APAC Automotive Telematics Market size is expected to reach US$ 3,147 Mn. by 2026, at a CAGR of 10.7% during the forecast period.To know about the Research Methodology :- Request Free Sample Report

APAC Automotive Telematics Market Overview:

The APAC automotive telematics market is expected to see growth during the forecast period. The rate of telematics usage has improved globally with a rise in the number of vehicles being incorporated with these systems. The automotive telematics market comprises in-car infotainment, navigation, remote diagnostics, & security features. Innovative telematics systems are leading in Japan & Korea. The automotive industry observed a radical transformation over the last two decades as an effect of digitization through computer-based control systems. Progressive technologies like in-vehicle digital systems & sensor-based intelligent vehicle functions are estimated to drive the Asia-Pacific automotive telematics market. Improved penetration of 3G communication technologies & the introduction of 4G LTE networks are anticipated to boost automotive telematics equipment. Vehicle manufacturing companies & their associated suppliers have focused on emerging standardized platforms & integrating solutions for telematics & infotainment systems with Government help. In APAC, infotainment & navigation & its related services drive a majority of the automotive telematics market. Improved demand for safety & security in Japan caused by the introduction of HELP NET services, which were kept by adoption by numerous other countries. Most countries in APAC lack adequate infrastructure for supporting features like real-time traffic for navigation systems, both in terms of telecommunication infrastructure & traffic data collection. The unavailability of traffic data is one of the major interferences to automotive telematics system adoption. Traffic data collection & aggregation require major government initiatives. For example, Korea’s Telematics Information Center & Japan’s Vehicle & Information Communication System offers crucial data which aids traffic monitoring systems. Communication speed in Japan has swiftly increased over the past decade, thus allowing spontaneous delivery of features in navigation systems over streaming of traffic updates & voice communication. Most of the countries in APAC have lagged behind as far as communication speeds are concerned, thus affecting the delivery mechanism. Along with hardware, software, & communications network, automotive telematics needs the setup & maintenance of service centers for ensuring regular consumer support, which needs major initial investments. Delayed returns on high initial investment are estimated to deter automotive telematics adoption through main APAC countries. Lack of customer awareness is estimated to challenge market growth during the forecast period as the APAC automotive telematics market evolves from infancy. Important industry contributors comprise Airbiquity Inc, Agero Inc., Connexis LLC, Verizon Telematics, WirelessCar AB, & NTT Docomo.Transforming Road & Telecom Infrastructure:

Internet penetration has improved globally, along with the bigger adoption of advanced wireless technology. Improved wireless technologies like 3G, 4G, and 5G & LTE are estimated to be used extensively in future. In most zones of the world, there is continuous improvement in the road & carrier infrastructure in telecom. Main countries in APAC region like India, Singapore, Japan, Australia, New Zealand, & China are taking the initiative to change their road & telecom infrastructure. The outcome is likely to result in the increase in demand for automotive telematics in the APAC region.Telematics Car Insurance in India:

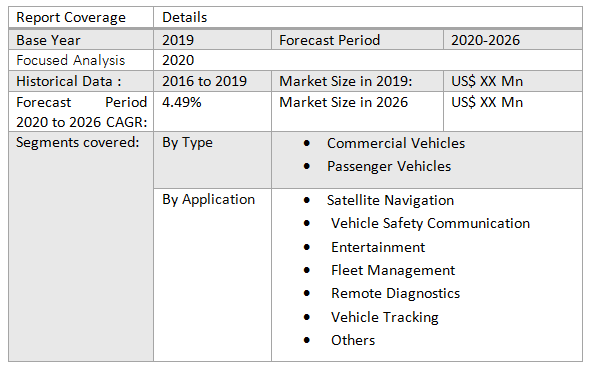

There have been some news reports which suggest that the Insurance Regulatory & Development Authority of India (IRDAI) is in favor of Telematics car insurance. With the apex insurance body in the country inspiring insurers, it is likely that key vehicle insurance companies will start proposing such policies in the future. Some insurers have started such policies but it will take time for the idea to be accepted enthusiastically by all stakeholders of the motor insurance industry as of the challenges involved; for instance, wide-spread use of tracking/Telematics devices in cars. The report covers Commercial Vehicles, Passenger Vehicles, with detailed analysis APAC Automotive Telematics Market industry with the classifications of the market on the Type, Application & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced Plastic Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the report.Scope of the APAC Automotive Telematics Market: Inquire before Buying

