Global Smart Card Market size was valued at USD 15.05 Bn in 2023 and is expected to reach USD 19.94 Bn by 2030, at a CAGR of 4.1%.Smart Card Market Overview

A smart card is a compact physical card housing an embedded integrated chip, serving as a secure authentication token. Typically resembling the size of a credit card, smart cards utilize either direct physical contact (chip and dip) or short-range wireless connectivity including RFID or NFC to connect to a reader. These cards feature either a microcontroller or embedded memory chip, ensuring tamper-resistant operations and encryption for data protection. While widely used for credit and payment transactions, smart cards also have applications in multifactor authentication systems. Smart Card Market growth in the United States, notably in healthcare and banking, following European popularity surge. Increased adoption drives growth. Their embedded microprocessors offer enhanced security and functionality compared to traditional magnetic stripe cards, driving their adoption globally.To know about the Research Methodology :- Request Free Sample Report Smart cards, equipped with embedded integrated chips, offer advanced security features and versatile functionality, making them indispensable in modern digital transactions. The adoption of smart cards is propelled by their ability to provide secure access control, authentication, and data protection in applications ranging from financial services and healthcare to government and transportation. The widespread implementation of smart cards for credit and debit payments, particularly with the adoption of EMV standards in regions including Europe, drives the Smart Card Market. The proliferation of contactless payment systems leveraging short-range wireless connectivity standards such as RFID and NFC further accelerates the growth of the smart card industry. In addition to payment cards, smart cards are increasingly utilized as tokens for multifactor authentication systems, enhancing security in online transactions and access control. The healthcare sector, particularly in Europe, extensively employs smart cards for patient identification, electronic health records, and insurance authentication. The government initiatives for secure identification and digital services contribute to the increasing smart card market.

Smart Card Market Trend

Integration of Biometric Authentication Technology Biometric smart cards, equipped with embedded biometric data for identification and authentication, represent a significant advancement in security and convenience. Traditionally, smart cards stored biometric data for comparison with information captured by separate biometric readers. However, recent innovations have led to the development of smart cards with embedded biometric sensors capable of performing on-device 1:1 matching. This evolution marks an essential shift in the industry, offering enhanced security and efficiency by enabling seamless authentication directly on the card itself. Biometric smart cards have extensive applications in various sectors, including identification documents, access control systems, and payment solutions. They are increasingly utilized as national ID cards, driving licenses, and Aadhaar cards in countries including India and the United States which boosts the Smart Card Market growth. They play physical access control deployments, ensuring multi-factor security in facilities where strong authentication is paramount. The financial service providers are actively exploring the integration of biometric smart cards for secure and convenient payment options at point-of-sale terminals. The commercial launch of these cards signifies a substantial milestone in the evolution of payment technology, promising to revolutionize the way transactions are conducted securely and efficiently. The increasing integration of biometric authentication technology underscores the Smart Card Market commitment to advancing security, convenience, and innovation in digital authentication solutions. Benefits of Biometric Smart Cards

Benefit Description Enhanced Privacy Biometric information stays secure on the card itself, acting as a personal database, firewall and authentication terminal. This reduces the risk of data breaches and unauthorized access. Enhanced Security Combining biometrics with smart cards strengthens authentication by requiring both the correct card and matching biometric data, minimizing the risk of unauthorized access even if the card is lost or stolen. Better Performance Smart cards offer contactless interfaces for faster authentication. Biometric matching happens directly on the card, often without needing to connect to a central database, improving speed and efficiency. Enhanced Flexibility Smart cards are easily programmed to store additional data, update authentication logic, or integrate with different identification systems. This allows for future upgrades and improved security measures such as incorporating newer biometric algorithms. Smart Card Market Dynamics

