Global Medical Packaging Films Market size was valued at USD 18.39 Bn. in 2023 and the total Pharma Packaging Films revenue is expected to grow by 6.3% from 2024 to 2030, reaching nearly USD 28.20 Bn.Medical Packaging Films Market Overview:

The Medical Packaging Films Market plays a critical role in the pharmaceutical Product Type by providing a safe and efficient solution for packaging drugs and medical devices. These films are designed to protect the products from external factors such as moisture, light, and oxygen, ensuring their stability and extending their shelf life. The global Medical Packaging Films Market has witnessed significant growth in recent years and is expected to continue growing during the forecast period. Several factors contribute to the growth, including the increasing demand for pharmaceutical products, advancements in packaging technology, and stringent regulations regarding product safety and quality. The chief drivers of the market are the rising prevalence of chronic diseases and the subsequent need for effective medications. As the global population continues to grow and age, there is a higher demand for pharmaceutical products, leading to increased production and packaging requirements. Pharma packaging films provide a reliable solution for protecting these sensitive products during transportation and storage.To know about the Research Methodology :- Request Free Sample Report Moreover, advancements in packaging technology have further fueled the market growth. Innovations such as high-barrier films, blister packs, and child-resistant packaging have gained prominence due to their ability to enhance product safety and convenience. These films offer excellent protection against moisture, light, and oxygen, minimizing the risk of product degradation and ensuring their efficacy. Stringent regulations imposed by regulatory authorities have also stimulated the Medical Packaging Films Market. Authorities such as the FDA (Food and Drug Administration) have implemented strict guidelines regarding pharmaceutical packaging to ensure product integrity and patient safety. Compliance with these regulations requires pharmaceutical manufacturers to utilize high-quality packaging materials, including films that meet specific criteria for barrier properties, chemical resistance, and tamper-evident features.

Medical Packaging Films Market Dynamics:

Medical Packaging Films Market Driver Rising Emphasis on Product Safety and Integrity Fuels the Growth of the Medical Packaging Films Market. The driver behind the growth of the Medical Packaging Films Market is the increasing emphasis on product safety and integrity within the pharmaceutical Product Type. With the rising concerns related to counterfeit drugs, tampering, and product contamination, pharmaceutical companies are placing a significant focus on packaging solutions that ensure the safety, quality, and authenticity of their products. Pharma packaging films play a vital role in maintaining the integrity of pharmaceutical products by providing barrier properties against moisture, oxygen, light, and other external factors that can degrade the efficacy and shelf life of medicines. These films are designed to protect the drugs from physical damage, temperature variations, and microbial contamination during transportation, storage, and usage. Moreover, stringent regulations and quality standards imposed by regulatory authorities, such as the Food and Drug Administration (FDA) and European Medicines Agency (EMA), further drive the adoption of advanced packaging solutions in the pharmaceutical sector. Pharma packaging films with features like tamper-evident seals, child-resistant closures, and serialization technologies help in preventing counterfeiting, safeguard patient health, and complying with regulatory requirements. Therefore, the increasing focus on product safety, integrity, and regulatory compliance acts as a key driver for the growth of the Medical Packaging Films Market. Pharmaceutical companies are investing in innovative packaging films that offer enhanced protection, sustainability, and traceability to meet the evolving demands of the Product Type and ensure the well-being of patients. Medical Packaging Films Market Restraint Escalating Raw Material Costs Pose Challenges to the Medical Packaging Films Market. The production of packaging films for pharmaceutical applications requires specialized materials that offer high barrier properties, chemical resistance, and compatibility with various drug formulations. These materials typically include polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and aluminum foil. The prices of these raw materials are volatile due to factors such as fluctuations in oil prices, supply-demand dynamics, and geopolitical events. Increases in raw material costs directly impact the manufacturing expenses of pharmaceutical packaging films, which put pressure on the profit margins of manufacturers and suppliers. Moreover, the pharmaceutical Product Type operates under stringent quality standards and regulations, necessitating the use of premium-grade materials for packaging films. This further adds to the cost challenges faced by the market participants. Manufacturers need to invest in research and development to develop cost-effective alternatives or optimize the formulation of packaging films without compromising on quality and performance. The rising raw material costs can also impact the pricing of pharmaceutical products, potentially affecting their affordability and accessibility to patients. This is a concern, especially in regions with limited healthcare budgets or in developing countries where access to affordable medications is crucial. To mitigate this restraint, market players explore strategies such as strategic sourcing, supplier partnerships, and process optimization to minimize the impact of raw material price fluctuations. Additionally, investing in sustainable and recyclable packaging materials can help in reducing overall costs and address environmental concerns. Medical Packaging Films Market Opportunity The rapid growth of biopharmaceuticals presents a significant opportunity for the Medical Packaging Films Market. Biopharmaceuticals, which include protein-based drugs, vaccines, and biosimilars, are experiencing a surge in demand due to their efficacy in treating various diseases, including cancer, autoimmune disorders, and chronic conditions. Unlike conventional small-molecule drugs, biopharmaceuticals are highly sensitive to external factors such as temperature, light, and oxygen. They require specialized packaging solutions to maintain their stability, potency, and efficacy throughout the manufacturing, storage, and transportation processes. Pharma packaging films play a vital role in ensuring the integrity and protection of biopharmaceutical products. These films provide excellent barrier properties against moisture, oxygen, and UV radiation, shielding delicate biologics from degradation and maintaining their therapeutic efficacy. Additionally, advanced packaging films can incorporate features like temperature-controlled packaging, anti-counterfeiting measures, and tamper-evident seals, further enhancing the safety and security of biopharmaceuticals. As the demand for biopharmaceuticals continues to rise, there is a growing need for specialized packaging solutions that cater to the unique requirements of these complex drug formulations. This opens up lucrative opportunities for the Medical Packaging Films Market to develop and supply innovative films specifically designed for biopharmaceutical applications. Moreover, the increasing adoption of personalized medicine and targeted therapies further fuels the demand for biopharmaceuticals, creating a larger market for pharma packaging films. Personalized medicines often require smaller batch sizes, specialized packaging formats, and unique labeling requirements, which can be effectively addressed through tailored packaging films.Medical Packaging Films Market Segment Analysis:

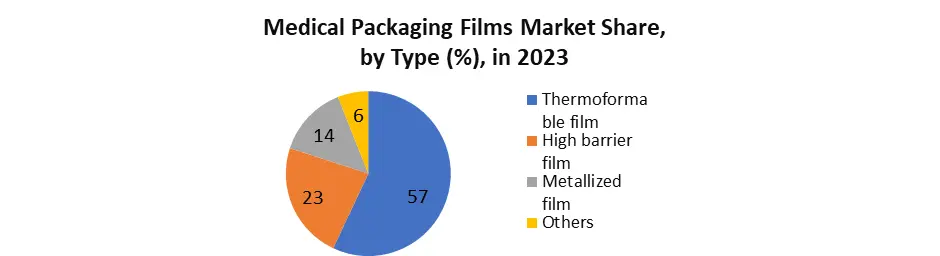

Based on Type: The market is segmented into Thermoformable film, High barrier film, Metallized film and Others. The Thermoformable film held the largest Medical Packaging Films Market share in the global market in 2023. Thermoformable film, also known as thermoforming film, represents a versatile packaging material capable of being shaped or molded through the application of heat. Typically constructed as a thin, pliable plastic film, it becomes malleable when subjected to heat, enabling it to adopt precise shapes or contours. This material finds extensive application in crafting tailored trays and clamshell packaging for medical equipment. Such packaging guarantees the secure and protected storage and transit of essential devices such as syringes, catheters, and surgical instruments.

Medical Packaging Films Market Regional Insights:

North America region dominated the Medical Packaging Films Market in the year 2023 and is expected to do the same during the forecast period. North America is home to a highly developed and advanced pharmaceutical industry. The region has a robust healthcare infrastructure, a strong regulatory framework, and a high demand for pharmaceutical products. This drives the need for efficient and reliable packaging solutions, including packaging films, to ensure the safety, integrity, and quality of medications. The pharmaceutical industry in North America operates under strict regulatory standards, particularly in the United States. Regulatory bodies such as the Food and Drug Administration (FDA) enforce stringent guidelines for drug packaging and labeling to ensure patient safety. Compliance with these regulations necessitates the use of high-quality packaging materials, including packaging films, that meet the required standards. The adherence to rigorous regulatory standards contributes to the demand for advanced and reliable pharma packaging films in the region.Medical Packaging Films Market Scope: Inquire before buying

