The Global Cyber Security Market size was valued at USD 175.5 Bn in 2023 and is expected to reach USD 276.6 Bn by 2030, at a CAGR of 6.7 %.Overview of the Global Cyber Security Market

Cyber security entails the proactive protection of computers, servers, mobile devices, electronic systems, networks, and data against malevolent attacks. It is interchangeably referred to as information technology security or electronic information security, and its relevance spans across diverse contexts, encompassing both corporate and mobile computing environments. The discipline categorized into several prevalent facets. These cyberattacks primarily target the unauthorized access, manipulation, or obliteration of sensitive information, coercing users into financial concessions through ransom ware, or the disruption of routine business operations. The contemporary landscape for implementing robust cyber security measures is notably complex. The graphical representation and structural exclusive information showed the dominating region of the Global Cyber Security Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Cyber Security Market.To know about the Research Methodology :- Request Free Sample Report

Cyber Security Market Dynamics

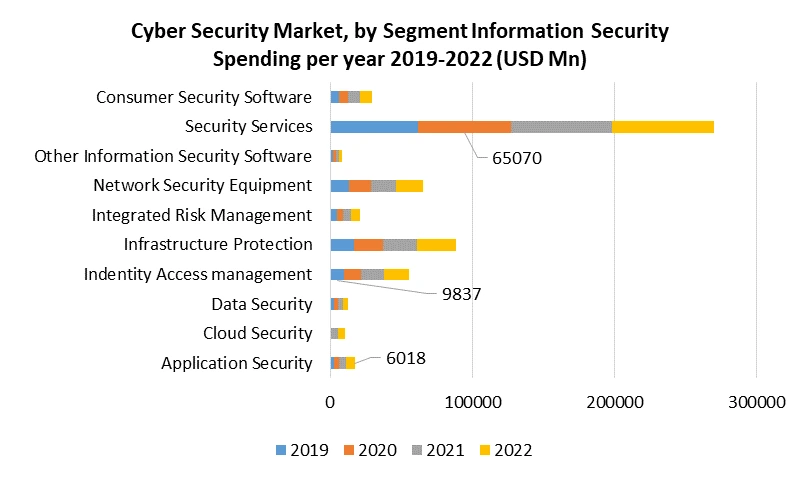

Escalating Targeted Cyberattacks Disrupting Operations, Streamlining Security Infrastructure with Cyber security Mesh Architecture (CSMA) and Increasing Need for Board-Level Cyber Expertise are the biggest growth drivers of Cyber Security Market The escalating frequency of target-based cyber-attacks poses a significant driver for the Cyber security market. With cybercriminals continually seeking to exploit vulnerabilities, the need for robust security solutions and services is on the rise. This is fostering growth in the network security market, industrial cyber security market, and the Cyber security market in India. The adoption of Cyber security Mesh Architecture (CSMA) is simplifying the security infrastructure for organizations. This innovative approach is streamlining the deployment of security measures, enhancing overall defence capabilities, and driving the growth of the cyber security industry. There is a growing recognition of the importance of cyber security at the executive level. Boards of directors and top management are increasingly aware of the implications of cyber threats and are seeking expertise in this domain. This demand for cyber-savvy boards is fostering the adoption of cutting-edge cyber security solutions, including Endpoint Protection Services, Data Breach Prevention, and Threat Intelligence Software. In today's evolving regulatory landscape, organizations are compelled to prioritize cyber security to meet data protection and privacy regulations like GDPR, HIPAA, and CCPA. Compliance with these legal mandates is driving demand for Cyber security solutions. This is particularly noticeable in the network security market and industrial cyber security market.Rising Adoption of Cloud Computing, Remote Work Trends and Financial Services Industry Emphasis Are booming drivers in the Cyber Security Market Organizations seek data protection, data breach prevention, and threat intelligence software to ensure they remain compliant and mitigate risks. The widespread adoption of cloud services has broadened the attack surface for cyber threats. As a result, businesses are investing in cloud security solutions to safeguard their data and infrastructure. This trend is bolstering growth in the overall Cyber security market, particularly in cloud security and endpoint protection services. The shift toward remote and hybrid work models has exposed organizations to new security challenges. To address these challenges, organizations are increasing their investment in remote access security solutions, secure virtual private networks (VPNs), and endpoint protection services. This growth is particularly evident in the network security market and the Cyber security market in India. The financial services sector is a prime target for cyberattacks due to the sensitive financial data it handles. This sector places a strong emphasis on Cyber security solutions and services, driving market growth. Financial institutions invest in network security, data breach prevention, and endpoint protection services to safeguard their assets and customer information.

