The Propane Market size was valued at USD 188.30 Mn Metric Tons in 2024 and the total Propane revenue is expected to grow at a CAGR of 4.12% from 2025 to 2032, reaching nearly USD 260.09 Mn Metric Tons.Propane Market Overview:

The three-carbon alkane propane has the chemical formula C3H8. Propane is present in the form of gas at room temperature and pressure, but it can be compressed into a liquid that can be transported. The Propane is commonly consumed as a fuel in home and industrial applications, as well as in low-emissions public transportation, as a by-product of natural gas processing and petroleum refining. It is a liquefied petroleum gas that belongs to a category of liquefied petroleum gases (LP gases).To know about the Research Methodology :- Request Free Sample Report Butane, propylene, butadiene, butylene, isobutylene, and combinations of these are among the others. Propane has a lower energy density than gasoline and coal, but it burns cleaner. Because of its low boiling point in nature, propane gas has become a prevalent choice for barbecues and portable stoves. Propane quickly vaporizes as soon as it is released from its pressurized container. Propane acts as fuel for buses, forklifts, taxis, outboard boat motors, and ice resurfacing machines, as well as recreational vehicles and campers for heat and cooking.

Global Propane Market Dynamics:

Surging Demand for Residential LPG & Supporting Government Policies

The consumption of liquefied petroleum gas (LPG) as a primary cooking fuel among the local population has increased as the population of Asia Pacific, Africa, North America, and other regions has grown. In India, for example, almost 80% of all residential families consumes LPG as a cooking fuel. LPG is easily accessible, clean, ecological, portable, and, most significantly, cost-effective when compared to traditional fuels like wood and coal. Many governments throughout the world have launched campaigns to promote the use of LPG as a cooking fuel thanks to its advantages over traditional fuel. For example, The Pradhan Mantri Ujjwala Yojna, an Indian government initiative in which 50 million LPG connections were expected to be distributed to women from low-income households, as well as other initiatives such as simplifying registration processes and payments, cylinder delivery, and cylinder subsidies, have resulted in increased acceptance of LPG as a household fuel, reducing reliance on traditionally used hazardous cooking fuels such as firewood and coal. As propane is one of the key ingredients in the production of LPG, these factors are expected to drive its demand.Global Propane Market Segment Analysis:

Based on Application, the propane market is segmented, portable stoves, refrigerant, domestic and industrial fuel, motor fuel, and shipping fuel. In 2024, the domestic and industrial fuel segment was dominant and held xx% of the overall market share in terms of revenue as it is widely used in many industrial and domestic applications. It is a common fuel for home heating and backup electricity generating in remote regions without natural gas pipelines since it is easily transportable. Propane is used to heat cattle shelters, grain dryers, and other heat-producing appliances in rural areas of North America and northern Australia. When propane is used for heating or grain drying, it is often stored in a huge, permanent cylinder that is refilled by a propane supply truck. In , 625 million households in the United States used propane as their major source of heat. In North America, big cylinders that are permanently installed on the property are filled by local delivery trucks with an average cylinder capacity of 3,000 US gallons, or other service vehicles swap empty propane cylinders with filled cylinders. Large tractor-trailer vehicles bring propane from the pipeline or refinery to the local bulk plant, with an average cylinder capacity of 10,000 US gallons.

Global Propane Market Regional Insights:

China is the world's largest propane consumer, accounting for over 20% of global consumption. To meet the enormous local demand, China imported 14.91 million metric tonnes of propane in , an increase of around 10.8% year on year above total imports in . The rising demand from propane dehydrogenation facilities, or PDH plants, is the main reason for the increase in propane imports in the country. China is the Asia-second-largest Pacific Autogas market, following Thailand. China's Autogas business grew substantially as a result of municipal programs promoting alternative fuels to combat the country's rising air pollution problem. Autogas schemes, which were first used in Guangzhou and Hong Kong, have already spread to over 25 additional cities. Nearly all of Guangzhou's 19,000 taxis and 90% of the city's 8,000 buses are running on Autogas. Similarly, Autogas is used by nearly all taxis in Hong Kong, a city of around 20,000 people, and 30% of all public buses. The objective of the report is to present a comprehensive analysis of the market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global market dynamics, structure by analyzing the market segments and projecting the global market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global market makes the report investor's guide.Global Propane Market Scope: Inquire before buying

