The Biomethane Market size was valued at USD 5761.62 Million in 2024 and the total Biomethane revenue is expected to grow at a CAGR of 6.08% from 2025 to 2032, reaching nearly USD 9238.75 Million. Biomethane is rising as a particularly lucrative opportunity for commodity traders, driven by rapid market growth, feedstock, end-consumer diversity, and early market positioning. As European production of biomethane is set to increase tenfold by , the biomethane market is expected to present a considerable trading (buying and selling) margin potential. This growth is fueled with the aid of the pressing need for decarbonization across challenging sectors which include heavy-obligation transport and business warmth, wherein biomethane serves as a possible alternative to standard natural gas. The European biomethane market, currently accounting for about 2% of overall natural gas intake, is expected to reach a total addressable market of 300 to 340 TWh by . Key factors contributing to the biomethane market's attractiveness include rapid growth in demand, diverse feedstock sources, and varying carbon intensities of biomethane production. The transport sector stands out as a major driver, with a significant shift towards biomethane replacing conventional compressed and liquefied natural gas. This shift is supported by political commitments, investment inflows, and evolving policies that create favorable conditions for biomethane trading. The biomethane market’s fragmentation, with various feedstocks ranging from agricultural waste to municipal waste, provides traders with opportunities to exploit differences in carbon intensity and pricing, leading to higher gross margins compared to conventional LNG trading. Moreover, the biomethane trading landscape remains in its nascent stage, offering traders the chance to influence and shape the market. As the sector matures, early participants will benefit from capturing substantial value, optimizing value chains, and establishing pan-European low-carbon systems. The diversity in feedstock and end-user requirements enables traders to engage in arbitrage and adjust their strategies based on carbon intensity and demand fluctuations. In the United States, biomethane market growth has been primarily driven by the transport sector, supported by initiatives such as the Renewable Fuel Standard (RFS) and California’s Low Carbon Fuels Standard (LCFS). Recent years have seen accelerated growth in biomethane production in the United States, thanks to new federal and state-level policies. The new RFS Set Rule aims to double biomethane supplies within three years, and combined targets for biogas, renewable natural gas (RNG), and injected biomethane in California suggest a 2.1-fold expansion over the next five years. Generous financial support from various programs, particularly those allowing additionality, provides a robust framework for this rapid growth. This environment is expected to significantly boost biomethane production, leveraging both federal incentives and state-level goals to meet rising demand and achieve ambitious sustainability targets. India is a lucrative region for biomethane providers to generate the highest revenue share. India also has considerable small-scale household biogas production in rural areas lacking grid access, with biogas being an important energy source for clean cooking and lighting. Through its One Nation One Gas Grid program, India plans to enlarge the role of natural gas in its economy by investing in new gas infrastructure, aiming to raise the share of natural gas in the energy sector to nearly 15% by (from 6.2% in ). India has recently announced a blending mandate of 5% biomethane in compressed natural gas (CNG) for transport and in piped natural gas for domestic use from , growing each year from 1% in FY .In China, the growth of the biomethane market has evolved significantly from its initial focus on household digesters to large-scale, engineered biogas projects. Early efforts concentrated on providing clean energy for cooking and residential use in rural areas, with household digesters accounting for approximately 300,000 TJ/year of biogas production. By , the Chinese Rural Household Biogas State Debt Project had successfully installed nearly 42 million digesters, reflecting a strong commitment to small-scale biogas systems. However, from onwards, China’s policy direction shifted towards supporting larger-scale biogas plants designed for combined heat and power generation. This transition was marked by increased capital aid and feed-in tariffs aimed at promoting engineered biogas projects. Since , the focus has been on large-scale bio-natural gas (BNG) or biomethane projects, which integrate rural and urban waste feedstocks to generate both electricity and gas for grid injection. The 14th Five-Year Plan for Renewable Energy Development, launched in , underscores a renewed push for biogas industry revitalization. Despite previous five-year plans falling short of their biogas targets, the sector is expected to grow due to several factors: increased investment from national and international energy companies such as PetroChina, China Three Gorges Corporation, China General Nuclear Power Group, and international firms like Air Liquide and EnviTec Biogas AG; strengthened policy support; and improved grid access.

To know about the Research Methodology :- Request Free Sample Report MMR Key Findings in the Global Biomethane Market: 1. Biomethane production in Europe saw a nearly 20% increase in , rising from 3.5 bcm in to 4.2 bcm in . This growth reflects the growing importance of biogases in Europe's energy mix, especially as the EU's dependency on natural gas imports increased from 83% in to 97% in . 2. Major biomethane producers in Europe include Germany, the United Kingdom, the Netherlands, Denmark, Sweden, and France. While most countries have a balanced production and consumption, Denmark and Germany produce more biomethane than they consume, with excess being exported or stored. In contrast, Sweden consumes more biomethane than it produces due to incentives focused on consumption rather than production. 3. Consumer willingness to pay for biomethane is heavily influenced by GHG emission reductions and additional costs compared to natural gas. The cross-border trade of biomethane remains limited, with ongoing efforts to establish European harmonization and cross-border cooperation. REGATRACE aims to improve the efficiency of biomethane trade by setting up a unified system for Guarantees of Origin (GoO) and integrating it with other renewable gas systems. 4. Shell's acquisition of Danish biomethane producer Nature Energy and plans to source biomethane from other European countries like Poland, France, Spain, and the Czech Republic highlight its strategy to integrate biomethane production and distribution across Europe. This supports the broader European goal of increasing biomethane output tenfold by as part of the RepowerEU plan.

