Automotive Fuel Rail Market was valued at US $ 4.63 Bn. in 2022. Global Automotive Fuel Rail Market size is estimated to grow at a CAGR of 2.6%. The market is expected to reach a value of US $ 5.54 Bn. in 2029.Automotive Fuel Rail Market Overview:

The Automotive Fuel Rail is a unit of a vehicle's fuel delivery system that contains a number of important components that aid in the efficient distribution of fuel. The vehicle fuel rail and fuel delivery system's principal job is to supply fuel to the engine. It's a fuel delivery pipe for internal combustion engines that delivers fuel to individual fuel injectors. The optimal distribution of fuels such as gasoline, methane, and other gases to the injectors is another function of the vehicle fuel rail. Endothermic systems can have high or low pressure systems. Automotive fuel rails are used to reduce evaporative fuel emissions, primarily in gasoline-powered vehicle. Because the pulse process variability may be removed from the fuel delivery system with the installation of the automobile fuel rail, total system cost and weight can be lowered. The instantaneous flow rate requirements are used to build the vehicle fuel rail. The stiffness balance and strength of the rail, as well as the volume elasticity, can be tuned, which helps in achieving the needed energy absorption performance and mechanical strength on the vehicle gasoline rail.To know about the Research Methodology:- Request Free Sample Report

Automotive Fuel Rail Market Dynamics:

The growth of the automotive fuel rail market is being driven by rising demand for automobiles, as well as increased automobile sales volume and numerous vehicle production facilities around the globe. The requirement to reduce the weight of vehicle components in order to minimize the engine's size is also supporting the market's growth. Another motivating element is the ability to customize the automotive gasoline rail to meet the needs of automobile manufacturers. Demand for more efficient fuel distribution systems is steadily increasing in order to meet increasingly rigorous pollution standards and improve fuel efficiency. The common rail fuel injection system has been shown to be an effective method of increasing engine fuel economy. Because the fuel pressure in the fuel delivery system can be maintained regardless of engine speed or load, most sophisticated engines are fitted with common rail fuel injection systems. As a result, more fuel may be injected, injection timing can be better controlled, and spray penetration and mixing can be improved. As a result, the engine runs smoother and is more efficient. A common-rail fuel distribution system's fuel pressure ranges from 100 to 2500 bar. To withstand this huge gasoline pressure, each component of the fuel distribution system must be designed and built with precision and accuracy. The fuel rail is an important part of the fuel delivery system since it transports high-pressure fuel to the injectors. When the engine is idling, the fuel rail pressure typically ranges from 300 to 400 bar. A fuel rail is made to withstand fuel pressures of up to 2500 bar, which is used in supercharged engines. The vehicle gasoline rail market's growth is being limited by its high initial investment cost. Rising demand for battery electric vehicles in the region is stifling the growth of the Automotive Fuel Rail Market indirectly. Automotive fuel rail contributes to sustainable development by lowering carbon emissions. The rise in popularity of hybrid and electric automobiles, as well as their distinct selling propositions as extremely fuel-efficient vehicles, is broadening the scope of the automotive fuel rail business. The increased adoption of gasoline direct injection engines, which need high-pressure automotive fuel rail, is one of the most visible developments in the automotive fuel rail market. Steel or thermoplastic materials with strong chemical, mechanical, and thermal resistance make up the vehicle fuel rail for gasoline engines.Automotive Fuel Rail Market Segment Analysis:

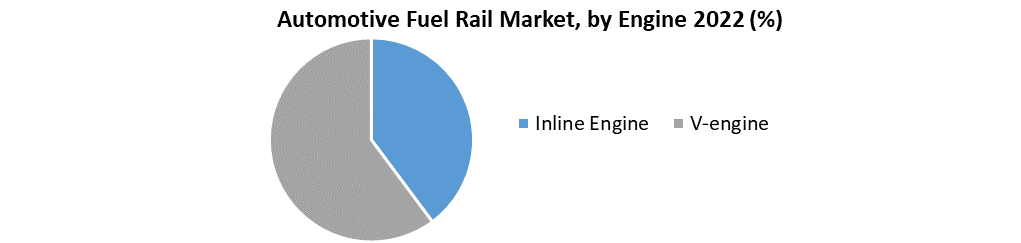

Based on Fuel Type, the market is sub-segmented into Gasoline, Diesel, and Alternative fuel. Diesel fuel type is leading the market in 2022. Diesel and gasoline have been used as automotive fuels since the development of internal combustion engines. These fuels' prices have been shifting in recent years due to their restricted supply. Diesel automobiles release more greenhouse gases than gasoline vehicles, making it a major cause of pollution. As a result, this factor propels the segment's growth in the Automotive Fuel Rail Market. Based on Engine, the market is sub-segmented into Inline engines and V – engines. Inline engines are the most common type of engine seen in automobiles. Inline engines are more common, although V-engines have greater advantages due to their reduced cost and simplicity. Two camshafts and two fuel rails are required in V-engines, making them intricate and costly. In terms of revenue, the inline sector of the automotive fuel rail market accounted for 88.16 % of the total market in 2019. During the forecast period, the segment is expected to grow at a CAGR of 2.43 %.