Growing Adoption of Contactless Payment Systems to Boost Market Growth Contactless payment systems revolutionize consumer engagement in financial transactions, providing a seamless and convenient experience. Utilizing wireless technology, customers effortlessly conduct purchases by tapping their security token, it chip-enabled bank cards or smartphone digital wallet apps, near the vendor's point-of-sale (POS) reader. This touch-free method, termed tap-and-go or proximity payments, gains popularity due to its simplicity and speed, reshaping the landscape of digital commerce. The idea of frictionless checkout, where transactions occur seamlessly without physical contact or prolonged processing times, becomes synonymous with the integration of contactless payments. The conventional payment methods involve the direct sharing of sensitive billing and payment information with vendors, and contactless payments employ encrypted communication channels and tokenization technology which drive Smart Card Market growth. Each transaction generates a unique one-time code, or token, ensuring limited access to information in case of intercepted wireless transmissions. This security framework instills confidence among consumers and merchants, mitigating concerns surrounding fraud and unauthorized access. The momentum behind the adoption of contactless payments receives impetus from external factors, particularly the COVID-19 pandemic. With an increased emphasis on hygiene and safety, consumers prefer contactless transactions to minimize person-to-person contact during in-store purchases. This behavioral shift accelerates the integration of contactless payment technologies across several industries, spanning retail, hospitality, transportation, and healthcare. Key industry organizations such as the U.S. Payments Forum and EMV (Europay, Mastercard, Visa) contribute significantly to driving the adoption of contactless payments. By establishing technical standards for smart payment cards and POS readers, these entities facilitate seamless implementation and interoperability across different systems. The rising adoption of contactless payments heralds a transformative shift in financial transaction practices, offering unmatched convenience, security, and efficiency helping to boost Smart Card Market growth. As consumers increasingly embrace tap-and-go transactions, the Smart Card industry grows, with contactless payments at the forefront of innovation in digital commerce. The increase in the number of mobile users worldwide has significantly boosted The Smart Card Market. With the proliferation of smartphones, the demand for secure digital transactions, access control, and identity verification has surged, driving the adoption of smart cards in various applications.Risk of Security Vulnerabilities and Data Breaches to hamper Market Growth The risk of security vulnerabilities and data breaches poses a significant constraint on the Smart Card Market due to its widespread utilization in secure transactions, encompassing financial transactions, access control, and identity verification. Any compromise in smart card security leads to severe repercussions such as financial losses, identity theft, and reputational damage for individuals and organizations alike. With smart card technology evolving, cybercriminals continuously devise new methods to exploit vulnerabilities, perpetually threatening the integrity of smart card systems. The extensive adoption of smart cards across sectors such as banking, healthcare, government, and transportation amplifies the potential impact of security breaches, necessitating urgent implementation of robust security measures and risk mitigation strategies. The complexity involved in deploying and maintaining secure smart card systems presents additional challenges, requiring substantial investments in advanced encryption protocols, secure authentication mechanisms, and regular updates to combat emerging threats. This complexity poses obstacles for smaller businesses or organizations lacking adequate resources and cybersecurity expertise.