Brazil Biomethane Market: Significant Growth Potential Region Brazil is expected to be the lucrative region, registering rapid CAGR, and generating a significant amount of revenue share in the global biomethane market during the forecast period. This growth is driven by the country's vast potential for biogas production from organic raw materials. According to the analysis, the production of biogas and biomethane is expected to capture 25% to 30% of Brazil's natural gas demand. This growth is fueled by a rising need for renewable energy sources and advancements in biogas technology. In addition, key factors contributing to this growth include the diversity of production sources. In Brazil, urban solid waste, by-products from the sugarcane industry, and animal waste are crucial raw materials. Municipal solid waste management and the sugarcane industry's organic by-products, such as vinasse and bagasse, play significant roles, while animal waste supports a circular economy approach to sustainability. The Brazilian government performs a critical role within the biogas and biomethane market through more than a few supportive guidelines and incentives. Recognizing the importance of renewable electricity, Brazil has carried out diverse initiatives to promote biogas and biomethane production. These consist of subsidies and tax incentives designed to draw investment and foster regional growth. Such economic measures are pivotal for encouraging both huge-scale and small-scale tasks within the biogas sector. A key initiative is the National Biogas and Biomethane Program, spearheaded by the Ministry of Mines and Energy. This application pursuits to reinforce the production and usage of biogas and biomethane throughout the United States. It presents technical and financial assistance to biogas projects, making sure they have the important guide to be successful. Additionally, this system makes a specialty of schooling experts and facilitates the adoption of modern technologies, thereby enhancing the overall performance and effectiveness of biogas and biomethane manufacturing. Moreover, precise regulation is important for sustainable market growth. The National Agency for Petroleum, Natural Gas, and Biofuels (ANP) is actively concerned with organizing standards and indications for biogas and biomethane manufacturing and commercialization. These rules are vital for keeping fuel exceptional and safe, making sure that biogas and biomethane meet enterprise standards and are dependable for use. Thus, Brazil’s biogas and biomethane market shows significant promise during the forecast period. With diverse production sources, economic benefits, and robust government support, the sector is well-positioned for growth. Continued investment in infrastructure, innovation, and supportive public policies will be key to realizing its full potential and establishing Brazil as a global leader in renewable energy. Ukraine's Strategic Entry into the Biomethane Market: A New Era of Renewable Energy and Investment Opportunities On May 30, , Ukrainian President Volodymyr Zelenskiy officially launched Ukraine’s biomethane market, positioning the country as a significant player in Europe's renewable energy landscape. This move aims to attract international investment and could potentially meet up to 20% of the European Union's biomethane demand, given Ukraine's capacity to produce 22 billion cubic meters (BCM) of biomethane. The country's extensive agricultural resources provide a robust foundation for this growth, with its potential exceeding that of many European nations. The newly enacted legislation focuses on streamlining customs control and clearance for biomethane transported via pipelines across Ukraine’s borders. With 22 biomethane plants either operational or in development, Ukraine is preparing to integrate these facilities into its gas distribution network. Technical approvals have been granted for plants in Kyiv and Dnipropetrovsk, with additional approvals pending for other regions. Currently, five refining plants are set to produce 77 million cubic meters of biomethane this year, with projections to double production by . Despite progress, Ukraine faced challenges due to wartime restrictions affecting biomethane exports. However, the recent lifting of these restrictions has renewed optimism. Ukraine is preparing to begin exports to Germany and align with EU sustainability criteria to facilitate integration into the European single market. The new legislation includes measures to ensure biomethane is subject to the same customs controls as natural gas, based on volume and sustainability standards. The biomethane initiative also aligns with Ukraine's strategic goals of reducing reliance on Russian energy imports and leveraging its agricultural assets for sustainable energy production. The State Agency for Energy Efficiency and the Ministry of Energy emphasize the need to stimulate both domestic and export markets for biomethane. Naftogaz Group has expressed support for expanding production and transportation infrastructure, including potential financial mechanisms to attract investment in the biomethane market. Worldwide Total Biogas Consumption Trends From 2015 To 2021 (Production in Volume in 1000 m3)