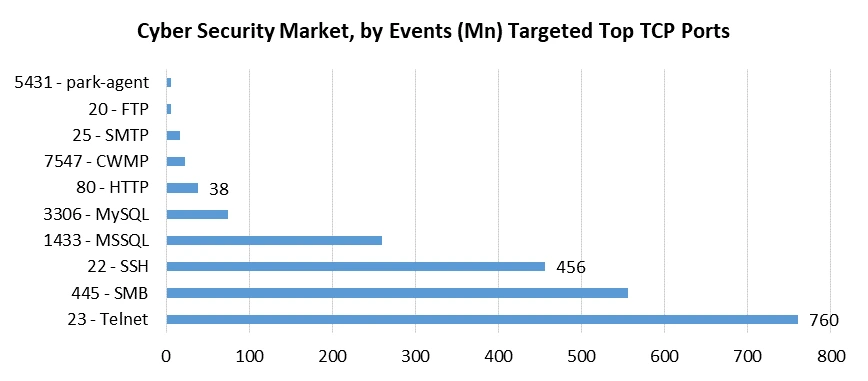

IoT's Emergence and Cyber security Challenges and Ransomware's Targeted Onslaught are growing trends in Cyber Security Market The rise in new technologies and devices, mostly driven by the Internet of Things (IoT), has potentially contributed to the increase in cyberattacks over the past decade. The IoT encompasses the massive array of physical devices globally that receive and transmit data via the internet, with projections showcasing over 41 billion IoT devices to be connected by 2025.This proliferation has expanded the potential attack surface, challenging security companies in the network security market, industrial cyber security market, and Cyber security market in India to keep pace. The result has been a twelvefold increase in cyberattacks during the first half of 2019, attributed to the growing IoT landscape. The implications extend to various devices, from fitness watches to baby monitors, which face heightened security risks, necessitating designers and manufacturers to urgently fortify security measures. Alarmingly, only 7% of companies and manufacturers have established comprehensive IoT security plans, and over 50% express concerns about security issues within their IoT devices, while more than a quarter of manufacturers lack any security policy for their vendors or IoT partners. Targeted Ransomware, a malevolent malware category designed to hold victims' data hostage for monetary gain, often in crypto currency, has witnessed a surge in its activities. This type of attack typically involves denying access to users and system administrators to specific files or entire digital networks, accompanied by a ransom demand for the release of data. The US government's report highlights an alarming statistic over 4,000 daily Ransomware attacks occur. In 2021, targeted Ransomware attacks are predicted to strike every 11 seconds, excluding individual-level attacks. Notably, a single targeted Ransomware attack in 2021 commanded a $40 million ransom, and the average ransom request reached $200,000 in 2020. While Ransomware attacks can manifest globally, they are particularly prevalent in regions with extensive internet access, with over 18% of such attacks transpiring in the United States, which records the highest number of Ransomware attacks. This growing cyber threat in the Cyber security industry has led experts to anticipate a continued escalation in targeted Ransomware attacks. The evolving landscape of remote work, with approximately 84% of businesses intending to persist with remote work post-COVID-19 restrictions, only heightens the vulnerability to data exposure. Cybercrime Magazine projects that targeted Ransomware damages are set to exceed $20 billion in 2021, reinforcing the imperative for enhanced security, especially for small to mid-sized businesses. Multi-Factor Authentication Evolution and Cloud-Based Services under Siege are also emerging trends in Cyber Security Market Multi-factor authentication, a robust electronic authentication method requiring users to provide multiple forms of identity evidence for access, has long been hailed for its security. However, prominent companies like Microsoft now discourage the use of SMS and voice authentication methods due to heightened security risks. Although SMS authentication remains a viable option when no other security alternatives are available, it remains susceptible to automated "man in the middle" attacks, with online banking at the forefront of such risks. To mitigate the potential for unauthorized account access, cyber security experts are increasingly advocating for the utilization of hardware security keys for verification when feasible. Cloud-based services remain a prime target for cyber threats, with misconfigurations accounting for the most costly security breaches. Misconfigurations can lead to data breaches, unauthorized network access, insecure interfaces, and account takeovers, with the average data breach incurring costs exceeding $3.5 million. The United States and Canada, in particular, face substantial threats, with losses reaching $7.91 million and $4.74 million, respectively. A striking 68% of companies identify asset misconfiguration as a significant contributor to cloud-based security risks. Furthermore, 75% of companies express concerns about their cloud security and associated threats. Cloud-based cyberattacks surged by nearly 630% between January and April the previous year. It is estimated that 20% of organizations' data breaches resulted from remote workers utilizing corporate cloud-based platforms. Therefore, it is imperative for companies to efficiently manage and minimize potential cloud-based security threats.

Cyber Security Market Segment Analysis

Software: Within the dynamic cyber security market, antivirus software is meticulously designed to discern, intercept, and obliterate malevolent software, more commonly referred to as malware, harboured within computer systems. Its core functionality revolves around the systematic examination of files and programs, adeptly identifying and eradicating threats like viruses, worms, and Trojans. This pivotal role fortifies the defence mechanisms against the ever-evolving landscape of cyber threats in the cyber security industry. In the network security market, firewall software stands as a formidable guardian, erecting a protective barrier between computer systems or networks and the potential perils emanating from the expansive realm of internet-based threats. It assumes a critical role in the constant vigilance, monitoring, and regulation of the ebb and flow of incoming and outgoing network traffic. Through the judicious application of predefined security rules, this software decisively determines the passage or blockade of data, thereby amplifying the bastion of network security. Recognized within the industrial cyber security market, endpoint security software extends its vigilant protection to individual devices, or endpoints, including computers, mobile devices, and servers. Its multifaceted arsenal comprises not only antivirus and anti-malware capabilities but also sophisticated device management functionalities. This comprehensive approach ensures that these pivotal components are safeguarded with unwavering dedication, fortifying the overall security posture. This is especially pertinent in the context of the burgeoning cyber security market in India, where the demand for such software is burgeoning. Endpoint Protection Services, Data Breach Prevention, and Threat Intelligence Software contribute to the comprehensive defence against a multitude of cyber threats. Services: In the dynamic cyber security market, consulting services play a pivotal role. These services offer expert guidance and comprehensive assessments to assist organizations in recognizing vulnerabilities, crafting effective security strategies, and ensuring adherence to industry-specific regulations and standards. They are instrumental in bolstering the overall cyber security industry as well as industrial cyber security Data Breach Prevention market. Within the network security market, Managed Security Services (MSS) providers specialize in the remote monitoring and management of an organization's security infrastructure. Their comprehensive services encompass vital aspects such as threat detection, incident response, and round-the-clock security monitoring. MSS providers play a critical role in enhancing the resilience of cyber security measures within the industrial cyber security market. Incident response services hold a crucial place in the arsenal of cyber security solutions. These services prove invaluable in guiding organizations' responses to security incidents, including data breaches and cyberattacks. They facilitate the swift identification of the incident's origin, enable effective damage control, and contribute to the prevention of future occurrences, fortifying the cyber security market. Often referred to as ethical hacking, penetration testing services are at the forefront of the battle to secure digital assets. These services simulate cyberattacks to uncover vulnerabilities within an organization's systems and networks. By proactively addressing these security weaknesses, organizations can fortify their defences, thereby contributing to the overall security posture in the cyber security market. Security training services are paramount in building a robust cyber security culture within organizations. These programs provide education and awareness, arming employees with the knowledge and practices necessary to uphold stringent security protocols. This proactive approach significantly reduces the risk of human errors that could potentially contribute to cyberattacks, a fundamental aspect in the defence against data breaches and the protection of sensitive information.

