Automotive HVAC Market was valued at USD 65.25 Bn. in 2024 and the total Global Automotive HVAC Market revenue is Expected to grow at a CAGR of 6.55% from 2025 to 2032 reaching nearly USD 108.39 Bn. by 2032.Automotive HVAC Market Overview:

An automotive heating, ventilation, and air conditioning (HVAC) system is a vehicle which is used to control the internal temperature of the vehicle cabin. It includes three subsystems, namely, heating, cooling, and air conditioning, that work together to provide purified air to the vehicle cabin, ensuring thermal comfort for drivers and passengers. It controls the air temperature, inspects the moisture content in the air, and eliminates excessive humidity from the circulating air. Well-established companies, such as Audi, Mercedes, and BMW, focus on customized and consumer-friendly HVAC systems.To know about the Research Methodology :- Request Free Sample Report For instance, the BMW 6 Series supports automatic air conditioning, including air distribution for driver and passengers, fogging sensor, and automatic climate control system. Automotive HVAC systems are used for controlling the climate and temperature of the cabin of the vehicle. Heating, ventilation, and air conditioning professionals must stay up-to-date on all industry standards, certifications, and advancements. Each time a new interior climate control feature becomes standardized across the automotive sector, for example, the technicians who service and maintain those systems in cars, trucks, and vans must reskill and become experts on those updates. As automotive HVAC systems grow increasingly more complex, so too will the set of skills and know-how required to repair and care for them. The report explores the Global Automotive HVAC Market segments (By Technology, By Application, By Component and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The MMR market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2023. The report investigates the Global Automotive HVAC Market drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Global Automotive HVAC Market contemporary competitive scenario.

Automotive HVAC Market Dynamics:

The installation of eco-friendly refrigerants such as R744/CO2 in automobiles would not only foster the growth of the automotive HVAC system market but also help in saving the environment. Substitute refrigerants such as R744 and CO2 would increase fuel efficiency and reduce pollution from vehicles, which would benefit the environment. Thus, adoption of eco-friendly refrigerants in automobiles holds a remarkable growth opportunity for the key players operating in the market. The increasing sales of vehicles and the growing requirement for air conditioning systems under extreme weather conditions across the globe leads to the growth of the Global Automotive HVAC Market. Automotive HVAC systems are widely used due to the increasing demand for enhanced performance, air quality and environmental issues. The rising demand for remote access control systems that assist in enhancing the efficiency of air conditioning and reducing fuel consumption are the factors which leads to the growth of the market during the forecast period. In addition to this, various technological innovations, such as the introduction of energy-efficient and eco-friendly automotive HVAC systems due to the increasing environmental consciousness among the masses, are providing a thrust to the market growth. HVAC system unit is highly costly to integrate and expensive to repair in case of a failure which is the major restrain which declines the growth of the Global Automotive HVAC Market during the forecast period. The increase in the overall cost of the automobile leads to the installation of HVAC unit in a vehicle. An automobile HVAC unit consists of compressor, condensers, evaporators, and other components. To keep these components in good working condition, regular maintenance is required, which is significantly expensive. Compressor is the costliest component in the systems and requires proper refrigerant and lubrication levels to reduce the risk of premature compression failure. Thus, high maintenance cost of the overall components of HVAC system is anticipated to hinder the growth of the global automotive HVAC market. The launch of new HVAC systems with advanced features that assist in demisting windshields, defrosting windows and dehumidifying air, and providing improved comfort to the passengers is boosting the market growth. Other factors which include the increasing demand for electric vehicles (EVs), rising expenditure capacities of consumers and the implementation of various government initiatives to promote energy-efficient systems, are the opportunities which leads to the growth of the Global Automotive HVAC Market during the forecast period. The augmenting research and developments in the automotive sector across the world are set to enhance the technological capabilities of the market players. These market players are introducing advanced technologies in automotive HVAC to develop new products that impart a competitive edge in the market. Energy efficacy is the other parameter which is driving the growth of the market during the forecast period. Another opportunity which leads to the growth of the market is manufacturers which are using green technologies to develop eco-friendly and energy-efficient automotive HVAC systems are increasing. New emerging markets, emerging consumer demographics, and stringent government regulations would provide growth opportunities for Automotive HVAC market in the coming years. One of the factors that challenges the automotive HVAC market is the noise generated by these systems inside the car cabin, inducing passenger discomfort. Clattering noises by these systems are produced due to the interactions between HVAC components and airflow. Passive absorbers on HVAC body and ducts are being used by HVAC suppliers on current designs to reduce system noises during its operation, providing comfort inside the car cabin.Automotive HVAC Market Segment Analysis:

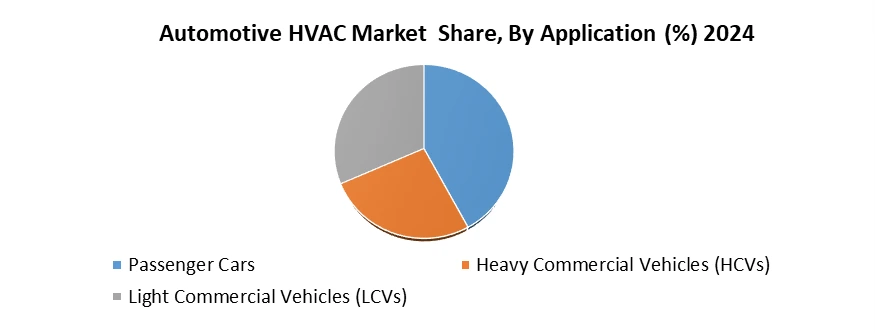

Based on Component, Automotive HVAC Market segmented into Evaporator, Compressor, Condenser, Receiver-drier, Expansion Valve and Others. Compressor segment dominated the market in 2024 and is expected to hold largest share during the forecast period. It is a belt driven pump, which is attached to the engine. The compressor helps in compressing and transferring of refrigerant gas. When the hot compressed gases are introduced on the top of a condenser, they are cooled instantly and after the cooling is complete, they condense and exit from the bottom of the condenser as a high-pressure fluid. The main purpose of an evaporator is to remove the heat from inside the vehicle and dehumidify the environment within it. Pressure regulating devices are meant for controlling the evaporator temperature by regulating the refrigerant pressure and flow into the evaporator. These are the factors which leads to the growth of the Global Automotive HVAC Market. Based on the Application, Automotive HVAC Market is segmented into Passenger Cars, Heavy Commercial Vehicles (HCVs) and Light Commercial Vehicles (LCVs). Passenger cars segment dominated the market in 2024 and is expected to hold largest share during the forecast period. The increasing disposable income and the availability of various finance schemes are the main factors which is responsible for the growth of the Global Automotive HVAC Market in passenger segment. Due to better financial schemes and rural demand, there is a rise at healthy pace for the demand of automotive HVAC systems in LCVs. Booming e-commerce and logistics sectors and soaring need for fleets to support last-mile connectivity are also boosting up the growth of the Global Automotive HVAC Market. Based on Technology Automotive HVAC Market is segmented into Manual, Semi-automatic and Automatic. Automatic segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Dominance due to low efficiency and complexity, the size of the manual systems segment where users must select temperature and blower settings is also affected which declines over the past years. Burgeoning demand for automatic automotive HVAC systems can be attributed to evolving consumer preferences and increasing demand for luxury vehicles which leads to the growth of the Global Automotive HVAC Market. In addition, technological advancements in HVAC technologies such as automatic air recirculation, automatic temperature controls, and fogging sensors are the factors which boost up the growth of the Global Automotive HVAC Market.

Automotive HVAC Market Regional Insights:

The North America region is expected to witness significant growth at a CAGR of XX% through the forecast period. The rising automotive production coupled with increasing penetration of premium vehicles in the region is the main which boost up the growth of the Global Automotive HVAC Market. Government initiatives to control energy consumption are expected to drive eco-friendly technology demand in the U.S. over the forecast period. Due to improving macroeconomic conditions and increasing vehicle production, leads to the growth of the Global Automotive HVAC Market in this region. The objective of the report is to present a comprehensive analysis of the Automotive HVAC Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Automotive HVAC Market dynamic, structure by analyzing the market segments and projecting the Automotive HVAC Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Automotive HVAC Market make the report investor’s guide.Automotive HVAC Market Scope: Inquire before buying

