The Microfluidics Device Market size was valued at USD 5.54 Bn in 2023 and market revenue is growing at a CAGR of 19.2% from 2024 to 2030, reaching USD 18.94 Bn by 2030.Microfluidics Device Market: Overview

The microfluidics device market has witnessed significant growth, boosted by the dominant trend of miniaturization in life sciences. This trend has captured the interest of various laboratories, spanning from those aiming to create innovative microfabricated structures to specialized application laboratories focusing on specific uses. Miniaturization in this context refers to the shrinking of traditional laboratory instruments into compact, integrated systems often referred to as lab-on-a-chip devices.To know about the Research Methodology :- Request Free Sample Report The research and development in miniaturization are imperative to minimize costs by reducing the consumption of expensive reagents and the desire to enhance throughput and automation. Leveraging technology originally developed by the microelectronics industry, miniaturized systems are becoming increasingly accessible and versatile. Much like how integrated circuits revolutionized the computing industry by drastically reducing the size of computers from room-sized mainframes to portable notebooks, miniaturization holds the promise of condensing entire laboratories onto a single chip. This transformation has significant implications for various applications within the life sciences, including but not limited to diagnostics, drug discovery, genomics, proteomics, and point-of-care testing. The Microfluidics Device Market is experiencing rapid growth as a result of these advancements, with a diverse range of stakeholders including academic research institutions, pharmaceutical companies, biotechnology firms, and diagnostic laboratories. Market growth is further driven by the increasing demand for point-of-care diagnostics, personalized medicine, and the continuous pursuit of more efficient and cost-effective analytical techniques. The microfluidics device market is poised for continued growth as innovations in miniaturization drive the development of increasingly sophisticated and integrated solutions for a wide array of life science applications.

Microfluidics Device Market: Dynamics

Driver Revolutionizing Point-of-Care Diagnostics boosts the Microfluidics Device Market The revolutionizing impact of microfluidics in point-of-care diagnostics is reshaping the healthcare landscape, driving the growth of the microfluidics device market. These devices offer a paradigm shift by enabling rapid and accurate analysis of biological samples directly at the point of care, without the need for centralized laboratory facilities. By integrating intricate microchannels and chambers onto a single chip, microfluidic devices streamline diagnostic processes, minimizing sample volumes, and reducing turnaround times. This advancement is particularly crucial for diagnosing diseases in resource-limited or remote settings where access to traditional laboratory infrastructure is limited. Microfluidic devices empower healthcare providers to perform on-the-spot testing for various conditions, including infectious diseases, cancer biomarkers, and genetic disorders. Their portability, automation capabilities, and cost-effectiveness make them indispensable tools for enhancing patient care and outcomes. As the demand for rapid and personalized diagnostics continues to surge, driven by factors such as aging populations, increasing prevalence of chronic diseases, and the need for early detection, the Microfluidics Device Market is poised for significant growth. These devices not only address current healthcare challenges but also pave the way for innovative solutions in personalized medicine, pharmaceutical development, and environmental monitoring, driving further growth and adoption across diverse applications.Complex Processes and High Costs Impede Microfluidics Device Market Growth The growth of the microfluidics device market faces significant impediments due to the complexities and high costs associated with fabrication processes. Traditional microfabrication techniques such as photolithography and reactive ion etching necessitate specialized equipment and cleanroom facilities, driving up manufacturing expenses. The intricate design requirements and precise control over microscale features add to development costs and time-to-market. These challenges hinder scalability and accessibility, particularly for smaller companies and research institutions with limited resources. The barrier to entry imposed by high costs limits market competitiveness and innovation, as companies struggle to invest in research and development efforts. Additionally, the expertise required for mastering these fabrication methods further exacerbates the issue, creating a talent gap within the industry. The constraints imposed by complex processes and high costs impede Microfluidics Device Market growth by deterring potential entrants and restricting the adoption of microfluidics devices across various sectors. Addressing these challenges through advancements in fabrication technologies, such as the