Automotive Paints Market size was valued at USD 10.85 Bn. in 2023 and the total revenue is expected to grow at a CAGR of 4.7 % through 2024 to 2030, reaching nearly USD 15.77 Bn.Automotive Paints Market:

Automotive paint is paint used on automobiles for both protective and decorative purposes. The global automotive painting and coating market is experiencing significant growth and transformation. The ever-evolving automotive industry plays a crucial role in enhancing the aesthetics, Automotive Paint Durability, and functionality of vehicles. Key factors shaping the market include technological advancements, environmental regulations, and shifting consumer preferences. The market is witnessing a shift towards eco-friendly and Water-Based Automotive Paints, driven by stringent environmental regulations. As sustainability gains importance, automakers are focusing on Eco-Friendly Automotive Paint which helps to reduce emissions, waste, and energy consumption in the painting process. The advancements in coating technologies, including self-healing coatings and anti-scratch solutions, are gaining traction. These innovations enhance the longevity and appearance of automotive finishes, contributing to customer satisfaction. Customization, color choices, and personalization are becoming significant drivers for consumer preferences, encouraging automakers to diversify their paint and coating options. This trend is expected to continue shaping the market's landscape.To know about the Research Methodology :- Request Free Sample Report

Automotive Paints Market Dynamics:

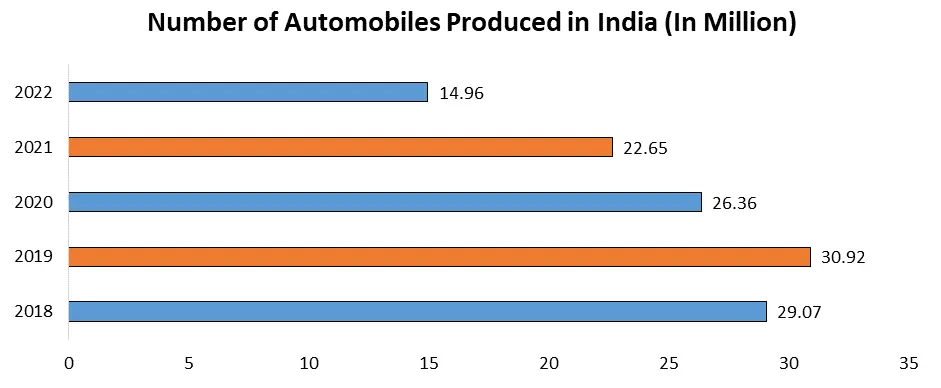

Growth of the automotive industry Boost the Market Growth The growth of the automotive industry significantly boosts the automotive paint market's expansion in several key ways. First and foremost, as the global automotive sector experiences continuous growth, there is a parallel increase in the demand for automotive paints to coat and protect vehicles. The automotive industry's expansion is driven by factors such as the rising global population, urbanization, and improving living standards, which have helped an increased demand for automobiles. Moreover, the ongoing technological advancements in the automotive industry have a direct impact on the demand for innovative paint solutions. This includes developments in electric vehicles (EVs), autonomous driving systems, and connectivity features, all of which require specialized coatings and finishes. Environmental concerns and stringent emissions regulations have further accelerated the demand for eco-friendly and High-Performance Car Paint such as low-VOC (volatile organic compounds) paints. As automakers strive to reduce their environmental footprint and meet sustainability targets, the automotive paint market adapts by offering environmentally friendly alternatives. Safety improvements, including advanced safety features such as airbags and anti-lock braking systems, are also driving demand for specialized coatings that withstand the rigors of these safety systems. The growth of the automotive industry leads to higher vehicle production and sales, generating a continuous need for automotive paints to provide to diverse consumer preferences for color, finish, and aesthetic appeal. In summary, the growth of the automotive industry significantly fuels the demand for automotive paints, driven by increased vehicle production, technological advancements, environmental considerations, safety requirements, and consumer customization preferences. For Instance, India enjoys a strong position in the global heavy vehicles market as it is the largest tractor producer, second-largest bus manufacturer, and third-largest heavy truck manufacturer in the world. India’s annual production of automobiles in FY22 was 22.93 million vehicles. India has a strong market in terms of domestic demand and exports.

