Global Active Pharmaceutical Ingredients Market size was valued at USD 100.1 Billion in 2024, and the total Active Pharmaceutical Ingredients Market revenue is expected to grow by 6.3% from 2025 to 2032, reaching nearly USD 163.19 Billion.Active Pharmaceutical Ingredients Market Overview

Active Pharmaceutical Ingredients (APIs) form the backbone of the pharmaceutical industry, providing the therapeutic effects that drive patient outcomes. Today, the API market is evolving rapidly, influenced by technological innovations, AI-assisted drug discovery, continuous manufacturing, and precision synthesis. These advancements are enabling manufacturers to deliver products that are more consistent, higher in quality, and produced at faster rates. Global demand for specialized therapies—ranging from precision medicines to biologics and chronic condition treatments—is reshaping the API industry.To know about the Research Methodology :- Request Free Sample Report Manufacturers are increasingly prioritizing high-quality standards, accelerated production timelines, and strict regulatory compliance to meet the expectations of global healthcare providers and patients. From a production perspective, India and China continue to dominate API supply globally, benefiting from cost-effective manufacturing, skilled labor, and extensive Good Manufacturing Practices (GMP) infrastructure. Meanwhile, North America and Europe are seeing a strategic push toward domestic API production, accelerated by post-COVID-19 initiatives aimed at building resilient supply chains. U.S. federal programs targeting supply chain security and self-reliance are also creating incentives to reduce dependency on overseas suppliers. The product mix within the API market is also shifting. While traditional small-molecule APIs remain significant, there is noticeable growth in APIs for biologics, peptides, and specialty therapies, particularly in oncology, autoimmune disorders, and rare diseases. Leading API producers—including Teva API, Dr. Reddy's API, Pfizer CentreOne, and Lonza—are leveraging AI, advanced purification technologies, and partnerships with biotech and Contract Development and Manufacturing Organizations (CDMOs) to enhance production capabilities and meet complex market demands.

Active Pharmaceutical Ingredients Market Dynamics

Chronic Disease Treatments to Drive Active Pharmaceutical Ingredients Market Growth The global rise in chronic conditions-such as diabetes, cancer, cardiovascular diseases, and autoimmune diseases-is increasing demand for APIMs at an alarming rate. An aging population and improvement of healthcare access worldwide has led to rapid growth in the pharmaceutical market, which is pursued further by high-potency active pharmaceutical ingredients (HPAPIs) and personalized and targeted therapies leading to sustained growth in market demand. Supply Chain Resilience and Onshoring Initiatives to Drive the Active Pharmaceutical Ingredients Market In the aftermath of COVID-19, pharmaceutical supply chains faced dramatic and unreal disruptions, and the industry has begun to shift its supplier’s production of API back to North America, Europe, and other areas. To mitigate its dependency on foreign sourcing-leading to increased dependence on supply from China and India-governments worldwide are incentivizing local sourcing for companies. Although these changes have implications for the changing landscape of sourcing, they are providing new opportunities for domestic companies and supporting global resilience in pharmaceuticals. Regulatory Compliance and High Production Costs to restrain Active Pharmaceutical Ingredients Market Despite the apparent growth opportunities in the API manufacturing arena, it has obviously not been an all roses proposition given a complex regulatory regime, stringent environmental compliance, and sharply rising production costs. API manufacturers must navigate recent standards imposed by the FDA, EMA, and any other relevant regulatory authority to bring appropriate products to market, which can dramatically limit competition to market entry - especially for smaller and mid-sized producers. In addition, the capital-intensive nature of API manufacturing dramatically reduces scalability and access for other market participants.Active Pharmaceutical Ingredients Market Segment Analysis