Smart Card Market Segment Analysis

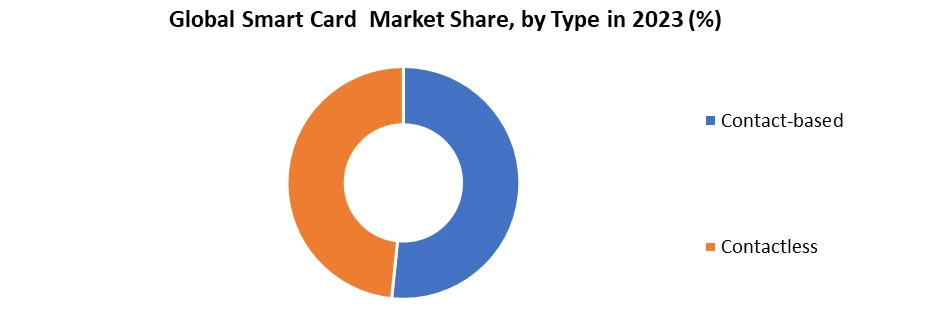

Based on the Type, the market is segmented into Contactless and Contact-based. Contactless type is expected to dominate the Smart Card Market during the forecast period. Contactless smart cards utilize radio frequency identification (RFID) or near-field communication (NFC) technology, enabling seamless communication between the card and a reader without the need for physical contact. Their widespread adoption is the convenience they offer. Unlike traditional magnetic stripe cards or contact-based smart cards, contactless smart cards allow for swift transactions with just a simple tap or wave, significantly reducing the time spent at payment terminals or access points. This convenience factor is particularly crucial in environments where speed and efficiency are paramount including public transportation systems, where contactless smart cards facilitate smooth entry and exit processes for commuters. The contactless smart cards boast enhanced security features compared to their counterparts. The absence of physical contact minimizes the risk of wear and tear, ensuring the longevity of the card and reducing the likelihood of malfunction or data loss. Contactless smart cards typically employ encryption and authentication protocols to safeguard sensitive information, such as financial data or personal identifiers, from unauthorized access or interception. This strong security framework instills confidence among users and organizations, making contactless smart cards an attractive choice for applications involving sensitive data, including payment cards, access control systems, and identification badges. The versatility of contactless smart cards extends beyond traditional payment and access control functions which boost Smart Card Market growth. These cards are utilized in various sectors, including healthcare, transportation, hospitality, and government services, to streamline processes, enhance security, and improve the user experience. 1. For instance, in healthcare settings, contactless smart cards enable quick and accurate patient identification, access to medical records, and authentication of healthcare professionals, thereby facilitating efficient and secure healthcare delivery.

Smart Card Market Regional Insights

North America dominated the Smart Card Market in 2023 and is expected to continue its dominance over the forecast period. The region boasts a highly developed and technologically advanced economy, characterized by a strong emphasis on innovation and digital transformation. This environment fosters a fertile ground for the adoption of smart card technology across various sectors, including banking, finance, healthcare, government, and transportation. The region's mature financial services industry, in particular, drives significant demand for smart cards, particularly in payment and transaction processing applications. With a large population of digitally savvy consumers accustomed to convenient and secure payment methods, the adoption of smart cards for contactless payments, EMV chip technology and secure authentication continues to surge across North America. The stringent regulatory standards and compliance requirements accelerate the adoption of smart card technology in the region. Regulatory initiatives such as the EMV (Europay, Mastercard, Visa) standards mandate the implementation of chip-enabled smart cards for payment transactions, driving widespread adoption among financial institutions and merchants. The government initiatives aimed at enhancing security, improving identity verification and modernizing public services fuel the deployment of smart card-based solutions in various government agencies and public sectors and drive Smart Card Market growth. . For instance, the implementation of smart card-based driver's licenses, national ID cards, and healthcare cards underscores the region's commitment to leveraging smart card technology for enhanced security and efficiency. North America benefits from a well-established infrastructure supporting smart card deployment and integration. The region boasts a strong network of smart card manufacturers, technology providers, system integrators, and service providers catering to diverse industry verticals. This ecosystem facilitates seamless collaboration and innovation in developing advanced smart card solutions tailored to specific market needs and requirements. The presence of leading technology giants and innovative startups propels the Smart Card Market growth in North America, driving advancements in biometric authentication, contactless payments, and secure identification solutions.Global Smart Card Market Scope: Inquire before buying

Global Smart Card Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 15.05 Bn. Forecast Period 2024 to 2030 CAGR: 4.1% Market Size in 2030: US $ 19.94 Bn. Segments Covered: by Type Contact-based Contactless by Component Microcontrollers Memory Chips Others by Application Banking and Financial Services Government and Public Sector Healthcare Transportation Telecommunications Others Global Smart Card Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Smart Card Key Players

