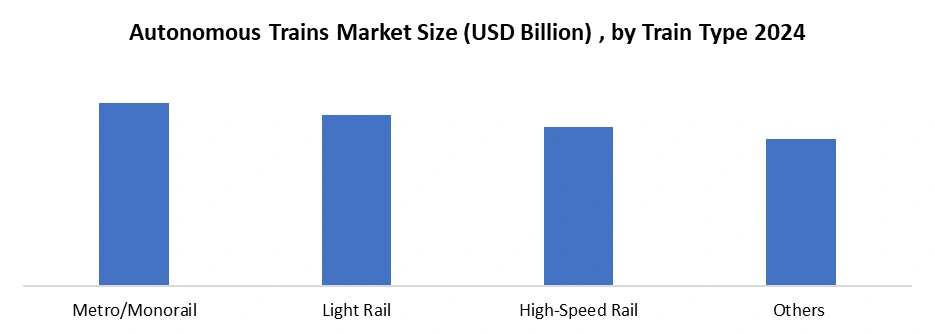

Based on the Automation of Grade, the market is segmented into the GoA1, GoA2, GoA3 and GoA4. GoA2 dominated Autonomous Trains Market in 2024. GoA2 is more feasible for widespread adoption across both developed and developing rail networks. Under GoA2, trains are operated automatically for functions such as acceleration, braking, and stopping, but a driver remains onboard to handle door operations, emergencies, and manual interventions. This blend of automation and human control has made GoA2 particularly attractive for metro systems, suburban railways, and regional networks, which boost the Autonomous Trains Market. The lower infrastructure modification costs compared to GoA3 and GoA4 support GoA2’s adoption, as existing rail systems integrate it without complete overhauls. Europe and Asia-Pacific lead in GoA2 deployment, with many metro and commuter rail systems using it as a standard, especially in cities such as London, Tokyo, and Berlin. GoA2 provides a practical pathway toward higher levels of automation, allowing rail operators to familiarize themselves with automation technologies while ensuring passenger confidence through visible driver presence. Based on the Train Type, the market is categorized into the Metro/Monorail, Light Rail, High-Speed Rail and Others. The Metro/Monorail dominates the Autonomous Trains Market, due to the growing adoption of driverless metros in urban areas to address congestion, environmental concerns, and rising commuter demand. Cities worldwide are embracing autonomous metro systems as part of their smart city initiatives, with major deployments in Asia-Pacific, Europe, and the Middle East. For example, Singapore’s Downtown Line, Dubai Metro, and numerous Chinese urban rail networks operate using fully automated systems, showcasing the scalability of metro automation. Metro and monorail projects are often prioritized because they operate in dedicated corridors, which reduces safety risks compared to mainline and freight trains that share tracks with other operators. This controlled environment accelerates the implementation of autonomous technologies such as CBTC, platform screen doors, and automatic train supervision systems.