Global Medical Packaging Films Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 18.39 Bn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: US $ 28.20 Bn. Segments Covered: by Type Thermoformable film High barrier film Metallized film Others by Material Polyethylene Polypropylene Polyvinyl chloride Polyamide Others by Application Bags Tubes Others Medical Packaging Films Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Medical Packaging Films Industry

1. Amcor plc 2. DuPont de Nemours, Inc. 3. Berry Global Inc. 4. Mitsubishi Chemical Holdings Corporation 5. Uflex Ltd. 6. Constantia Flexibles Group GmbH 7. Klöckner Pentaplast Group 8. Tekni-Plex, Inc. 9. Jindal Poly Films Limited 10. SABIC 11. Bemis Company, Inc. 12. Wipak Group 13. Toray Industries, Inc. 14. Cosmo Films Ltd. 15. Polifilm Group 16. Bilcare Limited 17. Sealed Air Corporation 18. Schott AG 19. Flex Films (USA) Inc. 20. Mondi Groupp Frequently Asked Questions: 1] What segments are covered in the Global Medical Packaging Films Market report? Ans. The segments covered in the Pharma Packaging Films Market report are based on Material, Type, Application and Region. 2] Which region is expected to hold the highest share in the Global Medical Packaging Films Market? Ans. The North America region is expected to hold the highest share of the Pharma Packaging Films Market. 3] What is the market size of the Global Medical Packaging Films Market by 2030? Ans. The market size of the Pharma Packaging Films Market by 2030 is expected to reach US$ 28.20 Bn. 4] What is the forecast period for the Global Medical Packaging Films Market? Ans. The forecast period for the Pharma Packaging Films Market is 2024-2030. 5] What was the market size of the Global Medical Packaging Films Market in 2023? Ans. The market size of the Pharma Packaging Films Market in 2023 was valued at US$ 18.39 Bn.