Europe’s Leadership in Biomethane Production: Advancing Renewable Energy Goals and Market Growth by 2032 Europe is the largest producer of biogas and biomethane in the world today. The region scale up production of these renewable gases in order to meet renewable energy demand by 2032 and achieve climate targets in 2050. The EU currently produces enough biomethane to satisfy around 2% of its total natural gas consumption. Therefore, the region held the largest market share and dominated the global biomethane market growth in 2023. Driven by electricity generation, the biogas industry is now pivoting towards biomethane due to recent policy shifts that emphasize diversification in biogas utilization. This trend is expected to continue, with the majority of biogas growth in Europe over the forecast period attributed to biomethane production from both new facilities and upgraded existing plants. In major European markets like Germany, biomethane's role in transportation has become particularly lucrative. Producers benefit from clean-fuel certificates and renewable fuel quotas, making transport the most profitable end-use for biomethane in these regions. Countries with established gas vehicle fleets and filling stations are experiencing robust growth driven by this sector. The European Union's integration of biogas and biomethane into its Guarantee of Origin (GO) system is further bolstering the biomethane market growth. This system aids compliance with the EU Emissions Trading System (EU ETS) and supports private companies in meeting their emissions reduction targets. The RED II regulation governs biogas GOs, and several European countries—such as Denmark, Germany, the Netherlands, Austria, Switzerland, the UK, and France—have established national registries and bilateral agreements to facilitate cross-border biomethane trading. Expanding this mechanism to other countries will enhance international trade, whether through physical gas exchanges or certificate trading. The EU's REPowerEU plan ambitions for a non-binding target of 35 BCM of biomethane via 2032. While some countries, like Denmark, have already done widespread biomethane integration (37.9% in November ), others, along with Belgium, Spain, and Poland, are at an earlier stage of development. Achieving the bold goal will require accelerated growth and supportive policy frameworks throughout the continent. Biogas production in Europe remained stable between and . However, the volume of refined biomethane in the market increased, reaching 44 TWh in . Europe is expanding its biomethane capacity, with nearly 20,000 biogas plants and about 1,400 biomethane plants. Denmark, a top producer, meets 40% of its gas demand with biomethane and aims for 100% by 2032. Other major producers include Germany, France, the UK, the Netherlands, and Italy. Despite softening natural gas prices, demand for biomethane remains strong, although uncertainty persists, prompting buyers to secure long-term agreements. Thus, these factors boosted the biomethane market growth in the European region.

Region/ Year 2015 2016 2017 2018 2019 2020 2021 Total 15791875 15808177 15748093 15677520 15593902 15485345 15375668 Africa 41645 47463 51090 56167 54997+ 60004 63597 Asia 15538196 15541482 15476423 15390249 15307792 15194130 15080919 C America + Caribbean 17673 20746 21623 21370 21366 21336 21314 South America 194360 198485 198956 209734 209709 209836 209794 Sweden’s Growing Biomethane Market: A Shift Towards Renewable Energy Amidst Energy Price Volatility and Strategic Goals for 2045 Sweden's biomethane market has shown an astonishing increase amidst a difficult challenging landscape. As of , energy gases contribute a modest 3% to Sweden's total energy supply, with biogas and biomethane accounting for a good-sized proportion. The use of electricity gases dropped from 20.4 TWh in to 16.2 TWh in , in large part because of soaring electricity charges exacerbated by the Russian conflict in Ukraine. Renewable gases, which include biogas and biomethane, represented 18% of the total energy gases used in , whilst fossil gases dominated at 72%. Biogas manufacturing in Sweden remained strong at 2.3 TWh in , with 67% of this biogas upgraded to biomethane. Most of the upgraded biomethane is applied inside the delivery zone, which displays Sweden's sturdy commitment to renewable fuels for lowering carbon emissions. The manufacturing of liquefied biogas (LBG) has accelerated notably, with a 63% rise in LBG output in as compared to the previous year, driven by new LBG vegetation and a shift closer to manure-based production. Sweden’s biogas and biomethane market faces a fragmented infrastructure, with nearby and nearby grids serving as main distribution channels. Biomethane as a delivery gasoline has grown, with an average biomethane of 96% in compressed natural gasoline (CNG) and 95% in liquefied herbal gasoline (LNG) in . The variety of CNG/CBG and LNG/LBG filling stations has multiplied, supporting a fleet of approximately 50,000 fuel vehicles. The national method for renewable electricity includes ambitious goals for 2045, specializing in a climate-neutral electricity sector and an enormous discount on greenhouse gas emissions. The roadmap for fossil-unfastened power gases envisions that each one power gases used in Sweden can be fossil-free by 2045. Key policy measures include a proposed countrywide biogas production target of 10 TWh by and continued assistance for biogas manufacturing via tax exemptions and manufacturing incentives.