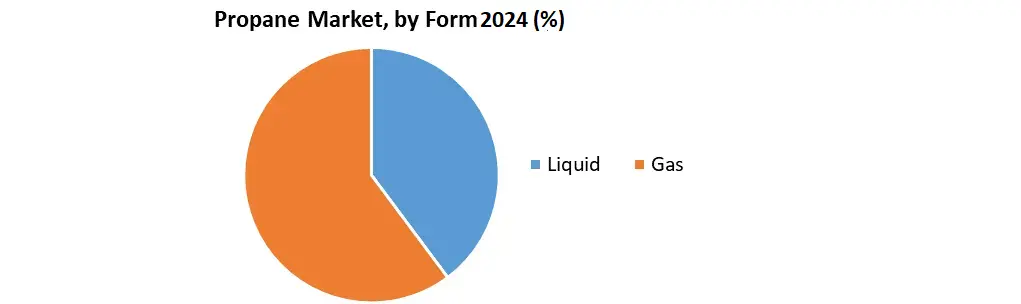

Global Propane Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 188.30 Mn Metric Tons. Forecast Period 2025 to 2032 CAGR: 4.12% Market Size in 2032: USD 260.09 Mn Metric Tons. Segments Covered: by Application Portable Stoves Refrigerant Domestic and Industrial Fuel Motor Fuel Shipping Fuel by Form Liquid Gas Global Propane Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Global Propane Market Key Players

North America 1. ExxonMobil (U.S) 2. Chevron Corporation (U.S) 3. Anadarko Petroleum Corporation (U.S) 4. Suburban Propane (U.S) 5. Dow DuPont (U.S) 6. ConocoPhillips (U.S) Europe 7. BP PLC (U.K) 8. Total SA (France) 9. Air Liquide (France) 10. Shell (Netherlands) 11. Sika AG (Switzerland) 12. Eni S.P.A (Italy) 13. Gazprom (Russia) Asia Pacific 14. China Petroleum & Chemical Corporation (China) 15. Sinopec (China) 16. Bharat Petroleum Corporation Limited (India) 17. Hindustan Petroleum Corporation Limited (India) 18. GAIL Limited (India) 19. Oil and Natural Gas Corporation (India) 20. P.T. Pertamina Gas (Indonesia) Middle East and Africa 21. Saudi Arabian Oil Company (Saudi Arabia) 22. NNPC (Nigeria) 23. EGPC (Egypt) 24. Abu Dhabi National Oil Company (UAE) 25. ENOC Company (UAE) 26. Kuwait Petroleum Corporation (KPC) (Kuwait) South America 27. Petrobras (Brazil) 28. PDVSA - Petróleos de Venezuela, SA. (Venezuela)Frequently Asked Questions:

1. What is the forecast period considered for the Propane market report? Ans. The forecast period for the propane market is 2025-2032 2. Which key factors are hindering the growth of the Propane market? Ans. The volatile prices of propane in the international market because of the supply-demand gap aroused due to the COVID-19 pandemic is the only key factor expected to hinder the growth of the market during the forecast period. 3. What is the compound annual growth rate (CAGR) of the Propane market for the next 8 years? Ans. The Propane market is expected to grow at a CAGR of 4.12% during the forecast period (2025-2032). 4. What are the key factors driving the growth of the Propane market? Ans. The growing adoption of LPG in the residential sector demanding consumption of propane and increased marine propane exports from the west coast of Canada are the key factors expected to drive the growth of the market during the forecast period. 5. Which are the worldwide major key players covered for the Propane market report? Ans. Gazprom, Shell, China Petroleum & Chemical Corporation, ExxonMobil, Saudi Arabian Oil Company, Chevron Corporation, Sinopec, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, ConocoPhillips, Sika AG, Total SA, Anadarko Petroleum Corporation, Dow DuPont, Eni S.P.A, and Others.