Market Growth Restraint:

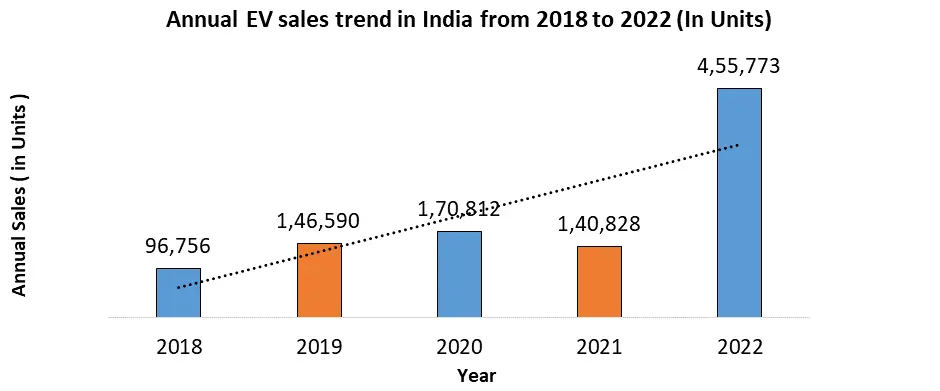

Increasing Stringency of Environmental Regulations Limits the Market Growth The automotive paints market is the increasing stringency of environmental regulations and the push for sustainable practices. Regulatory bodies around the world are imposing stricter rules on the automotive industry to reduce emissions, minimize volatile organic compound (VOC) emissions, and encourage the use of eco-friendly coatings. This has forced automotive paint manufacturers to invest in research and development to formulate low-VOC and water-based paint solutions. The transition to more sustainable paint formulations, while essential for the environment, often involves higher production costs. These costs can be a constraint for both paint manufacturers and automakers. Furthermore, the implementation of these eco-friendly coatings may necessitate the upgrading or replacement of existing painting facilities, which adds to the overall expenses. The automotive industry's move toward electric vehicles (EVs) presents a challenge for the automotive paints market. EVs generally require less paint than traditional internal combustion engine vehicles due to their smaller size and different materials. This shift helps to reduce the demand for automotive paints.Market Growth Opportunity:

The growing demand for electric vehicles (EVs) represents a significant opportunity for the automotive paints market. This shift towards EVs is driven by several compelling factors, and it has substantial implications for the types of coatings and paints required in the automotive industry. One of the primary reasons for the rising demand for EVs is the global focus on reducing carbon emissions and combating climate change. EVs are seen as a more environmentally friendly alternative to traditional internal combustion engine vehicles. As governments worldwide implement stricter emissions regulations, automakers are accelerating their efforts to produce electric vehicles. This shift to EVs has unique implications for the automotive paints market. Automotive Paint Technologies for Electric vehicles often have different materials, including lightweight composites and aluminium, which require specialized coatings to protect and enhance their appearance. These materials have distinct characteristics that demand specific paint formulations to ensure durability, corrosion resistance, and a pleasing finish. EV manufacturers and consumers often seek coatings that are not only protective but also contribute to the vehicle's overall efficiency. This includes paint solutions that reduce aerodynamic drag or are designed to enhance the cooling and thermal management of EV components like batteries and electric motors. The growth of the electric vehicle market offers an opportunity for automotive paint manufacturers to develop and supply innovative coatings tailored to the unique needs of EVs. As the demand for electric vehicles continues to surge, the automotive paints market stands to benefit from these evolving requirements and preferences.

