The Astronaut Space Suits Market size was valued at USD 1005.08 Million in 2024, and the total revenue is expected to grow at CAGR of 6.4 % from 2025 to 2032, reaching nearly USD 1650.95 Million. The Astronaut Space Suit Market Report provides an extensive and structured analysis covering all critical dimensions of the industry, including market evolution, engineering materials, suit specifications for ISS, lunar, Mars, and commercial missions, and detailed comparisons between IVA and EVA suits. It further examines space tourism suit requirements, pricing and procurement models, life-support technologies, next-generation engineering innovations, and global testing and certification standards. The report also assesses manufacturing ecosystems, supply chain risks, end-user procurement behaviors, maintenance and lifecycle management, sustainability metrics, and region-specific regulatory frameworks. these sections deliver a complete and data-driven understanding of current trends, technological advancements, and future developments across the astronaut space suit ecosystem. A spacesuit is a protective garment worn by astronauts in space to shield them from the harsh environment. Space radiation is hazardous to the human body and can cause hypothermia and heat strokes. It shields astronauts from the sun's UV radiation while also maintaining the ideal air pressure and atmosphere for breathing. During the forecast period, the astronaut spacesuit market is expected to grow rapidly due to an increase in space exploration missions and increased awareness of space programmes.To know about the Research Methodology :- Request Free Sample Report Increasing investments in deep space human exploration initiatives by countries such as US, China, India, and Russia are expected to boost demand for space suits through the forecast period. The market is expected to grow rapidly in the next years as new and upgraded spacesuits with advanced materials for low weight and increased mobility are developed. The Global Astronaut Space Suits Market is segmented by type, design and application. Based on type, the market is segmented into IVA Suits and EVA Suits. Based on design, the market is segmented into Soft-suit, Hard-shell suit, Skin-tight suit and Hybrid suit. Based on application, the market is segmented into Intravehicular Activity (IVA) and Extravehicular Activity (EVA). Based on region, the market is segmented into North America, Asia Pacific, Europe, Middle East & Africa, and South America. In the report, 2021 is considered as a base year to forecast the market from 2022 to 2027. 2021’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years' trends are considered while forecasting the market through 2027.

Astronaut Space Suits Market Dynamics

The need for a spacesuit is driven by the growing trend of commercial space flight, the development of multifunctional spacesuits, and wearable technologies. Furthermore, as the pace of space exploration missions picks up, so does the manufacture and demand for spacesuits for extravehicular activities, requiring more regional and international enterprises to participate. Several governments are increasing their investments in human space exploration initiatives in deep space. Additionally, the incorporation of technology for the construction of new-generation spacesuits with advanced materials for reduced weight and better mobility is propelling the global astronaut spacesuit market, which is expected to produce substantial demand over the forecast period. Rapid Increase in Extravehicular Activities Extravehicular activities on the space station are often activities for planetary exploration, such as spacewalks, satellite repair, and other exterior operations. Environmental protection, movement, communications, and life support are all provided by the extravehicular mobility unit (EMU) suits. Many countries are expanding their space programmes around the world. Furthermore, space research organisations like NASA have begun to launch several missions to the moon, Mars, and other planets. EVA suits are necessary for