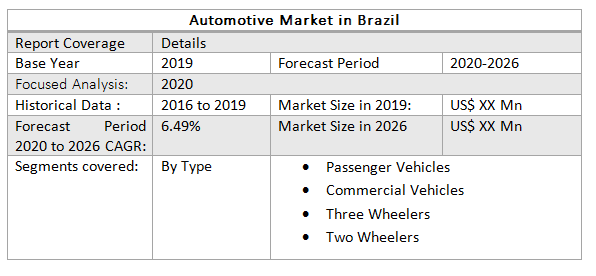

Automotive Market in Brazil size was valued at US$ XX Mn in 2019 and the total revenue is expected to grow at 6.49% through 2020 to 2026, reaching US$ XX Mn.To Know About The Research Methodology :- Request Free Sample Report

Making superior & supportable economic value:

Strong growth in Brazil’s automotive market for the first 2 weeks of March has been suddenly undermined by the downfall of the industry in the second 2 weeks because of Covid-19, Compared to the same month last year, March 2020 saw an complete drop in production, sales & exports of 21percent, & compared to February 2020 the retraction was 18 percent in sales & exports. The Brazilian auto segment bounced back in August, however the recovery is not robust enough to stop layoffs in an industry still winding from an economic downturn through the Covid-19 health crisis. The segment produced 210,900 light vehicles last month, up 23.6 percent from July. But compared to August 2019, there was a 21.8 percent decline. Sales, on the other hand, had a monthly rise of 5.1 percent, to 183,400 units, but cut down 24.5 percent against from August 2019.Extended closures:

Car manufacturing companies in Brazil stopped manufacturing in the second half of March. Toyota’s division in Brazil, which stopped manufacturing at its 4 plants in the state of São Paulo on March 24, has postponed the new restart date of April 6 by more than 2 months. It now strategies to revive the São Bernardo do Campo, Indaiatuba & Porto Feliz services on June 22, & the Sorocaba plant on June 24. General Motor is also extending shutdowns which began on March 23 to the middle of June. Which contains the Rio Grande do Sul plant, which forms Brazil’s best-selling car, the Chevrolet Onix. Fiat Chrysler Automobile closed manufacturing at its 3 plants in Betim, Goiana & Campo Largo on March 27, & it would restart on April 21 but this date is projected to be revised. Daimler, Volvo & VW have made similar moves. According to MMR report the vehicle production through Latin America is estimated to fall by 98,000 units in March & April. The impact of the Covid-19 follows a difficult 2019 for Brazil’s automotive industry &, the base case situation going forward is that Latin America as an entire will suffer a 10 percent drop in volume output of 450,000 compared to 2019, however that could double in a worst-case situation.Brazil's Auto Industry Trends:

The Brazilian automotive market is currently the 8th major in the world. Passenger vehicle sales in the year2018 were just under 2.5 Mn units rising over 13.8 percent from 2017. Brazil was one of the rare nations in the world which registered such positive development, mainly amongst emerging economies. In the year 2012, the government announced its 'INNOVAR' program to increase the production of fuel-efficient vehicles & inspire international vehicle producers to invest in the nation. This was mainly done through the method of managing tax exemptions for international firms. The program which expired in the year 2017, despite getting a lot of bad feedback, did manage to increase investments, production, & thereby sales in the nation, bringing in more option of vehicles & models. After the 'INNOVAR' program expired, the government introduced a new order known as ROTA 2030. With the main aim of focusing on energy efficiency & sustainability, this complete economic platform was meant to progress invention in areas like R&D, vehicle safety, & logistics among others. This program was specially meant to drive the industry to accelerate its growth in the production of hybrid & electric vehicles. However, despite the government's pro-activeness, some key OEMs with VW, GM, & Ford have exited the market threatening to disrupt the development in the market.Ford’s Exit Foretells Brazil’s Troubles:

Ford Motor Co. declared 12th March 2021 that it is closing all its plants in Brazil, bringing its more than 100-year history in the nation to a close. The Ford Motor Co said in a press release that a decrease in sales, the Corona Virus pandemic & the increase of the US dollar were issues in its decision. The Corona Virus pandemic increased the industry's persistent idle capacity & the drop in sales, causing in years of major losses, with the closure, an estimated 5,000 jobs will be lost both in Brazil & Argentina. Ford’s decision drives against the robust recovery observed in most segments of the country, many of them already registering results greater to the pre-crisis period. The report covers Commercial Vehicles, Passenger Vehicles, with detailed analysis Automotive Market in Brazil industry with the classifications of the market on the Type, Application & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in four regions. The major states policies about manufacturing & Covid 19 impact on demand side are covered in the report.Scope of the Automotive Market in Brazil: Inquire before buying

Automotive Market in Brazil Key Players

• BYD • Volkswagen • Toyota • Nissan • Fiat • MAN SE • Mitsubishi • Mercedes-Benz • Renault • Honda • Hyundai • Kia • Volvo • BMW • Subaru • Chery • Geely • JAC Motors • Lifan • Peugeot • Others

Automotive Market in Brazil

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Automotive Market in Brazil Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Automotive Market in Brazil Analysis and Forecast 7. Automotive Market in Brazil Analysis and Forecast, by Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. Automotive Market in Brazil Value Share Analysis, by Type 7.4. Automotive Market in Brazil Size (US$ Mn) Forecast, by Type 7.5. Automotive Market in Brazil Analysis, by Type 8. Automotive Market in Brazil Analysis 8.1. Automotive Market in Brazil Forecast, by Type 8.1.1. Passenger Vehicles 8.1.2. Commercial Vehicles 8.1.3. Three Wheelers 8.1.4. Two Wheelers 8.2. PEST Analysis 8.3. Key Trends 8.4. Key Developments 9. Company Profiles 9.1. Market Share Analysis, by Company 9.2. Competition Matrix 9.2.1. Competitive Benchmarking of key players by price, presence, market share, Raw material and R&D investment 9.2.2. New Raw material Launches and Raw material Enhancements 9.2.2.1. Market Consolidation 9.2.2.2. M&A by Regions, Investment and Raw material 9.2.2.3. M&A Key Players, Forward Integration and Backward Integration 9.3. Company Profiles: Key Players 9.3.1. BYD 9.3.2. Volkswagen 9.3.3. Toyota 9.3.4. Nissan 9.3.5. Fiat 9.3.6. MAN SE 9.3.7. Mitsubishi 9.3.8. Mercedes-Benz 9.3.9. Renault 9.3.10. Honda 9.3.11. Hyundai 9.3.12. Kia 9.3.13. Volvo 9.3.14. BMW 9.3.15. Subaru 9.3.16. Chery 9.3.17. Geely 9.3.18. JAC Motors 9.3.19. Lifan 9.3.20. Peugeot 9.3.21. Others.