Automotive Fuel Rail Market Regional Insights:

Commercial vehicles have a large market in North America. Commercial vehicles account for more than 60% of all vehicles in North America. Because of the vast mining sector and the rise of the construction, agriculture, and manufacturing industries in these regions, commercial vehicles are in high demand across North America and Latin America. China and India are two of the most important countries in the global automotive sector. These two countries are major vehicle makers and buyers. In these countries, population density, vehicle scarcity, and rising per capita income are all driving up demand for passenger vehicles. Because of the large number of passenger vehicles in Europe and Asia Pacific, the passenger vehicle sector leads the worldwide automotive fuel rail market. About half of all vehicles are produced in Asia Pacific. The objective of the report is to present a comprehensive analysis of the Automotive Fuel Rail Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help understand the Automotive Fuel Rail Market dynamic and structure by analyzing the market segments and projecting the Automotive Fuel Rail Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Automotive Fuel Rail Market make the report investor’s guide.Automotive Fuel Rail Market Scope: Inquire before buying

Automotive Fuel Rail Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 4.63 Bn. Forecast Period 2023 to 2029 CAGR: 2.6% Market Size in 2029: US $ 5.54 Bn. Segments Covered: by Fuel Type • Gasoline • Diesel • Alternative Fuel by Engine • Inline Engine • V-engine by Material • Steel • Aluminum • plastic by Sale Channel • OEM • Aftermarket by Vehicle • Passenger Vehicle • Commercial Vehicle by Pressure • Low-pressure fuel rail • High-pressure fuel rail Automotive Fuel Rail Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Automotive Fuel Rail Market Key Players

• Cooper Standard • Magneti Marelli S.p.A. • Roberts Bosch GmbH • Nikki Co. • Keihin Corporation • Landi Renzo S.p.A. • Linamar Corporation • Standard Motor Products, Inc. • Continental AG • ASINI SEIKI Co. • Sanoh Industrial Co. • TI Automotive • Aerospace Xingda • Delphi Automotive LLP • Denso Corporation Linamar • Lynn Tilton Company • Motonic • USUI CO., LTD. • TI Fluid Systems • DURA • Zhongyuan fuel • Aisin Seiki Frequently Asked Questions: 1. Which region has the largest share in Global Automotive Fuel Rail Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Automotive Fuel Rail Market? Ans: The Global Automotive Fuel Rail Market is growing at a CAGR of 2.6% during forecasting period 2023-2029. 3. What is scope of the Global Automotive Fuel Rail Market report? Ans: Global Automotive Fuel Rail Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Automotive Fuel Rail Market? Ans: The important key players in the Global Automotive Fuel Rail Market are – Cooper Standard, Magneti Marelli S.p.A., Roberts Bosch GmbH, Nikki Co., Keihin Corporation, Landi Renzo S.p.A., Linamar Corporation, Standard Motor Products, Inc., Continental AG, ASINI SEIKI Co., Sanoh Industrial Co., TI Automotive, Aerospace Xingda, Delphi Automotive LLP, Denso Corporation Linamar, Lynn Tilton Company, Motonic, USUI CO., LTD., TI Fluid Systems, DURA, Zhongyuan fuel, Aisin Seiki 5. What is the study period of this Market? Ans: The Global Automotive Fuel Rail Market is studied from 2022 to 2029.

