The All-Terrain Vehicle (ATV) Market size was valued at USD 5.84 Billion in 2024 and is expected to grow by 4.6% from 2025 to 2032, reaching nearly USD 8.37 billion in 2032All-Terrain Vehicle (ATV) Market Overview

All-Terrain Vehicle (ATV) are versatile off-road vehicles designed for rugged terrain, recreational activities, and utility purposes. Available in categories such as Utility, Sport, Recreational, and Youth ATVs, they are powered by gasoline, diesel, or electric engines. Widely used in agriculture, construction, outdoor sports, and adventure tourism, ATVs combine durability, maneuverability, and performance for diverse applications worldwide. The increasing demand for versatile off-road vehicles across recreational, commercial, and industrial applications drives the All-Terrain Vehicle (ATV) Market growth. The growing popularity of off-road adventure tourism and recreational sports, where high-performance sport and recreational ATVs are increasingly preferred. Technological advancements, such as enhanced suspension systems, safety features, and engine efficiency, are improving ATV performance and expanding consumer appeal. Gasoline-powered ATVs remain dominant due to their reliability, extended range, and established refueling infrastructure, while electric ATVs are emerging as a sustainable alternative amid rising environmental awareness.To know about the Research Methodology :- Request Free Sample Report North America leads the All-Terrain Vehicle (ATV) Market, driven by a strong culture of outdoor recreation, well-developed infrastructure, and high consumer spending on powersports vehicles. Europe is witnessing steady growth due to increasing off-road tourism, stricter environmental regulations encouraging electric ATVs, and the adoption of high-performance sport and utility models. Asia-Pacific presents significant opportunities, driven by expanding agricultural mechanization, rising disposable incomes, and growing interest in adventure sports. Manufacturers are focusing on expanding their global footprint through investments in production facilities, R&D for electrified ATVs, and partnerships to enhance distribution networks.

All-Terrain Vehicle (ATV) Market Dynamics

Increasing Demand for Multi-Purpose Utility Vehicles in Off-Road and Recreational Activities to drive the All-Terrain Vehicle (ATV) Market growth The increasing demand for multi-purpose utility vehicles that combine performance, versatility, and convenience drives, All-Terrain Vehicle (ATV) Market. Utility ATVs (UTVs) are becoming increasingly popular across agricultural, construction, and industrial applications due to their ability to transport equipment, carry multiple passengers, and navigate rugged terrains efficiently. Recreational activities and adventure tourism are driving growth, as off-road enthusiasts seek high-performance vehicles for sports, leisure, and outdoor exploration. The rising trend of outdoor recreational tourism, coupled with growing disposable income in developed and emerging markets, is expanding the consumer base for both recreational and sport ATVs. Technological innovations, including advanced suspension systems, improved safety features such as roll cages and braking systems, and fuel-efficient engines, are enhancing ATV performance and appeal. The adoption of gasoline and diesel-powered models for heavy-duty applications, along with the emergence of electric ATVs catering to eco-conscious consumers, drives the All-Terrain Vehicle (ATV) Market. The government initiatives promoting rural mobility and off-road transport solutions in agriculture and forestry are creating new opportunities for ATV adoption. High Costs and Regulatory Challenges Limiting Market Expansion High purchase and maintenance costs of ATVs, particularly utility and high-performance sport models, limit adoption among price-sensitive consumers in emerging markets. Fuel expenses, spare parts availability, and the need for specialized servicing add to the total cost of ownership, discouraging first-time buyers. Regulatory challenges also pose hurdles. Many countries enforce strict safety and emission standards for off-road vehicles, restricting usage in public areas and mandating costly compliance measures. Noise restrictions, environmental concerns, and limitations on off-road riding zones further constrain All-Terrain Vehicle (ATV) Market growth. The relatively high learning curve and safety risks associated with ATV operation, particularly among youth and recreational users, can reduce consumer confidence and slow adoption. Infrastructure limitations, such as inadequate off-road tracks and a lack of charging stations for electric ATVs, act as barriers. Combined, these cost, regulatory, and operational challenges limit short-term market growth despite rising interest in recreational and utility applications.All-Terrain Vehicle (ATV) Market Segment Analysis

