Heavy Duty Trucks Market size was valued at US$ 392.56 Bn. in 2023 and the total revenue is expected to grow at 5.2% of CAGR through 2023 to 2030, reaching US$ 551.90 Bn.Heavy Duty Trucks Market Overview:

Heavy-duty trucks, also known as heavy-duty vehicles or heavy-duty lorries, are a type of large and powerful vehicle designed for carrying and transporting substantial loads. These trucks are built to handle demanding tasks and are commonly used in various industries for transporting goods, equipment, and materials. Here are some key characteristics and applications of heavy-duty trucks The gross weight of a heavy-duty truck must be at least 33,000 lb. In order to haul bulky building materials or pull big loads, many heavy trucks are developed with powerful engines and transmissions. These trucks are frequently used in the business sector, particularly on construction sites. The heavy-duty truck industry is a cornerstone of the transportation sector, particularly for the demanding tasks of hauling substantial loads and construction materials. These trucks are meticulously engineered, boasting powerful engines and robust transmissions to meet the rigorous requirements of the heavy duty market, notably in construction and cargo transportation. Their capabilities extend well beyond 20,000 pounds, making them indispensable on construction sites and for various other weighty transport needs.To know about the Research Methodology :- Request Free Sample Report The Heavy-Duty Trucks have powerful engines and multiple axles, these trucks excel in transporting substantial loads. Widely used in logistics, construction, agriculture, and more, they contribute significantly to global commerce and infrastructure development. With applications ranging from long-haul freight transport to construction site operations, heavy-duty trucks play a pivotal role in various sectors. The surging demand for heavy-duty trucks is primarily attributed to the global upswing in infrastructure development and the escalating need for efficient cargo transportation. Governments worldwide, whether in industrialized or emerging economies, are channeling substantial investments into the enhancement and modernization of their road networks, placing heavy reliance on these durable vehicles to shoulder the load. The heavy duty truck industry stems from the environmental impact of these vehicles. Diesel fuel, commonly used in heavy-duty trucks, emits three times as much carbon as gasoline, contributing to the concerning rise in carbon emissions. This environmental issue is compelling the industry to explore innovative solutions for more environmentally friendly and fuel-efficient road freight trucks. Research Methodology A good sample size for the primary research in all regions has helped to make the report more authentic and deeper in size. The analysis has been discussed and validated by primary respondents, which include experts from the high-performance truck’s OEMs, and Tier I suppliers. Secondary sources include organizations like the International Council on Clean Transportation (ICCT), Green Truck Association (GTA), OEM websites, annual reports, and paid databases and directories like Factiva and Bloomberg. The research includes country-level model mapping of pickup trucks, medium- and heavy-duty trucks, and filtered trucks with a power output greater than 250 hp. Also, a review of several uses for high-performance vehicles (dumping, distribution, refrigeration, tanker, container, RMC, and special application). The Bottom-up approach is used for the high-performance truck market.

Heavy Duty Trucks Market Dynamics

The High Demand for Electric Heavy-duty Trucks to Drive the Heavy Duty Trucks Market Size Growth The strict emission norms set by governments are expected to drive the market for the hybrid electric segment in the forecast period. Advanced software programs are being created by the European Commission (EC) to calculate fuel use and CO2 emissions. Market players are releasing new models of fully electric and hybrid heavy-duty trucks in response to these policy changes in North America and Europe. Thanks to rising infrastructure and ongoing need for freight loading in North America, India, and Japan, electric truck segment is expected to witness high growth. The impact of these drivers is studied and analyzed to present in dollars value in the report. Since, due to the global economic slowdown in 2019, most countries witnessed a decline in truck sales. This trend continued in 2020 as a result of the COVID-19 outbreak. The growth curve in this segment is interestingly different and expected huge demand from some countries. Companies including Tesla, BYD, Volvo and Mercedes-Benz have introduced electric truck versions are expected to eventually replace diesel and gasoline-powered in upcoming years. High-cost trucks to hinder the growth of the heavy-duty truck Market Manufacturers, for their part, understand that high consumer demand means higher profit potential, and they price accordingly. The majority of base model trucks are supplied to commercial fleets and enterprises and are quite uncommon. For any heavy truck market, the majority of consumers prefer mid-grade trim models. However, the base model also serves as the manufacturer's marketing's "price draw" in terms of marketing. The dealer will likely wind up adding 30 to 50 % more to that base price in trim options and upgrades once the buyer arrives on the dealer's lot with the lowest price available.Heavy Duty Trucks Market Segment Analysis:

By Vehicle Type, the Pickup trucks segment held the largest Heavy Duty Trucks Market share in 2023. Light-duty vehicles like pickup trucks have an enclosed cab and an open cargo section with a hatchback. It comes in both compact and full sizes. Pickup trucks are typically employed as reliable transports, but they are also useful for personal transportation. North America is the leading region. OEMs with significant market share in the US, like General Motors and Ford, are creating light-duty trucks with features like high performance, improved driver experience, and fuel efficiency. Both in developed and developing countries, regulatory bodies place a strong emphasis on disaster preparedness and safety. The need for high-performance pickup trucks for safety applications like fire and rescue operations is also anticipated to rise as a result of this. By Fuel Type, LNG fuel type is expected to be the major growing segment of the heavy-duty truck. LNG provides benefits across a wide range of parameters. The per tonne-kilometer cost is a well-known determinant of truck and fuel choices. The current price per unit of LNG, which is lower than that of diesel, makes it a viable alternative. The purchase price of an LNG truck is approximately 22% higher; however, the operating costs are approximately 40% lower, resulting in an overall cost of ownership of an LNG truck that is 32% lower than that of a comparable diesel truck. The rise in demand is attributed to factors such as tightening emission standards and the abundance of LNG. The governments of Europe and the United States are focusing on the installation of more alternative fueling stations and the promotion of alternative commercial vehicles. For example, the US government has launched the J.B. Hunt LNG Truck Project, which involves the deployment of 262 heavy-duty LNG trucks in Southern California. By Application, the agriculture type segment held the largest Heavy Duty Trucks Market share in 2023. Across the globe, trucks are playing an increasingly important role in agriculture. They are used for transportation between farms, fields and warehouses. The heavy-duty trucks set themselves apart with a high payload, low fuel consumption, excellent driving comfort and the high-speed factors driving heavy-duty trucks in agriculture. These heavy-duty trucks are highly used to deliver items such as fertilizer, feed, and fuels; go into the fields as part of the harvest equipment; and haul the crops to markets, warehouses, or packing and processing plants. Most livestock is trucked to market. Key players operating in the global heavy-duty trucks market are Dongfeng Motor Group Company Ltd., Daimler Group, Ford Motor Company, Eicher Motors Limited, Navistar, Paccar, Tata Motors, Scania AB, Volkswagen, Peterbilt Volvo Freightliner, Kenworth, and Oshkosh Corporation.

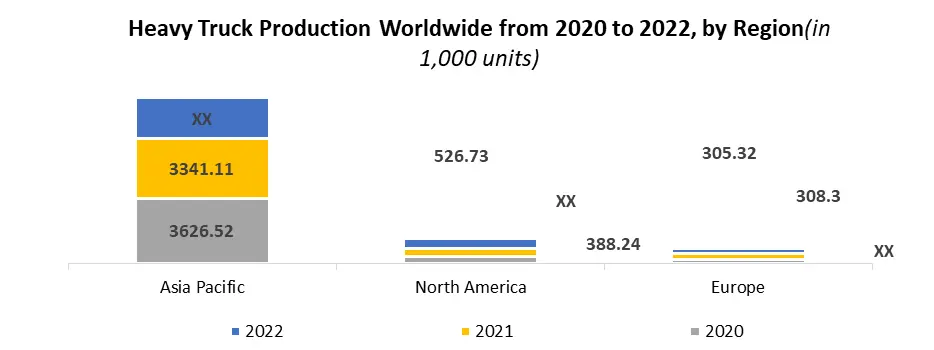

Heavy Duty Trucks Market Regional Insights:

Asia Pacific is estimated to be the largest high-performance truck market for high-performance trucks, in terms of volume. Trucks are the most important contributors to the Asia Pacific transportation sector. Regulatory changes such as revised emission standards, axle loading, and a consumer shift toward premium trucks are expected to drive the region's transportation industry growth. As a result, the market is expected to expand significantly. Additionally, the infrastructure requirements for the next Olympic competitions planned for South Korea in 2018, Japan in 2020, and China in 2022 would spur demand for high-performance dumping trucks to handle the region's heavy-duty applications. According to estimates, the RoW market for high-performance vehicles will expand the fastest in terms of volume. Due to the potential of the Brazilian and Russian markets as well as the alluring export opportunities for established markets, OEMs including Navistar, Volvo, Daimler, PACCAR, and GAZ Group are growing into undeveloped markets in this region. The greatest beef sector in the world also contributes significantly to the increase in demand for refrigerated trucks in this area. All of these elements were significant in spurring the Heavy Duty Trucks Market size growth.Heavy Duty Trucks Market Scope: Inquire before buying

Heavy Duty Trucks Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 392.56 Bn. Forecast Period 2024 to 2030 CAGR: 5.1% Market Size in 2030: US $ 551.90 Bn. Segments Covered: by Vehicle Type Medium Heavy-Duty Pickup by Fuel Type Diesel CNG LNG by Application Distribution Container Dumping Refrigeration Tanker RMC Special Application Logistic Agriculture defense Heavy Duty Trucks Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Heavy Duty Trucks Key Players are:

North America 1. Oshkosh Corporation (US) 2. Mack Trucks (US) 3. Navistar (US) 4. Kenworth (US) 5. Tesla Motors (US) 6. Paccar Inc. (US) Asia Pacific 7. Mahindra Motors (India) 8. Ashok Leyland (India) 9. TATA motors (India) 10. Eicher Motors (India) 11. Hindustan Motors (India) 12. Hino Motors (Japan) 13. Mitsubishi Fuso (Japan) 14. Isuzu Motors Ltd (Japan) 15. Dongfeng Motor Group Company Ltd (China) 16. Hyundai (South Korea) Europe 17. Daimler AG (Germany) 18. Ford Motor Company(Germany) 19. Volkswagen (Germany) 20. Scania AB (Sweden) 21. Volvo Trucks (Sweden) 22. MAN Truck (UK) 23. Renault Trucks (France) 24. DAF Trucks (Netherland) 25. IVECO (Netherland) Frequently Asked Questions: 1] What is the growth rate of the Global Heavy Duty Trucks Market? Ans. The Global Heavy Duty Trucks Market is growing at a significant rate of 5.2% during the forecast period. 2] Which region is expected to dominate the Global Heavy Duty Trucks Market? Ans. Asia Pacific region is expected to hold the Heavy Duty Trucks Market growth potential during the forecast period. 3] What is the expected Global Heavy Duty Trucks Market size by 2030? Ans. The Heavy Duty Trucks Market size is expected to reach USD 551.90 Bn by 2030. 4] Which are the top players in the Global Heavy Duty Trucks Market? Ans. The top key players are Mahindra Motors (India), Ashok Leyland (India), TATA motors (India) and others. 5] What are the factors driving the Global Heavy Duty Trucks Market growth? Ans. Electric heavy-duty truck is high in demand this key factor driving the heavy-duty truck market. 6] Which Country held the largest market share in 2023? Ans. India held the largest Heavy Duty Trucks Market share in 2023.