1. Propane Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Propane Market: Dynamics 2.1. Propane Market Trends by Region 2.1.1. North America Propane Market Trends 2.1.2. Europe Propane Market Trends 2.1.3. Asia Pacific Propane Market Trends 2.1.4. Middle East and Africa Propane Market Trends 2.1.5. South America Propane Market Trends 2.2. Propane Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Propane Market Drivers 2.2.1.2. North America Propane Market Restraints 2.2.1.3. North America Propane Market Opportunities 2.2.1.4. North America Propane Market Challenges 2.2.2. Europe 2.2.2.1. Europe Propane Market Drivers 2.2.2.2. Europe Propane Market Restraints 2.2.2.3. Europe Propane Market Opportunities 2.2.2.4. Europe Propane Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Propane Market Drivers 2.2.3.2. Asia Pacific Propane Market Restraints 2.2.3.3. Asia Pacific Propane Market Opportunities 2.2.3.4. Asia Pacific Propane Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Propane Market Drivers 2.2.4.2. Middle East and Africa Propane Market Restraints 2.2.4.3. Middle East and Africa Propane Market Opportunities 2.2.4.4. Middle East and Africa Propane Market Challenges 2.2.5. South America 2.2.5.1. South America Propane Market Drivers 2.2.5.2. South America Propane Market Restraints 2.2.5.3. South America Propane Market Opportunities 2.2.5.4. South America Propane Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Propane Industry 2.8. Analysis of Government Schemes and Initiatives For Propane Industry 2.9. Propane Market price trend Analysis 2.10. Propane Market Trade Analysis 2.10.1. Global Import Analysis 2.10.1.1. Top Importer of Propane 2.10.2. Global Export Analysis 2.10.2.1. Top Exporter of Propane 2.11. Propane Production Analysis 2.12. The Global Pandemic Impact on Propane Market 3. Propane Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) 2024-2032 3.1. Propane Market Size and Forecast, by Application (2024-2032) 3.1.1. Portable Stoves 3.1.2. Refrigerant 3.1.3. Domestic and Industrial Fuel 3.1.4. Motor Fuel 3.1.5. Shipping Fuel 3.2. Propane Market Size and Forecast, by Form (2024-2032) 3.2.1. Liquid 3.2.2. Gas 3.2.3. 3.2.5. 3.3. Propane Market Size and Forecast, by Region (2024-2032) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Propane Market Size and Forecast by Segmentation (by Value and Volume) 2024-2032 4.1. North America Propane Market Size and Forecast, by Application (2024-2032) 4.1.1. Portable Stoves 4.1.2. Refrigerant 4.1.3. Domestic and Industrial Fuel 4.1.4. Motor Fuel 4.1.5. Shipping Fuel 4.2. North America Propane Market Size and Forecast, by Form (2024-2032) 4.2.1. Liquid 4.2.2. Gas 4.2.3. 4.2.5. 4.3. North America Propane Market Size and Forecast, by Country (2024-2032) 4.3.1. United States 4.3.1.1. United States Propane Market Size and Forecast, by Application (2024-2032) 4.3.1.1.1. Portable Stoves 4.3.1.1.2. Refrigerant 4.3.1.1.3. Domestic and Industrial Fuel 4.3.1.1.4. Motor Fuel 4.3.1.1.5. Shipping Fuel 4.3.1.2. United States Propane Market Size and Forecast, by Form (2024-2032) 4.3.1.2.1. Liquid 4.3.1.2.2. Gas 4.3.1.2.3. 4.3.1.2.5. 4.7.2. Canada 4.3.2.1. Canada Propane Market Size and Forecast, by Application (2024-2032) 4.3.2.1.1. Portable Stoves 4.3.2.1.2. Refrigerant 4.3.2.1.3. Domestic and Industrial Fuel 4.3.2.1.4. Motor Fuel 4.3.2.1.5. Shipping Fuel 4.3.2.2. Canada Propane Market Size and Forecast, by Form (2024-2032) 4.3.2.2.1. Liquid 4.3.2.2.2. Gas 4.3.2.2.3. 4.3.2.2.5. 