Autonomous Trains Market Regional Analysis:

Asia Pacific dominated the Autonomous Trains Market in 2024 and is expected to continue its dominance over the forecast period. The rapid urbanization, government investment in smart transportation infrastructure, and the need for sustainable, high-capacity transit systems, Autonomous Trains Market. Indonesia marked a milestone in July 2023 with the launch of its first autonomous train, the LRT Jabodebek in Jakarta, featuring 31 driverless train sets capable of carrying up to 1,480 passengers each. While these trains operate without drivers, certified train attendants remain on board for emergency control, reflecting a hybrid approach to automation and safety. East Japan Railway (JR East) plans semi-autonomous Shinkansen operations in 2028, progressing to fully driverless systems on the Joetsu Shinkansen by the mid-2030s. This move is closely tied to Japan’s demographic challenges, particularly labor shortages, as well as the broader goal of enhancing railway efficiency and sustainability. Furthermore, recent trials in Tokyo, using technology from the Railway Technical Research Institute, demonstrated advanced obstacle detection and autonomous emergency braking, underscoring the safety readiness of driverless systems. Countries such as China, Singapore, and South Korea are also exploring large-scale autonomous metro projects, solidifying the region’s position as a global leader in smart rail mobility. Autonomous Trains Market Competitive Landscape: The Autonomous Trains Market competitive landscape is driven by a mix of established rolling stock manufacturers, technology providers, and rail operators investing heavily in automation, AI, and digital control systems. Leading players such as Siemens Mobility, Alstom, Hitachi Rail, CRRC, Bombardier (Alstom), and Wabtec dominate with integrated solutions combining signaling, communications, and driverless train technologies, tied to their strong presence in rolling stock manufacturing. European firms lead in urban metro automation, with Paris, Copenhagen, and London showcasing fully automated metros, while Asian giants like CRRC and Hitachi drive large-scale adoption in China, Japan, and Singapore through smart rail and high-speed projects. In North America, Autonomous Trains Companies such as Wabtec and General Electric (GE Transportation, merged with Wabtec) are pioneering autonomous freight train solutions, supported by partnerships with operators such as Union Pacific and BNSF Railway. Alongside OEMs, tech innovators including Thales, ABB, and Bosch Engineering are entering the ecosystem, providing critical sensor, control, and AI modules. The strong public–private collaborations, with governments investing in digital rail networks to improve safety, sustainability, and efficiency, drive the Autonomous Trains Market. Autonomous Trains Market Key Developments: • On 23 Sep 2024, Alstom launches ARTE project in Germany – The Autonomous Regional Train Evolution (ARTE) demonstration, held in Salzgitter, Germany, showcased driverless operation using ATO via ETCS on existing regional lines no additional track infrastructure required. In partnership with LNVG, TU Berlin, and the German Aerospace Center (DLR), and backed by funding from Germany’s federal and Lower Saxony authorities, the project will test Automated Train Operations (ATO) using the European Train Control System (ETCS). By focusing on existing rail lines, ARTE enables modernization without additional trackside infrastructure, advancing Europe’s vision for digital, efficient, and sustainable rail mobility. • On 7 March 2025, Wabtec advanced its push into autonomous rail with the Maverick traction module, a battery-powered unit tested in Pittsburgh. Designed for freight operations, the prototype is configured with diesel or hydrogen propulsion. Built on a repurposed three-axle bogie, the Maverick demonstrated autonomous hauling of freight cars over 1,130–1,600 km ranges. A forthcoming Pathfinder variant integrates cameras, sensors, and autonomous controls for smarter yard operations. Complementing this, Wabtec is developing teleoperation tools and robotic inspection systems such as Rail Ghost, targeting greater efficiency, reduced downtime, and more competitive freight rail logistics compared to trucking. Autonomous Trains Market Trends:

Trend Description Communication-Based Train Control (CBTC) Expansion Railway networks are increasingly adopting CBTC technology to enable higher automation, reduce human error, and optimize rail traffic. By allowing continuous, real-time communication between trains and trackside equipment, CBTC enhances both safety and operational efficiency. Its deployment shortens headways, increases route capacity, and supports fully driverless metros in major urban centers. CBTC is becoming the foundation for smart, autonomous rail systems, particularly across Europe, Asia-Pacific, and select U.S. urban networks. Growing Use of AI, IoT, and Predictive Maintenance The integration of AI, IoT sensors, and big data analytics is revolutionizing train automation and operational management. These technologies allow trains to self-diagnose, predict potential failures, and optimize maintenance schedules, significantly reducing downtime and operational costs. AI-powered algorithms enable obstacle detection, passenger flow management, and route optimization, improving safety and energy efficiency. IoT connectivity enhances real-time monitoring of critical systems, ensuring smooth and reliable performance. Rise of Green & Energy-Efficient Autonomous Trains With sustainability driving global transportation strategies, autonomous train systems are being designed with green propulsion and energy-efficient technologies. Electric and hybrid propulsion, regenerative braking, and energy-optimized driving algorithms help reduce carbon emissions while lowering operating costs. Autonomous trains can automatically adjust speed for optimal energy consumption, aligning with decarbonization targets set by the EU, Japan, and China. Ths Scope of the Autonomous Trains Market: Inquire before buying

Global Autonomous Trains Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 9.41 Bn. Forecast Period 2025 to 2032 CAGR: 5.8% Market Size in 2032: USD 14.77 Bn. Segments Covered: by Automation Grade GoA1 GoA2 GoA3 GoA4 by Component Sensors LiDAR modules RADAR modules Optical sensors & cameras Antennas Infrared cameras Others Communication Systems Control & Automation Systems Data Processing & Computing Others by Train Type Metro/Monorail Light Rail High-Speed Rail Others by Technology Automatic Train Protection (ATP) Automatic Train Control (ATC) Automatic Train Operation (ATO) Communication-Based Train Control (CBTC) Positive Train Control (PTC) Others by Application Passenger Trains Freight Trains Autonomous Trains Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Autonomous Trains Key Players

North America 1. Wabtec Corporation (U.S.) 2. Union Pacific Railroad (U.S.) 3. CSX Transportation (U.S.) 4. Norfolk Southern Railway (U.S.) 5. Canadian National Railway (CN) (Canada) 6. Canadian Pacific Kansas City (CPKC) (Canada) 7. Siemens Mobility USA (U.S.) 8. GE Transportation (U.S.) 9. BNSF Railway (U.S.) 10. Amtrak (U.S.) Europe 1. Siemens Mobility (Germany) 2. Alstom (France) 3. Thales Group (France) 4. Knorr-Bremse (Germany) 5. Bombardier Transportation (Germany) 6. CAF (Spain) 7. Stadler Rail (Switzerland) 8. ABB (Switzerland) 9. Deutsche Bahn (DB) (Germany) Asia-Pacific 1. CRRC Corporation Limited (China) 2. China Railway Signal & Communication (CRSC) (China) 3. Hitachi Rail (Japan) 4. Mitsubishi Heavy Industries (Japan) 5. Kawasaki Heavy Industries (Japan) 6. Hyundai Rotem (South Korea) 7. Toshiba Infrastructure Systems & Solutions (Japan) 8. Indian Railways & RDSO (India) 9. SMRT Corporation (Singapore) 10. Hong Kong MTR Corporation (Hong Kong)FAQ’S

1. Which region has the largest share in Global Autonomous Trains Market? Ans: Asia Pacific region held the largest Autonomous Trains Market share in 2024. 2. What is the growth rate of the Global Autonomous Trains Market? Ans: The Global Market is growing at a CAGR of 5.8% during the forecasting period 2024-2030. 3. What is the scope of the Global Autonomous Trains Market report? Ans: The scope of the Global Autonomous Trains Market report includes a comprehensive analysis of market trends, growth drivers, challenges, and opportunities across various regions. It also includes PESTEL, PORTER, and Recommendations for Investors& Leaders. 4. Who are the key players in the Global Autonomous Trains Market? Ans: The important key players in the Global Autonomous Trains Market are Wabtec Corporation (U.S.), Union Pacific Railroad (U.S.), CSX Transportation (U.S.), Norfolk Southern Railway (U.S.), Canadian National Railway (CN) (Canada) and Others. 5. What is the study period of the Global Autonomous Trains Market? Ans: The Global Autonomous Trains Market is studied from 2024 to 2032.