Automotive Paints Market Segment Analysis:

Based on Coating Type, The Clear Coat dominates the type segment of the Automotive Paints Market in the year 2023. Clear coats serve as a linchpin in the automotive industry, offering critical benefits that contribute to their prominence. Clear coats are indispensable for their protective functionality. They form an impermeable shield, safeguarding the underlying base coat and the vehicle's body from a barrage of environmental stressors, including harmful UV rays, abrasive road debris, chemical exposures, and adverse weather conditions. The need for robust protective coatings is inherent in the automotive world, considering the long-term durability and aesthetics of vehicles. Clear coats preserve the color's integrity and shield the finish, ensuring it remains vivid and true to the intended hue. This attribute is crucial for consumers seeking specific color choices and personalization for their vehicles. Clear coats are also important in preventing oxidation and rust, extending the vehicle's exterior lifespan, particularly in regions prone to adverse weather conditions.Based on the Resin Type, Polyurethane became a prominent player in Automotive Paints Market due to increasing demand in 2023. Polyurethane paint offers superior resistance to weather, UV radiation, chemicals, and abrasion, and it also provides an anti-scratch finish to the vehicle, thus propelling its demand among major players in the automotive industry. Furthermore, owing to a growing luxury and premium vehicle, coatings with protective and good appearance quality are highly demanded, thus propelling polyurethane’s demand and increasing market size. By Technology, Waterborne coating leads the market with a significant sales share due to its capability to guard automobiles against numerous weather conditions and tremendous cost reduction. In addition, waterborne technology offers lower temperature processing, excessive chemical resistance, and solvent-free practice of coatings. On the other hand, powder coating provides a precise film thickness that enables them to rectify inappropriately lined regions. This makes powder coating a preferred desire for huge stop-use packages. Also, the enterprise individuals comply with the appealing features of paints.

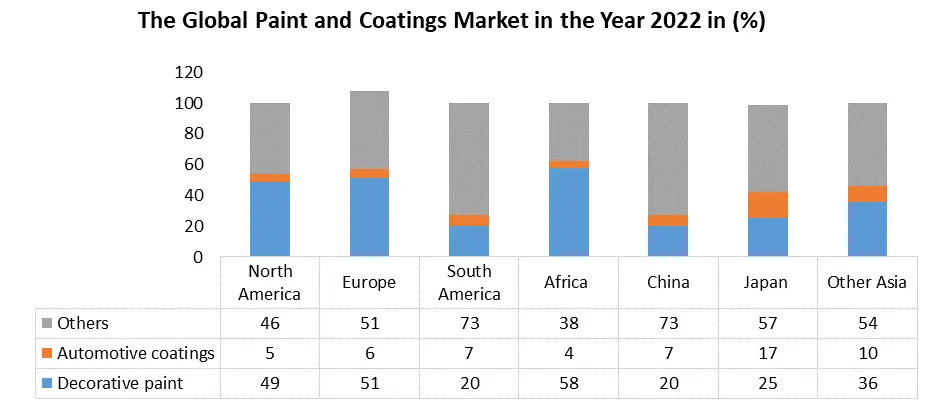

Automotive Paints Market Regional Insight:

Asia Pacific Region dominated the Automotive Paints Market in the year 2023. Because of its high vehicle production and growing economy. The automotive paints business has progressed in lockstep with the automobile. Both industries are working hard to give their clients Innovative technology and environmentally safe products. The Asia-Pacific region, especially countries like China and India, has witnessed rapid growth in the automotive industry. This includes both domestic production and consumption of vehicles. The Strong automotive manufacturing sector in this region generates significant demand for automotive paints. The rising middle-class population in Asia-Pacific countries has resulted in increased purchasing power and a growing appetite for automobiles. As more people can afford cars, the demand for vehicle coatings and finishes, and subsequently, automotive paints, has surged. Many Asia-Pacific governments have been actively promoting the automotive industry through incentives, infrastructure development, and supportive policies. These measures stimulate automotive production and sales, further boosting the automotive paints market. Asian consumers, particularly in markets such as China and India, show a strong preference for customization and personalization of their vehicles. A wide range of paint colors and finishes is therefore in high demand, driving the automotive paints market.