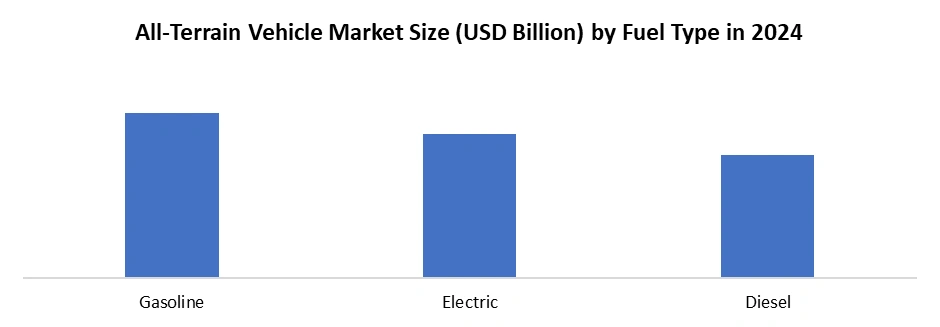

By Vehicle Type, the market is segmented into the Utility ATV (UTV), Sport ATV, Recreational ATV, Youth ATV and Others. Utility ATV (UTV dominated the All-Terrain Vehicle (ATV) Market in 2024. UTVs are increasingly preferred by farmers, construction operators, and outdoor enthusiasts because they can carry multiple passengers, transport equipment, and navigate rugged terrains efficiently. This demand is fueled by technological advancements such as improved suspension systems, enhanced off-road stability, and safety features, including roll cages and advanced braking systems. The Sport ATV segment, though growing rapidly, remains secondary as it primarily caters to recreational riders seeking speed and maneuverability rather than utility. Recreational ATVs and Youth ATVs contribute to the All-Terrain Vehicle (ATV) Market growth through leisure activities, but their limited payload capacity and smaller engine sizes restrict their dominance compared to UTVs.By Fuel Type, the market is categorized into Gasoline, Electric, and Diesel. Gasoline is expected to dominate the All-Terrain Vehicle (ATV) Market over the forecast period. They provide extended range and faster refueling compared to other fuel types, making them suitable for long-duration operations across rugged terrains. Gasoline ATVs cater to both commercial operators, such as farmers, construction workers, and outdoor service providers and recreational users, offering a balance of power, speed, and maneuverability. A wide variety of models, from compact utility vehicles to high-performance sport ATVs, ensures that gasoline-powered ATVs meet diverse consumer needs. The gasoline engines deliver responsive handling, higher acceleration, and superior off-road performance, enhancing their appeal for adventure tourism and off-road sports. Their established supply chains, ease of maintenance, and availability of spare parts reinforce their All-Terrain Vehicle (ATV) Market dominance.

All-Terrain Vehicle (ATV) Market Regional Insights

North America largest Terrain Vehicle Market share in 2024 and is expected to continue its dominance over the forecast period. This leadership is fueled by a combination of strong consumer demand, advanced recreational infrastructure, and robust manufacturing capabilities across the region. The United States and Canada, in particular, have witnessed a growing culture of outdoor adventure and off-road sports, which has significantly boosted ATV sales. Factors such as increasing disposable incomes, rising interest in recreational and utility-based ATV applications, and the proliferation of ATV clubs and adventure tourism have further reinforced market growth. Technological advancements in ATV design, including enhanced fuel efficiency, improved suspension systems, and innovative electric models, are also attracting new segments of environmentally conscious and tech-savvy consumers. Additionally, government initiatives promoting outdoor recreational activities, along with supportive regulations for vehicle safety and emission standards, are creating a favorable ecosystem for market expansion. The North American market is characterized by a competitive landscape, with major manufacturers focusing on product innovation, strategic partnerships, and after-sales services to capture a larger consumer base. The increasing trend of customization, where consumers seek personalized ATV designs and features, is shaping purchasing behavior and driving revenue growth. All-Terrain Vehicle (ATV) Market Competitive Landscape The global All-Terrain Vehicle (ATV) Market is highly competitive, characterized by the presence of several key players striving to capture market share through innovation, strategic partnerships, and diverse product offerings. All-Terrain Vehicle (ATV) Leading companies in the ATV industry include Polaris Industries Inc., Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., and BRP Inc. (Bombardier Recreational Products) . These industry giants dominate the market by offering a wide range of ATVs catering to various applications such as recreational, agricultural, military, and sports. Polaris Industries Inc., for instance, has established a strong presence in the North American market with its diverse product portfolio and innovative designs. Yamaha Motor Co., Ltd. and Honda Motor Co., Ltd. continue to lead in global sales, focusing on reliability, performance, and customer satisfaction. Kawasaki Heavy Industries, Ltd. and BRP Inc. have also maintained significant market positions by introducing technologically advanced models and expanding their global reach. In addition to these established players, the market also sees the emergence of new entrants and startups focusing on electric and specialized ATVs. Companies like Sherp, known for their amphibious off-road vehicles, and other niche manufacturers are gaining attention for their unique offerings. All-Terrain Vehicle (ATV) Market: Recent Developments On December 1, 2023, Polaris, a global leader in powersports and off-road innovation, was awarded the 2023 Popular Science "Best of What's New" Award for its all-electric RANGER XP Kinetic in the automotive category. This fully electric Utility Side-by-Side (UTV) showcases the benefits of electric technology for off-road applications, including instantaneous torque for precise control, quieter operation, and lower maintenance costs. Engineered through Polaris’ 10-year partnership with Zero Motorcycles, the RANGER XP Kinetic delivers industry-leading horsepower and torque, enhanced productivity, and connected vehicle services via RIDE COMMAND+, enabling remote monitoring, battery status tracking, and group ride management. This recognition underscores Polaris’ continued innovation in the All-Terrain Vehicle (ATV) market, setting new benchmarks for electric utility ATVs while addressing performance, sustainability, and user convenience across recreational and commercial off-road applications. On August 20, 2024, Honda announced that it had designated Swepsonville, North Carolina, as the North American hub for its All-Terrain Vehicle (ATV) production. The move follows a $21.5 million investment to expand the facility, which now produces Honda’s FourTrax utility ATV series and TRX sport models. This investment also marks the Swepsonville site as the first North American Honda facility to manufacture future electrified powersports and power equipment products. All ATV production was transferred from Honda’s Timmonsville, South Carolina, facility, which will now focus exclusively on side-by-side vehicles. Originally a lawnmower factory, the 650,000-square-foot Swepsonville site has been restructured to meet growing demand for Honda ATVs and support the company’s strategic focus on electrification and expansion of its powersports product lineup across North America. All-Terrain Vehicle (ATV) Market Trends

