Aircraft Antenna Market was valued at USD 482.47 Mn in 2024, and total global Aircraft Antenna Market revenue is expected to grow at CAGR of 7.4% & reaching nearly USD 854.09 Mn from 2025-2032Aircraft Antenna Market Overview

Aircraft antennas are critical components that enable seamless communication, navigation, and surveillance across commercial, military, and UAV platforms. Global aircraft antenna market encompasses the design, manufacturing, and integration of advanced antennas tailored for evolving aerospace requirements. Key driver has been the rising demand for high speed, real time connectivity in commercial aviation and the growing reliance on UAVs in defense. Combined with increasing aircraft production to meet surging global air travel evident from Airbus and Boeing’s record order books fuels both demand and supply of high-performance antennas. North America leads the market due to its large fleet size, defense investments, and innovation in SATCOM systems, Europe has strong OEM activity and regulatory modernization. Key players like Honeywell (U.S.), Thales Group (France) and Cobham (U.S.) dominate by robust R&D, strategic partnerships and diversification across frequency bands. OEMs contribute the majority of market share as advanced antennas are increasingly integrated into new aircraft builds, while the aftermarket segment grows by replacement cycles and upgrade programs. Trade disruptions, like U.S. FAA regulations on 5G interference and rising localization efforts are reshaping global supply chains and compliance protocols, impacting deployment timeline and product design strategies. Report covers the Aircraft Antenna Market dynamic, structure by analyzing the market segments and projecting Aircraft Antenna Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies and regional presence in the Aircraft Antenna Market.To know about the Research Methodology:-Request Free Sample Report

Aircraft Antenna Market Dynamics

High-Speed Data Connectivity to Drive the Aircraft Antenna Market Growth

The growing need for high-speed data connectivity is a significant driver for growth. As global air travel demand continues to rise, the aviation industry is expected to experience sustained growth over the next two decades. According to the International Air Transport Association (IATA), global passenger numbers are projected to double to 8.2 billion by 2037. In October 2024, IATA reported a 7.1% increase in global air travel demand compared to October 2023. As air traffic increases, airlines are expanding their fleets to accommodate more passengers. This surge in demand has led various airlines to place new aircraft orders at a higher rate. For instance, Airbus delivered 735 commercial aircraft in 2023, marking an 11% increase from 2022. Similarly, Boeing received a total of 1,314 net new orders in 2024, up from 774 net new orders in 2022. The number of aircraft orders is expected to continue rising in 2025 due to increased global air traffic. This increase in aircraft production directly relates to a heightened demand for advanced aircraft antennas, which are essential components of communication systems onboard aircraft. As airlines modernize their fleets and integrate new technologies, there is a growing need for sophisticated antennas that support enhanced communication and navigation capabilities. All these factors collectively contribute to the aircraft antenna market growth.Unmanned Aerial Vehicles for Commercial to Drive Aircraft Antenna Market Growth

A surge in aircraft up-gradation, an increase in demand for military UAV exercises, and a rise in the adoption of advanced communication & navigation systems are a few major factors that drive the global market. Military agencies are investing in developing military-class drones that are being used on the battlefield. Reliable communication has become a key aspect in the military applications of UAVs. Major key players are getting productive accreditation, inspiring market growth toward innovations, and operative resemblance in the industry. In April 2020, Lockheed Martin concluded the first phase of the Multi-Function Electronic Warfare Air Large (MFEW-AL) program for the U.S. Army. MFEW-AL program focuses on antenna technology for incorporating electronic warfare and cyber techniques in Unmanned Aerial Systems (UAS). The increase in demand for military UAVs is driving the growth of the market, as these unmanned systems require advanced antennas for reliable communication and data transmission. Moreover, the defense forces of various countries are allocating significant budgets for unmanned systems and associated technologies. For instance, in 2025, the U.S. Department of Defense's (DoD) budget requested to allocate USD 61.2 billion for Unmanned Aircraft Systems (UAS) such as the MQ-4 Triton and MQ-25 Stingray. As the production and development of UAVs increase, the demand for high-performance antennas to support communication, navigation, and surveillance rises. Thus, an increase in demand for unmanned systems from the defense forces and commercial applications leads to the growing demand for next-generation communication and navigational antennas that drive the aircraft antenna market growth.Stringent Government Regulations to Hinder Aircraft Antenna Market Growth

