The Alternative Protein Market size was valued at US$ 16.88 Billion in 2022 and the total Alternative Protein revenue is expected to grow at 9.84% through 2023 to 2029, reaching nearly US$ 32.58 Billion.Alternative Protein Market Overview:

Global Alternative proteins are also called meat substitutes. These are developed and produced to replace meat products. These are very important when the global ecosystem is considered. These reduce the environmental burden with reduced land use and feed use as well as promote less use of water. The majority of the agricultural land is used to grow feed for the livestock, alternative protein market reduces this stress on the global agricultural market.To know about the Research Methodology :- Request Free Sample Report The alternative protein market's growth reasons, as well as the market's many segments, are discussed. Data has been given by market participants, regions, and specific requirements. This market-ready study proposal includes a comprehensive overview of all the significant improvements that are presently prevailing in all market segments. Key data analysis is presented in the form of statistics, infographics, and presentations. The study discusses the alternative protein market's Drivers, Restraints, Opportunities, and Challenges. The report helps to assess the market growth drivers and determines how to use these drivers as a tool. The report also helps to rectify and resolve issues related to the alternative protein market condition.

Alternative Protein Market Dynamics:

A major driver in the alternative protein market is increasing capital investments in plant-based protein companies. For example, an Indian company Proeon raised US$ 2.4 million in seed funding to support the plant-based protein industry. Investments like these in meat substitute-based companies are projected to drive the global market during the forecast period (2023-2029). Other drivers of the global market are vegetarianism and veganism. The increase of obesity and health issues like cardiovascular diseases led to many consumers adopting these lifestyles. This trend is expected to fuel the overall market growth in the same forecast period. A major restraint in the market is the consumers who are unwilling to shift from regular meat to other alternatives. Countries like the US and the EU are one of the biggest meat-consuming countries in the world. The main diet ingredient in the majority of consumer diet in these countries is pork, beef, etc. The convincing of these consumers to shift to protein alternatives is a huge challenge. This trend is projected to hamper the overall market growth in the aforementioned forecast period. The key opportunity in the global alternative protein market is the rising threat of climate change. It is the need of time to reduce carbon emissions around the world. Most of the climate damage is done due to the excretion of methane gas by livestock animals. A shift to a plant-based protein diet can significantly reduce these emissions.Alternative Protein Market Segment Analysis:

By Source, the plant protein segment dominated the global market in the year 2022. This segment is projected to grow at the highest CAGR of 6.7% in the forecast period (2023-2029). Plant-based proteins are further divided into wheat, soy, pea, and oat-based proteins. Pea-based proteins are used in different egg-based and meat-based products. Low processing cost is the major factor that drives the pea processing segment growth. Furthermore, according to the CDC (Center for Prevention of Disease and Control), most of the diseases are caused by non-vegetarian meals. This is projected to drive the growth of this segment in the same forecast period. The Myprotein segment was worth US$550 million in 2022. Mycoprotein products mimic the taste and texture of actual meat than other substitutes like tempeh or seitan. These are high vitamin, high protein vegetable ingredients. These are factors are expected to contribute to the growth of this segment in the same forecast period. Insect protein is derived from mealworms, crickets, grasshopper flies, and ants. These insects have part of traditional protein intake in many south Asian countries. These are used because of their higher levels of conversion efficiency. This factor is expected to drive the growth of this segment in the forecast period. By Application, the food and beverage segment dominated the global alternative protein market in the year 2022. This segment is also projected to grow at the highest CAGR of 5.6% in the aforementioned forecast period. This can be attributed to different food alternatives like paneer are rapidly replacing the traditional protein sources. Alternative protein as a dietary supplement is projected to be a major contributor to the global market. This can be correlated with protein supplement demand in the healthcare industry. Patients who suffer from protein-deficient diseases like Kwashiorkor and Cachexia are most likely to be recommended dietary protein supplements by doctors. These factors are projected to influence the global alternative protein market in the aforementioned forecast period.

Regional Insights:

The North American region dominated the global alternative protein market in the year 2022.More than 50% of the total North American market is dominated by the United States. Soy protein is particularly gaining traction in this country. The rise of veganism in the region prompted the high growth of alternative proteins in this region. The European region is expected to contribute to the growth in the insect protein market. This region also dominated the insect protein segment in the year 2022. The European region is also estimated to dominate the pea protein segment in the year 2029. This can be attributed to EU countries like France being one of the largest producers of peas in the world. (approx. 230,000 tonnes in 2022) The objective of the report is to present a comprehensive analysis of the Alternative Protein market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Alternative Protein market dynamics, structure by analyzing the market segments and projecting the Alternative Protein market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Alternative Protein market make the report investor’s guide.Alternative Protein Market Scope: Inquire before buying