Global 1. Gemalto (Amsterdam, Netherlands) 2. Giesecke+Devrient (Munich, Germany) 3. IDEMIA (Courbevoie, France) 4. NXP Semiconductors (Eindhoven, Netherlands) 5. Infineon Technologies (Neubiberg, Germany) North America 1. CPI Card Group (Littleton, Colorado, USA) 2. CardLogix Corporation (Irvine, California, USA) 3. Versatile Card Technology (Downers Grove, Illinois, USA) 4. DATACARD Group (Shakopee, Minnesota, USA) Europe 1. Oberthur Technologies (Paris, France) 2. Smartrac Technology GmbH (Amsterdam, Netherlands) 3. Linxens (Perret, France) Asia Pacific 1. Watchdata Technologies (Beijing, China) 2. Eastcompeace Technology (Shanghai, China) 3. Wuhan Tianyu Information Industry Co., Ltd. (Wuhan, China) 4. KONA I Co., Ltd. (Seoul, South Korea) 5. XH Smart Tech (China) Co., Ltd. (Shenzhen, China) 6. Chengdu Mind Golden Card System Co., Ltd. (Chengdu, China) 7. Silone Cardtech (Shenzhen, China) Frequently Asked Questions: 1] What is the growth rate of the Global Smart Card Market? Ans. The Global Smart Card Market is growing at a significant rate of 4.1% during the forecast period. 2] Which region is expected to dominate the Global Smart Card Market? Ans. North America is expected to dominate the Smart Card Market during the forecast period. 3] What is the expected Global Smart Card Market size by 2030? Ans. The Smart Card Market size is expected to reach USD 19.94 Billion by 2030. 4] Which are the top players in the Global Smart Card Market? Ans. The major top players in the Global Smart Card Market are Gemalto (Amsterdam, Netherlands), Giesecke+Devrient (Munich, Germany) ,IDEMIA (Courbevoie, France),NXP Semiconductors (Eindhoven, Netherlands), Infineon Technologies (Neubiberg, Germany),CPI Card Group (Littleton, Colorado, USA) and Others. 5] What are the factors driving the Global Smart Card Market growth? Ans. The rising need for secure identification and authentication and increasing digitalization are expected to drive market growth during the forecast period.