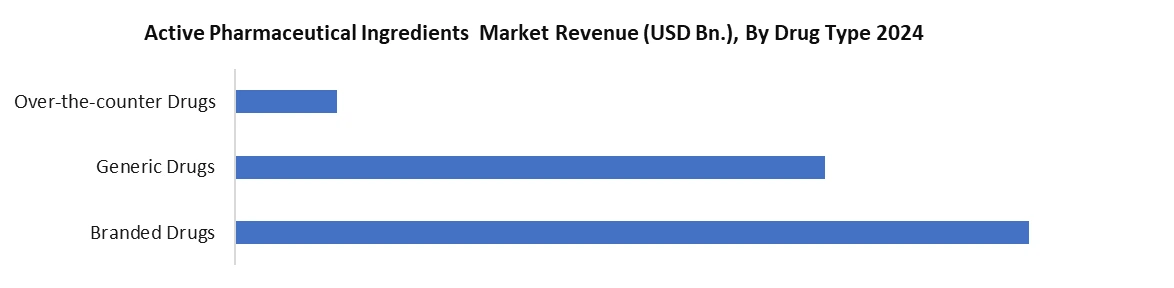

Based on Drug Type, the Active Pharmaceutical Ingredients (API) market is segmented into drug type including Branded Drugs, Generic Drugs and Over-the-Counter (OTC) Drugs. Branded Drugs provide high-value growth through the use of high-complexity API's like biologics and HPAPI's, supported by strong R&D and regulatory in developed markets. Generic Drugs are volume driven mostly by the need for affordable medicine once the patent has expired, and this is especially true in emerging economies. OTC is increasing also due to self-medication practices, as well as improved consumer health consciousness awareness, resulting in high volume demand of APIs to treat the majority of most of these common ailments. Collectively, these API segments provide balance to the overall growth of the API market.

Active Pharmaceutical Ingredients Market Competitive Landscape:

Teva Active Pharmaceutical Ingredients (Israel) and Dr. Reddy's Laboratories (India) are two key players in the global API marketplace. They each tap into API production and supply with an equivalent vision through an integrated lens; Teva is a leading and generalist API supplier with a significant API portfolio in multiple therapeutic areas or markets (e.g., oncology, cardiovascular, and CNS). Teva generally behaves as a dominant API supplier according to market share, using their vertically integrated business model, regulatory requirements (i.e., FDA, EMA), and distribution to meet the needs of both generic and branded manufacturers throughout the world. Dr. Reddy's has taken a high-quality, low-cost position as an API, and distinctly bases strategy on a backward (broadly) integrated vision and sustainability. All innovation at Dr. Reddy's seeks to green the chemistry and process of production, while also remaining capacity oriented during changing patent timelines. Dr. Reddy's undertakes R&D facilities in both India and Europe, enabling speedy development and custom synthesis, especially for generics that might be complex or in areas with limited therapeutics. Teva relies on and is using reliability-based standards, and volume capacity to penetrate growth in established markets. Conversely, Dr. Reddy's is using agility and are capacity oriented in price sensitive emerging markets. The volume of operational capacity and price (essentially, mark-up on price) brings both players towards a comparable path with their operational flexibility - but both organisations show different pricing and partnership strategies - Teva's is reliability and strength of supply chains and reliability, and for branded manufacturers globally, Dr. Reddy's is for pricing (affordability) and precision at more or less high standards (of API) in product diversity or differences in therapeutic outcome.Active Pharmaceutical Ingredients Market Key Developments:

Feb-2025-Eli Lilly-USA In the last three years, to exceed 50B USD in U.S. manufacturing investments, we have built four new U.S. pharmaceutical sites, each focused on their processes to manufacture active pharmaceutical ingredients and injectable therapies. These investments are expected to create 13,000 jobs overall, and represent the largest singular pharma manufacturing investments in U.S. history. Feb-2025-Eli Lilly-USA To develop three U.S. plants for pharmaceutical ingredient development, aiming to reshore essential segments of the drug supply chain now supplied primarily through foreign sourcing, enhanced domestic manufacturing resilience. Apr-2025-Novartis USA-To committed 23B USD over 5 years expanding US manufacturing and R&D with 10 facilities including 7 new locations has indicated it is doing this to acquire 100 % of important medications made in the US and a new R&D site in San Diego.Active Pharmaceutical Ingredients Market Key Trends:

More Outsourcing to (CMOs): Pharmaceutical companies are increasing outsourcing API production to CMOs to decrease costs, optimize their capabilities and focus on areas of primary expertise, drug development and commercialization. More Biopharmaceutical APIs: There is a preference for biopharmaceutical APIs, powered by advances in biotechnology, including more complex therapies like monoclonal antibodies and recombinant proteins. More Quality and Regulatory Compliance: Regulatory agencies across the globe are tightening standards on API manufacturing, including GMP quality standards and compliance, product safety, and product quality.Scope of the Active Pharmaceutical Ingredients Market Report: Inquire before buying