1. Autonomous Trains Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Autonomous Trains Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Autonomous Trains Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Autonomous Trains Market: Dynamics 3.1. Autonomous Trains Market Trends by Region 3.1.1. North America Autonomous Trains Market Trends 3.1.2. Europe Autonomous Trains Market Trends 3.1.3. Asia Pacific Autonomous Trains Market Trends 3.1.4. Middle East and Africa Autonomous Trains Market Trends 3.1.5. South America Autonomous Trains Market Trends 3.2. Autonomous Trains Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Autonomous Trains Market Drivers 3.2.1.2. North America Autonomous Trains Market Restraints 3.2.1.3. North America Autonomous Trains Market Opportunities 3.2.1.4. North America Autonomous Trains Market Challenges 3.2.2. Europe 3.2.2.1. Europe Autonomous Trains Market Drivers 3.2.2.2. Europe Autonomous Trains Market Restraints 3.2.2.3. Europe Autonomous Trains Market Opportunities 3.2.2.4. Europe Autonomous Trains Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Autonomous Trains Market Drivers 3.2.3.2. Asia Pacific Autonomous Trains Market Restraints 3.2.3.3. Asia Pacific Autonomous Trains Market Opportunities 3.2.3.4. Asia Pacific Autonomous Trains Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Autonomous Trains Market Drivers 3.2.4.2. Middle East and Africa Autonomous Trains Market Restraints 3.2.4.3. Middle East and Africa Autonomous Trains Market Opportunities 3.2.4.4. Middle East and Africa Autonomous Trains Market Challenges 3.2.5. South America 3.2.5.1. South America Autonomous Trains Market Drivers 3.2.5.2. South America Autonomous Trains Market Restraints 3.2.5.3. South America Autonomous Trains Market Opportunities 3.2.5.4. South America Autonomous Trains Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Autonomous Trains Industry 3.8. Analysis of Government Schemes and Initiatives For Autonomous Trains Industry 3.9. Autonomous Trains Market Trade Analysis 3.10. The Global Pandemic Impact on Autonomous Trains Market 4. Autonomous Trains Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 4.1.1. GoA1 4.1.2. GoA2 4.1.3. GoA3 4.1.4. GoA4 4.2. Autonomous Trains Market Size and Forecast, by Component (2024-2032) 4.2.1. Sensors 4.2.2. Communication Systems 4.2.3. Control & Automation Systems 4.2.4. Data Processing & Computing 4.2.5. Others 4.3. Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 4.3.1. Metro/Monorail 4.3.2. Light Rail 4.3.3. High-Speed Rail 4.3.4. Others 4.4. Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 4.4.1. Automatic Train Protection (ATP) 4.4.2. Automatic Train Control (ATC) 4.4.3. Automatic Train Operation (ATO) 4.4.4. Communication-Based Train Control (CBTC) 4.4.5. Positive Train Control (PTC) 4.4.6. Others 4.5. Autonomous Trains Market Size and Forecast, by Application (2024-2032) 4.5.1. Passenger Trains 4.5.2. Freight Trains 4.6. Autonomous Trains Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Autonomous Trains Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 5.1.1. GoA1 5.1.2. GoA2 5.1.3. GoA3 5.1.4. GoA4 5.2. North America Autonomous Trains Market Size and Forecast, by Component (2024-2032) 5.2.1. Sensors 5.2.2. Communication Systems 5.2.3. Control & Automation Systems 5.2.4. Data Processing & Computing 5.2.5. Others 5.3. North America Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 5.3.1. Metro/Monorail 5.3.2. Light Rail 5.3.3. High-Speed Rail 5.3.4. Others 5.4. North America Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 5.4.1. Automatic Train Protection (ATP) 5.4.2. Automatic Train Control (ATC) 5.4.3. Automatic Train Operation (ATO) 5.4.4. Communication-Based Train Control (CBTC) 5.4.5. Positive Train Control (PTC) 5.4.6. Others 5.5. North America Autonomous Trains Market Size and Forecast, by Application (2024-2032) 5.5.1. Passenger Trains 5.5.2. Freight Trains 5.6. North America Autonomous Trains Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 5.6.1.1.1. GoA1 5.6.1.1.2. GoA2 5.6.1.1.3. GoA3 5.6.1.1.4. GoA4 5.6.1.2. United States Autonomous Trains Market Size and Forecast, by Component (2024-2032) 5.6.1.2.1. Sensors 5.6.1.2.2. Communication Systems 5.6.1.2.3. Control & Automation Systems 5.6.1.2.4. Data Processing & Computing 5.6.1.2.5. Others 5.6.1.3. United States Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 5.6.1.3.1. Metro/Monorail 5.6.1.3.2. Light Rail 5.6.1.3.3. High-Speed Rail 5.6.1.3.4. Others 5.6.1.4. United States Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 5.6.1.4.1. Automatic Train