Blockchain Market was valued at US$ 8.06 Bn. in 2022. The Blockchain Market size is estimated to grow at a CAGR of 61.4% over the forecast period.Blockchain Market Overview:

The report explores the Blockchain market's segments (Component, Type, Application, and Deployment). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). This market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2022. The report investigates the Blockchain market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Blockchain market's contemporary competitive scenario across the globe. The past seven years' trends are considered while forecasting the market through 2029. 2021 is a year of exception and analysis, especially with the impact of lockdown by region.To know about the Research Methodology:-Request Free Sample Report

Blockchain Market Dynamics:

BFSI companies are adopting digital ledger technology to secure users’ financial data and identity. Technology applications, such as cross-border transactions, clearing and settlements, trade finance platforms, digital identity verification, and credit reporting are gaining traction across the BFSI industry. This is expected to foster market growth. For instance, In June 2022, India’s central banks, like the State Bank of India(SBI), HDFC, ICICI Bank, and others, collaborated to establish Indian Bank’s digital ledger infrastructure company private limited, Indian Banks' Blockchain Infrastructure Co (IBBIC), to secure transactions, reduce transaction processing time, and speed up the process of letters of credit. Therefore, the rising awareness of data protection from malware activities within enterprises and consumers is one of the emerging drivers projected to drive the blockchain market growth through the forecast period. Increasing Venture Capital funding and Investments in blockchain technology: Blockchain technology experienced a boom after the introduction of Bitcoin and is now being used by various financial institutions for booming transactions. The adoption of blockchain technology solutions has achieved massive popularity in the last 2–3 years for various business applications, such as payments, exchanges, smart contracts, documentation, and digital identity. Many startups have arrived in this market and started developing blockchain technology solutions. Some of these startups include Auxesis Group, Block point, SpinSys, Symbiotic, Bit fury, Confirm, Genomes, Newfound, Fetch.AI, Civet, and QubiTech, among many others. Investments of venture capitalists in blockchain technology tripled in 2021. 2021 was a crucial year in the history of both blockchain and cryptocurrency, with projects regularly announced at both the startup level and by top players in Blockchain Market in several industries. These are some of the factors that are leading to the growth of the Blockchain Market through the forecast period. Lack of Skilled Professionals to Hinder Market Growth: The rise in the digital transformation among industries has increased various threats and cyberattacks. Though, organizations face a lack of skilled professionals to overcome the situation of risk factors. So, the adoption of technologically advanced solutions is slow and is anticipated to impact the market growth for the next few years. Additionally, developing countries, such as India, Peru, and Mexico, are facing a lack of awareness about the risks associated with data protection. Therefore, the adoption of the technology is likely to be stagnant for a few years.Blockchain Market Trends:

The pandemic has created an upsurge in the opportunity for cloud-based services by creating an innovative strategy for enterprises to give work-from-home access. The demand for cloud-based solutions to grow virtual work platforms has surged. As a result, there is a growing demand for software across industries to ensure job continuity. BaaS is an ideal solution to the issues that small and medium-sized enterprises (SMEs) challenge. SMEs employing cloud-based solutions are implementing distributed ledger-based services to safeguard digital entities and authenticate human identities, thus increasing demand for BaaS products.Blockchain Market Segment Analysis:

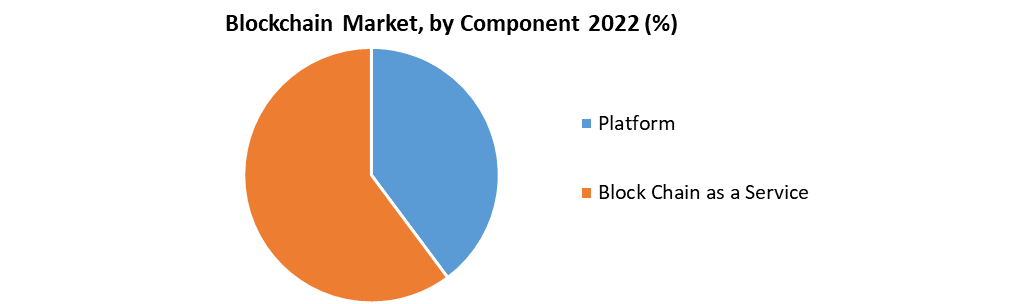

By Type, the Blockchain market is segmented into public, private, and consortium. The Public segment dominated the largest market share accounting for xx% in 2022 and is expected to grow at a CAGR of 3.8% during the forecast period. Private solutions and services enable businesses to reverse transactions and change regulations at a lower transaction cost. The consortium also referred to as a federated digital ledger, is beneficial where multiple businesses operate in the same industry and leverage a standard platform to streamline the operations. Consortium type offers collaborated platform to facilitate innovation across enterprises. Hence the Public segment is expected to grow through the forecast period. By Component, the Blockchain market is segmented into Platform/Solution and Blockchain as a Service (BaaS). The Platform/Solution segment dominated the largest market share accounting for xx% in 2021 and is expected to grow at a CAGR of 3.8% during the forecast period. Because of the increased demand in various industries for Hyperledger Fabric, Ethereum, R3 Corda, Ripple, and others. Platform/solution allows digital ledger network and application developers to design customized distributed ledger (DLT) networks for end-users. Blockchain as a Service (BaaS) is projected to increase at the fastest rate, owing to increasing enterprise usage of cloud-based services such as smart contracts, crowdfunding, crypto wallet development, and others.

