The Australia Electric Car Market size was valued at USD 322.82 Million in 2023 and the total Australia Electric Car revenue is expected to grow at a CAGR of 5.56 % from 2024 to 2030, reaching nearly USD 471.47 Million by 2030.Australia Electric Car Market Overview

Electric cars, or EVs, are vehicles powered by electric motors fueled by rechargeable batteries, producing zero tailpipe emissions and contributing to reduced reliance on fossil fuels for transportation. The Australia Electric Car market is experiencing a transformative shift, embracing sustainable transportation. The Australia electric car market has been steadily growing, albeit at a slower pace compared to some other developed nations. Electric cars, also known as electric vehicles (EVs), are automobiles powered by one or more electric motors using energy stored in rechargeable batteries. As of the current scenario, Australia's electric car market share remains relatively small, accounting for less than 1% of total vehicle sales, primarily due to factors such as limited government incentives, high upfront costs, and inadequate charging infrastructure. The growing environmental consciousness among consumers, coupled with advancements in EV technology, declining battery costs, and a broader variety of models being made available by manufacturers, are gradually stimulating interest and demand for electric vehicles in Australia. Recent developments within the Australia Electric Car Market have seen key players making significant strides. Companies such as Tesla, Nissan, Hyundai, and Mitsubishi have introduced various electric car models, showcasing improved range, performance, and features to attract Australian consumers. The Australian government's initiatives, such as proposed incentives and investments in charging infrastructure expansion across major cities and highways, are poised to further encourage EV uptake in the country. Despite these advancements, challenges persist, including the need for more aggressive policy support, increased public awareness campaigns, infrastructure development, and ongoing collaboration between the government, automobile industry, and energy sector to accelerate the adoption of electric vehicles and steer Australia towards a more sustainable transportation future.To know about the Research Methodology :- Request Free Sample Report

Australia Electric Car Market Dynamics:

Escalating Fuel Costs Motivate Consumers to opt for EVs Is Driving Australia Electric Car Market Growth In Australia, government initiatives stand as a significant driver boosting the Australia electric car market growth. Various states are rolling out ambitious plans and incentives to encourage EV adoption. For instance, New South Wales implemented a USD 490 million package offering rebates of up to USD 4,000 for EV purchases and exempting electric cars from stamp duty, enticing consumers to make the switch. Another key growth driver in Australia's electric car market is infrastructure expansion. Companies such as Chargefox are investing in expanding the charging network across the country, aiming to install 500 fast-charging stations by 2025. This infrastructure development addresses one of the key concerns for potential EV buyers: range anxiety. Norway, a global leader in EV adoption, experienced a similar surge due in part to its extensive charging infrastructure, making it convenient for users to charge their vehicles anywhere. Australia's efforts to replicate this infrastructure success could significantly boost consumer confidence and facilitate wider EV adoption across the nation.Limited Availability and Variety of EV Models in Australian Markets Hinder the Market Growth The high upfront cost of electric vehicles hindering the market growth of Australia Electric Car Market. Models such as the Tesla Model 3, though offering long-term savings on fuel and maintenance, pose a substantial initial investment for consumers compared to traditional combustion engine cars. This financial barrier mirrors challenges witnessed globally, where the relatively higher cost of entry for EVs deters many potential buyers, despite the promise of cost savings in the long run. The limited availability of affordable EV models in Australia adds to the challenge. With fewer options in the mid-range price segment, consumers' choices are restricted, hindering mass adoption. This scarcity echoes challenges faced in numerous markets worldwide, where a lack of diverse and reasonably priced EVs impedes their wider acceptance. In addition to financial constraints, Australia grapples with issues concerning charging infrastructure. Despite ongoing initiatives, gaps in the charging network persist, leading to range anxiety among EV owners. This anxiety, akin to challenges in developing EV markets globally, remains a significant deterrent for potential buyers who fear being stranded without adequate charging options. Concerns about the limited driving range of certain EV models compared to conventional vehicles add to the market's challenges. While some EVs offer ranges around 200-250 miles on a single charge, this falls short of the distances covered by many traditional cars, influencing consumers' decisions. These challenges collectively underscore the need for comprehensive solutions and strategic interventions to overcome barriers to widespread EV adoption in Australia.