1. Heavy Duty Trucks Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Heavy Duty Trucks Market: Dynamics 2.1. Heavy Duty Trucks Market Trends by Region 2.1.1. Global Heavy Duty Trucks Market Trends 2.1.2. North America Heavy Duty Trucks Market Trends 2.1.3. Europe Heavy Duty Trucks Market Trends 2.1.4. Asia Pacific Heavy Duty Trucks Market Trends 2.1.5. Middle East and Africa Heavy Duty Trucks Market Trends 2.1.6. South America Heavy Duty Trucks Market Trends 2.2. Heavy Duty Trucks Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Heavy Duty Trucks Market Drivers 2.2.1.2. North America Heavy Duty Trucks Market Restraints 2.2.1.3. North America Heavy Duty Trucks Market Opportunities 2.2.1.4. North America Heavy Duty Trucks Market Challenges 2.2.2. Europe 2.2.2.1. Europe Heavy Duty Trucks Market Drivers 2.2.2.2. Europe Heavy Duty Trucks Market Restraints 2.2.2.3. Europe Heavy Duty Trucks Market Opportunities 2.2.2.4. Europe Heavy Duty Trucks Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Heavy Duty Trucks Market Drivers 2.2.3.2. Asia Pacific Heavy Duty Trucks Market Restraints 2.2.3.3. Asia Pacific Heavy Duty Trucks Market Opportunities 2.2.3.4. Asia Pacific Heavy Duty Trucks Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Heavy Duty Trucks Market Drivers 2.2.4.2. Middle East and Africa Heavy Duty Trucks Market Restraints 2.2.4.3. Middle East and Africa Heavy Duty Trucks Market Opportunities 2.2.4.4. Middle East and Africa Heavy Duty Trucks Market Challenges 2.2.5. South America 2.2.5.1. South America Heavy Duty Trucks Market Drivers 2.2.5.2. South America Heavy Duty Trucks Market Restraints 2.2.5.3. South America Heavy Duty Trucks Market Opportunities 2.2.5.4. South America Heavy Duty Trucks Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis For Vehicle Type Industry 2.8. Analysis of Government Schemes and Initiatives For Vehicle Type Industry 2.9. The Global Pandemic Impact on Heavy Duty Trucks Market 2.10. Vehicle Type Price Trend Analysis (2021-22) 2.11. Global Heavy Duty Trucks Market Trade Analysis (2017-2022) 2.11.1. Global Import of Vehicle Type 2.11.1.1. Ten Largest Importer 2.11.2. Global Export of Vehicle Type 2.11.3. Ten Largest Exporter 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Vehicle Type Manufacturers: Global Installed Capacity 3. Heavy Duty Trucks Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 3.1. Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 3.1.1. Medium 3.1.2. Heavy-Duty 3.1.3. Pickup 3.2. Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 3.2.1. Diesel 3.2.2. CNG 3.2.3. LNG 3.3. Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 3.3.1. Distribution 3.3.2. Container 3.3.3. Dumping 3.3.4. Refrigeration 3.3.5. Tanker 3.3.6. RMC 3.3.7. Special Application 3.3.8. Logistic 3.3.9. Agriculture 3.3.10. Defense 3.4. Heavy Duty Trucks Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Heavy Duty Trucks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. North America Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 4.1.1. Medium 4.1.2. Heavy-Duty 4.1.3. Pickup 4.2. North America Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 4.2.1. Diesel 4.2.2. CNG 4.2.3. LNG 4.3. North America Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 4.3.1. Distribution 4.3.2. Container 4.3.3. Dumping 4.3.4. Refrigeration 4.3.5. Tanker 4.3.6. RMC 4.3.7. Special Application 4.3.8. Logistic 4.3.9. Agriculture 4.3.10. Defense 4.4. Heavy Duty Trucks Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 4.4.1.1.1. Medium 4.4.1.1.2. Heavy-Duty 4.4.1.1.3. Pickup 4.4.1.2. United States Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 4.4.1.2.1. Diesel 4.4.1.2.2. CNG 4.4.1.2.3. LNG 4.4.1.3. United States Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Distribution 4.4.1.3.2. Container 4.4.1.3.3. Dumping 4.4.1.3.4. Refrigeration 4.4.1.3.5. Tanker 4.4.1.3.6. RMC 4.4.1.3.7. Special Application 4.4.1.3.8. Logistic 4.4.1.3.9. Agriculture 4.4.1.3.10. Defense 4.4.2. Canada 4.4.2.1. Canada Type Market Size and Forecast, by Vehicle Type (2022-2029) 4.4.2.1.1. Medium 4.4.2.1.2. Heavy-Duty 4.4.2.1.3. Pickup 4.4.2.2. Canada Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 4.4.2.2.1. Diesel 4.4.2.2.2. CNG 4.4.2.2.3. LNG 4.4.2.3. Canada Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Distribution 4.4.2.3.2. Container 4.4.2.3.3. Dumping 4.4.2.3.4. Refrigeration 4.4.2.3.5. Tanker 4.4.2.3.6. RMC 4.4.2.3.7. Special Application 4.4.2.3.8. Logistic 4.4.2.3.9. Agriculture 4.4.2.3.10. Defense 4.4.3. Mexico 4.4.3.1. Mexico Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 4.4.3.1.1. Medium 4.4.3.1.2. Heavy-Duty 4.4.3.1.3. Pickup 4.4.3.2. Mexico Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 4.4.3.2.1. Diesel 4.4.3.2.2. CNG 4.4.3.2.3. LNG 4.4.3.3. Mexico Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Distribution 4.4.3.3.2. Container 4.4.3.3.3. Dumping 4.4.3.3.4. Refrigeration 4.4.3.3.5. Tanker 4.4.3.3.6. RMC 4.4.3.3.7. Special Application 4.4.3.3.8. Logistic 4.4.3.3.9. Agriculture 4.4.3.3.10. Defense 5. Europe Heavy Duty Trucks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. Europe Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 5.2. Europe Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 5.3. Europe Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 5.4. Europe Heavy Duty Trucks Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.1.2. United