Competitive Landscape

The Competitive Landscape of the Automotive PaintsMarket covers the number of key companies, company size, strengths, weaknesses, barriers, and threats. It also focuses on the Innovations in Auto Paints, Automotive Paint Brand Comparison, Automotive Paint Technologies , power of the company’s competitive rivals, potential, new market entrants, customers, suppliers, and substitute products that drive the profitability of the companies in the Automotive paints industry.The global Automotive Paints Market includes several market players at the country, regional, and global levels. Some of the milling machine manufacturers Nippon Paint Group, Sherwin-Williams, PPG, AkzoNobel, Axalta, BASF, Kansai Paint, Masoo, Asian Paints, and Jotun Many companies have conducted research and development activities to fulfill consumer demand and increase their portfolio. The company focuses on strategic partnerships mergers and acquisitions to expand the global reach and maintain the brand name.

Automotive Paints Industry Ecosystem

Automotive Paints Market Scope: Inquiry Before Buying

Automotive Paints Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 10.85 Bn Forecast Period 2024 to 2030 CAGR: 4.5% Market Size in 2030: USD 15.77 Bn Segments Covered: by Coating Type Primer Base coat Clear coat Electrocoat by Resin Type Polyurethane Other Resins Epoxy Acrylic by Technology Solvent borne Waterborne Powder Coating by Content Type Solvent-Borne Clearcoat Waterborne Basecoat Waterborne Clearcoat Automotive Paints Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Automotive Paints Key Players

1. Nippon Paint Group 2. Sherwin-Williams 3. PPG 4. AkzoNobel 5. Axalta 6. BASF 7. Kansai Paint 8. Masoo(Behr) 9. Asian Paints 10. Jotun 11. RPM 12. Akzo Nobel NV 13. Clariant AG 14. Solvay 15. DOW Chemical 16. 3M 17. KCC 18. DuPont Coatings & Color Technologies GroupFrequently Asked Questions:

1] What is the growth rate of the Global Automotive Paints Market? Ans. The Global Automotive Paints Market is growing at a significant rate of 4.7% during the forecast period. 2] Which region is expected to dominate the Global Automotive Paints Market? Ans. Asia Pacific is expected to dominate the Automotive Paints Market during the forecast period. 3] What is the expected Global Automotive Paints Market size by 2030? Ans. The Automotive Paints Market size is expected to reach USD 15.77 Bn by 2030. 4] Which are the top players in the Global Automotive Paints Market? Ans. The major top players in the Global Automotive Paints Market are Nippon Paint Group, Sherwin-Williams, PPG, AkzoNobel, Axalta, BASF, Kansai Paint, Masoo and Asian Paints 5] What are the factors driving the Global Automotive Paints Market growth? Ans. The increasing demand for Electric vehicles is expected to drive market growth during the forecast period.