Trend Description Electrification of ATVs Electric ATVs offer reduced emissions, lower noise levels, and improved efficiency, making them ideal for both recreational and utility applications. Advances in battery technology are extending riding range and reducing charging times, addressing earlier limitations. Manufacturers are investing in research and development to create more reliable, high-performance electric ATVs, while government incentives and eco-conscious consumer demand are further accelerating the adoption of these environmentally friendly vehicles. Adventure and Recreational Growth Rising consumer interest in off-road sports, adventure tourism, and outdoor recreational activities is fueling ATV sales worldwide. In North America, ATVs are deeply embedded in lifestyle and leisure, while Europe and the Asia-Pacific are experiencing growing adoption due to increasing disposable incomes and urbanization. Adventure parks, off-road trails, and organized ATV clubs are expanding, encouraging consumers to explore off-road experiences. Manufacturers are responding by designing lightweight, high-performance, and customizable ATVs specifically for recreational purposes. Technological Integration Modern ATVs are increasingly equipped with advanced technologies to enhance performance, safety, and user experience. Features such as GPS navigation, telematics, smart dashboards, and advanced suspension systems allow riders to navigate difficult terrains, monitor vehicle performance, and maintain safety. Technological innovations also enable remote diagnostics, ride analytics, and mobile app integration, appealing to both recreational enthusiasts and professional utility users. Additionally, connected and smart ATVs provide better control, customization, and efficiency. All-Terrain Vehicle (ATV) Market Report Scope: Inquire before buying

Global All-Terrain Vehicle (ATV) Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5.84 Bn. Forecast Period 2025 to 2032 CAGR: 4.6% Market Size in 2032: USD 8.37 Bn. Segments Covered: by Vehicle Type Utility ATV (UTV) Sport ATV Recreational ATV Youth ATV Others by Engine Capacity Below 400cc 400–800cc Above 800cc by Fuel Type Gasoline Electric Diesel by Application Agriculture & Farming Forestry & Logging Military & Defense Recreational & Sports Hunting & Fishing Utility & Industrial Others All-Terrain Vehicle (ATV) Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, and Rest of the MEA) South America (Brazil, Argentina, and Rest of South America)All-Terrain Vehicle (ATV) Key Players:

1. Polaris Inc. 2. Honda Motor Co., Ltd. 3. Yamaha Motor Co., Ltd. 4. BRP Inc. (Can-Am) 5. Kawasaki Heavy Industries, Ltd. 6. Suzuki Motor Corporation 7. Arctic Cat Inc. 8. Textron Inc. 9. CFMOTO 10. KYMCO (Kwang Yang Motor Co., Ltd.) 11. Hisun Motors Corp., USA 12. Linhai Group 13. Runtong Group 14. Italika 15. Tomcar USA 16. JSW Sarbloh Motors 17. Ace ATV Ltd 18. Supacat Ltd 19. Ineos Automotive 20. Land Rover (Defender OCTA) 21. Ford Motor Company (Raptor line) 22. Jeep (Wrangler & Gladiator) 23. Isuzu (D-Max AT35) 24. Mercedes-Benz (G-Class) 25. Toyota Motor Corporation (Land Cruiser) 26. Rivian Automotive 27. Brunswick Corporation 28. Thor Industries 29. Briggs & Stratton Corporation 30. Honda Power EquipmentFrequently Asked Questions:

1. Which region has the largest share in the All-Terrain Vehicle (ATV) Market? Ans: The North America region held the largest All-Terrain Vehicle (ATV) Market share in 2024. 2. What is the growth rate of the All-Terrain Vehicle (ATV) Market? Ans: The All-Terrain Vehicle (ATV) is growing at a CAGR of 4.6% during the forecasting period 2025-232. 3. What is the scope of the All-Terrain Vehicle (ATV Market report? Ans: All-Terrain Vehicle (ATV) Market report helps with the PESTEL, Porter's, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the All-Terrain Vehicle (ATV) Market? Ans: The key players in the All-Terrain Vehicle (ATV) Market are Polaris Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., BRP Inc. (Can-Am), Kawasaki Heavy Industries, Ltd., Suzuki Motor Corporation, Arctic Cat Inc., Textron Inc. and others. 5. What is the study period of the All-Terrain Vehicle (ATV) Market? Ans: The All-Terrain Vehicle (ATV) Market is studied from 2024 to 2032.