APAC Automotive Telematics Market, by Region

• APAC o China o India o South Korea o Japan o Australia o Rest of APAC o ASEAN Indonesia Malaysia Singapore Thailand VietnamAPAC Automotive Telematics Market Key Players

• Agero • Airbiquity • Continental • Verizon Telematics • Visteon • Bynx • Connexis • Ericsson • Fleetmatics • Luxoft • Magneti Marelli • WirelessCar AB • NTT Docomo. • AT&T Inc. • Ford Motor Company • BMW AG • Robert Bosch GmbH • Valeo S.A • Harman International Industries, Incorporated • Vodafone Group Plc • TELEFÓNICA, S.A.

APAC Automotive Telematics Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: APAC Automotive Telematics Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. APAC Automotive Telematics Market Analysis and Forecast 7. APAC Automotive Telematics Market Analysis and Forecast, by Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. APAC Automotive Telematics Market Value Share Analysis, by Type 7.4. APAC Automotive Telematics Market Size (US$ Mn) Forecast, by Type 7.5. APAC Automotive Telematics Market Analysis, by Type 8. APAC Automotive Telematics Market Analysis and Forecast, by Application 8.1. Introduction and Definition 8.2. Key Findings 8.3. APAC Automotive Telematics Market Value Share Analysis, by Application 8.4. APAC Automotive Telematics Market Size (US$ Mn) Forecast, by Application 8.5. APAC Automotive Telematics Market Analysis, by Application 8.6. APAC Automotive Telematics Market Attractiveness Analysis, by Application 9. APAC Automotive Telematics Market Analysis and Forecast, by Region 9.1. Introduction and Definition 9.2. Key Findings 9.3. APAC Automotive Telematics Market Value Share Analysis, by Region 9.4. APAC Automotive Telematics Market Size (US$ Mn) Forecast, by Region 9.5. APAC Automotive Telematics Market Analysis, by Region 10. APAC Automotive Telematics Market Analysis 10.1. Key Findings 10.2. APAC Automotive Telematics Market Overview 10.3. APAC Automotive Telematics Market Forecast, by Type 10.3.1. Commercial Vehicles 10.3.2. Passenger Vehicles 10.4. APAC Automotive Telematics Market Forecast, by Application 10.4.1. Satellite Navigation 10.4.2. Vehicle Safety Communication 10.4.3. Entertainment 10.4.4. Fleet Management 10.4.5. Remote Diagnostics 10.4.6. Vehicle Tracking 10.4.7. Others 10.5. APAC Automotive Telematics Market Forecast, by Region 10.5.1. China 10.5.2. India 10.5.3. Japan 10.5.4. Malaysia 10.5.5. Indonesia 10.5.6. Rest of Asia-Pacific 10.6. PEST Analysis 10.7. Key Trends 10.8. Key Developments 11. Asia-Pacific APAC Automotive Telematics Market Analysis 11.1. Key Findings 11.2. Asia-Pacific APAC Automotive Telematics Market Overview 11.3. Asia-Pacific APAC Automotive Telematics Market Forecast, by Grinder Type 11.3.1. Commercial Vehicles 11.3.2. Passenger Vehicles 11.4. Asia-Pacific APAC Automotive Telematics Market Forecast, by Application 11.4.1. Satellite Navigation 11.4.2. Vehicle Safety Communication 11.4.3. Entertainment 11.4.4. Fleet Management 11.4.5. Remote Diagnostics 11.4.6. Vehicle Tracking 11.4.7. Others 11.5. Asia-Pacific APAC Automotive Telematics