1. Automotive Paints Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Automotive Paints Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.4.1. Main suppliers and their market positioning 2.4.2. Key customers and adoption rates across different sectors 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. Vehicle Type Segment 2.5.4. Revenue (2023) 2.5.5. Key Development 2.5.6. Geographic distribution of major customers 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. Automotive Paints Market: Dynamics 3.1. Automotive Paints Market Trends 3.2. Automotive Paints Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. Trends and disruptions impacting customer business 3.4. Supply Chain Analysis 3.4.1. Role of companies in supply chain 3.5. Technology Analysis 3.5.1. Nano ceramic coatings 3.5.2. Smart paints 3.5.3. Self-cleaning paints 3.5.4. Dress up 3.5.5. Self-healing wraps 3.5.6. Paint atomizers 3.5.7. Smart automotive paint booth 3.5.8. Antimicrobial coatings 3.5.9. Impact of electric vehicles on the automotive paints market 3.6. Ecosystem Analysis 3.6.1. Raw Material Suppliers 3.6.2. Paint manufacturers 3.6.3. OEM and partnerships 3.6.4. Paint application and equipment providers 3.6.5. Distributors and dealers 3.6.6. End consumers 3.7. PORTER’s Five Forces Analysis 3.7.1. Intensity of the Rivalry 3.7.2. Threat of New Entrants 3.7.3. Bargaining Power of Suppliers 3.7.4. Bargaining Power of Buyers 3.7.5. Threat of Substitutes 3.8. Popularity of Automotive Colors Worldwide 3.8.1. Popular automotive colors 3.8.2. Vehicle depreciation value based on colors 3.8.3. New color trends by automakers 3.9. Trade Analysis 3.9.1. Import Data 3.9.1.1. Import data by country 3.9.2. Export data 3.9.2.1. Export data by country 3.10. Pricing analysis 3.10.1. Average selling price trend of automotive paints, by coating type 3.10.2. Average selling price trend of automotive paints, by region 3.11. Tariff and Regulatory Landscape 3.11.1. Tariff related automotive paints 3.11.2. Regulatory bodies, government agencies, and other organisations 3.12. Key stakeholders and buying criteria 3.12.1. Influence of stakeholders on buying process for automotive paints 3.12.2. Key buying criteria 3.13. Key conferences and events, 2023-2024 3.14. Regulatory Landscape by Region 3.14.1. North America 3.14.2. Europe 3.14.3. Asia Pacific 3.14.4. South America 3.14.5. MEA 4. Automotive Paints Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2023-2030) 4.1. Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 4.1.1. Primer 4.1.2. Base coat 4.1.3. Clear coat 4.1.4. Electrocoat 4.2. Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 4.2.1. Polyurethane 4.2.2. Other Resins 4.2.3. Epoxy 4.2.4. Acrylic 4.3. Automotive Paints Market Size and Forecast, by Technology (2023-2030) 4.3.1. Solvent borne 4.3.2. Waterborne 4.3.3. Powder Coating 4.4. Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 4.4.1. Solvent-Borne Clearcoat 4.4.2. Waterborne Basecoat 4.4.3. Waterborne Clearcoat 5. North America Automotive Paints Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 5.1.1. Primer 5.1.2. Base coat 5.1.3. Clear coat 5.1.4. Electrocoat 5.2. North America Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 5.2.1. Polyurethane 5.2.2. Other Resins 5.2.3. Epoxy 5.2.4. Acrylic 5.3. North America Automotive Paints Market Size and Forecast, by Technology (2023-2030) 5.3.1. Solvent borne 5.3.2. Waterborne 5.3.3. Powder Coating 5.4. North America Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 5.4.1. Solvent-Borne Clearcoat 5.4.2. Waterborne Basecoat 5.4.3. Waterborne Clearcoat 5.5. North America Automotive Paints Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 5.5.1.1.1. Primer 5.5.1.1.2. Base coat 5.5.1.1.3. Clear coat 5.5.1.1.4. Electrocoat 5.5.1.2. United States Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 5.5.1.2.1. Polyurethane 5.5.1.2.2. Other Resins 5.5.1.2.3. Epoxy 5.5.1.2.4. Acrylic 5.5.1.3. United States Automotive Paints Market Size and Forecast, by Technology (2023-2030) 5.5.1.3.1. Solvent borne 5.5.1.3.2. Waterborne 5.5.1.3.3. Powder Coating 5.5.1.4. United States Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 5.5.1.4.1. Solvent-Borne Clearcoat 5.5.1.4.2. Waterborne Basecoat 5.5.1.4.3. Waterborne Clearcoat 5.5.2. Canada 5.5.2.1. Canada Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 5.5.2.1.1. Primer 5.5.2.1.2. Base coat 5.5.2.1.3. Clear coat 5.5.2.1.4. Electrocoat 5.5.2.2. Canada Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 5.5.2.2.1. Polyurethane 5.5.2.2.2. Other Resins 5.5.2.2.3. Epoxy 5.5.2.2.4. Acrylic 5.5.2.3. Canada Automotive Paints Market Size and Forecast, by Technology (2023-2030) 5.5.2.3.1. Solvent borne 5.5.2.3.2. Waterborne 5.5.2.3.3. Powder Coating 5.5.2.4. Canada Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 5.5.2.4.1. Solvent-Borne Clearcoat 5.5.2.4.2. Waterborne Basecoat 5.5.2.4.3. Waterborne Clearcoat 5.5.3. Mexico 5.5.3.1. Mexico Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 5.5.3.1.1. Primer 5.5.3.1.2. Base coat 5.5.3.1.3. Clear coat 