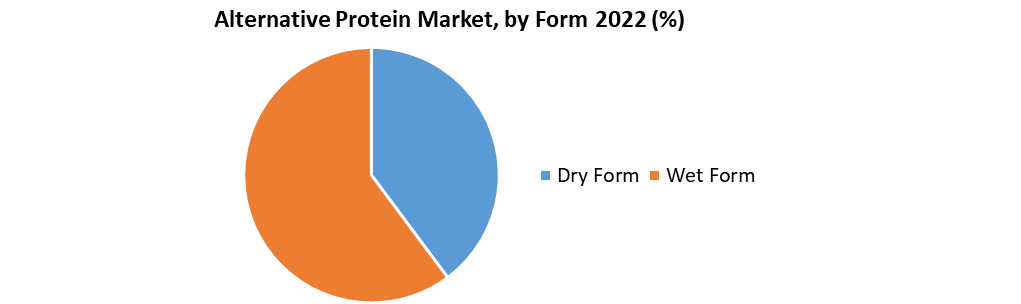

Global Alternative Protein Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 16.88 Billion. Forecast Period 2023 to 2029 CAGR: 9.84 % Market Size in 2029: US $ 32.58 Billion. Segments Covered: by Source Plant Protein Mycoprotein Algal Protein Insect Protein by Form Dry Form Wet Form by Application Food Beverage Dietary Supplement Feed Industry Alternative Protein Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Key Players

1. Corbion Biotech Inc. 2. Agriprotein Holdings Ltd 3. Algatechologies Ltd. 4. BurconNutraScience Corporation 5. Aspire Food Group 6. EntofoodSdn Bhd 7. MycoTechnology Inc. 8. Tianjin Norland Biotech Co., Ltd 9. Enterra Feed Corporation 10. Glanbia Plc. 11. Microalgaetech International SdnBhd 12. Ingredion Incorporated 13. Sun Chlorella Corporation 14. Parabel, Inc. 15. Plantible Foods, Inc. 16. Now foodsFAQs:

1. Which is the potential market for Alternative Protein in terms of the region? Ans. The North American region dominated the global alternative protein market in the year 2022. 2. What are the opportunities for new market entrants? Ans. The key opportunity in the global alternative protein market is the rising threat of climate change. 3. What is expected to drive the growth of the Alternative Protein market in the forecast period? Ans. A major driver in the global alternative protein market is increasing capital investments in plant-based protein companies. 4. What is the projected market size & growth rate of the Alternative Protein Market? Ans. Alternative Protein Market size was valued at US$ 16.88 Billion in 2022 and the total Alternative Protein revenue is expected to grow at 9.84% through 2023 to 2029, reaching nearly US$ 32.58 Billion. 5. What segments are covered in the Alternative Protein Market report? Ans. The segments covered are source, Form, application and region.

1. Global Alternative Protein Market: Research Methodology 2. Global Alternative Protein Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Alternative Protein Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Alternative Protein Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Alternative Protein Market Segmentation 4.1 Global Alternative Protein Market, by Source (2022-2029) • Plant Protein • Mycoprotein • Algal Protein • Insect Protein 4.2 Global Alternative Protein Market, by Form (2022-2029) • Dry Form • Wet Form 4.3 Global Alternative Protein Market, by Application (2022-2029) • Food • Beverage • Dietary Supplement • Feed Industry 5. North America Alternative Protein Market(2022-2029) 5.1 North America Alternative Protein Market, by Source (2022-2029) • Plant Protein • Mycoprotein • Algal Protein • Insect Protein 5.2 North America Alternative Protein Market, by Form (2022-2029) • Dry Form • Wet Form 5.3 North America Alternative Protein Market, by Application (2022-2029) • Food • Beverage • Dietary Supplement • Feed Industry 5.4 North America Alternative Protein Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Alternative Protein Market (2022-2029) 6.1. European Alternative Protein Market, by Source (2022-2029) 6.2. European Alternative Protein Market, by Form (2022-2029) 6.3. European Alternative Protein Market, by Application (2022-2029) 6.4. European Alternative Protein Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Alternative Protein Market (2022-2029) 7.1. Asia Pacific Alternative Protein Market, by Source (2022-2029) 7.2. Asia Pacific Alternative Protein Market, by Form (2022-2029) 7.3. Asia Pacific Alternative Protein Market, by Application (2022-2029) 7.4. Asia Pacific Alternative Protein Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Alternative Protein Market (2022-2029) 8.1 Middle East and Africa Alternative Protein Market, by Source (2022-2029) 8.2. Middle East and Africa Alternative Protein Market, by Form (2022-2029) 8.3. Middle East and Africa Alternative Protein Market, by Application (2022-2029) 8.4. Middle East and Africa Alternative Protein Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Alternative Protein Market (2022-2029) 9.1. South America Alternative Protein Market, by Source (2022-2029) 9.2. South America Alternative Protein Market, by Form (2022-2029) 9.3. South America Alternative Protein Market, by Application (2022-2029) 9.4 South America Alternative Protein Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Corbion Biotech Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Agriprotein Holdings Ltd 10.3 Algatechologies Ltd. 10.4 BurconNutraScience Corporation 10.5 Aspire Food Group 10.6 EntofoodSdn Bhd 10.7 MycoTechnology Inc. 10.8 Tianjin Norland Biotech Co., Ltd 10.9 Enterra Feed Corporation 10.10 Glanbia Plc. 10.11 Microalgaetech International SdnBhd 10.12 Ingredion Incorporated 10.13 Sun Chlorella Corporation 10.14 Parabel, Inc. 10.15 Plantible Foods, Inc. 10.16 Now foods