Regional Insights:

North America emerged as the dominant regional market share accounting for 3.18% in 2022. The high share is accredited to the growing occurrence of dedicated suppliers of the product along with the rising demand for signage in the retail industry. The U.K., Germany, and the U.S., in particular, are projected to exhibit considerable growth primarily due to the rising R&D activities by companies to enhance product quality and growing government initiatives to install digital signage software at various offices for maintaining continuous information flow systems. The Asia Pacific region is expected to witness significant growth at a CAGR of 3.6% in 2022 through the forecast period. As the fastest-growing regional market over the forecast period. The growth can be attributed to the growing awareness regarding the benefits of digital signage. India and China are witnessing significant growth primarily because of the rising application in retail stores, corporate offices, hospitals, and hotels. Increasing disposable income has surged the visitors to the malls and multiplex stores in the emerging countries of Asia Pacific. Enterprise is therefore this opportunity to promote their offerings through large displays, which helps them attract the targeted audience in a better manner. With the rising number of shopping malls and multiplexes, the adoption of digital signage in the hospitality industry is expected to increase over the forecast period. The objective of the report is to present a comprehensive analysis of the global Blockchain Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear, futuristic view of the industry to the decision-makers. The reports also help in understanding the Blockchain Market dynamic and structure by analyzing the market segments and projecting the Blockchain Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Blockchain Market make the report investor’s guide.Blockchain Market Scope: Inquire before buying

Blockchain Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 8.06 Bn. Forecast Period 2023 to 2029 CAGR: 61.4% Market Size in 2029: US $ 230.24 Bn. Segments Covered: by Component Platform Block Chain as a Service by Type Public Private Consortium by Application Digital Identity Payments Smart Contracts Supply Chain Management Others by Deployment Proof of Concept Pilot Production Blockchain Market by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players are:

1. IBM Corp. 2. Microsoft Corp. 3. The Linux Foundation 4. BTL Group Ltd. 5. Chain, Inc. 6. Circle Internet Financial Ltd. 7. Deloitte Touche Tohmatsu Ltd. 8. Digital Asset Holdings, LLC 9. Global Arena Holding, Inc. (GAHI) 10.Monax 11.Ripple Frequently Asked Questions: 1. Which region has the largest share in Global Blockchain Market? Ans: North Americ region held the highest share in 2022. 2. What is the growth rate of Global Blockchain Market? Ans: The Global Blockchain Market is growing at a CAGR of 61.4% during forecasting period 2023-2029. 3. What is scope of the Global Blockchain market report? Ans: Global Blockchain Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Blockchain market? Ans: The important key players in the Global Blockchain Market are – IBM Corp., Microsoft Corp., The Linux Foundation, BTL Group Ltd., Chain, Inc., Circle Internet Financial Ltd., Deloitte Touche Tohmatsu Ltd., Digital Asset Holdings, LLC, Global Arena Holding, Inc. (GAHI), Monax, and Ripple 5. What is the study period of this market? Ans: The Global Blockchain Market is studied from 2022 to 2029.

1. Blockchain Market Size: Research Methodology 2. Blockchain Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Blockchain Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Blockchain Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Blockchain Market Size Segmentation 4.1. Blockchain Market Size, by Component (2022-2029) • Platform • Block Chain as a Service 4.2. Blockchain Market Size, by Type (2022-2029) • Public • Private • Consortium 4.3. Blockchain Market Size by Application (2022-2029) • Digital Identity • Payments • Smart Contracts • Supply Chain Management • Others 4.4. Blockchain Market Size by Deployment (2022-2029) • Proof of Concept • Pilot • Production 5. North America Blockchain Market (2022-2029) 5.1. North America Blockchain Market Size, by Component (2022-2029) • Platform • Block Chain as a Service 5.2. North America Blockchain Market Size by Type (2022-2029) • Public • Private • Consortium 5.3. North America Blockchain Market Size by Application (2022-2029) • Digital Identity • Payments • Smart Contracts • Supply Chain Management • Others 5.4. North America Blockchain Market Size by Deployment (2022-2029) • Proof of Concept • Pilot • Production 5.5 North America Blockchain Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Blockchain Market (2022-2029) 6.1. European Blockchain Market, by Component (2022-2029) 6.2. European Blockchain Market, by Type (2022-2029) 6.3. European Blockchain Market, by Application (2022-2029) 6.4. European Blockchain Market, by Deployment (2022-2029) 6.5. European Blockchain Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Blockchain Market (2022-2029) 7.1. Asia Pacific Blockchain Market, by Component (2022-2029) 7.2. Asia Pacific Blockchain Market, by Type (2022-2029) 7.3. Asia Pacific Blockchain Market, by Application (2022-2029) 7.4. Asia Pacific Blockchain Market, by Deployment (2022-2029) 7.5. Asia Pacific Blockchain Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Blockchain Market (2021-20The 27) 8.1. The Middle East and Africa Blockchain Market, by Component (2022-2029) 8.2. The Middle East and Africa Blockchain Market, by Type (2022-2029) 8.3. The Middle East and Africa Blockchain Market, by Application (2022-2029) 8.4. The Middle East and Africa Blockchain Market, by Deployment (2022-2029) 8.5. The middle east and Africa Blockchain Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Blockchain Market (2022-2029) 9.1. South America Blockchain Market, by Component (2022-2029) 9.2. South America Blockchain Market, by Type (2022-2029) 9.3. South America Blockchain Market, by Application (2022-2029) 9.4. South America Blockchain Market, by Deployment (2022-2029) 9.5. South America Blockchain Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. IBM Corp. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Microsoft Corp. 10.3. The Linux Foundation 10.4. BTL Group Ltd. 10.5. Chain, Inc. 10.6. Circle Internet Financial Ltd. 10.7. Deloitte Touche Tohmatsu Ltd. 10.8. Digital Asset Holdings, LLC 10.9. Arena Holding, Inc. (GAHI) 10.10. Monax 10.11. Ripple