Cyber Security Market Regional Analysis

North America, specifically the United States, has strong base in the cyber security industry. It has fostered a strong ecosystem of cyber security companies, research organisations, and government-led initiatives. With widespread adoption of advanced cyber security solutions across various sectors, the region has cultivated a thriving market. The U.S. government, in particular, has proactively bolstered national cyber security through initiatives, regulations, and standards, significantly shaping the industry's benchmarks. North America has established for technological advancement, fostering cutting-edge cyber security technologies and startups, offering to the industry's ever-evolving landscape. The Asia-Pacific region has established as a strong player in the cyber security market. Advanced growth is driven by the widespread digital technology, gaining internet accessibility, and the increasing cyber threats. Organizations in the region have made substantial investments in cyber security solutions to safeguard their digital assets. Government initiatives in several Asia-Pacific countries have recognized the paramount importance of cyber security, implementing national strategies to fortify cyber defences. These governmental endeavor have played a pivotal role in boosting cyber security adoption and maturity. Also, the Asia-Pacific region has experienced a huge rise in cyber threats, necessitating increasing awareness and spending in cyber security solutions, with a particular prominence on areas such as data breach prevention and threat intelligence to protect sensitive information in the China, Japan, India, Australia, Singapore, Rest of Asia Pacific. Europe has imprinted a position for itself in the global cyber security market, considered by a growing and deep-rooted presence. European countries have directed significant investments into cyber security infrastructure and research to bolster their digital resilience and safeguard critical data. The European Union's stringent data protection regulations, notably the General Data Protection Regulation (GDPR), have been instrumental in propelling investments in data protection and privacy solutions. GDPR compliance is a paramount priority for organizations spanning various sectors. Therefore, European countries have fostered collaborative efforts in cyber security research and initiatives, underscoring a cooperative approach that has led to the development of innovative cyber security solutions, fortifying the region's standing in the global market.

Cyber Security Market Competitive Landscape

EY and IBM, in a significant development for the cyber security industry, have jointly unveiled EY.ai Workforce, a cutting-edge HR solution meticulously designed to seamlessly integrate artificial intelligence (AI) into core HR business processes. This collaborative effort between the two industry leaders marks a crucial milestone in the utilization of AI to enhance productivity within HR functions. EY.ai Workforce leverages the power of AI and automation from IBM's Watson Orchestrate, combining it with EY's extensive domain expertise in HR transformation. This dynamic solution empowers organizations to modernize their HR processes effectively in the cyber security market. With an in-depth understanding of businesses' unique processes, EY's expert teams work closely with organizations to deploy tailored AI-powered solutions. Watson Orchestrates automation capabilities break down complex tasks into manageable steps, simplifying processes like drafting job descriptions and generating payroll reports. The intuitive natural language interface ensures accessibility for all employees, freeing up valuable time for more high-value tasks. IBM has introduced new AI-powered Threat Detection and Response Services, enhancing its formidable presence in the cyber security market. This cutting-edge service offering is geared toward effectively ingesting and analysing security data from a wide array of technologies and vendors. IBM's 24x7 Threat Detection and Response Services provide round-the-clock monitoring, comprehensive investigation, and automated remediation of security alerts across diverse client environments, encompassing hybrid cloud, existing security tools, cloud-based solutions, on-premise technologies, and operational technologies (OT). These managed services are delivered by IBM Consulting's global team of security analysts, leveraging IBM's advanced security services platform, which deploys multiple layers of AI and contextual threat intelligence drawn from its vast global security network. This approach streamlines threat response by automating routine tasks and rapidly addressing critical security issues in the cyber security industry. Accenture has made a strategic investment through Accenture Ventures in Aliro Quantum, a pioneering provider of versatile, end-to-end entanglement-based secure quantum networks. This strategic move underscores the importance of secure quantum networks in the current cyber security landscape. As businesses increasingly engage with quantum computing, the need for robust quantum-specific security protocols and threat monitoring becomes paramount to ensure data and communication safety in this dynamic cyber security market. Accenture has recently acquired The Storytellers, a creative management consultancy based in the U.K., known for its partnership with CEOs and C-Suite executives to develop compelling narratives that drive transformative change and enhance organizational performance in the cyber security market.This acquisition further bolsters Accenture's capabilities in transformational change and equips the company to better assist clients in articulating and enacting their vision and change strategies. With a track record dating back to 2003, The Storytellers excels in employing a human-centered approach to activate transformations and new business strategies. Their expertise combines storytelling, facilitation, skills development, creative communications, and immersive digital and live event production to help leaders craft and deliver motivating narratives. Their work has benefited over 200 clients, guiding them in realizing the advantages of change in their organizations in the cyber security industry.

