Embedded System Market size was valued at US$ 97.73 Bn. in 2022 and the total revenue is expected to grow at a CAGR of 6.3% through 2023 to 2029, reaching nearly US$ 149.90 Bn.Embedded System Market Overview:

An embedded system is a computer system that performs a specific purpose within a larger mechanical or electronic system. It consists of a computer processor, computer memory, and input/output peripheral devices. Microcontrollers are commonly used in modern embedded systems. A microcontroller is a miniature computer with a CPU core, memory, and programmable input and output peripherals on a single integrated circuit. Because embedded systems are committed to completing specified tasks, they can be tuned to decrease product size and cost while increasing reliability and performance.To know about the Research Methodology :- Request Free Sample Report

Embedded System Market Dynamics:

The global embedded system market is being driven by the exponential growth in the number of mobile users and their rising penetration into the metropolitan population in both developed and developing countries. Because of the growing number of people who use tablets and smart phones that require internet connectivity, several governments have consistently placed a high priority on developing wireless communication infrastructure. The use of embedded computers as backend and network systems in the telecom sector, in order to supply superior bandwidth to consumers' preferences, is another factor driving the market growth. Embedded Systems has opened a new era in science. It's also part of the Internet of Things (IoT), a technology that gives objects, animals, and human’s unique identification and the ability to send data over a network without requiring human-to-human or human-to-computer interaction. The security of embedded devices is one of the primary problems that have restricted the growth of the embedded system market. Military forces, banks, data centers, and healthcare institutions may rely on information stored in embedded devices such as memory. As a result, protecting such devices from cyber attacks and security breaches is vital. Embedded systems are vulnerable to cyber attacks due to irregular security upgrades, a long device lifecycle, remote deployment, and attack replication, to name a few. As a result, the embedded system market's growth is expected to be hampered by its vulnerability to cyber threats and security breaches.Segment Analysis:

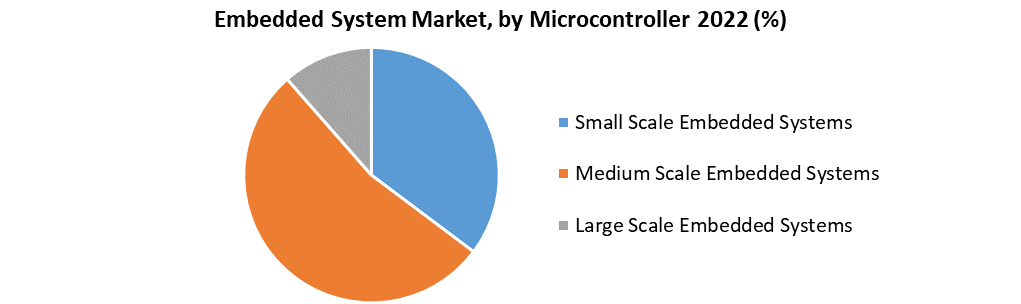

The Global Embedded System Market is segmented by Functionality, Microcontroller, Types, and Application. Based on the Functionality, the market is segmented into Standalone embedded systems, Real-time embedded systems, Networked embedded systems, and Mobile embedded systems. Real-time embedded systems segment is expected to hold the largest market shares of xx% by 2029. Real-time embedded systems are utilized in applications that need to respond quickly. Network embedded systems are real-time embedded systems that access resources and perform activities over a LAN, WAN, or the Internet. They can connect via wired or wireless means. One of the drivers boosting demand for real-time embedded systems is the rising integration of IoT in various devices, smart environments, and platforms. Furthermore, continuous improvements in sensors and actuators utilized in industrial automation, energy distribution, transportation, telecommunication networks, and healthcare applications are boosting global demand for real-time embedded systems. These are the key driver that boosts the growth of this segment in the Global Market during the forecast period 2023-2029. Based on the Application, the market is segmented into Automotive, Telecommunication, Healthcare, Industrial, Consumer electronics, Aerospace and defense, and others. Automotive segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Engine control, safety and security, infotainment, and other applications of embedded systems are used in the automotive industry. During the forecast period, the rise of this application in passenger automobiles, including those with lower prices, is expected to enhance the embedded systems market. Furthermore, the increasing demand for Hybrid Electric Vehicles (HEV) and Electric Vehicles (EV) is a significant growth factor for the embedded system market in the automotive application.

Regional Insights:

The Asia Pacific dominates the Global Embedded System market during the forecast period 2023-2029. The Asia Pacific is expected to hold the largest market shares of xx% by 2029. The embedded system market in the Asia Pacific region is growing due to rising per capita income and continuous large-scale industrialization and urbanization. Furthermore, the availability of low-cost electronic devices in the Asia Pacific is expected to lead to a growth in the region's demand for microprocessors and microcontrollers. Growing demand for embedded system hardware such as microprocessors and controllers for usage in industrial applications is expected in the Asia Pacific as autonomous robots and embedded vision systems become more common. These are the major drivers that boost the growth of this region in the global market during the forecast period 2023-2029. North America is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. The region has been at the forefront of major technological advancements in the electrical and electronic fields. Some of the country's most significant technology companies are headquartered in the region. The region's extremely promising R&D sector is also a major driver boosting the embedded systems market. The objective of the report is to present a comprehensive analysis of the Global Embedded System Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Embedded System Market dynamic, structure by analyzing the market segments and project the Global Embedded System Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Embedded System Market make the report investor’s guide.Embedded System Market Scope: Inquire before buying