Australia Electric Car Market Segment Analysis:

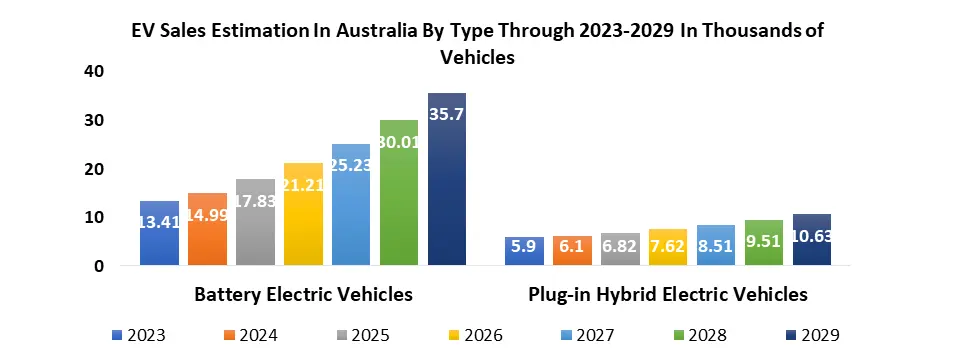

Based on Type, Battery Electric Vehicles (BEVs) dominated the Australia Electric Car market in 2023 as electric batteries, are gaining traction primarily in urban settings due to their zero-emission nature, appealing to environmentally conscious consumers and governmental initiatives promoting clean transportation. Plug-in Hybrid Electric Vehicles (PHEVs) is fast growing segment in Australia Electric Car market, offering both electric and internal combustion engine power, find favour among consumers seeking a balance between electric range and the convenience of a backup combustion engine, suitable for longer drives and regions with inadequate charging infrastructure. HEVs, operating on both electric and internal combustion engines but not requiring external charging, maintain popularity among consumers transitioning to electric mobility, especially in areas where charging infrastructure remains limited, serving as an intermediary step towards full electrification. BEVs dominate urban landscapes, PHEVs find application in mixed-use scenarios, and HEVs serve as a transitional option in regions with evolving charging infrastructure, reflecting diverse adoption patterns based on application suitability and regional infrastructure readiness.

Australia Electric Car Market Regional Insights:

Sydney Dominance in the Australia Electric Car Market The landscape of Australia electric car market unveils significant regional disparities in both adoption rates and infrastructure advancement. Urban hubs such as Sydney, Melbourne, and Brisbane stand out for their remarkable embrace of electric vehicles, attributed to robust infrastructure, heightened public awareness, and proactive governmental policies. These metropolises showcase extensive charging networks, providing a sense of convenience to EV owners while alleviating concerns about limited range. The denser populations in these urban centers afford increased exposure to and accessibility of diverse EV models, cultivating an environment that actively nurtures higher adoption rates. States such as New South Wales and Victoria, with their EV-friendly policies and initiatives such as rebates and subsidies, experience relatively higher EV adoption rates compared to regions with less robust government support. Lack of uniformity in policies across different states poses challenges, contributing to disparities in adoption rates between regions.

VIC ACT SA NSW TAS QLD NT WA Total number of charging stations 216 20 76 161 21 162 5 122 Charging stations per 100,000 residents 3.4 3.17 4.4 2.04 4.02 3.27 2.03 4.72 Total AC 208 17 70 148 21 138 5 107 DC 8 3 6 13 0 24 0 15 Total Capital City 114 20 32 86 4 58 3 77 Regional 102 0 44 75 17 104 2 45 Australia Electric Car Market Scope: Inquire before buying

Australia Electric Car Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 322.82 Mn. Forecast Period 2024 to 2030 CAGR: 5.56% Market Size in 2030: US $ 471.47 Mn. Segments Covered: By Type BEV PHEV HEV By Product Hatchback Sedan SUV Others By Battery LFP Li-NMC Others By Battery Capacity >201 Ah <201 Ah By End-User Shared mobility providers Government organizations Personal users Others Australia Electric Car Market Key Players:

1. Tesla ,Palo Alto, California, USA. 2. Nissan ,Yokohama, Japan. 3. BMW ,Munich, Germany. 4. Chevrolet ,Detroit, Michigan, USA. 5. Audi ,Ingolstadt, Germany. 6. Hyundai ,Seoul, South Korea. 7. Kia ,Seoul, South Korea. 8. Jaguar ,Coventry, UK. 9. Mercedes-Benz ,Stuttgart, Germany. 10. Ford ,Dearborn, Michigan, USA. 11. Renault ,Boulogne-Billancourt, France. 12. Volkswagen ,Wolfsburg, Germany. 13. Porsche ,Stuttgart, Germany. 14. Volvo ,Gothenburg, Sweden. 15. Mitsubishi ,Tokyo, Japan. 16. Rivian ,Irvine, California, USA. 17. Lucid Motors ,Newark, California, USA.FAQs:

1] What segments are covered in the Australia Electric Car Market report? Ans. The segments covered in the market report are based on Type, Product, Battery, Battery Capacity, End-User and Region. 2] Which region is expected to hold the highest share in the Australia Electric Car Market? Ans. Sydney region is expected to hold the highest share in the market. 3] What is the market size of the Australia Electric Car Market by 2030? Ans. The market size of the market by 2030 is expected to reach US$ 471.47 Mn. 4] What is the forecast period for the Australia Electric Car Market? Ans. The forecast period for the market is 2024-2030. 5] What was the market size of the Australia Electric Car Market in 2023? Ans. The market size of the market in 2023 was valued at US$ 322.82 Mn.

1. Australia Electric Car Market: Research Methodology 2. Australia Electric Car Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Australia Electric Car Market: Dynamics 3.1. Australia Electric Car Market Trends 3.2. Australia Electric Car Market Drivers 3.3. Australia Electric Car Market Restraints 3.4. Australia Electric Car Market Opportunities 3.5. Australia Electric Car Market Challenges 3.6. PORTER’s Five Forces Analysis 3.7. PESTLE Analysis 3.8. Technological Roadmap 3.9. Regulatory Landscape 3.10. Key Opinion Leader Analysis for Australia Electric Car End User 3.11. Analysis of Government Schemes and Initiatives for Australia Electric Car End User 3.12. The Covid 19 Pandemic Impact on Australia Electric Car Market 4. Australia Electric Car Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Australia Electric Car Market Size and Forecast, by Type (2023-2030) 4.1.1. BEV 4.1.2. PHEV 4.1.3. HEV 4.2. Australia Electric Car Market Size and Forecast, by Product (2023-2030) 4.2.1. Hatchback 4.2.2. Sedan 4.2.3. SUV 4.2.4. Others 4.3. Australia Electric Car Market Size and Forecast, by Battery (2023-2030) 4.3.1. LFP 4.3.2. Li-NMC 4.3.3. Others 4.4. Australia Electric Car Market Size and Forecast, by Battery Capacity (2023-2030) 4.4.1. >201 Ah 4.4.2. <201 Ah 4.5. Australia Electric Car Market Size and Forecast, by End-User (2023-2030) 4.5.1. Shared mobility providers 4.5.2. Government organizations 4.5.3. Personal users 4.5.4. Others 5. Australia Electric Car Market: Competitive Landscape 5.1. MMR Competition Matrix 5.2. Competitive Landscape 5.3. Key Players Benchmarking 5.3.1. Company Name 5.3.2. Service Segment 5.3.3. End-user Segment 5.3.4. Revenue (2023) 5.3.5. Company Locations 5.4. Leading Australia Electric Car Market Companies, by Market Capitalization 5.5. Market Structure 5.5.1. Market Leaders 5.5.2. Market Followers 5.5.3. Emerging Players 5.6. Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1. Tesla ,Palo Alto, California, USA. 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Scale of Operation (Small, Medium, and Large) 6.1.7. Details on Partnership 6.1.8. Regulatory Accreditations and Certifications Received by Them 6.1.9. Awards Received by the Firm 6.1.10. Recent Developments 6.2. Nissan ,Yokohama, Japan. 6.3. BMW ,Munich, Germany. 6.4. Chevrolet ,Detroit, Michigan, USA. 6.5. Audi ,Ingolstadt, Germany. 6.6. Hyundai ,Seoul, South Korea. 6.7. Kia ,Seoul, South Korea. 6.8. Jaguar ,Coventry, UK. 6.9. Mercedes-Benz ,Stuttgart, Germany. 6.10. Ford ,Dearborn, Michigan, USA. 6.11. Renault ,Boulogne-Billancourt, France. 6.12. Volkswagen ,Wolfsburg, Germany. 6.13. Porsche ,Stuttgart, Germany. 6.14. Volvo ,Gothenburg, Sweden. 6.15. Mitsubishi ,Tokyo, Japan. 6.16. Rivian ,Irvine, California, USA. 6.17. Lucid Motors ,Newark, California, USA. 7. Key Findings 8. End User Recommendations