Global Active Pharmaceutical Ingredients Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 100.1 Bn. Forecast Period 2025 to 2032 CAGR: 6.3 Market Size in 2032: USD 163.19 Bn. Segments Covered: by Synthesis Type Biotech Monoclonal Antibodies Recombinant Proteins Vaccines Synthetic by Drug Type Branded Drugs Generic Drugs Over-the-counter (OTC) Drugs by Manufacturer Type Captive Manufacturers Merchant Manufacturers by Therapeutic Area Cardiology Pulmonology Opthalmology Neurology Oncology Orthopedics Active Pharmaceutical Ingredients Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Active Pharmaceutical Ingredients Market, Key Players

North America 1. United States 2. Cambrex Corporation 3. Catalent Pharma Solutions 4. Patheon (Thermo Fisher Scientific) 5. AbbVie Inc. (USA) 6. Hospira Inc. (USA) Europe 1. Switzerland 2. Lonza Group 3. Siegfried Holding AG 4. EuroAPI 5. Bachem 6. Corden Pharma 7. Evonik Industries 8. EuroAPI (Headquarters) 9. Denmark 10. AGC Biologics 11. Bristol-Myers Squibb (Ireland) 12. Xellia Pharmaceuticals (Europe) Asia-Pacific 1. India 2. Dr. Reddy’s Laboratories 3. Aurobindo Pharma 4. Sun Pharmaceutical Industries 5. Neuland Laboratories 6. Granules India 7. Unichem Laboratories 8. Alkem Laboratories 9. Jubilant Life Sciences 10. WuXi AppTec 11. CSPC Pharmaceutical Group 12. Zhejiang Hisun Pharmaceutical 13. Fosun Pharma 14. Sino Biopharmaceutical 15. Samsung Biologics 16. Astellas Pharma Inc. (Japan) 17. Takeda Pharmaceutical Company (Japan) 18. Lupin Limited (India) 19. Cipla Inc. (India) Middle East 1. Teva APIFrequently Asked Questions

1. What factors are driving the growth of the API market? Ans: Factors such as increasing prevalence of chronic diseases, growing generic drug market, and rising demand for biopharmaceuticals are driving the growth of the API market. 2. Which region dominated the API market in terms of market share? Ans: Asia Pacific currently dominated the API market, with a significant market share attributed to the presence of major pharmaceutical manufacturing hubs. 3. What are some key challenges faced by the API market? Ans: Active Pharmaceutical Ingredients ensures that every user and device, regardless of location, undergoes strict authentication and authorization, reducing the risk of unauthorized access and data breaches in remote work scenarios. 4. What challenges does the Active Pharmaceutical Ingredients market face? Ans: Challenges include stringent regulatory requirements, quality compliance issues, and the increasing cost of API production. 5. How is the market responding to the trend of outsourcing API manufacturing? Ans: There is a notable trend of pharmaceutical companies outsourcing API manufacturing to reduce costs and focus on core competencies.