1. Smart Card Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Smart Card Market: Dynamics 2.1. Smart Card Market Trends by Region 2.1.1. North America Smart Card Market Trends 2.1.2. Europe Smart Card Market Trends 2.1.3. Asia Pacific Smart Card Market Trends 2.1.4. Middle East and Africa Smart Card Market Trends 2.1.5. South America Smart Card Market Trends 2.2. Smart Card Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Smart Card Market Drivers 2.2.1.2. North America Smart Card Market Restraints 2.2.1.3. North America Smart Card Market Opportunities 2.2.1.4. North America Smart Card Market Challenges 2.2.2. Europe 2.2.2.1. Europe Smart Card Market Drivers 2.2.2.2. Europe Smart Card Market Restraints 2.2.2.3. Europe Smart Card Market Opportunities 2.2.2.4. Europe Smart Card Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Smart Card Market Drivers 2.2.3.2. Asia Pacific Smart Card Market Restraints 2.2.3.3. Asia Pacific Smart Card Market Opportunities 2.2.3.4. Asia Pacific Smart Card Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Smart Card Market Drivers 2.2.4.2. Middle East and Africa Smart Card Market Restraints 2.2.4.3. Middle East and Africa Smart Card Market Opportunities 2.2.4.4. Middle East and Africa Smart Card Market Challenges 2.2.5. South America 2.2.5.1. South America Smart Card Market Drivers 2.2.5.2. South America Smart Card Market Restraints 2.2.5.3. South America Smart Card Market Opportunities 2.2.5.4. South America Smart Card Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Smart Card Industry 2.8. Analysis of Government Schemes and Initiatives For Smart Card Industry 2.9. Smart Card Market Trade Analysis 2.10. The Global Pandemic Impact on Smart Card Market 3. Smart Card Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Smart Card Market Size and Forecast, by Type (2023-2030) 3.1.1. Contact-based 3.1.2. Contactless 3.2. Smart Card Market Size and Forecast, by Component (2023-2030) 3.2.1. Microcontrollers 3.2.2. Memory Chips 3.2.3. Others 3.3. Smart Card Market Size and Forecast, by Application (2023-2030) 3.3.1. Banking and Financial Services 3.3.2. Government and Public Sector 3.3.3. Healthcare 3.3.4. Transportation 3.3.5. Telecommunications 3.3.6. Others 3.4. Smart Card Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Smart Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Smart Card Market Size and Forecast, by Type (2023-2030) 4.1.1. Contact-based 4.1.2. Contactless 4.2. North America Smart Card Market Size and Forecast, by Component (2023-2030) 4.2.1. Microcontrollers 4.2.2. Memory Chips 4.2.3. Others 4.3. North America Smart Card Market Size and Forecast, by Application (2023-2030) 4.3.1. Banking and Financial Services 4.3.2. Government and Public Sector 4.3.3. Healthcare 4.3.4. Transportation 4.3.5. Telecommunications 4.3.6. Others 4.4. North America Smart Card Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Smart Card Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Contact-based 4.4.1.1.2. Contactless 4.4.1.2. United States Smart Card Market Size and Forecast, by Component (2023-2030) 4.4.1.2.1. Microcontrollers 4.4.1.2.2. Memory Chips 4.4.1.2.3. Others 4.4.1.3. United States Smart Card Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Banking and Financial Services 4.4.1.3.2. Government and Public Sector 4.4.1.3.3. Healthcare 4.4.1.3.4. Transportation 4.4.1.3.5. Telecommunications 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Smart Card Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Contact-based 4.4.2.1.2. Contactless 4.4.2.2. Canada Smart Card Market Size and Forecast, by Component (2023-2030) 4.4.2.2.1. Microcontrollers 4.4.2.2.2. Memory Chips 4.4.2.2.3. Others 4.4.2.3. Canada Smart Card Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Banking and Financial Services 4.4.2.3.2. Government and Public Sector 4.4.2.3.3. Healthcare 4.4.2.3.4. Transportation 4.4.2.3.5. Telecommunications 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Smart Card Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Contact-based 4.4.3.1.2. Contactless 4.4.3.2. Mexico Smart Card Market Size and Forecast, by Component (2023-2030) 4.4.3.2.1. Microcontrollers 4.4.3.2.2. Memory Chips 4.4.3.2.3. Others 4.4.3.3. Mexico Smart Card Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Banking and Financial Services 4.4.3.3.2. Government and Public Sector 4.4.3.3.3. Healthcare 4.4.3.3.4. Transportation 4.4.3.3.5. Telecommunications 4.4.3.3.6. Others 5. Europe Smart Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Smart Card Market Size and Forecast, by Type (2023-2030) 5.2. Europe Smart Card Market Size and Forecast, by Component (2023-2030) 5.3. Europe Smart Card Market Size and Forecast, by Application (2023-2030) 5.4. Europe Smart Card Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Smart Card Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Smart Card Market Size and Forecast, by Component (2023-2030) 5.4.1.3. United Kingdom Smart Card Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Smart Card Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Smart Card Market Size and Forecast, by Component (2023-2030) 5.4.2.3. France Smart Card Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Smart Card Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Smart Card Market Size and Forecast, by Component (2023-2030) 5.4.3.3. Germany Smart Card Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Smart Card Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Smart Card Market Size and Forecast, by