Airlines across the globe are seeking budget-friendly solutions related to aircraft antennas. However, the current war situation has resulted in severe disruption of supply and distribution chains. Moreover, airline operators have failed to generate a considerable profit. Major restraints affecting the market growth include the increase in the number of cancellations of aircraft orders. This may include the decline in aircraft deliveries that occurred due to Boeing's retaliation from the contract of the BOEING 737 Max jet. Such incidents affect the overall market growth. The Federal Aviation Administration (FAA) is adopting a new Airworthiness Directive (AD) for all the company’s model airplanes to avoid the interference of 5G bands with the installed components, which could impact its functionality. These safety directives must be in effect for overall safety and need to be considered seriously. Implementation of 5G frequency bands in airports is restricting a few aircraft from following the guidelines, as some fleets have old systems installed. A few components get damaged when a plane lands at the airport because they are not compatible with new frequencies. This could act as a restraining factor for the market.Modernization of Air Traffic Management Infrastructures to Boost Aircraft Antenna Market Growth

The demand for technologically advanced aircraft has increased drastically over the last few years. Major players in developed countries are currently focusing on the innovative manufacturing of advanced aircraft. Modernization of air traffic management infrastructure improves the efficiency of the global aviation industry. Air traffic management infrastructure consists of air navigation services to handle air traffic and reduce flight delays more efficiently. Antennas help improve the connectivity to the aircraft, from air-air and air to land. Under the Federal Aviation Administration’s Next-Generation Air Transportation System program, the current communication infrastructure in the U.S. aviation industry is projected to be updated. The success of the program will increase the safety standards for passengers and the efficiency of air traffic management systems.Aircraft Antenna Market Segment Analysis

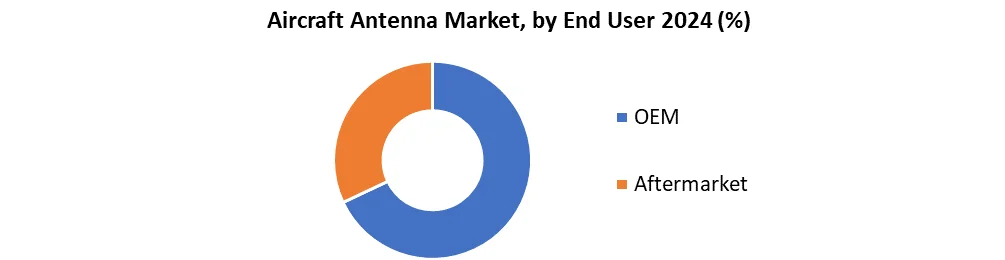

Based on frequency, the market is segmented into VHF & UHF band, Ka/Ku/K band, HF band, X band, C band, and others. The Ka/Ku/K band segment will showcase the highest rate during the forecast period. This growth is due to the rapid adoption of 5G in aviation. The Ka/Ku/K band hybrid aviation satcom antenna enables global broadband connectivity services for government and commercial users on worldwide high-capacity and conventional satellite networks. The X-band segment is projected to be the largest segment during the forecast period. The X band is a microwave radiofrequency. It is used for in-flight radar communication with Earth-based air traffic control stations. The X-band segment is expected to grow significantly owing to the rise in the use of military aircraft and UAVs for tactical communication, surveillance, and electronic warfare.Based on end-user, the market is divided into OEM and aftermarket. The OEM segment dominated the market and will continue to dominate during the forecast period. The presence of a large number of aviation antenna providers for numerous applications, such as communication, navigation, and surveillance for real-time data, drives the segment’s growth in the market. Original Equipment Manufacturers (OEMs) in the market constantly focus on integrating advanced antenna technologies into new aircraft designs. For instance, in May 2024, Eclipse Global Connectivity, ThinKom, Kontron, and Display Interactive announced a collaboration for retrofitting over 50 narrow-body aircraft with high-speed connectivity solutions, utilizing the ThinAir Ka2517 antenna for enhanced in-flight connectivity. Therefore, the surge in demand for sophisticated communication systems and in-flight entertainment capabilities further propels OEMs to innovate their product line and increase their market share in the industry. The aftermarket segment will witness the highest growth during the forecast period. Regular replacement of aircraft antennas due to limited life span and maintenance services of an aircraft for enhanced operations drive the growth of the aftermarket segment. For instance, in November 2023, VSE Aviation, a segment of VSE Corporation, secured six new distribution agreements valued at approximately USD 750 million from Honeywell International, Inc. This is an expansion of its existing agreement with Honeywell to be the sole aftermarket distributor for their JetWave tail-mounted antenna systems in Europe, the Middle East, Africa, and India (EMEAI).