development of simpler and more cost-effective manufacturing methods, is critical for unlocking the full potential of microfluidics and driving widespread adoption in healthcare, biotechnology, and beyond. Paper-Based Microfluidics Redefining Accessibility in Healthcare Boost the Market Growth Paper-based microfluidics is revolutionizing healthcare accessibility, driving significant growth in the microfluidics device market. These innovative devices offer a cost-effective and user-friendly alternative to traditional microfluidic systems, particularly in resource-limited settings and remote areas where access to sophisticated laboratory infrastructure is scarce. By leveraging the capillary action of paper, these devices enable precise manipulation and analysis of biological samples without the need for external pumps or power sources. This simplicity of operation makes paper-based microfluidics highly accessible to healthcare providers with minimal training, empowering them to perform rapid diagnostics directly at the point of care. The affordability and portability of paper-based microfluidics democratize healthcare by bringing diagnostic capabilities to underserved populations, including those in developing countries and rural areas. Moreover, their compatibility with a wide range of biological samples and analytes makes them versatile tools for diagnosing various diseases, from infectious pathogens to chronic conditions and genetic disorders. As the demand for decentralized healthcare solutions grows, driven by factors such as increasing global health disparities and the need for rapid epidemic response, paper-based microfluidics are poised to experience substantial market growth. Their ability to deliver reliable and cost-effective diagnostics in diverse settings not only expands access to essential healthcare services but also opens up new opportunities for market growth and innovation in the field of microfluidics.

Microfluidics Device Market: Segment Analysis

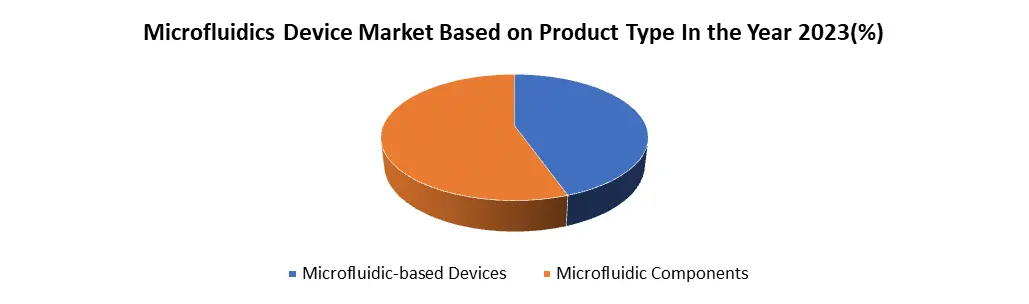

Based on Product Type, the microfluidic component segment dominated the Product Type segment of the Microfluidics Device Market in the year 2023. The dominance of the microfluidic component segment in the product type category of the microfluidics device market is attributed to several factors. Microfluidic components serve as the fundamental building blocks of microfluidic devices, including chips, pumps, valves, and connectors, essential for fluid manipulation and control. As such, they form the core technology that drives the functionality and performance of microfluidic systems across various applications, including healthcare, pharmaceuticals, biotechnology, and diagnostics. The versatility and customization options offered by microfluidic components contribute to their widespread adoption. Manufacturers tailor these components to meet specific application requirements, offering flexibility and adaptability to diverse end-users. Advancements in fabrication technologies have led to the development of high-performance microfluidic components with improved efficiency, precision, and reliability, further driving their demand in the market. The critical role played by microfluidic components in enabling advanced functionalities and applications positions them as the dominant segment within the microfluidics device market.Microfluidics Device Market Regional Analysis:

North America Dominated the Microfluidics Device Market in the year 2023. North America's leadership in the microfluidics device industry is driven by a convergence of factors that foster innovation, entrepreneurship, and collaboration. With a strong emphasis on research and development (R&D), institutions such as MIT, Stanford, and UC Berkeley have propelled the region to the forefront of microfluidics technology. Silicon Valley, renowned for its entrepreneurial spirit and technological prowess, has become a nucleus for startups and companies pioneering microfluidic innovations.The region's mature healthcare and biotechnology sectors provide a fertile ground for the adoption of microfluidic devices, which offer precise and efficient solutions for various applications, including diagnostics and drug discovery. Also, North America benefits from a supportive regulatory environment, where agencies like the FDA provide clear pathways for the approval of medical devices, instilling confidence in investors and developers alike. Access to capital further fuels innovation, with a vast ecosystem of venture capital firms, angel investors, and government funding programs supporting microfluidics startups and companies. This financial backing enables research, prototype development, and scale-up, driving the commercialization of microfluidic technologies. Crucially, collaboration between academia and industry accelerates technology transfer and commercialization, leveraging the expertise of both sectors to develop practical solutions to real-world challenges. This synergy amplifies North America's competitive edge in the global microfluidics market, solidifying its position as a hub for innovation and driving continued growth and advancement in the field.