Germany’s Thriving Biomethane Market: Leveraging GHG Quotas and International Trade Amidst Energy Crisis and Market Dynamics The German biomethane market has emerged as a highly attractive sector due to its dynamic regulatory framework and evolving market conditions. Central to its appeal is the greenhouse gas (GHG) quota system, which incentivizes the use of sustainable biofuels by setting legal mandates for reducing emissions. This system, introduced in , replaced the earlier biofuel quota, focusing on actual GHG reductions rather than merely the energetic quantity of biofuels. Under this system, biomethane, especially that produced from advanced substrates like farm manure, qualifies for significant benefits, including double crediting for GHG reductions. Germany's biomethane market saw record sales exceeding 11 TWh in , driven by heightened demand for biomethane in the fuel sector and increased import/export activities. The GHG quota's influence on the market is profound; it creates a lucrative environment for biomethane producers by linking revenue to the amount of GHG reduction achieved. This system favors biomethane from substrates like manure, which offers superior GHG reduction values, thus enhancing revenue prospects. Price development for biomethane is influenced by both long-term contracts and spot market dynamics. Long-term contracts provide stability with the potential for significant revenue, while the spot market offers opportunities based on current prices and immediate supply-demand balances. The energy crisis and rising natural gas prices have further heightened interest in biomethane, contributing to its growing market value and increasing international trade. International trade is crucial, with a notable increase in biomethane imports from neighboring EU countries due to the GHG quota's favorable conditions. Countries such as Poland, the Czech Republic, Spain, and France play significant roles in supplying biomethane to Germany. However, the complex certification process and varied regulations for biomethane imports from outside the EU pose challenges. Ensuring compliance with sustainability standards and navigating certification requirements are essential for successful market participation. Overall, the German biomethane market is characterized by robust regulatory support, evolving market dynamics, and increasing international interest, making it a promising sector for both domestic and international stakeholders.

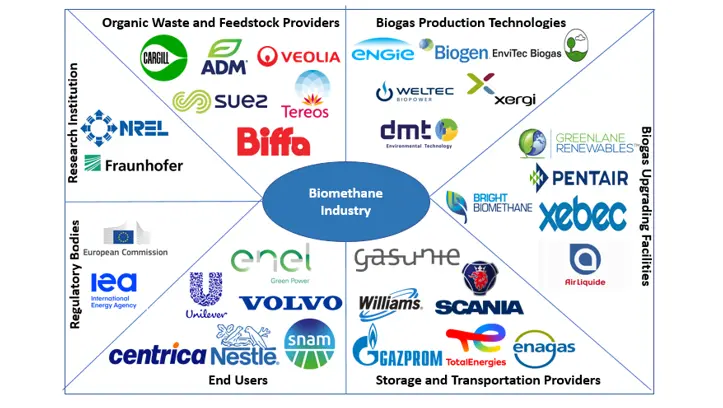

Biomethane Industry Ecosystem

Biomethane Market Scope: Inquiry Before Buying

Global Biomethane Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5761.62 Mn. Forecast Period 2025 to 2032 CAGR: 6.08% Market Size in 2032: USD 9238.75 Mn. Segments Covered: by Feedstock Energy Crops Animal Manure Municipal Waste Waste Water Sludge Others by Production Method Anaerobic Digestion Gasification Others by Application Transportation Power Generation Others by End-User Type Industrial Commercial Residential Biomethane Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Biomethane Market, Key Players:

1. Air Liquide (France) 2. Engie (France) 3. Nature Energy Biogass A/S (Denmark) 4. Terega Solutions (France) 5. Waga Energy (France) 6. Total Energy (France) 7. Archea Energy (Texas) 8. Envitec Biogas AG (Germany) 9. Future Biogas Ltd. (US) 10. Gaz Métro (Énergir) - Montreal, Canada 11. Greenlane Renewables - Burnaby, Canada 12. VERBIO - Leipzig, Germany 13. Landwärme GmbH - Munich, Germany 14. Future Biogas - Cambridge, UK 15. PlanET Biogas - Vreden, Germany 16. EnviTec Biogas AG - Lohne, Germany 17. Schmack Biogas - Schwandorf, Germany 18. BioConstruct GmbH - Melle, Germany 19. Scandinavian Biogas - Stockholm, Sweden 20. BTS Biogas - Brescia, Italy 21. Agraferm Technologies AG - Pfaffenhofen, Germany 22. Agrinz Technologies GmbH - Vienna, Austria 23. Puregas Solutions - Kalmar, Sweden 24. Nature Energy – DenmarkFAQs:

1. What are the growth drivers for the Biomethane market? Ans. The increasing demand for renewable energy, government incentives, advancements in production technology, and the need for sustainable waste management solutions are expected to be the major drivers for the Biomethane market. 2. What are the factors restraining the global Biomethane market growth during the forecast period? Ans. The high production costs, limited infrastructure for distribution, regulatory challenges, and competition from other renewable energy sources are expected to be the major factors restraining the global Biomethane market growth during the forecast period. 3. Which region is expected to lead the global Biomethane market during the forecast period? Ans. Europe is expected to lead the global Biomethane market during the forecast period. 4. What was the Global Biomethane Market size in 2024? Ans: The Global Biomethane Market size was USD 5761.62 Million in 2024. 5. What segments are covered in the Biomethane Market report? Ans. The segments covered in the Biomethane market report are Feedstock, Production Method, Application, End-User, and Region.