Aircraft Antenna Market Regional Analysis

North America dominated the market in 2024 and this growth is attributed to the presence of a well-flourished aviation industry, and the highest aircraft fleet in the U.S. Furthermore, rising investments in developing technologically advanced aircraft antennas boost the market growth in the region. The military forces of the countries in this region are investing in reliable connectivity solutions for military operations. For instance, in September 2024, Viasat, Inc. received a USD 33.6 million contract from the U.S. Air Force Research Laboratory (AFRL) under the Defense Experimentation Using Commercial Space Internet (DEUCSI) program. The contract aims to develop and deliver Active Electronically Scanned Array (AESA) systems for resilient satellite communications for tactical aircraft, including rotary-wing platforms. Such developments will drive other aircraft antenna providers in the region to focus on innovation and production of advanced satellite antenna systems.Aircraft Antenna Market Competitive Landscape

The global aircraft antenna market is competitive, with top players like Honeywell International Inc. (U.S), Thales Group (France) and Cobham Aerospace Communications (U.S) shaping industry's strategic direction by advanced technology, robust partnerships and global reach. Companies maintain strong position in both commercial and military aviation by offering diversified, reliable and scalable antenna system made for evolving aviation demands. 1. Honeywell International Inc., a dominant force in aerospace technologies, is integrating its avionics system to enhance in flight connectivity and navigation capability. The company invests heavily in R&D to introduce lightweight, multi band antennas optimized for next-generation aircraft and urban air mobility platforms. 2. Thales Group, have significant market share across Europe and beyond, with cutting edge innovations in SATCOM, navigation and surveillance antennas. Its strategic collaborations with defence organizations and civil aviation authorities enable Thales to remain agile and forward looking in high reliability antenna systems. 3. Cobham Aerospace Communications is known for its SATCOM and blade antenna technologies used in both commercial jets and fighter aircraft. The firm’s technical excellence, global supply chain and continuous investment in miniaturized, high performance antennas position it as a pioneer in aerospace communication hardware.Aircraft Antenna Market Key Trends

Trends Details Rising Demand for In-Flight Connectivity Increasing passenger expectations for high-speed Wi-Fi and real-time data services are driving the demand for advanced SATCOM antennas, especially Ka/Ku-band systems. Miniaturization and Lightweight Antenna Design Aircraft manufacturers are prioritizing compact, lightweight antennas to improve fuel efficiency and reduce payload impact without compromising signal performance. Integration of Multi-Band and Multi-Function Antennas There is a growing shift toward integrated antennas that support multiple functions (e.g., communication, navigation, surveillance) across various frequency bands, reducing the number of components on aircraft. Aircraft Antenna Market Recent Development

1. 21st May 2024, Thales Group (France) strengthened its satellite communication capabilities by acquiring Israeli antenna specialist Get SAT, renowned for electronically steered phased-array systems like Milli Sling Blade and Lesa Blade aero ESA. 2. 17th December 2024, Sierra Nevada Corporation (U.S) and ThinKom (U.S) Solutions successfully flight-tested the ThinAir GT 2517 phased-array antenna on SNC’s RAPCON X aircraft bolstering high-performance Beyond Line of Sight connectivity. 3. 12th June 2023, Honeywell (U.S) expanded its in-flight connectivity portfolio by introducing JetWave MCX, an enhanced version of its Ka band SATCOM system, offering encrypted communications and multi-network connections for defense and commercial jets. 4. 22nd January 2025, NASA (U.S) developed and flight-tested an innovative 3D printed antenna via a weather balloon, demonstrating how additive manufacturing can accelerate complex antenna fabrication and support distributed aerospace production. 5. 22nd April 2025, Ericsson (Sweden) expands antenna manufacturing in India, while primarily telecom-focused, Ericsson’s plan to locally manufacture all telecom antennas including for aviation and defense in India (via a JV with VVDN in Gurgaon, with Pune for logistics) signals broader strategic investments in advanced antenna production capacity.Aircraft Antenna Market Scope: Inquire before buying