1. Active Pharmaceutical Ingredients Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Active Pharmaceutical Ingredients Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Company Location 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Active Pharmaceutical Ingredients Market: Dynamics 3.1. Region-wise Trends of Active Pharmaceutical Ingredients Market 3.1.1. North America Active Pharmaceutical Ingredients Market Trends 3.1.2. Europe Active Pharmaceutical Ingredients Market Trends 3.1.3. Asia Pacific Active Pharmaceutical Ingredients Market Trends 3.1.4. Middle East and Africa Active Pharmaceutical Ingredients Market Trends 3.1.5. South America Active Pharmaceutical Ingredients Market Trends 3.2. Active Pharmaceutical Ingredients Market Dynamics 3.2.1. Active Pharmaceutical Ingredients Market Drivers 3.2.2. Active Pharmaceutical Ingredients Market Opportunity 3.2.3. Active Pharmaceutical Ingredients Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Capital Investment Trends in Smart Manufacturing 3.4.2. Rising Labour Costs in Emerging Markets 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Active Pharmaceutical Ingredients Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 4.1.1. Biotech 4.1.2. Monoclonal Antibodies 4.1.3. RECOMBINANAT PROTEINS 4.1.4. Vaccines 4.1.5. Oncology 4.2. Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 4.2.1. Branded Drugs 4.2.2. Generic Drugs 4.2.3. Over-the-counter (OTC) Drugs 4.3. Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 4.3.1. Opthalmology 4.3.2. Merchant Manufacturers 4.4. Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 4.4.1. Cardiology 4.4.2. Pulmonology 4.4.3. Opthalmology 4.4.4. Neurology 4.4.5. Oncology 4.4.6. Orthopedics 4.4.7. Others 4.5. Active Pharmaceutical Ingredients Market Size and Forecast, By region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Active Pharmaceutical Ingredients Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 5.1.1. Biotech 5.1.2. Monoclonal Antibodies 5.1.3. RECOMBINANAT PROTEINS 5.1.4. Vaccines 5.1.5. Synthetic 5.2. North America Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 5.2.1. Branded Drugs 5.2.2. Generic Drugs 5.2.3. Over-the-counter (OTC) Drugs 5.3. North America Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 5.3.1. Captive Manufacturers 5.3.2. Merchant Manufacturers 5.4. North America Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 5.4.1. Cardiology 5.4.2. Pulmonology 5.4.3. Opthalmology 5.4.4. Neurology 5.4.5. Oncology 5.4.6. Orthopedics 5.4.7. Others 5.5. North America Active Pharmaceutical Ingredients Market Size and Forecast, By Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 5.5.1.1.1. Biotech 5.5.1.1.2. Monoclonal Antibodies 5.5.1.1.3. RECOMBINANAT PROTEINS 5.5.1.1.4. Vaccines 5.5.1.1.5. Synthetic 5.5.1.2. United States Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 5.5.1.2.1. Branded Drugs 5.5.1.2.2. Generic Drugs 5.5.1.2.3. Over-the-counter (OTC) Drugs 5.5.1.3. United States Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 5.5.1.3.1. Captive Manufacturers 5.5.1.3.2. Merchant Manufacturers 5.5.1.4. United States Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 5.5.1.4.1. Cardiology 5.5.1.4.2. Pulmonology 5.5.1.4.3. Opthalmology 5.5.1.4.4. Neurology 5.5.1.4.5. Oncology 5.5.1.4.6. Orthopedics 5.5.1.4.7. Others 5.5.2. Canada 5.5.2.1. Canada Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 5.5.2.1.1. Biotech 5.5.2.1.2. Monoclonal Antibodies 5.5.2.1.3. RECOMBINANAT PROTEINS 5.5.2.1.4. Vaccines 5.5.2.1.5. Synthetic 5.5.2.2. Canada Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 5.5.2.2.1. Branded Drugs 5.5.2.2.2. Generic Drugs 5.5.2.2.3. Over-the-counter (OTC) Drugs 5.5.2.3. Canada Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 5.5.2.3.1. Captive Manufacturers 5.5.2.3.2. Merchant Manufacturers 5.5.2.4. Canada Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 5.5.2.4.1. Cardiology 5.5.2.4.2. Pulmonology 5.5.2.4.3. Opthalmology 5.5.2.4.4. Neurology 5.5.2.4.5. Oncology 5.5.2.4.6. Orthopedics 5.5.2.4.7. Others 5.5.3. Mexico 5.5.3.1. Mexico Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 5.5.3.1.1. Biotech 5.5.3.1.2. Monoclonal Antibodies 5.5.3.1.3. RECOMBINANAT PROTEINS 5.5.3.1.4. Vaccines 5.5.3.1.5. Synthetic 5.5.3.2. Mexico Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 5.5.3.2.1. Branded Drugs 5.5.3.2.2. Generic Drugs 5.5.3.2.3. Over-the-counter (OTC) Drugs 5.5.3.3. Mexico Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 5.5.3.3.1. Captive Manufacturers 5.5.3.3.2. Merchant Manufacturers 5.5.3.3.3. Stationary Systems 5.5.3.3.4. Drone-based Units 5.5.3.4. Mexico Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 5.5.3.4.1. Cardiology 5.5.3.4.2. Pulmonology 5.5.3.4.3. Opthalmology 5.5.3.4.4. Neurology 5.5.3.4.5. Oncology 5.5.3.4.6. Orthopedics 5.5.3.4.7. Others 6. Europe Active Pharmaceutical Ingredients Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 6.2. Europe Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 6.3. Europe Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 6.4. Europe Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 6.5. Europe Active Pharmaceutical Ingredients Market Size and Forecast, By Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 6.5.1.2. United Kingdom Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 6.5.1.3. United Kingdom Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 6.5.1.4. United Kingdom Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 6.5.2. France 6.5.2.1. France Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 6.5.2.2. France Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 6.5.2.3. France Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 6.5.2.4. France Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 6.5.3.2. Germany Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 6.5.3.3. Germany Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 6.5.3.4. Germany Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 6.5.4.2. Italy Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 6.5.4.3. Italy Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 6.5.4.4. Italy Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 6.5.5.2. Spain Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 6.5.5.3. Spain Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 6.5.5.4. Spain Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 6.5.6.2. Sweden Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 6.5.6.3. Sweden Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 6.5.6.4. Sweden Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 6.5.7.2. Austria Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 6.5.7.3. Austria Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 6.5.7.4. Austria Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 6.5.8.2. Rest of Europe Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 6.5.8.3. Rest of Europe Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 6.5.8.4. Rest of Europe Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7. Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.2. Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.3. Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.4. Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5. Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast, By Country (2024-2032) 7.5.1. China 7.5.1.1. China Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.1.2. China Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.1.3. China Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.1.4. China Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.2.2. S Korea Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.2.3. S Korea Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.2.4. S Korea Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.3.2. Japan Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.3.3. Japan Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.3.4. Japan Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.4. India 7.5.4.1. India Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.4.2. India Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.4.3. India Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.4.4. India Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.5.2. Australia Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.5.3. Australia Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.5.4. Australia Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.6.2. Indonesia Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.6.3. Indonesia Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.6.4. Indonesia Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.7.2. Philippines Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.7.3. Philippines Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.7.4. Philippines Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.8.2. Malaysia Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.8.3. Malaysia Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.8.4. Malaysia Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.9.2. Vietnam Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.9.3. Vietnam Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.9.4. Vietnam Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.10.2. Thailand Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.10.3. Thailand Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.10.4. Thailand Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 7.5.11.4. Rest of Asia Pacific Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 8. Middle East and Africa Active Pharmaceutical Ingredients Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 8.2. Middle East and Africa Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 8.3. Middle East and Africa Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 8.4. Middle East and Africa Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 8.5. Middle East and Africa Active Pharmaceutical Ingredients Market Size and Forecast, By Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 8.5.1.2. South Africa Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 8.5.1.3. South Africa Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 8.5.1.4. South Africa Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 8.5.2.2. GCC Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 8.5.2.3. GCC Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 8.5.2.4. GCC Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 8.5.3.2. Nigeria Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 8.5.3.3. Nigeria Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 8.5.3.4. Nigeria Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 8.5.4.2. Rest of ME&A Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 8.5.4.3. Rest of ME&A Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 8.5.4.4. Rest of ME&A Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 9. South America Active Pharmaceutical Ingredients Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 9.2. South America Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 9.3. South America Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 9.4. South America Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 9.5. South America Active Pharmaceutical Ingredients Market Size and Forecast, By Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 9.5.1.2. Brazil Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 9.5.1.3. Brazil Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 9.5.1.4. Brazil Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 9.5.2.2. Argentina Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 9.5.2.3. Argentina Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 9.5.2.4. Argentina Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Active Pharmaceutical Ingredients Market Size and Forecast, By Synthesis Type (2024-2032) 9.5.3.2. Rest of South America Active Pharmaceutical Ingredients Market Size and Forecast, By Drug Type (2024-2032) 9.5.3.3. Rest of South America Active Pharmaceutical Ingredients Market Size and Forecast, By Manufacturer Type (2024-2032) 9.5.3.4. Rest of South America Active Pharmaceutical Ingredients Market Size and Forecast, By Therapeutic Area (2024-2032) 10. Company Profile (Detailed Profile for all Major Industry Players) 10.1. Dr. Reddy’s Laboratories 10.1.1. Business Portfolio 10.1.2. Financial Overview 10.1.3. SWOT Analysis 10.1.4. Strategic Analysis 10.1.5. Recent Developments 10.2. Cambrex Corporation 10.3. Catalent Pharma Solutions 10.4. Patheon (Thermo Fisher Scientific) 10.5. AbbVie Inc. (USA) 10.6. Hospira Inc. (USA) 10.7. Switzerland 10.8. Lonza Group 10.9. Siegfried Holding AG 10.10. EuroAPI 10.11. Bachem 10.12. Corden Pharma 10.13. Evonik Industries 10.14. EuroAPI (Headquarters) 10.15. AGC Biologics 10.16. Bristol-Myers Squibb (Ireland) 10.17. Xellia Pharmaceuticals (Europe) 10.18. Aurobindo Pharma 10.19. Sun Pharmaceutical Industries 10.20. Neuland Laboratories 10.21. Granules India 10.22. Unichem Laboratories 10.23. Alkem Laboratories 10.24. Jubilant Life Sciences 10.25. WuXi AppTec 10.26. CSPC Pharmaceutical Group 10.27. Zhejiang Hisun Pharmaceutical 10.28. Fosun Pharma 10.29. Sino Biopharmaceutical 10.30. Samsung Biologics 10.31. Astellas Pharma Inc. (Japan) 10.32. Takeda Pharmaceutical Company (Japan) 10.33. Lupin Limited (India) 10.34. Cipla Inc. (India) 10.35. Teva API 11. Analyst Recommendations 12. Active Pharmaceutical Ingredients Market: Research Methodology