various extravehicular activities. Moreover, continual developments in astronaut spacesuits are expected to drive the global astronaut spacesuit market growth through the forecast period. Growing Importance of New Products, Applications and Services Companies are readily entering the market and providing a variety of on-demand services. As a result, the opportunities for new applications, products, and services are expanding. Many private actors, for example, are presently offering internet-based space exploration to the general public. The decreasing cost of building and launching satellites has led in an increase in forthcoming launches for earth observation, surveillance, and communication purposes by both military and corporate enterprises around the world. Moreover, compared to the relatively restricted sources in the 1990s, financing for private spaceflight has risen in recent years from a bigger pool of sources. With a 100-fold increase since 1980, some investors believe the traditional spaceflight sector is poised for competition. A total of USD 1.8 billion was invested in private spaceflight businesses by venture capital firms, which was more than they had invested in the preceding 15 years. Lux Capital, Bessemer Venture Partners, Khosla, Founders Fund, RRE Ventures, and Draper Fisher Jurvetson were the largest and most active investors in space. These factors are driving the astronaut space suit market. Substantial Growth in Investment for Space Exploration Missions Countries all across the world are investing more on space exploration projects. Because of a rise in space exploration missions and projects, the Asia-Pacific and European regions are expected to drive global market growth. Moreover, the next generation space suits are lighter and more mobile, providing astronauts with greater comfort and safety. Also, space projects indicate a country's strength in the aeronautics sector, resulting in an increase in investment and chances for leading market participants to increase output. Wearables, a urine collection transfer assembly, a pharmaceutical support assembly, and an air pressure control helmet make up these spacesuits. The spacesuits also protect astronauts from the harsh conditions of space, such as micrometeorites and rapid temperature changes.Astronaut Space Suits Market Segment Analysis

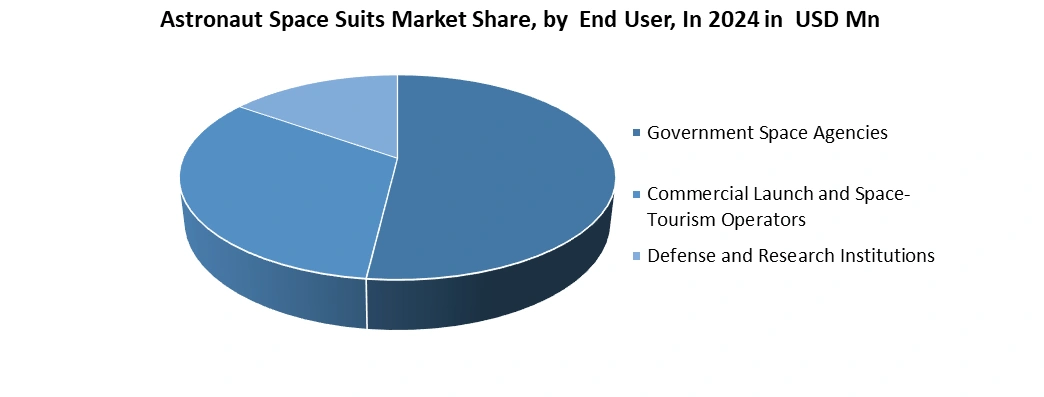

Based on the Suit Type, In 2024, EVA suits is expected to dominate the global Astronaut Space Suits Market due to the rising number of spacewalks, ISS maintenance operations, and growing commercial missions. IVA suits rank as the second-dominant segment, supported by continuous demand for crew transport, pre-launch operations, and commercial capsules from NASA, SpaceX, and emerging private operators. Planetary surface suits (xEMU/AxEMU) remain the fastest-growing category, propelled by Artemis lunar missions and future Mars exploration requiring advanced mobility, dust mitigation, and next-gen life-support systems. Overall, increasing mission complexity, private astronaut programs, and renewed lunar ambitions are reshaping suit engineering and boosting adoption across all suit types. Based on the End User, In 2024, government space agencies are expected to dominate the global Astronaut Space Suits Market, driven by large-scale programs such as NASA’s Artemis, ESA’s exploration missions, CNSA and Roscosmos operations, and ISS-based EVA activities that require continuous suit upgrades, testing, and certification. Commercial launch and space-tourism operators form the second-largest segment, expanding rapidly as SpaceX, Blue Origin, and Axiom Space increase crewed flights and private astronaut missions, boosting demand for customized IVA and training suits. Defense and Research Institutions hold a steady but smaller share, supported by R&D in extreme-environment technologies, life-support systems, material science, and analog mission simulations. Together, these end users drive innovation in mobility, safety, modularity, and planetary surface readiness, shaping next-generation suit development.