4.7.3. Mexico 4.3.3.1. Mexico Propane Market Size and Forecast, by Application (2024-2032) 4.3.3.1.1. Portable Stoves 4.3.3.1.2. Refrigerant 4.3.3.1.3. Domestic and Industrial Fuel 4.3.3.1.4. Motor Fuel 4.3.3.1.5. Shipping Fuel 4.3.3.2. Mexico Propane Market Size and Forecast, by Form (2024-2032) 4.3.3.2.1. Liquid 4.3.3.2.2. Gas 4.3.3.2.3. 4.3.3.2.5. 5. Europe Propane Market Size and Forecast by Segmentation (by Value and Volume) 2024-2032 5.1. Europe Propane Market Size and Forecast, by Application (2024-2032) 5.2. Europe Propane Market Size and Forecast, by Form (2024-2032) 5.3. Europe Propane Market Size and Forecast, by Country (2024-2032) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Propane Market Size and Forecast, by Application (2024-2032) 5.3.1.2. United Kingdom Propane Market Size and Forecast, by Form (2024-2032) 5.3.2. France 5.3.2.1. France Propane Market Size and Forecast, by Application (2024-2032) 5.3.2.2. France Propane Market Size and Forecast, by Form (2024-2032) 5.3.3. Germany 5.3.3.1. Germany Propane Market Size and Forecast, by Application (2024-2032) 5.3.3.2. Germany Propane Market Size and Forecast, by Form (2024-2032) 5.3.4. Italy 5.3.4.1. Italy Propane Market Size and Forecast, by Application (2024-2032) 5.3.4.2. Italy Propane Market Size and Forecast, by Form (2024-2032) 5.3.5. Spain 5.3.5.1. Spain Propane Market Size and Forecast, by Application (2024-2032) 5.3.5.2. Spain Propane Market Size and Forecast, by Form (2024-2032) 5.3.6. Sweden 5.3.6.1. Sweden Propane Market Size and Forecast, by Application (2024-2032) 5.3.6.2. Sweden Propane Market Size and Forecast, by Form (2024-2032) 5.3.7. Austria 5.3.7.1. Austria Propane Market Size and Forecast, by Application (2024-2032) 5.3.7.2. Austria Propane Market Size and Forecast, by Form (2024-2032) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Propane Market Size and Forecast, by Application (2024-2032) 5.3.8.2. Rest of Europe Propane Market Size and Forecast, by Form (2024-2032) 6. Asia Pacific Propane Market Size and Forecast by Segmentation (by Value and Volume) 2024-2032 6.1. Asia Pacific Propane Market Size and Forecast, by Application (2024-2032) 6.2. Asia Pacific Propane Market Size and Forecast, by Form (2024-2032) 6.7. Asia Pacific Propane Market Size and Forecast, by Country (2024-2032) 6.3.1. China 6.3.1.1. China Propane Market Size and Forecast, by Application (2024-2032) 6.3.1.2. China Propane Market Size and Forecast, by Form (2024-2032) 6.3.2. S Korea 6.3.2.1. S Korea Propane Market Size and Forecast, by Application (2024-2032) 6.3.2.2. S Korea Propane Market Size and Forecast, by Form (2024-2032) 6.3.3. Japan 6.3.3.1. Japan Propane Market Size and Forecast, by Application (2024-2032) 6.3.3.2. Japan Propane Market Size and Forecast, by Form (2024-2032) 6.3.4. India 6.3.4.1. India Propane Market Size and Forecast, by Application (2024-2032) 6.3.4.2. India Propane Market Size and Forecast, by Form (2024-2032) 6.3.5. Australia 6.3.5.1. Australia Propane Market Size and Forecast, by Application (2024-2032) 6.3.5.2. Australia Propane Market Size and Forecast, by Form (2024-2032) 6.3.6. Indonesia 6.3.6.1. Indonesia Propane Market Size and Forecast, by Application (2024-2032) 6.3.6.2. Indonesia Propane Market Size and Forecast, by Form (2024-2032) 6.3.7. Malaysia 6.3.7.1. Malaysia Propane Market Size and Forecast, by Application (2024-2032) 6.3.7.2. Malaysia Propane Market Size and Forecast, by Form (2024-2032) 6.3.8. Vietnam 6.3.8.1. Vietnam