1. Biomethane Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Biomethane Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.4.1. Main suppliers and their market positioning 2.4.2. Key customers and adoption rates across different sectors 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2024) 2.5.5. Geographic distribution of major customers 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. Market Size Estimation Methodology 3.1.1. Bottom-Up Approach 3.1.2. Top-Down Approach 4. Market Dynamics 4.1. Biomethane Market Trends By Region 4.1.1. North America Biomethane Market Trends 4.1.2. Europe Biomethane Market Trends 4.1.3. Asia Pacific Biomethane Market Trends 4.1.4. South America Biomethane Market Trends 4.1.5. Middle East & Africa (MEA) Biomethane Market Trends 4.2. Biomethane Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.3.1. Threat of New Entrants 4.3.2. Threat of Substitutes 4.3.3. Bargaining Power of Suppliers 4.3.4. Bargaining Power of Buyers 4.3.5. Intensity of Competitive Rivalry 4.4. PESTLE Analysis 4.5. Regulatory Landscape By Region 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. South America 4.5.5. MEA 4.6. Analysis of Government Schemes and Initiatives For the Biomethane Industry 4.7. Value Chain Analysis 4.8. Supply Chain Analysis 4.8.1. Biomethane Feedstock Providers 4.8.2. Biomethane Transportation Providers 4.8.3. Technology Providers 4.8.4. Engineering, Procurement and Construction Contractors 4.9. Pricing Analysis 4.9.1. Average Selling Price Trend of Biomethane, By Region 4.9.2. Indicative Pricing Analysis of Biomethane, By Application 4.10. Biomethane Industry Ecosystem 4.10.1. Key Players in the Biomethane Industry Ecosystem 4.10.2. Role of Companies in the Biomethane Industry Ecosystem 4.11. Patent Analysis 4.11.1. Key Companies with the Highest number of Patents 4.11.2. Patent Registration Analysis 4.11.3. Number of Patents Granted Still 2024 4.12. Technology Analysis 4.12.1. Power-to-Gas Technologies 4.12.2. Biogas Upgrading Technology 4.13. Trade Analysis By Region 4.13.1. Import Data for Biomethane Compliant Products 4.13.2. Export Data for Biomethane Compliant Products 4.14. Investment and Funding Scenario 4.14.1. Major Investment and Funding 5. Biomethane Market: Global Market Size and Forecast By Segmentation (By Value USD Mn) (2024-2032) 5.1. Biomethane Market Size and Forecast, By Feedstock(2024-2032) 5.1.1. Energy Crops 5.1.2. Animal Manure 5.1.3. Municipal Waste 5.1.4. Waste Water Sludge 5.1.5. Others 5.2. Biomethane Market Size and Forecast, By Production Method(2024-2032) 5.2.1. Anaerobic Digestion 5.2.2. Gasification 5.2.3. Others 5.3. Biomethane Market Size and Forecast, By Application(2024-2032) 5.3.1. Transportation 5.3.2. Power Generation 5.3.3. Others 5.4. Biomethane Market Size and Forecast, By End-User Type(2024-2032) 5.4.1. Industrial 5.4.2. Commercial 5.4.3. Residential 5.5. Biomethane Market Size and Forecast, By Region(2024-2032) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. South America 5.5.5. MEA 6. North America Biomethane Market Size and Forecast By Segmentation (By Value USD Mn) (2024-2032) 6.1. North America Biomethane Market Size and Forecast, By Feedstock(2024-2032) 6.1.1. Energy Crops 6.1.2. Animal Manure 6.1.3. Municipal Waste 6.1.4. Waste Water Sludge 6.1.5. Others 6.2. North America Biomethane Market Size and Forecast, By Production Method(2024-2032) 6.2.1. Anaerobic Digestion 6.2.2. Gasification 6.2.3. Others 6.3. North America Biomethane Market Size and Forecast, By Application(2024-2032) 6.3.1. Transportation 6.3.2. Power Generation 6.3.3. Others 6.4. North America Biomethane Market Size and Forecast, By End-User Type(2024-2032) 6.4.1. Industrial 6.4.2. Commercial 6.4.3. Residential 6.5. North America Biomethane Market Size and Forecast, By Country (2024-2032) 6.5.1. United States 6.5.1.1. United States Biomethane Market Size and Forecast, By Feedstock(2024-2032) 6.5.1.1.1. Energy Crops 6.5.1.1.2. Animal Manure 6.5.1.1.3. Municipal Waste 6.5.1.1.4. Waste