Microfluidics Device Market Scope:Inquire before buying

Global Microfluidics Device Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.54 Bn. Forecast Period 2024 to 2030 CAGR: 19.2% Market Size in 2030: US $ 18.94 Bn. Segments Covered: by Product Microfluidic-based Devices Microfluidic Components Microfluidic Chips Flow & Pressure Sensors Flow & Pressure Controllers Microfluidic Valves Micropumps Microneedles Other Components by Application In-vitro Diagnostics Pharmaceutical & Life Science Research and Manufacturing Therapeutics by End User Hospitals & Diagnostic Centers Academic & Research Institutes Pharmaceutical & Biotechnology Companies Microfluidics Device Market, By Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Microfluidics Device Market, Key Players

Key Players in North America 1. Agilent Technologies, Inc. (United States) 2. Thermo Fisher Scientific Inc. (United States) 3. Danaher Corporation (United States) 4. PerkinElmer, Inc. (United States) 5. Bio-Rad Laboratories, Inc. (United States) 6. Illumina, Inc. (United States) 7. Fluidigm Corporation (United States) 8. Cepheid (a subsidiary of Danaher Corporation) (United States) 9. Abbott Laboratories (United States) 10. Becton, Dickinson and Company (BD) (United States) Key Players in Europe 1. F. Hoffmann-La Roche Ltd (Switzerland) 2. Micronit Microtechnologies B.V.(Netherlands) 3. Siemens Healthineers (Germany) 4. Micronit GmbH (Germany) 5. BioFluidix GmbH (Germany) 6. Microfluidic ChipShop GmbH (Germany) 7. Cellix Ltd. (Ireland) Frequently Asked Questions 1] What segments are covered in the Global Microfluidics Device Market report? Ans. The segments covered in the Microfluidics Device Market report are based on, Product, Application, End User and Regions. 2] Which region is expected to hold the highest share of the Global Microfluidics Device Market? Ans. The North America region is expected to hold the highest share of the Microfluidics Device Market. 3] What is the market size of the Global Microfluidics Device Market by 2030? Ans. The market size of the Microfluidics Device Market by 2030 is expected to reach US$ 18.94 Bn. 4] What was the market size of the Global Microfluidics Device Market in 2023? Ans. The market size of the Microfluidics Device Market in 2023 was valued at US$ 5.54 Bn. 5] Key players in the Microfluidics Device Market. Ans. Agilent Technologies, Inc. (United States), Thermo Fisher Scientific Inc. (United States), Danaher Corporation (United States), PerkinElmer, Inc. (United States), Bio-Rad Laboratories, Inc. (United States)

1. Microfluidics Device Market: Research Methodology 2. Microfluidics Device Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Microfluidics Device Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Product Segment 3.3.3. End-user Segment 3.3.4. Revenue (2023) 3.3.5. Company Headquarter 3.4. Leading Microfluidics Device Market Companies, by Market Capitalization 3.5. Market Structure 3.5.1. Market Leaders 3.5.2. Market Followers 3.5.3. Emerging Players 3.6. Mergers and Acquisitions Details 4. Microfluidics Device Market: Dynamics 4.1. Microfluidics Device Market Trends by Region 4.1.1. North America Microfluidics Device Market Trends 4.1.2. Europe Microfluidics Device Market Trends 4.1.3. Asia Pacific Microfluidics Device Market Trends 4.1.4. Middle East and Africa Microfluidics Device Market Trends 4.1.5. South America Microfluidics Device Market Trends 4.2. Microfluidics Device Market Dynamics by Region 4.2.1. North America 4.2.1.1. North America Microfluidics Device Market Drivers 4.2.1.2. North America Microfluidics Device Market Restraints 4.2.1.3. North America Microfluidics Device Market Opportunities 4.2.1.4. North America Microfluidics Device Market