The Automotive Fuel Injection Pump Market size was valued at USD 19.83 Bn. in 2022 and the total Automotive Fuel Injection Pump revenue is expected to grow by 8.96 % from 2023 to 2029, reaching nearly USD 36.16 Bn.Automotive Fuel Injection Pump Market Overview:

Automotive Fuel Injection Pump is a device designed to facilitate the seamless delivery of fuel into the cylinders of diesel engines. The automotive fuel injection pump market characterizes an expanding global industry that encompasses the production, distribution, and sale of fuel injection pumps tailored for a wide array of vehicles, ranging from passenger cars to commercial vehicles and off-highway machines. These pumps hold immense significance as essential components within modern internal combustion engines, playing a key role in ensuring efficient fuel distribution and optimizing engine performance. The automotive fuel injection pump market has experienced remarkable growth in recent decades, a trajectory largely driven by the surging demand for vehicles that prioritize fuel efficiency and eco-friendliness. This growth has led to fuel injection pumps replacing traditional carburettors in the automotive landscape, offering a host of advantages, including improved fuel economy, reduced emissions, and enhanced engine responsiveness. The market's expansion has been further augmented by the escalating process of urbanization, which has fueled an increased need for automobiles, driving the demand for fuel injection pumps across the automotive industry. Market players continuously doing advancements in product development. For instance, DENSO Corporation, a global automotive trader, developed a revolutionary common rail diesel fuel injection system (DCR) with the world's highest injection pressure at 2,500 bar. This advanced system offers a substantial increase in fuel efficiency by 3% and significant reductions in particulate matter by up to 50% and nitrogen oxides by up to 8%, based on DENSO's research. The breakthrough technology promises improved automotive performance and contribute to a greener, more sustainable environment. Automotive Fuel Injection Pump Market Scope and Research Methodology The Automotive Fuel Injection Pump Market report offers a thorough evaluation of the market for the forecast period. It examines patterns and factors shaping the market, including drivers, constraints, opportunities, and challenges. The report also provides expected revenue growth for the Automotive Fuel Injection Pump Market during the forecast period. The research on the Automotive Fuel Injection Pump Market analyses major applications, business strategies, and influencing factors. The report examines market trends, volume, cost, share, supply and demand, and utilizes methods like SWOT and PESTLE analysis. Primary research resources include databases and surveys.Automotive Fuel Injection Pump Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Automotive Fuel Injection Pump Market Dynamics:

The Automotive Fuel Injection Pump Market is experiencing substantial growth driven by several market drivers. One crucial factor is the implementation of strict emission regulations by governments worldwide to combat climate change. These regulations have led to rising demand for fuel-efficient vehicles globally. Fuel injection pumps play a pivotal role in achieving better fuel combustion and reducing harmful exhaust emissions, making them indispensable in meeting these stringent requirements. A prime example of such regulations is India's Central Motor Vehicles Act of 1989, which governs emission levels for motor vehicles and is subject to regular revisions to control pollution effectively. The Automotive Research Association of India (ARAI) plays a key role in handling emission limit notifications, exhaust emissions measurements, and fuel consumption calculations. The Pollution Under Control Certificate (PUC Certificate) serves as validation for vehicles complying with mandated emission levels, reinforcing the significance of fuel-efficient technologies like fuel injection pumps. Advancements in fuel injection pump technology have been another driving force. Innovations such as direct injection systems and electronic control have significantly enhanced engine efficiency and performance. As fuel prices continue to rise and environmental concerns intensify, the demand for fuel-efficient vehicles has seen a surge. Fuel injection pumps play a crucial role in optimizing fuel delivery, resulting in improved mileage and lower fuel consumption, making them essential components in the pursuit of eco-friendly transportation solutions. Urbanization has accelerated the need for automobiles, leading to an expanding vehicle fleet. As cities grow and populations increase, the demand for fuel injection pumps to power these vehicles has risen correspondingly. In emerging economies, the growing middle-class population has also played a vital role in stimulating the fuel injection pump market. As vehicle ownership increases, the number for more efficient and eco-friendly transportation solutions becomes stronger, further driving the demand for fuel injection pumps in these regions. Automotive Fuel Injection Pump Market Restraint Technological Challenges and Material Durability Impeding Fuel Injection Pump Market The higher initial cost of fuel injection pumps compared to traditional carburettors is a key restraint in the automotive fuel injection pump market, discouraging cost-sensitive consumers and budget-conscious buyers from choosing vehicles equipped with this advanced technology. The complexity of fuel injection pumps necessitates skilled technicians and specialized tools for maintenance, resulting in potentially higher upkeep expenses, especially in regions with limited access to qualified service centres. The increasing popularity of electric vehicles is also impacting the market, as they do not require fuel injection pumps, leading to reduced demand. Stringent emission regulations are pushing automakers towards advanced systems like gasoline direct injection (GDI) and diesel common rail (DCR), increasing the complexity and cost of fuel injection pumps. For instance, according to Euro 7 emission norms, OEMs must prioritize lower emission segments, adopt powertrain lightweight, and promote electrification to meet CO2 compliance targets by 2021. Countries like France and the UK will reduce diesel vehicles, leading to a marginal decline in the Automotive Fuel Injection Pump market. Technological challenges such as developing more durable materials and optimizing control algorithms are also impeding the market's growth. Automotive Fuel Injection Pump market opportunities: Fuel Injection Pump Market's Potential with Electric and Hybrid Vehicles The automotive fuel injection pump market is offering opportunities driven by various factors. The growing adoption of electric and hybrid vehicles creates a chance for manufacturers to develop efficient pumps for hybrid propulsion systems. Untapped markets in developing countries offer opportunities for expansion. Investing in R&D can lead to innovative fuel injection pump solutions to meet future automotive needs. The increasing global focus on fuel efficiency and reduced emissions fuels demand for fuel injection pumps as eco-friendly transportation options gain popularity. Ongoing advancements in fuel injection pump technology, such as direct injection systems and electronic control units, present opportunities for cutting-edge products. The electric vehicle market growth positively impacts the fuel injection pump industry, providing opportunities to supply components for hybrid vehicles. Emerging economies' increasing vehicle production provides an opportunity for fuel injection pump manufacturers to tap into expanding markets. Stringent emission regulations create opportunities for providing emission-compliant solutions. Continued R&D efforts drive innovations, while a robust aftermarket fuels steady revenue streams. Integration of connectivity features in fuel injection pumps enables real-time data monitoring, diagnostics, and remote updates, granting a competitive edge to smart and connected fuel injection pump solutions.

Automotive Fuel Injection Pump Market Segment Analysis:

Based on Type, The Common Rail Fuel Injection Pump dominated the Automotive Fuel Injection Pump Market with the largest market share in 2022. It is a modern and advanced type widely used in contemporary diesel engines. Common Rail Fuel Injection Pump operates by delivering fuel under high pressure, allowing precise control of fuel injection timings and quantities. Common Rail pumps offer better fuel efficiency, reduced emissions, and enhanced engine performance. Due to their superior features, they have gained significant popularity among OEMs and vehicle owners. They are commonly found in passenger cars, commercial vehicles, and off-highway vehicles. The Rotary Distributor Fuel Injection Pump is a fast-growing segment in Automotive Fuel Injection Pump Market although older in design, continues to be used in certain applications, primarily in older diesel engines. These pumps work by distributing fuel to individual engine cylinders through a rotary mechanism. While they lack the precision and efficiency of Common Rail pumps, they are still employed in specific sectors like agricultural machinery and industrial equipment.Automotive Fuel Injection Pump Market. by Type(%) In 2022