Water Sludge 6.5.1.1.5. Others 6.5.1.2. United States Biomethane Market Size and Forecast, By Production Method(2024-2032) 6.5.1.2.1. Anaerobic Digestion 6.5.1.2.2. Gasification 6.5.1.2.3. Others 6.5.1.3. United States Biomethane Market Size and Forecast, By Application(2024-2032) 6.5.1.3.1. Transportation 6.5.1.3.2. Power Generation 6.5.1.3.3. Others 6.5.1.4. United States Biomethane Market Size and Forecast By End-User Type(2024-2032) 6.5.1.4.1. Industrial 6.5.1.4.2. Commercial 6.5.1.4.3. Residential 6.5.2. Canada 6.5.2.1. Canada Biomethane Market Size and Forecast, By Feedstock(2024-2032) 6.5.2.1.1. Energy Crops 6.5.2.1.2. Animal Manure 6.5.2.1.3. Municipal Waste 6.5.2.1.4. Waste Water Sludge 6.5.2.1.5. Others 6.5.2.2. Canada Biomethane Market Size and Forecast, By Production Method(2024-2032) 6.5.2.2.1. Anaerobic Digestion 6.5.2.2.2. Gasification 6.5.2.2.3. Others 6.5.2.3. Canada Biomethane Market Size and Forecast, By Application(2024-2032) 6.5.2.3.1. Transportation 6.5.2.3.2. Power Generation 6.5.2.3.3. Others 6.5.2.4. Canada Biomethane Market Size and Forecast, By End-User Type(2024-2032) 6.5.2.4.1. Industrial 6.5.2.4.2. Commercial 6.5.2.4.3. Residential 6.5.3. Mexico 6.5.3.1. Mexico Biomethane Market Size and Forecast, By Feedstock(2024-2032) 6.5.3.1.1. Energy Crops 6.5.3.1.2. Animal Manure 6.5.3.1.3. Municipal Waste 6.5.3.1.4. Waste Water Sludge 6.5.3.1.5. Others 6.5.3.2. Mexico Biomethane Market Size and Forecast, By Production Method(2024-2032) 6.5.3.2.1. Anaerobic Digestion 6.5.3.2.2. Gasification 6.5.3.2.3. Others 6.5.3.3. Mexico Biomethane Market Size and Forecast, By Application(2024-2032) 6.5.3.3.1. Transportation 6.5.3.3.2. Power Generation 6.5.3.3.3. Others 6.5.3.4. Mexico Biomethane Market Size and Forecast, By End-User Type(2024-2032) 6.5.3.4.1. Industrial 6.5.3.4.2. Commercial 6.5.3.4.3. Residential 7. Europe Biomethane Market Size and Forecast By Segmentation (By Value USD Mn) (2024-2032) 7.1. Europe Biomethane Market Size and Forecast, By Feedstock(2024-2032) 7.2. Europe Biomethane Market Size and Forecast, By Production Method(2024-2032) 7.3. Europe Biomethane Market Size and Forecast, By Application(2024-2032) 7.4. Europe Biomethane Market Size and Forecast, By End-User Type(2024-2032) 7.5. Europe Biomethane Market Size and Forecast, By Country (2024-2032) 7.5.1. United Kingdom 7.5.1.1. United Kingdom Biomethane Market Size and Forecast, By Feedstock(2024-2032) 7.5.1.2. United Kingdom Biomethane Market Size and Forecast, By Production Method(2024-2032) 7.5.1.3. United Kingdom Biomethane Market Size and Forecast, By Application(2024-2032) 7.5.1.4. United Kingdom Biomethane Market Size and Forecast By End-User Type(2024-2032) 7.5.2. France 7.5.2.1. France Biomethane Market Size and Forecast, By Feedstock(2024-2032) 7.5.2.2. France Biomethane Market Size and Forecast, By Production Method(2024-2032) 7.5.2.3. France Biomethane Market Size and Forecast, By Application(2024-2032) 7.5.2.4. France Biomethane Market Size and Forecast, By End-User Type(2024-2032) 7.5.3. Germany 7.5.3.1. Germany Biomethane Market Size and Forecast, By Feedstock(2024-2032) 7.5.3.2. Germany Biomethane Market Size and Forecast, By Production Method(2024-2032) 7.5.3.3. Germany Biomethane Market Size and Forecast, By Application(2024-2032) 7.5.3.4. Germany Biomethane Market Size and Forecast, By End-User Type(2024-2032) 7.5.4. Italy 7.5.4.1. Italy Biomethane Market Size and Forecast, By Feedstock(2024-2032) 7.5.4.2. Italy Biomethane Market Size and Forecast, By Production Method(2024-2032) 7.5.4.3. Italy Biomethane Market Size and Forecast, By Application(2024-2032) 7.5.4.4. Italy Biomethane Market Size and Forecast, By End-User Type(2024-2032) 7.5.5. Spain 7.5.5.1. Spain Biomethane Market Size and Forecast, By Feedstock(2024-2032) 7.5.5.2. Spain Biomethane Market Size and Forecast, By Production Method(2024-2032) 7.5.5.3. Spain Biomethane Market Size and Forecast, By Application(2024-2032) 7.5.5.4. Spain Biomethane Market Size and Forecast, By End-User