Global Automotive HVAC Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2018 to 2023 Market Size in 2024: USD 65.25 Bn. Forecast Period 2025 to 2032 CAGR: 6.55% Market Size in 2032: USD 108.39 Bn. Segments Covered: by Technology Manual Semi-automatic Automatic by Component Evaporator Compressor Condenser Receiver-drier Expansion Valve Others by Application Passenger Cars Heavy Commercial Vehicles (HCVs) Light Commercial Vehicles (LCVs) Automotive HVAC Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Automotive HVAC Market, Key Players are

1. Denso Corporation 2. Mahle Group 3. Valeo 4. Hanon Systems 5. Calsonic Kansei Corporation 6. Keihin Corporation 7. Johnson Electric Holdings Ltd 8. Sanden Holdings Corporation 9. Japan Climate System Corporation 10. MAHLE GmbH 11. Brose Fahrzeugteile GmbH & Co. Kg 12. Air International Thermal Systems 13. Hanon Systems 14. Calsonic Kansei 15. Engineered Plastic Components 16. DelStar Technologies 17. Sanden Holdings Corporation 18. Behr GmbH 19. Halla Climate Control Corp. 20. Delphi Automotive 21. Calsonic Kansei 22. Visteon Corp. 23. Sanden Corp.Frequently Asked Questions:

1] What segments are covered in the Global Automotive HVAC Market report? Ans. The segments covered in the Global Market report are based on Technology, Application and Component. 2] Which region is expected to hold the highest share in the Global Market? Ans. North America region is expected to hold the highest share in the Global Market. 3] What is the market size of the Global Automotive HVAC Market by 2032? Ans. The market size of the Global Automotive HVAC Market by 2032 is expected to reach US$ 108.39 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Global Market is 2025-2032. 5] What was the market size of the Global Market in 2024? Ans. The market size of the Global Market in 2024 was valued at USD 65.25 Bn.