5.5.3.1.4. Electrocoat 5.5.3.2. Mexico Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 5.5.3.2.1. Polyurethane 5.5.3.2.2. Other Resins 5.5.3.2.3. Epoxy 5.5.3.2.4. Acrylic 5.5.3.3. Mexico Automotive Paints Market Size and Forecast, by Technology (2023-2030) 5.5.3.3.1. Solvent borne 5.5.3.3.2. Waterborne 5.5.3.3.3. Powder Coating 5.5.3.4. Mexico Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 5.5.3.4.1. Solvent-Borne Clearcoat 5.5.3.4.2. Waterborne Basecoat 5.5.3.4.3. Waterborne Clearcoat 6. Europe Automotive Paints Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 6.2. Europe Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 6.3. Europe Automotive Paints Market Size and Forecast, by Technology (2023-2030) 6.4. Europe Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 6.5. Europe Automotive Paints Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 6.5.1.2. United Kingdom Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 6.5.1.3. United Kingdom Automotive Paints Market Size and Forecast, by Technology (2023-2030) 6.5.1.4. United Kingdom Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 6.5.2. France 6.5.2.1. France Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 6.5.2.2. France Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 6.5.2.3. France Automotive Paints Market Size and Forecast, by Technology (2023-2030) 6.5.2.4. France Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 6.5.3. Germany 6.5.3.1. Germany Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 6.5.3.2. Germany Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 6.5.3.3. Germany Automotive Paints Market Size and Forecast, by Technology (2023-2030) 6.5.3.4. Germany Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 6.5.4. Italy 6.5.4.1. Italy Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 6.5.4.2. Italy Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 6.5.4.3. Italy Automotive Paints Market Size and Forecast, by Technology (2023-2030) 6.5.4.4. Italy Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 6.5.5. Spain 6.5.5.1. Spain Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 6.5.5.2. Spain Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 6.5.5.3. Spain Automotive Paints Market Size and Forecast, by Technology (2023-2030) 6.5.5.4. Spain Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 6.5.6.2. Sweden Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 6.5.6.3. Sweden Automotive Paints Market Size and Forecast, by Technology (2023-2030) 6.5.6.4. Sweden Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 6.5.7. Austria 6.5.7.1. Austria Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 6.5.7.2. Austria Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 6.5.7.3. Austria Automotive Paints Market Size and Forecast, by Technology (2023-2030) 6.5.7.4. Austria Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 6.5.8.2. Rest of Europe Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 6.5.8.3. Rest of Europe Automotive Paints Market Size and Forecast, by Technology (2023-2030) 6.5.8.4. Rest of Europe Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 7. Asia Pacific Automotive Paints Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 7.2. Asia Pacific Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 7.3. Asia Pacific Automotive Paints Market Size and Forecast, by Technology (2023-2030) 7.4. Asia Pacific Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 7.5. Asia Pacific Automotive Paints Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 7.5.1.2. China Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 7.5.1.3. China Automotive Paints Market Size and Forecast, by Technology (2023-2030) 7.5.1.4. China Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 7.5.2.2. S Korea Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 7.5.2.3. S Korea Automotive Paints Market Size and Forecast, by Technology (2023-2030) 7.5.2.4. S Korea Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 7.5.3. Japan 7.5.3.1. Japan Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 7.5.3.2. Japan Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 7.5.3.3. Japan Automotive Paints Market Size and Forecast, by Technology (2023-2030) 7.5.3.4. Japan Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 7.5.4. India 7.5.4.1. India Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 7.5.4.2. India Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 7.5.4.3. India Automotive Paints Market Size and Forecast, by Technology (2023-2030) 7.5.4.4. India Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 7.5.5. Australia 7.5.5.1. Australia Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 7.5.5.2. Australia Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 7.5.5.3. Australia Automotive Paints Market Size and Forecast, by Technology (2023-2030) 7.5.5.4. Australia Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 7.5.6. ASIAN 7.5.6.1. ASIAN Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 7.5.6.2. ASIAN Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 