Astronaut Space Suits Market Regional Insights

Asia Pacific region is estimated to dominate the Astronaut Space Suits market through the forecast period. The Astronaut Space Suits market in Asia-Pacific region is expected to grow at the highest rate during the forecast period. Human space exploration plans are moving forward in Asia-Pacific countries including China, Japan, and India, among others, with plans to send humans to Mars for planetary explortion in the coming years. China intends to build and operate a space station in low earth orbit (LEO) as part of its human space exploration programme. The nation intends to complete building the space station by 2024. The China National Space Administration has announced that human exploration of the moon will begin in the 2030s. The Indian Space Research Organisation (ISRO) has announced that four astronauts would be sent to the International Space Station (ISS) in 2022. ISRO created a new spacesuit for the astronauts (prototype presented in September 2018) with one oxygen cylinder carrying capacity for this mission. In the coming years, such space exploration missions are expected to increase demand for IVA and EVA suits. In February 1970, Japan launched its first satellite, Osumi, into orbit, becoming the fourth country after the Soviet Union, the United States, and France to do so. It now has a satellite fleet that includes communications, meteorological, earth observation, and astronomical observation satellites.Increased space investment in North America is expected to boost the demand for astronaut space suits. The United States is expected to be North America's most crucial and major contributing market. The expansion of the Astronaut Space Suits market in the United States is largely due to NASA. One of the primary factors driving the astronaut space suit market is the increase in the number of satellite launches and launch vehicles. Another key element driving the market in the North American area is increased expenditure on space exploration initiatives. European area is expected to contribute significantly to the growth of the Astronaut Space Suits market. In comparison to other European countries, Russia Federation dominates the Europe area, launching the majority of space satellites and spaceships. The origins of the Russian space programme can be traced back to 1957, when the Soviet Union launched Sputnik 1, the world's first artificial satellite. The country today has the world's third-largest spacecraft fleet, which includes communications, meteorological, and reconnaissance satellites. The United Kingdom, France, Germany, and Luxembourg are among the few European countries that have contributed significantly to the growth of the global Astronaut Space Suits market. Middle East & Africa and South America is estimated to grow at a steady rate and hold a significant share of the Astronaut Space Suits market during the forecast period. The global astronaut space suit market is consolidated, with only a few vendors and consumers, with the National Aeronautics and Space Administration (NASA) serving as the dominant end user. Thus, established suppliers prevent new entrants from entering the niche market. New spacesuits for astronauts are being developed by space organisations and industrial businesses, with superior materials, improved communications systems, and more mobility. In future, the corporations are expected to expand their global footprint as the demand for human space exploration missions increases. The objective of the report is to present a comprehensive analysis of the global Astronaut Space Suits Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Astronaut Space Suits Market dynamic, structure by analyzing the market segments and projecting the Astronaut Space Suits Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Astronaut Space Suits Market make the report investor’s guide.

Astronaut Space Suits Market Scope: Inquiry Before Buying

Global Astronaut Space Suits Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1005.08 Mn. Forecast Period 2025 to 2032 CAGR: 6.4% Market Size in 2032: USD 1650.95 Mn. Segments Covered: by Suit Type IVA Suits EVA Suits Planetary Surface Suits (xEMU / AxEMU) by Material Technology Soft Suit Hard Shell Hybrid/Mechanical Counter-Pressure (MCP) by Weight Up to 50 kg 50 to 100 kg Above 100 kg by Life Support Architecture Backpack PLSS Distributed-system PLSS Suitport-Integrated Systems by Application Space Exploration Space Tourism Scientific Research Training and Simulation by End User Government Space Agencies Commercial Launch and Space-Tourism Operators Defense and Research Institutions Astronaut Space Suits Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Key Players of Astronaut Space Suits Market

1. SpaceX 2. NASA 3. Axiom Space, Inc. 4. ILC Dover LP 5. Collins Aerospace 6. David Clark Company 7. Oceaneering International, Inc. 8. Paragon Space Development Corporation 9. Final Frontier Design 10. NPP Zvezda (Russia) 11. Pacific Spaceflight 12. Sure Safety (India) Ltd. 13. The Boeing Company 14. Blue Origin Enterprises, L.P. 15. Vinyl Technology Inc. 16. Austrian Space Forum (OeWF) 17. Sierra Nevada Corporation 18. JAXA 19. Roscosmos / RSC Energia (Russia) 20. China National Space Administration (CNSA) 21. European Space Agency (ESA) 22. OthersFrequently Asked Questions:

1] What segments are covered in the Astronaut Space Suits Market report? Ans. The segments covered in the Astronaut Space Suits Market report are based on Suit Type, Material Technology, Weight, Life Support Architecture, Application, End User and region 2] Which region is expected to hold the highest share of the Astronaut Space Suits Market? Ans. The North America region is expected to hold the highest share of the Astronaut Space Suits Market. 3] What is the market size of the Astronaut Space Suits Market by 2032? Ans. The market size of the Astronaut Space Suits Market by 2032 is USD 1650.95 Mn. 4] What is the growth rate of the Astronaut Space Suits Market? Ans. The Global Astronaut Space Suits Market is growing at a CAGR of 6.4 % during the forecasting period 2025-2032. 5] What was the market size of the Astronaut Space Suits Market in 2024? Ans. The market size of the Astronaut Space Suits Market in 2024 was USD 1005.08 Mn.