Based on Technology, The Multipoint Fuel Injection System dominated the market in 2022 and is expected to continue its dominance in the Automotive Fuel Injection Pump Market throughout the forecast period. This traditional and widely-used technology is prevalent in gasoline engines, operating by injecting fuel into the intake manifold and distributing it to each cylinder. Despite not being as advanced as Direct Injection systems, Multipoint Fuel Injection systems offer reliability, cost-effectiveness, and ease of maintenance. They find common applications in mainstream passenger cars, compact cars, and light commercial vehicles, serving a diverse range of customers. The Direct Injection System is expected to maintain a substantial market share during the forecast period. This advanced technology is prevalent in modern gasoline engines, injecting fuel directly into the combustion chamber at high pressure. This process leads to enhanced fuel combustion, resulting in improved engine performance. Direct Injection systems excel in fuel efficiency, emission reduction, and increased power output, surpassing conventional Multipoint Fuel Injection systems. High-performance vehicles, sports cars, and luxury automobiles commonly employ this technology, prioritizing engine performance and fuel economy.

Automotive Fuel Injection Pump Market, by Type(%) In 2022

Automotive Fuel Injection Pump Market Regional Insights: North America dominated the Automotive Fuel Injection Pump Market in 2022 with 37% market share. The driving force behind this growth lies in the escalating demand for fuel-efficient and eco-friendly vehicles within the United States and Canada. Stringent emission regulations in these countries have spurred the adoption of such vehicles. The rising popularity of electric vehicles is causing a notable impact on the traditional fuel injection pump market. Europe is the second largest region in Automotive Fuel Injection Pump Market exhibits substantial growth. Countries like Germany, France, and the United Kingdom are at the forefront of this expansion, seeking fuel-efficient and emissions-compliant vehicles. To meet stringent emission standards, innovative fuel injection pump technologies are being readily embraced. Asia-Pacific is a fast-growing region in the Automotive Fuel Injection Pump Market, driven by demand for fuel-efficient and eco-friendly vehicles in China, India, and Japan, amid industrialization and urbanization. As automotive production soars, disposable incomes rise, and focus intensifies on advanced fuel injection systems, manufacturers in the Asia-Pacific region are presented with remarkable growth opportunities.

Automotive Fuel Injection Pump Market Regional Insights by % (2022)