Cyber Security Market Scope: Inquiry Before Buying

Cyber Security Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 175.5 Bn. Forecast Period 2024 to 2030 CAGR: 6.7% Market Size in 2030: US $ 276.6 Bn Segments Covered: by Components Hardware Software Services by Software Antivirus Software Firewall Software Endpoint Security Software Network Security Software Security Information and Event Management(SIEM) Software Identity and Access management (IAM) Software Encryption Software Threat Intelligence Software Above 75 gallons by Services Consulting Services Managed Security Services (MSS) Incident Response Services Penetration Testing Services Security Training and Awareness Vulnerability Assessment Services Forensics and Investigation Services Security Compliance Services by Security Type Network Security solutions Endpoint Protection Services Application Security Cloud Security by Deployment Mode On-Premises Cloud-Based by Organization Size Small and Medium-sized Enterprises (SMEs) Large Enterprises by Vertical Financial Services Healthcare organizations Manufacturing sector Government and Defense sector Retail sector Energy and Utilities sector Education Telecommunications Entertainment Cyber Security Market, by Regions

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Cyber Security Market

1. International Business Machines Corp 2. Accenture Plc 3. Palo Alto Networks Inc 4. Cybereason Inc 5. SecureWorks Corp 6. AT&T Inc 7. NTT DATA Corp 8. Netskope Inc 9. McAfee Corp 10. Gen Digital Inc 11. AO Kaspersky Lab 12. Fortinet Inc 13. VMware Inc 14. Versa Capital Management, Inc. 15. Juniper Networks Inc 16. The Cato Corp 17. Perimeter 81 Ltd 18. Forcepoint 19. Synopsys Inc 20. Veracode Inc 21. Contrast Security Inc 22. Sync Lab S.R.L. 23. F5 Networks Inc 24. ThreatModeler Software Inc 25. Checkmarx 26. Wipro Ltd 27. Singtel Optus Pty Ltd 28. BAE Systems Inc 29. BT Group Plc 30. Lumen Technologies Inc 31. Orange SA Frequently Asked Questions 1. What is the Cyber Security Market? Ans: The cyber security market involves the buying and selling of products and services designed to protect digital systems and data from cyber threats. 2. Why is the cyber security industry essential? Ans: The cyber security industry is crucial because it safeguards sensitive information, prevents data breaches, and defends against cyberattacks that can disrupt operations. 3. What are common cyber security services? Ans: Services include consulting, threat detection, incident response, and compliance solutions to help organizations fortify their defences. 4. What's the outlook for the cyber security market in India? Ans: The cyber security market in India is on the rise due to increasing digitalization and the need to protect against cyber threats. It offers significant growth opportunities. 5. How can businesses benefit from endpoint protection services? Ans: Endpoint protection services secure individual devices connected to networks, safeguarding against malware and unauthorized access.