Type(2024-2032) 7.5.6. Sweden 7.5.6.1. Sweden Biomethane Market Size and Forecast, By Feedstock(2024-2032) 7.5.6.2. Sweden Biomethane Market Size and Forecast, By Production Method(2024-2032) 7.5.6.3. Sweden Biomethane Market Size and Forecast, By Application(2024-2032) 7.5.6.4. Sweden Biomethane Market Size and Forecast, By End-User Type(2024-2032) 7.5.7. Austria 7.5.7.1. Austria Biomethane Market Size and Forecast, By Feedstock(2024-2032) 7.5.7.2. Austria Biomethane Market Size and Forecast, By Production Method(2024-2032) 7.5.7.3. Austria Biomethane Market Size and Forecast, By Application(2024-2032) 7.5.7.4. Austria Biomethane Market Size and Forecast, By End-User Type(2024-2032) 7.5.8. Rest of Europe 7.5.8.1. Rest of Europe Biomethane Market Size and Forecast, By Feedstock(2024-2032) 7.5.8.2. Rest of Europe Biomethane Market Size and Forecast, By Production Method(2024-2032) 7.5.8.3. Rest of Europe Biomethane Market Size and Forecast, By Application(2024-2032) 7.5.8.4. Rest of Europe Biomethane Market Size and Forecast, By End-User Type(2024-2032) 8. Asia Pacific Biomethane Market Size and Forecast By Segmentation (By Value USD Mn) (2024-2032) 8.1. Asia Pacific Biomethane Market Size and Forecast, By Feedstock(2024-2032) 8.2. Asia Pacific Biomethane Market Size and Forecast, By Production Method(2024-2032) 8.3. Asia Pacific Biomethane Market Size and Forecast, By Application(2024-2032) 8.4. Asia Pacific Biomethane Market Size and Forecast, By End-User Type(2024-2032) 8.5. Asia Pacific Biomethane Market Size and Forecast, By Country (2024-2032) 8.5.1. China 8.5.1.1. China Biomethane Market Size and Forecast, By Feedstock(2024-2032) 8.5.1.2. China Biomethane Market Size and Forecast, By Production Method(2024-2032) 8.5.1.3. China Biomethane Market Size and Forecast, By Application(2024-2032) 8.5.1.4. China Biomethane Market Size and Forecast, By End-User Type(2024-2032) 8.5.2. S Korea 8.5.2.1. S Korea Biomethane Market Size and Forecast, By Feedstock(2024-2032) 8.5.2.2. S Korea Biomethane Market Size and Forecast, By Production Method(2024-2032) 8.5.2.3. S Korea Biomethane Market Size and Forecast, By Application(2024-2032) 8.5.2.4. S Korea Biomethane Market Size and Forecast, By End-User Type(2024-2032) 8.5.3. Japan 8.5.3.1. Japan Biomethane Market Size and Forecast, By Feedstock(2024-2032) 8.5.3.2. Japan Biomethane Market Size and Forecast, By Production Method(2024-2032) 8.5.3.3. Japan Biomethane Market Size and Forecast, By Application(2024-2032) 8.5.3.4. Japan Biomethane Market Size and Forecast, By End-User Type(2024-2032) 8.5.4. India 8.5.4.1. India Biomethane Market Size and Forecast, By Feedstock(2024-2032) 8.5.4.2. India Biomethane Market Size and Forecast, By Production Method(2024-2032) 8.5.4.3. India Biomethane Market Size and Forecast, By Application(2024-2032) 8.5.4.4. India Biomethane Market Size and Forecast, By End-User Type(2024-2032) 8.5.5. Australia 8.5.5.1. Australia Biomethane Market Size and Forecast, By Feedstock(2024-2032) 8.5.5.2. Australia Biomethane Market Size and Forecast, By Production Method(2024-2032) 8.5.5.3. Australia Biomethane Market Size and Forecast, By Application(2024-2032) 8.5.5.4. Australia Biomethane Market Size and Forecast, By End-User Type(2024-2032) 8.5.6. ASEAN 8.5.6.1. ASEAN Biomethane Market Size and Forecast, By Feedstock(2024-2032) 8.5.6.2. ASEAN Biomethane Market Size and Forecast, By Production Method(2024-2032) 8.5.6.3. ASEAN Biomethane Market Size and Forecast, By Application(2024-2032) 8.5.6.4. ASEAN Biomethane Market Size and Forecast, By End-User Type(2024-2032) 8.5.7. Rest of Asia Pacific 8.5.7.1. Rest of Asia Pacific Biomethane Market Size and Forecast, By Feedstock(2024-2032) 8.5.7.2. Rest of Asia Pacific Biomethane Market Size and Forecast, By Production Method(2024-2032) 8.5.7.3. Rest of Asia Pacific Biomethane Market Size and Forecast, By Application(2024-2032) 8.5.7.4. Rest of Asia Pacific Biomethane Market Size and Forecast, By End-User Type(2024-2032) 9. South America Biomethane