Propane Market Size and Forecast, by Application (2024-2032) 6.3.8.2. Vietnam Propane Market Size and Forecast, by Form (2024-2032) 6.3.9. Taiwan 6.3.9.1. Taiwan Propane Market Size and Forecast, by Application (2024-2032) 6.3.9.2. Taiwan Propane Market Size and Forecast, by Form (2024-2032) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Propane Market Size and Forecast, by Application (2024-2032) 6.3.10.2. Rest of Asia Pacific Propane Market Size and Forecast, by Form (2024-2032) 7. Middle East and Africa Propane Market Size and Forecast by Segmentation (by Value and Volume) 2024-2032 7.1. Middle East and Africa Propane Market Size and Forecast, by Application (2024-2032) 7.2. Middle East and Africa Propane Market Size and Forecast, by Form (2024-2032) 7.7. Middle East and Africa Propane Market Size and Forecast, by Country (2024-2032) 7.7.1. South Africa 7.3.1.1. South Africa Propane Market Size and Forecast, by Application (2024-2032) 7.3.1.2. South Africa Propane Market Size and Forecast, by Form (2024-2032) 7.7.2. GCC 7.3.2.1. GCC Propane Market Size and Forecast, by Application (2024-2032) 7.3.2.2. GCC Propane Market Size and Forecast, by Form (2024-2032) 7.7.3. Nigeria 7.3.3.1. Nigeria Propane Market Size and Forecast, by Application (2024-2032) 7.3.3.2. Nigeria Propane Market Size and Forecast, by Form (2024-2032) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Propane Market Size and Forecast, by Application (2024-2032) 7.3.4.2. Rest of ME&A Propane Market Size and Forecast, by Form (2024-2032) 8. South America Propane Market Size and Forecast by Segmentation (by Value and Volume) 2024-2032 8.1. South America Propane Market Size and Forecast, by Application (2024-2032) 8.2. South America Propane Market Size and Forecast, by Form (2024-2032) 8.7. South America Propane Market Size and Forecast, by Country (2024-2032) 8.3.1. Brazil 8.3.1.1. Brazil Propane Market Size and Forecast, by Application (2024-2032) 8.3.1.2. Brazil Propane Market Size and Forecast, by Form (2024-2032) 8.3.2. Argentina 8.3.2.1. Argentina Propane Market Size and Forecast, by Application (2024-2032) 8.3.2.2. Argentina Propane Market Size and Forecast, by Form (2024-2032) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Propane Market Size and Forecast, by Application (2024-2032) 8.3.3.2. Rest Of South America Propane Market Size and Forecast, by Form (2024-2032) 9. Global Propane Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Production of 2024 9.3.6. Company Locations 9.4. Leading Propane Market Companies, by market capitalization 9.5. Analysis of Organized and Unorganized Key Players in Propane Industry 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ExxonMobil (U.S) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Chevron Corporation (U.S) 10.3. Anadarko Petroleum Corporation (U.S) 10.4. Suburban Propane (U.S) 10.5. Dow DuPont (U.S) 10.6. ConocoPhillips (U.S) 10.7. BP PLC (U.K) 10.8. Total SA (France) 10.9. Air Liquide (France) 10.10. Shell (Netherlands) 10.11. Sika AG (Switzerland) 10.12. Eni S.P.A (Italy) 10.13. Gazprom (Russia) 10.14. China Petroleum & Chemical Corporation (China) 10.15. Sinopec (China) 10.16. Bharat Petroleum Corporation Limited (India) 10.17. Hindustan Petroleum Corporation Limited (India) 10.18. GAIL Limited (India) 10.19. Oil and Natural Gas Corporation (India) 10.20. P.T. Pertamina Gas (Indonesia) 11. Key Findings 12. Industry Recommendations 13. Propane Market: Research Methodology 14. Terms and Glossary