1. Automotive HVAC Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Automotive HVAC Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Automotive HVAC Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Automotive HVAC Market: Dynamics 3.1. Automotive HVAC Market Trends by Region 3.1.1. North America Automotive HVAC Market Trends 3.1.2. Europe Automotive HVAC Market Trends 3.1.3. Asia Pacific Automotive HVAC Market Trends 3.1.4. Middle East and Africa Automotive HVAC Market Trends 3.1.5. South America Automotive HVAC Market Trends 3.2. Automotive HVAC Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Automotive HVAC Market Drivers 3.2.1.2. North America Automotive HVAC Market Restraints 3.2.1.3. North America Automotive HVAC Market Opportunities 3.2.1.4. North America Automotive HVAC Market Challenges 3.2.2. Europe 3.2.2.1. Europe Automotive HVAC Market Drivers 3.2.2.2. Europe Automotive HVAC Market Restraints 3.2.2.3. Europe Automotive HVAC Market Opportunities 3.2.2.4. Europe Automotive HVAC Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Automotive HVAC Market Drivers 3.2.3.2. Asia Pacific Automotive HVAC Market Restraints 3.2.3.3. Asia Pacific Automotive HVAC Market Opportunities 3.2.3.4. Asia Pacific Automotive HVAC Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Automotive HVAC Market Drivers 3.2.4.2. Middle East and Africa Automotive HVAC Market Restraints 3.2.4.3. Middle East and Africa Automotive HVAC Market Opportunities 3.2.4.4. Middle East and Africa Automotive HVAC Market Challenges 3.2.5. South America 3.2.5.1. South America Automotive HVAC Market Drivers 3.2.5.2. South America Automotive HVAC Market Restraints 3.2.5.3. South America Automotive HVAC Market Opportunities 3.2.5.4. South America Automotive HVAC Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Automotive HVAC Industry 3.8. Analysis of Government Schemes and Initiatives For Automotive HVAC Industry 3.9. Automotive HVAC Market Trade Analysis 3.10. The Global Pandemic Impact on Automotive HVAC Market 4. Automotive HVAC Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 4.1.1. Manual 4.1.2. Semi-automatic 4.1.3. Automatic 4.2. Automotive HVAC Market Size and Forecast, by Component (2024-2032) 4.2.1. Evaporator 4.2.2. Compressor 4.2.3. Condenser 4.2.4. Receiver-drier 4.2.5. Expansion Valve 4.2.6. Others 4.3. Automotive HVAC Market Size and Forecast, by Application (2024-2032) 4.3.1. Passenger Cars 4.3.2. Heavy Commercial Vehicles (HCVs) 4.3.3. Light Commercial Vehicles (LCVs) 4.4. Automotive HVAC Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Automotive HVAC Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 5.1.1. Manual 5.1.2. Semi-automatic 5.1.3. Automatic 5.2. North America Automotive HVAC Market Size and Forecast, by Component (2024-2032) 5.2.1. Evaporator 5.2.2. Compressor 5.2.3. Condenser 5.2.4. Receiver-drier 5.2.5. Expansion Valve 5.2.6. Others 5.3. North America Automotive HVAC Market Size and Forecast, by Application (2024-2032) 5.3.1. Passenger Cars 5.3.2. Heavy Commercial Vehicles (HCVs) 5.3.3. Light Commercial Vehicles (LCVs) 5.4. North America Automotive HVAC Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 5.4.1.1.1. Manual 5.4.1.1.2. Semi-automatic 5.4.1.1.3. Automatic 5.4.1.2. United States Automotive HVAC Market Size and Forecast, by Component (2024-2032) 5.4.1.2.1. Evaporator 5.4.1.2.2. Compressor 5.4.1.2.3. Condenser 5.4.1.2.4. Receiver-drier 5.4.1.2.5. Expansion Valve 5.4.1.2.6. Others 5.4.1.3. United States Automotive HVAC Market Size and Forecast, by Application (2024-2032) 5.4.1.3.1. Passenger Cars 5.4.1.3.2. Heavy Commercial Vehicles (HCVs) 5.4.1.3.3. Light Commercial Vehicles (LCVs) 5.4.2. Canada 5.4.2.1. Canada Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 5.4.2.1.1. Manual 5.4.2.1.2. Semi-automatic 5.4.2.1.3. Automatic 5.4.2.2. Canada Automotive HVAC Market Size and Forecast, by Component (2024-2032) 5.4.2.2.1. Evaporator 5.4.2.2.2. Compressor 5.4.2.2.3. Condenser 5.4.2.2.4. Receiver-drier 5.4.2.2.5. Expansion Valve 5.4.2.2.6. Others 5.4.2.3. Canada Automotive HVAC Market Size and Forecast, by Application (2024-2032) 5.4.2.3.1. Passenger Cars 5.4.2.3.2. Heavy Commercial Vehicles (HCVs) 5.4.2.3.3. Light Commercial Vehicles (LCVs) 5.4.3. Mexico 5.4.3.1. Mexico Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 5.4.3.1.1. Manual 5.4.3.1.2. Semi-automatic 5.4.3.1.3. Automatic 5.4.3.2. Mexico Automotive HVAC Market Size and Forecast, by Component (2024-2032) 5.4.3.2.1. Evaporator 5.4.3.2.2. Compressor 5.4.3.2.3. Condenser 5.4.3.2.4. Receiver-drier 5.4.3.2.5. Expansion Valve 5.4.3.2.6. Others 5.4.3.3. Mexico Automotive HVAC Market Size and Forecast, by Application (2024-2032) 5.4.3.3.1. Passenger Cars 5.4.3.3.2. Heavy Commercial Vehicles (HCVs) 5.4.3.3.3. Light Commercial Vehicles (LCVs) 6. Europe Automotive HVAC Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 6.2. Europe Automotive HVAC Market Size and Forecast, by Component (2024-2032) 6.3. Europe Automotive HVAC Market Size and Forecast, by Application (2024-2032) 6.4. Europe Automotive HVAC Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 6.4.1.2. United Kingdom Automotive HVAC Market Size and Forecast, by Component (2024-2032) 6.4.1.3. United Kingdom Automotive HVAC Market Size and Forecast, by Application (2024-2032) 6.4.2. France 6.4.2.1. France Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 6.4.2.2. France Automotive HVAC Market Size and Forecast, by Component (2024-2032) 6.4.2.3. France Automotive HVAC Market Size and Forecast, by Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 6.4.3.2. Germany Automotive HVAC Market Size and Forecast, by Component (2024-2032) 6.4.3.3. Germany Automotive HVAC Market Size and