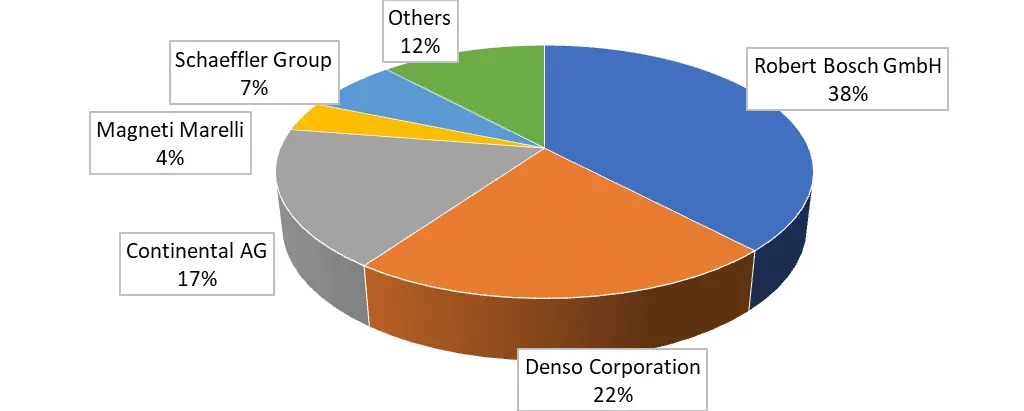

Competitive Landscape: The automotive fuel injection pump market is characterized by intense competition among key players, including industry leaders like Robert Bosch GmbH, Denso Corporation, Continental AG, and Magneti Marelli. These companies have a strong global presence, and extensive R&D capabilities, and offer a wide range of cutting-edge fuel injection pump solutions, driving advancements in technology and fuel efficiency. For instance, DENSO Corporation, a global automotive supplier, presents groundbreaking innovations in fuel injection systems. The common rail diesel fuel injection system (DCR) achieves a record-high 2,500 bar injection pressure, offering up to 3% enhanced fuel efficiency, up to 50% reduced particulate matter (PM), and up to 8% lower nitrogen oxides (NOx). Also, as a leading car provider, DENSO introduces DIETFI, an electronic fuel injection system specially designed for small motorcycles. Departing from traditional methods, DIET-FI eliminates the need for choke position sensors or engine temperature sensors. Instead, it harnesses advanced control technologies, delivering comparable efficiency and environmental performance while achieving cost reductions. This marks the world's first-of-its-kind fuel injection system. New entrants and smaller players enter the market with niche offerings, focusing on cost-effective solutions or specialized fuel injection pumps for specific applications. Partnerships, collaborations, and mergers are common strategies to enhance market position and expand product portfolios. The market's competitive landscape is also influenced by government regulations and emission standards, pushing manufacturers to develop emission-compliant fuel injection pumps.

Automotive Fuel Injection Pump Market Shares by Market Players in 2022 (%)

Automotive Fuel Injection Pump Market Scope: Inquire before buying

Automotive Fuel Injection Pump Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 19.83 Bn. Forecast Period 2023 to 2029 CAGR: 8.96% Market Size in 2029: US $ 36.16 Bn. Segments Covered: by Type Common Rail Fuel Injection Pump Rotary Distributor Fuel Injection Pump by Pressure Low Pressure Pump High Pressure Pump by Vehicle Type Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles by End-User Direct Injection System Multipoint Fuel Injection System by Engine Type Gasoline Diesel by Component Valves & Nozzles Sensors ECM Fuel Supply Pump by Sales Channel Original Equipment Manufacturer (OEM) Aftermarket Sales Automotive Fuel Injection Pump Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive Fuel Injection Pump Market Key Players

1. Arkansas Fuel Injection, Inc. 2. Bosch 3. Continental AG 4. Cummins, Inc 5. Daimler AG 6. DeatschWerks, LLC., 7. Denso Corporation 8. Hitachi Ltd 9. Infineon Technologies 10. Johnson Electric 11. Magneti Marelli 12. MAHLE GmbH 13. Mitsubishi Electric 14. Perkins Engines Company Limited 15. Robert Bosch 16. Sagar Fuel 17. Schaeffler Group 18. Shiyan QiJing Industry & Trading Co., Ltd. 19. TI Automotive INC 20. ValeoFrequently Asked Questions:

1] What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on Type, Engine Type, Component, Pressure, Sales Channel, Technology, End Users and Region. 2] Which region is expected to hold the highest share of the Global Market? Ans. The North America region is expected to hold the highest share of the Market. 3] What is the market size of the Global Market by 2029? Ans. The market size of the Market by 2029 is expected to reach USD 36.16 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2022-2029. 5] What was the market size of the Global Market in 2022? Ans. The market size of the Market in 2022 was valued at USD 19.83 Bn.