1. Medical Packaging Films Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Medical Packaging Films Market: Dynamics 2.1. Medical Packaging Films Market Trends by Region 2.1.1. North America Medical Packaging Films Market Trends 2.1.2. Europe Medical Packaging Films Market Trends 2.1.3. Asia Pacific Medical Packaging Films Market Trends 2.1.4. Middle East and Africa Medical Packaging Films Market Trends 2.1.5. South America Medical Packaging Films Market Trends 2.2. Medical Packaging Films Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Medical Packaging Films Market Drivers 2.2.1.2. North America Medical Packaging Films Market Restraints 2.2.1.3. North America Medical Packaging Films Market Opportunities 2.2.1.4. North America Medical Packaging Films Market Challenges 2.2.2. Europe 2.2.2.1. Europe Medical Packaging Films Market Drivers 2.2.2.2. Europe Medical Packaging Films Market Restraints 2.2.2.3. Europe Medical Packaging Films Market Opportunities 2.2.2.4. Europe Medical Packaging Films Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Medical Packaging Films Market Drivers 2.2.3.2. Asia Pacific Medical Packaging Films Market Restraints 2.2.3.3. Asia Pacific Medical Packaging Films Market Opportunities 2.2.3.4. Asia Pacific Medical Packaging Films Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Medical Packaging Films Market Drivers 2.2.4.2. Middle East and Africa Medical Packaging Films Market Restraints 2.2.4.3. Middle East and Africa Medical Packaging Films Market Opportunities 2.2.4.4. Middle East and Africa Medical Packaging Films Market Challenges 2.2.5. South America 2.2.5.1. South America Medical Packaging Films Market Drivers 2.2.5.2. South America Medical Packaging Films Market Restraints 2.2.5.3. South America Medical Packaging Films Market Opportunities 2.2.5.4. South America Medical Packaging Films Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Medical Packaging Films Industry 2.8. Analysis of Government Schemes and Initiatives For Medical Packaging Films Industry 2.9. Medical Packaging Films Market Trade Analysis 2.10. The Global Pandemic Impact on Medical Packaging Films Market 3. Medical Packaging Films Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 3.1.1. Thermoformable film 3.1.2. High barrier film 3.1.3. Metallized film 3.1.4. Others 3.2. Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 3.2.1. Polyethylene 3.2.2. Polypropylene 3.2.3. Polyvinyl chloride 3.2.4. Polyamide 3.2.5. Others 3.3. Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 3.3.1. Bags 3.3.2. Tubes 3.3.3. Others 3.4. Medical Packaging Films Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Medical Packaging Films Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 4.1.1. Thermoformable film 4.1.2. High barrier film 4.1.3. Metallized film 4.1.4. Others 4.2. North America Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 4.2.1. Polyethylene 4.2.2. Polypropylene 4.2.3. Polyvinyl chloride 4.2.4. Polyamide 4.2.5. Others 4.3. North America Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 4.3.1. Bags 4.3.2. Tubes 4.3.3. Others 4.4. North America Medical Packaging Films Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Thermoformable film 4.4.1.1.2. High barrier film 4.4.1.1.3. Metallized film 4.4.1.1.4. Others 4.4.1.2. United States Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 4.4.1.2.1. Polyethylene 4.4.1.2.2. Polypropylene 4.4.1.2.3. Polyvinyl chloride 4.4.1.2.4. Polyamide 4.4.1.2.5. Others 4.4.1.3. United States Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Bags 4.4.1.3.2. Tubes 4.4.1.3.3. Others 4.4.2. Canada 4.4.2.1. Canada Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Thermoformable film 4.4.2.1.2. High barrier film 4.4.2.1.3. Metallized film 4.4.2.1.4. Others 4.4.2.2. Canada Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 4.4.2.2.1. Polyethylene 4.4.2.2.2. Polypropylene 4.4.2.2.3. Polyvinyl chloride 4.4.2.2.4. Polyamide 4.4.2.2.5. Others 4.4.2.3. Canada Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Bags 4.4.2.3.2. Tubes 4.4.2.3.3. Others 4.4.3. Mexico 4.4.3.1. Mexico Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Thermoformable film 4.4.3.1.2. High barrier film 4.4.3.1.3. Metallized film 4.4.3.1.4. Others 4.4.3.2. Mexico Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 4.4.3.2.1. Polyethylene 4.4.3.2.2. Polypropylene 4.4.3.2.3. Polyvinyl chloride 4.4.3.2.4. Polyamide 4.4.3.2.5. Others 4.4.3.3. Mexico Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Bags 4.4.3.3.2. Tubes 4.4.3.3.3. Others 5. Europe Medical Packaging Films Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 5.2. Europe Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 5.3. Europe Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 5.4. Europe Medical Packaging Films Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 5.4.1.3. United Kingdom Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 5.4.2.3. France Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 5.4.3.3. Germany Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 5.4.4.3. Italy Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 5.4.5.3. Spain Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 5.4.6.3. Sweden Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 5.4.7.3. Austria Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 5.4.8.3. Rest of Europe Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Medical Packaging Films Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.3. Asia Pacific Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Medical Packaging Films Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.1.3. China Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.2.3. S Korea Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.3.3. Japan Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.4.3. India Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.5.3. Australia Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.6.3. Indonesia Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.7.3. Malaysia Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.8.3. Vietnam Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.9.3. Taiwan Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 6.4.10.3. Rest of Asia Pacific Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Medical Packaging Films Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 7.3. Middle East and Africa Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Medical Packaging Films Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 7.4.1.3. South Africa Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 7.4.2.3. GCC Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 7.4.3.3. Nigeria Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 7.4.4.3. Rest of ME&A Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 8. South America Medical Packaging Films Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 8.2. South America Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 8.3. South America Medical Packaging Films Market Size and Forecast, by Application(2023-2030) 8.4. South America Medical Packaging Films Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 8.4.1.3. Brazil Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 8.4.2.3. Argentina Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Medical Packaging Films Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Medical Packaging Films Market Size and Forecast, by Material (2023-2030) 8.4.3.3. Rest Of South America Medical Packaging Films Market Size and Forecast, by Application (2023-2030) 9. Global Medical Packaging Films Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Medical Packaging Films Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Amcor plc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. DuPont de Nemours, Inc. 10.3. Berry Global Inc. 10.4. Mitsubishi Chemical Holdings Corporation 10.5. Uflex Ltd. 10.6. Constantia Flexibles Group GmbH 10.7. Klöckner Pentaplast Group 10.8. Tekni-Plex, Inc. 10.9. Jindal Poly Films Limited 10.10. SABIC 10.11. Bemis Company, Inc. 10.12. Wipak Group 10.13. Toray Industries, Inc. 10.14. Cosmo Films Ltd. 10.15. Polifilm Group 10.16. Bilcare Limited 10.17. Sealed Air Corporation 10.18. Schott AG 10.19. Flex Films (USA) Inc. 10.20. Mondi Groupp 11. Key Findings 12. Industry Recommendations 13. Medical Packaging Films Market: Research Methodology 14. Terms and Glossary