Challenges 4.2.2. Europe 4.2.2.1. Europe Microfluidics Device Market Drivers 4.2.2.2. Europe Microfluidics Device Market Restraints 4.2.2.3. Europe Microfluidics Device Market Opportunities 4.2.2.4. Europe Microfluidics Device Market Challenges 4.2.3. Asia Pacific 4.2.3.1. Asia Pacific Microfluidics Device Market Drivers 4.2.3.2. Asia Pacific Microfluidics Device Market Restraints 4.2.3.3. Asia Pacific Microfluidics Device Market Opportunities 4.2.3.4. Asia Pacific Microfluidics Device Market Challenges 4.2.4. Middle East and Africa 4.2.4.1. Middle East and Africa Microfluidics Device Market Drivers 4.2.4.2. Middle East and Africa Microfluidics Device Market Restraints 4.2.4.3. Middle East and Africa Microfluidics Device Market Opportunities 4.2.4.4. Middle East and Africa Microfluidics Device Market Challenges 4.2.5. South America 4.2.5.1. South America Microfluidics Device Market Drivers 4.2.5.2. South America Microfluidics Device Market Restraints 4.2.5.3. South America Microfluidics Device Market Opportunities 4.2.5.4. South America Microfluidics Device Market Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Regulatory Landscape by Region 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 4.6. Key Opinion Leader Analysis for Microfluidics Device Market 4.7. Analysis of Government Schemes and Initiatives for Microfluidics Device Market 5. Microfluidics Device Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 5.1. Microfluidics Device Market Size and Forecast, by Product (2023-2030) 5.1.1. Microfluidic-based Devices 5.1.2. Microfluidic Components 5.1.2.1. Microfluidic Chips 5.1.2.2. Flow & Pressure Sensors 5.1.2.3. Flow & Pressure Controllers 5.1.2.4. Microfluidic Valves 5.1.2.5. Micropumps 5.1.2.6. Microneedles 5.1.2.7. Other Components 5.2. Microfluidics Device Market Size and Forecast, by Application (2023-2030) 5.2.1. In-vitro Diagnostics 5.2.2. Pharmaceutical & Life Science 5.2.3. Research and Manufacturing 5.2.4. Therapeutics 5.3. Microfluidics Device Market Size and Forecast, by End User (2023-2030) 5.3.1. Hospitals & Diagnostic Centers 5.3.2. Academic & Research Institutes 5.3.3. Pharmaceutical & Biotechnology Companies 5.4. Microfluidics Device Market Size and Forecast, by region (2023-2030) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Microfluidics Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. North America Microfluidics Device Market Size and Forecast, by Product (2023-2030) 6.1.1. Microfluidic-based Devices 6.1.2. Microfluidic Components 6.1.2.1. Microfluidic Chips 6.1.2.2. Flow & Pressure Sensors 6.1.2.3. Flow & Pressure Controllers 6.1.2.4. Microfluidic Valves 6.1.2.5. Micropumps 6.1.2.6. Microneedles 6.1.2.7. Other Components 6.2. North America Microfluidics Device Market Size and Forecast, by Application (2023-2030) 6.2.1. In-vitro Diagnostics 6.2.2. Pharmaceutical & Life Science Research and Manufacturing 6.2.3. Therapeutics 6.3. North America Microfluidics Device Market Size and Forecast, by End User (2023-2030) 6.3.1. Hospitals & Diagnostic Centers 6.3.2. Academic & Research Institutes 6.3.3. Pharmaceutical & Biotechnology Companies 6.4. North America Microfluidics Device Market Size and Forecast, by Country (2023-2030) 6.4.1. United States 6.4.1.1. United States Microfluidics Device Market Size and Forecast, by Product (2023-2030) 6.4.1.1.1. Microfluidic-based Devices 6.4.1.1.2. Microfluidic Components 6.4.1.1.2.1. Microfluidic Chips 6.4.1.1.2.2. Flow & Pressure Sensors 6.4.1.1.2.3. Flow & Pressure Controllers 6.4.1.1.2.4. Microfluidic Valves 6.4.1.1.2.5. Micropumps 6.4.1.1.2.6. Microneedles 6.4.1.1.2.7. Other Components 6.4.1.2. United States Microfluidics Device Market Size and Forecast, by Application (2023-2030) 6.4.1.2.1. In-vitro