Aircraft Antenna Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 482.47 Mn. Forecast Period 2025 to 2032 CAGR: 7.4% Market Size in 2032: USD 854.09 Mn. Segments Covered: by Platform Aircraft UAV by Frequency VHF & UHF Band Ka/Ku/K Band HF Band X Band C Band Others by Application Communication Navigation & Surveillance by End User OEM Aftermarket Aircraft Antenna Market, By Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Aircraft Antenna Market key players are:

North America 1. Honeywell International Inc. (U.S) 2. L3Harris Technologies, Inc. (U.S) 3. Cobham Aerospace Communications (U.S) 4. Sensor Systems, Inc. (U.S) 5. Chelton Ltd. (U.S) 6. Raytheon Technologies Corporation (U.S) 7. Collins Aerospace (U.S) 8. Curtiss-Wright Corporation (U.S) 9. Astronics Corporation (U.S) 10. Northrop Grumman Corporation (U.S) Europe 11. Thales Group (France) 12. Rohde & Schwarz GmbH & Co KG (Germany) 13. Cobham Limited (UK) 14. Hensoldt AG (Germany) 15. Leonardo S.p.A. (Italy) 16. Radiall (France) 17. Terma A/S (Denmark) Asia Pacific 18. Japan Radio Co., Ltd. (Japan) 19. Mitsubishi Electric Corporation (Japan) 20. Shenzhen Sunway Communication Co., Ltd. (China) 21. Tamarack Aerospace Group (China) 22. Antenna Research Associates (ARA) (India) 23. Taiyo Yuden Co., Ltd. (Japan) 24. AVIC Avionics Systems Co., Ltd. (China) Middle East & Africa 25. Elbit Systems Ltd. (Israel) 26. IAI – Israel Aerospace Industries (Israel) 27. South African Aerospace & Defence Industry (South Africa) South America 28. AEL Sistemas S.A. (Brazil) 29. Avibras Indústria Aeroespacial S.A. (Brazil) 30. Embraer Defense & Security (Brazil)Frequently Asked Questions

1. Who are the key players in the Aircraft Antenna Market? Ans. Honeywell International Inc. (U.S), L3Harris Technologies, Inc. (U.S), Thales Group (France), Rohde & Schwarz GmbH & Co KG (Germany), Cobham Limited (UK) are some of the key players of the Aircraft Antenna market. 2. Which segment dominates the Aircraft Antenna Market? Ans. By Platform is the dominating segment in the Aircraft Antenna Market. 3. How big is the Aircraft Antenna Market? Ans. The Global Aircraft Antenna Market size reached USD 482.47 Mn in 2024 and is expected to reach USD 854.09 Mn by 2032, growing at a CAGR of 7.4% during the forecast period. 4. What are the key regions in the global Aircraft Antenna Market? Ans. Based On the region, the Aircraft Antenna Market has been classified into North America, Europe, Asia Pacific, the Middle East and Africa, and South America. North America dominates the global Aircraft Antenna market. 5. What is the study period of this market? Ans. The Global Market is studied from 2024 to 2032.