1. All-Terrain Vehicle (ATV) Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global All-Terrain Vehicle (ATV) Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading All-Terrain Vehicle (ATV) Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. All-Terrain Vehicle (ATV) Market: Dynamics 3.1. All-Terrain Vehicle (ATV) Market Trends by Region 3.1.1. North America All-Terrain Vehicle (ATV) Market Trends 3.1.2. Europe All-Terrain Vehicle (ATV) Market Trends 3.1.3. Asia Pacific All-Terrain Vehicle (ATV) Market Trends 3.1.4. Middle East and Africa All-Terrain Vehicle (ATV) Market Trends 3.1.5. South America All-Terrain Vehicle (ATV) Market Trends 3.2. All-Terrain Vehicle (ATV) Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America All-Terrain Vehicle (ATV) Market Drivers 3.2.1.2. North America All-Terrain Vehicle (ATV) Market Restraints 3.2.1.3. North America All-Terrain Vehicle (ATV) Market Opportunities 3.2.1.4. North America All-Terrain Vehicle (ATV) Market Challenges 3.2.2. Europe 3.2.2.1. Europe All-Terrain Vehicle (ATV) Market Drivers 3.2.2.2. Europe All-Terrain Vehicle (ATV) Market Restraints 3.2.2.3. Europe All-Terrain Vehicle (ATV) Market Opportunities 3.2.2.4. Europe All-Terrain Vehicle (ATV) Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific All-Terrain Vehicle (ATV) Market Drivers 3.2.3.2. Asia Pacific All-Terrain Vehicle (ATV) Market Restraints 3.2.3.3. Asia Pacific All-Terrain Vehicle (ATV) Market Opportunities 3.2.3.4. Asia Pacific All-Terrain Vehicle (ATV) Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa All-Terrain Vehicle (ATV) Market Drivers 3.2.4.2. Middle East and Africa All-Terrain Vehicle (ATV) Market Restraints 3.2.4.3. Middle East and Africa All-Terrain Vehicle (ATV) Market Opportunities 3.2.4.4. Middle East and Africa All-Terrain Vehicle (ATV) Market Challenges 3.2.5. South America 3.2.5.1. South America All-Terrain Vehicle (ATV) Market Drivers 3.2.5.2. South America All-Terrain Vehicle (ATV) Market Restraints 3.2.5.3. South America All-Terrain Vehicle (ATV) Market Opportunities 3.2.5.4. South America All-Terrain Vehicle (ATV) Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For All-Terrain Vehicle (ATV) Industry 3.8. Analysis of Government Schemes and Initiatives For All-Terrain Vehicle (ATV) Industry 3.9. All-Terrain Vehicle (ATV) Market Trade Analysis 3.10. The Global Pandemic Impact on All-Terrain Vehicle (ATV) Market 4. All-Terrain Vehicle (ATV) Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 4.1.1. Utility ATV (UTV) 4.1.2. Sport ATV 4.1.3. Recreational ATV 4.1.4. Youth ATV 4.1.5. Others 4.2. All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 4.2.1. Below 400cc 4.2.2. 400–800cc 4.2.3. Above 800cc 4.3. All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 4.3.1. Gasoline 4.3.2. Electric 4.3.3. Diesel 4.4. All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 4.4.1. Agriculture & Farming 4.4.2. Forestry & Logging 4.4.3. Military & Defense 4.4.4. Recreational & Sports 4.4.5. Hunting & Fishing 4.4.6. Utility & Industrial 4.4.7. Others 4.5. All-Terrain Vehicle (ATV) Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America All-Terrain Vehicle (ATV) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 5.1.1. Utility ATV (UTV) 5.1.2. Sport ATV 5.1.3. Recreational ATV 5.1.4. Youth ATV 5.1.5. Others 5.2. North America All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 5.2.1. Below 400cc 5.2.2. 400–800cc 5.2.3. Above 800cc 5.3. North America All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 5.3.1. Gasoline 5.3.2. Electric 5.3.3. Diesel 5.4. North America All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 5.4.1. Agriculture & Farming 5.4.2. Forestry & Logging 5.4.3. Military & Defense 5.4.4. Recreational & Sports 5.4.5. Hunting & Fishing 5.4.6. Utility & Industrial 5.4.7. Others 5.5. North America All-Terrain Vehicle (ATV) Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.1.1.1. Utility ATV (UTV) 5.5.1.1.2. Sport ATV 5.5.1.1.3. Recreational ATV 5.5.1.1.4. Youth ATV 5.5.1.1.5. Others 5.5.1.2. United States All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 5.5.1.2.1. Below 400cc 5.5.1.2.2. 400–800cc 5.5.1.2.3. Above 800cc 5.5.1.3. United States All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 5.5.1.3.1. Gasoline 5.5.1.3.2. Electric 5.5.1.3.3. Diesel 5.5.1.4. United States All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Agriculture & Farming 5.5.1.4.2. Forestry & Logging 5.5.1.4.3. Military & Defense 5.5.1.4.4. Recreational & Sports 5.5.1.4.5. Hunting & Fishing 5.5.1.4.6. Utility & Industrial 5.5.1.4.7. Others 5.5.2. Canada 5.5.2.1. Canada All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.2.1.1. Utility ATV (UTV) 5.5.2.1.2. Sport ATV 5.5.2.1.3. Recreational ATV 5.5.2.1.4. Youth ATV 5.5.2.1.5. Others 5.5.2.2. Canada All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 5.5.2.2.1. Below 400cc 5.5.2.2.2. 400–800cc 5.5.2.2.3. Above 800cc 5.5.2.3. Canada All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 5.5.2.3.1. Gasoline 5.5.2.3.2. Electric 5.5.2.3.3. Diesel 5.5.2.4. Canada All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Agriculture & Farming 5.5.2.4.2. Forestry & Logging 5.5.2.4.3. Military & Defense 5.5.2.4.4. Recreational & Sports 5.5.2.4.5. Hunting & Fishing 5.5.2.4.6. Utility & Industrial 5.5.2.4.7. Others 5.5.3. Mexico 5.5.3.1. Mexico All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.3.1.1. Utility ATV (UTV) 5.5.3.1.2. Sport ATV 5.5.3.1.3. Recreational ATV 5.5.3.1.4. Youth ATV 5.5.3.1.5. Others 5.5.3.2. Mexico All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 5.5.3.2.1. Below 400cc 5.5.3.2.2. 400–800cc 5.5.3.2.3. Above 800cc 5.5.3.3. Mexico All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 5.5.3.3.1. Gasoline 5.5.3.3.2. Electric 5.5.3.3.3. Diesel 5.5.3.4. Mexico All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Agriculture & Farming 5.5.3.4.2. Forestry & Logging 5.5.3.4.3. Military & Defense 5.5.3.4.4. Recreational & Sports 5.5.3.4.5. Hunting & Fishing 5.5.3.4.6. Utility & Industrial 5.5.3.4.7. Others 6. Europe All-Terrain Vehicle (ATV) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 6.2. Europe All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 6.3. Europe All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 6.4. Europe All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 6.5. Europe All-Terrain Vehicle (ATV) Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.1.2. United Kingdom All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.1.3. United Kingdom All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 6.5.1.4. United Kingdom All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.2.2. France All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.2.3. France All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 6.5.2.4. France All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.3.2. Germany All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.3.3. Germany All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 