Market Forecast, by Country 11.5.1. China 11.5.2. India 11.5.3. Japan 11.5.4. Malaysia 11.5.5. Indonesia 11.5.6. Rest of Asia-Pacific 11.6. China APAC Automotive Telematics Market Forecast, by Type 11.6.1. Commercial Vehicles 11.6.2. Passenger Vehicles 11.7. China APAC Automotive Telematics Market Forecast, by Application 11.7.1. Satellite Navigation 11.7.2. Vehicle Safety Communication 11.7.3. Entertainment 11.7.4. Fleet Management 11.7.5. Remote Diagnostics 11.7.6. Vehicle Tracking 11.7.7. Others 11.8. India APAC Automotive Telematics Market Forecast, by Type 11.8.1. Commercial Vehicles 11.8.2. Passenger Vehicles 11.9. India APAC Automotive Telematics Market Forecast, by Application 11.9.1. Satellite Navigation 11.9.2. Vehicle Safety Communication 11.9.3. Entertainment 11.9.4. Fleet Management 11.9.5. Remote Diagnostics 11.9.6. Vehicle Tracking 11.9.7. Others 11.10. Japan APAC Automotive Telematics Market Forecast, by Type 11.10.1. Commercial Vehicles 11.10.2. Passenger Vehicles 11.11. Japan APAC Automotive Telematics Market Forecast, by Application 11.11.1. Satellite Navigation 11.11.2. Vehicle Safety Communication 11.11.3. Entertainment 11.11.4. Fleet Management 11.11.5. Remote Diagnostics 11.11.6. Vehicle Tracking 11.11.7. Others 11.12. ASEAN APAC Automotive Telematics Market Forecast, by Type 11.12.1. Commercial Vehicles 11.12.2. Passenger Vehicles 11.13. ASEAN APAC Automotive Telematics Market Forecast, by Application 11.13.1. Satellite Navigation 11.13.2. Vehicle Safety Communication 11.13.3. Entertainment 11.13.4. Fleet Management 11.13.5. Remote Diagnostics 11.13.6. Vehicle Tracking 11.13.7. Others 11.14. Rest of APAC Automotive Telematics Market Forecast, by Grinder Type 11.14.1. Commercial Vehicles 11.14.2. Passenger Vehicles 11.15. Rest of APAC Automotive Telematics Market Forecast, by Application 11.15.1. Satellite Navigation 11.15.2. Vehicle Safety Communication 11.15.3. Entertainment 11.15.4. Fleet Management 11.15.5. Remote Diagnostics 11.15.6. Vehicle Tracking 11.15.7. Others 11.16. Beverages PEST Analysis 11.17. Key Trends 11.18. Key Developments 12. Company Profiles 12.1. Market Share Analysis, by Company 12.2. Market Share Analysis, by Region 12.3. Market Share Analysis, by Country 12.4. Competition Matrix 12.4.1. Competitive Benchmarking of key players by price, presence, market share, Raw material and R&D investment 12.4.2. New Raw material Launches and Raw material Enhancements 12.4.2.1. Market Consolidation 12.4.2.2. M&A by Regions, Investment and Raw material 12.4.2.3. M&A Key Players, Forward Integration and Backward Integration 12.5. Company Profiles: Key Players 12.5.1. Agero 12.5.2. Airbiquity 12.5.3. Continental 12.5.4. Verizon Telematics 12.5.5. Visteon 12.5.6. Bynx 12.5.7. Connexis 12.5.8. Ericsson 12.5.9. Fleetmatics 12.5.10. Luxoft 12.5.11. Magneti Marelli 12.5.12. WirelessCar AB 12.5.13. NTT Docomo. 12.5.14. AT&T Inc. 12.5.15. Ford Motor Company 12.5.16. BMW AG 12.5.17. Robert Bosch GmbH 12.5.18. Valeo S.A 12.5.19. Harman International Industries, Incorporated 12.5.20. Vodafone Group Plc 12.5.21. TELEFÓNICA, S.A.