1. Automotive Fuel Injection Pump Market: Research Methodology 2. Automotive Fuel Injection Pump Market: Executive Summary 3. Automotive Fuel Injection Pump Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Automotive Fuel Injection Pump Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. Automotive Fuel Injection Pump Market: Segmentation (by Value USD and Volume Units) 5.1. Automotive Fuel Injection Pump Market, by Type (2022-2029) 5.1.1. Common Rail Fuel Injection Pump 5.1.2. Rotary Distributor Fuel Injection Pump 5.2. Automotive Fuel Injection Pump Market, by Engine Type (2022-2029) 5.2.1. Gasoline 5.2.2. Diesel 5.3. Automotive Fuel Injection Pump Market, by Component (2022-2029) 5.3.1. Valves & Nozzles 5.3.2. Sensors 5.3.3. ECM 5.3.4. Fuel Supply Pump 5.4. Automotive Fuel Injection Pump Market, by Pressure (2022-2029) 5.4.1. Low-Pressure Pump 5.4.2. High-Pressure Pump 5.5. Automotive Fuel Injection Pump Market, by Sales Channel (2022-2029) 5.5.1. Original Equipment Manufacturer (OEM) 5.5.2. Aftermarket Sales 5.6. Automotive Fuel Injection Pump Market, by Technology (2022-2029) 5.6.1. Direct Injection System 5.6.2. Multipoint Fuel Injection System 5.7. Automotive Fuel Injection Pump Market, by End User (2022-2029) 5.7.1. Passenger Cars 5.7.2. Light Commercial Vehicles 5.7.3. Heavy Commercial Vehicles 5.8. Automotive Fuel Injection Pump Market, by Region (2022-2029) 5.8.1. North America 5.8.2. Europe 5.8.3. Asia Pacific 5.8.4. Middle East and Africa 5.8.5. South America 6. North America Automotive Fuel Injection Pump Market (by Value USD and Volume Units) 6.1. North America Automotive Fuel Injection Pump Market, by Type (2022-2029) 6.1.1. Common Rail Fuel Injection Pump 6.1.2. Rotary Distributor Fuel Injection Pump 6.2. North America Automotive Fuel Injection Pump Market, by Engine Type (2022-2029) 6.2.1. Gasoline 6.2.2. Diesel 6.3. North America Automotive Fuel Injection Pump Market, by Component (2022-2029) 6.3.1. Valves & Nozzles 6.3.2. Sensors 6.3.3. ECM 6.3.4. Fuel Supply Pump 6.4. North America Automotive Fuel Injection Pump Market, by Pressure (2022-2029) 6.4.1. Low-Pressure Pump 6.4.2. High-Pressure Pump 6.5. North America Automotive Fuel Injection Pump Market, by Sales Channel (2022-2029) 6.5.1. Original Equipment Manufacturer (OEM) 6.5.2. Aftermarket Sales 6.6. North America Automotive Fuel Injection Pump Market, by Technology (2022-2029) 6.6.1. Direct Injection System 6.6.2. Multipoint Fuel Injection System 6.7. North America Automotive Fuel Injection Pump Market, by End User (2022-2029) 6.7.1. Passenger Cars 6.7.2. Light Commercial Vehicles 6.7.3. Heavy Commercial Vehicles 6.8. North America Automotive Fuel Injection Pump Market, by Country (2022-2029) 6.8.1. United States 6.8.2. Canada 6.8.3. Mexico 7. Europe Automotive Fuel Injection Pump Market (by Value USD and Volume Units) 7.1. Europe Automotive Fuel Injection Pump Market, by Type (2022-2029) 7.2. Europe Automotive Fuel Injection Pump Market, by Engine Type (2022-2029) 7.3. Europe Automotive Fuel Injection Pump Market, by Component (2022-2029) 7.4. Europe Automotive Fuel Injection Pump Market, by Pressure (2022-2029) 7.5. Europe Automotive Fuel Injection Pump Market, by Sales Channel (2022-2029) 7.6. Europe Automotive Fuel Injection Pump Market, by Technology (2022-2029) 7.7. Europe Automotive Fuel Injection Pump Market, by End User (2022-2029) 7.8. Europe Automotive Fuel Injection Pump Market, by