Forecast, by Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 6.4.4.2. Italy Automotive HVAC Market Size and Forecast, by Component (2024-2032) 6.4.4.3. Italy Automotive HVAC Market Size and Forecast, by Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 6.4.5.2. Spain Automotive HVAC Market Size and Forecast, by Component (2024-2032) 6.4.5.3. Spain Automotive HVAC Market Size and Forecast, by Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 6.4.6.2. Sweden Automotive HVAC Market Size and Forecast, by Component (2024-2032) 6.4.6.3. Sweden Automotive HVAC Market Size and Forecast, by Application (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 6.4.7.2. Austria Automotive HVAC Market Size and Forecast, by Component (2024-2032) 6.4.7.3. Austria Automotive HVAC Market Size and Forecast, by Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 6.4.8.2. Rest of Europe Automotive HVAC Market Size and Forecast, by Component (2024-2032) 6.4.8.3. Rest of Europe Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Automotive HVAC Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.2. Asia Pacific Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.3. Asia Pacific Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Automotive HVAC Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.1.2. China Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.1.3. China Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.2.2. S Korea Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.2.3. S Korea Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.3.2. Japan Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.3.3. Japan Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4.4. India 7.4.4.1. India Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.4.2. India Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.4.3. India Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.5.2. Australia Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.5.3. Australia Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.6.2. Indonesia Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.6.3. Indonesia Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.7.2. Malaysia Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.7.3. Malaysia Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.8.2. Vietnam Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.8.3. Vietnam Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.9.2. Taiwan Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.9.3. Taiwan Automotive HVAC Market Size and Forecast, by Application (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 7.4.10.2. Rest of Asia Pacific Automotive HVAC Market Size and Forecast, by Component (2024-2032) 7.4.10.3. Rest of Asia Pacific Automotive HVAC Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Automotive HVAC Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 8.2. Middle East and Africa Automotive HVAC Market Size and Forecast, by Component (2024-2032) 8.3. Middle East and Africa Automotive HVAC Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Automotive HVAC Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 8.4.1.2. South Africa Automotive HVAC Market Size and Forecast, by Component (2024-2032) 8.4.1.3. South Africa Automotive HVAC Market Size and Forecast, by Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 8.4.2.2. GCC Automotive HVAC Market Size and Forecast, by Component (2024-2032) 8.4.2.3. GCC Automotive HVAC Market Size and Forecast, by Application (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 8.4.3.2. Nigeria Automotive HVAC Market Size and Forecast, by Component (2024-2032) 8.4.3.3. Nigeria Automotive HVAC Market Size and Forecast, by Application (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 8.4.4.2. Rest of ME&A Automotive HVAC Market Size and Forecast, by Component (2024-2032) 8.4.4.3. Rest of ME&A Automotive HVAC Market Size and Forecast, by Application (2024-2032) 9. South America Automotive HVAC Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 9.2. South America Automotive HVAC Market Size and Forecast, by Component (2024-2032) 9.3. South America Automotive HVAC Market Size and Forecast, by Application(2024-2032) 9.4. South America Automotive HVAC Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 9.4.1.2. Brazil Automotive HVAC Market Size and Forecast, by Component (2024-2032) 9.4.1.3. Brazil Automotive HVAC Market Size and Forecast, by Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 9.4.2.2. Argentina Automotive HVAC Market Size and Forecast, by Component (2024-2032) 9.4.2.3. Argentina Automotive HVAC Market Size and Forecast, by Application (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Automotive HVAC Market Size and Forecast, by Technology (2024-2032) 9.4.3.2. Rest Of South America Automotive HVAC Market Size and Forecast, by Component (2024-2032) 9.4.3.3. Rest Of South America Automotive HVAC Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Denso Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Mahle Group 10.3. Valeo 10.4. Hanon Systems 10.5. Calsonic Kansei Corporation 10.6. Keihin Corporation 10.7. Johnson Electric Holdings Ltd 10.8. Sanden Holdings Corporation 10.9. Japan Climate System Corporation 10.10. MAHLE GmbH 10.11. Brose Fahrzeugteile GmbH & Co. Kg 10.12. Air International Thermal Systems 10.13. Hanon Systems 10.14. Calsonic Kansei 10.15. Engineered Plastic Components 10.16. DelStar Technologies 10.17. Sanden Holdings Corporation 10.18. Behr GmbH 10.19. Halla Climate Control Corp. 10.20. Delphi Automotive 10.21. Calsonic Kansei 10.22. Visteon Corp. 10.23. Sanden Corp. 11. Key Findings 12. Industry Recommendations 13. Automotive HVAC Market: Research Methodology 14. Terms and Glossary