Embedded System Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 97.73Bn. Forecast Period 2023 to 2029 CAGR: 6.3% Market Size in 2029: US $ 149.90 Bn. Segments Covered: by Functionality Standalone Embedded Systems Real Time Embedded Systems Networked Embedded Systems Mobile Embedded Systems by Microcontroller Small Scale Embedded Systems Medium Scale Embedded Systems Large Scale Embedded Systems by Application Automotive Telecommunication Healthcare Industrial Consumer Electronics by Types Embedded Hardware Software Embedded System Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Key Players are:

1.Intel Corporation (U.S.) 2.Microsoft Corporation (U.S.) 3.NXP Semiconductors (Netherlands) 4.Atmel Corporation (U.S.) 5.Renesas Electronics Corporation (Japan) 6.HCL Technologies, Ltd. (India) 7.Infosys, Ltd. (India) 8.Freescale Semiconductor, Inc. (U.S.) 9.Infineon Technologies AG (Germany) 10.Texas Instruments, Inc. (U.S.) 11.Philips 12.Motorola 13.LG Electronics 14.VOLVO 15.Robert Bosch 16.VVDN Technologies Frequently Asked Questions: 1] What segments are covered in Global Market report? Ans. The segments covered in Global Market report are based on Functionality, Microcontroller, Types, and Application. 2] Which region is expected to hold the highest share in the Global Embedded System Market? Ans. Asia Pacific is expected to hold the highest share in the Global Market. 3] Who are the top key players in the Global Embedded System Market? Ans. Intel Corporation (U.S.), Microsoft Corporation (U.S.), NXP Semiconductors (Netherlands), Atmel Corporation (U.S.), and Renesas Electronics Corporation (Japan) are the top key players in the Global Market. 4] Which segment holds the largest market share in the Global Embedded System market by 2029? Ans. Real time embedded systems segment holds the largest market share in the Global market by 2029. 5] What is the market size of the Global Embedded System market by 2029? Ans. The market size of the Global market is US $149.90 Bn. by 2029. 6] What was the market size of the Global Embedded System market in 2022? Ans. The market size of the Global market was worth US $97.73 Bn. in 2022.

1. Global Embedded System Market: Research Methodology 2. Global Embedded System Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Embedded System Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Embedded System Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Embedded System Market Segmentation 4.1 Global Embedded System Market, by Functionality (2022-2029) • Standalone embedded systems • Real time embedded systems • Networked embedded systems • Mobile embedded systems 4.2 Global Embedded System Market, by Microcontroller (2022-2029) • Small scale embedded systems • Medium scale embedded systems • Large scale embedded systems 4.3 Global Embedded System Market, by Types (2022-2029) • Embedded Hardware • Embedded Software 4.4 Global Embedded System Market, by Application (2022-2029) • Automotive • Telecommunication • Healthcare • Industrial • Consumer electronics • Aerospace and defense • Others 5. North America Global Embedded System Market (2022-2029) 5.1 Global Embedded System Market, by Functionality (2022-2029) • Standalone embedded systems • Real time embedded systems • Networked embedded systems • Mobile embedded systems 5.2 Global Embedded System Market, by Microcontroller (2022-2029) • Small scale embedded systems • Medium scale embedded systems • Large scale embedded systems 5.3 Global Embedded System Market, by Types (2022-2029) • Embedded Hardware • Embedded Software 5.4 Global Embedded System Market, by Application (2022-2029) • Automotive • Telecommunication • Healthcare • Industrial • Consumer electronics • Aerospace and defense • Others 5.5 North America Global Embedded System Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Global Embedded System Market (2022-2029) 6.1. Asia Pacific Global Embedded System Market, by Functionality (2022-2029) 6.2. Asia Pacific Global Embedded System Market, by Microcontroller (2022-2029) 6.3. Asia Pacific Global Embedded System Market, by Types (2022-2029) 6.4. Asia Pacific Global Embedded System Market, by Application (2022-2029) 6.5. Asia Pacific Global Embedded System Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Global Embedded System Market (2022-2029) 7.1 Middle East and Africa Global Embedded System Market, by Functionality (2022-2029) 7.2. Middle East and Africa Global Embedded System Market, by Microcontroller (2022-2029) 7.3. Middle East and Africa Global Embedded System Market, by Types (2022-2029) 7.4. Middle East and Africa Global Embedded System Market, by Application (2022-2029) 7.5. Middle East and Africa Global Embedded System Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Global Embedded System Market (2022-2029) 8.1. Latin America Global Embedded System Market, by Functionality (2022-2029) 8.2. Latin America Global Embedded System Market, by Microcontroller (2022-2029) 8.3. Latin America Global Embedded System Market, by Types (2022-2029) 8.4. Latin America Global Embedded System Market, by Application (2022-2029) 8.5. Latin America Global Embedded System Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European Global Embedded System Market (2022-2029) 9.1. European Global Embedded System Market, by Functionality (2022-2029) 9.2. European Global Embedded System Market, by Microcontroller (2022-2029) 9.3. European Global Embedded System Market, by Types (2022-2029) 9.4. European Global Embedded System Market, by Application (2022-2029) 9.5. European Global Embedded System Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Intel Corporation (U.S.) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Microsoft Corporation (U.S.) 10.3. NXP Semiconductors (Netherlands) 10.4. Atmel Corporation (U.S.) 10.5. Renesas Electronics Corporation (Japan) 10.6. HCL Technologies, Ltd. (India) 10.7. Infosys, Ltd. (India) 10.8. Freescale Semiconductor, Inc. (U.S.) 10.9. Infineon Technologies AG (Germany) 10.10. Texas Instruments, Inc. (U.S.) 10.11. Philips 10.12. Motorola 10.13. LG Electronics 10.14. VOLVO 10.15. Robert Bosch 10.16. VVDN Technologies