Diagnostics 6.4.1.2.2. Pharmaceutical & Life Science Research and Manufacturing 6.4.1.2.3. Therapeutics 6.4.1.3. United States Microfluidics Device Market Size and Forecast, by End User (2023-2030) 6.4.1.3.1. Hospitals & Diagnostic Centers 6.4.1.3.2. Academic & Research Institutes 6.4.1.3.3. Pharmaceutical & Biotechnology Companies 6.4.2. Canada 6.4.2.1. Canada Microfluidics Device Market Size and Forecast, by Product (2023-2030) 6.4.2.1.1. Microfluidic-based Devices 6.4.2.1.2. Microfluidic Components 6.4.2.1.2.1. Microfluidic Chips 6.4.2.1.2.2. Flow & Pressure Sensors 6.4.2.1.2.3. Flow & Pressure Controllers 6.4.2.1.2.4. Microfluidic Valves 6.4.2.1.2.5. Micropumps 6.4.2.1.2.6. Microneedles 6.4.2.1.2.7. Other Components 6.4.2.2. Canada Microfluidics Device Market Size and Forecast, by Application (2023-2030) 6.4.2.2.1. In-vitro Diagnostics 6.4.2.2.2. Pharmaceutical & Life Science Research and Manufacturing 6.4.2.2.3. Therapeutics 6.4.2.3. Canada Microfluidics Device Market Size and Forecast, by End User (2023-2030) 6.4.2.3.1. Hospitals & Diagnostic Centers 6.4.2.3.2. Academic & Research Institutes 6.4.2.3.3. Pharmaceutical & Biotechnology Companies 6.4.3. Mexico 6.4.3.1. Mexico Microfluidics Device Market Size and Forecast, by Product (2023-2030) 6.4.3.1.1. Microfluidic-based Devices 6.4.3.1.2. Microfluidic Components 6.4.3.1.2.1. Microfluidic Chips 6.4.3.1.2.2. Flow & Pressure Sensors 6.4.3.1.2.3. Flow & Pressure Controllers 6.4.3.1.2.4. Microfluidic Valves 6.4.3.1.2.5. Micropumps 6.4.3.1.2.6. Microneedles 6.4.3.1.2.7. Other Components 6.4.3.2. Mexico Microfluidics Device Market Size and Forecast, by Application (2023-2030) 6.4.3.2.1. In-vitro Diagnostics 6.4.3.2.2. Pharmaceutical & Life Science Research and Manufacturing 6.4.3.2.3. Therapeutics 6.4.3.3. Mexico Microfluidics Device Market Size and Forecast, by End User (2023-2030) 6.4.3.3.1. Hospitals & Diagnostic Centers 6.4.3.3.2. Academic & Research Institutes 6.4.3.3.3. Pharmaceutical & Biotechnology Companies 7. Europe Microfluidics Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Europe Microfluidics Device Market Size and Forecast, by Product (2023-2030) 7.2. Europe Microfluidics Device Market Size and Forecast, by Application (2023-2030) 7.3. Europe Microfluidics Device Market Size and Forecast, by End User (2023-2030) 7.4. Europe Microfluidics Device Market Size and Forecast, by Country (2023-2030) 7.4.1. United Kingdom 7.4.1.1. United Kingdom Microfluidics Device Market Size and Forecast, by Product (2023-2030) 7.4.1.2. United Kingdom Microfluidics Device Market Size and Forecast, by Application (2023-2030) 7.4.1.3. United Kingdom Microfluidics Device Market Size and Forecast, by End User (2023-2030) 7.4.2. France 7.4.2.1. France Microfluidics Device Market Size and Forecast, by Product (2023-2030) 7.4.2.2. France Microfluidics Device Market Size and Forecast, by Application (2023-2030) 7.4.2.3. France Microfluidics Device Market Size and Forecast, by End User (2023-2030) 7.4.3. Germany 7.4.3.1. Germany Microfluidics Device Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Germany Microfluidics Device Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Germany Microfluidics Device Market Size and Forecast, by End User (2023-2030) 7.4.4. Italy 7.4.4.1. Italy Microfluidics Device Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Italy Microfluidics Device Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Italy Microfluidics Device Market Size and Forecast, by End User (2023-2030) 7.4.5. Spain 7.4.5.1. Spain Microfluidics Device Market Size and Forecast, by Product (2023-2030) 7.4.5.2. Spain Microfluidics Device Market Size and Forecast, by Application (2023-2030) 7.4.5.3. Spain Microfluidics Device Market Size and