1. Astronaut Space Suits Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Million) - By Segments, Regions, and Country 2. Astronaut Space Suits Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. Market Share (%) 2.3.5. Revenue, (2024) 2.3.6. R&D Investment (%) 2.3.7. Profit Margin (%) 2.3.8. Certifications 2.3.9. Technological Maturity 2.3.10. Patents 2.3.11. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Astronaut Space Suits Market: Dynamics 3.1. Astronaut Space Suits Market Trends 3.2. Astronaut Space Suits Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Astronaut Space Suits Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Astronaut Space Suit Market Overview 4.1.1. Evolution Of Space Suits Over Time 4.1.2. Space Suit Requirements For Different Missions 4.1.3. ISS, Lunar, Mars & Commercial Mission Suit Specifications 4.1.4. Differences Between IVA & EVA Suits 4.1.5. Suit Manufacturing Ecosystem & Value Chain 5. Space Suit Engineering & Materials Analysis 5.1.1. Advanced Fabrics (Kevlar, Nomex, Vectran) 5.1.2. Layered Protection Systems & Pressure Bladders 5.1.3. Radiation Shielding Materials & Innovations 5.1.4. Liquid Cooling & Ventilation Garments 5.1.5. Helmet & Visor Innovation (HUD, Anti-Fog Coatings) 5.1.6. Flexible Joint Mobility & Bearings 5.1.7. Next-Gen Polymer & Nanomaterial Applications 6. Space Tourism Suit Demand Analysis 6.1.1. Commercial Spaceflight Suit Specifications 6.1.2. Comfort-Focused vs Mission-Focused Designs 6.1.3. Safety Requirements For Civilian Passengers 6.1.4. Custom Branding & Commercial Suit Aesthetics 6.1.5. Market Potential In Suborbital & Orbital Tourism 6.1.6. Suit Rental vs Ownership Models 7. Pricing, Procurement & Cost Structure Assessment 7.1.1. Prices Of Astronaut Space Suits By Suit Type (2019–2024) 7.1.2. Government Procurement Models And Contracting Frameworks 7.1.3. Cost Structure Breakdown Of Suit Manufacturing 7.1.4. Supply Chain Dependencies And Vendor Margin Analysis 7.1.5. Impact Of R&D, Certification, And Testing On Suit Pricing 7.1.6. Economies Of Scale And Modularization Opportunities 7.1.7. Budget Allocation Trends Among Government And Commercial Operators 8. Space Suit Life Support & Safety Systems 8.1.1. PLSS Architecture & Cooling Loop 8.1.2. CO₂ Scrubbing Technologies 8.1.3. Oxygen Supply & Pressure Regulation 8.1.4. Medical Monitoring & Bio-Sensing Layers 8.1.5. Dust Mitigation Systems For Planetary Suits 8.1.6. Emergency Redundancy & Fail-Safe Mechanisms 8.1.7. Mobility Enhancements For Lunar & Martian Terrain 9. Technology & Engineering Advancement Analysis 9.1.1. Evolution Of Pressure Suit Engineering And Next-Generation Materials 9.1.2. Advancements In Mobility Joints, Bearings, And Life-Support Integration 9.1.3. Engineering Breakthroughs In Soft, Hard-Shell, And MCP Suit Architectures 9.1.4. Thermal Regulation, Radiation Shielding, And Micrometeoroid Protection Innovations 9.1.5. Sensor Integration, Biomonitoring Technologies, And Real-Time Telemetry Systems 9.1.6. Miniaturization Trends In Electronics And Avionics Embedded In Suits 9.1.7. Testing Protocols, Qualification Standards, And Reliability Assessments For Manned Missions 10. Space Suit Testing, Certification & Simulation 10.1.1. Vacuum Chamber Testing 10.1.2. Thermal & Radiation Exposure Testing 10.1.3. Mobility & Fatigue Testing 10.1.4. Pressure Testing & Leak Detection 10.1.5. Neutral Buoyancy Lab (NBL) Training 10.1.6. Environmental Chamber Simulations (Mars, Moon Conditions) 10.1.7. Regulatory Certification Processes (NASA, ESA, CNSA) 11. Supply Chain & Manufacturing Analysis 11.1.1. Raw Material Procurement (High-Strength Fabrics, Electronics) 11.1.2. Global Manufacturing Hubs & Capacity 11.1.3. Production Lead Time & Customization Requirements 11.1.4. Coordination Between OEMs & Space Agencies 11.1.5. Supply Chain Risks & Quality Control 11.1.6. Import/Export Dependencies & Constraints 11.1.7. Outsourcing vs In-House Manufacturing Models 12. End-User Behavior & Procurement Trends 12.1.1. Government vs Private Procurement Strategies 12.1.2. Long-Term Suit Contracts & Maintenance 12.1.3. Budget Cycles & Funding Patterns 12.1.4. Custom vs Standardized Suit Preferences 12.1.5. Outsourcing vs In-House Suit Development 12.1.6. Influence Of Mission Type On Suit Specification 13. Space Suit Logistics, Maintenance & Lifecycle Management 13.1.1. Suit Storage & Transport Requirements 13.1.2. Maintenance Schedules & Wear/Degradation 13.1.3. On-Station Repair & Replacement Modules 13.1.4. Spare Part Logistics 13.1.5. Suit Longevity Optimization 13.1.6. Training Suits vs Operational Suits Lifecycle 14. Sustainability, Durability & Lifecycle Impact 14.1.1. Durability Benchmarks For High-Stress, Long-Duration Missions 14.1.2. Reusability Trends, Refurbishment Cycles, And Waste Reduction Strategies 14.1.3. Environmental Impact Of Suit Manufacturing And Material Sourcing 14.1.4. Energy Consumption And Carbon Intensity In Production Processes 14.1.5. Circularity Potential In Composite Recycling And Fabric Reclamation 14.1.6. Radiation-Proofing Longevity And Degradation Modeling 14.1.7. Life-Cycle Performance Metrics Across Mission Types 15. Safety, Standards & Regulatory Framework By Region 15.1.1. EVA/IVA Safety Performance Metrics And Failure-Mode Assessments 15.1.2. NASA, ESA, And International Safety Certification Requirements 15.1.3. Pressure Integrity, Life-Support Reliability, And Environmental Testing Standards 15.1.4. Compliance With Planetary Protection And Contamination Control Rules 15.1.5. Regulatory Mandates For Commercial Spaceflight Operator Suits 15.1.6. Data Protection And Cybersecurity Requirements For Telemetry-Integrated Suits 15.1.7. Legal And Liability Considerations For Private Astronaut Missions 16. Astronaut Space Suits Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 16.1. Astronaut Space Suits Market Size and Forecast, By Suit Type (2024-2032) 16.1.1. IVA Suits 16.1.2. EVA Suits 16.1.3. Planetary Surface Suits (xEMU / AxEMU) 16.2. Astronaut Space Suits Market Size and Forecast, By Material Technology (2024-2032) 16.2.1. Soft Suit 16.2.2. Hard Shell 16.2.3. Hybrid/Mechanical Counter-Pressure (MCP) 16.3. Astronaut Space Suits Market Size and Forecast, By Weight (2024-2032) 16.3.1. Up to 50 kg 16.3.2. 