Market Size and Forecast By Segmentation (By Value USD Mn) (2024-2032) 9.1. South America Biomethane Market Size and Forecast, By Feedstock(2024-2032) 9.2. South America Biomethane Market Size and Forecast, By Production Method(2024-2032) 9.3. South America Biomethane Market Size and Forecast, By Application(2024-2032) 9.4. South America Biomethane Market Size and Forecast, By End-User Type(2024-2032) 9.5. South America Biomethane Market Size and Forecast, By Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Biomethane Market Size and Forecast, By Feedstock(2024-2032) 9.5.1.2. Brazil Biomethane Market Size and Forecast, By Production Method(2024-2032) 9.5.1.3. Brazil Biomethane Market Size and Forecast, By Application(2024-2032) 9.5.1.4. Brazil Biomethane Market Size and Forecast, By End-User Type(2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Biomethane Market Size and Forecast, By Feedstock(2024-2032) 9.5.2.2. Argentina Biomethane Market Size and Forecast, By Production Method(2024-2032) 9.5.2.3. Argentina Biomethane Market Size and Forecast, By Application(2024-2032) 9.5.2.4. Argentina Biomethane Market Size and Forecast, By End-User Type(2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Biomethane Market Size and Forecast, By Feedstock(2024-2032) 9.5.3.2. Rest Of South America Biomethane Market Size and Forecast, By Production Method(2024-2032) 9.5.3.3. Rest Of South America Biomethane Market Size and Forecast, By Application(2024-2032) 9.5.3.4. Rest Of South America Biomethane Market Size and Forecast, By End-User Type(2024-2032) 10. Middle East and Africa Biomethane Market Size and Forecast By Segmentation (By Value USD Mn) (2024-2032) 10.1. Middle East and Africa Biomethane Market Size and Forecast, By Feedstock(2024-2032) 10.2. Middle East and Africa Biomethane Market Size and Forecast, By Production Method(2024-2032) 10.3. Middle East and Africa Biomethane Market Size and Forecast, By Application(2024-2032) 10.4. Middle East and Africa Biomethane Market Size and Forecast, By End-User Type(2024-2032) 10.5. Middle East and Africa Biomethane Market Size and Forecast, By Country (2024-2032) 10.5.1. South Africa 10.5.1.1. South Africa Biomethane Market Size and Forecast, By Feedstock(2024-2032) 10.5.1.2. South Africa Biomethane Market Size and Forecast, By Production Method(2024-2032) 10.5.1.3. South Africa Biomethane Market Size and Forecast, By Application(2024-2032) 10.5.1.4. South Africa Biomethane Market Size and Forecast, By End-User Type(2024-2032) 10.5.2. GCC 10.5.2.1. GCC Biomethane Market Size and Forecast, By Feedstock(2024-2032) 10.5.2.2. GCC Biomethane Market Size and Forecast, By Production Method(2024-2032) 10.5.2.3. GCC Biomethane Market Size and Forecast, By Application(2024-2032) 10.5.2.4. GCC Biomethane Market Size and Forecast, By End-User Type(2024-2032) 10.5.3. Rest Of MEA 10.5.3.1. Rest Of MEA Biomethane Market Size and Forecast, By Feedstock(2024-2032) 10.5.3.2. Rest Of MEA Biomethane Market Size and Forecast, By Production Method(2024-2032) 10.5.3.3. Rest Of MEA Biomethane Market Size and Forecast, By Application(2024-2032) 10.5.3.4. Rest Of MEA Biomethane Market Size and Forecast, By End-User Type(2024-2032) 11. Company Profile: Key Players 11.1. Air Liquide 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. Engie 11.3. Nature Energy Biogass A/S 11.4. Terega Solutions 11.5. Waga Energy 11.6. Total Energy 11.7. Archea Energy 11.8. Envitec Biogas AG 11.9. Future Biogas Ltd. 11.10. Gaz Métro (Énergir) 11.11. Greenlane Renewables 11.12. VERBIO 11.13. Landwärme GmbH 11.14. Future Biogas 11.15. PlanET Biogas 11.16. EnviTec Biogas AG 11.17. Schmack Biogas 11.18. BioConstruct GmbH 11.19. Scandinavian Biogas 11.20. BTS Biogas 11.21. Agraferm Technologies AG 11.22. Agrinz Technologies GmbH 11.23. Puregas Solutions 11.24. Nature Energy 12. Key Findings 13. Analyst Recommendations 13.1. Attractive Opportunities for Players in the Biomethane Market 13.2. Future Outlooks 14. Biomethane Market: Research Methodology