1. Cyber Security Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Cyber Security Market: Dynamics 2.1. Cyber Security Market Trends by Region 2.1.1. North America Cyber Security Market Trends 2.1.2. Europe Cyber Security Market Trends 2.1.3. Asia Pacific Cyber Security Market Trends 2.1.4. Middle East and Africa Cyber Security Market Trends 2.1.5. South America Cyber Security Market Trends 2.2. Cyber Security Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Cyber Security Market Drivers 2.2.1.2. North America Cyber Security Market Restraints 2.2.1.3. North America Cyber Security Market Opportunities 2.2.1.4. North America Cyber Security Market Challenges 2.2.2. Europe 2.2.2.1. Europe Cyber Security Market Drivers 2.2.2.2. Europe Cyber Security Market Restraints 2.2.2.3. Europe Cyber Security Market Opportunities 2.2.2.4. Europe Cyber Security Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Cyber Security Market Drivers 2.2.3.2. Asia Pacific Cyber Security Market Restraints 2.2.3.3. Asia Pacific Cyber Security Market Opportunities 2.2.3.4. Asia Pacific Cyber Security Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Cyber Security Market Drivers 2.2.4.2. Middle East and Africa Cyber Security Market Restraints 2.2.4.3. Middle East and Africa Cyber Security Market Opportunities 2.2.4.4. Middle East and Africa Cyber Security Market Challenges 2.2.5. South America 2.2.5.1. South America Cyber Security Market Drivers 2.2.5.2. South America Cyber Security Market Restraints 2.2.5.3. South America Cyber Security Market Opportunities 2.2.5.4. South America Cyber Security Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Cyber Security Deployment Mode 2.8. Analysis of Government Schemes and Initiatives For Cyber Security Deployment Mode 2.9. The Global Pandemic Impact on Cyber Security Market 2.10. Evolution of regulatory and legal framework 3. Cyber Security Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Cyber Security Market Size and Forecast, by Component (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Cyber Security Market Size and Forecast, by Software (2023-2030) 3.2.1. Antivirus Software 3.2.2. Firewall Software 3.2.3. Endpoint Security Software 3.2.4. Network Security Software 3.2.5. Security Information and Event Management(SIEM) Software 3.2.6. Identity and Access management (IAM) Software 3.2.7. Encryption Software 3.2.8. Threat Intelligence Software Above 75 gallons 3.3. Cyber Security Market Size and Forecast, by Services (2023-2030) 3.3.1. Consulting Services 3.3.2. Managed Security Services (MSS) 3.3.3. Incident Response Services 3.3.4. Penetration Testing Services 3.3.5. Security Training and Awareness 3.3.6. Vulnerability Assessment Services 3.3.7. Forensics and Investigation Services 3.3.8. Security Compliance Services 3.4. Cyber Security Market Size and Forecast, by Security Type (2023-2030) 3.4.1. Network Security solutions 3.4.2. Endpoint Protection Services 3.4.3. Application Security 3.4.4. Cloud Security 3.5. Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 3.5.1. On-premise 3.5.2. Cloud-based 3.6. Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 3.6.1. Small and Medium Enterprise 3.6.2. Large Enterprise 3.7. Cyber Security Market Size and Forecast, by Vertical (2023-2030) 3.7.1. Financial Services 3.7.2. Healthcare organizations 3.7.3. Manufacturing sector 3.7.4. Government and Defense sector 3.7.5. Retail sector 3.7.6. Energy and Utilities sector 3.7.7. Education 3.7.8. Telecommunications 3.8. Cyber Security Market Size and Forecast, by Region (2023-2030) 3.8.1. North America 3.8.2. Europe 3.8.3. Asia Pacific 3.8.4. Middle East and Africa 3.8.5. South America 4. North America Cyber Security Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Cyber Security Market Size and Forecast, by Component (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. North America Cyber Security Market Size and Forecast, by Software (2023-2030) 4.2.1. Antivirus Software 4.2.2. Firewall Software 4.2.3. Endpoint Security Software 4.2.4. Network Security Software 4.2.5. Security Information and Event Management(SIEM) Software 4.2.6. Identity and Access management (IAM) Software 4.2.7. Encryption Software 4.2.8. Threat Intelligence Software Above 75 gallons 4.3. North America Cyber Security Market Size and Forecast, by Services (2023-2030) 4.3.1. Consulting Services 4.3.2. Managed Security Services (MSS) 4.3.3. Incident Response Services 4.3.4. Penetration Testing Services 4.3.5. Security Training and Awareness 4.3.6. Vulnerability Assessment Services 4.3.7. Forensics and Investigation Services 4.3.8. Security Compliance Services 4.4. North America Cyber Security Market Size and Forecast, by Security Type (2023-2030) 4.4.1. Network Security solutions 4.4.2. Endpoint Protection Services 4.4.3. Application Security 4.4.4. Cloud Security 4.5. North America Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.1. On-premise 4.5.2. Cloud-based 4.6. North America Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 4.6.1. Small and Medium Enterprise 4.6.2. Large Enterprise 4.7. North America Cyber Security Market Size and Forecast, by Vertical (2023-2030) 4.7.1. Financial Services 4.7.2. Healthcare organizations 4.7.3. Manufacturing sector 4.7.4. Government and Defense sector 4.7.5. Retail sector 4.7.6. Energy and Utilities sector 4.7.7. Education 4.7.8. Telecommunications 4.8. North America Cyber Security Market Size and Forecast, by Country (2023-2030) 4.8.1. United States 4.8.1.1. United States Cyber Security Market Size and Forecast, by Component (2023-2030) 4.8.1.1.1. Hardware 4.8.1.1.2. Software 4.8.1.1.3. Services 4.8.1.2. United States Cyber Security Market Size and Forecast, by Software (2023-2030) 4.8.1.2.1. Antivirus Software 4.8.1.2.2. Firewall Software 4.8.1.2.3. Endpoint Security Software 4.8.1.2.4. Network Security Software 4.8.1.2.5. Security Information and Event Management(SIEM) Software 4.8.1.2.6. Identity and Access management (IAM) Software 4.8.1.2.7. Encryption Software 4.8.1.2.8. Threat Intelligence Software Above 75 gallons 4.8.1.3. United States Cyber Security Market Size and Forecast, by Services (2023-2030) 4.8.1.3.1. Consulting Services 4.8.1.3.2. Managed Security Services (MSS) 4.8.1.3.3. Incident Response Services 4.8.1.3.4. Penetration Testing Services 4.8.1.3.5. Security Training and Awareness 4.8.1.3.6. Vulnerability Assessment Services 4.8.1.3.7. Forensics and Investigation Services 4.8.1.3.8. Security Compliance Services 4.8.1.4. United States Cyber Security Market Size and Forecast, by Security Type (2023-2030) 4.8.1.4.1. Network Security solutions 4.8.1.4.2. Endpoint Protection Services 4.8.1.4.3. Application Security 4.8.1.4.4. Cloud Security 4.8.1.5. United States Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 4.8.1.5.1. On-premise 4.8.1.5.2. Cloud-based 4.8.1.6. United States Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 4.8.1.6.1. Small and Medium Enterprise 4.8.1.6.2. Large Enterprise 4.8.1.7. United States Cyber Security Market Size and Forecast, by Vertical (2023-2030) 4.8.1.7.1. Financial Services 4.8.1.7.2. Healthcare organizations 