50 to 100 kg 16.3.3. Above 100 kg 16.4. Astronaut Space Suits Market Size and Forecast, By Life Support Architecture (2024-2032) 16.4.1. Backpack PLSS 16.4.2. Distributed-system PLSS 16.4.3. Suitport-Integrated Systems 16.5. Astronaut Space Suits Market Size and Forecast, By Application (2024-2032) 16.5.1. Space Exploration 16.5.2. Space Tourism 16.5.3. Scientific Research 16.5.4. Training and Simulation 16.6. OthersAstronaut Space Suits Market Size and Forecast, By End User (2024-2032) 16.6.1. Government Space Agencies 16.6.2. Commercial Launch and Space-Tourism Operators 16.6.3. Defense and Research Institutions 16.7. Astronaut Space Suits Market Size and Forecast, By Region (2024-2032) 16.7.1. North America 16.7.2. Europe 16.7.3. Asia Pacific 16.7.4. Middle East and Africa 16.7.5. South America 17. North America Astronaut Space Suits Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 17.1. North America Astronaut Space Suits Market Size and Forecast, By Suit Type (2024-2032) 17.1.1. IVA Suits 17.1.2. EVA Suits 17.1.3. Planetary Surface Suits (xEMU / AxEMU) 17.2. North America Astronaut Space Suits Market Size and Forecast, By Material Technology (2024-2032) 17.2.1. Soft Suit 17.2.2. Hard Shell 17.2.3. Hybrid/Mechanical Counter-Pressure (MCP) 17.3. North America Astronaut Space Suits Market Size and Forecast, By Weight (2024-2032) 17.3.1. Up to 50 kg 17.3.2. 50 to 100 kg 17.3.3. Above 100 kg 17.4. North America Astronaut Space Suits Market Size and Forecast, By Life Support Architecture (2024-2032) 17.4.1. Backpack PLSS 17.4.2. Distributed-system PLSS 17.4.3. Suitport-Integrated Systems 17.5. North America Astronaut Space Suits Market Size and Forecast, By Application (2024-2032) 17.5.1. Space Exploration 17.5.2. Space Tourism 17.5.3. Scientific Research 17.5.4. Training and Simulation 17.6. North America Astronaut Space Suits Market Size and Forecast, By End User (2024-2032) 17.6.1. Government Space Agencies 17.6.2. Commercial Launch and Space-Tourism Operators 17.6.3. Defense and Research Institutions 17.7. North America Astronaut Space Suits Market Size and Forecast, by Country (2024-2032) 17.7.1. United States 17.7.1.1. United States Astronaut Space Suits Market Size and Forecast, By Suit Type (2024-2032) 17.7.1.1.1. IVA Suits 17.7.1.1.2. EVA Suits 17.7.1.1.3. Planetary Surface Suits (xEMU / AxEMU) 17.7.1.2. United States Astronaut Space Suits Market Size and Forecast, By Material Technology (2024-2032) 17.7.1.2.1. Soft Suit 17.7.1.2.2. Hard Shell 17.7.1.2.3. Hybrid/Mechanical Counter-Pressure (MCP) 17.7.1.3. United States Astronaut Space Suits Market Size and Forecast, By Weight (2024-2032) 17.7.1.3.1. Up to 50 kg 17.7.1.3.2. 50 to 100 kg 17.7.1.3.3. Above 100 kg 17.7.1.4. United States Astronaut Space Suits Market Size and Forecast, By Life Support Architecture (2024-2032) 17.7.1.4.1. Backpack PLSS 17.7.1.4.2. Distributed-system PLSS 17.7.1.4.3. Suitport-Integrated Systems 17.7.1.5. United States Astronaut Space Suits Market Size and Forecast, By Application (2024-2032) 17.7.1.5.1. Space Exploration 17.7.1.5.2. Space Tourism 17.7.1.5.3. Scientific Research 17.7.1.5.4. Training and Simulation 17.7.1.6. United States Astronaut Space Suits Market Size and Forecast, By End User (2024-2032) 17.7.1.6.1. Government Space Agencies 17.7.1.6.2. Commercial Launch and Space-Tourism Operators 17.7.1.6.3. Defense and Research Institutions 17.7.2. Canada 17.7.2.1. Canada Astronaut Space Suits Market Size and Forecast, By Suit Type (2024-2032) 17.7.2.1.1. IVA Suits 17.7.2.1.2. EVA Suits 17.7.2.1.3. Planetary Surface Suits (xEMU / AxEMU) 17.7.2.2. Canada Astronaut Space Suits Market Size and Forecast, By Material Technology (2024-2032) 17.7.2.2.1. Soft Suit 17.7.2.2.2. Hard Shell 17.7.2.2.3. Hybrid/Mechanical Counter-Pressure (MCP) 17.7.2.3. Canada Astronaut Space Suits Market Size and Forecast, By Weight (2024-2032) 17.7.2.3.1. Up to 50 kg 17.7.2.3.2. 