7.5.6.3. ASIAN Automotive Paints Market Size and Forecast, by Technology (2023-2030) 7.5.6.4. ASIAN Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 7.5.7. Rest of Asia Pacific 7.5.7.1. Rest of Asia Pacific Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 7.5.7.2. Rest of Asia Pacific Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 7.5.7.3. Rest of Asia Pacific Automotive Paints Market Size and Forecast, by Technology (2023-2030) 7.5.7.4. Rest of Asia Pacific Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 8. Middle East and Africa Automotive Paints Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 8.2. Middle East and Africa Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 8.3. Middle East and Africa Automotive Paints Market Size and Forecast, by Technology (2023-2030) 8.4. Middle East and Africa Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 8.5. Middle East and Africa Automotive Paints Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 8.5.1.2. South Africa Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 8.5.1.3. South Africa Automotive Paints Market Size and Forecast, by Technology (2023-2030) 8.5.1.4. South Africa Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 8.5.2. S GCC 8.5.2.1. GCC Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 8.5.2.2. GCC Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 8.5.2.3. GCC Automotive Paints Market Size and Forecast, by Technology (2023-2030) 8.5.2.4. GCC Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 8.5.3. Egypt 8.5.3.1. Egypt Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 8.5.3.2. Egypt Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 8.5.3.3. Egypt Automotive Paints Market Size and Forecast, by Technology (2023-2030) 8.5.3.4. Egypt Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 8.5.4. Nigeria 8.5.4.1. Nigeria Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 8.5.4.2. Nigeria Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 8.5.4.3. Nigeria Automotive Paints Market Size and Forecast, by Technology (2023-2030) 8.5.4.4. Nigeria Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 8.5.5. Rest of ME &A 8.5.5.1. Rest of ME &A Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 8.5.5.2. Rest of ME &A Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 8.5.5.3. Rest of ME &A Automotive Paints Market Size and Forecast, by Technology (2023-2030) 8.5.5.4. Rest of ME &A Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 9. South America Automotive Paints Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 9.2. South America Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 9.3. South America Automotive Paints Market Size and Forecast, by Technology (2023-2030) 9.4. South America Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 9.5. South America Automotive Paints Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 9.5.1.2. Brazil Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 9.5.1.3. Brazil Automotive Paints Market Size and Forecast, by Technology (2023-2030) 9.5.1.4. Brazil Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 9.5.2.2. Argentina Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 9.5.2.3. Argentina Automotive Paints Market Size and Forecast, by Technology (2023-2030) 9.5.2.4. Argentina Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest of South America Automotive Paints Market Size and Forecast, by Coating Type (2023-2030) 9.5.3.2. Rest of South America Automotive Paints Market Size and Forecast, by Resin Type (2023-2030) 9.5.3.3. Rest of South America Automotive Paints Market Size and Forecast, by Technology (2023-2030) 9.5.3.4. Rest of South America Automotive Paints Market Size and Forecast, by Content Type (2023-2030) 10. Company Profile: Key Players 10.1. Altran 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.3.1. Total Revenue 10.1.3.2. Segment Revenue 10.1.3.3. Annual Revenue 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Aptiv 10.3. Autocrypt 10.4. Autotalks Ltd. 10.5. Blackberry Certicom 10.6. Continental 10.7. Denso Corporation 10.8. Escrypt 10.9. Green Hills Software 10.10. Harman International 10.11. ID Quantique 10.12. IDNomic 10.13. Infineon Technologies AG 10.14. Karamba Security 10.15. Lear Corporation 10.16. NXP 10.17. Onboard Security (Qualcomm) 10.18. Saferide Technologies 10.19. Secunet 10.20. STMicroelectronics 10.21. Trillium Secure Inc. 10.22. Vector Informatik GmbH 11. Key Findings and Analyst Recommendations: Attractive Opportunities to the Key Players in the Market 12. Automotive Paints Market: Research Methodology 12.1. Research Data 12.1.1. Secondary Data 12.1.1.1. Secondary sources 12.1.1.2. Key data from secondary sources 12.1.2. Primary Data 12.1.2.1. Breakdown of primary interviews 12.1.2.2. Primary participants 12.1.3. Sampling techniques and data collection methods 12.2. Market size estimation 12.2.1. Bottom-up Approach 12.2.2. Top-down Approach 12.3. Factor analysis 12.4. Research Assumptions 12.5. Data triangulation 12.6. Research limitations 12.7. Recession impact analysis