4.8.1.7.3. Manufacturing sector 4.8.1.7.4. Government and Defense sector 4.8.1.7.5. Retail sector 4.8.1.7.6. Energy and Utilities sector 4.8.1.7.7. Education 4.8.1.7.8. Telecommunications 4.8.2. Canada 4.8.2.1. Canada Cyber Security Market Size and Forecast, by Component (2023-2030) 4.8.2.1.1. Hardware 4.8.2.1.2. Software 4.8.2.1.3. Services 4.8.2.2. Canada Cyber Security Market Size and Forecast, by Software (2023-2030) 4.8.2.2.1. Antivirus Software 4.8.2.2.2. Firewall Software 4.8.2.2.3. Endpoint Security Software 4.8.2.2.4. Network Security Software 4.8.2.2.5. Security Information and Event Management(SIEM) Software 4.8.2.2.6. Identity and Access management (IAM) Software 4.8.2.2.7. Encryption Software 4.8.2.2.8. Threat Intelligence Software Above 75 gallons 4.8.2.3. Canada Cyber Security Market Size and Forecast, by Services (2023-2030) 4.8.2.3.1. Consulting Services 4.8.2.3.2. Managed Security Services (MSS) 4.8.2.3.3. Incident Response Services 4.8.2.3.4. Penetration Testing Services 4.8.2.3.5. Security Training and Awareness 4.8.2.3.6. Vulnerability Assessment Services 4.8.2.3.7. Forensics and Investigation Services 4.8.2.3.8. Security Compliance Services 4.8.2.4. Canada Cyber Security Market Size and Forecast, by Security Type (2023-2030) 4.8.2.4.1. Network Security solutions 4.8.2.4.2. Endpoint Protection Services 4.8.2.4.3. Application Security 4.8.2.4.4. Cloud Security 4.8.2.5. Canada Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 4.8.2.5.1. On-premise 4.8.2.5.2. Cloud-based 4.8.2.6. Canada Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 4.8.2.6.1. Small and Medium Enterprise 4.8.2.6.2. Large Enterprise 4.8.2.7. Canada Cyber Security Market Size and Forecast, by Vertical (2023-2030) 4.8.2.7.1. Financial Services 4.8.2.7.2. Healthcare organizations 4.8.2.7.3. Manufacturing sector 4.8.2.7.4. Government and Defense sector 4.8.2.7.5. Retail sector 4.8.2.7.6. Energy and Utilities sector 4.8.2.7.7. Education 4.8.2.7.8. Telecommunications 4.8.3. Mexico 4.8.3.1. Mexico Cyber Security Market Size and Forecast, by Component (2023-2030) 4.8.3.1.1. Hardware 4.8.3.1.2. Software 4.8.3.1.3. Services 4.8.3.2. Mexico Cyber Security Market Size and Forecast, by Software (2023-2030) 4.8.3.2.1. Antivirus Software 4.8.3.2.2. Firewall Software 4.8.3.2.3. Endpoint Security Software 4.8.3.2.4. Network Security Software 4.8.3.2.5. Security Information and Event Management(SIEM) Software 4.8.3.2.6. Identity and Access management (IAM) Software 4.8.3.2.7. Encryption Software 4.8.3.2.8. Threat Intelligence Software Above 75 gallons 4.8.3.3. Mexico Cyber Security Market Size and Forecast, by Services (2023-2030) 4.8.3.3.1. Consulting Services 4.8.3.3.2. Managed Security Services (MSS) 4.8.3.3.3. Incident Response Services 4.8.3.3.4. Penetration Testing Services 4.8.3.3.5. Security Training and Awareness 4.8.3.3.6. Vulnerability Assessment Services 4.8.3.3.7. Forensics and Investigation Services 4.8.3.3.8. Security Compliance Services 4.8.3.4. Mexico Cyber Security Market Size and Forecast, by Security Type (2023-2030) 4.8.3.4.1. Network Security solutions 4.8.3.4.2. Endpoint Protection Services 4.8.3.4.3. Application Security 4.8.3.4.4. Cloud Security 4.8.3.5. Mexico Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 4.8.3.5.1. On-premise 4.8.3.5.2. Cloud-based 4.8.3.6. Mexico Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 4.8.3.6.1. Small and Medium Enterprise 4.8.3.6.2. Large Enterprise 4.8.3.7. Mexico Cyber Security Market Size and Forecast, by Vertical (2023-2030) 4.8.3.7.1. Financial Services 4.8.3.7.2. Healthcare organizations 4.8.3.7.3. Manufacturing sector 4.8.3.7.4. Government and Defence sector 4.8.3.7.5. Retail sector 4.8.3.7.6. Energy and Utilities sector 4.8.3.7.7. Education 4.8.3.7.8. Telecommunications 5. Europe Cyber Security Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Cyber Security Market Size and Forecast, by Component (2023-2030) 5.2. Europe Cyber Security Market Size and Forecast, by Software (2023-2030) 5.3. Europe Cyber Security Market Size and Forecast, by Services (2023-2030) 5.4. Europe Cyber Security Market Size and Forecast, by Security Type (2023-2030) 5.5. Europe Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 5.6. Europe Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 5.7. Europe Cyber Security Market Size and Forecast, by Vertical (2023-2030) 5.8. Europe Cyber Security Market Size and Forecast, by Country (2023-2030) 5.8.1. United Kingdom 5.8.1.1. United Kingdom Cyber Security Market Size and Forecast, by Component (2023-2030) 5.8.1.2. United Kingdom Cyber Security Market Size and Forecast, by Software (2023-2030) 5.8.1.3. United Kingdom Cyber Security Market Size and Forecast, by Services (2023-2030) 5.8.1.4. United Kingdom Cyber Security Market Size and Forecast, by Security Type (2023-2030) 5.8.1.5. United Kingdom Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 5.8.1.6. United Kingdom Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 5.8.1.7. United Kingdom Cyber Security Market Size and Forecast, by Vertical (2023-2030) 5.8.2. France 5.8.2.1. France Cyber Security Market Size and Forecast, by Component (2023-2030) 5.8.2.2. France Cyber Security Market Size and Forecast, by Software (2023-2030) 5.8.2.3. France Cyber Security Market Size and Forecast, by Services (2023-2030) 5.8.2.4. France Cyber Security Market Size and Forecast, by Security Type (2023-2030) 5.8.2.5. France Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 5.8.2.6. France Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 5.8.2.7. France Cyber Security Market Size and Forecast, by Vertical (2023-2030) 5.8.3. Germany 5.8.3.1. Germany Cyber Security Market Size and Forecast, by Component (2023-2030) 5.8.3.2. Germany Cyber Security Market Size and Forecast, by Software (2023-2030) 5.8.3.3. Germany Cyber Security Market Size and Forecast, by Services (2023-2030) 5.8.3.4. Germany Cyber Security Market Size and Forecast, by Security Type (2023-2030) 5.8.3.5. Germany Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 5.8.3.6. Germany Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 5.8.3.7. Germany Cyber Security Market Size and Forecast, by Vertical (2023-2030) 5.8.4. Italy 5.8.4.1. Italy Cyber Security Market Size and Forecast, by Component (2023-2030) 5.8.4.2. Italy Cyber Security Market Size and Forecast, by Software (2023-2030) 5.8.4.3. Italy Cyber Security Market Size and Forecast, by Services (2023-2030) 5.8.4.4. Italy Cyber Security Market Size and Forecast, by Security Type (2023-2030) 5.8.4.5. Italy Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 5.8.4.6. Italy Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 5.8.4.7. Italy Cyber Security Market Size and Forecast, by Vertical (2023-2030) 5.8.5. Spain 5.8.5.1. Spain Cyber Security Market Size and Forecast, by Component (2023-2030) 5.8.5.2. Spain Cyber Security Market Size and Forecast, by Software (2023-2030) 5.8.5.3. Spain Cyber Security Market Size and Forecast, by Services (2023-2030) 5.8.5.4. Spain Cyber Security Market Size and Forecast, by Security Type (2023-2030) 5.8.5.5. Spain Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 