50 to 100 kg 17.7.2.3.3. Above 100 kg 17.7.2.4. Canada Astronaut Space Suits Market Size and Forecast, By Life Support Architecture (2024-2032) 17.7.2.4.1. Backpack PLSS 17.7.2.4.2. Distributed-system PLSS 17.7.2.4.3. Suitport-Integrated Systems 17.7.2.5. Canada Astronaut Space Suits Market Size and Forecast, By Application (2024-2032) 17.7.2.5.1. Space Exploration 17.7.2.5.2. Space Tourism 17.7.2.5.3. Scientific Research 17.7.2.5.4. Training and Simulation 17.7.2.6. Canada Astronaut Space Suits Market Size and Forecast, By End User (2024-2032) 17.7.2.6.1. Government Space Agencies 17.7.2.6.2. Commercial Launch and Space-Tourism Operators 17.7.2.6.3. Defense and Research Institutions 17.7.3. Mexico 17.7.3.1. Mexico Astronaut Space Suits Market Size and Forecast, By Suit Type (2024-2032) 17.7.3.1.1. IVA Suits 17.7.3.1.2. EVA Suits 17.7.3.1.3. Planetary Surface Suits (xEMU / AxEMU) 17.7.3.2. Mexico Astronaut Space Suits Market Size and Forecast, By Material Technology (2024-2032) 17.7.3.2.1. Soft Suit 17.7.3.2.2. Hard Shell 17.7.3.2.3. Hybrid/Mechanical Counter-Pressure (MCP) 17.7.3.3. Mexico Astronaut Space Suits Market Size and Forecast, By Weight (2024-2032) 17.7.3.3.1.1. Up to 50 kg 17.7.3.3.1.2. 50 to 100 kg 17.7.3.3.1.3. Above 100 kg 17.7.3.4. Mexico Astronaut Space Suits Market Size and Forecast, By Life Support Architecture (2024-2032) 17.7.3.4.1. Backpack PLSS 17.7.3.4.2. Distributed-system PLSS 17.7.3.4.3. Suitport-Integrated Systems 17.7.3.5. Mexico Astronaut Space Suits Market Size and Forecast, By Application (2024-2032) 17.7.3.5.1. Space Exploration 17.7.3.5.2. Space Tourism 17.7.3.5.3. Scientific Research 17.7.3.5.4. Training and Simulation 17.7.3.6. Mexico Astronaut Space Suits Market Size and Forecast, By End User (2024-2032) 17.7.3.6.1. Government Space Agencies 17.7.3.6.2. Commercial Launch and Space-Tourism Operators 17.7.3.6.3. Defense and Research Institutions 18. Europe Astronaut Space Suits Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 18.1. Europe Astronaut Space Suits Market Size and Forecast, By Suit Type (2024-2032) 18.2. Europe Astronaut Space Suits Market Size and Forecast, By Material Technology (2024-2032) 18.3. Europe Astronaut Space Suits Market Size and Forecast, By Weight (2024-2032) 18.4. Europe Astronaut Space Suits Market Size and Forecast, By Life Support Architecture (2024-2032) 18.5. Europe Astronaut Space Suits Market Size and Forecast, By Application (2024-2032) 18.6. Europe Astronaut Space Suits Market Size and Forecast, By End User (2024-2032) 18.7. Europe Astronaut Space Suits Market Size and Forecast, By Country (2024-2032) 18.7.1. United Kingdom 18.7.2. France 18.7.3. Germany 18.7.4. Italy 18.7.5. Spain 18.7.6. Sweden 18.7.7. Russia 18.7.8. Rest of Europe 19. Asia Pacific Astronaut Space Suits Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 19.1. Asia Pacific Astronaut Space Suits Market Size and Forecast, By Suit Type (2024-2032) 19.2. Asia Pacific Astronaut Space Suits Market Size and Forecast, By Material Technology (2024-2032) 19.3. Asia Pacific Astronaut