Protection (ATP) 5.6.1.4.2. Automatic Train Control (ATC) 5.6.1.4.3. Automatic Train Operation (ATO) 5.6.1.4.4. Communication-Based Train Control (CBTC) 5.6.1.4.5. Positive Train Control (PTC) 5.6.1.4.6. Others 5.6.1.5. United States Autonomous Trains Market Size and Forecast, by Application (2024-2032) 5.6.1.5.1. Passenger Trains 5.6.1.5.2. Freight Trains 5.6.2. Canada 5.6.2.1. Canada Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 5.6.2.1.1. GoA1 5.6.2.1.2. GoA2 5.6.2.1.3. GoA3 5.6.2.1.4. GoA4 5.6.2.2. Canada Autonomous Trains Market Size and Forecast, by Component (2024-2032) 5.6.2.2.1. Sensors 5.6.2.2.2. Communication Systems 5.6.2.2.3. Control & Automation Systems 5.6.2.2.4. Data Processing & Computing 5.6.2.2.5. Others 5.6.2.3. Canada Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 5.6.2.3.1. Metro/Monorail 5.6.2.3.2. Light Rail 5.6.2.3.3. High-Speed Rail 5.6.2.3.4. Others 5.6.2.4. Canada Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 5.6.2.4.1. Automatic Train Protection (ATP) 5.6.2.4.2. Automatic Train Control (ATC) 5.6.2.4.3. Automatic Train Operation (ATO) 5.6.2.4.4. Communication-Based Train Control (CBTC) 5.6.2.4.5. Positive Train Control (PTC) 5.6.2.4.6. Others 5.6.2.5. Canada Autonomous Trains Market Size and Forecast, by Application (2024-2032) 5.6.2.5.1. Passenger Trains 5.6.2.5.2. Freight Trains 5.6.3. Mexico 5.6.3.1. Mexico Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 5.6.3.1.1. GoA1 5.6.3.1.2. GoA2 5.6.3.1.3. GoA3 5.6.3.1.4. GoA4 5.6.3.2. Mexico Autonomous Trains Market Size and Forecast, by Component (2024-2032) 5.6.3.2.1. Sensors 5.6.3.2.2. Communication Systems 5.6.3.2.3. Control & Automation Systems 5.6.3.2.4. Data Processing & Computing 5.6.3.2.5. Others 5.6.3.3. Mexico Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 5.6.3.3.1. Metro/Monorail 5.6.3.3.2. Light Rail 5.6.3.3.3. High-Speed Rail 5.6.3.3.4. Others 5.6.3.4. Mexico Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 5.6.3.4.1. Automatic Train Protection (ATP) 5.6.3.4.2. Automatic Train Control (ATC) 5.6.3.4.3. Automatic Train Operation (ATO) 5.6.3.4.4. Communication-Based Train Control (CBTC) 5.6.3.4.5. Positive Train Control (PTC) 5.6.3.4.6. Others 5.6.3.5. Mexico Autonomous Trains Market Size and Forecast, by Application (2024-2032) 5.6.3.5.1. Passenger Trains 5.6.3.5.2. Freight Trains 6. Europe Autonomous Trains Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 6.2. Europe Autonomous Trains Market Size and Forecast, by Component (2024-2032) 6.3. Europe Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 6.4. Europe Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 6.5. Europe Autonomous Trains Market Size and Forecast, by Application (2024-2032) 6.6. Europe Autonomous Trains Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 6.6.1.2. United Kingdom Autonomous Trains Market Size and Forecast, by Component (2024-2032) 6.6.1.3. United Kingdom Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 6.6.1.4. United Kingdom Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 6.6.1.5. United Kingdom Autonomous Trains Market Size and Forecast, by Application (2024-2032) 6.6.2. France 6.6.2.1. France Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 6.6.2.2. France Autonomous Trains Market Size and Forecast, by Component (2024-2032) 6.6.2.3. France Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 6.6.2.4. France Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 6.6.2.5. France Autonomous Trains Market Size and Forecast, by Application (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 6.6.3.2. Germany Autonomous Trains Market Size and Forecast, by Component (2024-2032) 6.6.3.3. Germany Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 6.6.3.4. Germany Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 6.6.3.5. Germany Autonomous Trains Market Size and Forecast, by Application (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 6.6.4.2. Italy Autonomous Trains Market Size and Forecast, by Component (2024-2032) 6.6.4.3. Italy Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 6.6.4.4. Italy Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 6.6.4.5. Italy Autonomous Trains Market Size and Forecast, by Application (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 6.6.5.2. Spain Autonomous Trains Market Size and Forecast, by Component (2024-2032) 6.6.5.3. Spain Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 6.6.5.4. Spain Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 6.6.5.5. Spain Autonomous Trains Market Size and Forecast, by Application (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 