1. Automotive Fuel Rail Market Size: Research Methodology 2. Automotive Fuel Rail Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Automotive Fuel Rail Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Automotive Fuel Rail Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Automotive Fuel Rail Market Size Segmentation 4.1. Automotive Fuel Rail Market Size, by Fuel type (2022-2029) • Gasoline • Diesel • Alternative Fuel 4.2. Automotive Fuel Rail Market Size, by Engine (2022-2029) • Inline Engine • V-Engine 4.3. Automotive Fuel Rail Market Size, by Material (2022-2029) • Steel • Aluminum • plastic 4.4. Automotive Fuel Rail Market Size, by Sale channel (2022-2029) • OEM • Aftermarket 4.5. Automotive Fuel Rail Market Size, by Vehicle (2022-2029) • Passenger Vehicle • Commercial Vehicle 4.6. Automotive Fuel Rail Market Size, by Pressure (2022-2029) • Low-pressure fuel rail • High-pressure fuel rail 5. North America Automotive Fuel Rail Market (2022-2029) 5.1. North America Automotive Fuel Rail Market Size, by Fuel type (2022-2029) • Gasoline • Diesel • Alternative Fuel 5.2. North America Automotive Fuel Rail Market Size, by Engine (2022-2029) • Inline Engine • V-Engine 5.3. North America Automotive Fuel Rail Market Size, by Material (2022-2029) • Steel • Aluminum • plastic 5.4. North America Automotive Fuel Rail Market Size, by Sale channel (2022-2029) • OEM • Aftermarket 5.5. North America Automotive Fuel Rail Market Size, by Vehicle (2022-2029) • Passenger Vehicle • Commercial Vehicle 5.6. North America Automotive Fuel Rail Market Size, by Pressure (2022-2029) • Low-pressure fuel rail • High-pressure fuel rail 5.7. North America Automotive Fuel Rail Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Automotive Fuel Rail Market (2022-2029) 6.1. European Automotive Fuel Rail Market, by Fuel type(2022-2029) 6.2. European Automotive Fuel Rail Market Size, by Engine (2022-2029) 6.3. European Automotive Fuel Rail Market Size, by Material (2022-2029) 6.4. European Automotive Fuel Rail Market Size, by Sale channel (2022-2029) 6.5. European Automotive Fuel Rail Market Size, by Vehicle (2022-2029) 6.6. European Automotive Fuel Rail Market Size, by Pressure (2022-2029) 6.7. European Automotive Fuel Rail Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Automotive Fuel Rail Market (2022-2029) 7.1. Asia Pacific Automotive Fuel Rail Market, by Fuel type(2022-2029) 7.2. Asia Pacific Automotive Fuel Rail Market Size, by Engine (2022-2029) 7.3. Asia Pacific Automotive Fuel Rail Market Size, by Material (2022-2029) 7.4. Asia Pacific Automotive Fuel Rail Market Size, by Sale channel (2022-2029) 7.5. Asia Pacific Automotive Fuel Rail Market Size, by Vehicle (2022-2029) 7.6. Asia Pacific Automotive Fuel Rail Market Size, by Pressure (2022-2029) 7.7. Asia Pacific Automotive Fuel Rail Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Automotive Fuel Rail Market (2022-2029) 8.1. Middle East and Africa Automotive Fuel Rail Market, by Fuel Type(2022-2029) 8.2. Middle East and Africa America Automotive Fuel Rail Market Size, by Engine (2022-2029) 8.3. Middle East and Africa Automotive Fuel Rail Market Size, by Material (2022-2029) 8.4. Middle East and Africa Automotive Fuel Rail Market Size, by Sale channel (2022-2029) 8.5. Middle East and Africa Automotive Fuel Rail Market Size, by Vehicle (2022-2029) 8.6. Middle East and Africa Automotive Fuel Rail Market Size, by Pressure (2022-2029) 8.7. Middle East and Africa Automotive Fuel Rail Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Automotive Fuel Rail Market (2022-2029) 9.1. Latin America Automotive Fuel Rail Market, by Fuel Type(2022-2029) 9.2. Latin America Automotive Fuel Rail Market Size, by Engine (2022-2029) 9.3. Latin America Automotive Fuel Rail Market Size, by Material (2022-2029) 9.4. Latin America Automotive Fuel Rail Market Size, by Sale channel (2022-2029) 9.5. Latin America Automotive Fuel Rail Market Size, by Vehicle (2022-2029) 9.6. Latin America Automotive Fuel Rail Market Size, by Pressure (2022-2029) 9.7. Latin America Automotive Fuel Rail Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Cooper Standard 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Magneti Marelli S.p.A. 10.3. Roberts Bosch GmbH 10.4. Nikki Co. 10.5. Keihin Corporation 10.6. Landi Renzo S.p.A. 10.7. Linamar Corporation 10.8. Standard Motor Products, Inc. 10.9. Continental AG 10.10. ASINI SEIKI Co. 10.11. Sanoh Industrial Co. 10.12. TI Automotive 10.13. Aerospace Xingda 10.14. Delphi Automotive LLP 10.15. Denso Corporation Linamar 10.16. Lynn Tilton Company 10.17. Motonic 10.18. USUI CO., LTD. 10.19. TI Fluid Systems 10.20. DURA 10.21. Zhongyuan fuel 10.22. Aisin Seiki