5.8.5.6. Spain Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 5.8.5.7. Spain Cyber Security Market Size and Forecast, by Vertical (2023-2030) 5.8.6. Sweden 5.8.6.1. Sweden Cyber Security Market Size and Forecast, by Component (2023-2030) 5.8.6.2. Sweden Cyber Security Market Size and Forecast, by Software (2023-2030) 5.8.6.3. Sweden Cyber Security Market Size and Forecast, by Services (2023-2030) 5.8.6.4. Sweden Cyber Security Market Size and Forecast, by Security Type (2023-2030) 5.8.6.5. Sweden Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 5.8.6.6. Sweden Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 5.8.6.7. Sweden Cyber Security Market Size and Forecast, by Vertical (2023-2030) 5.8.7. Austria 5.8.7.1. Austria Cyber Security Market Size and Forecast, by Component (2023-2030) 5.8.7.2. Austria Cyber Security Market Size and Forecast, by Software (2023-2030) 5.8.7.3. Austria Cyber Security Market Size and Forecast, by Services (2023-2030) 5.8.7.4. Austria Cyber Security Market Size and Forecast, by Security Type (2023-2030) 5.8.7.5. Austria Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 5.8.7.6. Austria Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 5.8.7.7. Austria Cyber Security Market Size and Forecast, by Vertical (2023-2030) 5.8.8. Rest of Europe 5.8.8.1. Rest of Europe Cyber Security Market Size and Forecast, by Component (2023-2030) 5.8.8.2. Rest of Europe Cyber Security Market Size and Forecast, by Software (2023-2030) 5.8.8.3. Rest of Europe Cyber Security Market Size and Forecast, by Services (2023-2030) 5.8.8.4. Rest of Europe Cyber Security Market Size and Forecast, by Security Type (2023-2030) 5.8.8.5. Rest of Europe Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 5.8.8.6. Rest of Europe Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 5.8.8.7. Rest of Europe Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6. Asia Pacific Cyber Security Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Cyber Security Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Cyber Security Market Size and Forecast, by Software (2023-2030) 6.3. Asia Pacific Cyber Security Market Size and Forecast, by Services (2023-2030) 6.4. Asia Pacific Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.5. Asia Pacific Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.6. Asia Pacific Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.7. Asia Pacific Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8. Asia Pacific Cyber Security Market Size and Forecast, by Country (2023-2030) 6.8.1. China 6.8.1.1. China Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.1.2. China Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.1.3. China Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.1.4. China Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.1.5. China Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.1.6. China Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.1.7. China Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8.2. S Korea 6.8.2.1. S Korea Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.2.2. S Korea Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.2.3. S Korea Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.2.4. S Korea Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.2.5. S Korea Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.2.6. S Korea Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.2.7. S Korea Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8.3. Japan 6.8.3.1. Japan Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.3.2. Japan Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.3.3. Japan Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.3.4. Japan Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.3.5. Japan Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.3.6. Japan Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.3.7. Japan Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8.4. India 6.8.4.1. India Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.4.2. India Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.4.3. India Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.4.4. India Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.4.5. India Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.4.6. India Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.4.7. India Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8.5. Australia 6.8.5.1. Australia Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.5.2. Australia Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.5.3. Australia Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.5.4. Australia Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.5.5. Australia Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.5.6. Australia Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.5.7. Australia Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8.6. Indonesia 6.8.6.1. Indonesia Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.6.2. Indonesia Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.6.3. Indonesia Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.6.4. Indonesia Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.6.5. Indonesia Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.6.6. Indonesia Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.6.7. Indonesia Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8.7. Malaysia 6.8.7.1. Malaysia Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.7.2. Malaysia Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.7.3. Malaysia Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.7.4. Malaysia Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.7.5. Malaysia Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.7.6. Malaysia Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.7.7. Malaysia Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8.8. Vietnam 6.8.8.1. Vietnam Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.8.2. Vietnam Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.8.3. Vietnam Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.8.4. Vietnam Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.8.5. Vietnam Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.8.6. Vietnam Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.8.7. Vietnam Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8.9. Taiwan 6.8.9.1. Taiwan Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.9.2. Taiwan Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.9.3. Taiwan Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.9.4. Taiwan Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.9.5. Taiwan Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.9.6. Taiwan Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.9.7. Taiwan Cyber Security Market Size and Forecast, by Vertical (2023-2030) 6.8.10. Rest of Asia Pacific 6.8.10.1. Rest of Asia Pacific Cyber Security Market Size and Forecast, by Component (2023-2030) 6.8.10.2. Rest of Asia Pacific Cyber Security Market Size and Forecast, by Software (2023-2030) 6.8.10.3. Rest of Asia Pacific Cyber