6.5.3.4. Germany All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.4.2. Italy All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.4.3. Italy All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 6.5.4.4. Italy All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.5.2. Spain All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.5.3. Spain All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 6.5.5.4. Spain All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.6.2. Sweden All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.6.3. Sweden All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 6.5.6.4. Sweden All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.7.2. Austria All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.7.3. Austria All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 6.5.7.4. Austria All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.8.2. Rest of Europe All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.8.3. Rest of Europe All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 6.5.8.4. Rest of Europe All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.2. Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.3. Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.4. Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.1.2. China All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.1.3. China All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.1.4. China All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.2.2. S Korea All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.2.3. S Korea All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.2.4. S Korea All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.3.2. Japan All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.3.3. Japan All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.3.4. Japan All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.4.2. India All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.4.3. India All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.4.4. India All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.5.2. Australia All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.5.3. Australia All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.5.4. Australia All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.6.2. Indonesia All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.6.3. Indonesia All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.6.4. Indonesia All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.7.2. Malaysia All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.7.3. Malaysia All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.7.4. Malaysia All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.8.2. Vietnam All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.8.3. Vietnam All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.8.4. Vietnam All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.9.2. Taiwan All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.9.3. Taiwan All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.9.4. Taiwan All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.10.2. Rest of Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.10.3. Rest of Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 7.5.10.4. Rest of Asia Pacific All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa All-Terrain Vehicle (ATV) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 8.2. Middle East and Africa All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 8.3. Middle East and Africa All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 8.4. Middle East and Africa All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa All-Terrain Vehicle (ATV) Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.1.2. South Africa All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 8.5.1.3. South Africa All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 8.5.1.4. South Africa All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.2.2. GCC All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 8.5.2.3. GCC All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 8.5.2.4. GCC All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.3.2. Nigeria All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 8.5.3.3. Nigeria All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 8.5.3.4. Nigeria All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.4.2. Rest of ME&A All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 8.5.4.3. Rest of ME&A All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 8.5.4.4. Rest of ME&A All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 9. South America All-Terrain Vehicle (ATV) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 9.2. South America All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 9.3. South America All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type(2024-2032) 9.4. South America All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 9.5. South America All-Terrain Vehicle (ATV) Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 9.5.1.2. Brazil All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 9.5.1.3. Brazil All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 9.5.1.4. Brazil All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 9.5.2.2. Argentina All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 9.5.2.3. Argentina All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 9.5.2.4. Argentina All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America All-Terrain Vehicle (ATV) Market Size and Forecast, by Vehicle Type (2024-2032) 9.5.3.2. Rest Of South America All-Terrain Vehicle (ATV) Market Size and Forecast, by Engine Capacity (2024-2032) 9.5.3.3. Rest Of South America All-Terrain Vehicle (ATV) Market Size and Forecast, by Fuel Type (2024-2032) 9.5.3.4. Rest Of South America All-Terrain Vehicle (ATV) Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Polaris Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Honda Motor Co., Ltd. 10.3. Yamaha Motor Co., Ltd. 10.4. BRP Inc. (Can-Am) 10.5. Kawasaki Heavy Industries, Ltd. 10.6. Suzuki Motor Corporation 10.7. Arctic Cat Inc. 10.8. Textron Inc. 10.9. CFMOTO 10.10. KYMCO (Kwang Yang Motor Co., Ltd.) 10.11. Hisun Motors Corp., USA 10.12. Linhai Group 10.13. Runtong Group 10.14. Italika 10.15. Tomcar USA 10.16. JSW Sarbloh Motors 10.17. Ace ATV Ltd 10.18. Supacat Ltd 10.19. Ineos Automotive 10.20. Land Rover (Defender OCTA) 10.21. Ford Motor Company (Raptor line) 10.22. Jeep (Wrangler & Gladiator) 10.23. Isuzu (D-Max AT35) 10.24. Mercedes-Benz (G-Class) 10.25. Toyota Motor Corporation (Land Cruiser) 10.26. Rivian Automotive 10.27. Brunswick Corporation 10.28. Thor Industries 10.29. Briggs & Stratton Corporation 10.30. Honda Power Equipment 11. Key Findings 12. Industry Recommendations 13. All-Terrain Vehicle (ATV) Market: Research Methodology 14. Terms and Glossary