1. Aircraft Antenna Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Aircraft Antenna Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Aircraft Antenna Market: Dynamics 3.1. Region wise Trends of Aircraft Antenna Market 3.1.1. North America Aircraft Antenna Market Trends 3.1.2. Europe Aircraft Antenna Market Trends 3.1.3. Asia Pacific Aircraft Antenna Market Trends 3.1.4. Middle East and Africa Aircraft Antenna Market Trends 3.1.5. South America Aircraft Antenna Market Trends 3.2. Aircraft Antenna Market Dynamics 3.2.1. Global Aircraft Antenna Market Drivers 3.2.1.1. Rising Air Travel 3.2.1.2. UAV Adoption Growth 3.2.1.3. Demand for Connectivity 3.2.2. Global Aircraft Antenna Market Restraints 3.2.3. Global Aircraft Antenna Market Opportunities 3.2.3.1. 5G Integration 3.2.3.2. Aftermarket Expansion 3.2.3.3. Multi-band Innovation 3.2.4. Global Aircraft Antenna Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. FAA 5G Regulations 3.4.2. Defense Budget Increases 3.4.3. Tech Manufacturing Shift 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Aircraft Antenna Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 4.1.1. Aircraft 4.1.2. UAV 4.2. Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 4.2.1. VHF & UHF Band 4.2.2. Ka/Ku/K Band 4.2.3. HF Band 4.2.4. X Band 4.2.5. C Band 4.2.6. Others 4.3. Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 4.3.1. Communication 4.3.2. Navigation & Surveillance 4.4. Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 4.4.1. OEM 4.4.2. Aftermarket 4.5. Aircraft Antenna Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Aircraft Antenna Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 5.1.1. Aircraft 5.1.2. UAV 5.2. North America Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 5.2.1. VHF & UHF Band 5.2.2. Ka/Ku/K Band 5.2.3. HF Band 5.2.4. X Band 5.2.5. C Band 5.2.6. Others 5.3. North America Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 5.3.1. Communication 5.3.2. Navigation & Surveillance 5.4. North America Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 5.4.1. OEM 5.4.2. Aftermarket 5.5. North America Aircraft Antenna Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 5.5.1.1.1. Aircraft 5.5.1.1.2. UAV 5.5.1.2. United States Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 5.5.1.2.1. VHF & UHF Band 5.5.1.2.2. Ka/Ku/K Band 5.5.1.2.3. HF Band 5.5.1.2.4. X Band 5.5.1.2.5. C Band 5.5.1.2.6. Others 5.5.1.3. United States Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 5.5.1.3.1. Communication 5.5.1.3.2. Navigation & Surveillance 5.5.1.4. United States Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 5.5.1.4.1. OEM 5.5.1.4.2. Aftermarket 5.5.2. Canada 5.5.2.1. Canada Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 5.5.2.1.1. Aircraft 5.5.2.1.2. UAV 5.5.2.2. Canada Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 5.5.2.2.1. VHF & UHF Band 5.5.2.2.2. Ka/Ku/K Band 5.5.2.2.3. HF Band 5.5.2.2.4. X Band 5.5.2.2.5. C Band 5.5.2.2.6. Others 5.5.2.3. Canada Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 5.5.2.3.1. Communication 5.5.2.3.2. Navigation & Surveillance 5.5.2.4. Canada Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 5.5.2.4.1. OEM 5.5.2.4.2. Aftermarket 5.5.3. Mexico 5.5.3.1. Mexico Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 5.5.3.1.1. Aircraft 5.5.3.1.2. UAV 5.5.3.2. Mexico Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 5.5.3.2.1. VHF & UHF Band 5.5.3.2.2. Ka/Ku/K Band 5.5.3.2.3. HF Band 5.5.3.2.4. X Band 5.5.3.2.5. C Band 5.5.3.2.6. Others 5.5.3.3. Mexico Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 5.5.3.3.1. Communication 5.5.3.3.2. Navigation & Surveillance 5.5.3.4. Mexico Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 5.5.3.4.1. OEM 5.5.3.4.2. Aftermarket 6. Europe Aircraft Antenna Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 6.2. Europe Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 6.3. Europe Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 6.4. Europe Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 6.5. Europe Aircraft Antenna Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 6.5.1.2. United Kingdom Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 6.5.1.3. United Kingdom Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 6.5.1.4. United Kingdom Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 6.5.2. France 6.5.2.1. France Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 6.5.2.2. France Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 6.5.2.3. France Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 6.5.2.4. France Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 6.5.3.2. Germany Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 6.5.3.3. Germany Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 6.5.3.4. Germany Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 6.5.4.2. Italy Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 6.5.4.3. Italy Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 6.5.4.4. Italy Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 6.5.5.2. Spain Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 6.5.5.3. Spain Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 6.5.5.4. Spain Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 6.5.6.2. Sweden Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 6.5.6.3. Sweden Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 6.5.6.4. Sweden Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 6.5.7.2. Russia Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 6.5.7.3. Russia Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 6.5.7.4. Russia Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 6.5.8.2. Rest of Europe Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 6.5.8.3. Rest of Europe Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 6.5.8.4. Rest of Europe Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7. Asia Pacific Aircraft Antenna Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.2. Asia Pacific Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.3. Asia Pacific Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5. Asia Pacific Aircraft Antenna Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.1.2. China Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.1.3. China Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.1.4. China Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.2.2. S Korea Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.2.3. S Korea Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.2.4. S