Component (2023-2030) 5.4.4.3. Italy Smart Card Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Smart Card Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Smart Card Market Size and Forecast, by Component (2023-2030) 5.4.5.3. Spain Smart Card Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Smart Card Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Smart Card Market Size and Forecast, by Component (2023-2030) 5.4.6.3. Sweden Smart Card Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Smart Card Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Smart Card Market Size and Forecast, by Component (2023-2030) 5.4.7.3. Austria Smart Card Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Smart Card Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Smart Card Market Size and Forecast, by Component (2023-2030) 5.4.8.3. Rest of Europe Smart Card Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Smart Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Smart Card Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Smart Card Market Size and Forecast, by Component (2023-2030) 6.3. Asia Pacific Smart Card Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Smart Card Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.1.3. China Smart Card Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.2.3. S Korea Smart Card Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.3.3. Japan Smart Card Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.4.3. India Smart Card Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.5.3. Australia Smart Card Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.6.3. Indonesia Smart Card Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.7.3. Malaysia Smart Card Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.8.3. Vietnam Smart Card Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.9.3. Taiwan Smart Card Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Smart Card Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Smart Card Market Size and Forecast, by Component (2023-2030) 6.4.10.3. Rest of Asia Pacific Smart Card Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Smart Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Smart Card Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Smart Card Market Size and Forecast, by Component (2023-2030) 7.3. Middle East and Africa Smart Card Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Smart Card Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Smart Card Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Smart Card Market Size and Forecast, by Component (2023-2030) 7.4.1.3. South Africa Smart Card Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Smart Card Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Smart Card Market Size and Forecast, by Component (2023-2030) 7.4.2.3. GCC Smart Card Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Smart Card Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Smart Card Market Size and Forecast, by Component (2023-2030) 7.4.3.3. Nigeria Smart Card Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Smart Card Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Smart Card Market Size and Forecast, by Component (2023-2030) 7.4.4.3. Rest of ME&A Smart Card Market Size and Forecast, by Application (2023-2030) 8. South America Smart Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Smart Card Market Size and Forecast, by Type (2023-2030) 8.2. South America Smart Card Market Size and Forecast, by Component (2023-2030) 8.3. South America Smart Card Market Size and Forecast, by Application(2023-2030) 8.4. South America Smart Card Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Smart Card Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Smart Card Market Size and Forecast, by Component (2023-2030) 8.4.1.3. Brazil Smart Card Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Smart Card Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Smart Card Market Size and Forecast, by Component (2023-2030) 8.4.2.3. Argentina Smart Card Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Smart Card Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Smart Card Market Size and Forecast, by Component (2023-2030) 8.4.3.3. Rest Of South America Smart Card Market Size and Forecast, by Application (2023-2030) 9. Global Smart Card Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Smart Card Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Gemalto (Amsterdam, Netherlands) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Giesecke+Devrient (Munich, Germany) 10.3. IDEMIA (Courbevoie, France) 10.4. NXP Semiconductors (Eindhoven, Netherlands) 10.5. Infineon Technologies (Neubiberg, Germany) 10.6. CPI Card Group (Littleton, Colorado, USA) 10.7. CardLogix Corporation (Irvine, California, USA) 10.8. Versatile Card Technology (Downers Grove, Illinois, USA) 10.9. DATACARD Group (Shakopee, Minnesota, USA) 10.10. Oberthur Technologies (Paris, France) 10.11. Smartrac Technology GmbH (Amsterdam, Netherlands) 10.12. Linxens (Perret, France) 10.13. Watchdata Technologies (Beijing, China) 10.14. Eastcompeace Technology (Shanghai, China) 10.15. Wuhan Tianyu Information Industry Co., Ltd. (Wuhan, China) 10.16. KONA I Co., Ltd. (Seoul, South Korea) 10.17. XH Smart Tech (China) Co., Ltd. (Shenzhen, China) 10.18. Chengdu Mind Golden Card System Co., Ltd. (Chengdu, China) 10.19. Silone Cardtech (Shenzhen, China) 11. Key Findings 12. Industry Recommendations 13. Smart Card Market: Research Methodology 14. Terms and Glossary