Country (2022-2029) 7.8.1. UK 7.8.2. France 7.8.3. Germany 7.8.4. Italy 7.8.5. Spain 7.8.6. Sweden 7.8.7. Austria 7.8.8. Rest of Europe 8. Asia Pacific Automotive Fuel Injection Pump Market (by Value USD and Volume Units) 8.1. Asia Pacific Automotive Fuel Injection Pump Market, by Type (2022-2029) 8.2. Asia Pacific Automotive Fuel Injection Pump Market, by Engine Type (2022-2029) 8.3. Asia Pacific Automotive Fuel Injection Pump Market, by Component (2022-2029) 8.4. Asia Pacific Automotive Fuel Injection Pump Market, by Pressure (2022-2029) 8.5. Asia Pacific Automotive Fuel Injection Pump Market, by Sales Channel (2022-2029) 8.6. Asia Pacific Automotive Fuel Injection Pump Market, by Technology (2022-2029) 8.7. Asia Pacific Automotive Fuel Injection Pump Market, by End User (2022-2029) 8.8. Asia Pacific Automotive Fuel Injection Pump Market, by Country (2022-2029) 8.8.1. China 8.8.2. S Korea 8.8.3. Japan 8.8.4. India 8.8.5. Australia 8.8.6. Indonesia 8.8.7. Malaysia 8.8.8. Vietnam 8.8.9. Taiwan 8.8.10. Bangladesh 8.8.11. Pakistan 8.8.12. Rest of Asia Pacific 9. Middle East and Africa Automotive Fuel Injection Pump Market (by Value USD and Volume Units) 9.1. Middle East and Africa Automotive Fuel Injection Pump Market, by Type (2022-2029) 9.2. Middle East and Africa Automotive Fuel Injection Pump Market, by Engine Type (2022-2029) 9.3. Middle East and Africa Automotive Fuel Injection Pump Market, by Component (2022-2029) 9.4. Middle East and Africa Automotive Fuel Injection Pump Market, by Pressure (2022-2029) 9.5. Middle East and Africa Automotive Fuel Injection Pump Market, by Sales Channel (2022-2029) 9.6. Middle East and Africa Automotive Fuel Injection Pump Market, by Technology (2022-2029) 9.7. Middle East and Africa Automotive Fuel Injection Pump Market, by End User (2022-2029) 9.8. Middle East and Africa Automotive Fuel Injection Pump Market, by Country (2022-2029) 9.8.1. South Africa 9.8.2. GCC 9.8.3. Egypt 9.8.4. Nigeria 9.8.5. Rest of ME&A 10. South America Automotive Fuel Injection Pump Market (by Value USD and Volume Units) 10.1. South America Automotive Fuel Injection Pump Market, by Type (2022-2029) 10.2. South America Automotive Fuel Injection Pump Market, by Engine Type (2022-2029) 10.3. South America Automotive Fuel Injection Pump Market, by Component (2022-2029) 10.4. South America Automotive Fuel Injection Pump Market, by Pressure (2022-2029) 10.5. South America Automotive Fuel Injection Pump Market, by Sales Channel (2022-2029) 10.6. South America Automotive Fuel Injection Pump Market, by Technology (2022-2029) 10.7. South America Automotive Fuel Injection Pump Market, by End User (2022-2029) 10.8. South America Automotive Fuel Injection Pump Market, by Country (2022-2029) 10.8.1. Brazil 10.8.2. Argentina 10.8.3. Rest of South America 11. Company Profile: Key players 11.1. Arkansas Fuel Injection, Inc. 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Bosch 11.3. Continental AG 11.4. Cummins, Inc 11.5. Daimler AG 11.6. DeatschWerks, LLC., 11.7. Delphi Automotive 11.8. Denso Corporation 11.9. Hitachi Ltd 11.10. Infineon Technologies 11.11. Johnson Electric 11.12. Magneti Marelli 11.13. MAHLE GmbH 11.14. Mitsubishi Electric 11.15. Perkins Engines Company Limited 11.16. Robert Bosch 11.17. Sagar Fuel 11.18. Schaeffler Group 11.19. Shiyan QiJing Industry & Trading Co., Ltd. 11.20. TI Automotive INC 11.21. Valeo 12. Key Findings 13. Industry Recommendation