Forecast, by End User (2023-2030) 7.4.6. Sweden 7.4.6.1. Sweden Microfluidics Device Market Size and Forecast, by Product (2023-2030) 7.4.6.2. Sweden Microfluidics Device Market Size and Forecast, by Application (2023-2030) 7.4.6.3. Sweden Microfluidics Device Market Size and Forecast, by End User (2023-2030) 7.4.7. Austria 7.4.7.1. Austria Microfluidics Device Market Size and Forecast, by Product (2023-2030) 7.4.7.2. Austria Microfluidics Device Market Size and Forecast, by Application (2023-2030) 7.4.7.3. Austria Microfluidics Device Market Size and Forecast, by End User (2023-2030) 7.4.8. Rest of Europe 7.4.8.1. Rest of Europe Microfluidics Device Market Size and Forecast, by Product (2023-2030) 7.4.8.2. Rest of Europe Microfluidics Device Market Size and Forecast, by Application (2023-2030) 7.4.8.3. Rest of Europe Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8. Asia Pacific Microfluidics Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Asia Pacific Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.2. Asia Pacific Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.3. Asia Pacific Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4. Asia Pacific Microfluidics Device Market Size and Forecast, by Country (2023-2030) 8.4.1. China 8.4.1.1. China Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.1.2. China Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.1.3. China Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4.2. S Korea 8.4.2.1. S Korea Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.2.2. S Korea Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.2.3. S Korea Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4.3. Japan 8.4.3.1. Japan Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Japan Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Japan Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4.4. India 8.4.4.1. India Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.4.2. India Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.4.3. India Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4.5. Australia 8.4.5.1. Australia Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.5.2. Australia Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.5.3. Australia Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4.6. Indonesia 8.4.6.1. Indonesia Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.6.2. Indonesia Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.6.3. Indonesia Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4.7. Malaysia 8.4.7.1. Malaysia Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.7.2. Malaysia Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.7.3. Malaysia Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4.8. Vietnam 8.4.8.1. Vietnam Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.8.2. Vietnam Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.8.3. Vietnam Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4.9. Taiwan 8.4.9.1. Taiwan Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.9.2. Taiwan Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.9.3. Taiwan Microfluidics Device Market Size and Forecast, by End User (2023-2030) 8.4.10. Rest of Asia Pacific 8.4.10.1. Rest of Asia Pacific Microfluidics Device Market Size and Forecast, by Product (2023-2030) 8.4.10.2. Rest of Asia Pacific Microfluidics Device Market Size and Forecast, by Application (2023-2030) 8.4.10.3. Rest of Asia Pacific Microfluidics Device Market Size and Forecast, by End User (2023-2030) 9. Middle East and Africa Microfluidics Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. Middle East and Africa Microfluidics Device Market Size and Forecast, by Product (2023-2030) 9.2. Middle East and Africa Microfluidics Device