Space Suits Market Size and Forecast, By Weight (2024-2032) 19.4. Asia Pacific Astronaut Space Suits Market Size and Forecast, By Life Support Architecture (2024-2032) 19.5. Asia Pacific Astronaut Space Suits Market Size and Forecast, By Application (2024-2032) 19.6. Asia Pacific Astronaut Space Suits Market Size and Forecast, By End User (2024-2032) 19.7. Asia Pacific Astronaut Space Suits Market Size and Forecast, by Country (2024-2032) 19.7.1. China 19.7.2. S Korea 19.7.3. Japan 19.7.4. India 19.7.5. Australia 19.7.6. Indonesia 19.7.7. Malaysia 19.7.8. Philippines 19.7.9. Thailand 19.7.10. Vietnam 19.7.11. Rest of Asia Pacific 20. Middle East and Africa Astronaut Space Suits Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 20.1. Middle East and Africa Astronaut Space Suits Market Size and Forecast, By Suit Type (2024-2032) 20.2. Middle East and Africa Astronaut Space Suits Market Size and Forecast, By Material Technology (2024-2032) 20.3. Middle East and Africa Astronaut Space Suits Market Size and Forecast, By Weight (2024-2032) 20.4. Middle East and Africa Astronaut Space Suits Market Size and Forecast, By Life Support Architecture (2024-2032) 20.5. Middle East and Africa Astronaut Space Suits Market Size and Forecast, By Application (2024-2032) 20.6. Middle East and Africa Astronaut Space Suits Market Size and Forecast, By End User (2024-2032) 20.7. Middle East and Africa Astronaut Space Suits Market Size and Forecast, By Country (2024-2032) 20.7.1. South Africa 20.7.2. GCC 20.7.3. Nigeria 20.7.4. Rest of ME&A 21. South America Astronaut Space Suits Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 21.1. South America Astronaut Space Suits Market Size and Forecast, By Suit Type (2024-2032) 21.2. South America Astronaut Space Suits Market Size and Forecast, By Material Technology (2024-2032) 21.3. South America Astronaut Space Suits Market Size and Forecast, By Weight (2024-2032) 21.4. South America Astronaut Space Suits Market Size and Forecast, By Life Support Architecture (2024-2032) 21.5. South America Astronaut Space Suits Market Size and Forecast, By Application (2024-2032) 21.6. South America Astronaut Space Suits Market Size and Forecast, By End User (2024-2032) 21.7. South America Astronaut Space Suits Market Size and Forecast, By Country (2024-2032) 21.7.1. Brazil 21.7.2. Argentina 21.7.3. Colombia 21.7.4. Chile 21.7.5. Rest of South America 22. Company Profile: Key Players 22.1. SpaceX 22.1.1. Company Overview 22.1.2. Business Portfolio 22.1.3. Financial Overview 22.1.4. SWOT Analysis 22.1.5. Strategic Analysis 22.1.6. Recent Developments 22.2. NASA 22.3. Axiom Space, Inc. 22.4. ILC Dover LP 22.5. Collins Aerospace 22.6. David Clark Company 22.7. Oceaneering International, Inc. 22.8. Paragon Space Development Corporation 22.9. Final Frontier Design 22.10. NPP Zvezda (Russia) 22.11. Pacific Spaceflight 22.12. Sure Safety (India) Ltd. 22.13. The Boeing Company 22.14. Blue Origin Enterprises, L.P. 22.15. Vinyl Technology Inc. 22.16. Austrian Space Forum (OeWF) 22.17. Sierra Nevada Corporation 22.18. JAXA 22.19. Roscosmos / RSC Energia (Russia) 22.20. China National Space Administration (CNSA) 22.21. European Space Agency (ESA) 22.22. Others 23. Key Findings 24. Analyst Recommendations 25. Astronaut Space Suits Market – Research Methodology