Kingdom Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 5.4.1.3. United Kingdom Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 5.4.2. France 5.4.2.1. France Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.2.2. France Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 5.4.2.3. France Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.3.2. Germany Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 5.4.3.3. Germany Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.4.2. Italy Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 5.4.4.3. Italy Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.5.2. Spain Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 5.4.5.3. Spain Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.6.2. Sweden Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 5.4.6.3. Sweden Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.7.2. Austria Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 5.4.7.3. Austria Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.8.2. Rest of Europe Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 5.4.8.3. Rest of Europe Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Heavy Duty Trucks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.2. Asia Pacific Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.3. Asia Pacific Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Heavy Duty Trucks Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.1.2. China Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.1.3. China Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.2.2. S Korea Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.2.3. S Korea Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.3.2. Japan Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.3.3. Japan Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.4.2. India Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.4.3. India Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.5.2. Australia Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.5.3. Australia Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.6.2. Indonesia Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.6.3. Indonesia Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.7.2. Malaysia Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.7.3. Malaysia Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.8.2. Vietnam Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.8.3. Vietnam Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.9.2. Taiwan Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.9.3. Taiwan Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Heavy Duty Trucks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 7.2. Middle East and Africa Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 7.3. Middle East and Africa Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Heavy Duty Trucks Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 7.4.1.2. South Africa Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 7.4.1.3. South Africa Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 7.4.2.2. GCC Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 7.4.2.3. GCC Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 7.4.3.2. Nigeria Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 7.4.3.3. Nigeria Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 7.4.4.2. Rest of ME&A Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 7.4.4.3. Rest of ME&A Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 8. South America Heavy Duty Trucks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 8.2. Middle East and Africa Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 8.3. Middle East and Africa Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 8.4. Middle East and Africa Heavy Duty Trucks Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 8.4.1.2. Brazil Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 8.4.1.3. Brazil Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 8.4.2.2. Argentina Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 8.4.2.3. Argentina Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Heavy Duty Trucks Market Size and Forecast, by Vehicle Type (2022-2029) 8.4.3.2. Rest Of South America Heavy Duty Trucks Market Size and Forecast, by Fuel Type (2022-2029) 8.4.3.3. Rest Of South America Heavy Duty Trucks Market Size and Forecast, by Application (2022-2029) 9. Global Heavy Duty Trucks Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Heavy Duty Trucks Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Mahindra Motors (India) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ashok Leyland (India) 10.3. TATA motors (India) 10.4. Eicher Motors (India) 10.5. Hindustan Motors (India) 10.6. Daimler AG (Germany) 10.7. Ford Motor Company(Germany) 10.8. Volkswagen (Germany) 10.9. Oshkosh Corporation (US) 10.10. Mack Trucks (US) 10.11. Navistar (US) 10.12. Kenworth (US) 10.13. Tesla Motors (US) 10.14. Paccar Inc. (US) 10.15. Hino Motors (Japan) 10.16. Mitsubishi Fuso (Japan) 10.17. Isuzu Motors Ltd (Japan) 10.18. Scania AB (Sweden) 10.19. Volvo Trucks (Sweden) 10.20. MAN Truck (UK) 10.21. Dongfeng Motor Group Company Ltd (China) 10.22. Renault Trucks (France) 10.23. DAF Trucks (Netherland) 10.24. IVECO (Netherland) 10.25. Hyundai (South Korea) 11. Key Findings 12. Industry Recommendations 13. Heavy Duty Trucks Market: Research Methodology 14. Terms and Glossary