Market Size and Forecast, by Application (2023-2030) 9.3. Middle East and Africa Microfluidics Device Market Size and Forecast, by End User (2023-2030) 9.4. Middle East and Africa Microfluidics Device Market Size and Forecast, by Country (2023-2030) 9.4.1. South Africa 9.4.1.1. South Africa Microfluidics Device Market Size and Forecast, by Product (2023-2030) 9.4.1.2. South Africa Microfluidics Device Market Size and Forecast, by Application (2023-2030) 9.4.1.3. South Africa Microfluidics Device Market Size and Forecast, by End User (2023-2030) 9.4.2. GCC 9.4.2.1. GCC Microfluidics Device Market Size and Forecast, by Product (2023-2030) 9.4.2.2. GCC Microfluidics Device Market Size and Forecast, by Application (2023-2030) 9.4.2.3. GCC Microfluidics Device Market Size and Forecast, by End User (2023-2030) 9.4.3. Nigeria 9.4.3.1. Nigeria Microfluidics Device Market Size and Forecast, by Product (2023-2030) 9.4.3.2. Nigeria Microfluidics Device Market Size and Forecast, by Application (2023-2030) 9.4.3.3. Nigeria Microfluidics Device Market Size and Forecast, by End User (2023-2030) 9.4.4. Rest of ME&A 9.4.4.1. Rest of ME&A Microfluidics Device Market Size and Forecast, by Product (2023-2030) 9.4.4.2. Rest of ME&A Microfluidics Device Market Size and Forecast, by Application (2023-2030) 9.4.4.3. Rest of ME&A Microfluidics Device Market Size and Forecast, by End User (2023-2030) 10. South America Microfluidics Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 10.1. South America Microfluidics Device Market Size and Forecast, by Product (2023-2030) 10.2. South America Microfluidics Device Market Size and Forecast, by Application (2023-2030) 10.3. South America Microfluidics Device Market Size and Forecast, by End User (2023-2030) 10.4. South America Microfluidics Device Market Size and Forecast, by Country (2023-2030) 10.4.1. Brazil 10.4.1.1. Brazil Microfluidics Device Market Size and Forecast, by Product (2023-2030) 10.4.1.2. Brazil Microfluidics Device Market Size and Forecast, by Application (2023-2030) 10.4.1.3. Brazil Microfluidics Device Market Size and Forecast, by End User (2023-2030) 10.4.2. Argentina 10.4.2.1. Argentina Microfluidics Device Market Size and Forecast, by Product (2023-2030) 10.4.2.2. Argentina Microfluidics Device Market Size and Forecast, by Application (2023-2030) 10.4.2.3. Argentina Microfluidics Device Market Size and Forecast, by End User (2023-2030) 10.4.3. Rest Of South America 10.4.3.1. Rest Of South America Microfluidics Device Market Size and Forecast, by Product (2023-2030) 10.4.3.2. Rest Of South America Microfluidics Device Market Size and Forecast, by Application (2023-2030) 10.4.3.3. Rest Of South America Microfluidics Device Market Size and Forecast, by End User (2023-2030) 11. Company Profile: Key Players 11.1. Agilent Technologies, Inc. (United States) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Details on Partnership 11.1.7. Recent Developments 11.2. Agilent Technologies, Inc. (United States) 11.3. Thermo Fisher Scientific Inc. (United States) 11.4. Danaher Corporation (United States) 11.5. PerkinElmer, Inc. (United States) 11.6. Bio-Rad Laboratories, Inc. (United States) 11.7. Illumina, Inc. (United States) 11.8. Fluidigm Corporation (United States) 11.9. Cepheid (a subsidiary of Danaher Corporation) (United States) 11.10. Abbott Laboratories (United States) 11.11. Becton, Dickinson and Company (BD) (United States) 11.12. F. Hoffmann-La Roche Ltd (Switzerland) 11.13. Micronit Microtechnologies B.V.(Netherlands) 11.14. Siemens Healthineers (Germany) 11.15. Micronit GmbH (Germany) 11.16. BioFluidix GmbH (Germany) 11.17. Microfluidic ChipShop GmbH (Germany) 11.18. Cellix Ltd. (Ireland) 12. Key Findings 13. Industry Recommendations