Korea Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.3.2. Japan Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.3.3. Japan Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.3.4. Japan Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.4. India 7.5.4.1. India Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.4.2. India Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.4.3. India Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.4.4. India Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.5.2. Australia Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.5.3. Australia Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.5.4. Australia Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.6.2. Indonesia Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.6.3. Indonesia Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.6.4. Indonesia Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.7.2. Malaysia Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.7.3. Malaysia Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.7.4. Malaysia Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.8.2. Philippines Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.8.3. Philippines Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.8.4. Philippines Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.9.2. Thailand Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.9.3. Thailand Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.9.4. Thailand Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.10.2. Vietnam Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.10.3. Vietnam Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.10.4. Vietnam Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 7.5.11.2. Rest of Asia Pacific Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 7.5.11.3. Rest of Asia Pacific Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 7.5.11.4. Rest of Asia Pacific Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa Aircraft Antenna Market Size and Forecast (by Value in USD Million) (2024-2032 8.1. Middle East and Africa Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 8.2. Middle East and Africa Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 8.3. Middle East and Africa Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 8.5. Middle East and Africa Aircraft Antenna Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 8.5.1.2. South Africa Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 8.5.1.3. South Africa Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 8.5.1.4. South Africa Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 8.5.2.2. GCC Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 8.5.2.3. GCC Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 8.5.2.4. GCC Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 8.5.3.2. Egypt Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 8.5.3.3. Egypt Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 8.5.3.4. Egypt Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 8.5.4.2. Nigeria Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 8.5.4.3. Nigeria Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 8.5.4.4. Nigeria Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 8.5.5.2. Rest of ME&A Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 8.5.5.3. Rest of ME&A Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 8.5.5.4. Rest of ME&A Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 9. South America Aircraft Antenna Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 9.1. South America Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 9.2. South America Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 9.3. South America Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 9.4. South America Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 9.5. South America Aircraft Antenna Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 9.5.1.2. Brazil Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 9.5.1.3. Brazil Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 9.5.1.4. Brazil Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 9.5.2.2. Argentina Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 9.5.2.3. Argentina Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 9.5.2.4. Argentina Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 9.5.3.2. Colombia Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 9.5.3.3. Colombia Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 9.5.3.4. Colombia Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 9.5.4.2. Chile Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 9.5.4.3. Chile Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 9.5.4.4. Chile Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 9.5.5. Rest of South America 9.5.5.1. Rest of South America Aircraft Antenna Market Size and Forecast, By Platform (2024-2032) 9.5.5.2. Rest of South America Aircraft Antenna Market Size and Forecast, By Frequency (2024-2032) 9.5.5.3. Rest of South America Aircraft Antenna Market Size and Forecast, By Application (2024-2032) 9.5.5.4. Rest of South America Aircraft Antenna Market Size and Forecast, By End User (2024-2032) 10. Company Profile: Key Players 10.1. Honeywell International Inc. (U.S) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. L3Harris Technologies, Inc. (U.S) 10.3. Cobham Aerospace Communications (U.S) 10.4. Sensor Systems, Inc. (U.S) 10.5. Chelton Ltd. (U.S) 10.6. Raytheon Technologies Corporation (U.S) 10.7. Collins Aerospace (U.S) 10.8. Curtiss-Wright Corporation (U.S) 10.9. Astronics Corporation (U.S) 10.10. Northrop Grumman Corporation (U.S) 10.11. Thales Group (France) 10.12. Rohde & Schwarz GmbH & Co KG (Germany) 10.13. Cobham Limited (UK) 10.14. Hensoldt AG (Germany) 10.15. Leonardo S.p.A. (Italy) 10.16. Radiall (France) 10.17. Terma A/S (Denmark) 10.18. Japan Radio Co., Ltd. (Japan) 10.19. Mitsubishi Electric Corporation (Japan) 10.20. Shenzhen Sunway Communication Co., Ltd. (China) 10.21. Tamarack Aerospace Group (China) 10.22. Antenna Research Associates (India) 10.23. Taiyo Yuden Co., Ltd. (Japan) 10.24. AVIC Avionics Systems Co., Ltd. (China) 10.25. Elbit Systems Ltd. (Israel) 10.26. IAI – Israel Aerospace Industries (Israel) 10.27. South African Aerospace & Defence Industry (South Africa) 10.28. AEL Sistemas S.A. (Brazil) 10.29. Avibras Indústria Aeroespacial S.A. (Brazil) 10.30. Embraer Defense & Security (Brazil) 11. Key Findings 12. Industry Recommendations 13. Aircraft Antenna Market: Research Methodology