Security Market Size and Forecast, by Services (2023-2030) 6.8.10.4. Rest of Asia Pacific Cyber Security Market Size and Forecast, by Security Type (2023-2030) 6.8.10.5. Rest of Asia Pacific Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 6.8.10.6. Rest of Asia Pacific Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 6.8.10.7. Rest of Asia Pacific Cyber Security Market Size and Forecast, by Vertical (2023-2030) 7. Middle East and Africa Cyber Security Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Cyber Security Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Cyber Security Market Size and Forecast, by Software (2023-2030) 7.3. Middle East and Africa Cyber Security Market Size and Forecast, by Services (2023-2030) 7.4. Middle East and Africa Cyber Security Market Size and Forecast, by Security Type (2023-2030) 7.5. Middle East and Africa Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 7.6. Middle East and Africa Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 7.7. Middle East and Africa Cyber Security Market Size and Forecast, by Vertical (2023-2030) 7.8. Middle East and Africa Cyber Security Market Size and Forecast, by Country (2023-2030) 7.8.1. South Africa 7.8.1.1. South Africa Cyber Security Market Size and Forecast, by Component (2023-2030) 7.8.1.2. South Africa Cyber Security Market Size and Forecast, by Software (2023-2030) 7.8.1.3. South Africa Cyber Security Market Size and Forecast, by Services (2023-2030) 7.8.1.4. South Africa Cyber Security Market Size and Forecast, by Security Type (2023-2030) 7.8.1.5. South Africa Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 7.8.1.6. South Africa Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 7.8.1.7. South Africa Cyber Security Market Size and Forecast, by Vertical (2023-2030) 7.8.2. GCC 7.8.2.1. GCC Cyber Security Market Size and Forecast, by Component (2023-2030) 7.8.2.2. GCC Cyber Security Market Size and Forecast, by Software (2023-2030) 7.8.2.3. GCC Cyber Security Market Size and Forecast, by Services (2023-2030) 7.8.2.4. GCC Cyber Security Market Size and Forecast, by Security Type (2023-2030) 7.8.2.5. GCC Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 7.8.2.6. GCC Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 7.8.2.7. GCC Cyber Security Market Size and Forecast, by Vertical (2023-2030) 7.8.3. Nigeria 7.8.3.1. Nigeria Cyber Security Market Size and Forecast, by Component (2023-2030) 7.8.3.2. Nigeria Cyber Security Market Size and Forecast, by Software (2023-2030) 7.8.3.3. Nigeria Cyber Security Market Size and Forecast, by Services (2023-2030) 7.8.3.4. Nigeria Cyber Security Market Size and Forecast, by Security Type (2023-2030) 7.8.3.5. Nigeria Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 7.8.3.6. Nigeria Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 7.8.3.7. Nigeria Cyber Security Market Size and Forecast, by Vertical (2023-2030) 7.8.4. Rest of ME&A 7.8.4.1. Rest of ME&A Cyber Security Market Size and Forecast, by Component (2023-2030) 7.8.4.2. Rest of ME&A Cyber Security Market Size and Forecast, by Software (2023-2030) 7.8.4.3. Rest of ME&A Cyber Security Market Size and Forecast, by Services (2023-2030) 7.8.4.4. Rest of ME&A Cyber Security Market Size and Forecast, by Security Type (2023-2030) 7.8.4.5. Rest of ME&A Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 7.8.4.6. Rest of ME&A Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 7.8.4.7. Rest of ME&A Cyber Security Market Size and Forecast, by Vertical (2023-2030) 8. South America Cyber Security Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America Cyber Security Market Size and Forecast, by Component (2023-2030) 8.2. South America Cyber Security Market Size and Forecast, by Software (2023-2030) 8.3. South America Cyber Security Market Size and Forecast, by Services (2023-2030) 8.4. South America Cyber Security Market Size and Forecast, by Security Type (2023-2030) 8.5. South America Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 8.6. South America Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 8.7. South America Cyber Security Market Size and Forecast, by Vertical (2023-2030) 8.8. South America Cyber Security Market Size and Forecast, by Country (2023-2030) 8.8.1. Brazil 8.8.1.1. Brazil Cyber Security Market Size and Forecast, by Component (2023-2030) 8.8.1.2. Brazil Cyber Security Market Size and Forecast, by Software (2023-2030) 8.8.1.3. Brazil Cyber Security Market Size and Forecast, by Services (2023-2030) 8.8.1.4. Brazil Cyber Security Market Size and Forecast, by Security Type (2023-2030) 8.8.1.5. Brazil Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 8.8.1.6. Brazil Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 8.8.1.7. Brazil Cyber Security Market Size and Forecast, by Vertical (2023-2030) 8.8.2. Argentina 8.8.2.1. Argentina Cyber Security Market Size and Forecast, by Component (2023-2030) 8.8.2.2. Argentina Cyber Security Market Size and Forecast, by Software (2023-2030) 8.8.2.3. Argentina Cyber Security Market Size and Forecast, by Services (2023-2030) 8.8.2.4. Argentina Cyber Security Market Size and Forecast, by Security Type (2023-2030) 8.8.2.5. Argentina Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 8.8.2.6. Argentina Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 8.8.2.7. Argentina Cyber Security Market Size and Forecast, by Vertical (2023-2030) 8.8.3. Rest Of South America 8.8.3.1. Rest Of South America Cyber Security Market Size and Forecast, by Component (2023-2030) 8.8.3.2. Rest Of South America Cyber Security Market Size and Forecast, by Software (2023-2030) 8.8.3.3. Rest Of South America Cyber Security Market Size and Forecast, by Services (2023-2030) 8.8.3.4. Rest Of South America Cyber Security Market Size and Forecast, by Security Type (2023-2030) 8.8.3.5. Rest Of South America Cyber Security Market Size and Forecast, by Deployment Mode (2023-2030) 8.8.3.6. Rest Of South America Cyber Security Market Size and Forecast, by Organization Size (2023-2030) 8.8.3.7. Rest Of South America Cyber Security Market Size and Forecast, by Vertical (2023-2030) 9. Global Cyber Security Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Service Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Cyber Security Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. International Business Machines Corp 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Accenture Plc 10.3. Palo Alto Networks Inc 10.4. Cybereason Inc 10.5. SecureWorks Corp 10.6. AT&T Inc 10.7. NTT DATA Corp 10.8. Netskope Inc 10.9. McAfee Corp 10.10. Gen Digital Inc 10.11. AO Kaspersky Lab 10.12. Fortinet Inc 10.13. VMware Inc 10.14. Versa Capital Management, Inc. 10.15. Juniper Networks Inc 10.16. The Cato Corp 10.17. Perimeter 81 Ltd 10.18. Forcepoint 10.19. Synopsys Inc 10.20. Veracode Inc 10.21. Contrast Security Inc 10.22. Sync Lab S.R.L. 10.23. F5 Networks Inc 10.24. ThreatModeler Software Inc 10.25. Checkmarx 10.26. Wipro Ltd 10.27. Singtel Optus Pty Ltd 10.28. BAE Systems Inc 10.29. BT Group Plc 10.30. Lumen Technologies Inc 10.31. Orange SA 11. Key Findings 12. Deployment Mode Recommendations