6.6.6.2. Sweden Autonomous Trains Market Size and Forecast, by Component (2024-2032) 6.6.6.3. Sweden Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 6.6.6.4. Sweden Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 6.6.6.5. Sweden Autonomous Trains Market Size and Forecast, by Application (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 6.6.7.2. Austria Autonomous Trains Market Size and Forecast, by Component (2024-2032) 6.6.7.3. Austria Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 6.6.7.4. Austria Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 6.6.7.5. Austria Autonomous Trains Market Size and Forecast, by Application (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 6.6.8.2. Rest of Europe Autonomous Trains Market Size and Forecast, by Component (2024-2032) 6.6.8.3. Rest of Europe Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 6.6.8.4. Rest of Europe Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 6.6.8.5. Rest of Europe Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Autonomous Trains Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.2. Asia Pacific Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.3. Asia Pacific Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.4. Asia Pacific Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.5. Asia Pacific Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6. Asia Pacific Autonomous Trains Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.1.2. China Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.1.3. China Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.1.4. China Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.1.5. China Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.2.2. S Korea Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.2.3. S Korea Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.2.4. S Korea Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.2.5. S Korea Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.3.2. Japan Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.3.3. Japan Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.3.4. Japan Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.3.5. Japan Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6.4. India 7.6.4.1. India Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.4.2. India Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.4.3. India Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.4.4. India Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.4.5. India Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.5.2. Australia Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.5.3. Australia Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.5.4. Australia Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.5.5. Australia Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.6.2. Indonesia Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.6.3. Indonesia Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.6.4. Indonesia Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.6.5. Indonesia Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.7.2. Malaysia Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.7.3. Malaysia Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.7.4. Malaysia Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.7.5. Malaysia Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.8.2. Vietnam Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.8.3. Vietnam Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.8.4. Vietnam Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.8.5. Vietnam Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.9.2. Taiwan Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.9.3. Taiwan Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.9.4. Taiwan Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.9.5. Taiwan Autonomous Trains Market Size and Forecast, by Application (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 7.6.10.2. Rest of Asia Pacific Autonomous Trains Market Size and Forecast, by Component (2024-2032) 7.6.10.3. Rest of Asia Pacific Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 7.6.10.4. Rest of Asia Pacific Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 7.6.10.5. Rest of Asia Pacific Autonomous Trains Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Autonomous Trains Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 8.2. Middle East and Africa Autonomous Trains Market Size and Forecast, by Component (2024-2032) 8.3. Middle East and Africa Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 8.4. Middle East and Africa Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 8.5. Middle East and Africa Autonomous Trains Market Size and Forecast, by Application (2024-2032) 8.6. Middle East and Africa Autonomous Trains Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 8.6.1.2. South Africa Autonomous Trains Market Size and Forecast, by Component (2024-2032) 8.6.1.3. South Africa Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 8.6.1.4. South Africa Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 8.6.1.5. South Africa Autonomous Trains Market Size and Forecast, by Application (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 8.6.2.2. GCC Autonomous Trains Market Size and Forecast, by Component (2024-2032) 8.6.2.3. GCC Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 8.6.2.4. GCC Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 8.6.2.5. GCC Autonomous Trains Market Size and Forecast, by Application (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 8.6.3.2. Nigeria Autonomous Trains Market Size and Forecast, by Component (2024-2032) 8.6.3.3. Nigeria Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 8.6.3.4. Nigeria Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 8.6.3.5. Nigeria Autonomous Trains Market Size and Forecast, by Application (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 8.6.4.2. Rest of ME&A Autonomous Trains Market Size and Forecast, by Component (2024-2032) 8.6.4.3. Rest of ME&A Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 8.6.4.4. Rest of ME&A Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 8.6.4.5. Rest of ME&A Autonomous Trains Market Size and Forecast, by Application (2024-2032) 9. South America Autonomous Trains Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 9.2. South America Autonomous Trains Market Size and Forecast, by Component (2024-2032) 9.3. South America Autonomous Trains Market Size and Forecast, by Train Type(2024-2032) 9.4. South America Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 9.5. South America Autonomous Trains Market Size and Forecast, by Application (2024-2032) 9.6. South America Autonomous Trains Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 9.6.1.2. Brazil Autonomous Trains Market Size and Forecast, by Component (2024-2032) 9.6.1.3. Brazil Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 9.6.1.4. Brazil Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 9.6.1.5. Brazil Autonomous Trains Market Size and Forecast, by Application (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 9.6.2.2. Argentina Autonomous Trains Market Size and Forecast, by Component (2024-2032) 9.6.2.3. Argentina Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 9.6.2.4. Argentina Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 9.6.2.5. Argentina Autonomous Trains Market Size and Forecast, by Application (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Autonomous Trains Market Size and Forecast, by Automation Grade (2024-2032) 9.6.3.2. Rest Of South America Autonomous Trains Market Size and Forecast, by Component (2024-2032) 9.6.3.3. Rest Of South America Autonomous Trains Market Size and Forecast, by Train Type (2024-2032) 9.6.3.4. Rest Of South America Autonomous Trains Market Size and Forecast, by Technology (2024-2032) 9.6.3.5. Rest Of South America Autonomous Trains Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Wabtec Corporation (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Union Pacific Railroad (U.S.) 10.3. CSX Transportation (U.S.) 10.4. Norfolk Southern Railway (U.S.) 10.5. Canadian National Railway (CN) (Canada) 10.6. Canadian Pacific Kansas City (CPKC) (Canada) 10.7. Siemens Mobility USA (U.S.) 10.8. GE Transportation (U.S.) 10.9. BNSF Railway (U.S.) 10.10. Amtrak (U.S.) 10.11. Siemens Mobility (Germany) 10.12. Alstom (France) 10.13. Thales Group (France) 10.14. Knorr-Bremse (Germany) 10.15. Bombardier Transportation (Germany) 10.16. CAF (Spain) 10.17. Stadler Rail (Switzerland) 10.18. ABB (Switzerland) 10.19. Deutsche Bahn (DB) (Germany) 10.20. CRRC Corporation Limited (China) 10.21. China Railway Signal & Communication (CRSC) (China) 10.22. Hitachi Rail (Japan) 10.23. Mitsubishi Heavy Industries (Japan) 10.24. Kawasaki Heavy Industries (Japan) 10.25. Hyundai Rotem (South Korea) 10.26. Toshiba Infrastructure Systems & Solutions (Japan) 10.27. Indian Railways & RDSO (India) 10.28. SMRT Corporation (Singapore) 10.29. Hong Kong MTR Corporation (Hong Kong) 11. Key Findings 12. Industry Recommendations 13. Autonomous Trains Market: Research Methodology 14. Terms and Glossary